Streaming Statistics By Revenue, Number of Podcast Users And Subscribers

Updated · Nov 06, 2024

Table of Contents

- Introduction

- Editor’s Choice

- Revenue of Digital Streaming Services in Different Countries

- Increase in Internet Users

- Digital Music Revenue

- Video-on-Demand Users in The United States

- Video Streaming Service Monthly Subscription Price in The US

- Number of Podcast Users Worldwide

- Consumer Spending in Digital Home Entertainment

- Spotify Premium Subscribers

- List of Video Streaming Services

- List of Audio Streaming Services

- Video Hosting services

- Streaming overview

- Conclusion

Introduction

Streaming Statistics: Streaming video refers to multimedia streaming playback for online and offline media viewing. Mostly, it deals with various networks using packets from servers to clients that get rendered in real-time. The landscape encompasses video, music, and gaming platforms, fundamentally altering how consumers engage with digital content.

The shift towards streaming services has been accelerated by improved internet infrastructure, widespread mobile device adoption, and changing consumer preferences. As we go forward, we will go through the Streaming Statistics and learn relevant information about this entertainment platform.

Editor’s Choice

- United States leads digital media revenue with $174.72 billion in 2023

- Netflix maintains highest premium streaming price at $19.99 monthly

- Spotify reached 246 million premium subscribers by Q2 2024

- US internet users are projected to reach 343.48 million by 2029

- Music streaming revenue expected to hit $13.96 billion by 2027

- AVOD services predicted to reach over 200 million users by 2027

- Digital home entertainment spending approached $40 billion in 2023

Revenue of Digital Streaming Services in Different Countries

(Reference: statista.com)

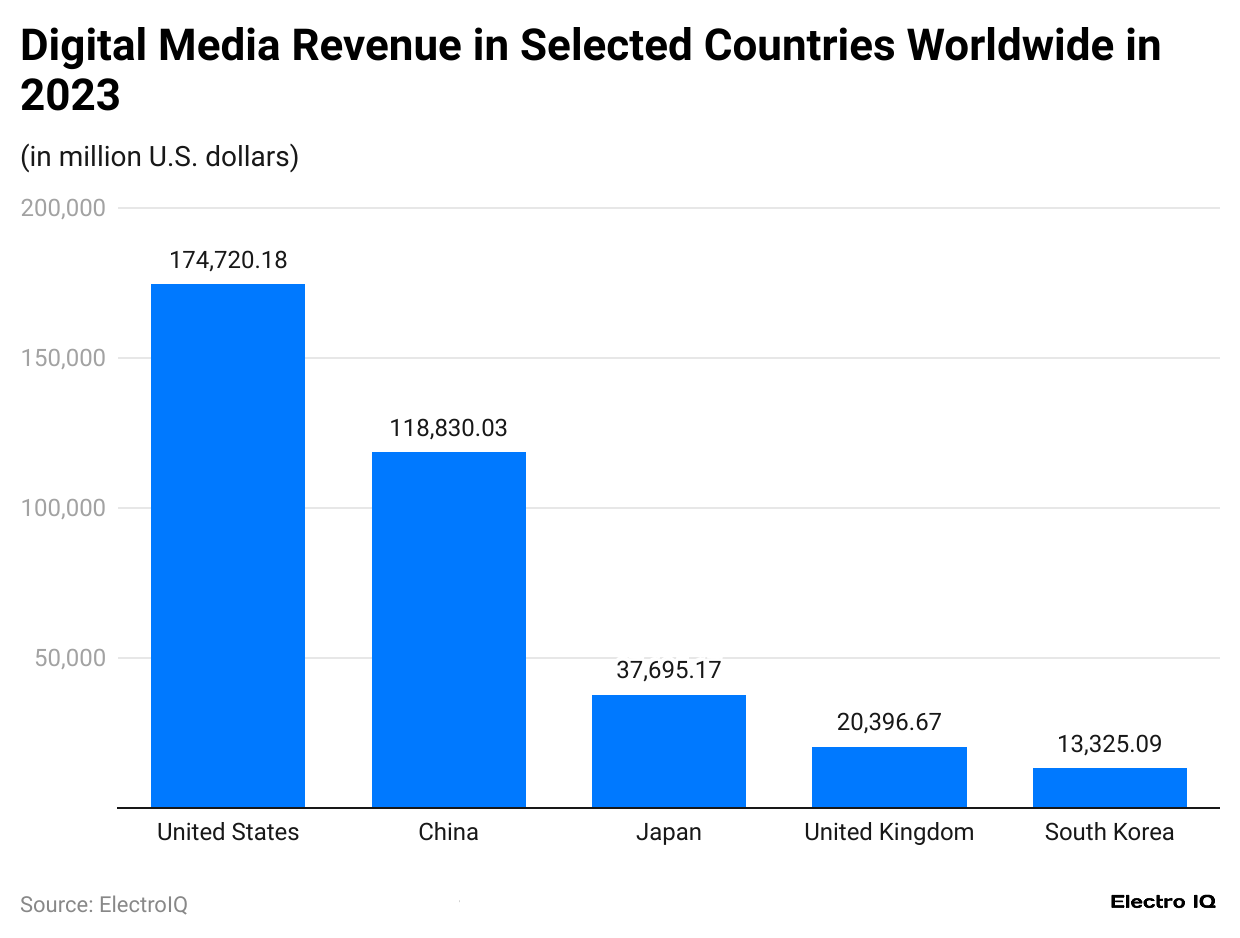

- Streaming Statistics show that the revenue from digital media is concentrated in the following regions: China, the United Kingdom, South Korea, Japan, and the United States.

- The United States leads significantly in digital media revenue, generating $174.72 billion in 2023, followed by China with $118.83 billion, Japan with $37.7 billion, and the United Kingdom and South Korea with $20.4 billion and $13.3 billion.

Increase in Internet Users

(Reference: statista.com)

- Streaming Statistics show a steady increase in internet users in the United States from 2020 to 2029, though the growth rate appears to slow down slightly in the latter years.

- The number of internet users in the United States was 301.78 million in 2020 and is projected to grow consistently yearly.

- It is estimated that by 2029, the number of users is expected to reach 343.48 million Internet users.

Digital Music Revenue

(Reference: statista.com)

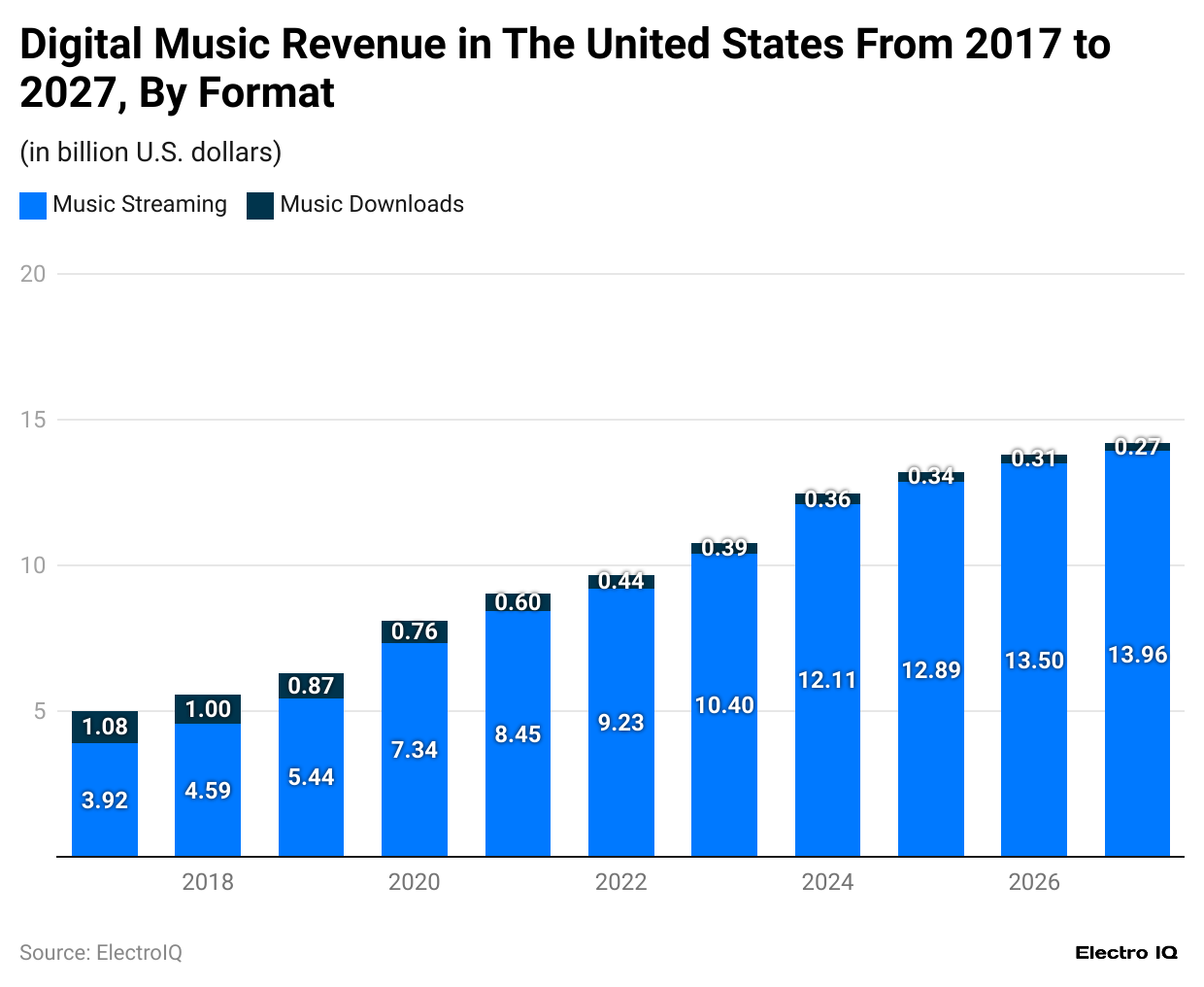

- Streaming Statistics show that there has been a clear shift in consumer preference from music downloads to streaming services over the decade, with streaming becoming the primary revenue source for digital music in the United States while downloads phase out almost entirely.

- The revenue for music streaming was $3.92 billion, which increased to $10.4 billion by the end of 2023. By the end of 2027, the revenue will be $13.96 billion.

- Music downloads, however, have declined, dropping from $1.08 billion in 2017 to a forecasted $0.27 billion in 2027.

Video-on-Demand Users in The United States

(Reference: statista.com)

- Streaming Statistics show that AVOD and SVOD services dominate the video-on-demand market in the U.S., reflecting consumer preference for streaming models that offer either ad-supported free access or subscription-based content.

- Advertising Video-on-Demand (AVOD) maintains the highest user count throughout the period, with over 200 million users by 2027. Video Streaming (SVOD) shows steady growth, rising from around 100 million users in 2017 to over 150 million by 2027.

- Pay-per-view (TVOD) and Free Ad-Supported Streaming TV (FAST) have comparatively lower user counts, with TVOD stabilizing at around 50 million users. At the same time, FAST will grow gradually from around 20 million to 40 million by 2027. Video Downloads (EST) will remain the least popular, with minimal growth and a user base below 30 million.

Video Streaming Service Monthly Subscription Price in The US

(Reference: statista.com)

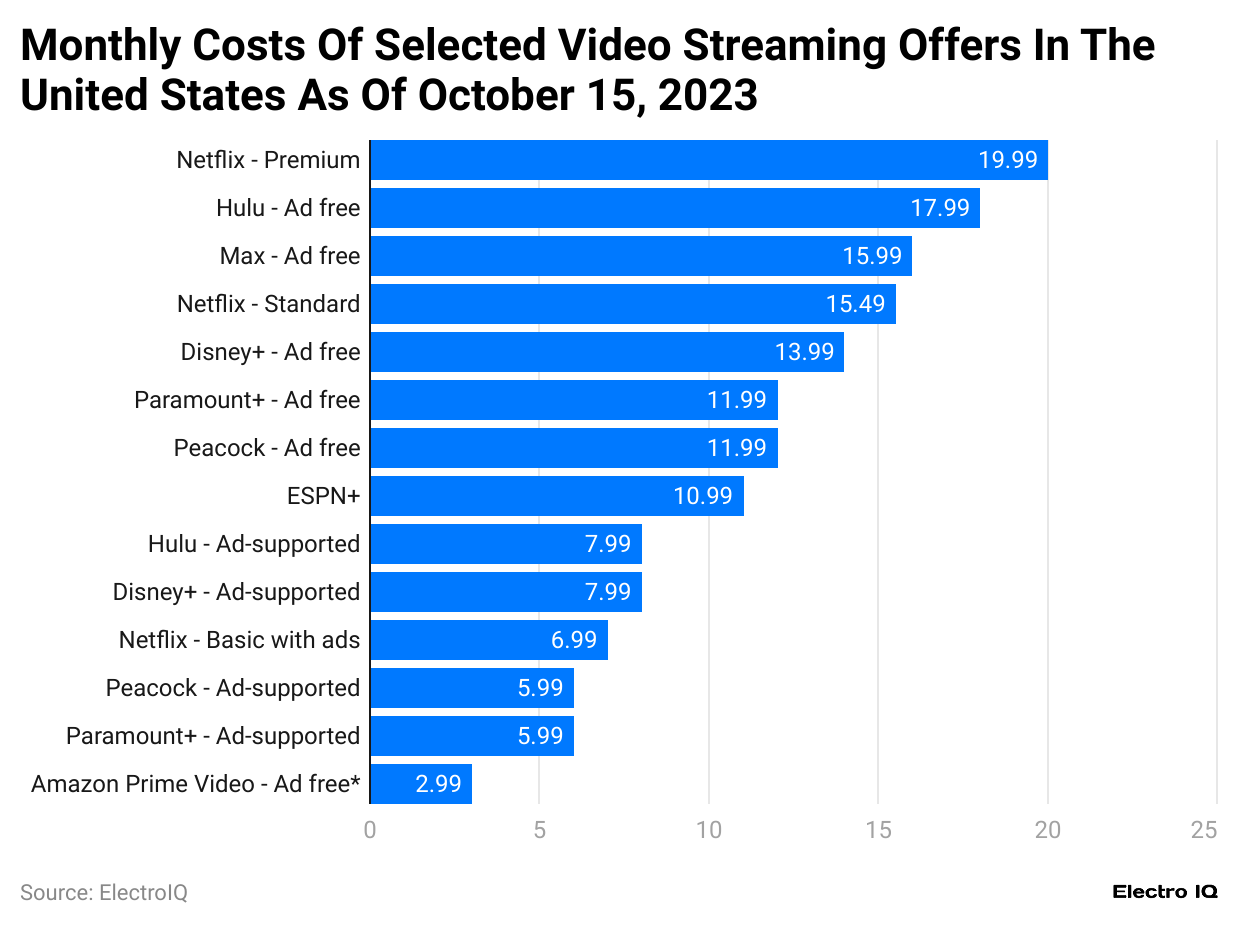

- Streaming Statistics show that Netflix's premium streaming price is highest at $19.99.

- Hulu follows it with $17.99 Max with $15.99.

- Ad-free options are generally more expensive across services, reflecting a premium placed on uninterrupted viewing experiences in the streaming market.

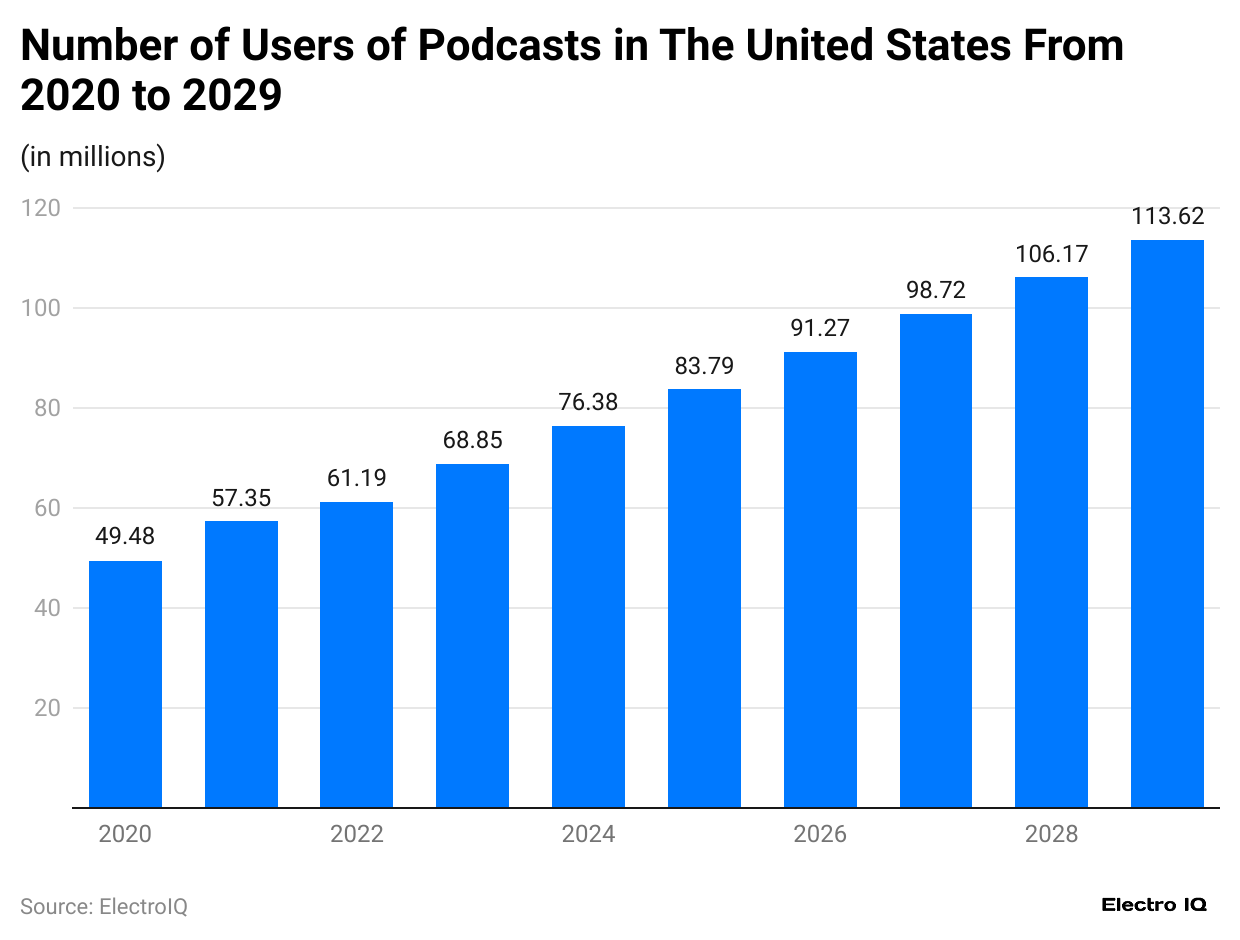

Number of Podcast Users Worldwide

(Reference: statista.com)

- Streaming Statistics show an upward trend in podcast listenership in the United States. Thus reflecting increased consumer interest in on-demand and diverse audio experiences.

- In 2020, the number of podcast users was 49.48 million, which increased to 68.85 million.

- By the end of 2029, the number of users is predicted to be 113.62 million.

Consumer Spending in Digital Home Entertainment

(Reference: statista.com)

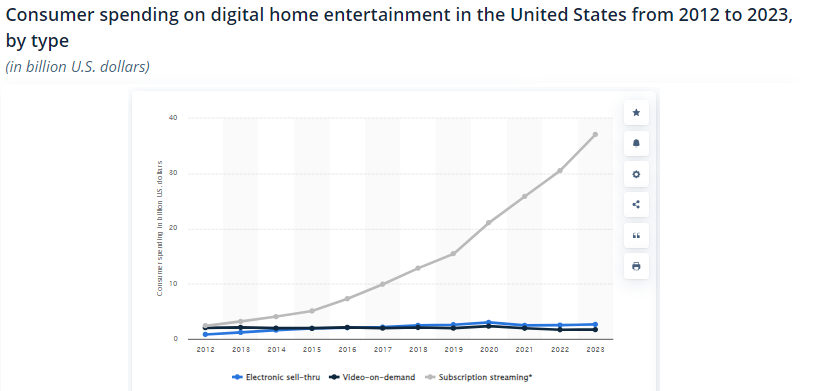

- Streaming Statistics show a rapid rise in consumer spending on subscription streaming services.

- Subscription streaming saw a dramatic increase in consumer spending in the United States, growing from a relatively low base in 2012 to nearly $40 billion by 2023.

- Spending on electronic sell-through and video-on-demand remained relatively flat over this period, indicating minimal growth compared to subscription streaming. From 2020 onward, subscription streaming experienced the steepest growth rate, likely accelerated by the shift towards digital entertainment during the pandemic.

Spotify Premium Subscribers

(Reference: statista.com)

- Streaming Statistics show a continuous increase in Spotify’s premium subscribers, highlighting the platform's sustained global popularity and effective retention and acquisition strategies in a highly competitive streaming market.

- Spotify's premium subscribers have grown steadily from 18 million in Q1 2015 to 246 million by Q2 2024. The period from Q1 2020 to Q2 2024 shows particularly robust growth, with Spotify gaining approximately 100 million premium subscribers in just over four years. Since Q1 2023, Spotify’s premium subscriber base has consistently exceeded 230 million, indicating a strong foothold in the global market.

List of Video Streaming Services

- d-anime Store

- BritBox

- AMC+

- U-Next

- Paramount+ & SkyShowtime

- Lemino

- iQIYI

- AltBalaji

- Acorn TV

- Aha

- Shahid

- ZEE5

- Starz (Lionsgate+)

- BET+

- Rakuten TV

- RightNow Media

- Crave

- Royal Bioscope

- BlazeTV

- Youku

- Dooflix

- Apple TV+

- FuboTV

- Crunchyroll

- Video

- Netflix

- SonyLIV

- Globoplay

- Disney+, Hulu & ESPN+

- Philo

- HayU

- Noggin

- Curiosity Stream

- Mubi

- Player

- Dropout

- Tencent Video

- Telasa

- Viaplay

- NOW

- iWantTFC

- Discovery+

- iflix

- Shudder

- DailyWire+

- Hulu Japan

- Claro Video

- Neon

- Kayo Sports

- Showmax

- Hulu

- JioCinema

- Stan

- Videoland

- Allblk

- Angel Studios

- YouTube Premium

- Viu

- MAX

- Peacock

- VMX

- Viki

- Sommt TV

- Right Now

(Source: wikipedia.org)

List of Audio Streaming Services

- Spotify

- Pandora

- Tidal

- Amazon Music

- Anghami

- Gaana

- JioSaavn

- Apple Music

- Deezer

- Napster

- QQ Music

- Joox

- SoundCloud

- iHeartRadio

- NetEase Cloud Music

- AccuRadio

- TuneIn

- Yandex Music

- Line Music

- Melon

- KKBox

- Boomplay

- Moov

- ADAGIO

- Qobuz

- VIBE

- Wolfgang's

(Source: wikipedia.org)

Video Hosting services

- YouTube

- Vimeo

- Dailymotion

- BitChute

- Rumble

- Aparat

- PeerTube

- Niconico

- Rutube

- Internet Archive

- Youku

- Odysee

- MetaCDN

- QQ Video

- Tudou

- Godtube

- EngageMedia

- Veoh

- Flickr

- SchoolTube

Streaming overview

In recent years, the streaming industry has seen tremendous growth, fueled by advancements in digital technology, increased internet access, and the proliferation of mobile devices. Streaming statistics reveal that video, music, and gaming platforms have transformed consumer behavior, entertainment, and spending habits worldwide. As of 2023, the global streaming industry generated around 95 billion US dollars in revenue, with a forecasted growth rate of 10% annually. By 2024, revenue is expected to surpass 105 billion US dollars, driven by increased subscription rates and ad-supported streaming services. This report explores key streaming statistics from a market research perspective, analyzing revenue trends, user growth, and market preferences.

#1. Growth in Video Streaming Services

Video streaming is the largest segment in the industry, and its growth is reflected in revenue and user statistics. In 2023, streaming services like Netflix, Disney+, and Hulu collectively generated over 80 billion US dollars in revenue globally. This figure accounts for more than 85% of total streaming revenue, highlighting the dominance of video streaming in the market. According to streaming statistics, this revenue is expected to grow by 12% in 2024, reaching approximately 90 billion US dollars. Subscription video-on-demand (SVOD) remains consumers' preferred option, followed by advertising video-on-demand (AVOD) services, especially in emerging markets.

Streaming statistics show that in the United States alone, video-on-demand users reached 215 million by the end of 2023. The majority of these users, around 70%, subscribed to paid services, while the rest accessed content through ad-supported platforms. By 2024, the US video-on-demand user base is expected to reach 225 million as more households transition from traditional TV to streaming. Notably, SVOD services are projected to grow at an annual rate of 8% in the US, reaching around 80 billion US dollars by 2024.

#2. Music Streaming Services See Steady Growth

Music streaming has also experienced steady growth, though at a slower pace compared to video streaming. In 2023, global revenue from music streaming services, such as Spotify, Apple Music, and Amazon Music, reached approximately 15 billion US dollars. Streaming statistics indicate a projected growth of around 7% in 2024, pushing the revenue to around 16 billion US dollars. This growth is largely driven by the increasing number of premium subscribers, especially in North America and Europe.

In the US, Spotify remains the leading music streaming platform, accounting for over 40% of the market share. As of Q2 2024, Spotify reported 246 million premium subscribers globally, up from 230 million in 2023. Other major players, like Apple Music and Amazon Music, have also seen growth in user subscriptions, contributing to the overall revenue increase in the music streaming industry. Additionally, ad-supported music streaming options are growing in popularity among younger users, who prefer free services despite occasional ads.

#3. Gaming Streaming Continues to Evolve

The gaming streaming sector is a relatively new but rapidly growing segment of the streaming industry. Platforms like Twitch, YouTube Gaming, and Facebook Gaming have capitalized on the popularity of esports and interactive gaming. In 2023, gaming streaming generated close to 7 billion US dollars globally, a 15% increase from the previous year. Streaming statistics forecast this number to grow by 20% in 2024, reaching around 8.4 billion US dollars as more gamers and viewers turn to live-streaming platforms.

In the United States, gaming streaming users exceeded 50 million in 2023. This user base is anticipated to grow by approximately 10% in 2024, reaching around 55 million users. The primary drivers of this growth include the increasing popularity of eSports events, gaming influencers, and interactive features that allow viewers to engage with live content. Revenue from gaming streaming is primarily generated through advertisements, paid subscriptions, and viewer donations. Twitch remains the dominant platform in this sector, holding over 60% of the global market share in 2023.

#4. Consumer Spending Trends in Streaming

Consumer spending on streaming services has consistently risen, reflecting shifting entertainment preferences. In the United States, consumers spent nearly 40 billion US dollars on digital home entertainment in 2023. This includes spending on video streaming subscriptions, music streaming, and pay-per-view content. By 2024, consumer spending on digital streaming is expected to increase by 8%, reaching around 43 billion US dollars. Subscription-based services account for most of this spending, with video streaming leading in expenditure.

One notable trend in consumer spending is the increasing adoption of ad-supported streaming services. In 2023, around 30% of streaming service users in the United States opted for ad-supported plans, up from 25% in 2022. This shift indicates a growing preference for flexible options that balance affordability with access to a wide range of content. Streaming statistics reveal that as prices for premium services continue to rise, more consumers will likely choose ad-supported options in 2024, further diversifying the revenue model for streaming providers.

#5. Regional Insights and Market Preferences

Streaming statistics reveal that North America and Europe are the largest markets for streaming services, accounting for nearly 70% of global revenue in 2023. In North America alone, streaming revenue reached approximately 50 billion US dollars in 2023, with the United States contributing the majority. This region is projected to see moderate growth of 5% in 2024, driven primarily by the increased adoption of bundled streaming packages that combine video, music, and gaming services.

Asia-Pacific is the fastest-growing region, with an expected growth rate of 15% in 2024. Countries like India, Japan, and South Korea are experiencing rapid adoption of streaming services due to improved internet infrastructure and affordable subscription plans. China, in particular, stands out as a key player in the market, with streaming revenue projected to reach 25 billion US dollars by 2024. In this region, mobile streaming dominates, with more than 80% of users accessing content via smartphones.

#6. The Future of Streaming

Streaming statistics indicate a promising future for the industry, with emerging trends such as personalized content, multi-device access, and AI-driven recommendations likely to shape the market. In 2024, streaming platforms are expected to increasingly adopt AI technology to enhance user experience by offering personalized playlists, targeted ads, and tailored content suggestions. Furthermore, the rise of 5G technology will enable higher-quality streaming and faster access to content, supporting the growth of streaming services in developed and developing markets.

One potential challenge for the industry is the increasing competition among streaming providers, leading to consumer subscription fatigue. With more platforms entering the market, viewers may hesitate to pay for multiple subscriptions, which could impact overall revenue. To address this, streaming companies will likely explore innovative pricing models and bundle options in 2024, making it easier for consumers to access various content without financial strain. Streaming statistics for 2023 and 2024 reveal a dynamic and rapidly evolving industry with significant growth across video, music, and gaming segments. With global revenue projected to exceed 105 billion US dollars by 2024, the streaming industry continues to shape the digital entertainment landscape, offering new opportunities and challenges for providers and consumers alike. From a market researcher’s perspective, monitoring these trends and adapting to consumer preferences will be essential for streaming platforms to maintain competitive advantage in an increasingly saturated market.

Conclusion

The streaming industry is pivotal in growth and innovation, demonstrating remarkable resilience and adaptation to changing consumer demands. Streaming Statistics show that the global revenue is projected to exceed $105 billion by 2024, and the sector continues to evolve through technological advancement and market expansion.

The dominance of video streaming, accounting for 85% of total streaming revenue, alongside the steady growth in music and gaming segments, indicates a mature yet dynamic market. As the industry moves forward, the focus on innovative pricing models, enhanced user experiences, and technological integration will play a vital role in the coming years.

Sources

FAQ.

The United States leads with $174.72 billion in digital media revenue (2023).

Spotify reached 246 million premium subscribers by Q2 2024.

Netflix Premium is the most expensive at $19.99 per month.

Projections indicate 343.48 million internet users in the US by 2029.

US podcast listeners are expected to reach 113.62 million by 2029.

Music streaming revenue is projected to reach $13.96 billion by 2027.

Over 80% of Asian users access streaming content via smartphones.

Consumer spending reached nearly $40 billion in digital home entertainment.

Asia-Pacific shows a 15% growth rate, the fastest-growing region.

AVOD services are projected to exceed 200 million users by 2027.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.