Adobe Creative Cloud Statistics By Revenue, Usage and Facts

Updated · Mar 10, 2025

Table of Contents

- Introduction

- Editor’s Choice

- General Adobe Creative Cloud Statistics

- Adobe Systems Digital Media Revenue

- Adobe Financial Projections for FY 2025

- Adobe Financial Projections for Q1 of FY 2025

- Adobe Creative Cloud Collaborations and Project Management

- Adobe Market Share

- Adobe Stock Price

- Adobe Creative Cloud’s Strong Growth and Adoption

- Conclusion

Introduction

Adobe Creative Cloud Statistics 2025: Adobe’s Creative Cloud suite of applications has cemented its place in the Creative League Industry. The suite offers a complete array of tools for professionals and amateurs alike. By the year 2024, the number of applications grew to nearly 30 million subscribers, a testament to the application’s global acceptance and integral role in creative workflows.

This article discusses the latest Adobe Creative Cloud statistics, with special emphasis on growth, financial statistics, and the innovative features that have been introduced.

Editor’s Choice

- Adobe Creative Cloud statistics state that Adobe Creative Cloud, with close to 30 million subscribers in 2024, is an indication of global acceptance.

- In 2023, Adobe earned about USD 19 billion, with Creative Cloud and Document Cloud being the most significant contributors.

- Adobe Experience Cloud contributes for more than 20% of total revenue for the company and is on a growing trend.

- Adobe’s digital media revenues were USD 15.55 billion in 2024, and they are expected to surpass USD 20 billion by 2025.

- For the fiscal year 2025, Adobe projects total revenue between USD 23.30 and USD 23.55 billion.

- The Digital Media segment’s revenue is expected to be between USD 17.25 and USD 17.40 billion, with an 11% YoY ARR growth.

- The company’s Q1 2025 revenue is expected to be between USD 5.63 and USD 5.68 billion, with Digital Media contributing USD 4.17 and USD 4.20 billion to this revenue.

- Adobe Creative Cloud statistics indicate that Generative AI (GenAI) is being integrated across Adobe’s cloud solutions, enhancing workflows and user experience.

- Firefly, which is an AI-powered creative model, allows users to generate images and assets using text prompts.

- Adobe Sensei is augmenting marketing workflows and personalized content creation within Adobe Experience Cloud.

- Collaboration and project management challenges persist, with 70% of creatives facing project workflow obstacles.

- Adobe Creative Cloud statistics show that 60% of creatives believe better project management features could enhance their productivity.

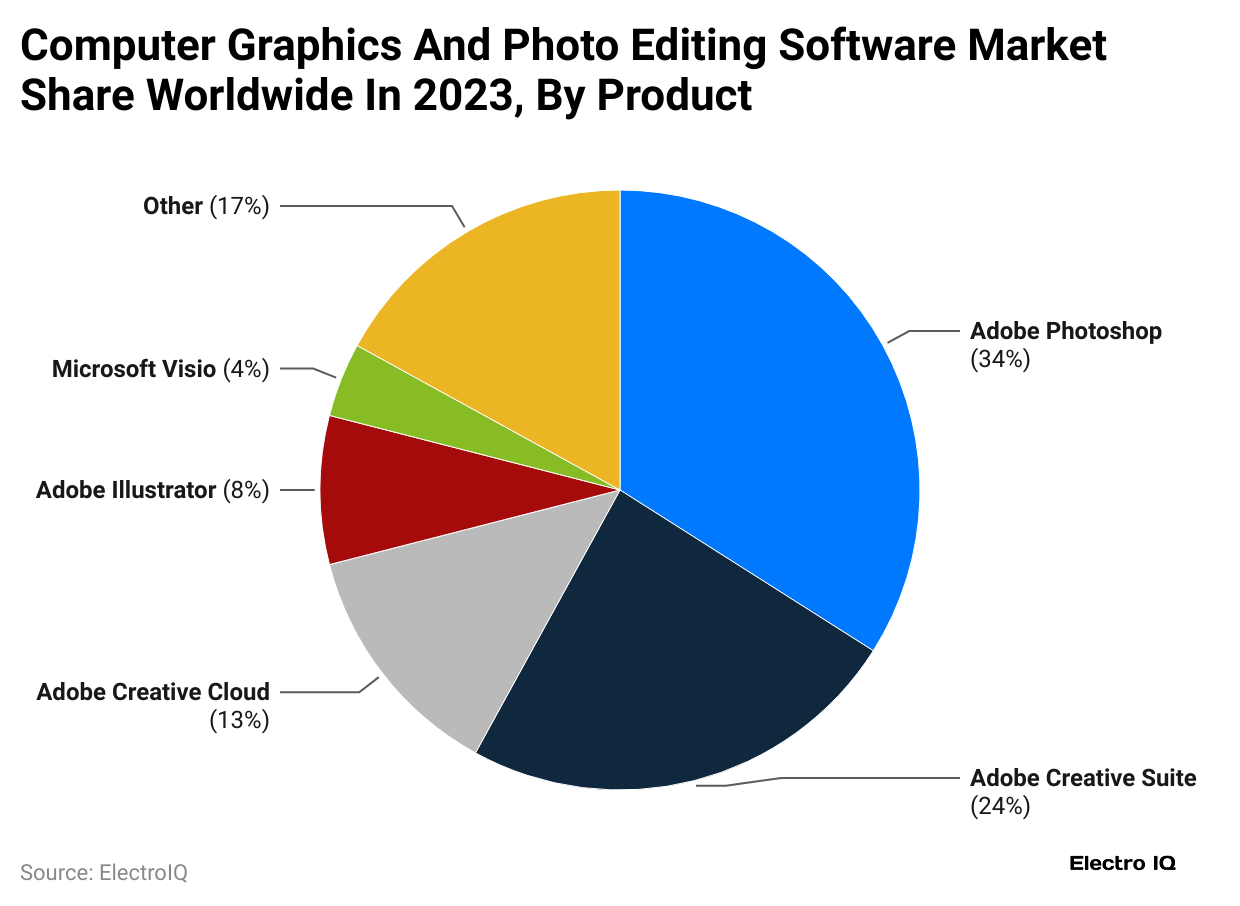

- With a 34% market share, Adobe Photoshop is the most dominant creative software.

- Adobe Creative Suite and Creative Cloud have both 24% and 13% market shares, respectively.

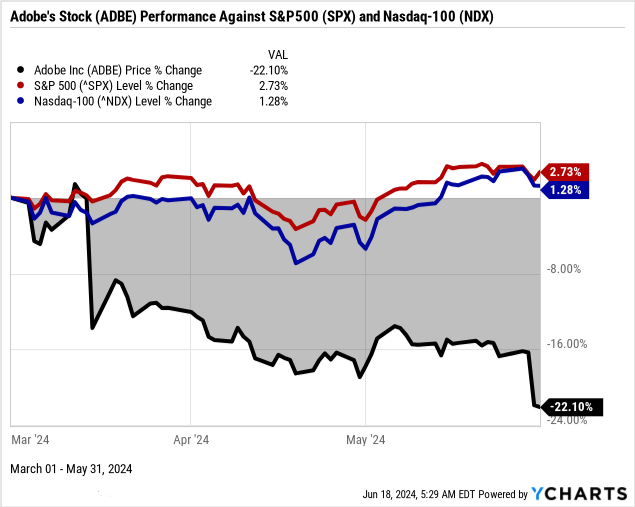

- Adobe stocks fell 22.1% in that quarter, from USD 561.11 to USD 444.76, in stark contrast to the market’s stability.

- Despite the fall, Adobe remains with a market capitalization of USD 199.25 billion.

- Creative Cloud has grown by 85% since 2017, with estimates of subscriber accounts reaching 37 million in 2024.

- Adobe continues to add just under 1 million new subscribers each quarter or 10,000 new users a day.

- It has been eight years since Adobe stopped selling CS6 and has since moved to the cloud entirely.

General Adobe Creative Cloud Statistics

- Adobe Creative Cloud statistics state that the transition to cloud-based subscription services has proved extremely rewarding for Adobe, leading to revenues of more than USD 19 billion in 2023.

- This change has fortified its flagship products, Creative Cloud, which basically consists of Photoshop and Illustrator, and Document Cloud, which consists of Acrobat, generating significant revenue for the company.

- With the purchase of Omniture (a leading web analytics and online marketing company), Adobe has also expanded into the digital marketing space.

- Adobe Experience Cloud has emerged as a major player, accounting for more than 20% of Adobe’s total revenue.

- The company is integrating Generative AI (GenAI) into its cloud solutions to strengthen its competitive edge in the digital landscape.

- With the launch of Firefly, a collection of AI-powered creative models; users are now able to generate images and creative assets based on text prompts.

- Adobe is integrating Adobe Sensei, a service based on GenAI, into Adobe Experience Cloud to create more efficient marketing workflows and personalized content.

- The integration of GenAI is revitalizing workflows and customer experiences and modernizing old products. Adobe continues to innovate and extend its reach within industries, effectively positioning itself for years of rogue growth and ever-increasing success thereafter.

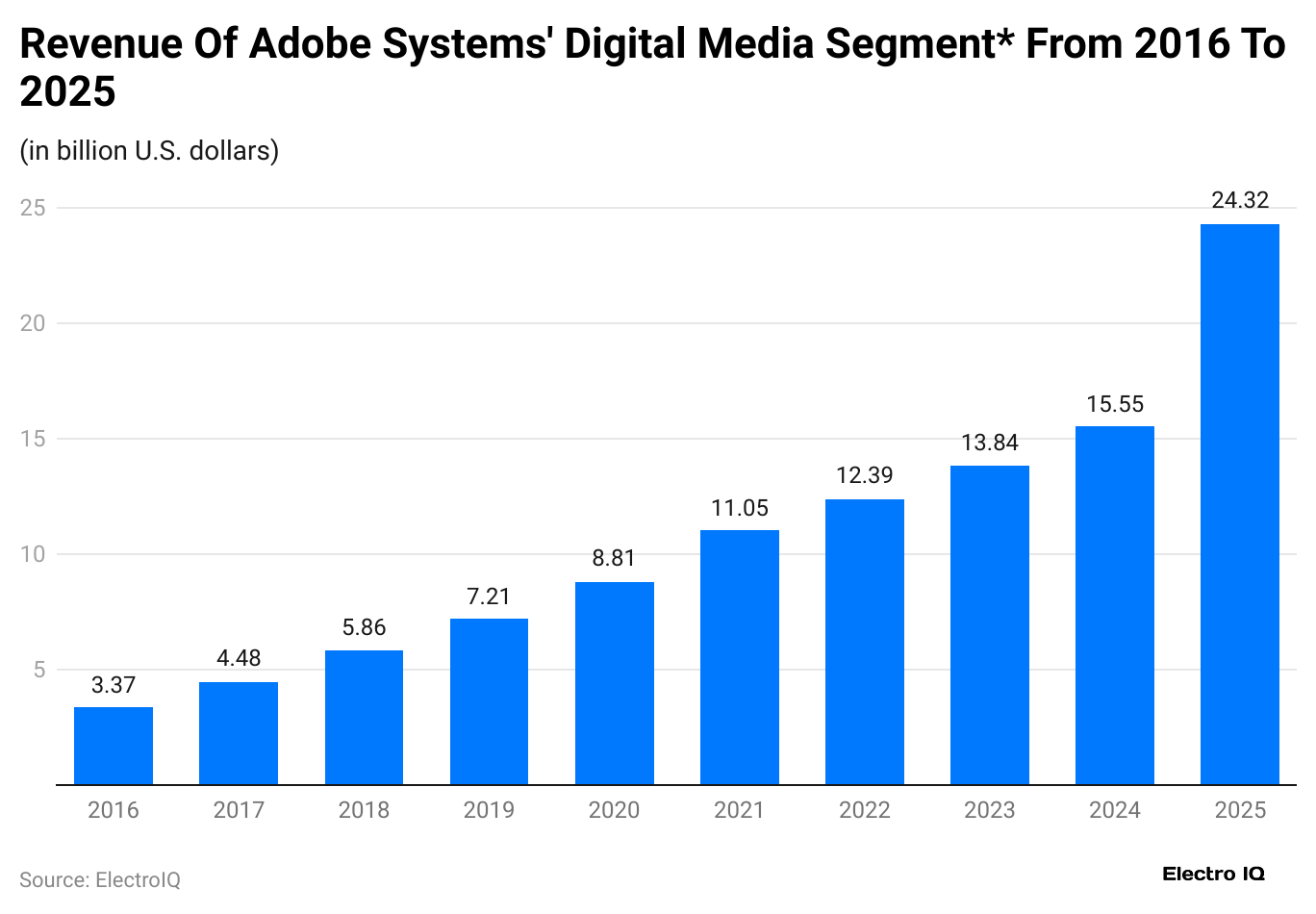

Adobe Systems Digital Media Revenue

(Reference: statista.com)

(Reference: statista.com)

- The department under which Adobe’s digital media segment falls has been growing like a tree since 2016. In 2024, it produced almost USD 15.55 billion in revenue, an amount derived purely from Creative Cloud and Document Cloud.

- Adobe Creative Cloud statistics show the continuous increment in Adobe’s market reach, which it is making for itself while growing in the sectors of content production and document management.

- Forecasting ahead, revenue is expected to jump dramatically, reaching over USD 20 billion as early as 2025.

- This expected growth indicates a surge in demand for Adobe’s cloud applications and consistent innovations in all things creative and document-related.

Adobe Financial Projections for FY 2025

- For FY 2025, Adobe anticipates overall revenue from USD 23.3 billion to USD 23.55 billion. Their Digital Media division (Creative Cloud and Document Cloud) is projected to contribute about USD 17.25 billion to USD 17.40 billion to the revenue.

- Thus, the ARR in this segment highlights sustained demand for Adobe’s subscription service with anticipated growth of approximately 11% year-on-year.

- The Digital Experience, which includes Adobe Experience Cloud naturally and its related services, is expected to amount to around USD 5.80-USD 5.90 billion, with subscription revenues accounting for USD 5.375-USD 5.425 billion.

- The company expects EPS for the year to be approximately USD 15.80-USD 16.10 (GAAP) and USD 20.20-USD 20.50 (non-GAAP).

- The company targets almost a non-GAAP operating margin of 46%, a non-GAAP tax rate of 18.5%, and an approximate diluted share count of about 433 million for the fiscal year.

Adobe Financial Projections for Q1 of FY 2025

- For Q1 of FY 2025, Adobe forecasts total revenue at between USD 5.63 billion and USD 5.68 billion.

- Digital Media is expected to be between USD 4.17 and USD 4.20 billion, with the Digital Experience realm recording USD 1.38-USD 1.40 billion.

- The Digital Experience anticipates a subscription revenue contribution of USD 1.27-USD 1.29 billion. Adobe expects EPS of around USD 3.85-USD 3.90 (GAAP) and USD 4.95-USD 5.00 (non-GAAP) for Q1.

- These projections are highly reflective of continued strong performance and growth of the company across all digital platforms.

Adobe Creative Cloud Collaborations and Project Management

- Adobe employees, whether they be the most creative or otherwise, even as they are also being asked to do more work under the same conditions now, nothing changes in that regard.

- Adobe Creative Cloud statistics show that 28% of non-creatives and 22% of creatives agree that their companies are giving them more work assignments. 60% of both groups report that they expect to complete their tasks quicker than before.

- Collaboration and project management are the main constraints on speed, and they continue to hinder smooth workflow processing.

- 70% of creatives mention project management as a significant pain point, with 27% stating they do not have sufficiently clear project requirements and 26% are struggling with the reviews.

- Generative AI comes as a possible silver bullet; its supposed efficiency-enhancing capabilities have made waves lately among many professionals. As said by the Senior Designer, Havas Play, Lewis Oliver, the tools in Creative Cloud enable instant sharing and collaborative editing of files by mass users.

- They are all going to make the tasks of collection feedback and document sharing less painfully slow and ensure better team collaboration.

- For example: 26% of creatives want to automate tracking reviews, and although 60% agree that project management features could enhance efficiency, only 14% prefer to reduce review time.

- Another 50% of non-creatives face challenges of collaboration, they ask themselves what to do when 30% face extremely long waiting time for reviews; 22% struggle with version control; and 19% with file sharing during reviews.

- Improved project management tools and AI-driven tools would hold the key to streamlining workflows, enhancing efficiencies, and removing manual process burdens in both creative and non-creative environments.

(Reference: vstar.com)

(Reference: vstar.com)

- According to Adobe Creative Cloud statistics, the usage of Adobe Photoshop makes it currently the highest among the shares for creative software users at 34% of the total market. The dominance reflects the software’s being widely used by all and sundry professionals and amateurs for different activities for photo-editing, graphic design, and digital artistry. Extensive features, industry-standard tools, and continuous innovation through AI have made it a popular provider of the service.

- Following Adobe is the Creative Suite with a market share of 24%. Many users still use this line comprising older versions of software like Photoshop, Illustrator, and InDesign even after Adobe went for cloud-based form services. This illustrates a considerable segment that prefers the conventional license mode of purchasing software rather than subscriptions.

- This new subscription-based model, Adobe Creative Cloud, to replace Creative Suite, signs at 13% in such terms. Though not as good as the Creative Suite, it keeps growing as more and more users are accustomed to cloud-based workflows. Such people wish for an access-all-adobe-apps-with-cloud-storage-and-ai-sold-easy features app that packs into the heads of contemporary designers and businesses.

- Adobe Illustrator is the most popular software used by graphic designers, branding professionals, and artists for high-quality scalable artwork. It has a market share of 8%. Although its niche usage is not as lavishly broad as that of Photoshop, this keeps it steady in its measure.

- Microsoft Visio is a 4% market share of the specialized tool for diagramming and vector graphics. This application is used widely in business for generating flowcharts, organograms, and network diagrams. While it does not directly compete with Adobe’s creative suite, it has a small but stable territory in the industry.

- Among them, the other creative software tools add up to 17%.

- This includes all the design, editing, and illustration tools from all the other contenders such as CorelDRAW, Affinity Designer, Sketch, and many up-and-coming creative platforms, basically compiling all of the otherwise interested users in cost-effective or specialist designs outside the Adobe ecosystem.

Adobe Stock Price

- Adobe Creative Cloud statistics show that over the quarter, Adobe stock has been rather disappointing, recording a very large drop-off of 22.1% from the opening price of USD 561.11 to the closing price of USD 444.76.

- This drop is a complete disconnected view from the broader market indices, the leading index, the S&P 500, climbing at only a modest 2.7%, and the NASDAQ 100 rising at just 1.3%.

- The differentiation prompts that Adobe’s stock has suffered from something when not the most, company-specific problems or worries that hit investor confidence, while the rest of the market nonetheless fared quite well.

- For the complete quarter, Adobe had some very high-volatility trading sessions, with stock moving high as USD 585.35 and low at USD 433.97.

- Such huge movement evidences the awful uncertainty and performance instability of the specific stock, most likely induced by external issues related to industry trends, the company’s earnings result, or general investor sentiment. With the fall, Adobe is still keeping a remarkable market capitalization of USD 199.25 billion, showing its place in the industry’s shoes.

- As steeply as the price drops, however, it seems to hint that investors harbor doubts about future growth potential, competitive standing, or financial performance.

- This fall would seem to indicate that the market perception of Adobe has undergone some turnabout on what could be revenue forecasts, competition, or net effects that impact the technology sector as a whole.

Adobe Creative Cloud’s Strong Growth and Adoption

- Adobe Creative Cloud has existed for over a decade, and the software is becoming increasingly popular worldwide.

- Adobe Creative Cloud statistics from the recent past thus prove that it is growing and yet being universally adopted. According to Adobe’s financial results for the year 2024, the Creative Cloud segment recorded an increase of 10.9% in recurring revenue over the last year.

- Previous annual growth rates were thus: 12.7% in 2023, 13.4% in 2022, and 17.3% in 2021.

- As the 12 million-odd paid subscribers were counted in 2017, by the end of 2020, Adobe estimated about 85% growth for the Creative Cloud business since then.

- Following these trends, the estimated number of total Creative Cloud subscribers by December 2024 is around 37 million. This number denotes more than double the number of subscribers from five years ago and represents an increase of around 3.63 new subscribers added in the last one year.

- Adobe Creative Cloud statistics reveal that by adding new subscribers to almost 1 million every quarter, Adobe has revolutionized the subscription intake to around 10,000 active paid members being subscribed in daily operations and will be seeing its upcoming CC 2025 product line.

- Prior to its move to a subscription-only model, around 12.8 million users had installed Adobe Creative Suite (CS) software in approximately 10 years. There have been over two times this many since Creative Cloud began 12 years ago.

- An important aspect of this setup is that every Creative Cloud user now has the latest software updates and so can work together on the same version.

- Adobe stopped selling CS6 eight years ago because Creative Cloud offered better value for the price. Creative Cloud provides access to almost all Adobe products for a simple monthly fee without large upfront costs.

- Thus, for the present, this subscription model has made Creative Cloud one of the most talked-about and successful offerings of Adobe.

Conclusion

According to Adobe Creative Cloud statistics, Adobe upholds its stronghold in the creative software industry through Adobe Creative Cloud, which currently boasts a subscriber base of nearly 30 million, a healthy financial bottom line, and space for increasing innovation. With AI tools like Adobe Firefly and resources like Adobe Stock, the company is living its motto—’User Experience and Need’. Such initiatives give more credence to Adobe’s already well-known will to do better.

FAQ.

According to 2024 data, Adobe Creative Cloud has nearly 30 million subscribers, with expectations of reaching 37 million subscribers by the end of the year. With a consistent addition of almost 1 million new subscribers per quarter, such data continue to show a very robust adoption globally.

Inside Digital Media, which includes Creative Cloud and Document Cloud, contributed US$15.55 billion to Adobe’s revenue in 2024. It is inferred that its revenue projections should exceed US$20 billion in 2025 due to high demand for Adobe cloud-based creative and document solutions.

Adobe has integrated GenAI within its cloud-based offerings: Firefly, an inventive model that automatically creates creative assets with text prompts; and Adobe Sensei, supporting developing personalised content for consumers and marketing workflows in Adobe Experience Cloud.

The most significant problems there are for creatives using Creative Cloud are: Collaboration and project management problems (as indicated by 70% of creatives). Ambiguity over project requirements (27%) and hindrances in the review process (26%) create issues. The rest of the bunch: non-creatives also complain about file sharing, version control, and lengthy review times.

The market for creative software is splintered into a thousand pieces, and Adobe has been quite good at holding onto these pieces: Photoshop – 34% market share (the leading image editing software). Creative Suite – 24% market share (old software still used by most). Creative Cloud – 13% market share (-challenging and growing cloud-based subscription model). Illustrator – 8% market share (the preferred tool for vector graphics).

Adobe’s stock fell by 22.1% in the quarter, going from US$561.11 to US$444.76, even when the market was stable. The fall is attributed to investors’ fears of competition and revenue expectations. Nevertheless, Adobe still commands a market capitalisation of US$199.25 billion and remains the crowning glory of the creative software industry.

Joseph D'Souza founded ElectroIQ in 2010 as a personal project to share his insights and experiences with tech gadgets. Over time, it has grown into a well-regarded tech blog, known for its in-depth technology trends, smartphone reviews and app-related statistics.