Mobile Accessories Statistics and Facts

Updated · Jan 27, 2025

Table of Contents

Introduction

Mobile Accessories Statistics: The mobile accessories market has seen a significant rise in demand in due course of the past few years. The rise in the adoption of smartphones and continuous advancements in technology are some of the major forces that have boosted the demand for mobile accessories.

These work wonders starting from their protective cases, and touch-and-go wireless buds and intensify the functionality, shielding, and personalization factors of mobile devices. By 2024 there was no reason not to assume the global sale of mobile accessories would top ongoing memory segment trends as their preference by consumers constantly took shape in the new choices. This article will show the mobile accessories statistics trends and growth.

Editor’s Choice

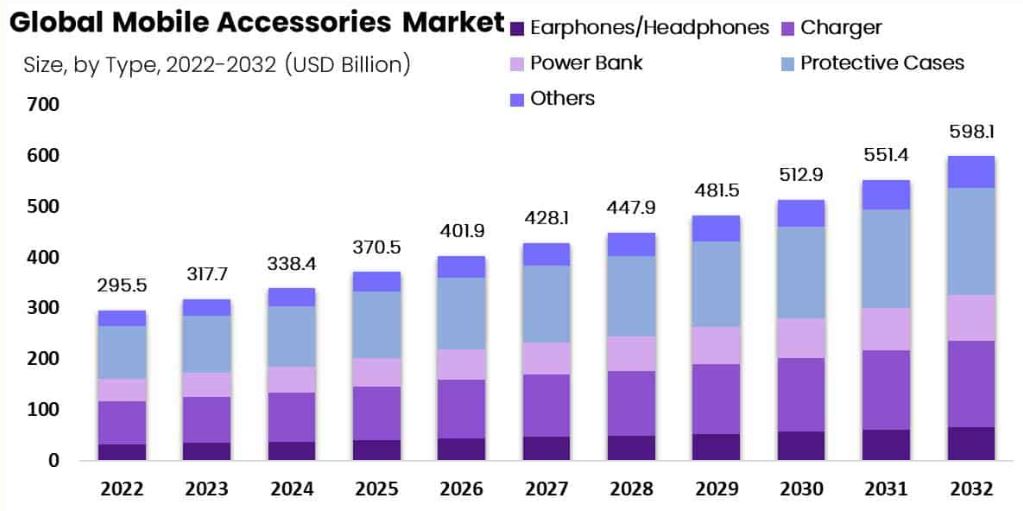

- In 2024, mobile accessories market revenue was USD 338.4 billion, with consistent growth observed in subsequent years.

- By 2031, revenue is forecasted to reach USD 551.4 billion, growing at a compound annual growth rate (CAGR) of 7.5%.

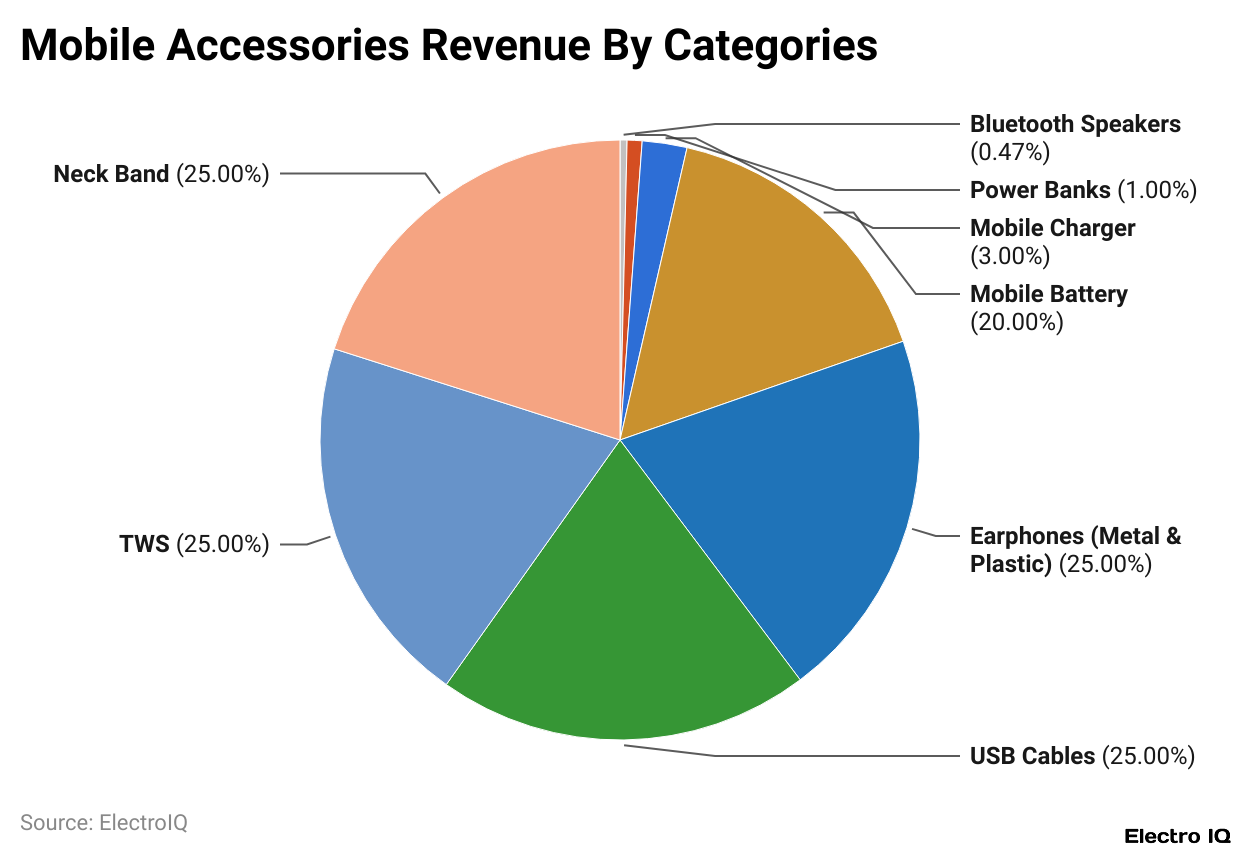

- Mobile chargers (3%), power banks (1%), Bluetooth speakers (0.47%), mobile batteries (20%), earphones (25%), USB cables (25%), TWS Earbuds (25%), and neckbands (25%) formed the revenue distribution in the product category.

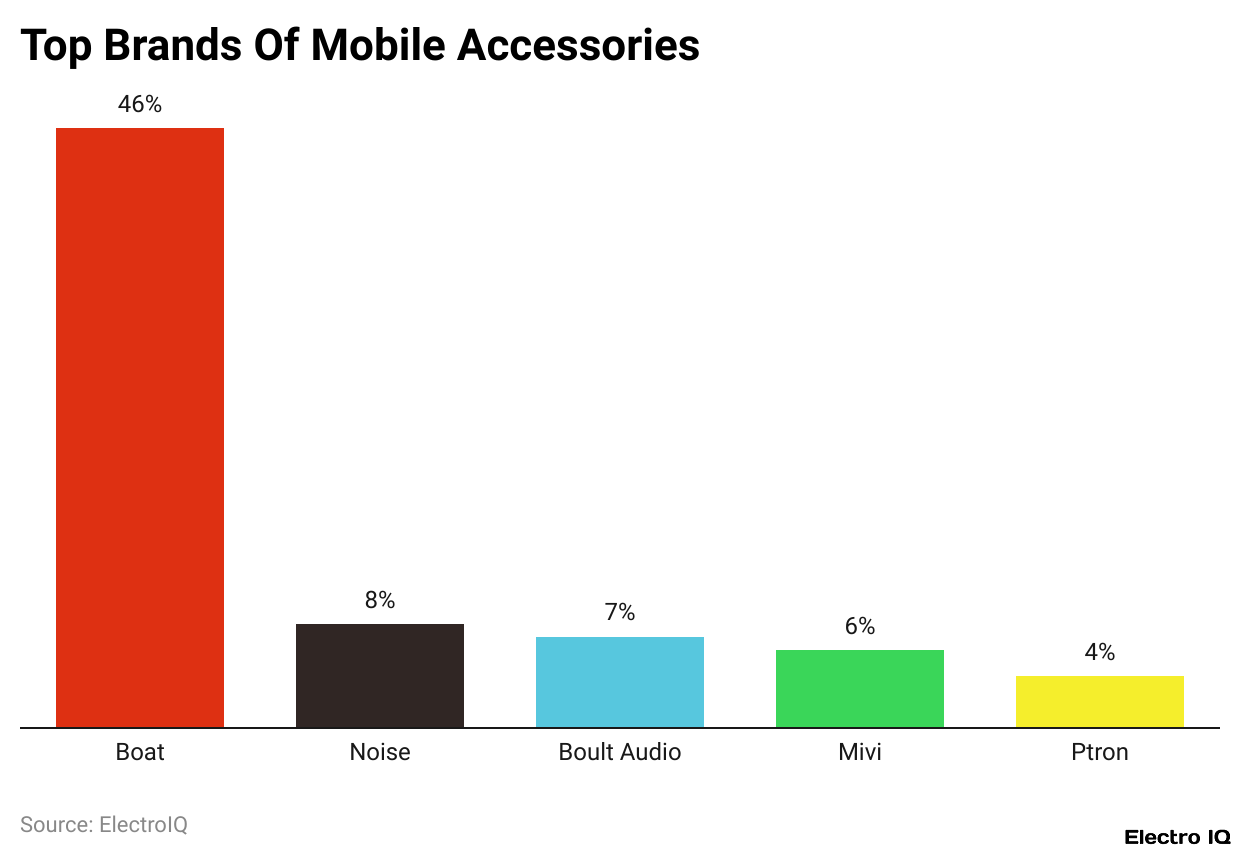

- The biggest competitor in the market is with a 46% share Boat, followed by Noise (8%), Boult Audio (7%), Mivi (6%), and Ptron (4%).

- Mobile accessories statistics show that market size was pegged at USD 9.83 billion in 2023 and is anticipated to be USD 17.75 billion by 2030 with an 8.2% CAGR.

- Young smartphone users (16-24 years) have the most number of accessories as opposed to the older age groups.

- eReader usage dropped from 31% in 2015 to 26% in 2019, with only 30% of their users operating on a daily basis.

- Smartwatch ownership stumps from 1% of the year 2014 to 10% in 2019, where 64% of such devices are used daily.

- A survey conducted among 4,150 UK citizens revealed that 89% have smartphones, thus indicating the saturation of the market.

- Consumers aged 16-24 averaged eight smartphone accessories, while the overall adult population averaged six.

- Mobile accessories statistics reveal that 53% aged between 16-24 years used smartphones on a daily basis for video content, whereas 37% used them primarily for phone calls.

Mobile Accessories Revenue

(Reference: statista.com)

(Reference: statista.com)

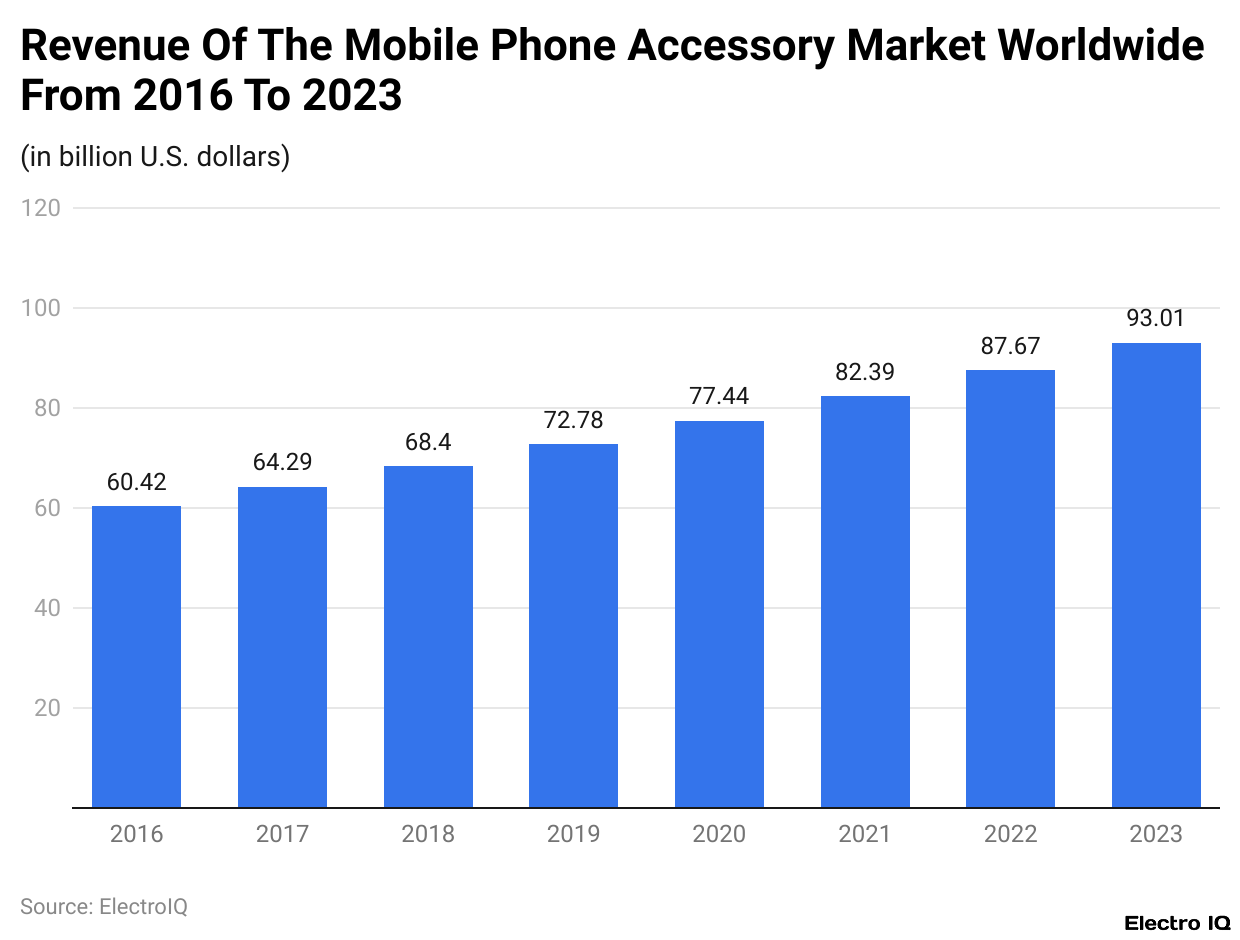

- Mobile accessories statistics state that the mobile phone accessories market has been growing steadily in recent years. In 2016, the market size stood at around USD 60.42 billion but increased during the past couple of years, eventually hitting USD 93.01 billion.

- The upward trend has been marked by consistent growth in revenue year over year -sales driven by the popularity of smartphones, technological advances, and the demand for accessories-enhanced use, such as protective cases, wireless audio devices, power banks, and others.

- People around the world have been spending more and more on various accessories, which has led to the growth of the market.

- Given that mobile devices are becoming crucial for use in daily lives, demand for their accessories is expected to become more pronounced.

Mobile Accessories Market Size By Type

(Source: scoop.market.us)

(Source: scoop.market.us)

- Mobile accessories statistics show that the mobile accessories market has been consistent in terms of revenue growth over the past years and is believed to continue with this trend during the forecast period.

- The market recorded a market size of USD 254.5 billion in 2020, rising to USD 278.2 billion last year. In 2022, the trend continued, and sales reached USD 295.5 billion, with a 2023 forecast being estimated at USD 317.7 billion.

- The market would remain on the higher side with revenues forecasted to brain USD 338.4 billion in 2024 and USD 370.5 billion in 2025.

- By 2026, the total market capacity equals USD 401.9 billion. It is expected that market growth will remain steady even in the years to come, reaching USD 428.1 billion in 2027, USD 447.9 billion in 2028, and USD 481.5 billion in 2029.

- On a longer-term horizon, this will mean that the market for mobile accessories will grow to USD 512.9 billion in 2030, USD 551.4 billion in 2031, and USD 598.1 billion in 2032.

- With the compound annual growth rate (CAGR) projected at 7.5%, these values point solidly toward a bright and promising future for the industry and its sustained expansion, which is driven by technological advancements and a continually increasing demand from consumers.

Mobile Accessories Revenue By Categories

- Mobile accessories statistics show that the proportion of total revenue is not linked solely to market sales products contribute differently to the entire market.

- A small 3% goes to mobile chargers showing that they are essential in powering devices.

- Others suggest that the relatively small share section means that people either have chargers with their phones or buy alternatives from third parties.

- However, power banks rake just 1% into the pool, evidently indicating the reduced necessity for power banks with every advancement in smartphone battery efficiency and available fast-charging solutions.

- Bluetooth speakers now account for 0.47% of the market, quite minute, perhaps due to the fact that users are replacing them with more personal devices in audio earphones and TWS (True Wireless Stereo).

- Among these, 20% comes from mobile batteries, and there is high demand for the products: replacement phone batteries over time to extend the device lifespan.

- The earphone market accounts for 25% with the existence of metal and polymer counterparts since their uses in music, calls, and gaming.

- Also, similar share percentages are obtained for USB cables-they account for 25% of the market; mobile devices use them for charging and transfer of data.

- TWS earbuds also add up to make 25% of the shares, marking its increase in popularity simply because it is wireless and comfortable with new-rated sound since it works with active noise cancellation.

- Mobile accessories statistics indicate that Neckband’s share is 25%, so these seem to remain fairly competitive in the category of TWS earbuds among customers desiring long-lasting battery life, steady physical activities, and affordability.

- The distribution of revenue across categories suggests the health of the mobile accessories market while some traditional players like chargers, power banks, and some small tickets are increasing their share; wireless audio devices, power banks, and USB cables largely form larger market segments.

Top Brands Of Mobile Accessories

(Reference: slideshare.net)

(Reference: slideshare.net)

- Mobile accessories statistics state that the market of mobile accessories is quite competitive with a number of big brands vying for buyer attention. Leading the market is Boat, a brand that dominates the scene with a 46% market share highest in the market and the most users.

- The high appeal of products lies in a vast catalogue that serves the double role of high quality even with low pricing, covering products like earphones, headphones, smartwatches, and speakers.

- This brand has become very reputable because it contains stylish designs with advanced features that make consumers prefer it. Right on Boat’s heels at 8% of the market is Noise, which emerges as the second preference of clients.

- Noise is famous among youngsters and health enthusiasts due to its smart wearables like smartwatches and wireless earbuds. It is one of the most innovative, and cost-effective players in the mobile accessories market.

- Boult Audio comes in close third with a 7% market share. The company is making waves in the audio accessories marketplace because of its high-performance wireless earbuds, and headphones go at high prices, which are certainly very competitive in today’s context. Its attention to sound quality and durability has brought it a good number of customers.

- Holding a 6% share in the entire market makes Mivi a newly emerging name in the mobile accessories industry. As promised, its “Made in India” audio products draw one immediate spike in revenues.

- Mobile accessories statistics show that the “sound quality” of Mivi speaks to the real value of the scripts and writings. The market keeps growing along with more products, extending its market within India. In the field of mobile accessories, Ptron is great with its 4% market share.

- How it satisfies budget-conscious consumers is nothing less than impressive, offering affordable yet feature-rich accessories to wireless earphones, chargers, and smart wearables.

- Regardless of the fierce competition from the players, they were able to make their niche market all for Ptron, and it has a vision for price-sensitive buyers.

- All is very dynamic in the market of mobile accessories, which are continuously innovating with the consumer choice.

- Although Boat has kept the lion’s share size of the section, other brands like Noise, Boult Audio, and Mivi have also gone a step further with the invention of new headphones and microphones.

- So are other brands like Ptron, which have witnessed the slowest growth in this part of the audio.

India’s Market Dynamics

- Focusing more on Indian markets, significant expansions have so far been noted in the mobile accessories markets.

- Mobile accessories statistics state that in 2023, the figure was at USD 9.83 billion, and it will witness a growth rate for arriving at an opportunity worth USD 17.75 billion by 2030. With an estimated CAGR of 8.2%, it will surely propel from 2024 to 2030.

- This growth is associated with the increasing adoption of mobile phones, greater internet accessibility, and expansion in the number of online retail stores offering access to almost every accessory.

- Smartphones are getting better, and now, there is a high demand for protective accessories to prevent damage. This has engendered good sales with outsize growth in cases and screen protector purchases by customers as they secure their devices.

- The era of wireless has made the products a hit with the proliferation of wireless earbuds and headphones. The convenience that wireless ears encrypted devices bring has made them an essential accessory for very many smartphone users.

- With more features on smartphones, greater expectations for durable power sources are evident. This has made sales soar for power banks and fast chargers, which are critical when it comes to offering extended battery life and immediate recharge solutions.

Type Of Mobile Accessories

- Young smartphone users nowadays have been observed to have a rich variety of gear, particularly those aged 16 to 24 years, when compared to users representing other age groups.

- Indeed, eReading has suffered a popularity loss over the years, with sharp ownership falling from 31% to 26%.

- Hence, among eReader owners, only 30% of them use the electronic book not more than once a day. Smartwatches, unlike eReaders, experienced a bumper increase in positivity. Their adoption grew sharply from 1% to 10%.

- A significant number, 64%, of the owners, which makes it impressive, had incorporated them fully into their daily schedules.

- Mobile accessories statistics show that a 4,150 population survey demonstrated the smartphone usage trends of the residents of the U.K., indicating that 89% of Britain now has a smartphone, which could mean that reaching smartphone-ownership saturation point in the country is in the near future.

- The young smartphone-reliant users drive usage that is moving towards a growingly pervasive market for accessories, especially among those between 16 and 24.

- An average of eight accessories is seen in this age group; on the other hand, the average adult uses only six accessories.

- About half of those aged from 16 to 24 use smartphones every day for watching stories, videos or live posts, while only one-third use those gadgets every day to make calls.

Conclusion

As per mobile accessories statistics, Such innovative changes are seen through a maturation process into a major industry of mobile accessories. Everything that has to do with our daily life is from mobile phones- banks to shopping, booking a cab to updates of our life to watching live television-the mobile phone markets have come in such manifold ways into our lives.

Sources

FAQ.

Harnessing cumulative growth, the global mobile accessories market has projected an increase in revenue from US$254.5 billion in 2020 to an estimated US$598.1 billion by 2032 driven by a 7.5% CAGR.

Earphones-25 %, USB cables-25 %, TWS earbuds-25 %, Neckbands-25 %, and Mobile batteries-20 % contributed the most. Chargers-3 %, power banks-1 %, and Bluetooth speakers-0.47 % are the lower kinds.

Leading the mobile accessory segment, Boat has a market share of 46%. It is followed by Noise (8%), Boult Audio (7%), Mivi (6%), and Ptron (4%) as the players who define wireless, budget-friendly accessories in the competitive landscape.

The market for mobile accessories in India was worth US$9.83 billion in 2023, and it is expected to grow further to touch US$17.75 billion by 2030, at a CAGR of about 8.2 %, due to a hike in the adoption of smartphones and an increase in penetration of e-commerce activities.

The rise in the use of smartphones, an increase in demand for wireless technology (earbuds and neckbands), the sale of various protective accessories (cases, screen protectors), and a turn towards fast charging and power solutions shaped the industry.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.