Chiplets Statistics By Market Size and Facts

Updated · Jan 28, 2025

Table of Contents

Introduction

Chiplets Statistics: Chiplets are separate semiconductor units that can be linked or superimposed to form a larger and more powerful chip. It makes it easier and even possible to integrate various microarchitectures on one silicon, addressing the subtler and often frustrating drawbacks of conventional monolithic chip designs.

The segmented market has been growing rapidly because of the technical growth area. The demand for high-performance computing is increasing; because chiplets are favourable in resource utilization-optimal segmentation into various functions; industry specialists anticipate many economies in health care, security, graphics, and information technology will grow significantly shortly.

In this article, we will discuss & highlight the Chiplets Statistics.

Editor’s Choice

- According to Chiplets statistics, the Chiplets market is expected to grow by USD 100 million from December 2024. It was reported at USD 4.4 billion, which was in 2024.

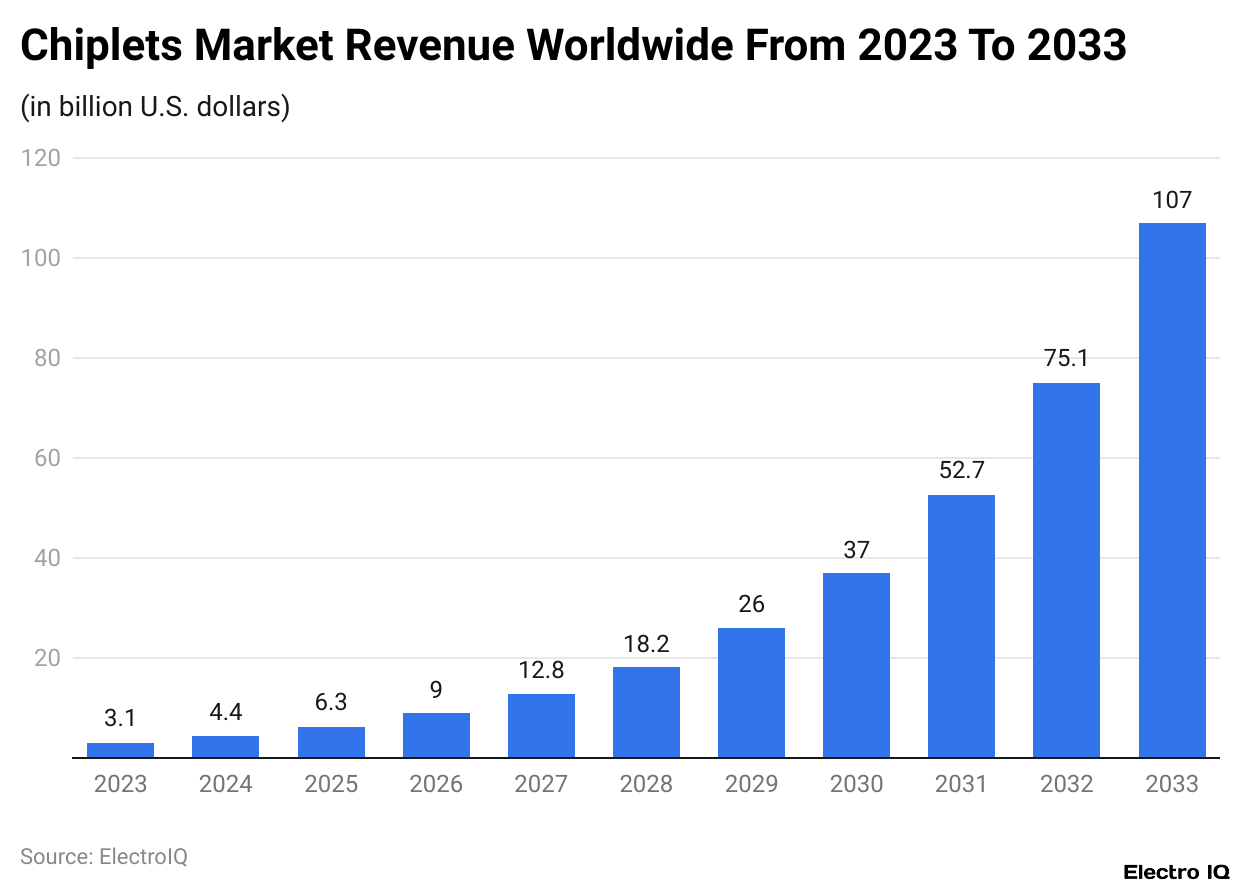

- In 2023, the estimation on a global level was equal to USD 3.1 billion, and by 2033, a CAGR of 42.5% will take USD 107.0 billion.

- The largest segment is microprocessors, and Chiplet-based microprocessors could reach USD 452 million in 2018 and increase up to USD 2.4 billion in 2024.

- High up the list of major investments in chiplets technology might be referred to Intel’s US$7 billion to put in additional packaging facilities in Arizona and AMD’s US$35 billion of the Xilinx buy.

- The focus of the market at that juncture, particularly where high performance is necessary, has been set by Nvidia with the acquisition of ARM at US$40 billion; it has meshed with their strategies in incorporating chiplets.

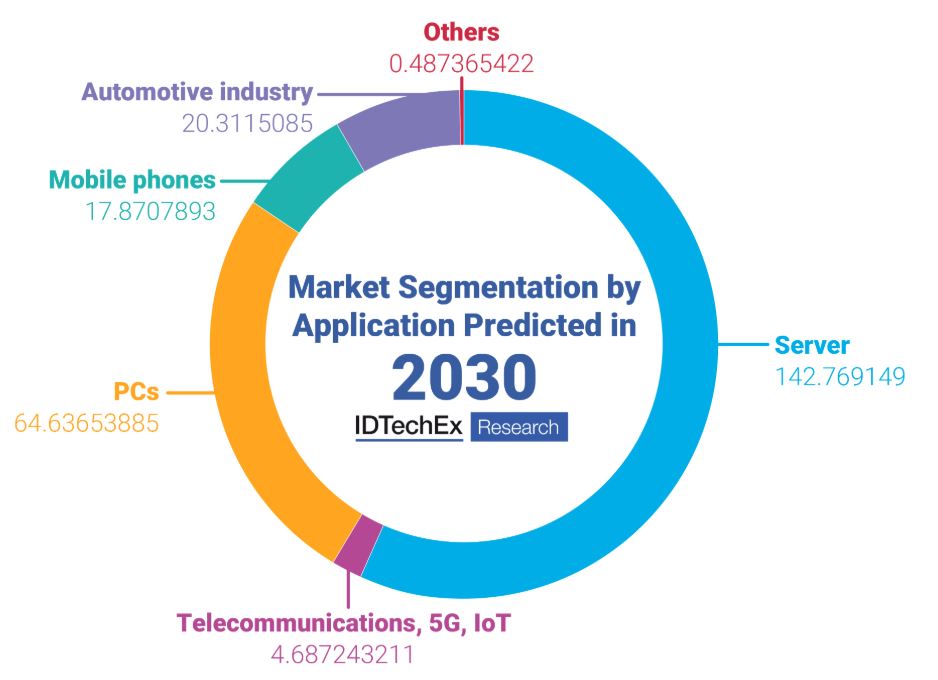

- According to Chiplets statistics, by 2030, the PC segment will be leading with a 64.64% share, with servers pinning it at 142.77% and then automotive hitting 20.31%.

- Another acceptable market share for mobile phones is at 17.87% while growing shares are for telecommunications and IoT applications, expected in a 4.69% increment.

- Growing at a compound annual growth rate (CAGR) of 42.5% is said to ensure the market share growth of the chipsets market with an end-of-decade value of USD 107.0 billion in 2033.

- Specifically, the chip market valuation in 2024 to be at USD 4.4 billion would see a growth of the year.

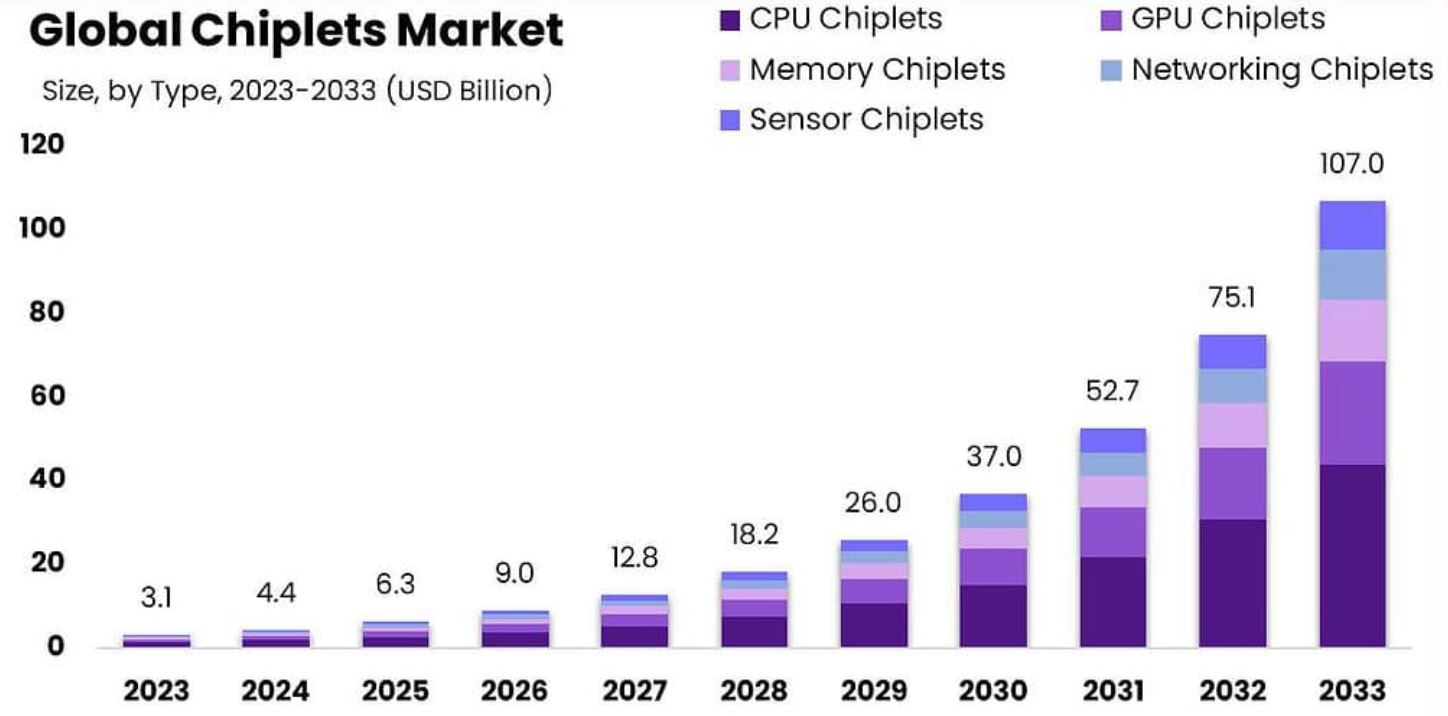

- Though they had a low market share percentage in 2023 with only 41%, CPU Chiplets at that time had already gained dominance in the market because they not only boosted the overall processing power but also ensured energy efficiency.

- Chiplets statistics reveal that in 2023, the Consumer Electronics segment accounted for the market lead and claimed 26% market share.

- Also in 2023, IT and Telecommunications were among the major players, with market share contributions as high as 24%.

- By 2023, Asia Pacific emerged as the most important player, owning over 40% of the market.

- Around 29.8 of the global chipset market is kept by North America. There are high expectations in Europe, led by countries like Germany, the UK, and France, to account for about 20.9% of the market share in 2023.

- Chiplets statistics state that in Latin America, the analogue status for the chipset market accounts for about 5.7% and displays a gradual upward growth share in this section, though still lagging behind other regions.

- Middle East and Africa have recently become emerging markets with 3.1% of the share in the chiplets industry, demonstrating a promising potential for future enlargement.

Chiplets Market Revenue

(Reference: statista.com)

(Reference: statista.com)

- Chiplets is a term used to refer to discrete building blocks of semiconductors, which can be combined or otherwise assembled to create a larger and more complex chip.

- This has enabled the designers to create chips by combining different micro-architectures thus creating highly flexible, performance-oriented products.

- Day by day, the chiplets market has been growing due to the increasing utility of current advanced packaging methods.

- Chiplets statistics state that the global market for Chiplets alone was valued at 4.4 billion USD come 2024, what with all these megabuck chiplet technologies kinnetasizing across the globe.

- Future forecasts see this trend rising through to 2033 where the market is forecasted to value around 100 billion USD: developments of greater powerful, less pricey and customizable semiconductor solutions in a range of industries that meet dynamic requirements for semiconductors.

Chiplets Market Size By Type

(Source: semiwiki.com)

(Source: semiwiki.com)

- The global size of chiplets market in 2023 reached 3.1 billion US dollars. Such growth is expected to gradually take place for fifty years, from enablers to solution providers, during which the industry will evolve and grow at a compound annual rate of 42.5%, culminating in an anticipated 107 billion USD market size by 2033.

- In 2024, the market is expected to start with 4.4 billion USD. Participation in the chip market comprises stand-alone devices that can be combined to form large integrated circuits (ICs) and systems-on-chip (SoCs).

- There are components for performing different functions, such as processing, carrying out assertiveness, and output operations.

- The chiplet approach is superior to traditional, monolithic IC designs. It has the following significant advantages, i.e., it is highly flexible, scalable, and modular.

- Between 2022 and 2023, the chiplets market has seen several strategic decisions taken by different major companies in the semiconductor industry in terms of investments, making clear how the technology is fully capable of addressing challenges related to the issues of complexity in both semiconductor manufacturing and design.

- Chiplets statistics done by Omdia show that microprocessors will become the largest market segment for chiplets, with the market share on chips that can accommodate chiplets expected to grow from USD 452 million in 2018 to USD 2.4 billion in 2024.

- Intel has partnered with IMEC, a research centre in Belgium, to further develop interconnects and packaging for chiplets. As well, Intel’s capital expenditure of US$7 billion in Arizona, towards constructing new packaging plants combined with TSMC, shows its strategic direction to promote chiplet integration.

- This move thus indicates a deeper commitment toward assuring 3D packaging technologies for the future of next-gen semiconductor devices.

- Similarly, AMD’s acquisition of Xilinx for US$35 billion shows that this will be an increasing concern with the strategic importance of chiplets and packaging within the next three years, particularly for applications demanding high computational power such as data centres and AI.

- Chiplets statistics indicate that Nvidia’s acquisition of ARM for a sum of US$40 billion, and that launch itself that year with announced GPU using multi-chip deep packaging launching in the 2023-24 timeframe, marks the trend that gives it a similar focus and direction in chipset-based approaches to survive within the high-performance computing market.

Chiplets Market Segmentation By Application

- A segmentation analysis for the chiplets market in 2030 will characterize the different adoption rates across application sectors.

- The leading segment will be expected to come from PCs, serving 64.64% of the market.

- Chiplets statistics reflect a significant need for chiplet consoles in personal computers. In servers, the figures can be stated at 142.77%.

- Estimations indicate that the automotive industry will also make high usage of chiplets-20.31%, and the reason seems to be the fact that automotive systems need very advanced semiconductor technologies.

- Another 17.87% of the value is expected to come from mobile equipment, which is indicative of the ongoing requirement for such extremely powerful and efficient chips for use in smartphones.

- These telecommunications applications will occupy 4.69% of the market, driven by the demands and high-speed performance of connectivity infrastructure technology.

- “Others” will hold a minor part or 0.49%.

Chiplets Market By Region

- Chiplets statistics state that North America has the highest market share, standing at 52.5%. Major players in the technology sector and a healthy business ecosystem drive technological innovation in this region.

- The close second is Europe with 50.3% shares.

- The region has a growing focus on automotive and industrial avenues, thus expanding the chiplets market.

- Further, Europe dreams of minimising e-waste and improving energy efficiency with the help of chiplets and thus advances research in this field shortly, thus being labelled a valued contributor to sustainable electronic design.

- The next is Latin America at a rate of 48.6%, all of which is quite competitive based on a rise in overall investments.

- Growing demand for advanced semiconductor solutions is expected with escalating intended connectivity and initiation of new digital transformation schemes.

- One of the most profound chip system markets will continue to be Asia-Pacific, which accounts for nearly 54.6% of the entire global market for regional share.

- The most important attribute that Asia-Pacific has as compared to the rest is very extensive manufacturing activities.

- These industries, on the other hand, have rapidly flourished, particularly consumer electronics and automotive.

- The Middle East & Africa’s share is 39.8%, marking that the region has high growth potential.

Conclusion

As per Chiplets statistics, the future market of Chiplets optimization is driven and the continued increase in high-performance calculations will foster a cost-effective alternative arrangement for semiconductors. While there are issues in standardization and IP protection, there are considerable advantages of chiplets being modular across different industries and they are certainly poised to become a significant constituent of the chip-making technology domain in the future.

Sources

FAQ.

Chiplets Market will achieve 42.5% annual growth, putting the market capitalization at US$107.0 billion by 2033 from US$4.4 billion in 2024.

Top industries that will incorporate chiplets will be PCs, which will have 64.64% of the market by 2030, servers (142.77%), automotive (20.31%), handset (17.87%), and industry-specific communications/product lines (4.69%). All on account of high-performance computing and cost-effective semiconductor solutions.

Key investment actions include Intel’s US$7 billion in an Arizona packaging facility with TSMC, AMD’s US$35 billion to acquire Xilinx, and Nvidia’s US$40 billion bid to acquire ARM in an effort to further advance 3D packaging technologies as well as high-performance computing.

Still, the strongest contribution to the market of Chiplets goes to Asia Pacific at 54.6%, followed by North America (52.5%), Europe (50.3%), Latin America (48.6%), and Middle East & Africa (39.8%), with growth driven by semiconductor manufacturing, telecommunications, and digital transformation.

Manufacturers can integrate different microarchitectures using Chiplets. These could help offer flexibility, scalability, modularity, and cost efficiency to manufacturers. This approach addresses the challenge of growing design complexity and aims to enhance performance without the limitations that monolithic chip fabrication incurs.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.