Cloud Kitchen Statistics and Facts

Updated · Jul 02, 2025

Table of Contents

Introduction

Cloud Kitchen Statistics: The global food industry is changing rapidly, and one of the major transformations in recent years has been the emergence of cloud kitchens. Also known as ghost kitchens or virtual kitchens, this concept has revolutionized the way consumers access their favourite dishes. These kitchens focus exclusively on delivery services and do not offer dine-in facilities.

(Source: stocktake-online.com)

Their primary goal is to fulfil online orders from food delivery apps or their own websites. The convenience of having food delivered to one’s doorstep, combined with lower overhead costs, has attracted both entrepreneurs and consumers to cloud kitchens. In this article, we will explore key statistics, trends, and projections that are shaping the current landscape of cloud kitchens.

Editor’s Choice

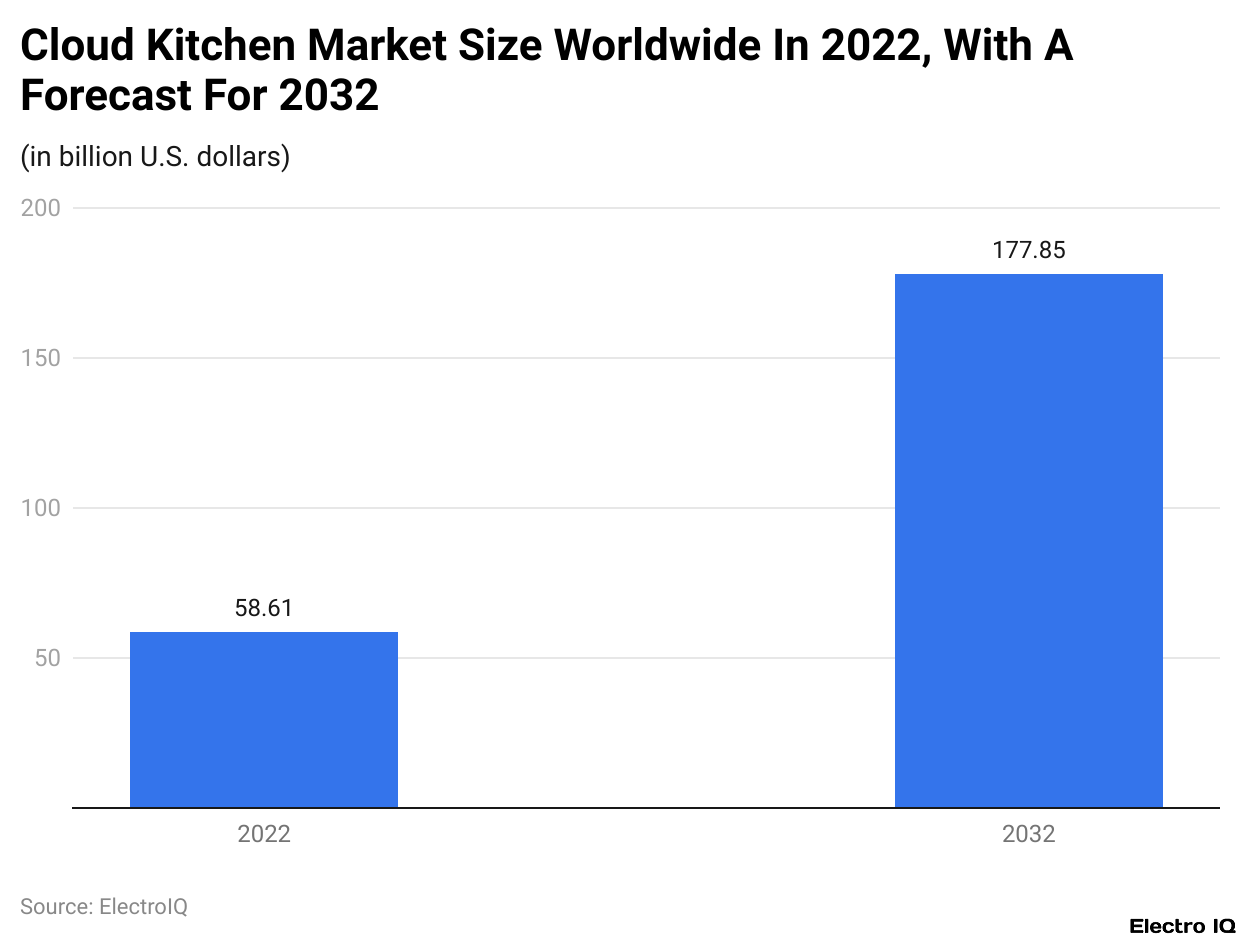

- The global cloud kitchen market was valued at USD 58.61 billion in 2022 and is expected to reach USD 177.85 billion by 2032 due to high food delivery demand.

- The revenue from cloud kitchens in 2022 was USD 63.9 billion. Independent cloud kitchens contributed USD 39 billion, while commissary/shared kitchens and kitchen pods contributed USD 19 billion and USD 6 billion, respectively.

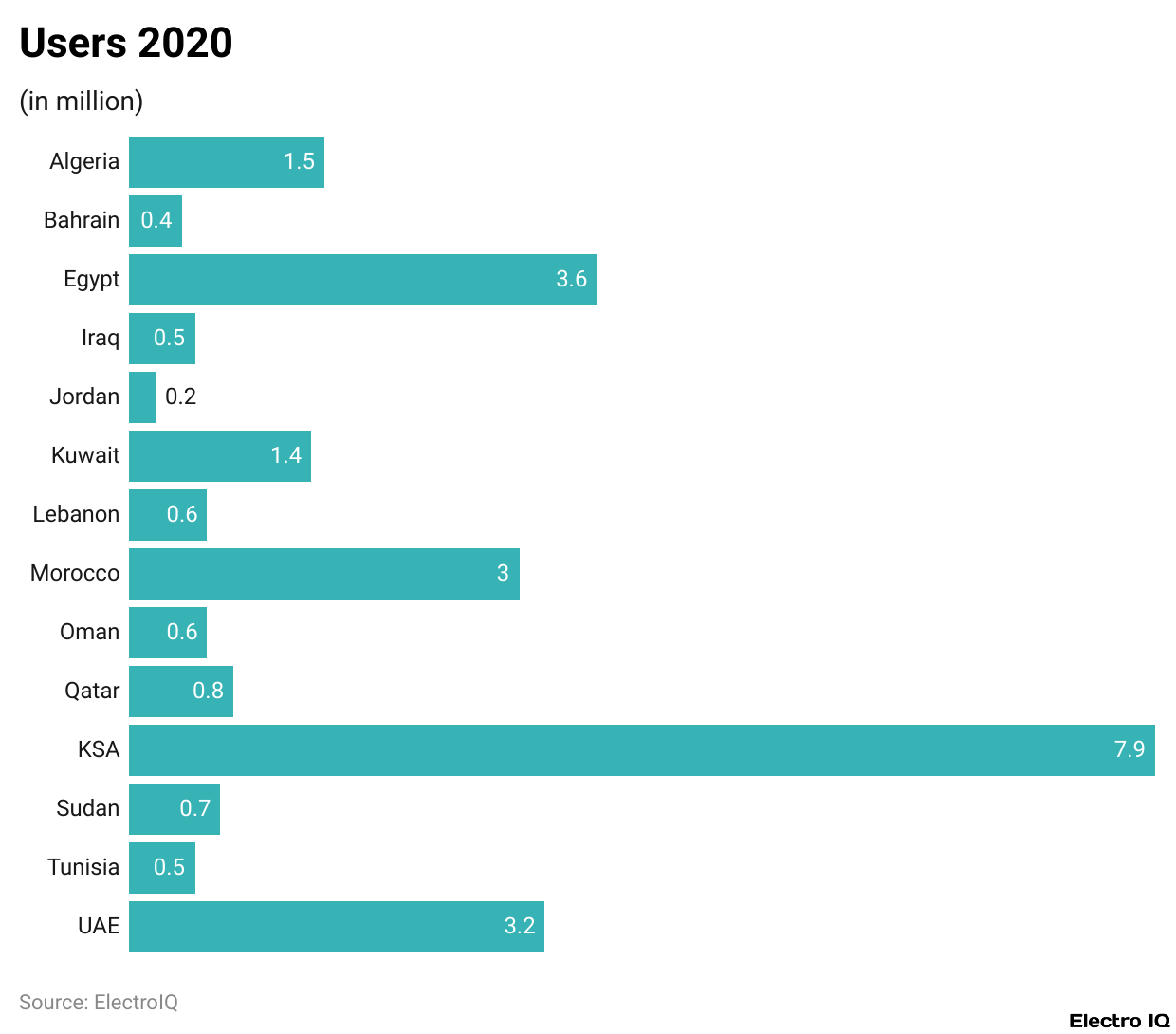

- The number of online food delivery users varies by country, with Saudi Arabia leading at 7.9 million users, followed by Egypt (3.6 million), UAE (3.2 million), and Morocco (3.0 million).

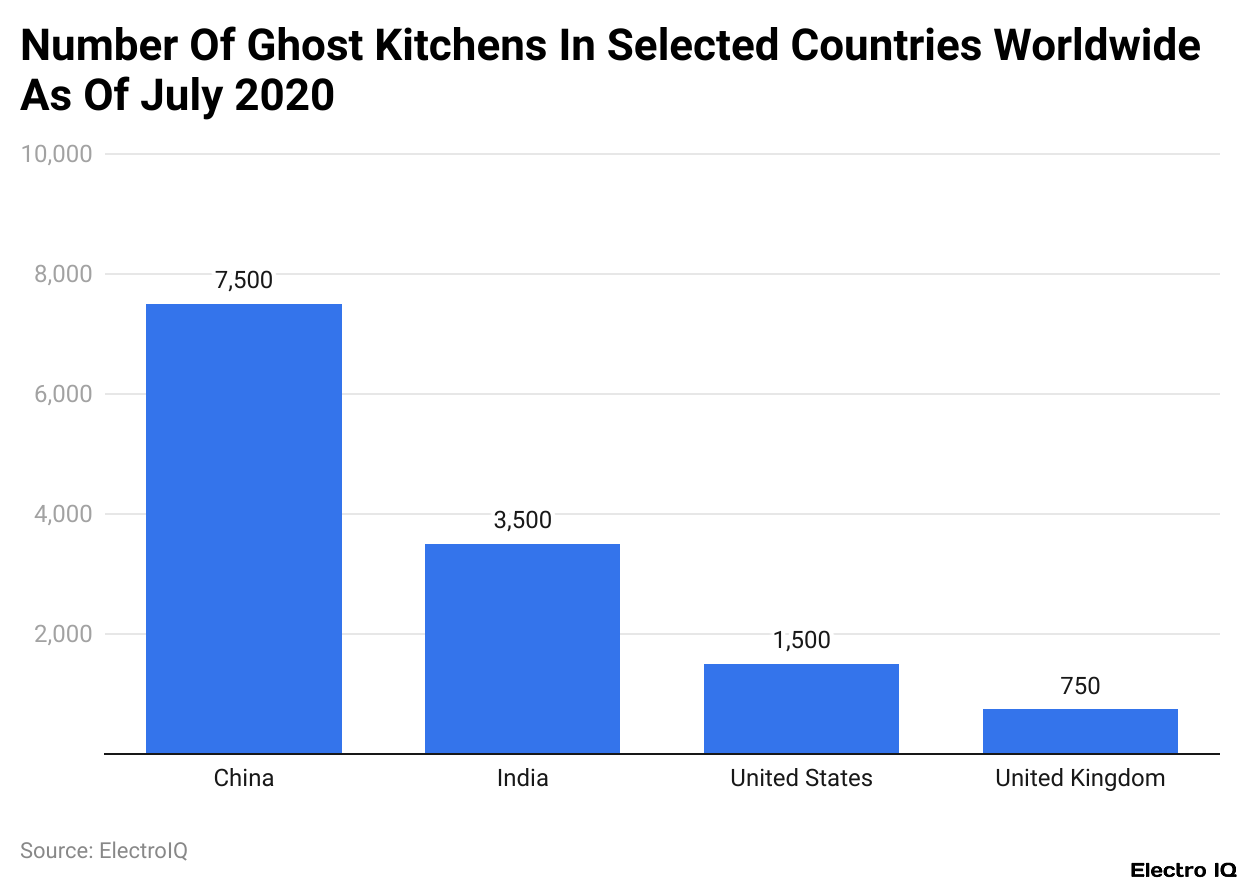

- By 2020, 7,500 ghost kitchens were operating in China, while the UK had 750. Ghost kitchens are expected to cover 50% of the global take-out and fast-casual food space by 2030.

- CloudKitchens, founded by Travis Kalanick in 2018, holds 25% of the U.S. food industry market share.

- Ghost kitchen investments reached 16 deals in 2019, totaling USD 1.9 billion.

- The creation of food delivery apps could cost between USD 2,500 to USD 3,500 for live location tracking, USD 4,000 to USD 5,000 for in-app chat, and USD 800 to USD 1,500 for online payments.

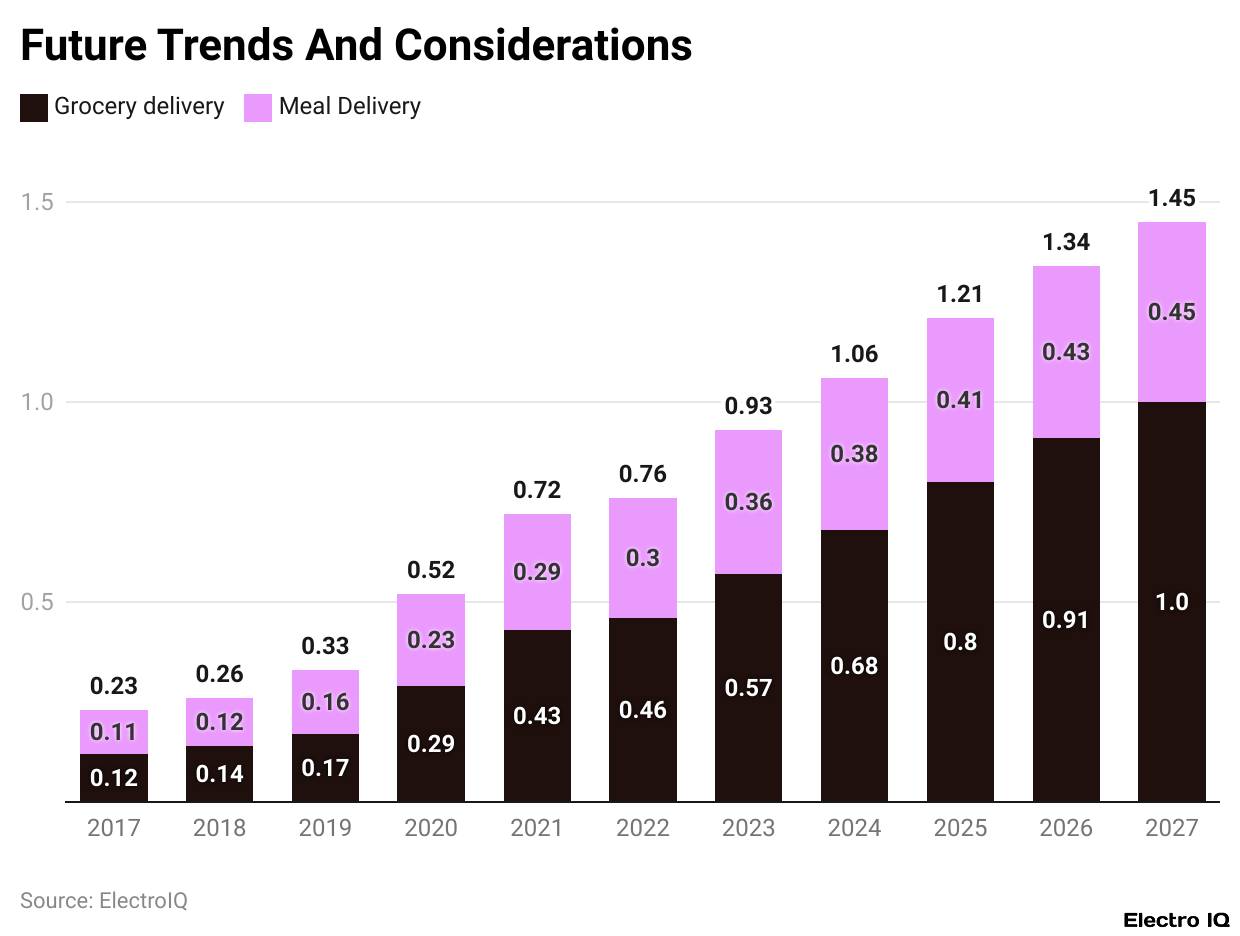

- The global food delivery market grew from USD 0.23 trillion in 2017 to an estimated USD 1.45 trillion by 2027, with steady growth in groceries and daily meals.

- In 2023, Reef Technology acquired Boon Burger Café for USD 100 million, expanding its plant-based cloud kitchens in North America.

- In 2023, DoorDash acquired Chowbotics for USD 70 million, focused on developing cloud kitchen automation.

- Uber Eats launched Virtual Restaurants in 2024, allowing eateries to create brands digitally.

- In 2023, Kitopi launched its premier Cloud Brands in the Middle East, focusing on exclusive online brand concepts for food items.

- Taster raised USD 37 million in 2023 to expand cloud kitchens across Europe.

- Rebel Foods raised USD 175 million in 2024 to expand into U.S. and Middle Eastern markets.

- By 2025, 30% of cloud kitchens are expected to implement AI-based Plate-Specific Offerings to improve customer satisfaction, automation, and efficiency.

- By 2024, 25% of kitchens are expected to utilize robotic technology and automation, improving labor cost efficiency and operations.

Cloud Kitchen Market Size

(Reference: statista.com)

(Reference: statista.com)

- Cloud kitchens also built up under the terms “dark kitchen”, “ghost kitchen,” and “virtual restaurant” are one kind of restaurant versed only in food delivery, the restaurant possessing neither dining nor takeaway services.

- These cloud kitchens run largely on sales through food delivery apps, websites, or direct calls. This model has found fame for its operation without physical dining space, leading to reduced operational costs.

- Cloud kitchen statistics state that the cloud kitchen market worldwide has seen broad growth, with an estimated size of 58.61 billion U.S. dollars in 2022.

- It is anticipated to continue its expansion to reach 177.85 billion U.S. dollars by 2032.

- The expanding cloud kitchen operation is based on the demand for easy access to food delivery and the cost efficiencies they provide to entrepreneurs and operators, thus becoming an attractive option in the developing food service industry.

Cloud Kitchen Market Size By Market.us

(Reference: market.us)

- The global cloud kitchen market is expected to reach USD 194.6 billion by 2032, growing at a CAGR of 12.1% between 2023 and 2032.

- The market growth is driven by factors such as increasing demand for online food delivery, changing lifestyles, rising disposable incomes, and technological advancements within the cloud kitchen industry.

- The independent cloud kitchen segment holds 61% of the market share.

- Burgers/sandwiches are the leading product types, contributing 25% of the market revenue.

- Franchised cloud kitchens dominate the market, holding a 65% market share.

- High initial costs and trust issues are major challenges limiting market growth.

- The rising popularity of online food orders and lower startup costs create significant growth opportunities.

- Key market players include Gustasi Chef, Faasos, Behrouz Biryani, DoorDash Inc., Kitchen United, Kitopi Catering Services LLC, Rebel Foods Private Limited, Zuul Kitchens Inc., Ghost Kitchen Orlando, CloudKitchens, Swiggy, Starbucks Coffee Company, Domino’s Pizza Inc., Firehouse Restaurant Group Inc., Yum Brands Inc., Toast Inc., and Inspire Brands Inc.

- Busy lifestyles have led to a preference for online food orders supported by social media and food delivery apps.

- Asia Pacific holds the largest market share at 58%.

- North America is expected to grow the fastest in the cloud kitchen market.

Online Food Delivery By Users

(Reference: wamda.com)

(Reference: wamda.com)

- According to cloud kitchen statistics, the usage of cloud kitchens among countries changes: in Algeria, it goes as high as 1.5 million; Bahrain shows a figure of around 0.4 million;

- Egypt is way up with about 3.6 million; Morocco follows with 3.0 million; and UAE stands at 3.2 million.

- In the Gulf states, Kuwait is marching ahead towards 1.4 million users, with Oman and Lebanon close behind at 0.6 million, while Qatar hits around 0.8 million.

- KSA tops the list in the region with an enormous 7.9 million users, indicating healthy demand for online food delivery services.

- Other countries, such as Iraq and Tunisia, are said to have around 0.5 million each, while Jordan has around 0.2 million.

- Sudan also chips in a small part of the market with 0.7 million users.

- Truly, these figures suggest a significant rise in cloud kitchens and online food delivery across various countries, showing the change in consumer behaviour and rising dependence on digital food ordering platforms.

Ghost Kitchens By Country

(Reference: statista.com)

(Reference: statista.com)

- Ghost kitchens, also known as dark kitchens, cloud kitchens, and virtual restaurants, are restaurant formats that skip dine-in business as well as takeaway.

- Operated, mainly online, food deliveries through apps like Grubhub or from their websites, they may still make sales via phone.

- The concept is heavily catching on in China, with China functioning as its market driver.

- Cloud kitchen statistics show that as of July 2020, China had 7,500 active ghost kitchens, compared to the UK, which had about 750 operating ghost kitchens.

- This contrast involves regions manifest in a varying degree of acceptance, depending on differences in population size, attention to food delivery, and digital infrastructure.

- Future projections hint that ghost kitchens might dominate half of the global fast-food drive-thru and carryout markets, pointing to the impact they have in this industry.

- In 2020, Karma Kitchen, a major European ghost kitchen company, made headlines by securing an asset worth of €300 million within a single funding round.

- UK-based Roo Foods Limited, a subsidiary of Deliveroo, was ranked third among the biggest online food delivery services, even after launching Deliveroo’s Editions program in 2017 for the aid of those looking to open a virtual restaurant without the threat and expense of setting up other real restaurants.

- One of the biggest names who seemed to move food delivery industry trends within the U.S. was Travis Kalanick, the co-founder of Uber Eats, which had a 25% service market share.

- Realizing the potential in 2018, he moved CloudKitchens into the ghost kitchen line.

- As of December 2020, 59 companies operated in the ghost kitchen industry. This year witnessed a remarkable event when DoorDash opened its very first ghost kitchen in Redwood City, California.

- The increase in investment in profit kitchens has translated into a 2.4 times rise in divestiture value since 2016.

- They set a record revenue of USD 1.9 billion across 16 primary deals in 2019, and this alone exemplifies investor anticipation in the future of ghost kitchens.

Food Delivery App Development Cost

| Food Delivery App Features | Cost in ($) |

| Cuisine listings, sub-menus, and products | 2500-3500 |

| Search filters for pricing, delivery costs, and diverse cuisine options | 800-1000 |

| Add to cart and order history | 1000-2000 |

| In-app messaging and chat support | 4000-5000 |

| Signup with 2FA | 1500-2000 |

| Sign in or order as guest options | 1000-2500 |

| Delivery tracking via live location | 2500-3500 |

| Online payment | 800-1500 |

| Push notifications | 1000-2000 |

| Reviews & ratings | 1500-2000 |

(Source: ripenapps.com)

- When the purchaser requests an app interface for his consumption, the delivery of food abides by certain categories, each category having an estimated cost.

- Cloud kitchen statistics reveal that the listing of cuisines into their sub-menus and products will range from USD 2500 to USD 3500, and the filters that qualify them for being filtered with respect to price, delivery charges, and selecting a food type imply an expense of around USD 800 to USD 1000.

- For user-friendliness, one shall be keeping the add-to-cart and order history version implementation somewhere between USD 1000 to USD 2000.

- Adding a price-effective in-app messaging and chat assistance is billed between USD 4000 to USD 5000 sum. Sign-up 2FA assumes a cost of somewhere over USD 2000, and sign-in/guest order ranges between USD 1000 to USD 2500.

- Live location tracking is valued at USD 2500 to USD 3500 for delivery tracking, while online payment integration costs USD 800 to USD 1500.

- Push notifications start from USD 1000 and go up to USD 2000. Review and rating can be priced from USD 1500 to USD 2000. These collectively define the app’s performance, interaction with users, and efficiency.

Cloud Kitchen Market By Type

- The growth of food delivery has been sustained for years, benefiting both grocery delivery and meal delivery.

- In 2017, grocery delivery made a market worth USD 0.12 trillion, while meal drop-off reached USD 0.11 trillion, making a total of USD 0.23 trillion.

- The market value in 2018 was USD 0.27 trillion, with groceries increasing to USD 0.14 trillion and meals to USD 0.12 trillion.

- By 2019, groceries finally made it to USD 0.16 trillion, while meals rose even more to USD 0.17 trillion, tallying USD 0.33 trillion.

- The growth was quite substantial in 2020, with groceries at USD 0.29 trillion and meals at USD 0.23 trillion, pushing the total to an expected USD 0.52 trillion.

- The trend continued in 2021 as groceries soared to USD 0.43 trillion, with meals fast on growth at USD 0.29 trillion, making a total of USD 0.72 trillion.

- The market has further expanded to USD 0.76 trillion by 2022, the only rise seen because of bitter competition between groceries, at USD 0.46 trillion, and meal delivery, at USD 0.30 trillion, taking that market to a hefty USD 0.92 trillion in 2023.

- That being the case, the situation will make the grocery delivery mark at USD 0.68 trillion in 2024 and meal delivery at USD 0.38 trillion for the final market number of USD 1.06 trillion.

- According to cloud kitchen statistics, Forward to 2025, these calculations expect grocery delivery to hit USD 0.80 trillion, and meal delivery to make USD 0.41 trillion, thus making the total market size lying at USD 1.21 trillion.

- In 2026, these figures are expected to jump to USD 0.91 for grocery delivery and USD 0.43 for meal delivery, resulting in a total market size of USD 1.34 trillion.

- Through the continuing trend into 2027, it is expected that grocery delivery will attain around USD 1.0 trillion, meal delivery USD 0.45 trillion, and a total market cap of USD 1.45 trillion.

- This growth reflects the increasing preference for convenience and digitalization among consumers in both grocery and meal delivery services.

Recent Developments

- According to cloud kitchen statistics, in the year 2023, gigantic Reef Technology went all the way to Canada to acquire Boon Burger Café, which was a major vegan restaurant chain, for, according to projections, USD 100 million.

- This follows Reef’s ambitious plan to penetrate plant-based eating across North America using its cloud kitchen outlets.

- Over the same duration, DoorDash paid USD 70 million to acquire Chowbotics, the robotic food prep company, so as to work on automation within its cloud kitchen operations, focusing on making the food preparation and delivery speed even better.

- Uber Eats continued extinction in 2024 by introducing Virtual Restaurants, creating a platform for the world’s best brands to build additional delivery-only brands out of their existing identities with no need for the added physical leeway.

- This innovation allowed for the restaurant’s slow adaptation to use its cloud kitchen model to diversify streams of income.

- On the other hand, by 2023, Kitopi, a top cloud kitchen player, will have provided Cloud Brands across the Middle East, exclusive operators of digital-first food brands to address burgeoning demand for conveniently acquired online food.

- The level of investment in the sector cannot be swept under the carpet. In 2023, Taster, another cloud kitchen operator from Europe, surged to USD 37 million in funding raised to expand across Europe and build and enhance operations technologies for the delivery of virtual food brands.

- Technology has laid out the carpet for shifting this industry, whereby AI-managed menu personalization is beginning to grow, where over 30% of this industry is expected to incorporate AI tools by 2025.

- These AI tools will be the way forward: optimized menus, better efficiency, and boosting customer satisfaction.

- A further inclination towards robotics and automation has been observed as 25% of the projection for cloud kitchens with robotic food preparation and packaging by 2024, which brings down labour costs and helps to streamline operational processes.

Conclusion

Based on cloud kitchen statistics, such as the continuous growth in the industry, cloud kitchens are expected to capture even more attention within the food-delivery space. The global market is on track to surpass USD 91.3 billion in the industry for the year, and cloud kitchens offer entrepreneurs a cheaper, faster, and easily scalable alternative in contrast to traditional restaurants due to the future’s awakening of interest from markets.

The industry shall embody more efficiency, better technology, and changing consumer trends. With a future full of potential growing opportunities, the cloud-kitchen industry remains an indication of great promise.

FAQ.

The global cloud kitchen market was noted to have a net worth of US$58.61 billion in 2022, estimated to escalate beyond US$177.85 billion by 2032 among surges of demand for food delivery services and budget-friendly kitchen operations approaching.

Saudi Arabia tops the list with 7.9 million online food delivery users, followed by Egypt (3.6M), UAE (3.2M), and Morocco (3.0M) – strong demand for cloud kitchen services in these regions.

In 2019 a couple of large deals alone accounted for around US$1.9 billion invested across 16 transactions in ghost kitchens. Examples of what is considered key include Reef Technologies acquiring Boon Burger Café for around US$100M; Door Dash also acquired Chowbotics for around US$70M, amidst AI having the eyes of investors.

Half of all cloud kitchens will start using artificial intelligence-driven expert systems to create and maintain customer loyalty by 2025; further, Table of Artificial Intelligence and automation will already take over a quarter of cloud kitchens by 2024. On the other hand, it is expected that the impending labor costs will be considerably curtailed by automation and modified food preparation practices.

Developing a food delivery app can cost anywhere from US$800 to US$5,000 per feature. Key functionalities include live location tracking (US$2,500–US$3,500), in-app chat (US$4,000–US$5,000), and online payment integration (US$800–US$1,500), among others.

Joseph D'Souza founded ElectroIQ in 2010 as a personal project to share his insights and experiences with tech gadgets. Over time, it has grown into a well-regarded tech blog, known for its in-depth technology trends, smartphone reviews and app-related statistics.