Red Hat Statistics and Facts By Market Share, Product and Services, And Competitors (2025)

Updated · Nov 03, 2025

Table of Contents

Introduction

Red Hat Statistics: Red Hat continues to be deeply embedded in enterprise IT, forever blending its Linux roots with the increasingly modern cloud, security, and hybrid solutions. The innovations through software, managed services, and OpenShift are trusted by thousands of organisations worldwide, including the majority of Fortune 500 companies, generating billions of dollars in recurring revenues. Apart from being a solid performance leader worldwide in the U.S., India, Europe, and more,

Red Hat has always been a name to trust for security, issuing thousands of advisories annually. The company stands at the forefront of various digital transformation activities, from high-margin software growth to a flourishing partner ecosystem. The purpose of this article is to showcase the recent trends in the Red Hat statistics.

Editor’s Choice

- The competitor landscape is led by Sage with 40,070 domains (30.06%), followed by NetSuite with 27,969 domains (20.98%).

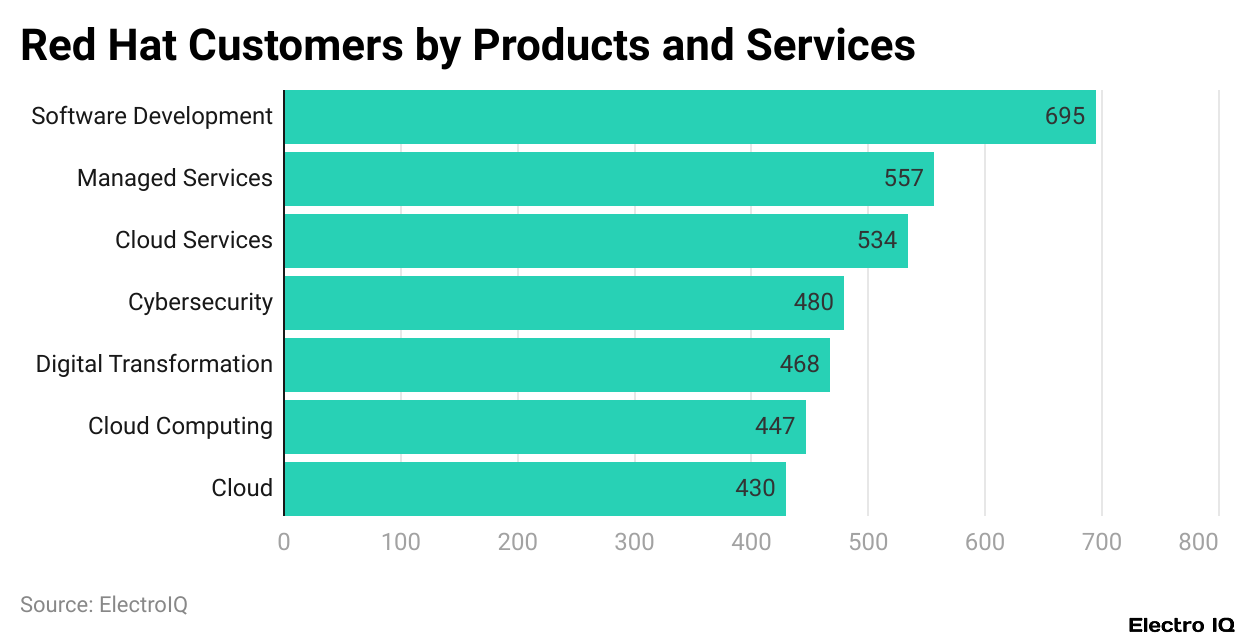

- The software products of Red Hat serve the largest customer base with 695 clients, with managed service 557, cloud services 534, and cybersecurity offerings 480, also holding good client numbers.

- IBM Hybrid Platform & Solutions for 2024, including Red Hat, posted revenues of US$18.808 billion.

- With an 11.4% incremental rise in revenue margins, Red Hat is performing above the market, whereas OpenShift is closing in on US$1.4 billion in annual recurring revenues.

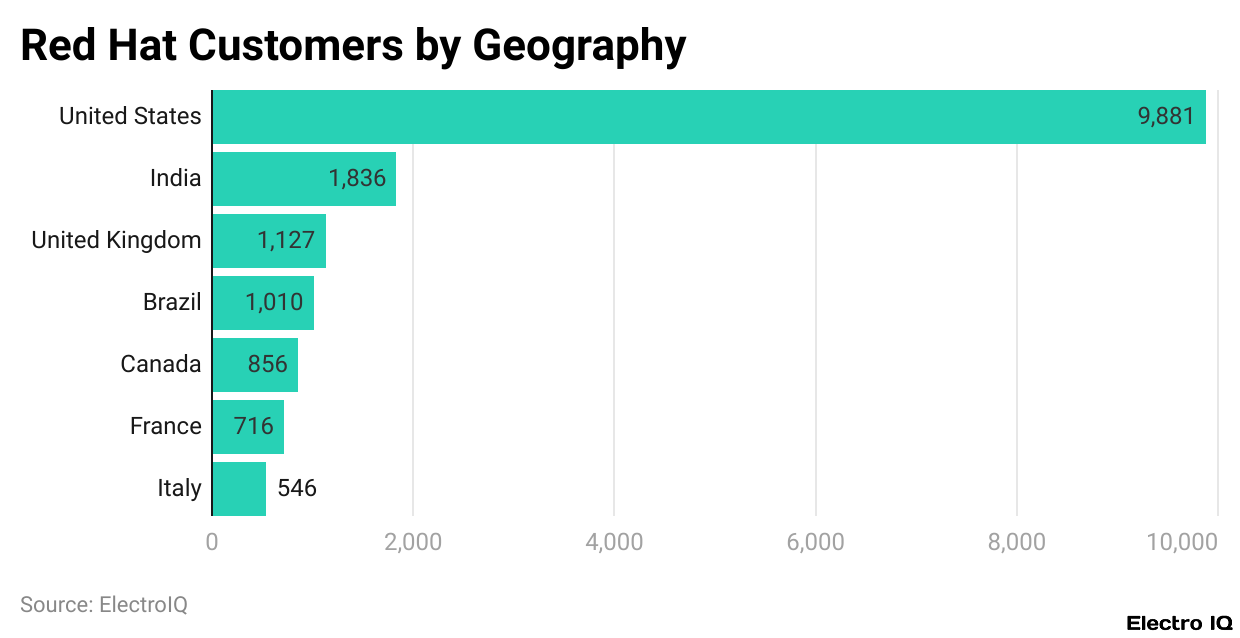

- Red Hat supports about 9,881 customers in the U.S., 1,836 in India, as well as other noticeable numbers in the U.K., Brazil, Canada, France, and Italy, thus showcasing a widespread global footprint.

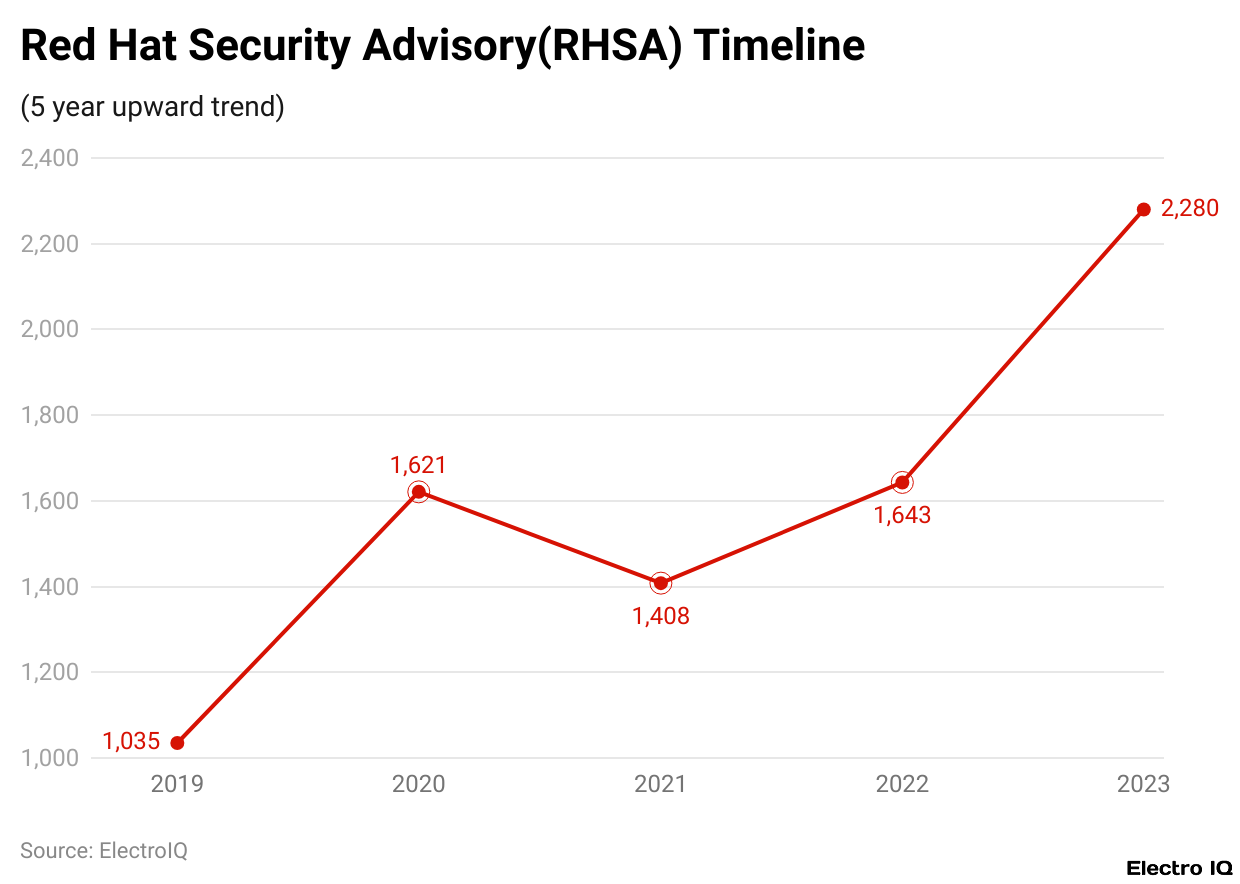

- The company released 2,280 security advisories in 2024, including 65 critical and 1,405 important ones, suggesting improved vulnerability management and transparency.

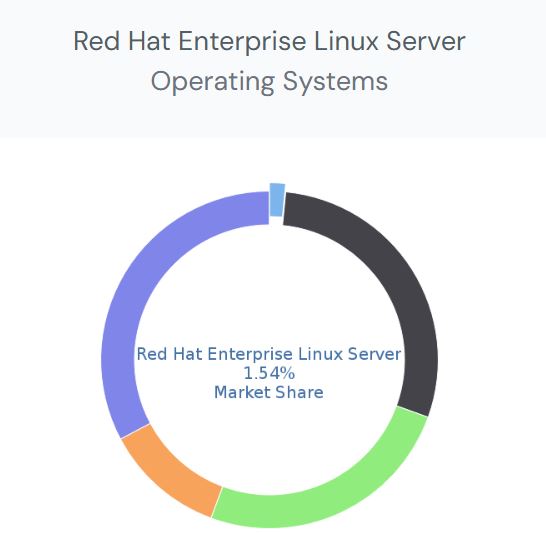

- Red Hat Enterprise Linux Server has 1.5% shares in the global OS market, delineating its stronghold in enterprise-grade and business-critical environments.

- Red Hat is IBM’s significant profit contributor, supporting such high software gross margins of 83.7% and up 15.8% in year-over-year segment profit growth.

General Facts

- Red Hat takes various other statistics to justify its dominance in the enterprise IT market.

- Over 90% of the Fortune 500 companies employ Red Hat, displaying witness to its trust, and acceptance goes the world over across leading businesses.

- The RHEL partner ecosystem is around US$138 billion, growing at 8% CAGR, a good, lucrative, and growing marketplace.

- The company is claiming rugged customer loyalty with claimed 100% renewal rates of RHEL subscriptions, meaning almost every eligible customer does renew.

- Those customers who are using RHEL Management tools such as Red Hat Insights and Satellite actually see renewal rates of 100-plus, which implies upgrades or contract expansions.

- Next up would be a rather tricky statistic: for every single dollar of revenue generated through RHEL subscription, partners manage to leverage US$3.50 in value-added services like consulting and support, implying and adding the multiplier effect of the ecosystem.

- Red Hat further claims that over 40,000 existing RHEL customers use its management solutions, adding validity to its position as a trusted enterprise platform.

- With respect to lifecycle milestones, RHEL 7 reached the end of its maintenance phase on June 30, 2024, thereby signalling enterprises to implement upgrades to newer versions.

- Also, by 2027, SAP users must be migrated to SAP HANA, which runs only on Linux-based systems, creating a strategic opening for RHEL during the preparations of enterprises for that deadline.

Red Hat Top Competitors

| Technology | Domains |

Market Share (Est.)

|

| Sage | 40,070 | 30.06% |

| NetSuite | 27,969 | 20.98% |

| ServiceNow ITSM | 7,388 | 5.54% |

| Spiceworks | 5,396 | 4.05% |

| Wrike | 4,297 | 3.22% |

| TOPdesk | 3,018 | 2.26% |

| Sap Solution Manager | 2,912 | 2.18% |

(Source: 6sense.com)

- As per 6 Sense, Red Hat statistics show that Red Hat is a contender among other technology providers in the number of estimated domains and market share.

- With an estimated 40,070 domains, Sage stood strong in the lead with about 30.06% of the market share.

- This brand took the second position with a market share of 20.98% and 27,969 domains.

- ServiceNow ITSM has 7,388 domains, which is equal to 5.54%, while Spiceworks holds the market with 5,396 domains of about 4.05%, Wrike is nearly back with 4,297 domains, and 3.22% of the market.

- Other key players are TOPdesk with 3,018 domains (2.26%), SAP Solution Manager with 2,912 domains (2.18%), and Newtek Technology Solutions with 2,841 domains (2.13% market share).

- ConnectWise Manage and SysAid would be winning smaller pieces of the pie, at 1.53% and 1.19%, respectively.

- ConnectWise Automate is roughly 1.18%. CDW owns 1,369 domains with just over 1% of market share, while ManageEngine ServiceDesk Plus commands 1,182 domains for 0.89%.

- The rest are accounted for with under-1% market share. Atera has 1,019 domains (0.76%), BlueFolder follows with 807 domains (0.61%), 4me holds on to 739 domains (0.55%), C1 (formerly Converge One) grabs 675 domains (0.51%), and Sify has 624 domains (0.47%).

Red Hat Customers By Product And Services

(Reference: 6sense.com)

- These enumerations illustrate how Red Hat’s customer base is spread among the offerings.

- With 695 customers associated with Red Hat’s software product getting group, classic onset subscription still sits hardest.

- Next comes Managed Services with 557 customers, reflecting the buzz around the continued support and outsourcing.

- Cloud Services attract 534 customers, underlining the role of Red Hat in moving enterprises into workload transfers.

- Cybersecurity-related offerings count 480 customers, showing that Red Hat is relied upon to provide secure enterprise environments.

- Digital transformation services stand at 468 customers, reflecting the company’s influence over the modernisation strategies.

- Cloud computing engagements fall slightly behind with 447 customers, but again are very significant, while a more generic “cloud” category has 430 customers, again emphasising that cloud-based solutions make up a serious chunk of Red Hat’s business.

- These numbers, when taken together, show how software continues to be the anchor in this balancing act, while cloud and service-based solutions are becoming just as important, for Red Hat is a company that balances its traditional Linux roots with modern digital and cloud-driven needs.

Key Red Hat / Hybrid Platform and Solutions

- IBM’s Hybrid Platform & Solutions division, which consists of Red Hat, recorded sales of US$18.808 billion in 2024, showing a reported year-on-year growth of 8.1%, or 8.7% on a currency-adjusted basis.

- In revenue terms, Red Hat grew at a rate of 11.4% as reported and 12.0% currency-adjusted, faster than the other drivers that make up the segment as a whole.

- Further, IBM noted the following: OpenShift and Ansible grew at double-digit rates, with OpenShift hitting an ARR of some US$1.4 billion by year-end 2024.

- More broadly speaking, the Hybrid Platform & Solutions business closed the year with an ARR of US$15.3 billion, which includes Red Hat subscriptions, SaaS/PaaS models, and maintenance/support contracts; therefore, strong recurring revenues.

- At the company level, total Software revenue for IBM reached US$27.085 billion in 2024, reflecting an 8.3% YoY growth (or 9.0% if adjusted for currency).

- IBM mentioned that this increase in software revenue was in part due to both Red Hat and Automation having double-digit percentage growth, reaffirming the importance of Red Hat.

- Profitability, therefore, remained high. The Software segment gross profit margin, for instance, was 83.7%, up 0.8 percentage points from 2023.

- Segment profits of US$8.684 billion were up 15.8% year-over-year.

Red Hat Customers By Geography

(Reference: 6sense.com)

- These numbers show where most of Red Hat’s customers are geographically clustered.

- The U.S. leads in customer count by a fairly large margin, boasting 9,881 customers, so to speak, pointing to a very strong domestic footprint.

- India comes a close second, having 1,836 customers, which indicates a growing footprint in Asia and highlights the importance of the Indian IT and enterprise sector.

- With 1,127 customers, the United Kingdom takes third place, possibly with Brazil somehow in fourth, since they have 1,010 customers, showing decent adoption in Europe and Latin America, respectively.

- Canada, with its 856 customers, fell next in North American ranking; meanwhile, France, with its 716 customers, bested Italy’s 546 in the European challenge.

- Thus, one can conclude that despite Red Hat having a stronghold in the U.S., the company also caters to quite a good number of customers on multiple continents, with a distinct forte in emerging markets like India and Brazil, and eminent ones in Europe.

Red Hat Security Advisory By Severity

(Reference: redhat.com)

- As per the Red Hat Report, Red Hat statistics state that the data gives information about the number of Red Hat security advisories issued, segmented into different severities, as well as a comparison of how these numbers changed in the year 2022.

- In total, 2,280 advisories were issued, which was an addition of 637 advisories than what were issued in the previous year, representing a clear increase in recognised and addressed issues.

- Of these, 65 were considered critical, a sharp rise of 30 from 2022.

- Most were considered important, with 1,405 advisories, an increase of 512, implying that lots of issues needed major attention.

- There were 760 advisories considered moderate, up 125, indicating a steady increase in the mid-level vulnerabilities.

- Low-severity advisories, meanwhile, had decreased to 50, which is down by 30 from 2022, which could mean either fewer certain low-level issues were reported, or more were assigned to higher severity levels.

- To sum it up, the statistics reflect that Red Hat has been increasing its efforts in discovering and disclosing vulnerabilities, with more prevention advisories of higher severity than the previous year.

(Source: enlyft.com)

- Red Hat Enterprise Linux Server holds about 1.5% of the operating systems market, implying that only a small fraction of all the global OS options run RHEL Server.

- While this share may seem modest compared to giants like Windows or macOS, it is significant in the enterprise space since RHEL focuses mainly on servers, data centers, and business-critical workloads rather than consumer desktops.

- That 1.5% slice highlights Red Hat as a specialised, enterprise-grade operating system that companies turn to when they require stability, support, and security instead of mass consumer adoption.

Conclusion

Red Hat Statistics: Red Hat, with its Linux base and a set of cloud, hybrid, and cybersecurity solutions, remains at the forefront of enterprise IT. The high growth of software, managed services, and OpenShift has been enabling the recurring revenue streams and has helped to significantly increase the profitability of IBM.

With major territories in the U.S., India, Europe, and emerging markets, loyal users, and the thriving US$138 billion partner ecosystem, Red Hat is truly the market leader. An increase in security advisories underscores Red Hat’s transparency and protection efforts. Accountable for 1.5% of the global OS market and with an enterprise-grade reliability focus, Red Hat is shaping the digital transformation of tomorrow.

FAQ.

Red Hat provides enterprise-grade software, cloud, hybrid, and cybersecurity solutions. More than 90% of Fortune 500 companies trust it to modernise workloads, improve security, and drive digital transformation.

It boosts IBM’s Hybrid Platform & Solutions segment growth, which generated US$18.808 billion in 2024 with revenues growing at 11.4%. OpenShift stood at US$1.4 billion in ARR alone, increasing profitability.

Red Hat maintains a global clientele, with its largest customers in the United States (9,881), followed by India (1,836), the United Kingdom, Brazil, Canada, France, and Italy, displaying widespread adoption in various regions.

Through 2024, the company issued 2,280 security advisories, from which 65 were critical advisories and 1,405 were important advisories, showing active identification and disclosure of vulnerabilities in keeping enterprise environments secure.

RHEL nonetheless has an enterprise ring above it, with suddenly 1.5% in the global operating systems market, favouring servers, data centers, and business core workloads.

Aruna Madrekar is an editor at Smartphone Thoughts, specializing in SEO and content creation. She excels at writing and editing articles that are both helpful and engaging for readers. Aruna is also skilled in creating charts and graphs to make complex information easier to understand. Her contributions help Smartphone Thoughts reach a wide audience, providing valuable insights on smartphone reviews and app-related statistics.