ZTE Statistics By Market Growth, Expenses And Cost Management

Updated · Feb 13, 2025

Table of Contents

- Introduction

- Editor’s Choice

- Revenue Of Leading Technology Companies

- Leading Companies Spending On R&D

- ZTE Domestic Market Growth

- ZTE Expenses And Cost Management

- ZTE R&D Investments

- Telecom Equipment Market Share

- Companies With Highest Share Of Global 5G Technology Patents

- ZTE Employee Compensation And Incentive Programs

- ZTE Strategic Developments

- Conclusion

Introduction

ZTE Statistics: ZTE Corporation, the topmost global supplier providing all integrated solutions in information and communication technology, has continued its resilience and growth in the year 2025. With its significant financial feat despite the complicated external environment, the advancement of artificial intelligence as well as the technology in its innovation, proved the dedication brought by the company.

The present article focuses primarily on the details of the financial performance achieved by ZTE statistics, the key figures, and the development of different business segments.

Editor’s Choice

- The top five telecom vendors experienced a growth of 5.7% YoY in Q1 2024 against their previous year’s revenue of USD 51.8 billion, headlined by Huawei and ZTE in the growth.

- According to ZTE statistics, ZTE Q1 2024 revenue grew by 4.9% YoY to USD 4.3 billion (CNY 30.6 billion), gaining from China’s digital transformation and application of AI.

- ZTE spent 7.5% more in R&D, up YoY at about USD 0.9 billion (CNY 6.4 billion), accounting for 20.9% of the total revenue going into R&D.

- ZTE H1 2024 reported that the digital economy in China was strong at 3.0% YoY growth in stable telecom revenues of RMB 894.1 billion.

- AI integration sped up across industries, with domestic intelligent computing capacity of 30%, surpassing 30% total computing power.

- ZTE’s H1 2024 R&D spending totaled RMB 12.73 billion, which was a 0.51% decrease YoY and was equivalent to 20.37% of operating revenues.

- Selling and distribution expenses fell 9.29% between years, reaching RMB 4.19 billion as a result of lowered marketing expenses.

- Administrative expenses were reduced by 11.09% between years from RMB 2.24 billion due to better management efficiency.

- Exchange rate fluctuations caused financial costs to soar by 105.69% YoY to reach RMB46.31 million.

- ZTE’s total R&D funding for the first half of 2024 is RMB 13.43 billion, indicating a drop of about 0.97%.

- Telecom equipment market shares are: Huawei tops the list with 30%, Nokia has 15%, ZTE is left with 11% and Ericsson drops to 13%.

- Leaders in global 5G patent filings: Huawei – 15.4%, Samsung – 13.3%, Nokia – 13.2%, Qualcomm – 12.9%, LG – 8.7%, ZTE – 5.6%.

- By 30 June 2024, ZTE had 68,214 employees and an overall compensation of RMB 17.1 billion.

Revenue Of Leading Technology Companies

(Source: twimbit.com)

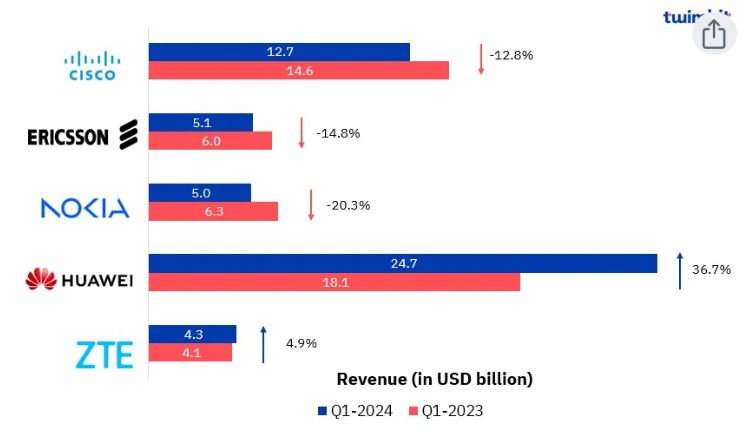

- The five largest telecommunications vendors showed a 5.7% year-on-year (yoy) increase in revenues, to USD 51.8 billion in the first quarter of 2024, compared with previous-year-level figures.

- Most of the contributions to this growth are owed mainly to Huawei and Cisco. Growth, however, is slightly less than the growth of 5.9% yoy recorded in Q1 2023, as most developed markets complete deployment of 5G.

- Huawei and ZTE enjoyed revenue increases of 36.7 and 4.9%, respectively. Cisco, Ericsson, and Nokia reported decreases in their revenue streams of 12.8, 14.8, and 20.3%, respectively.

- The Q1 revenues of ZTE recorded North American growth of 4.9%, equivalent to USD 4.3 billion (CNY 30.6 billion).

- This was driven by opportunities arising from digital transformation and artificial intelligence activities in China.

- To navigate through a complex external environment, ZTE employs a ‘precision and pragmatism for steady growth’ strategy.

- The company has graduated from pure connectivity to ‘connectivity + computing power’ to cater to an expanded market as well as mitigate the impact of reduced CAPEX spending by telecom operators in China.

Leading Companies Spending On R&D

(Source: twimbit.com)

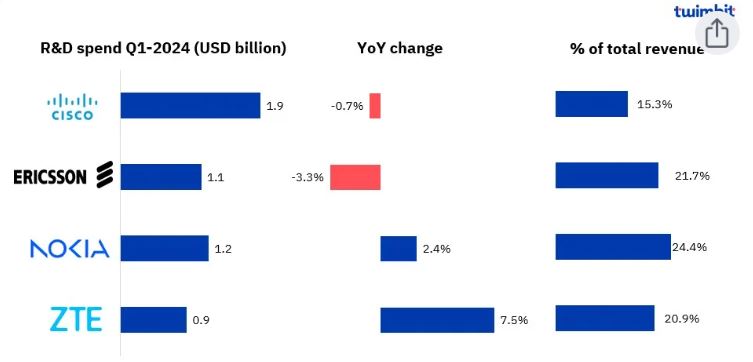

- According to ZTE statistics, ZTE in Q1 2024 recorded a considerable increase of 7.5% YoY in R&D expenditure, which amounted to USD 0.9 billion (CNY 6.4 billion), out of which 20.9% was attributed to total revenue.

- The strong R&D activities of ZTE are, in fact, a cornerstone for business innovation in maintaining product competitiveness.

- AI integration with terminals for product innovation and intelligent upgrades toward a comprehensive smart ecosystem continues to be ZTE’s top priority.

- Cisco registered a slight decrease in R&D spending, decreasing by 0.7% YoY to USD 1.9 billion, which corresponded to 15.3% of total revenues.

- Reduced headcount-related expenses and spending on contracted services contributed to the decrease, which was partially offset by increased expenditure in share-based compensation, cash compensation from acquisitions, and discretionary spending.

- On the other hand, Ericsson’s R&D expenditure for FY 2023 fell by 3.3% YoY to USD 1.1 billion (SEK 11.6 billion), accounting for 21.7% of total revenue.

- The decline was mostly due to cost-saving efforts, offset by increases in salaries and variable incentive accruals. Nokia’s R&D spending advanced by 2.4% YoY to USD 1.2 billion (EUR 1.1 billion).

- The increase was driven by higher-margin investments in Mobile Networks and Nokia Technologies. Consequently, R&D expenses as a percentage of revenue advanced 540 basis points to 24.3% in Q1 2024.

ZTE Domestic Market Growth

- Such upward divinity geotagging representation efficacious progressed during the continuous growth of the ZTE digital economy in the first half of this year compared to last, owing to the continuous improvement in communication infrastructural technology and its complete inclusion of artificial intelligence in the real economy.

- With the improvements made in optical network terminal upgrades, many potential avenues opened up for productivity improvements of superior quality.

- ZTE statistics show that in telecommunications, revenue growth had slowed but showed stability in the domestic communication industry: RMB 894.1 billion worth of revenue with a year-on-year rise of 3.0%, showing continued enhancement in infrastructure like 5G and GB-grade optical networks.

- Domestic carriers were already actively applying agencies equipped with 5G-Advanced (5G-A) innovations, engaging them in test runs and commercial deployments across advanced technologies such as verifying communication-sense integration, low-altitude communication, passive Internet of Things, network intelligence, XR enhancement, industrial Internet, and new solutions for audio and video.

- The AI sector has seen considerable investments from local governments, telecom carriers, and Internet companies, further advancing the development of smart computing centers to support a national integrated computing network.

- ZTE statistics show that by around the middle of 2024, more than 30% of the nation’s total computing power accounted for the domestic intelligent computing capacity.

- Furthermore, the super-embedded nature of AI in different industries highlights an increasing need for novel applications in Internet services, finance, government operations, telecommunications, transportation, and healthcare.

- Such advances are among the predominant forces driving the revolution of traditional industries to digital segments, thus reaffirming China’s future commitment to being one powered by AI-driven tech innovation.

ZTE Expenses And Cost Management

- ZTE statistics state that For the first half of the fiscal year of 2024, ZTE has incurred R&D expenditure amounting to RMB 12.73 billion, showing a year-on-year decline of 0.51%. R&D expense as a percentage of operating revenue stood at 20.37%, down 0.70 percentage points from the previous year.

- Selling and distribution expenses were made to the tune of RMB4.19 billion, a year-on-year reduction of 9.29%.

- As a percentage of total operating revenue, selling and distribution expenses accounted for 6.70%, down 0.90 percentage points from the past year, mainly as a result of lower advertising costs.

- Conversely, administrative expenses amounted to RMB2.24 billion, a decline of 11.09% over the previous year.

- As a percentage of operating revenue, they have decreased by 0.56 percentage points to 3.58%, mainly due to the increased efficiency of management.

- ZTE statistics indicate that finance costs surged to RMB 46.31 million, registering a year-on-year rise of 105.69%, mainly due to a loss on exchange arising out of currency fluctuations, compared to a gain on exchange in the same period last year.

- Tax expenses of the company stood at RMB 566.79 million, showing a year-on-year decline of 15.03%, mainly owing to the increase in deferred tax assets.

ZTE R&D Investments

- According to ZTE statistics, Total R&D investment by ZTE in the first half of 2024 was RMB 13.43 billion, which is a decline of 0.97% year on year from RMB 13.56 billion during the same time frame in 2023.

- Of this total, RMB 12.73 billion was charged to expenses, which is a decline of 0.51% year-on-year from RMB 12.79 billion in the previous year.

- Meanwhile, capitalized R&D investment amounted to RMB 703 million, reflecting an 8.55% year-on-year decrease from RMB 769 million in H1 2023.

- In terms of operating revenue, ZTE’s total R&D investment was at 21.49%, a decrease of 0.85 percentage points compared to 22.34% in the previous year.

- Capitalized R&D investment was 5.24% of total R&D spending, a decline of 0.43 percentage points from 5.67% in H1 2023.

(Source: coolest-gadgets.com)

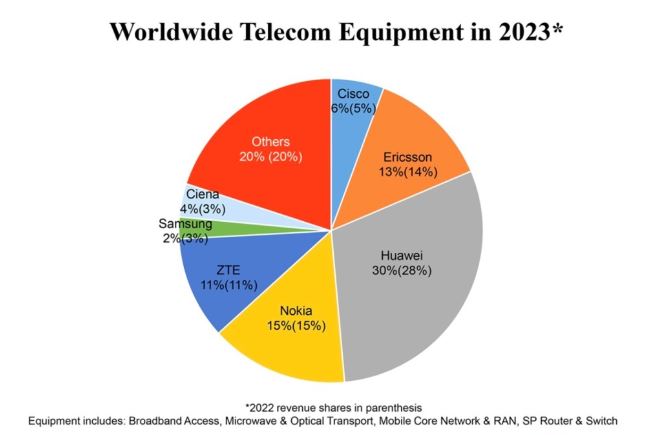

- A change has been observed in the market share distribution of telecom equipment compared to the previous year.

- Huawei is the only major player still in the market, with an increase in its share from earlier 28% to 30% now.

- Nokia holds a 15% share, which stays unchanged from last year; ZTE statistics state that ZTE still holds an 11% share. The share of Ericsson reduced from 14% to 13%, while that of Samsung declined from 3% to 2%.

- On the other hand, Cisco has improved its position slightly to 6% from 5%, while Ciena has been exhibiting growth from 3% to 4%.

- That category is still unchanged at 20%, as it refers to various smaller players in the telecom equipment industry.

(Reference: statista.com)

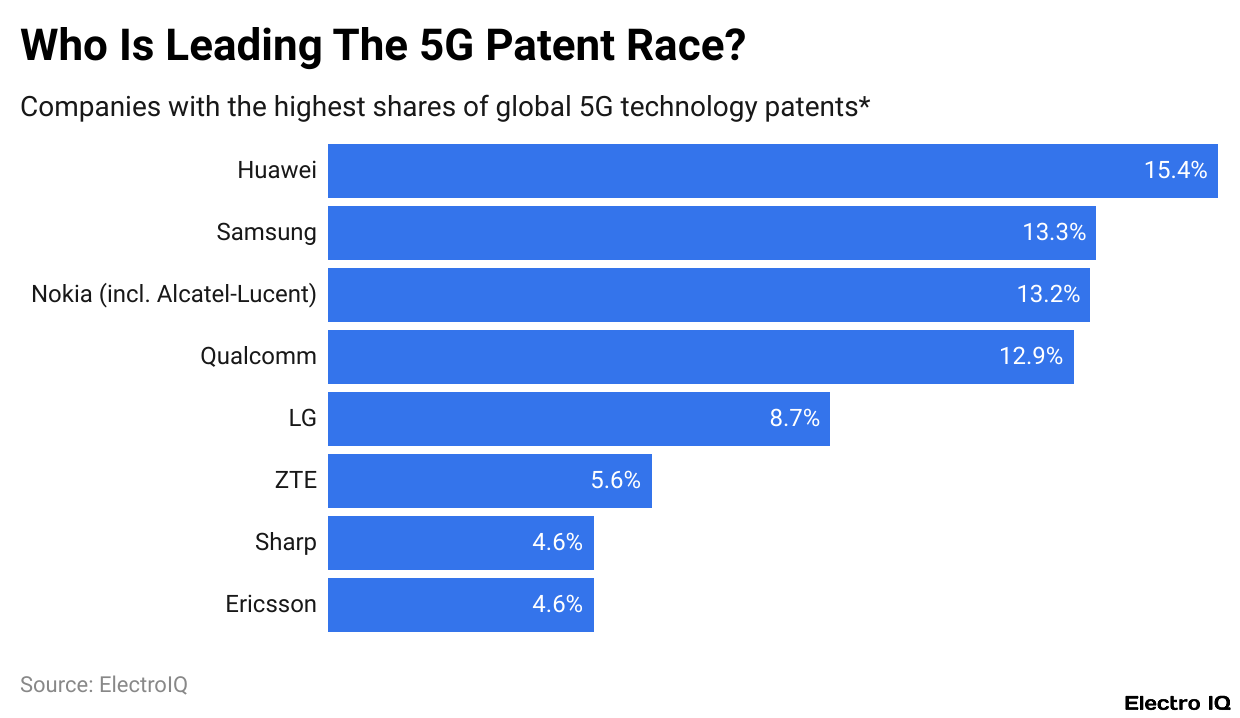

- According to statistical patent counts on a global scale, with an apparent 15.4% share, Huawei is currently the largest holder of 5G technology patents.

- Following thereafter are Samsung, with 13.3%; and Nokia, with 13.2% shares, thus the top three contributors in 5G patent ownership.

- Also, another very strong player in the industry, QUALCOMM, presently holds 12.9% of global 5G patents. LG has 8.7% shares in this area, and ZTE contributes with 5.6%.

- Other major players include Sharp and Ericsson, each holding a 4.6% share of 5G technology patents, thus promoting next-generation network development.

- These are the companies that inspire 5G technology development altogether to the future of telecommunications the world over.

ZTE Employee Compensation And Incentive Programs

- ZTE statistics reveal that as of 2024, the total employee count stands at 68,214. Staff remuneration during the reporting period amounted to approximately RMB 17.1 billion.

- The employee compensation package includes salary, bonuses, and allowances, with additional benefits, including accident insurance, business travel insurance, housing allowances, retirement packages, and other fringe benefits.

- According to local regulations in the countries where its employees are located, ZTE participates in government-organized social insurance schemes, making social insurance contributions on behalf of each employee based on an applicable percentage of their monthly salary.

- To create further long-term incentives and performance management, the company introduced share option-based incentive programs and a management stock ownership program, with the intent of providing incentives for groups of key employees and management personnel.

ZTE Strategic Developments

- ZTE statistics show that ZTE has been partnering very pursuantly by establishing strategic alliances in all parts of the world, which will improve and enhance innovations in the field of telecommunications.

- The 50G PON trial between ZTE and Telecom Egypt enabled a significant improvement in its nationwide broadband network and will introduce innovative services across the country by the telco.

- Moreover, ZTE is working with China Mobile to set up a high-performance 400G QPSK ultra-long-haul optical backbone link, which is set to be completed by mid-2024.

- ZTE has also successfully conducted a 3-in-1 50G PON Combo trial in collaboration with Türk Telekom in Turkey, resulting in improved quality of the networking services.

- ZTE statistics Meanwhile, in Mexico, ZTE executed an all-in-one core network solution based on Red Hat OpenShift and OpenStack platforms with MVNO izzi Telecom. Value-Added Services (VAS) will also be part of the solution.

- In Indonesia, ZTE formed an MoU with Phintraco Ekasarana to expand both companies into new market opportunities and deliver best-in-class IT solutions.

- In Malaysia, Celcom Digi and ZTE are collaborating in a strategic partnership for 5G advancement, leveraging Digital Twin technology, Natural Navigated 5G AGVS, and Smart Helmets across multiple sectors.

- Likewise, U Mobile and ZTE signed an MoU for collaboration in network modernization, focusing on 5G Advanced technology, autonomous networks, and driving 5G adoption for enterprises.

- In Indonesia, Telkomsel and ZTE set up a Strategic Partnership Agreement (SPA) to jointly explore and implement advanced network technologies like Network Edge AI, 5G Advanced, and Intelligent Home Networks.

- ZTE statistics state that Likewise, ZTE cooperated with Turkcell to successfully verify the longest terrestrial long-haul transmission, which surpassed 2,000 kilometers.

- Moreover, ZTE worked alongside Qualcomm, China Mobile, and Sky Limit Entertainment to successfully validate 5G-Advanced (5G-A) technology-based multi-user concurrent XR services, reiterating its commitment to next-generation telecommunications solutions.

Conclusion

As per ZTE statistics, ZTE showed strong financial performance and dedication to innovation. By investing heavily in research and development, the company has cemented its position as an ICT industry leader. While ZTE seeks to navigate the fast-changing technology landscape, a strategic focus on connectivity and computing provides a pivot for long-term growth and success.

Sources

FAQ.

In Q1 2024, ZTE’s revenue grew by 4.9% year-on-year (YoY) to USD 4.3 billion (CNY 30.6 billion) on the back of digital transformation in China's economy and some AI applications. For the first half of 2024 (H1 2024), the China telecom revenue remained stable at RMB 894.1 billion, an increase of 3.0% YoY.

ZTE’s R&D investment in H1 2024 was RMB 13.43 billion, 0.97% lower than the same period of the previous year. Of this amount, RMB 12.73 billion was charged to expenses, which is 20.37% of total operating revenue. The company continues to put its focus on AI innovation and intelligent ecosystem development.

An 11% market share enables ZTE to hold up its position from the previous year. Being ahead with 30% is Huawei as the first runner, followed by Nokia, which has earned 15%, while the position for Ericsson fell to 13%. In the top five globally for 5G patents, that is also ZTE with the share amounting to 5.6%.

ZTE worked with Telecom Egypt, China’s Mobile, Türk Telekom, and Celcom Digi to promote 5G, AI, and broadband network capabilities. The agreement is required to validate 5G-Advanced (5G-A) XR services made by Qualcomm, China Mobile, and Sky Limit Entertainment.

The total selling and distribution costs came down by 9.29% to RMB 4.19 billion, primarily due to the reduction in marketing expenses. Administrative expenses saw a decline of 11.09% to RMB 2.24 billion as well, showing an increase in the efficiency of management. However, finance costs went up by a huge 105.69% to RMB 46.31 million, driven by exchange rate fluctuations.

Aruna Madrekar is an editor at Smartphone Thoughts, specializing in SEO and content creation. She excels at writing and editing articles that are both helpful and engaging for readers. Aruna is also skilled in creating charts and graphs to make complex information easier to understand. Her contributions help Smartphone Thoughts reach a wide audience, providing valuable insights on smartphone reviews and app-related statistics.