DocuSign Statistics By Market And Revenue

Updated · Jul 02, 2025

Table of Contents

Introduction

DocuSign Statistics: For the last couple of years, business processes have been undergoing a digital transformation faster than ever, and the evolution could be attributed to electronic signature solutions such as DocuSign. , as a frontrunner in the electronic signature and agreement management industries, DocuSign spearheaded the progression of this phenomenon.

For this performance, DocuSign’s activities shall reflect as highly impacted by its international market in customer figures, and technological advancements. In this article, we will discuss the important DocuSign statistics.

Editor’s Choice

- According to DocuSign statistics, DocuSign’s revenue for 2023 amounted to US$2.8 billion, an increase of US$1.8 billion compared with 2019. That’s not all because it has been consistent over the years.

- The entire amount of revenue reached US$712.4 million during the fiscal year 2025, representing an increase of 8% from the previous year. Subscription revenue increased to US$695.7 million as billings jumped 13% to US$833.1 million.

- DocuSign ended the quarter with US$1.2 billion in cash and investments and had repayments of US$689.9 million convertible senior notes.

- Total revenue during the fiscal year 2024 amounted to US$2.8 billion, an increase of 10%. Subscription revenues were US$2.7 billion, also an increase of 10%.

- Billings increased by 9% to a total of US$2.9 billion, while the non-GAAP gross margin improved to 83%.

- GAAP net income per basic share was 0.36, while the fiscal year 2023 had a loss of 0.49. Non-GAAP net income per diluted share was US$2.98, up from US$2.03.

- DocuSign continued its continuous increase in net sales, reaching US$2.76 billion in 2024, with estimates for the years beyond at US$2.96 billion by 2025 and US$3.39 billion by 2027.

- DocuSign statistics reveal that by the end of 2024, EBITDA rose to US$787.1 million and is expected to reach US$1.2 billion by 2027.

- EBIT exhibited a similar rise, growing to US$711.4 million by 2024 and expected to exceed US$1.04 billion by 2027.

- DocuSign commands 67 percent of the market, significantly ahead of competitors, and is still at the forefront of digital document management.

- The company’s shares are currently selling for US$83.17, up 2.325 percent. The highest during these 52 weeks was US$107.86, while the lowest was US$48.70.

- DocuSign statistics show that DocuSign has seen a drop from 110% asa net retention rate in Q2 2023 to 98% in Q4 2024, thereby suggesting some challenges in retaining and expanding customers.

- The company reached its all-time high of 1,080,000 customers in Q4 2023, but it continued to dip marginally in fiscal year 2024, ending somewhere between 1,045,000 to 1,060,000 customers.

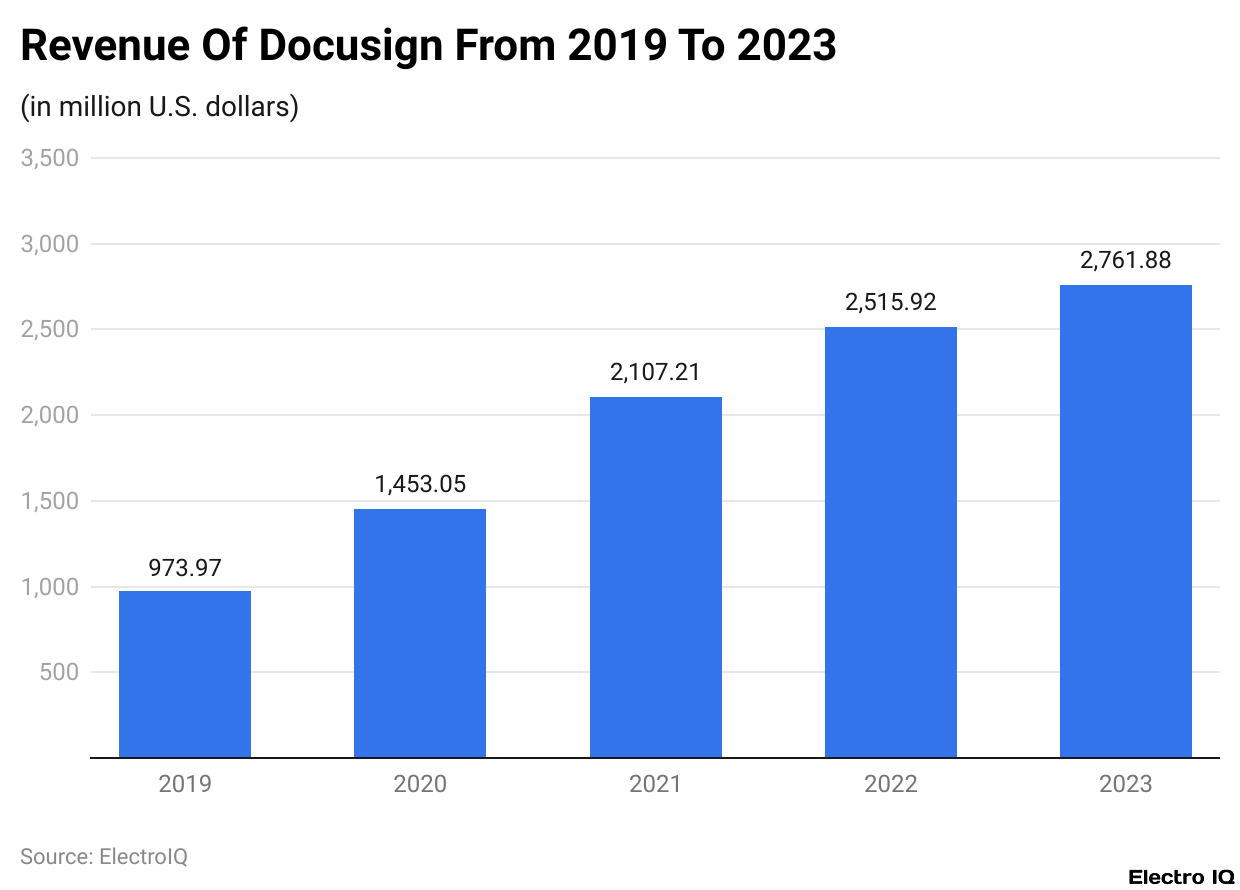

DocuSign Revenue

(Reference: statista.com)

- DocuSign statistics show that DocuSign, which is based in the US, posted US$2.8 billion in revenue in 2023. The company observes a fiscal year ending January 31.

- When stacked against 2019 revenue, this is a significant increase of around US$1.8 billion, and facts showing this growth remained linear through the ages reflect a constant rise from 2019 to 2023.

DocuSign Financial Highlights 2025

- DocuSign statistics reveal that DocuSign reported revenue of US$712.4 million, up 8% year-on-year. Included in this revenue, subscription revenues continued to reflect an increase of 8%, reaching US$695.7 million when compared to the previous year’s subscription revenues.

- Professional services and other revenue were US$16.7 million, a 5% increase from the previous year. Billings at US$833.1 million, this is a 13% increase from the billings a year ago.

- GAAP gross margins were the same, at 79%, in both periods; their Non-GAAP gross margin was 82%, slightly below the 83% reported in the same period last year.

- A GAAP net income of US$0.13 per basic share was recorded based on 206 million shares, clearly an improvement as compared to US$0.02 per share on 202 million shares a year ago.

- A diluted basis showed an improvement in GAAP earnings of US$0.13 on 210 million shares, compared to US$0.02 on 206 million shares outstanding in the prior year.

- Non-GAAP earnings per diluted share were just above US$0.76 on 210 million shares versus US$0.65 on 206 million shares a year prior.

- Net cash from operations of US$270.7 million is a significant increase from US$137.1 million for the same period a year prior. Free cash flow was US$248.6 million compared to US$113.0 million a year ago.

- The company ended the quarter with cash, cash equivalents, restricted cash, and investments amounting to US$1.2 billion.

- During the quarter, DocuSign also repaid a principal of US$689.9 million associated with its 2024 convertible senior notes.

- Total revenue was US$2.8 billion in the fiscal year 2024, marking a 10% increase from the same period last year.

- Meanwhile, subscription revenue was US$2.7 billion, also a 10% increase; professional services and other revenue amounted to US$75.2 million, up 2% year-on-year. Billings grew to US$2.9 billion, representing a 9% increase year-on-year.

- While GAAP gross margin remained at 79% in both years, non-GAAP gross margin was at 83%, up from 82% in the previous year.

- GAAP net income per basic share was US$0.36 per share based on the existence of 204 million shares, as opposed to a loss of US$0.49 per share based on an existence of 201 million shares in the fiscal year 2023.

- On a diluted basis, the GAAP net income per share was US$0.36 based on the existence of 209 million shares; in comparison, a loss of US$0.49 per share was recorded in the previous year.

- Non-GAAP net income per diluted share was at US$2.98 based on 209 million shares, which is a significant jump from US$2.03 in the fiscal year 2023 based on 206 million shares.

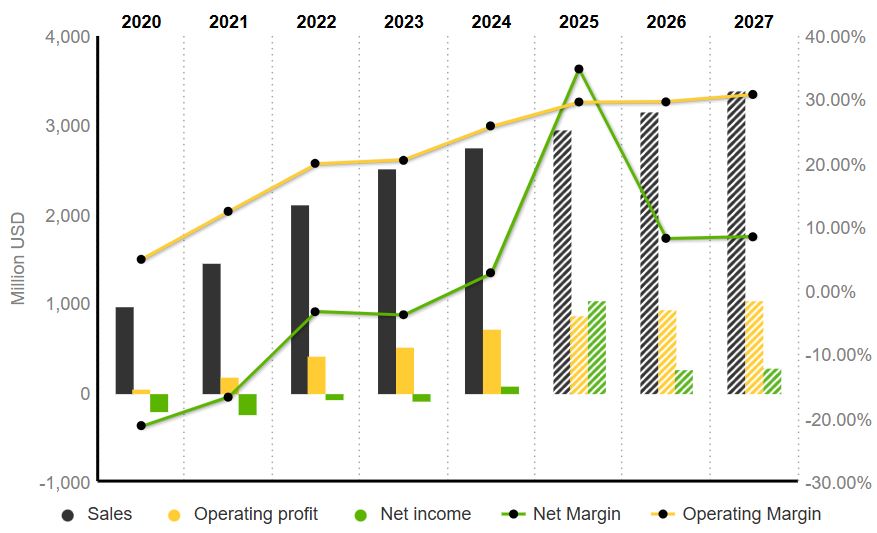

DocuSign Income Statement

(Source: in.marketscreener.com)

- Net sales continued to steadily increase at DocuSign. In 2020, net sales were US$974 million, which increased by 49.19% in 2021 to US$1.45 billion.

- Sales continued to rise in 2022, with an increase of 45.02% to US$2.1 billion. By then, the growth ratehad slowed in 2023, albeit at a positive 19.4% increase, leading to net sales of US$2.52 billion. In 2024, net sales reached US$2.76 billion, reflecting an increase of 9.78% compared to the previous year.

- With this positive tendency in mind, projected sales will reach US$2.96 billion in 2025, US$3.15 billion in 2026, and US$3.39 billion in 2027, with annual rates of growth ranging from 6.39% to 7.53%. EBITDA also keeps going up and up.

- In 2020, EBITDA was at US$97.51 million. Then, in 2021, it grew a whopping 131.88% to US$226.1 million. The good times kept rolling with EBITDA in 2022 shooting up by 110.62% to US$476.2 million. In 2023, growth slowed somewhat to 22.29%, and EBITDA was reported at US$582.4 million.

- DocuSign statistics show that in 2024, a great surge was recorded at 35.14% to US$787.1 million, while EBITDA is anticipated at US$967.2 million for 2025, US$1.08 billion for 2026, and US$1.2 billion for 2027, with the forecast growth rates across these years ranging between 10.93% to 22.89%.

- Earnings before interest and taxes (EBIT) showed similar growth. In the year 2020, EBIT was recorded as US$47.33 million, and it surged by an astonishing 281.65% in 2021 to reach US$180.6 million.

- The growth remained high in 2022, where growth was 132.01% to US$419.1 million. EBIT for 2023 stood at US$516.8 million after growing by 23.32%, followed by a 37.64% rise in 2024, which pushed EBIT to US$711.4 million.

- It is believed in the forecast that EBIT will be US$875.8 million in 2025, US$935.7 million in 2026, and US$1.04 billion in 2027, all with growth rates between 6.84% and 23.12%. Interest payments have had variance throughout the year.

- According to 2020, interest categorized as paid was -US$29.25 million, slightly rising to -US$30.8 million in 2021, while by 2022, it had dropped drastically to -US$6.44 million yet remained virtually at -US$6.39 million in 2023.

- Interest paid in 2024 was -US$6.84 million and was projected to be -US$1.48 million in 2025, -US$1.9 million in 2026, and -US$1.65 million in 2027. Earnings before taxes (EBT) gradually recover from negative values.

- The figure for EBT in 2020 was -US$203.6 million, while EBT dropped further to -US$229.5 million in 2021. In 2022, EBT, however, tremendously improved, with losses reduced by 70.84% to -US$66.91 million.

- By 2023, EBT was at -US$89.88 million, which means a range of 34.32% drop against last year. However, by 2024, the company was back to earning tax before attaining US$93.68 million.

- DocuSign statistics estimate promise the continuing growth projection; EBT is expected to be at US$224.9 million in 2025, US$274.3 million in 2026, and US$354.4 million in 2027, with a range of annual growth rates from 21.96% to 29.22%.

- The net income also has a similar trend. In 2020, the net income was -US$208.4 million, dipping further to -US$243.3 million in 2021.

- Significant improvement in loss reduction was achieved by the company in 2022, registering a 71.23% drop to -US$69.98 million in net losses.

- However, net income was down again in negative territory in 2023 at -US$97.45 million. But by 2024, the company made a comeback with a net income of US$73.98 million.

- The future projects show a sharp rise in 2025, which goes up to US$1.03 billion.

- But net income reduces to US$257.1 million in 2026, then rises again up to US$287.2 million in 2027.

- Annual changes were expected to fluctuate dramatically, with an exceptional 1,294.24% increase in 2025, followed by a steep decline of 75.07% in 2026 and then a gentle increase of 11.71% in 2027.

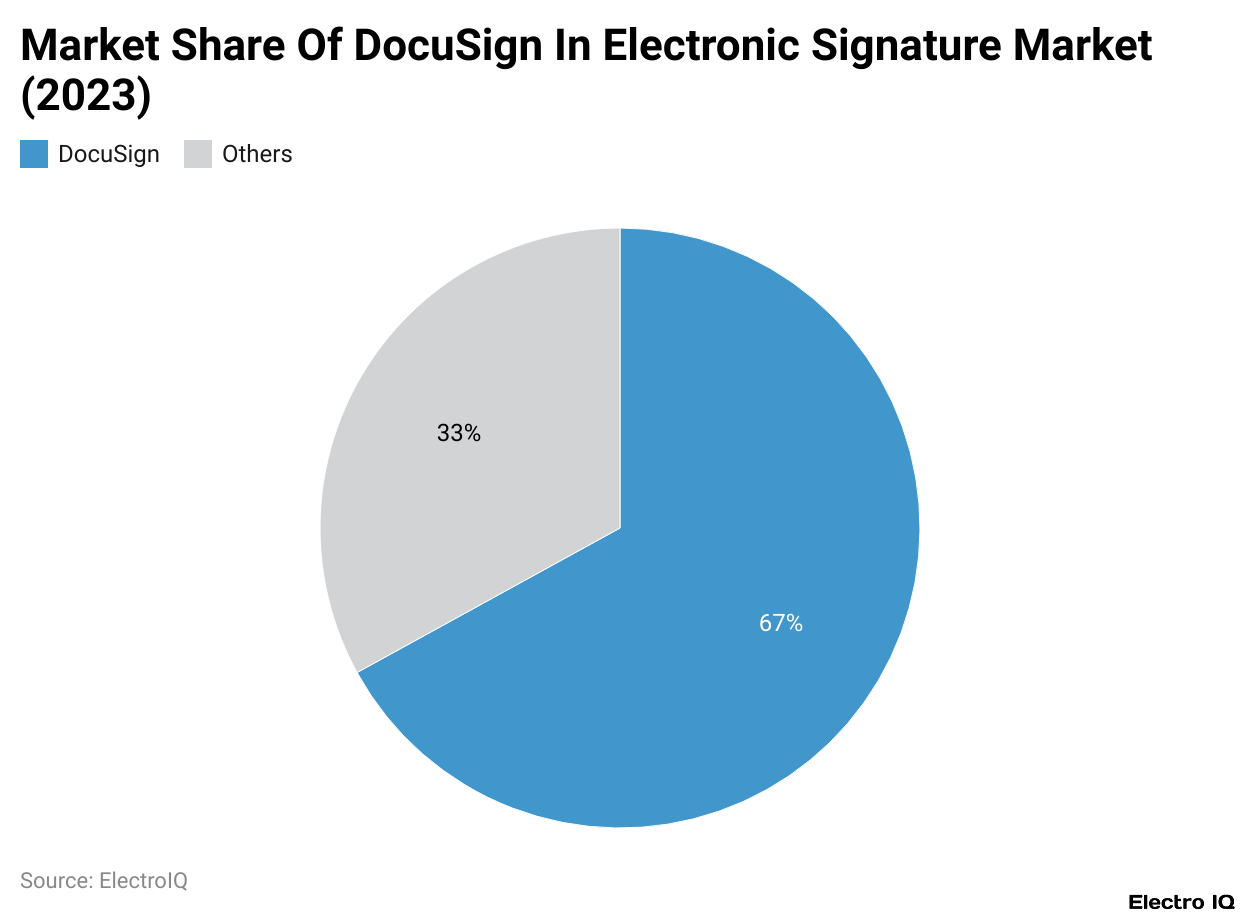

(Reference: co-variance.medium.com)

- DocuSign controls 67% of the market and leads its competitors by far.

- DocuSign statistics indicate that the company is the largest supplier in the field: The remaining market of 33% is distributed to companies that provide similar services.

- This distribution confirms the strongly entrenched position of DocuSign and the mass adoption of its services because most businesses and individuals depend on DocuSign for digital document management and electronic signature services.

- Such a large share in the market means that DocuSign has successfully branded itself as the first choice in this area because of brand awareness, customer reliability, and ongoing innovation.

- For a whole bunch of competitors to carve out only 33% among them means that the temptation exists, but none could put any serious dent in the leadership of DocuSign.

- Certain attributes like a rich feature set, seamless integration ability, and powerful customer support keep the competition at bay for DocuSign.

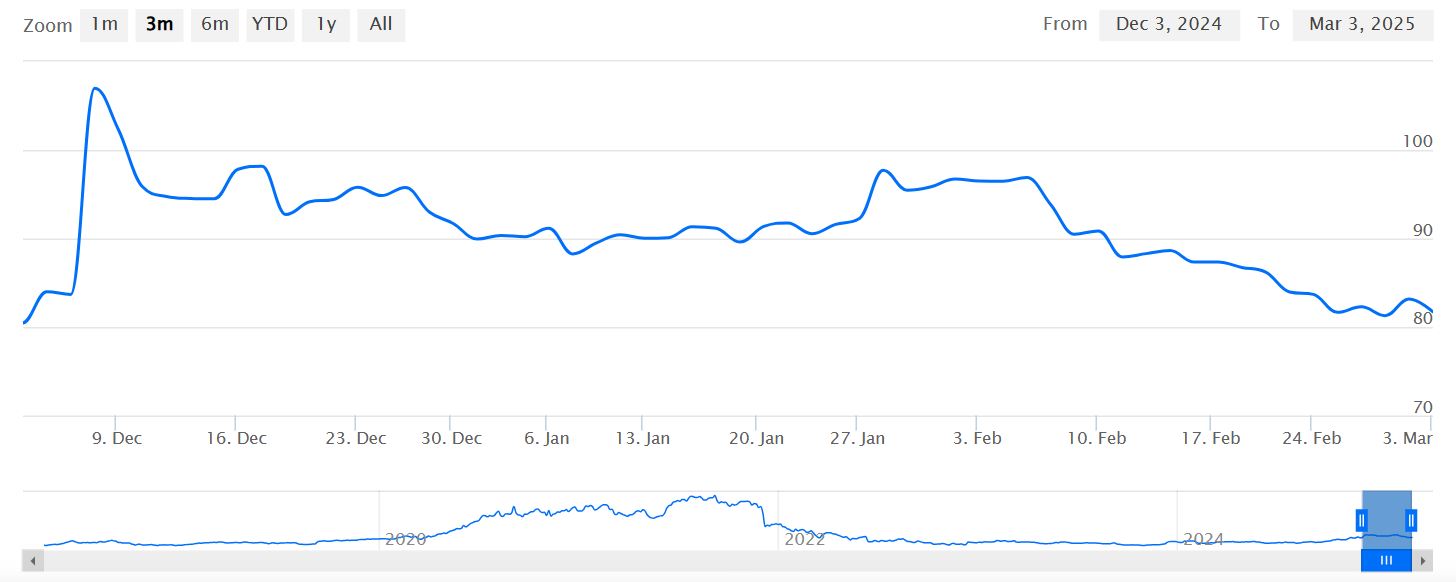

DocuSign Stock Price

(Source: investor.docusign.com)

- DocuSign statistics show that DocuSign shares trade under the ticker symbol DOCU on NASDAQ, currently priced at US$83.17, up US$1.89 for the day. In percentage terms, this translates into a rise of nearly 2.325%.

- Throughout the trading day, the stock saw intraday highs of US$83.18 and lows of US$79.81.

- It opened at US$81.02, indicating that it was slightly higher than the last closing price of US$81.28. The shares had important price action during the previous 52 weeks.

- These shares traded in a 52-week range of US$48.70-US$107.86, which indicates that there was some volatility within the last year.

- During the trading session, the volume of shares traded comprised 737, which indicates the shares traded in the market. Therefore, it can be inferred that this trading and price action indicate active investor interest.

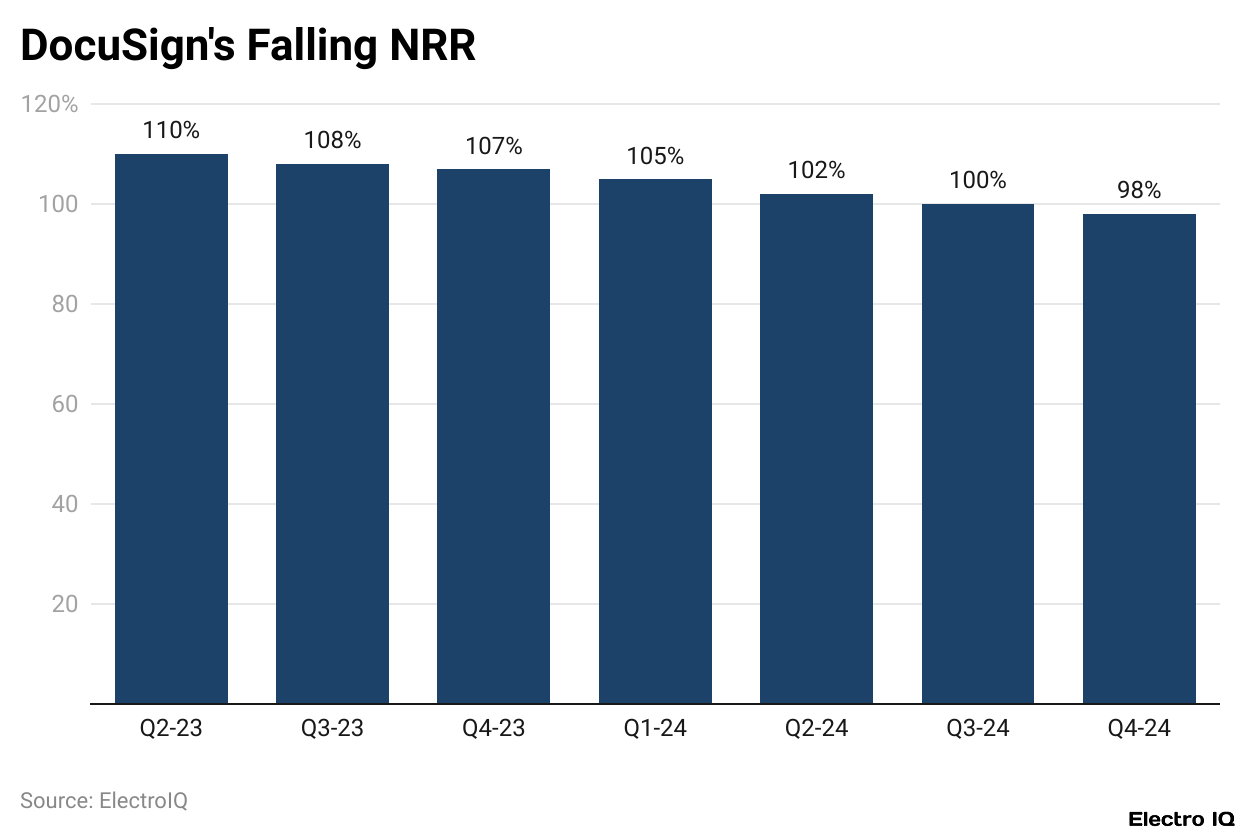

Docusign Net Retention Rate

(Reference: nanalyze.com)

- DocuSign statistics state that DocuSign has been experiencing a decreasing net retention rate over the last few quarters. For instance, during Q2 of the fiscal year 2023, this rate stood at 110%, denoting increased spending by existing customers on the services offered by DocuSign.

- Subsequently, this rate reduced to 108% in Q3 and again dropped to 107% during the final quarter of 2023.

- This downward trend has persisted into the fiscal year 2024, and for Q1, the net retention declined further to 105, meaning Q2 saw a further dip to 102.

- This continued to a 100% rate by Q3, indicating that revenue from current customers stopped growing.

- The Q4 rate for the fiscal year 2024 saw another drop to 98%, showing that some of the customers began to decrease their in use or even leave the platform.

- This net continuous downward trend indicates that there are inherent challenges in customer retention as well as expansion, perhaps triggered by market conditions or pricing propositions coupled with the competition.

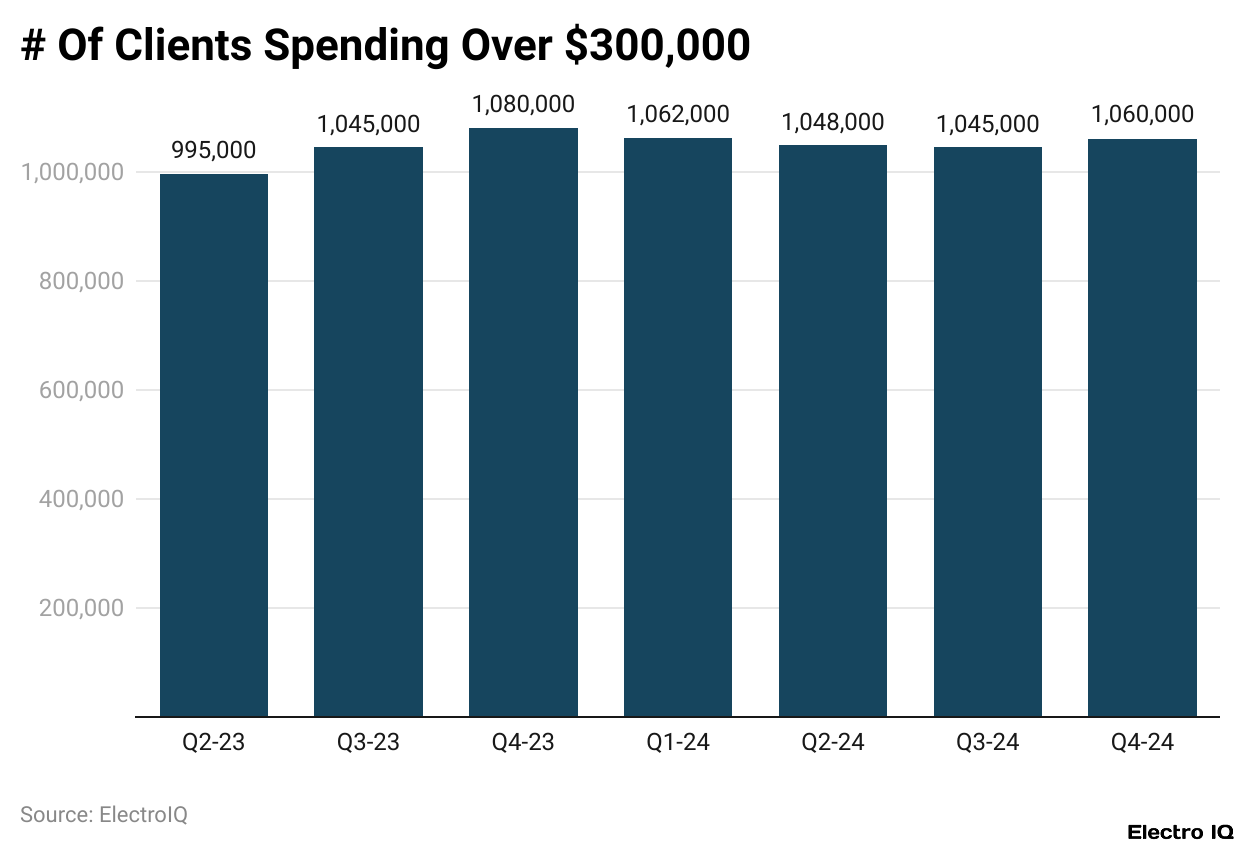

DocuSign Clients

(Reference: nanalyze.com)

- DocuSign statistics reveal that the number of DocuSign clients presents a certain variability for the past two years. In Q2 of FY 2023, the company boasted 995,000 clients.

- This grew into 1,045,000 in Q3 and further increased into 1,080,000 by Q4 of the same fiscal year.

- Then, clients dropped slightly in Q1 of FY 2024 to 1,062,000. The declining trend continued, and by Q2, it was at 1,048,000 clients.

- The trend continued to be steady by Q3 at 1,045,000. Still, it increased again in Q4 of FY 2024, reaching a headcount of 1,060,000.

- To sum up, the count of clients peaked at 1,080,000 in Q4 of the fiscal year 2023.

- However, it recorded a slight decline in the fiscal year 2024, though the volume rose and fell as it hovered around a generally stable base of clients numbering from 1,045,000 to 1,060,000.

Conclusion

As per DocuSign statistics, DocuSign has become increasingly embedded in how business gets done. While it is one much-needed tool during the pandemic, electronic signatures facilitate conversion, reduce cost, and speed up time.

FAQ.

DocuSign has achieved continuous growth in revenues over time, reaching US$2.8 billion in 2023, an increase of US$1.8 billion from the year 2019. For fiscal year 2025, total revenue was US$712.4 million, an 8% year-over-year increase. It is further projected that the revenue would grow to US$2.96 billion in 2025 and US$3.39 billion by 2027.

DocuSign, holding an immense 67% of the market share in digital document management and eSigning, is the largest vendor in the segment. The remaining 33% is divided between quite a number of competitors, none of which has even remotely challenged DocuSign for its supremacy.

In FY24 they incurred a net GAAP income of USUS$0.36 basic share and gained an impressive turnaround from an actual net loss of US$0.49 in FY23. The free cash flow rose to USUS$248.6 million this year and USUS$113.0 million last year, with cash and short-term investments approximately USUS$1.2 billion at the end of the quarter.

The net retention rate has decreased from 110% in Q2 2023 to 98% in Q4 2024, signalling that existing customers spend less or even leave the platform. This decline indicates a difficulty in customer retention and expansion.

DocuSign is said to have peaked with clients at 1,080,000 in Q4 2023 while continuing to fluctuate between the 1,045,000 and 1,060,000 marks during FY 2024. Although with some year-on-year declines, the client base appears largely stable.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.