Car Rental Statistics By Revenue, Users, Sales, Companies and Facts

Updated · Mar 24, 2025

Table of Contents

Introduction

Car Rental Statistics: Throughout the year 2024, the car rental industry has been evolving. This means that it has grown as an important part of the global travel and transport system. The car rental industry is in a recognised period of significant evolution as technological advancements the rising importance of sustainable practices, and enhanced customer experience adaptation have started making ways towards its fold.

This article will look into the latest car rental statistics, trends, and insights about the car rental industry this year.

Editor’s Choice

- According to car rental statistics, almost 25% of car renting transactions from corporate customers would contribute to the US market (USD 99.54 billion in 2023).

- The world market expects annual growth of about 8.70% from 2022 to 2032.

- To anticipate almost 348.9 million new users between 2027 and 1990, the car rental market in Asia needs to be developed.

- The economy segment comprises more than 2 million vehicles in the U.S., and the global market has captured 602.2 million customers by 2026.

- Car rental statistics reveal that the revenue generated by the car rental segment annually is about half of that of the U.S. In contrast, the rental user base in the States is expected to increase further to 108.5 million by 2027.

- According to a study about customer preferences in the UK, The car rental business generated a division net income of USD 81.32 billion by the end of 2022.

- 55% of the leisure segment holds the market share, but the commercial sector makes up 45%.

- This led to a decrease of 27.4% in profit in the year 2020 compared with 2019.

- Car rental statistics show that ERAC is reportedly the most favored car rental company and uses more than 84% of respondents.

- For Hertz, ranked second among the world’s largest companies, revenues declined by about 56% and filed for bankruptcy in 2020 before exiting the sector in 2021.

- In 2021, some 132,908 individuals found employment in the car rental business as car rental agents accounted for 50.5% of the workers employed.

- Considerably, big investments have been found in the startups in the car rental sector with very popular funding rounds; for instance, FINN raised USD 110 million in Series C in 2024, HyreCar secured $12.25 million in 2023, and Kyte raised around USD 60 million in 2022.

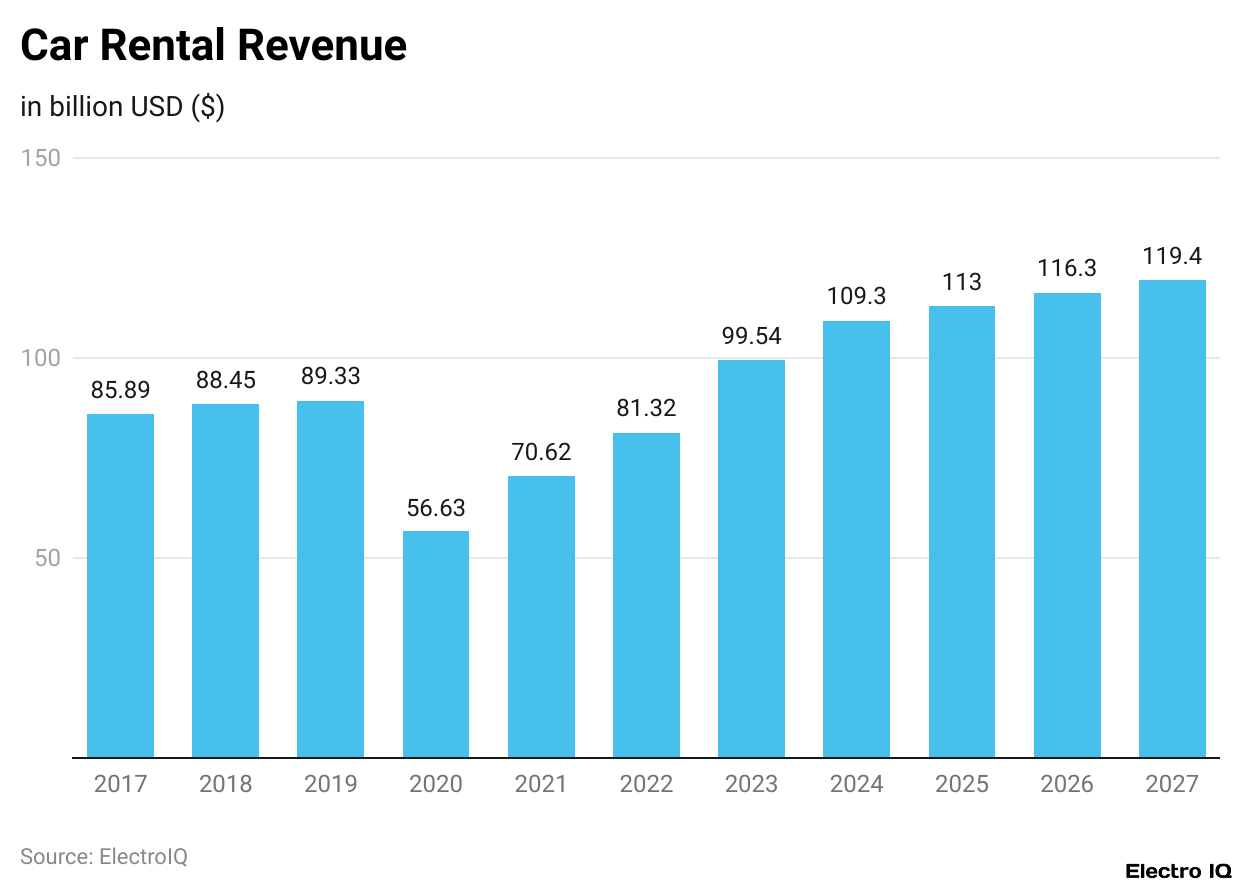

Car Rental Revenue

- Over the five years from 2017 to 2021, the car rental industry experienced fluctuating income figures.

- Car rental statistics show that USD 85.89 billion was inaugurated in 2017, which rose a bit from around USD 88.45 billion of income in 2018, and this figure swelled up to approximately USD 89.33 billion by 2019.

- The year 2020, however, presented quite a drastic decline as it was affected by global junctures.

- Earnings bartered off at approximately USD 56.63 billion during the year.

- The following year, which was 2021, saw some partial recovery in which the figure settled at around USD 70.62 billion, and in 2022, the sector began regaining momentum and had grown in revenue up to USD 81.32 billion.

- The industry continued to grow such that in 2023, a profit of about USD 99.54 billion was expected. 2024, thereafter, was slated to have about USD 109.30 billion in earnings-200, 2025 to have earnings at about USD 113 billion-300, and 2026 earnings would climb to USD 116.30 billion-300.

- By 2027, more than $119.40 billion would have been earned with 3% continual growth per annum towed for another year. It is a vivid showcase of the resilience and potential growth of the car rental market.

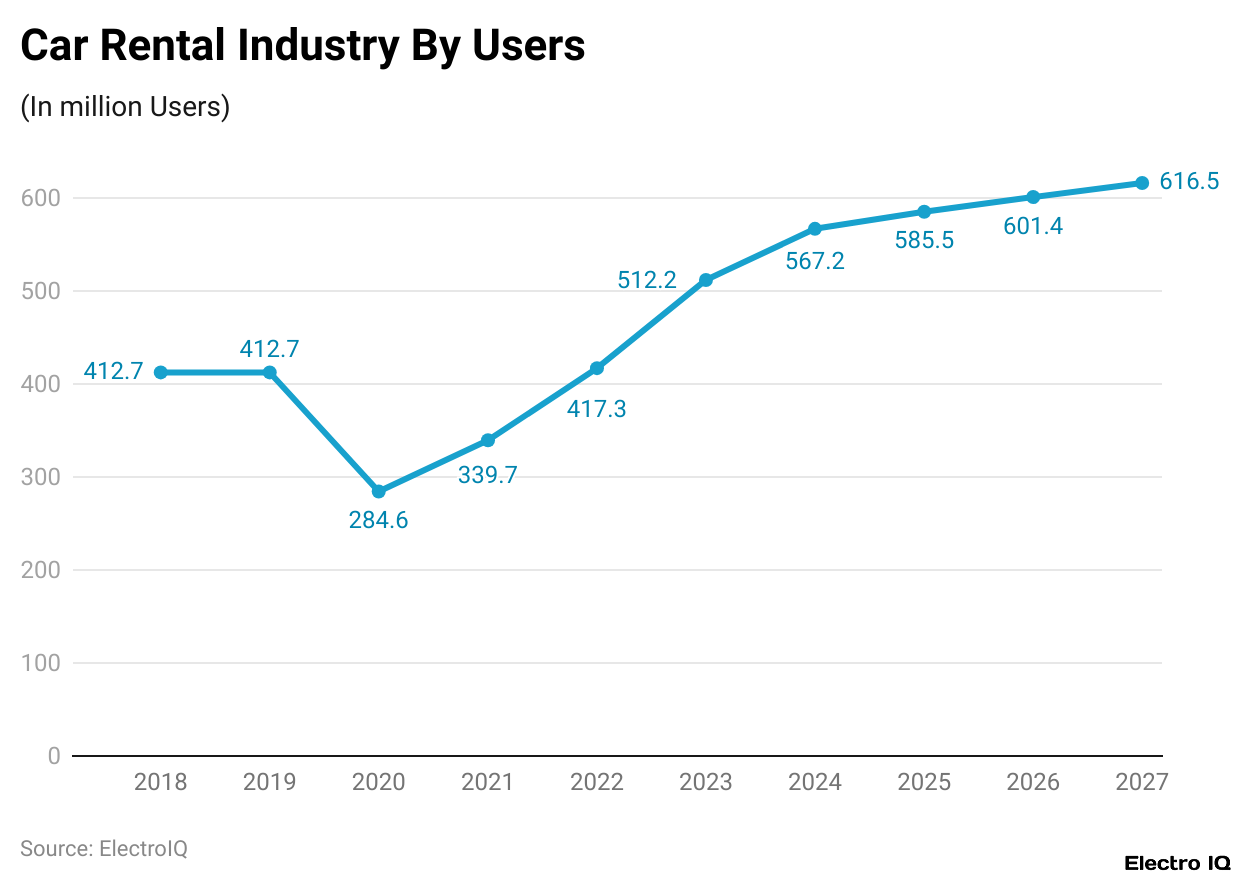

Car Rental Users

(Reference: statista.com)

(Reference: statista.com)

- According to car rental statistics, car rental users grew from 412.7 million in 2019 to a much smaller 284.6 million users in 2020 following the impact of COVID-19 on traveling and rental-related activities.

- With the recovery of the industry in 2021, the number grew to 339.7 million, followed by further growth in 2022, reaching 417.3 million users.

- In 2023, the recovery continued, with figures expected to jump up to 512.2 million.

- Estimates have put the growth of the user base to 567.2 million for the year 2024 and most likely higher to 585.5 million by 2025.

- It then surprisingly stops at 601.4 million users, respecting 2026 estimates, following 616.5 million provisions as of 2027, reflecting uniform rise and recuperative activities.

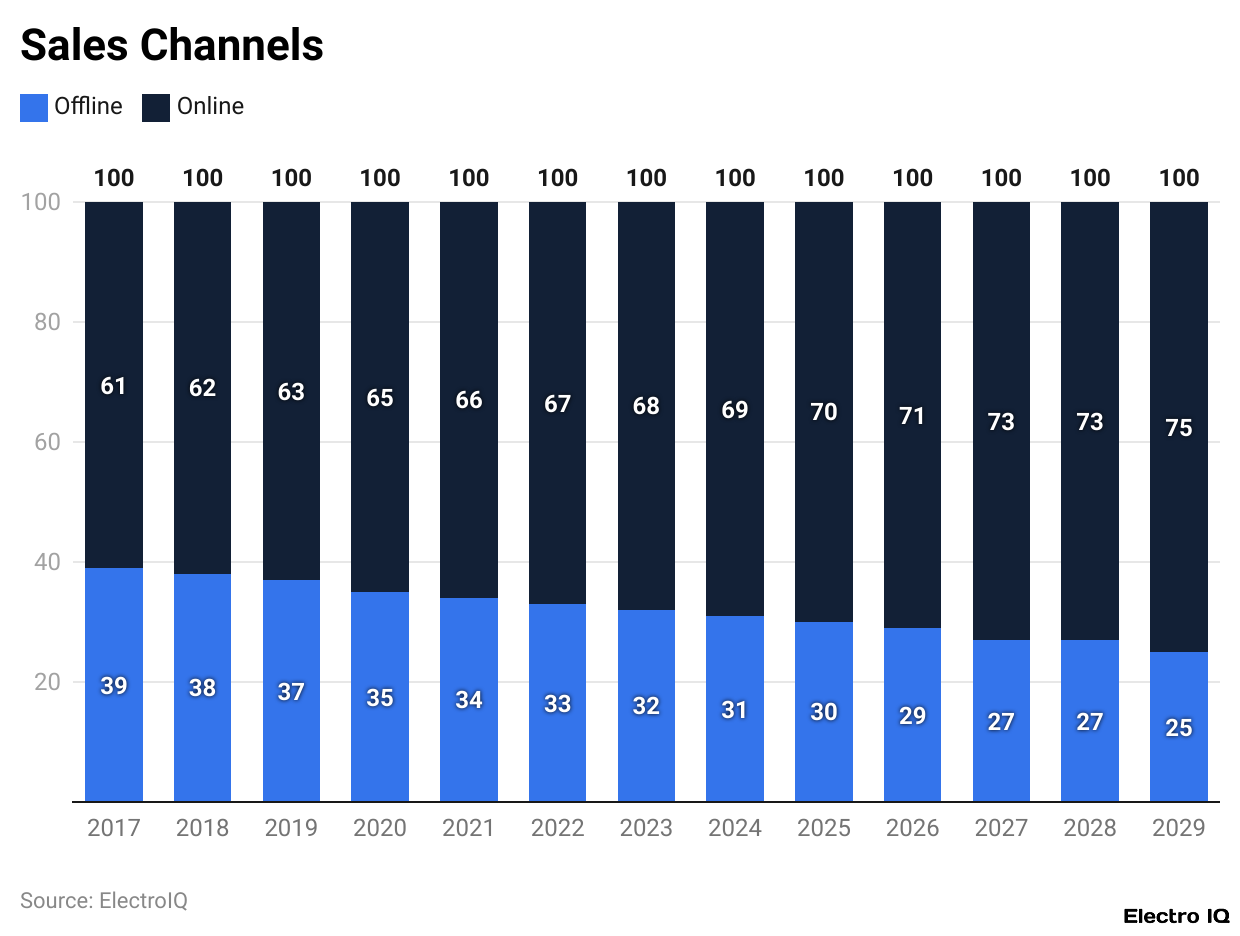

Car Rental Sales

- During the last five years, the industry seemed to be leaning towards setting things up online when it came to car bookings, as it seemed to have fallen back the percentage of offline rentals to almost 40% of the total.

- In 2017, only 39% of rentals happened offline, whereas the rest, 61%, were closed online.

- Additionally, there were very few shifts between offline and online bookings in 2018; offline bookings improved to merely 38%, and online bookings shot to 62% to oppose the traditional trends.

- Years to follow saw fractional decreases in offline sales; for the year ended in 2019, offline bookings were 37% as opposed to 63% with their online purchases.

- The situation worsened in 2020 and 2021 because the ratio went below 36:64 and then 35:65.

- However, the trend continued and reached just 34% in 2022, while 66% was for online booking.

- Car rental statistics projections revealed that by the year 2023, the ratio was expected to fall to 33:67.

- Forecasts for the next years suggest that the same pattern would carry forward with ratios of 31:69 in 2024, 30:70 in 2025, 29:71 in 2026, and 28:72 in 2027.

- Similarly, it is clear from these statistics that online bookings have quite dominated the car rental industry, with today’s results pointing towards the time when online would be the key way the customers were served.

Car Rental Rates

(Reference: statista.com)

(Reference: statista.com)

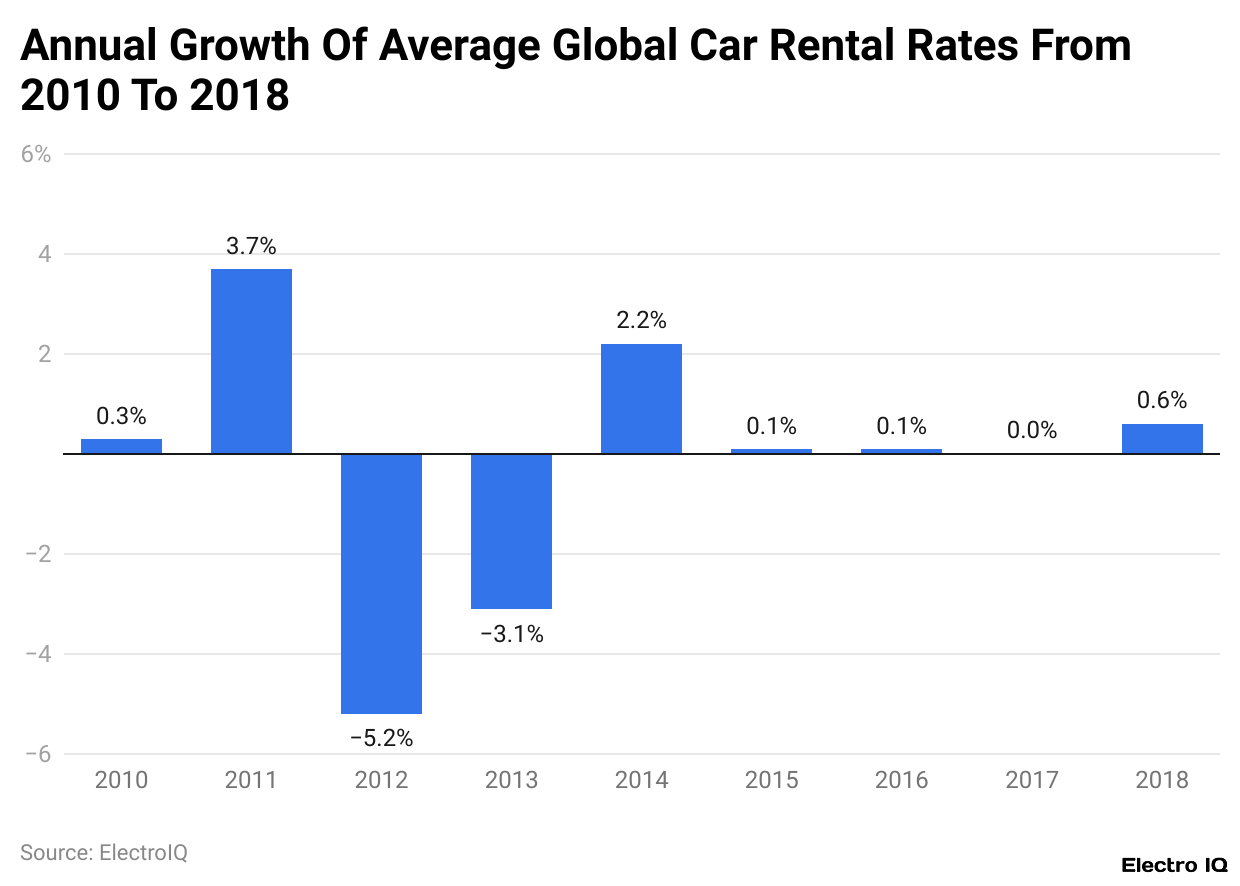

- Car rental statistics for 2009 to 2018 show that average car rental rates around the world had the highest rental growth rates per year.

- In 2014, global rental rates grew on average by 2.2%, which is a significant increase over other past years. One might find that the demand is high or market adjustments took place during this quarter resulting in the high price increase.

- By 2018, rental prices decelerated significantly and it is projected that the growth in rental prices will be about 0.6% from their earlier level. This slower growth rate implies an improved environment for the market that is more stable or competitive.

- A rise is moderated owing to a decrease in price variation. In comparison, this has shifted from high rates of growth in price to moderated and constant increases of rates in the car rental sector from 2014 to 2018.

Car Rental By Region

Worldwide

- According to car rental statistics, on a global basis, it is projected that by 2024, the USD 104.40 billion revenue from the global car rental market will surpass 3.52% at a compound annual growth rate (CAGR) figure until 2029. At that time, these markets are supposed to reach USD 124.10 billion.

- The number of users is expected to grow to about 0.82 billion. The user penetration will be expected to increase from about 7.7% in 2024 to 10.1% in 2029.

- The ARPU, or average revenue per user, is expected to range at US $175.40, with 75% of that coming from online sales.

- The largest source of revenue growth in the world is the U.S., with a projected revenue in the sector as high as U.S. $31.54 billion by 2024.

- To compete with the evolving rise of ridesharing services, the firms are now offering a wide variety of flexible rental plan options as well as loyalty programs in the United States.

Africa

- In Africa, the car rental sector is forecast to grow to an estimated USD 3.57 billion for 2023 at an ARPU of USD 53.90.

- Car rental statistics state that it is expected that by 2027, 56% of revenue will emanate from online sales, with the market growing to 91 million users.

- At an estimation of 5.3% user penetration in 2023, the user ratio will grow to 6.6% by 2027, with approximately 8.47% growth in revenue yearly to jump to USD 4.94 billion by 2027.

Americas

- In the Americas, the car rental sector is expected to achieve a revenue boost of USD 38.5 billion by 2023.

- By 2027, users are projected to rise to 108.5 million, breathing life into a user penetration level of 9.8% to 10.4% in 2023.

- A forecast level of USD 390 in ARPU, with 77% of its revenues from the online segment, is a good indication of growth toward a somewhat modest CAGR of 2.44% at about USD 42.4 billion by 2027.

Asia-Pacific

- In 2024, with a CAGR of 3.10%, the car hire revenue was estimated at USD 37.94 billion. The market’s overall estimation leads to USD 44.20 billion by 2029.

- The users are projected to grow to 459.8 million, and the user penetration is expected to rise from 7.5% in 2024 to 10.4% by 2029.

- ARPU is forecasted to be USD 118.60, with 73% of revenue coming from online sales by 2029.

- The largest similar market has been expected to develop in the United States, with revenue of approximately USD 31.54 billion for the year 2024.

Europe

- There are expectations that user penetration in European car rental will increase from 6.4% in 2023 to 7.5% by 2027.

- By 2027, the region will record 63.4 million users, and 72% of revenue is generated online.

- The ARPU is expected to be USD 279.60, and the market is expected to grow from USD 15.11 billion in 2023 to USD 18.69 billion by 2027, at a CAGR of 5.46%.

Car Rental Companies

(Source: statista.com)

(Source: statista.com)

- Traditional companies like Hertz and Budget, which rent out cars, have been facing a tough time. The companies witnessed their fleet sizes shrink dramatically after the pandemic, which drove some of them to sell off as many vehicles as possible.

- The problems were compounded by worldwide problems in the semiconductor industry and the increased cost of re-stocking vehicles, so prices have been hitting the roof for customers.

- Specialists opine that the high costs will continue into the foreseeable future. This changing market was seen as great and also captures the insights that were brought to light in Statista’s Consumer Insights.

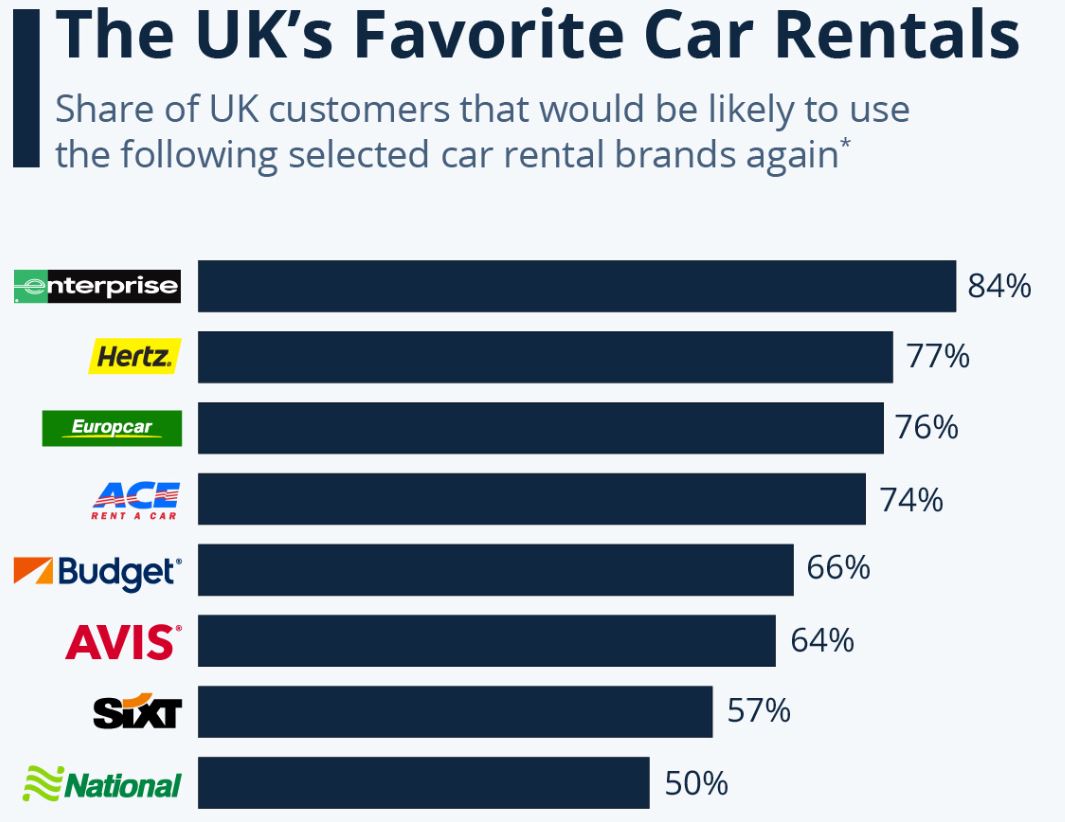

- It observed customer attitudes toward car rentals. In a survey of UK clients in August 2022, there was a preference for Enterprise Rent-A-Car, with 84% of respondents implying their willingness to rent a car from the company.

- Car rental statistics show that The respondents had mentioned Hertz next, with 77%, followed by Europcar with 76% and ACE with 74%. National had the least number of people willing to return to doing business with them: only half.

- The research also looked into factors influencing the choice of rental companies respondents trusted known and reputed brands, though 22%.

- 17% were driven solely by the price of the services and not the service quality, while others considered low prices their highest priority.

- Only 15% knew enough about car rental services, meaning a high level of lack of knowledge among the consumers.

Car Rental Market Fund Raised By Startup

- Car rental statistics show that the car rental business has attracted significant investment during the past several years, which is good for young innovators wishing to either start a business or grow it with credit from financial institutions and advice from some of the investors.

- FINN, a car subscription service, went ahead. It will secure USD 110m, drawing all the venture funds up to Series C 2024. HyreCar, an online car rental start-up got USD 12.25M in new funding in 2023.

- In 2022, another notable car app sharing, Kyte, obtained USD 60M in Series B investment. In the beginning, Dishangtie took USD 200M in Series D at the Chinese car rental company in 2022. This investment brings in Ikea as one of the investors.

- A French car rental company, Virtuo, had received the largest funding round of USD 96 m from the company, bringing the total funding to USD 172 million. MILES Mobility of Germany made a total of USD 5.68 m through two rounds, while Cluno saw USD 28 m for its Series B funding round.

- In China, QEEQ received support from Alibaba Group in 2022, while Huizuche got investments of around USD 40 m for three different rounds.

- Indian startups have made their investments, too, with IndusGo getting USD 12 m in 2022 to expand their fleet and Revv, USD 31.2 m over seven rounds.

- In the Middle East, Invygo, the Napoli-style car rental subscription, raised the USD 10 m for Series A investment.

- The most recent ones are Hopper, a Canadian travel service that has managed to pull in USD 170 million in 2021, and Bipi, a Spanish car rental subscription company, which has gotten an allocation of funds amounting to USD 29.94 million spread across its six rounds.

- Of these, German RV rental startups Roadsurfer and PaulCamper raised USD 28.6 million and USD 12.70 million, respectively, while Denmark’s goat-to-peer car rental startup, GoMore, attracted USD 18.2 million in funds, and South Africa’s FlexClub received USD 6.2 million in two rounds.

Conclusion

The car rental industry is about growth, innovation, and shifting towards sustainability. According to car rental statistics, predicted market value of USD 602.2 million by 2026, the increase in online booking preference, and the increasing demand for electric vehicles, the industry is transforming based on customer demands and environmental requirements.

For the customer, diversified choices of cars, competitive prices, and an experience of a different digital kind keep car rentals in the business of business as well as leisure travel.

Sources

FAQ.

Revenue over different periods saw some changes in revenue within the car rental industry 2017-2021, with 2020 falling short the most due to COVID-19 implications, even though it was already on the recovery path by then. Indeed, this phenomenon is expected to trickle up and attain an approximate US$109.30 billion projected revenue by 2024, only to actualise sales of over US$119.40 billion come 2027, showing a continuous growth uptick near a 7% surge.

By far, the number of prior-year users declined considerably in 2020 due to the pandemic, with 284.6 million users. This was followed by a swift recovery, resulting in an increase in the number of users to 417.3 million by 2022, with projected figures of 567.2 million in 2024 and 585.5 % in 2025.

Online bookings have now come to rule the style of car bookings, with offline bookings making their way down from 39% in 2017 to 34% in 2022. And then 72% online is said to have composed the market by 2027.

As it reaches US$31.54 billion in 2024, the United States continues to generate the largest overall amount. Asia-Pacific is expected to surpass US$31.94 billion by 2024 and grow to US$44.2 billion in 2029. Other regions, such as Europe and Africa, anticipate noticeable growth regarding user penetration and revenue generation, albeit with varying sizes.

Enterprise Rent-A-Car is strongly preferred in the UK, with 84% of the respondents. Other big fits are Hertz, Europcar, and ACE. Despite the capital destruction during the pandemic phase, companies such as Hertz and Budget are starting to recover slowly, opening ways for new start-ups to attract greater investments, as does FINN by securing $110 million in 2024.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.