Disney+ Statistics and Facts (2025)

Updated · Mar 13, 2025

Table of Contents

- Introduction

- Editor’s Choice

- Key Facts

- Disney+ Revenue

- Disney+ Subscribers Worldwide

- Disney+ App Download In The U.S

- Disney Leading Apps Revenue

- Disney+ Monthly ARPU

- Monthly Subscription Prices Of Disney’s Video Streaming Offers

- Disney+ Demographics

- Disney+ Market Share Of SVOD Streaming

- Number Of Disney Plus Viewers On Ad-supported Plan

- Disney’s Spending On Content

- Conclusion

Introduction

Disney+ Statistics: Since its launch in November 2019, Disney+ has become a strong competitor in the streaming industry. In the first quarter of 2024, the platform had 149.6 million subscribers.

This article will provide various Disney+ statistics, offering an insight into its performance, subscriber trends, revenues, and market standing.

Editor’s Choice

- Revenues grew from USD 2.8 billion in 2020 to USD 8.4 billion in 2023. As of Q3 2024, they stand at USD 7.75 billion, with a good chance of surpassing last year’s overall figure.

- In Q4-2024, Disney+ had approximately 125 million subscribers worldwide. The growth may be steady, but it is facing many competitors, Netflix offering more to the young adults in the U.S.

- Disney+ statistics indicate that in late 2024, Disney announced additional member pricing and raised costs for its streaming services Disney+, Hulu, and ESPN+.

- Its direct-to-consumer (DTC) segment became profitable by reporting earnings of USD 143 million in 2024.

- Disney+ mobile app downloads recorded around 4.5 million so far in Q3 2024, and more than 8.5 million downloads in the U.S. during the first half of the year. It remains Disney’s highest-grossing mobile app, with USD 1.22 billion in in-app revenue.

- ESPN: Live Sport & Scores ranks second among Disney’s apps for in-app revenue, at USD 223.8 million globally.

- Disney+ statistics show that ARPU for Disney+ Core (taking India Hotstar out of the equation) in Q4-2024 counted an average of USD 7.18.

- Again, on October 17, 2024, Disney increased the prices of its streaming services for the second year running. The biggest spikes hit Hulu + Live TV, which jumped to USD 95.99 a month for the ad-free plan and USD 82.99 for the ad-supported version.

- The largest share of Disney+ users are in the 25- to 34-year-old age bracket (24.7%), followed by the 35- to 44-year-old age bracket (19.2%).

- Men slightly outnumber women on the platform, 55% vs. 45% female.

- Disney+ had a 12% share in the U.S. SVOD market in 2022, but it lost one point in 2023 and another point in Q1 2024, primarily due to competition from the other streaming platforms.

- The growth of ad-supported tiers has been steady, 109.8 million viewers in 2022, 122 million in 2023, and 134 million by the end of 2024. Projections for 2025 and 2026 show further increases to 145.2 and 152.8 million viewers respectively.

- Disney+ statistics reveal that Disney’s content spending hit USD 29.9 billion in 2022 but has been in decline since, with estimates of USD 27.2 billion in 2023 and about USD 25 billion in 2024.

Key Facts

- Disney+ marked its fifth anniversary in November 2024, and has been the leading streaming service for all content pertaining to Marvel, Pixar, Star Wars, and Disney.

- It now boasts a subscriber base of over 150 million globally, with late 2024 figures estimating this to be just about 154 million users.

- Originally launched in only a few markets, access to Disney+ has now extended to over 80 countries across North America, Latin America, Europe, Africa, and the Asia-Pacific region.

- Disney+ even outperformed the target for 2024 subscribers, set between the range of 60-90 million.

- Although Netflix is the biggest SVOD provider, it took approximately a decade to amass a similar number of customers when the market was not very crowded.

- In a bid to improve profitability, Disney+ also took cost-reduction measures, including creating an ad-supported option, which is now attracting one of four users.

- Disney+ statistics state that Disney+ had estimated an increase of USD 300 million in ad revenues for the U.S. between 2023 and 2025.

- The consumer satisfaction enjoyed by Disney+ originals fell by 7% points from 2022 to 202,3, with Marvel-exclusive shows falling out of favor.

- Disney was looking to save USD 3 billion in programming expenses to cover operating shortfalls.

- Disney’s spending on content has reduced over the last year following a peak in SVOD commissions in Q3 2022.

- For the first time, in Q3 2024, Disney+ reported positive operating income, a wave of success in slashing costs.

- Disney remains a major player in the streaming industry, proving that it can adjust its strategy to fit the highly competitive market while maintaining the quality of its content and subscribers’ satisfaction.

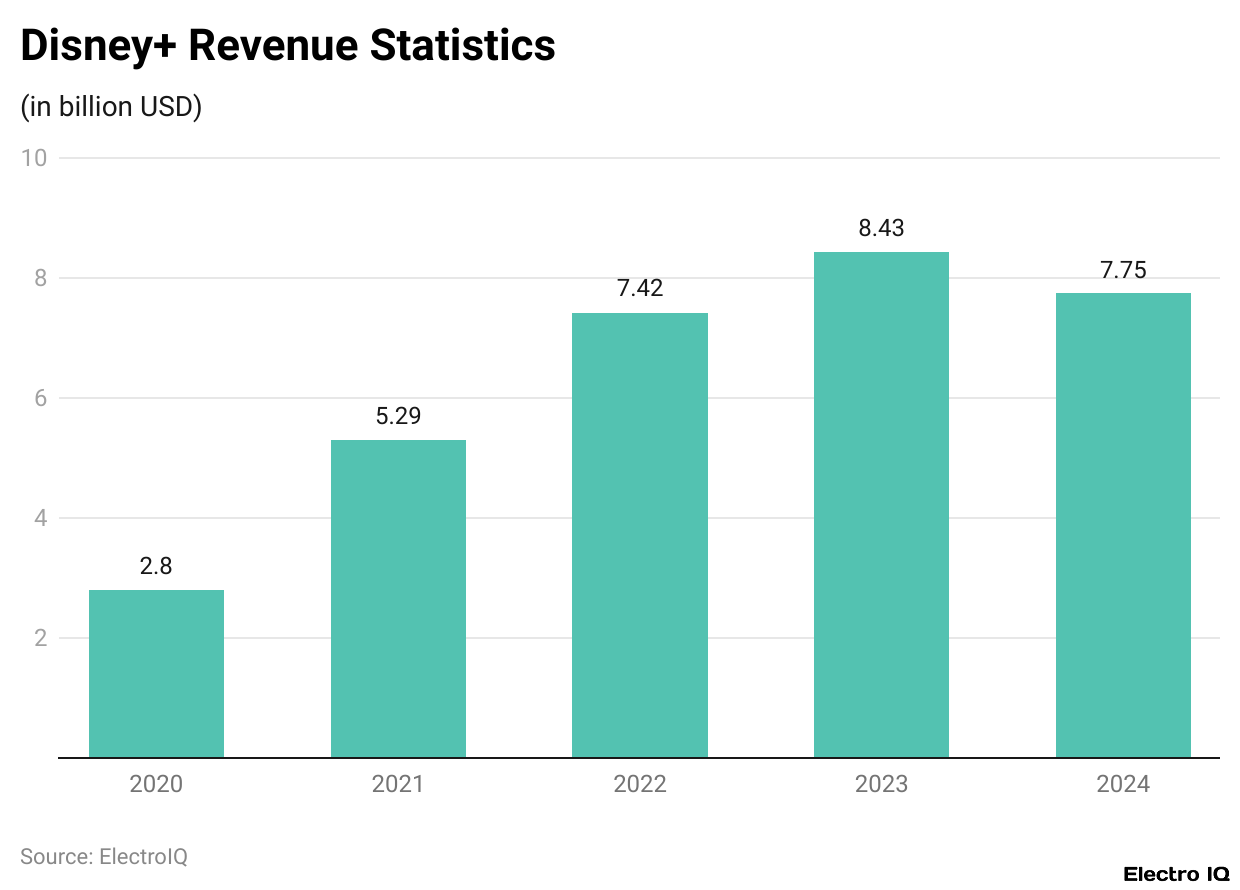

Disney+ Revenue

(Reference: demandsage.com)

- Disney+ has exhibited remarkable revenue growth since its inception in 2019. In 2020, it racked up USD 2.8 billion in revenue, an indicator of its fast climb up the streaming ladder.

- This doubled within a year, raking in USD 5.3 billion by the end of 2021, as more subscribers signed up and entered new territories.

- This buoyancy was also evidenced in 2022, with revenue shooting up to USD 7.4 billion, as an increasing library of contents and strategic worldwide expansion added to Disney+’s growing revenue base.

- Disney+’s highest-ever revenue was USD 8.4 billion in 2023, although the service lost some subscribers.

- Price changes, the launch of a new ad-supported tier, and the success of original content contributed to this growth.

- By Q3 2024 alone, the platform is well ahead of the game, hefting USD 7.75 billion in revenue for this quarter alone, proving that it is very much possibly on target to meet or even exceed last year’s record.

- Well, that will also prove that Disney+ can earn a profit even in turbulent times in the ever-competitive world.

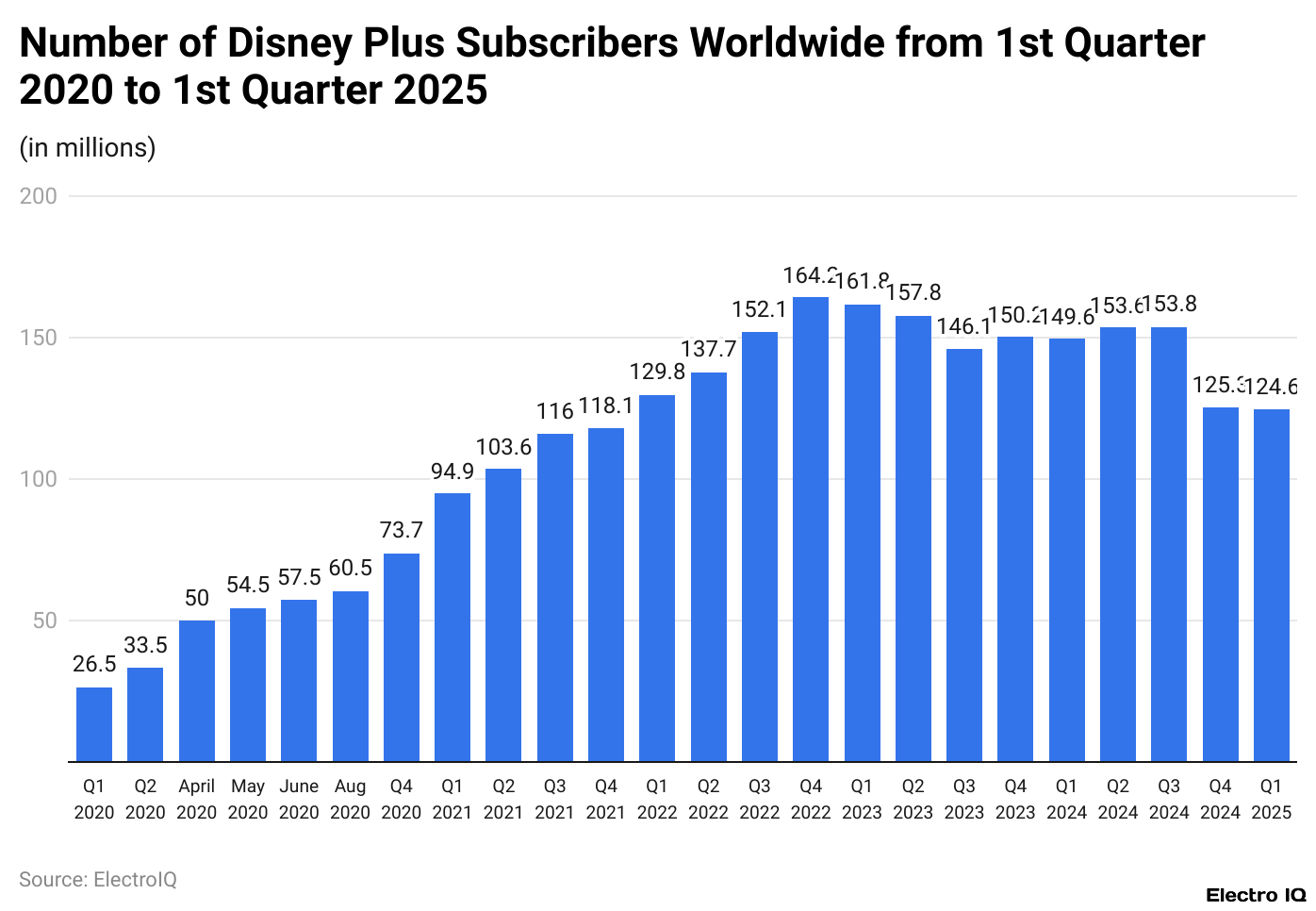

Disney+ Subscribers Worldwide

(Reference: statista.com)

- Disney+ statistics show that as of the first quarter of 2025, Disney+ totaled around 125 million global subscribers since its introduction in November 2019.

- This unprecedented growth can only be compared to Netflix’s experience: reaching a similar subscriber number after nearly a decade in a less competitive market.

- Although impressive, such a base seems increasingly challenged by strong competition from other services, particularly for the youth.

- As per October 2023, Netflix remained the leading subscription video service consumed by children aged 5-11 in the U.S. with 34% followed closely behind by Disney+ with 31%.

- This has led to Disney imposing extra member pricing in many countries, with those extra costs varying across countries from HKUSD 3.58 in Hong Kong to €6.67 in Italy, as part of how they improved profitability while retaining customers.

- Disney also changed its pricing strategies in line with the evolving streaming landscape. Towards the end of 2024, the price of monthly subscriptions for Disney+, Hulu, and ESPN+ was increased in the USA. This happened after improvements made in the segment of direct-to-consumer streaming because operational losses declined massively, moving from 2022 to 2024.

- In 2024, the DTC profit in the entertainment business reported income of nearly USD 143 million after a few years of losses, which alludes that Disney has indeed delivered on its strategy of taking it to profitability.

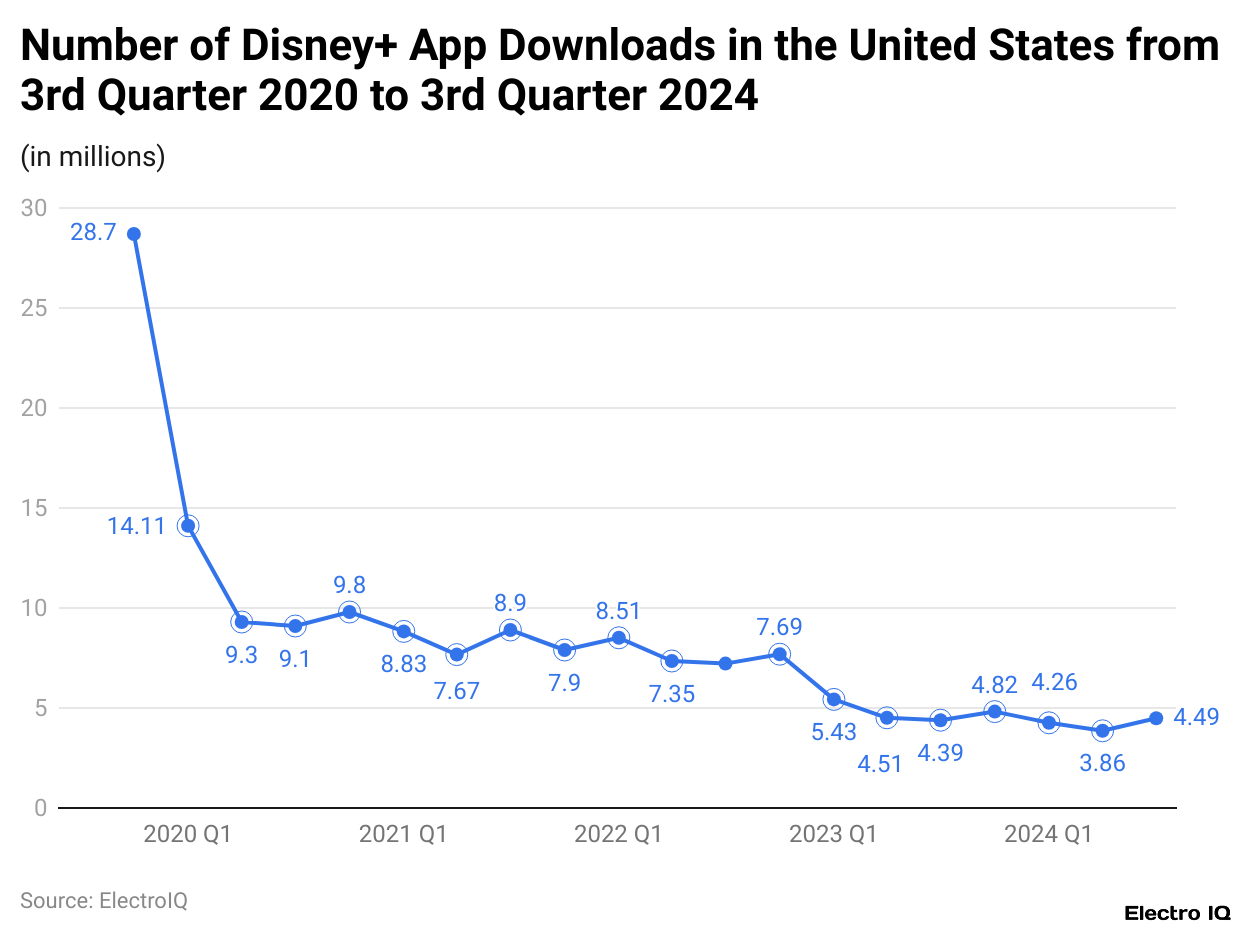

Disney+ App Download In The U.S

(Reference: statista.com)

- Disney+ statistics state that in Q3 2024, its mobile app received almost 4.5 million downloads from users in the United States.

- Since its initiation in November 2019, it has always attracted a large base of users: in the first half of 2024 alone, approximately 8.12 million app downloads were made by users from the U.S.

- Among all Disney mobile services, Disney+ was the leading app in 2024, generating in-app revenue worldwide of USD 224 million.

- Hence, this clearly reiterates the platform’s holding presence in the market and continued success in engaging users around the world through its mobile application.

Disney Leading Apps Revenue

| Characteristic |

Revenue in U.S. dollars

|

| Disney+ | 1,226.94 |

| ESPN: Live Sports & Scores | 223.85 |

| Hulu: Stream TV shows & movies | 48.26 |

| Disney+ Hotstar | 16.02 |

| Star+ | 14.12 |

| My Disney Experience | 9.1 |

| Marvel Unlimited | 3.6 |

| Hulu for Android TV | 3 |

| ESPN Fantasy Sports & More | 0.55 |

| National Geographic | 0.31 |

(Source: statista.com)

- By mid-December 2024, Disney+ would have topped the charts as the most successful mobile app of The Walt Disney Company in terms of revenue from in-app purchases -approx. USD 1.22 billion- from users around the world.

- This impressive revenue reflects the platform’s strength in the streaming business market and its ability to lure paying subscribers via different monetisation tactics.

- Not so far behind Disney+, the next highest-grossing Disney app is ESPN: Live Sport & Scores, raking in USD 223.8 million in Google Play and Apple App Store combined during the same period. ESPN was part of Disney upon its purchase of Capital Cities/ABC, the former parent company of ESPN, back in 1996.

- This historic property thus made it easier for Disney to strategically widen its footprint in the sports streaming industry while maintaining a strong digital presence across multiple platforms.

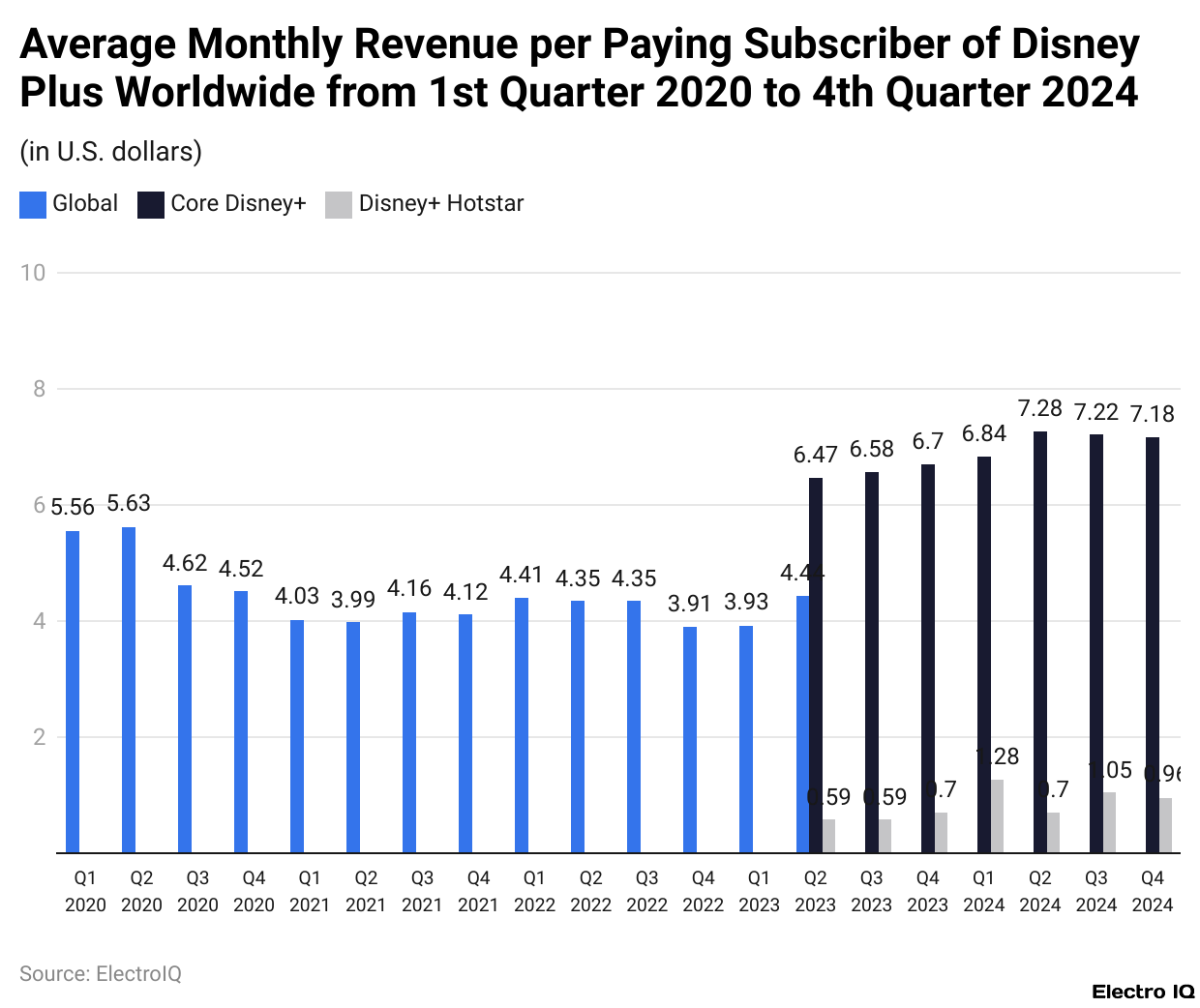

Disney+ Monthly ARPU

(Reference: statista.com)

- Disney+ Core, including all countries except Disney+ Hotstar in India, on average earned an estimated USD 7.18 a month per paying subscriber globally during the fourth quarter of 2024.

- This revenue increased slightly compared to the prior quarter of the same year, although Disney continues to endure difficult times regarding turning a profit from its streaming division.

- In general, Disney’s direct-to-consumer business lost money, while competitors Netflix and Warner Bros. Discovery’s DTC division recorded operating profits.

- Another aspect that has been a challenge, especially for Disney+, was customer retention. Disney+ Hotstar in India witnessed a reduction in subscribers in the first two financial quarters of 2023.

- Despite this, Disney+ continues to be a very strong player in subscription video-on-demand, due to its enormous content library from various affiliates such as Lucasfilm, 20th Century Studios, Pixar, and Marvel Entertainment; thus, the offering appeals to all ages.

- In addition, original series such as Moon Knight and Obi-Wan Kenobi, exclusive to the service, further persuade its audience that Disney+ is on par with streaming competitors.

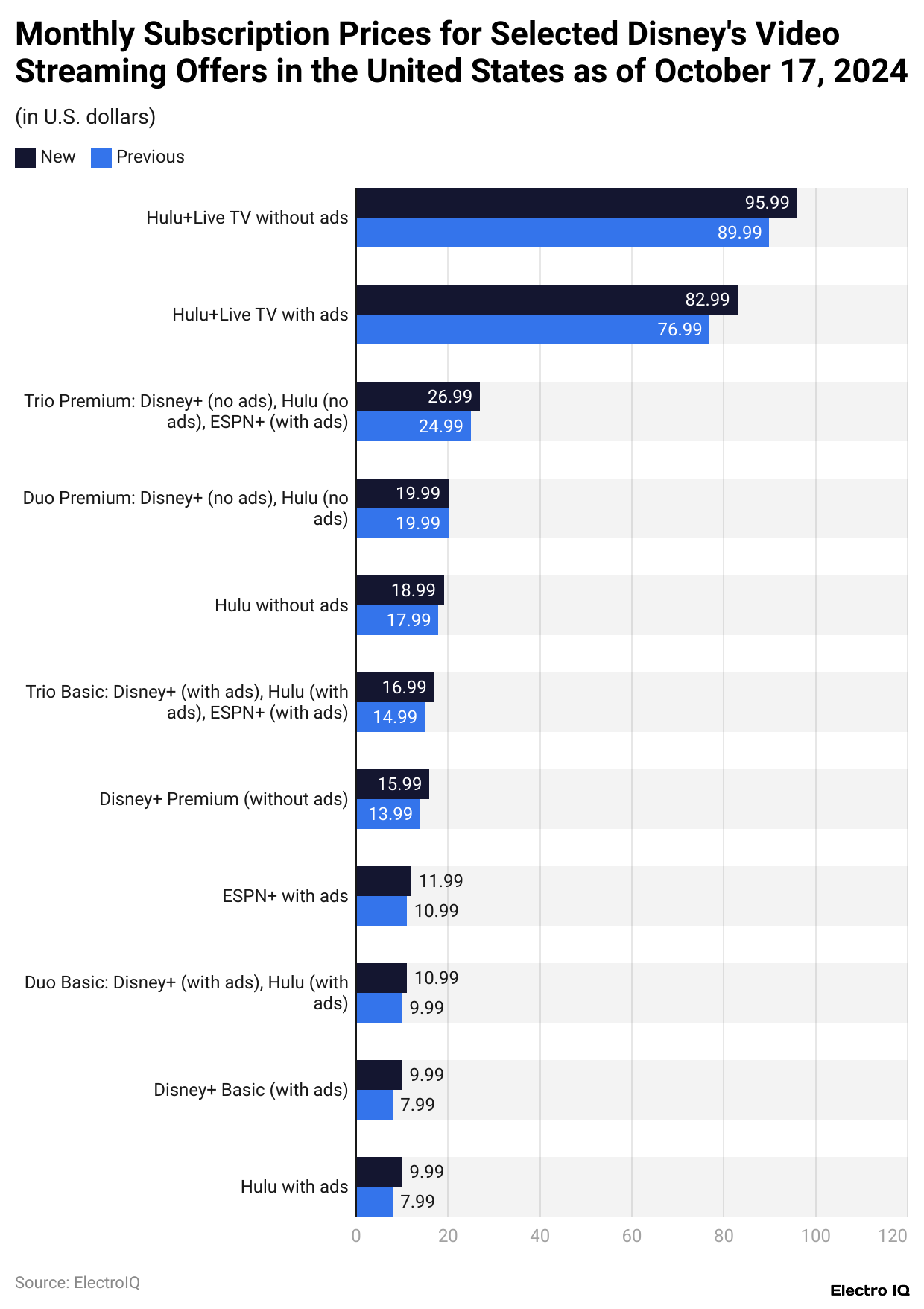

Monthly Subscription Prices Of Disney’s Video Streaming Offers

(Reference: statista.com)

- Disney+ statistics show that Disney has announced yet another price hike for its streaming platforms, Disney+, Hulu, and ESPN+, effective October 17, 2024.

- This price increase for the U.S. market, Disney’s streaming service tier, is one more in a line of price adjustments initiated in 2023.

- The most massive price increases are across Hulu + Live TV, wherein the ad-free plan has moved up to USD 95.99 per month and the ad-supported version to USD 82.99 per month.

- These excerpts reflect Disney’s continued efforts for profit maximisation and opportunities in a changing streaming market, balanced against subscriber retention.

Disney+ Demographics

- Disney+ entertains an audience with various demographics. The lion’s share of subscribers, 24.7% of the user group, fall into the 25 to 34-year-old age range.

- The next largest segment is the 35 to 44-year-olds, who make up 19.2% of the total population.

- Following the 35-44-year-old set, the next biggest group would be young adults 18-24 years of age, comprising 16.7% of users, and kids 0-11 years of age, comprising 15.2%.

- K-Plus participants between the ages of 12 and 17 comprise 10.3% of users in addition to those in the 45-54 age group representing 11.9%. The subscription distribution is minimal at the older end with approximately 7.0% of subscribers aged 55-64, while a mere 4.7% are made up of those aged 65+.

- These Disney+ statistics underline that the service’s appeal lies most with young adults and families, thereby reinforcing its image as a provider of nostalgic and family-friendly content.

- Slightly more than half, or 55%, of its audience on Disney+ are men with women constituting 45% of its subscribers.

- This gender distribution depicts that Disney+ has a diverse audience, though it is slightly more skewed toward the interests of male viewers.

- Its varied content, which ranges from action-packed franchises such as Marvel and Star Wars to family-friendly and animated movies, certainly helps maintain this gender balance.

(Reference: backlinko.com)

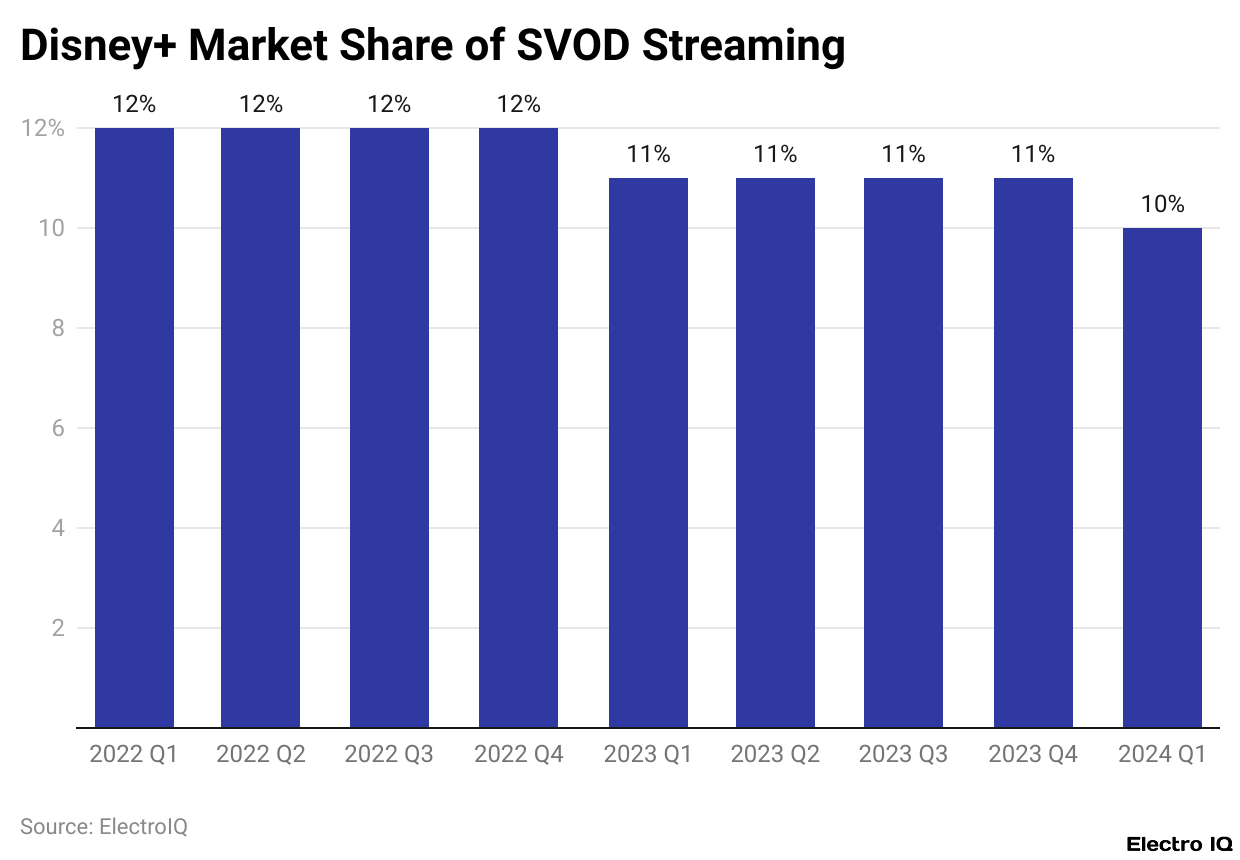

- Disney+ statistics reveal that It maintained a steady 12% share in the U.S. subscription video-on-demand market throughout 2022.

- Gradually, in 2023, its market share came down marginally to 11%, which remained constant in all the four quarters.

- This downward trend continued into early 2024, with the company capturing only 10% of the market for subscription video-on-demand offerings in the first quarter.

- Thus, the dismal figures reflect how the streaming industry is facing more intense competition, with some players, such as Netflix, Amazon Prime Video, and many other newer players, creating their own fronts in attempts to attract subscribers.

- Many of those contributed to such market share changes, increased competition in terms of the pricing scheme, the development of the content library, and changes in consumer preferences.

- Nevertheless, despite the small drop, Disney+ is still one of the giants in the American streaming landscape.

Number Of Disney Plus Viewers On Ad-supported Plan

- According to Disney+ statistics, the number of Disney+ viewers availing ad-supported tiers has been gradually increasing with the years, signifying that more people are now appreciating this type of subscription as it offers cheaper package options. Last year, the ad-supported plan viewer base was around 109.8 million.

- This increased to an estimated 122 million in 2023, thanks to many opting for budget-friendly streaming. The same pattern was carried over into this year when the viewership was again expected to peak at around 134 million.

- Such continued growth indicated the future monetisation avenues Disney+ would take in expanding. There is expected further growth; for 2025 and 2026, the audience will reach about 145.2 million and 152.8 million, respectively.

- Such a raise is indicative of the success recorded at Disney+ in terms of its ad-supported architecture to attract more audience into the ever-important genre, which again becomes a vital revenue generation model for the platform.

Disney’s Spending On Content

- Disney’s spending on content has fluctuated from year to year, depending on strategy shifts and market conditions.

- In 2019, the firm spent about USD 17.6 billion on content, which sharply increased to USD 20.2 billion in 2020, when everyone was breaking out into streaming services.

- The expenditure was increased again in 2021 and stood at USD 25.3 billion, reaching its peak at USD 29.9 billion in 2022, the highest ever investment in creating content.

- The multinational company cut its budget to USD 27.2 billion in 2023, thus shifting its focus toward cutting spending for profitability.

- Disney+ statistics state that the trend continued into 2024, where the projected budget would fall further to USD 25 billion.

- The decline in expenditures suggests that Disney is concentrating on financial sustainability while still maintaining a strong content library with which to compete in the streaming industry.

Conclusion

According to Disney+ statistics, the Company’s journey has been marked by rapid growth, strategic adaptations, and a commitment to delivering diverse content. While 2023 presented challenges in subscriber retention, the platform’s return to profitability and ongoing content expansion signal a promising future.

As the streaming landscape evolves, Disney+’s ability to innovate and adapt will be crucial in maintaining its position as a leading entertainment provider.

Sources

FAQ.

As of the first quarter of 2024, Disney+ has approximately 149.6 million global subscribers, with projections estimating around 125 million subscribers in early 2025.

Disney+ revenue has grown significantly, from US$2.8 billion in 2020 to US$8.4 billion in 2023. By Q3 2024, it had already reached US$7.75 billion, indicating the potential to surpass the previous year’s total.

In Q4 2024, Disney+ Core (excluding India’s Hotstar) had an ARPU of US$7.18 per paying subscriber worldwide.

The Disney+ ad-supported plan has seen continuous growth, with 109.8 million viewers in 2022, 122 million in 2023, and an estimated 134 million in 2024. Projections suggest it will reach 152.8 million viewers by 2026.

Disney+ has implemented price increases, extra member pricing, and cost-cutting measures, such as reducing content spending from US$29.9 billion in 2022 to US$25 billion in 2024. The platform also reported a US$143 million profit in 2024, marking a shift toward profitability.

Joseph D'Souza founded ElectroIQ in 2010 as a personal project to share his insights and experiences with tech gadgets. Over time, it has grown into a well-regarded tech blog, known for its in-depth technology trends, smartphone reviews and app-related statistics.