Action Camera Statistics By Revenue And Market Share

Updated · Oct 14, 2024

Table of Contents

- Introduction

- Editor’s Choice

- Digital Cameras Market Share

- Digital Camera Revenue Worldwide

- Top 20 Digital Cameras Worldwide

- Shipment of Lenses And Digital Cameras Worldwide

- Share of Digital Camera Owners in Top Countries

- Optoelectronic Market Revenue

- List of Digital Camera Brands

- List of Famous Photographic Equipment Makers

- Action Camera Overview

- Conclusion

Introduction

Action Camera Statistics: Action cameras are used for recording action and are waterproof, rugged, and practical. They primarily utilize advanced sensors to ensure adequate image reproduction. As we go forward, we will review the Action Camera Statistics to learn about the relevant aspects of this photographic system and more about high-quality photos and videos developed using these systems. We will also learn about intelligent systems and the popular camera systems that are present and utilized accordingly for a better user experience.

Editor’s Choice

- Canon dominates the digital camera market with a 46.5% market share, followed by Sony at 26.1%

- The digital camera industry revenue is projected to reach $25.86 billion by 2029

- Hasselblad X1D-50c leads the top digital cameras with a DxOMark score of 102

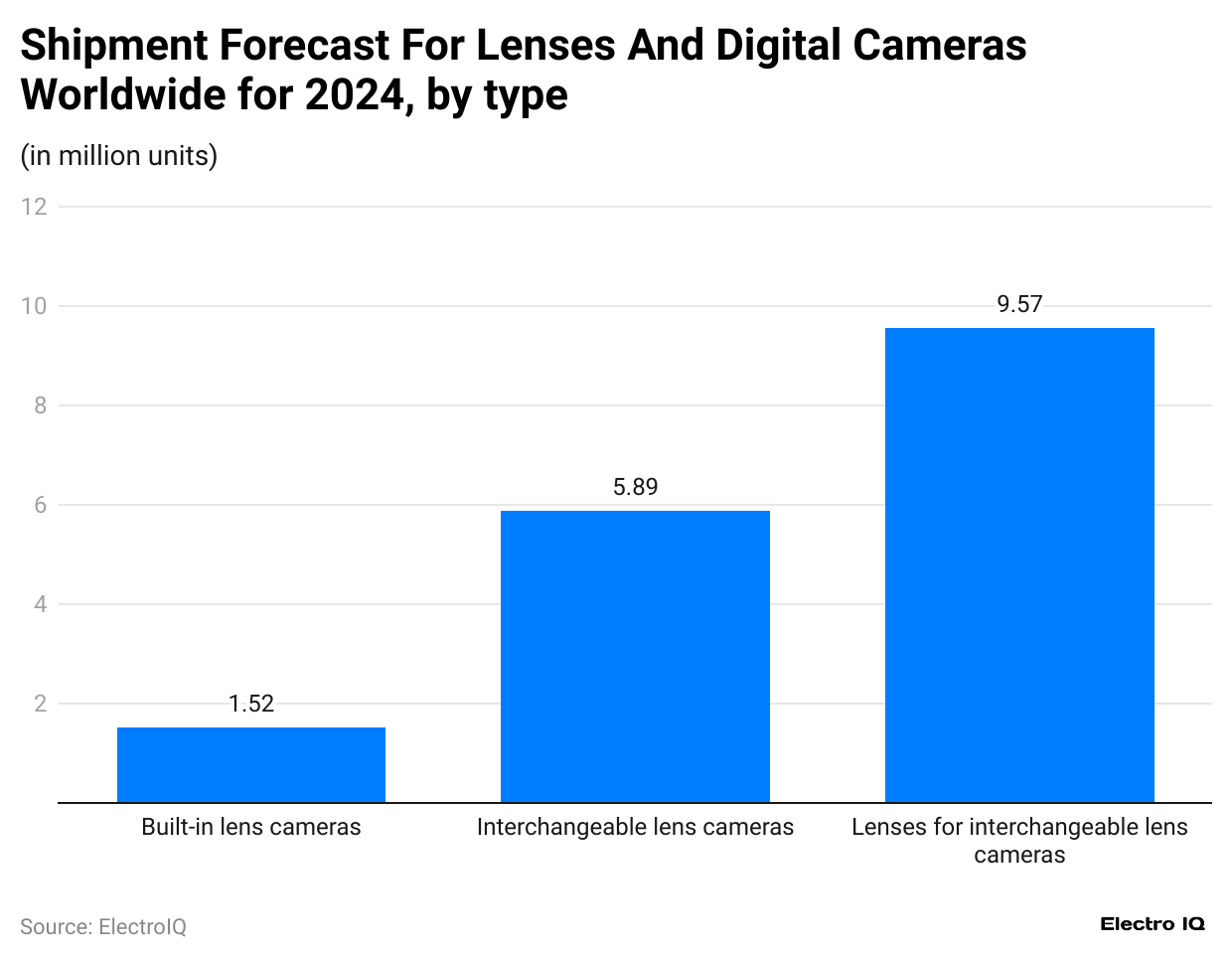

- Lenses of interchangeable lens cameras show the highest shipments at 9.57 million units

- Russia leads digital camera ownership with 47% market penetration

- The global action camera market reached $4.2 billion in 2023

- 60% of action camera users are aged 18-34 years

- GoPro maintains market leadership with 47% global market share

- Average selling price of action cameras reached $350 in 2023

- Online sales account for 55% of total action camera sales

- North America represents 40% of total action camera sales

- 70% of action camera owners regularly share videos on social media

- Post-pandemic outdoor activities drove 80% of 2023 action camera purchases

- 25% of consumers prioritize eco-friendly practices in camera purchases

(Reference: statista.com)

- Action Camera Statistics show that Canon, Sony, Nikon, Fujifilm, and Panasonic are the most popular camera brands.

- Canon has the highest market share with 46.5%, followed by Sony with 26.1% market share, Nikon with 11.7% market share, Fujifilm with 5.8% market share, Other with 5.6% market share, and Panasonic with 4.3% market share.

Digital Camera Revenue Worldwide

(Reference: statista.com)

- Action Camera Statistics show that the revenue of digital cameras has been increasing consistently.

- In 2019, the digital cameras industry’s revenue was $23.22 billion; in 2023, it was $22.98 billion.

- By the end of 2029, the digital camera industry will be $25.86 billion.

Top 20 Digital Cameras Worldwide

(Reference: statista.com)

- Action Camera Statistics show that Leica Q2, Nikon Z8, Sony A7R V, Panasonic Lumix DC-S1R, Sony Cyber-shot DSC-RX1R II, Nikon Z9, Canon EOS R3, Sony A1, Hasselblad X1D-50c, Nikon D810, Sony A7R IV, Nikon D850, Leica M11, Sony A7R III, Nikon Z7, Pentax K-1, Nikon Z7II, Nikon Z6, Sony A7IV, Pentax 645Z, Sony A7R II rank among top digital cameras as of 2024.

- Hasselblad X1D-50c has the highest DxOMark score with 102, followed by Pentax with 101 DxOMark score, Leica with 100 DxOMark score, Panasonic with 100 DxOMark score, Nikon with 100 DxOMark score, Sony with 100 DxOMark score, Nikon with 99 DxOMark score, Sony with 99 DxOMark score, Nikon with 98 DxOMark score, Sony with 98 DxOMark score, Nikon with 98 DxOMark score, Sony with 98 DxOMark score, Nikon with 97 DxOMark score, Sony with 97 DxOMark score, Sony with 97 DxOMark score, Leica with 96 DxOMark score, Pentax with 96 DxOMark score, Canon with 96 DxOMark score.

Shipment of Lenses And Digital Cameras Worldwide

(Reference: statista.com)

- Action Camera Statistics show built-in lens cameras, interchangeable lenses, and lenses of interchangeable lenses.

- The lenses of interchangeable lens cameras have the highest shipments, with 9.57 million units, followed by those with 5.89 million units and 1.52 million units of built-in camera lenses.

(Reference: statista.com)

- Action Camera Statistics show that Italy, Turkey, Brazil, Poland, Colombia, Netherlands, Nigeria, Argentina, United Arab Emirates, Lithuania, United Kingdom, Israel, Hungary, Mexico, Saudi Arabia, Danmark, Philippines, Germany, India, Morocco, Pakistan, Thailand, Greece, Canada, China, Peru, Dominican Republic, Finland, Romania, Serbia, United States, Kanya, New Zealand, Vietnam, France, Switzerland, Chile, South Korea, Norway, Ireland, Russia, Sweden, Belgium, South Africa, Portugal, Austria, Czechia, Japan, Singapore, Egypt, Taiwan, Indonesia, Malaysia rank among top countries for digital cameras.

- Russia has the highest market share at 47%, followed by Italy at 46%, Austria at 46%, and Portugal at 45%.

Optoelectronic Market Revenue

![]()

(Reference: statista.com)

- Action Camera Statistics show that in 2008, the revenue of the optoelectronic market increased consistently.

- In 2008, the optoelectronic market revenue was $17.9 billion, which increased to $45.28 billion by the end of 2023.

- By the end of 2024, the optoelectronic market revenue will be $42.32 billion.

List of Digital Camera Brands

Consumer Camera Brands:

- Kodak (United States): Compact digital and bridge cameras (manufactured by JK Imaging).

- Nikon (Japan): Coolpix compact digital cameras, Nikon 1 MILCs, D-series DSLRs.

- Canon (Japan): PowerShot, EOS M MILC, Digital EOS/ Rebel DSLRs.

- GoPro (United States): Rugged action cameras are compact and personal.

- BenQ (Taiwan): Compact digital cameras and bridge cameras.

- Insta360 (China): Action cameras, 360-degree cameras.

- DJI (China): Drones, action cameras, digital cinema cameras.

- Hasselblad (Sweden): Medium format and mirrorless medium format cameras.

- Sony (Japan): Cyber-shot compact cameras, α DSLRs, NEX MILCs.

- Akaso (China): Compact digital cameras.

- Samsung (South Korea): Compact digital cameras, NX-series MILCs.

- Leica (Germany): Compact, DSLRs, MILCs, rangefinder cameras.

- Fujifilm (Japan): FinePix compact cameras, X-series MILCs.

- OM System (Japan): Compact cameras, E-series DSLRs, mirrorless Micro Four Thirds.

- Pentax (Japan): Optio compact, K-series DSLRs, Q MILCs.

- Polaroid (United States): Instant cameras, printers.

- Blackmagic Design (Australia): Digital video cameras, consumer & professional.

- Flashback (Australia): Film camera-mimicking compact digital cameras.

- Kinefinity (China): Digital cinema and broadcast cameras.

- Vivitar (United States): Compact digital cameras.

- Ricoh (Japan): Caplio compact cameras, GXR MILCs.

- Sigma (Japan): Compact digital cameras, SD-series DSLRs.

- VisionTek (Canada): IP cameras are commercial- and small-business-focused.

- Vageeswari (India): Wooden field cameras.

- Praktica (Germany): Compact digital cameras.

- Z CAM (China): Digital cinema and virtual reality cameras.

Non-Consumer Camera Brands:

- Apple (United States): Cameraphones, tablets, webcams (previously offered QuickTake).

- Alcatel (France): Cameraphones.

- Arri (Germany): Professional cinema cameras.

- Aiptek (Taiwan): Camcorders.

- Bushnell (United States): Trail cameras.

- BlackBerry (Canada): Cameraphones.

- Contour (United States): Wearable HD action cameras.

- Arecont Vision (United States): IP cameras, HDTV surveillance.

- Brica: Cameras.

- ABUS (Germany): Security and surveillance cameras.

- Buckeye Cam (United States): Long-range wireless camera systems.

- Axis (Sweden): Network cameras, standalone webcams.

Other Notable Camera Brands:

- Tevion (Germany): Compact digital and trail cameras.

- Minox (Germany): Compact digital cameras.

- Foscam (China): IP cameras.

- Aigo (China): Compact digital cameras.

- Advert Tech (China): CCTV, IP cameras, high-definition cameras.

- Bell & Howell (United States): Compact digital cameras.

- Medion (Germany): Consumer digital cameras.

- Memoto (Sweden): Wearable lifelogging cameras.

- Thomson (France): Waterproof digital cameras.

- Traveler (Germany): Compact digital cameras.

(Source: wikipedia.org)

List of Famous Photographic Equipment Makers

- Ricoh

- Leica

- Argus

- LOMO (Leningradskoye Optiko Mechanichesckoye Obyedinenie)

- Plaubel

- Zorki see KMZ

- Bell & Howell Co.

- Fujifilm

- Hanimex

- Schneider Kreuznach

- Agfa

- Voigtländer (name used under license; original company defunct)

- Samyang Optics (Samyang SLR lenses are also branded as Vivitar, Rokinon, Walimex, Bower or Pro-Optic)

- Nikon

- Polaroid

- Canon

- Kenko (part of KenkoTokina Corporation)

- Franka Kamerawerk

- Olympus

- Heliopan

- Sony

- Tamron (The second shareholder is Sony)

- Zorki

- Walz

- Voigtländer

- Tiffen

- Fujinon (see Fujifilm)

- Blackmagic Design

- Bell & Howell

- Mirfak

- Cosina

- Kiron

- Minolta

- Lytro (makers of consumer plenoptic cameras)

- Mamiya (part of Phase One)

- Fuji

- Phase One

- Kowa

- Exakta

- Schneider Kreuznach

- Topcon (still manufactures optical instruments)

- Zenit see KMZ

- Leica

- Nikon

- Ebony

- Bron Elektronik

- Bolex

- Sinar

- Walimex

- OPL

- Hasselblad

- Canon

- Jupiter

- Argus

- ADOX

- Olympus

- Zenit see KMZ

- Asahi (see Pentax)

- Laowa, see Venus Optics

- Nimslo (4 lens 35 mm 3D camera)

- Agfa

- Samyang

- Davidson

Action Camera Overview

- Action cameras have grown in popularity over the past few years thanks to their durability and ability to capture high-quality video and images in various settings. In 2023, the global action camera market was valued at approximately $4.2 billion US dollars. This figure is expected to grow significantly in 2024, reaching an estimated $5.2 billion US dollars, indicating a robust annual growth rate of around 24%. The increasing demand for adventure sports and outdoor activities contributes to this growth as users seek to document their experiences with high-quality footage.

- Younger generations primarily drive the demand for action cameras, particularly Millennials and Gen Z. Approximately 60% of action camera users fall within the age range of 18 to 34. This demographic is more inclined to share their experiences on social media platforms, further propelling the demand for action cameras. In 2023, it was reported that around 70% of action camera owners frequently share their videos on social media, showing the significant impact of social media on consumer behavior in this market.

- Regarding market share, GoPro remains the dominant player in the action camera industry. As of 2023, GoPro held approximately 47% of the global market share. The company’s innovative products, such as the GoPro HERO11 Black, have strengthened its position. However, several competitors, including DJI and Insta360, are gaining traction. DJI, for instance, captured about 20% of the market share in 2023, up from 15% in 2022, showcasing its growing popularity and consumer trust.

- Pricing strategies also play a critical role in the action camera market. In 2023, an action camera’s average selling price (ASP) was around US$ 350. Analysts predict this figure will rise to $400 US dollars in 2024, driven by the introduction of more advanced features, such as improved image stabilization and higher resolution capabilities. As consumers seek better quality and advanced technology, they are often willing to invest more in premium models.

- The rise in adventure tourism is another critical factor influencing the growth of the action camera market. According to recent studies, 35% of travelers now consider capturing their adventures on camera essential to their travel experience. In 2023, the global adventure tourism market was valued at approximately $683 billion US dollars, with projections indicating it will exceed $1 trillion US dollars by 2028. This surge in adventure tourism directly correlates with the rising demand for action cameras as travelers look to document their experiences.

- Moreover, the increasing influence of extreme sports has also contributed to the growth of action camera sales. For instance, a survey found that about 45% of action camera users engage in extreme sports such as mountain biking, surfing, and skydiving. The ability of action cameras to withstand harsh conditions and capture fast-paced action makes them ideal for these activities. In 2023, action camera sales for extreme sports grew by 30%, highlighting the demand for specialized products.

- Consumer preferences are shifting towards cameras with advanced features such as 4K video recording, waterproof capabilities, and longer battery life. Approximately 75% of consumers indicated that video quality is the most crucial factor when choosing an action camera. Additionally, features like built-in stabilization technology have become increasingly important, with around 65% of users prefer cameras that offer this functionality.

- When looking at the geographic distribution of the action camera market, North America remains the largest market, accounting for approximately 40% of total sales in 2023. This is followed by Europe, with a share of about 30%. The Asia-Pacific region is expected to grow fastest, with a projected CAGR of 30% from 2023 to 2024. Countries like China and India are emerging markets for action cameras due to rising disposable incomes and an increasing interest in outdoor activities.

- Retail channels also play a significant role in the distribution of action cameras. In 2023, online sales accounted for approximately 55% of total sales, reflecting the growing e-commerce trend. Consumers appreciate the convenience and often find better deals online. However, traditional retail stores still maintain a presence, with 35% of sales occurring in brick-and-mortar stores, particularly in locations that cater to outdoor sports and adventure gear.

- The COVID-19 pandemic has also influenced consumer behavior. In 2023, many consumers returned to outdoor activities, leading to a resurgence in action camera sales. Increased activities such as hiking, biking, and water sports post-pandemic have driven demand for these devices. Data shows that 80% of consumers who purchased action cameras in 2023 cited their desire to capture outdoor experiences as the primary reason for their purchase.

- Sustainability is becoming a significant consideration for consumers when purchasing action cameras. Approximately 25% of consumers preferred brands that prioritize eco-friendly practices in their production processes. Companies that adopt sustainable practices may gain a competitive edge in the market as consumers are increasingly aware of environmental issues.

- The landscape of the action camera market is evolving rapidly, with technological advancements and changing consumer preferences shaping its future. As we move into 2024, key players in the industry are expected to continue innovating and improving their product offerings to meet the demands of a diverse consumer base.

- In summary, Action Camera Statistics highlights a thriving market driven by young consumers, adventure tourism, and the popularity of social media. The projected growth from $4.2 billion US dollars in 2023 to $5.2 billion US dollars in 2024 underlines the increasing demand for these versatile devices. As the market continues to evolve, the focus on quality, features, and sustainability will shape the competitive landscape in the years to come.

Conclusion

The action camera market demonstrates remarkable growth and evolution, driven by technological advancement and changing consumer preferences. Action Camera Statistics showcases the market’s expansion from $4.2 billion in 2023 to an anticipated $5.2 billion in 2024, reflecting strong consumer demand and industry innovation.

Key trends include the dominance of online sales channels, the growing importance of sustainability, and the significant influence of younger consumers aged 18-34. As we look ahead, the industry’s focus on innovation, sustainability, and user experience will likely shape its trajectory in meeting evolving consumer demands.

Sources

FAQ.

GoPro leads with 47% market share, followed by DJI at 20%.

The average selling price in 2023 was $350, expected to rise to $400 in 2024.

60% of users are between 18-34 years old.

55% of sales occur online, while 35% happen in physical stores.

North America leads with 40% of total sales, followed by Europe at 30%.

75% of consumers prioritize video quality as the most crucial factor.

Approximately 70% of owners share their videos on social media platforms.

Saisuman is a skilled content writer with a passion for mobile technology, law, and science. She creates featured articles for websites and newsletters and conducts thorough research for medical professionals and researchers. Fluent in five languages, Saisuman's love for reading and languages sparked her writing career. She holds a Master's degree in Business Administration with a focus on Human Resources and has experience working in a Human Resources firm. Saisuman has also worked with a French international company. In her spare time, she enjoys traveling and singing classical songs. Now at Smartphone Thoughts, Saisuman specializes in reviewing smartphones and analyzing app statistics, making complex information easy to understand for readers.