Zoom vs Microsoft Teams Statistics By Revenue And Usage (2025)

Updated · Jun 23, 2025

Table of Contents

Introduction

Zoom vs Microsoft Teams Statistics: For the majority of 2024, video conferencing has been the pivotal medium for work, schooling, and general socialising across the globe. Zoom and Microsoft Teams have been the overriding competitors. Zoom is appreciated for its simplicity and usability, whereas Teams is disadvantaged by its Microsoft 365 integration.

Through crisp numbers, sharing with percentages and dollar figures, we wish to impartially discuss how the platforms Zoom vs Microsoft Teams statistics culminating in the last year have formed some aspects of digital communication.

Editor’s Choice

- Zoom generated US$1.146 billion in revenue up until January 2024, staying steady at a 29% increase for the three-year period, with Microsoft Teams being the component of Microsoft 365 that reached well beyond US$8 billion in 2023 following explosive growth from 2017.

- The mobile app for Zoom held in APAC with the most installs at 17.6 million in Q3 2024, whereas Microsoft Teams showed peak downloads in MEA at 8.6 million.

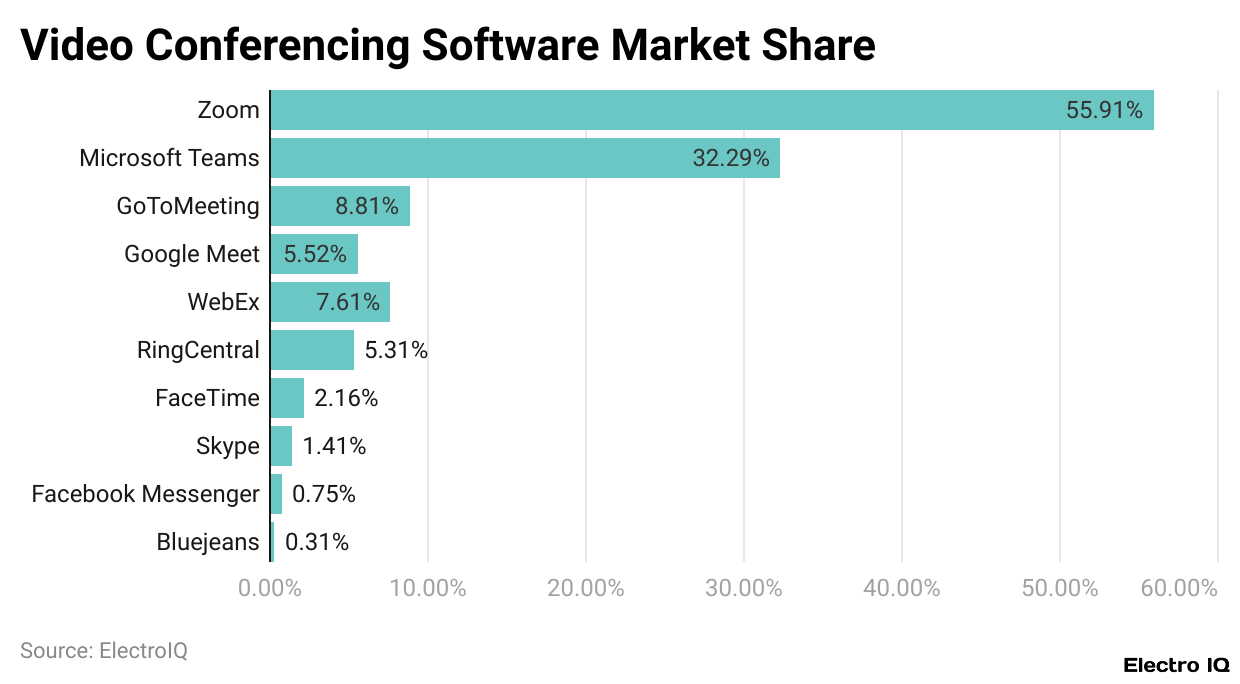

- Accruing total revenue around 5.5 billion as of 2023, globally, Zoom enjoys 55.91% of the video conferencing market, whereas its counterpart, Microsoft Teams, has a fair 32.29% of this share.

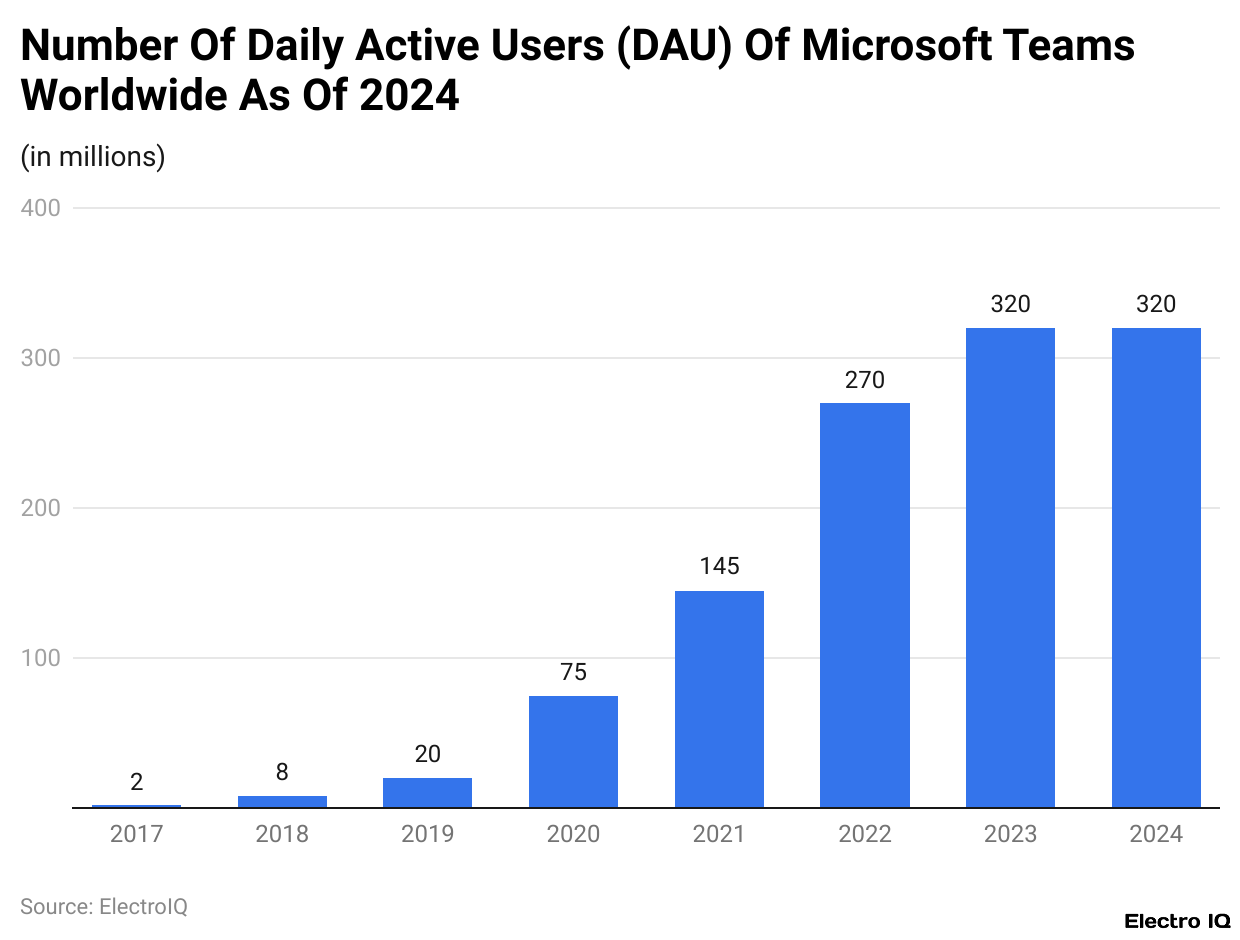

- By early 2024, Zoom was averaging 300 million daily users, whereas Microsoft Teams had marginally edged past it with an average of 320 million daily users over the past year.

- Because it was so easy to use, Zoom witnessed the growth that came with the early pandemic days, whereas Microsoft Teams managed long-term growth by dint of its integration with Microsoft 365 and adoption by enterprises.

- The incidence of meetings rose, too, in U.S. professionals, with an average of 10 hours, with the implication that both platforms became eminent in the working setup.

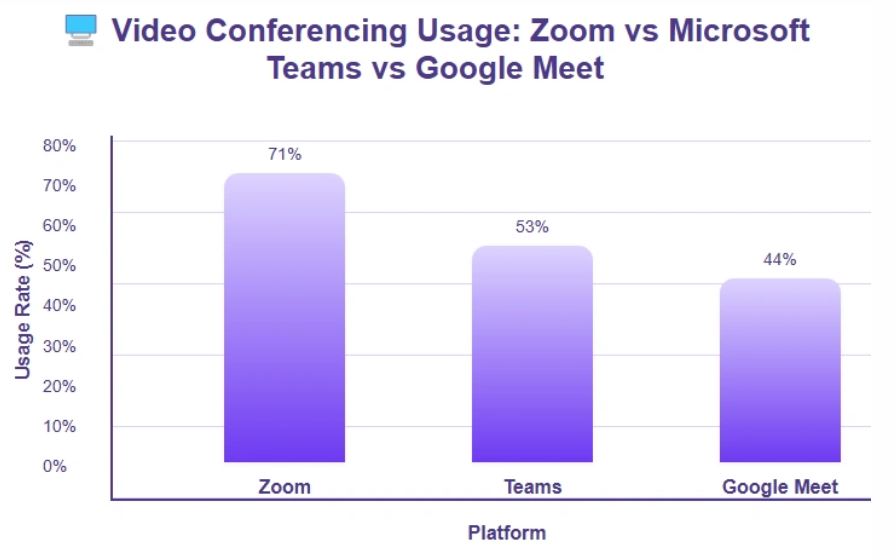

- Being a favourite professional video-conferencing platform among 71% of the respondent population, Zoom stands in direct opposition to Microsoft Teams, which is favoured by 59% of the mid-to-large corporations for internal communications.

- Within educational contexts, Google Meet shines as being preferred by 62% of the students, with Zoom trailing behind at 38%, signaling relatively low academic use despite being widely used.

- Better-adopted by 49% of telemedicine providers than Microsoft Teams with an adoption rate of 13%, Zoom is one of the topmost contenders, having Doxy.me at 27% shares.

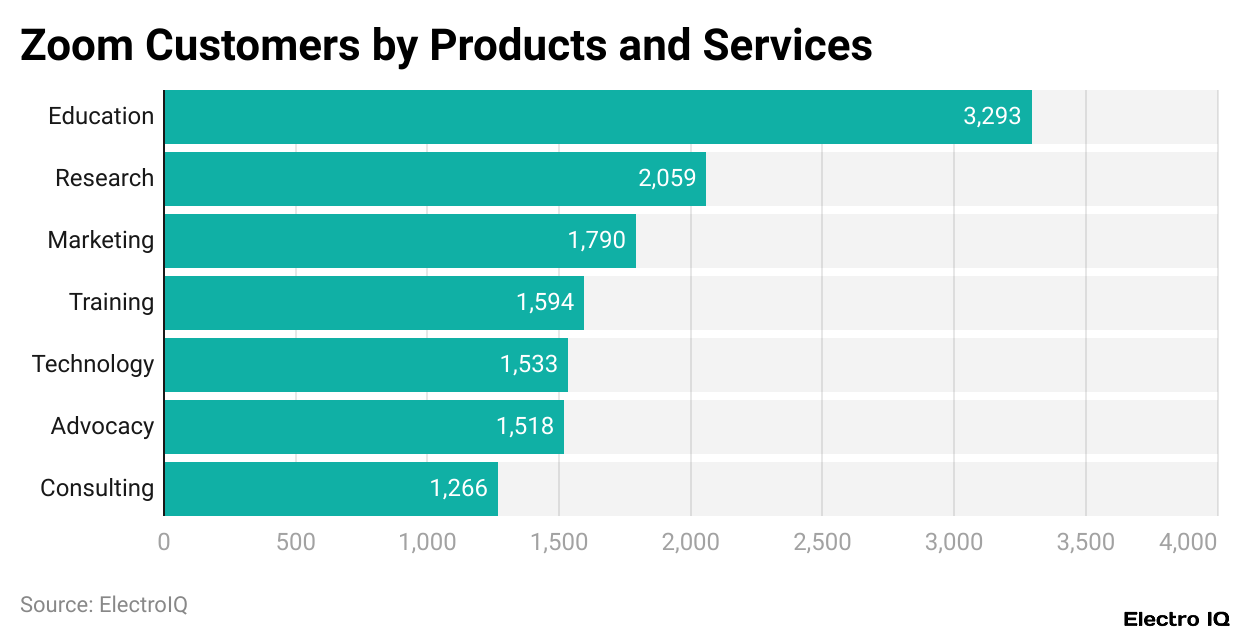

- Apart from the educational purposes, which use Zoom most (3,293 institutions), followed by research, marketing, training, technology, advocacy, and consulting.

Revenue Statistics

Zoom

(Source: backlinko.com)

Microsoft Teams

(Source: demandsage.com)

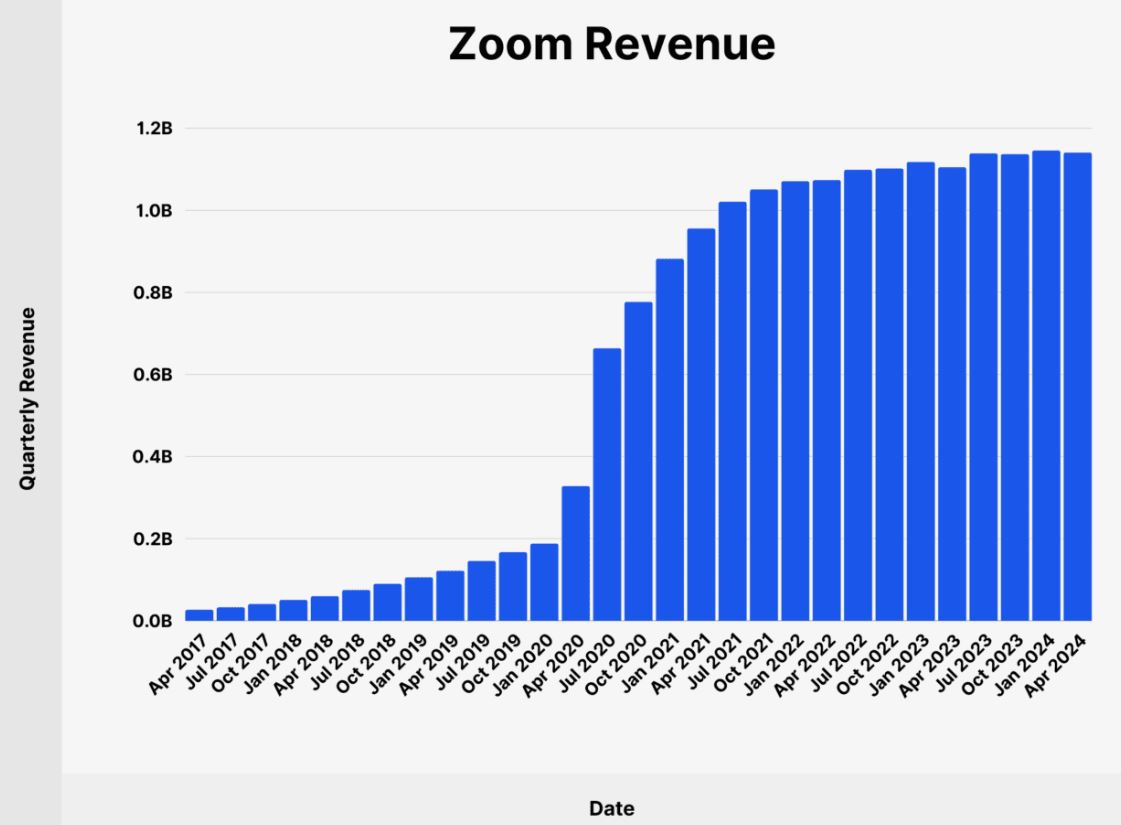

- According to Backlingo and Demandsage, Zoom vs Microsoft Teams statistics show that Zoom has displayed consistent revenue growth, with revenues recorded at US$882 million in January 2021, US$1.146 billion in January 2024, and a slight dip of US$1.141 billion as of April 2024.

- The quarter-to-quarter revenue growth thus remains relatively steady, increasing around 29% during the past three years. In contrast, Microsoft Teams has had a much more dramatic rise.

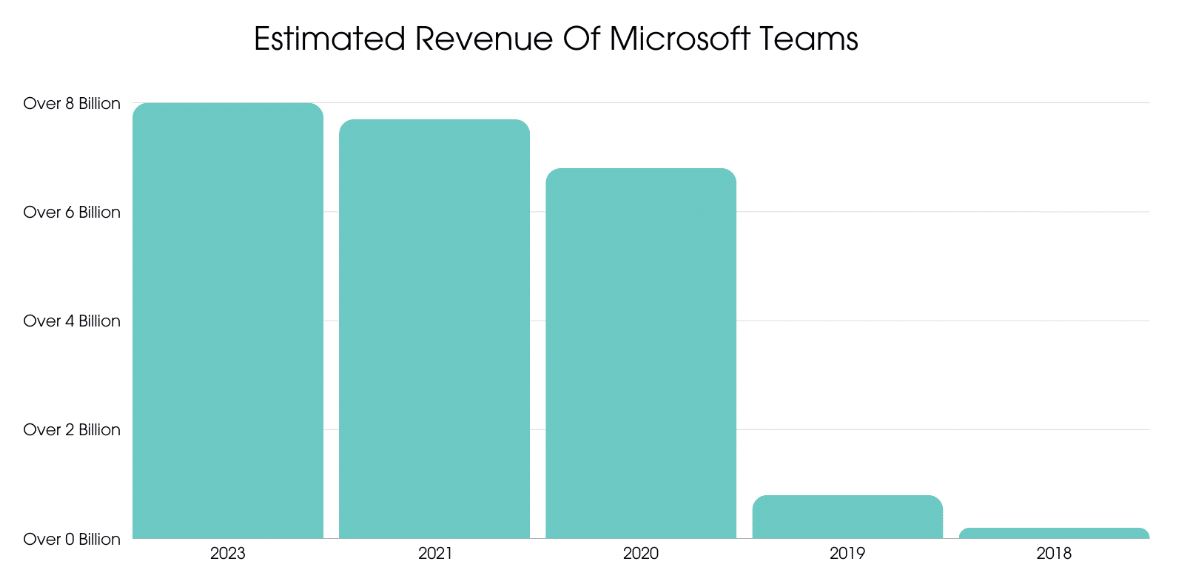

- From a relatively low US$10 million in 2017, it went to US$200 million in 2018 and then to US$800 million in 2019.

- The COVID-19 pandemic took its growth rate to exponential, reaching US$6.8 billion in revenue in 2020.

- This momentum kept pushing until it reached US$7.7 billion in 2021 and beyond US$8 billion in 2023.

- While Zoom displays linear growth at a very high pace of consistency, Teams has been growing exponentially, with the interspersing of Microsoft 365, massive enterprise-level adoption on the way, and one of the fastest-growing collaboration tools in existence.

App Downloads By Region

Zoom

(Reference: statista.com)

Microsoft Teams

(Reference: statista.com)

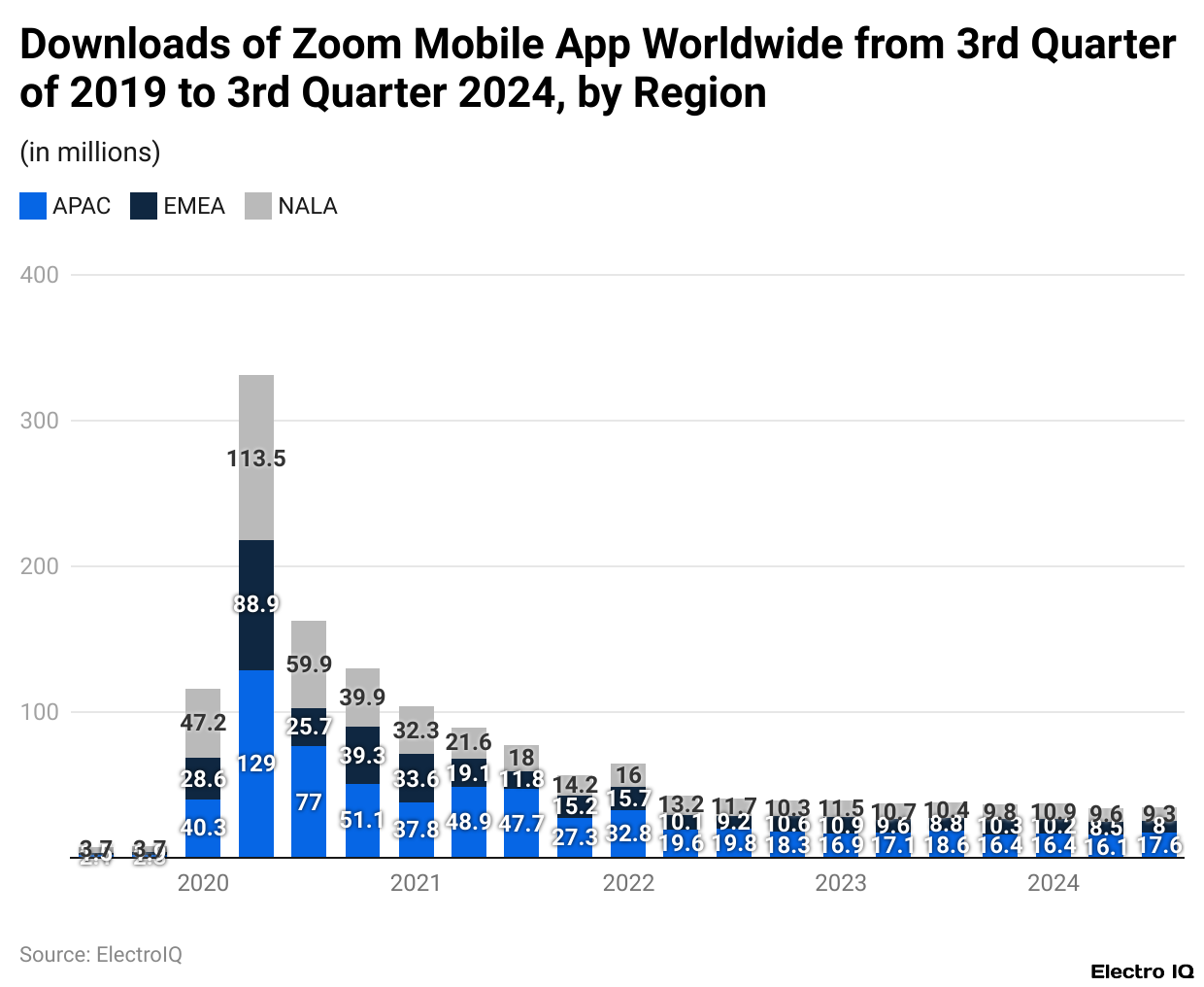

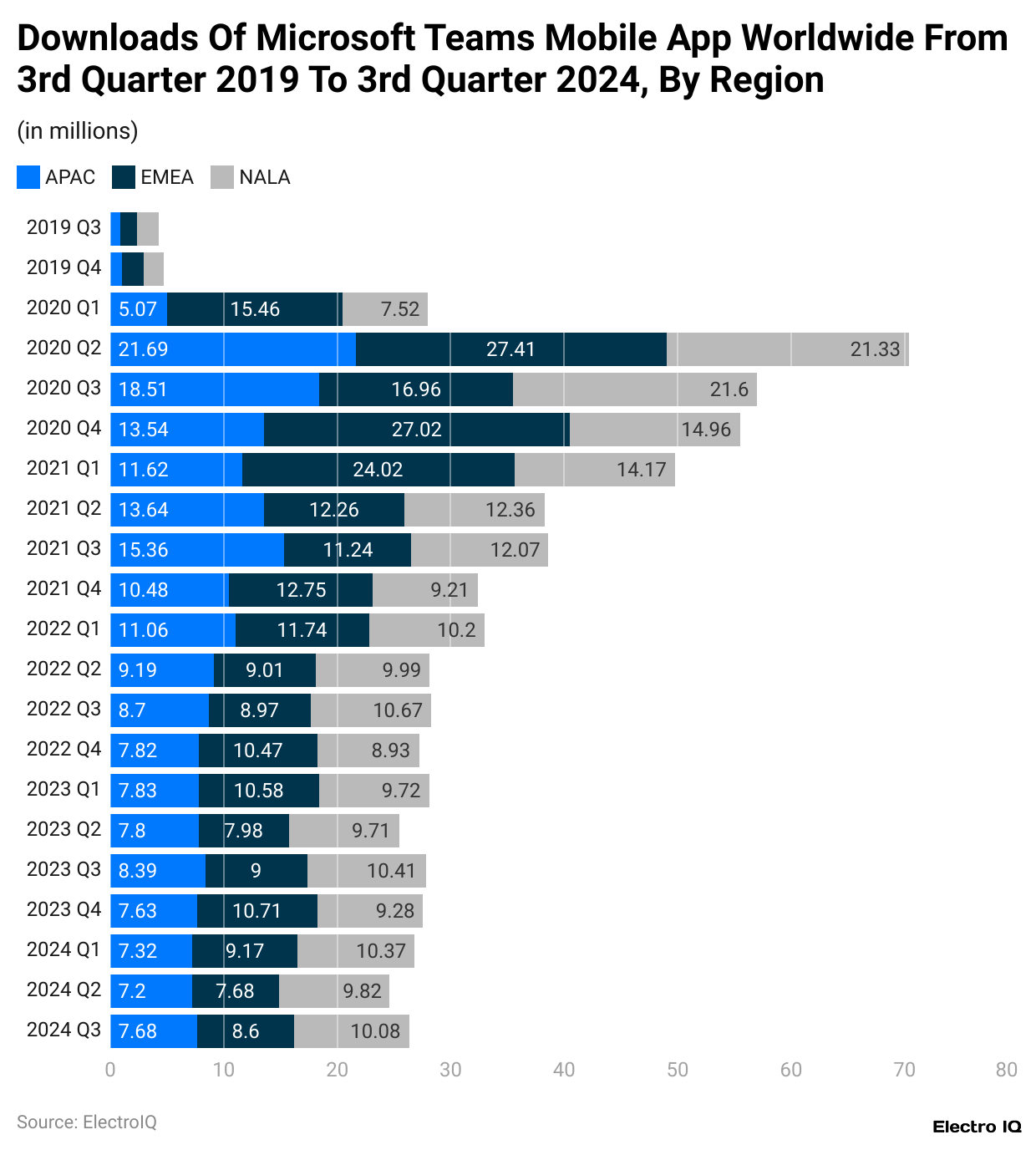

- According to a Statista report, Zoom vs Microsoft Teams statistics reveal that with about 17.6 million downloads in the Asia-Pacific during the third quarter of 2024, Zoom was way ahead of Microsoft Teams, which had its best-ever downloads in the Middle East and Africa of about 8.6 million downloads during that time.

- As far back as 2020 though, both platforms had their explosive growth spurts as communication went from traditional face-to-face to digital platforms; Zoom was installed by a huge number of users worldwide from January 2020 to June 2020 alone, with downloads reaching 129 million in the Asia-Pacific, whereas in Europe, the Middle East, and Africa, Microsoft Teams app usage grew by over 750% in the last quarter of 2019 and the first quarter of 2020.

- By 2023, boasting over 55% market share worldwide, Zoom will finally emerge as the largest competing platform for videoconferencing against Microsoft Teams, with 32%. This disparity is reflected in the usage data; given that, in April 2020, Zoom saw approximately 300 million participants attending meetings daily, while Microsoft Teams recorded 75 million daily users for the same timeframe.

- Microsoft Teams has since grown to over 320 million active users by 2023, showing increased traction in use cases including enterprise and education.

- Zoom’s financial performance remained potent through 2024, bringing home gross revenues of about US$4.5 billion-plus, more than 10 times January-December earnings of 2019.

- Its operating income was around US$170 million during the last quarter.

- Furthermore, zoomed toward reinforcing reinvestment directions would be balance sheets that sequestered US$1.5 billion for sales and marketing and above US$800 million for R&D through 2024.

- On the contrary, Microsoft Teams does not give separate financials, but being part of the Microsoft productivity suite landscape, it is quite understandably integrated with Outlook, SharePoint, and OneDrive, thus contributing to its lead over other enterprise software vendors.

- Work habits are a reflection of platform reach. In the United States, over 10 hours per week went into meetings, fostering the rise of a great number of astonishing toolsets. Though better in direct downloads and market share, Zoom has been losing ground to Microsoft Teams integration, especially in places such as the Middle East and Africa. In a much wider tech sphere, Microsoft continues to spearhead digital communication through email and the adoption of AI.

- In March 2024, almost 15% of Americans declared using AI tools for assisting them in generating email content, whereas 25% are considering using it shortly.

- Microsoft’s Outlook, with somewhat fewer open rates than Apple’s MPP and Gmail, sits nestled within the comprehensive communication ecosystem.

- Standalone-wise, Zoom steals the spotlight in terms of usage and downloads, whereas Microsoft Teams is strategically strong as a competitor through integration and enterprise-scale considerations.

Active Users

Zoom

| Year |

Number Of Zooms Daily Active Zoom Users

|

| December 31, 2019 | 10 million |

| March 31, 2020 | 200 million |

| April 21, 2020 | 300 million |

| January 2024* | 300 million+ |

(Source: demandsage.com)

Microsoft Teams

(Reference: statista.com)

- Starting with December 2019, Zoom users started skyrocketing from 10 million daily active users to above 300 million daily active users by April 2020, maintaining this daily active user number till January 2024.

- Meanwhile, Microsoft Teams currently holds an upper hand over Zoom in daily active users by a slight margin, with approximately 320 million daily active users in the past year.

- Both platforms have seen their unprecedented growth during the COVID-19 times, while Microsoft Teams had the upper hand by being coupled into the Microsoft 365 Suite, thus becoming the default of choice for many enterprises and institutions.

- Subsequently, lockdowns in the early half of the 2020s gave a big fillip to internet usage across the United States, with average daily in-home data consumption shooting up by 4.4 gigabytes—close to a 40% rise compared to 2019.

- An increase in activities such as social media, gaming, streaming, and video conferencing has driven this spike, with Zoom and Microsoft Teams being at the zenith of the two.

- As per Statista and Demandsage, Zoom vs Microsoft Teams statistics show that Zoom’s initial growth was very rapid, owing to its simplicity and quick adoption for social and educational purposes, while the durability in the growth of Microsoft Teams was underpinned by its efficient collaboration features, coupled with seamless integration with other Microsoft tools.

(Reference: demandsage.com)

- Zoom rules the video conferencing market with a commanding 55.91% share, boosting more than half of the users to pick it as their choice of online meeting platform. This popularity technically flows from views such as a very simple interface, and an excellent reputation for reliability in virtual communication.

- Next in line is Microsoft Teams, holding a share in the market worth 32.29%. Though lower in comparison to Zoom, it still remains highly relevant, especially for corporate users and organisations subscribed to the Microsoft 365 ecosystem.

- All others have substantially minor shares.

- GoToMeeting, which is still being used by some companies for virtual meetings, holds only 8.81% market share.

- WebEx by Cisco comes next with the 7.61% market share and is usually adopted within corporate environments.

- Google Meet, which comes embedded within the Google Workspace suite and is used by many Gmail users, accounts for 5.52% of the market.

- These numbers establish Zoom and Microsoft Teams’ near-monopoly over this niche with their combined market share of almost 90%, thus leaving other software vendors in a fierce battle for the remainder.

Zoom vs Microsoft Teams Usage

(Source: zebracat.ai)

- According to a report by Zebracat, Zoom is the most widely used video conferencing tool for professional purposes and is used and trusted by 71% of users versus 53% for Microsoft Teams and 44% for Google Meet.

- Preferences change quite a bit in the educational sector, where 62% of students prefer Google Meet to be used in online classes, while only 38% regularly use Zoom in an academic context.

- In the corporate scene, Microsoft Teams holds sway as the in-house platform for internal chatter among mid-to-large organisations, with 59% of such companies adopting it for this function.

- Once the big guy in video calls, Skype now has a marginal presence, with merely 8% of the entire video conferencing activity spanning the varied user categories.

- Zoom, on the other hand, still takes a considerable share of telehealth video consultations, with 49% of healthcare providers using it.

- Nonetheless, it’s up against existing competition, with Doxy.me holding 27% of the market share and Microsoft Teams at 13%. This suggests that while Zoom is the undisputed leader in many markets, its dominance varies by industry and use cases.

Industry Usage

Zoom

(Reference: 6sense.com)

Microsoft Teams

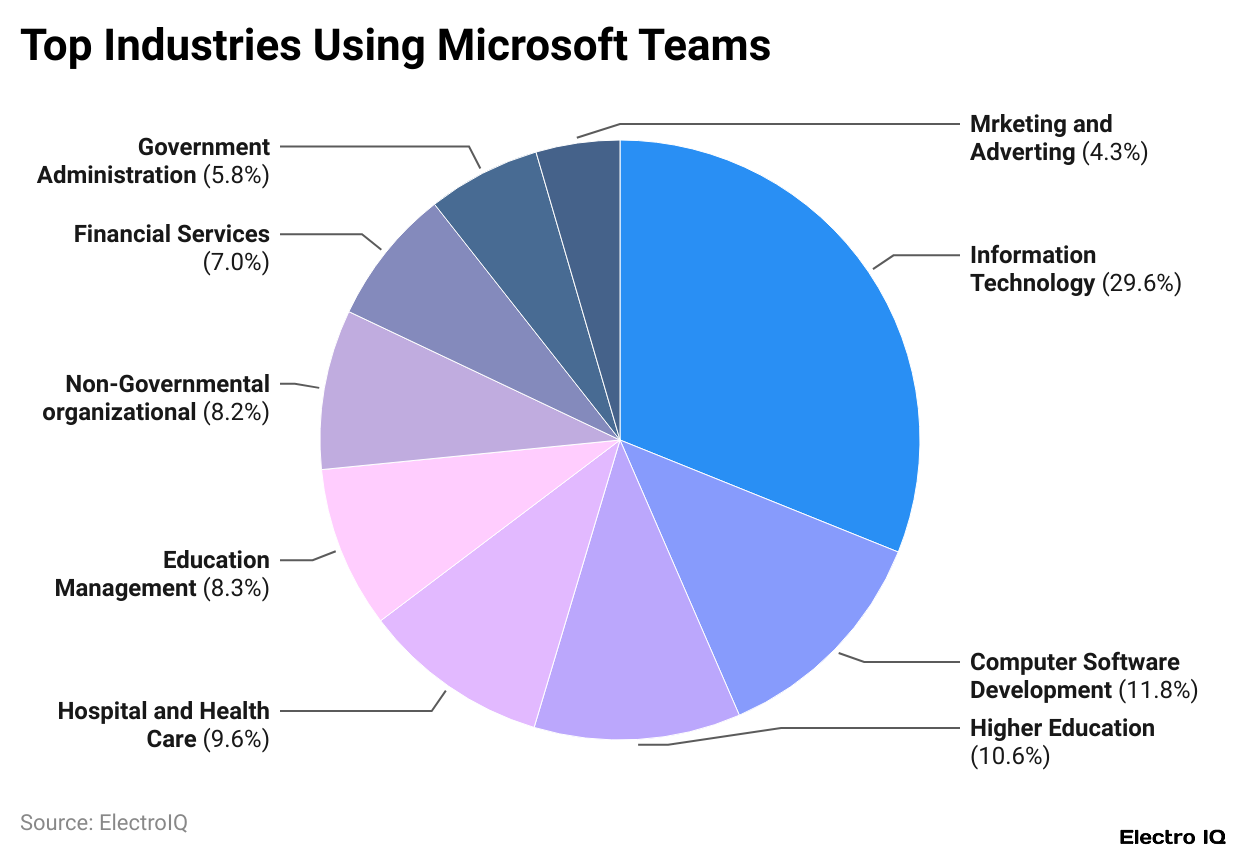

(Reference: usesignhouse.com)

- As per 6Sense and Usesignhouse, Zoom vs Microsoft Teams statistics state that the highest industry usage of Zoom is in education, where 3,293 institutions use the platform. This is followed by research at 2,059, marketing at 1,790, training at 1,594, technology at 1,533, advocacy at 1,518, and consulting at 1,206.

- This perspective into the industry landscape shows Zoom’s dominance in academic, nonprofit, and communication-intensive sectors, where interaction in real-time is highly essential.

- Conversely, Microsoft Teams is spread out more evenly across many industries, with the highest share at the IT sector of 29.6%, closely followed by computer software development at 11.8%.

- Schools and higher-ed institutions constitute 10.6% of Teams’ user base, thus witnessing a slightly lesser Thanos effect made by Zoom in that sector.

- The Healthcare vertical claims 9.6% of Teams’ share, with education management and NGOs comprising 8.3% and 8.2%, respectively.

- Other sectors with notable adoption levels under Microsoft Teams include financial services(7%), government administration(5.8%), and marketing and advertising(4.3%), cementing its presence in balanced enterprise, public, and regulated environments.

- By contrast, Zoom must seem more specialised for academic, advocacy, and training uses where rapid setup and easy access are key.

- This suggests that Zoom matches sectors that focus on straightforward communication, while Teams has the upper hand in structured, collaborative, and enterprise-driven scenarios.

Conclusion

Despite competition between each other to grab the limelight, Zoom and Microsoft Teams serve different customer requirements. Zoom leads in overall market share with 55.91% and also in ease of use, with adoption in the education sector, telemedicine, and smaller organisations.

From January 2024, with US$1.146 billion in revenue by then, Zoom had ascended into the realms of 300 million daily users. Microsoft Teams, integrated with Microsoft 365, is rather successful in enterprise collaboration with 320 million daily users and a US$8 billion-plus revenue. In the end, Zoom wins in accessibility while Teams takes the enterprise functionality and integration crown.

FAQ.

By early 2024, Microsoft Teams slightly eclipsed Zoom with some 320 million daily active users against 300 million for Zoom. Yet, the two platforms both enjoy massive daily engagement and have different strengths. Teams are best at enterprise settings, aided by Microsoft 365 integration, while Zoom is widely used primarily for its ease of use and additional accessibility.

In the global market, Zoom enjoys an overwhelming 55.91% market share, which it is able to maintain because of strong brand equity, a simple, user-friendly design, and strong adoption in education, telehealth, and professional conferencing activities. In contrast, Microsoft Teams trails with a share of 32.29%.

In 2024, the revenue of Zoom was estimated at around US$4.66 billion, with good stability seen in growth on a year-over-year basis. However, Microsoft Teams generated in excess of US$8 billion in revenue by 2023 as part of the Microsoft 365 suite. Teams experienced exponential growth in revenues because of Microsoft’s heavy enterprise footprint and a strategy to bundle their various software offerings together.

Zoom dominates in the educational sector (3,293 institutions), but it is also heavily used in research, marketing, and advocacy. Microsoft Teams is strongest in enterprise IT, software development, government, and finance. It is especially popular among mid-to-large corporations for internal collaboration purposes.

With 17.6 million app downloads in the Asia-Pacific region in Q3 2024, Zoom was the most popular platform in the region. Microsoft Teams saw 8.6 million downloads in the Middle East and Africa, pointing to its rising significance in emerging enterprise markets.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.