Ricoh Statistics By Operating Profit, Sales, Total Assets and Number of Employees

Updated · Oct 25, 2024

Table of Contents

Introduction

Ricoh Statistics: Ricoh Company, Ltd. is a prominent global leader in office equipment, imaging, and document management solutions. The company has demonstrated remarkable resilience and adaptability in navigating the evolving technological landscape and global market challenges.

By going through the Ricoh Statistics, we can learn the aspects that have contributed towards supporting the company’s operations spanning multiple continents and a diverse product portfolio ranging from traditional imaging equipment to cutting-edge digital solutions.

We will delve into key performance indicators, market presence, and strategic initiatives that have shaped Ricoh’s journey through recent years.

Editor’s Choice

- Ricoh achieved its peak operating profit of 120.35 billion yen in 2013

- Digital services lead revenue generation at 1,650.4 billion Japanese yen

- Japan commands the largest market share at 37.7% of total sales

- R&D spending peaked at 118.78 billion yen in 2015

- Total sales reached 2.13 trillion yen in 2022, showing a strong recovery

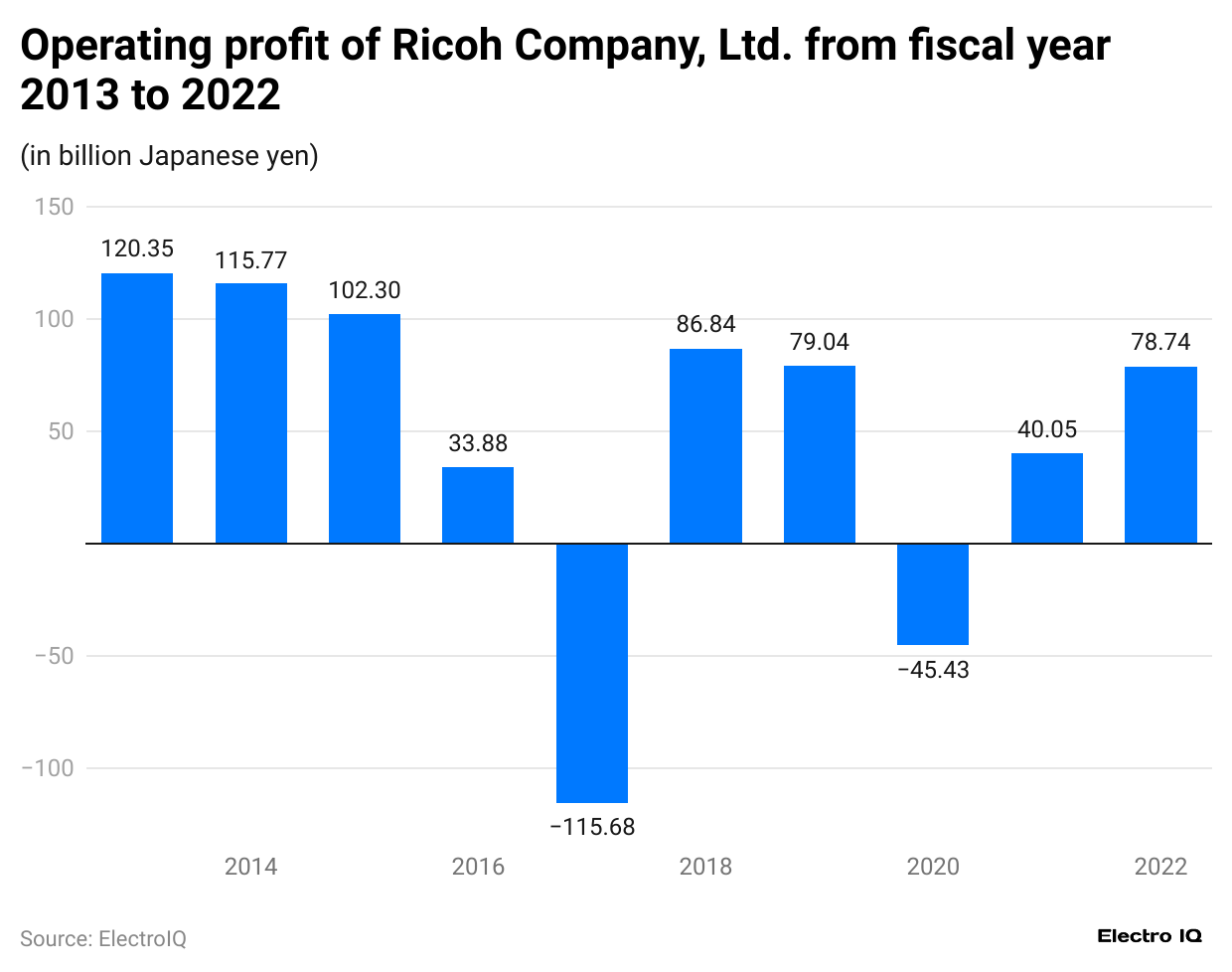

Ricoh Operating Profit

(Reference: statista.com)

- Ricoh Statistics show that the company had its highest operating profit in 2013, with 35 billion yen.

- The company faced its most significant loss in 2017, which was -115.68 billion yen.

- After another loss in 2020, Ricoh returned to profitability in 2021 and improved in 2022 with a profit of 74 billion yen.

- Overall, Ricoh’s operating profit fluctuated significantly between 2013 and 2022.

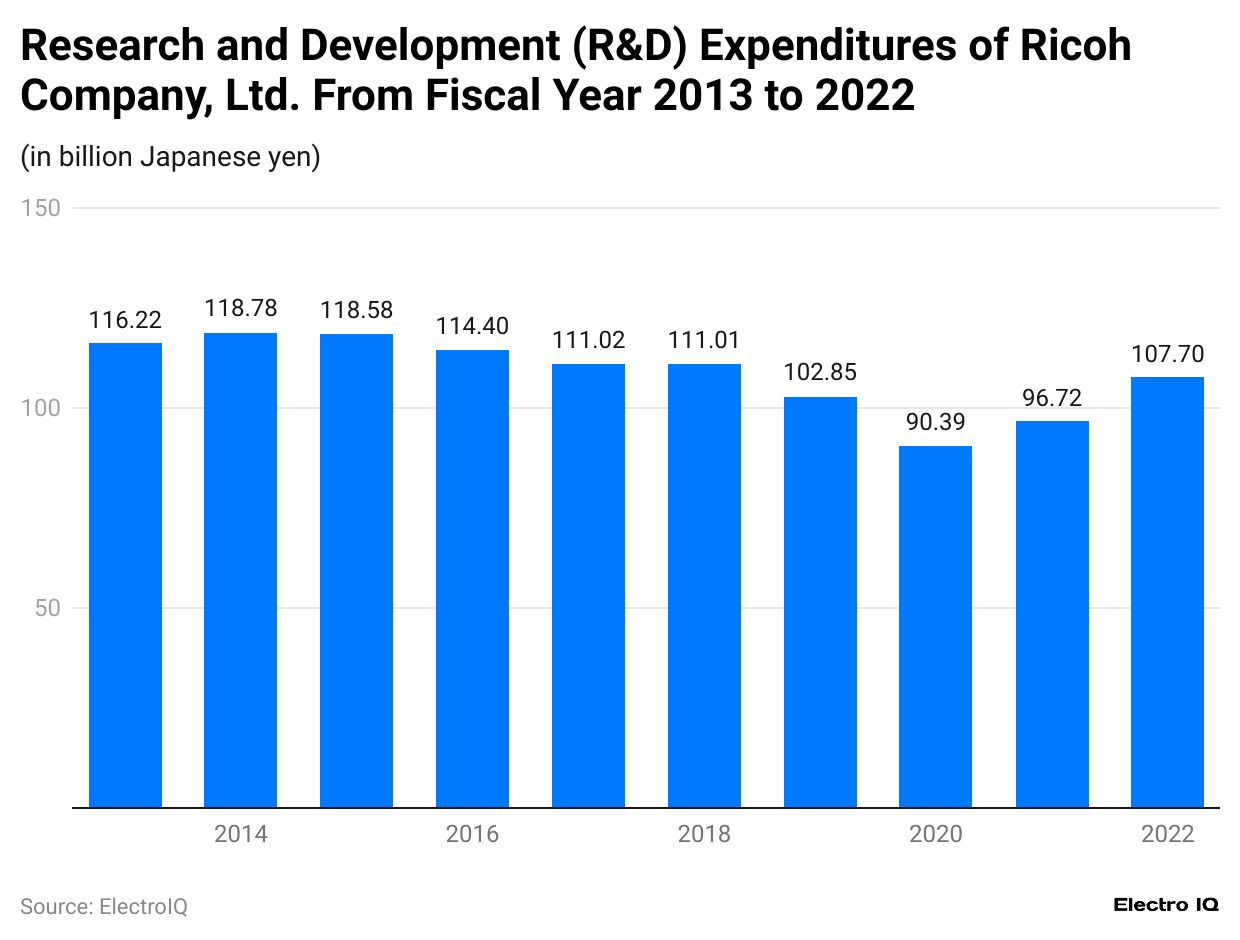

Ricoh Research And Development Expenses

(Reference: statista.com)

- Ricoh Statistics show that its R&D expenditures were consistently above 100 billion yen from 2013 to 2018.

- The highest R&D spending occurred in 2015, with 78 billion yen.

- In 2019, the spending dropped to 85 billion yen and decreased in 2020 to 90.39 billion yen.

- The trend shows fluctuations, with a significant dip in 2020 and a recovery.

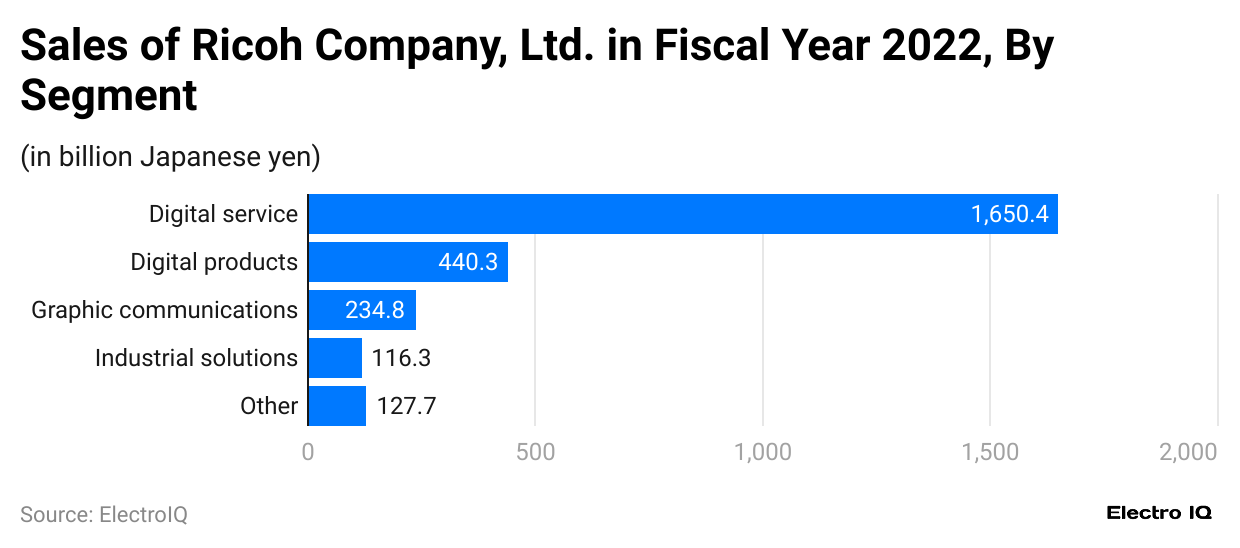

Sales of Ricoh By Segment

(Reference: statista.com)

- Ricoh Statistics show that Graphic communications, Digital services, Industrial Solutions, and Digital products are different product segments of Richoh.

- Digital service has the highest revenue, with 1,650.4 billion Japanese yen, followed by Digital products with 440.3 billion Japanese yen, Graphic communications with 234.8 billion Japanese yen, other products with 127.7 billion Japanese yen, and Industrial solutions with 116.3 billion Japanese yen.

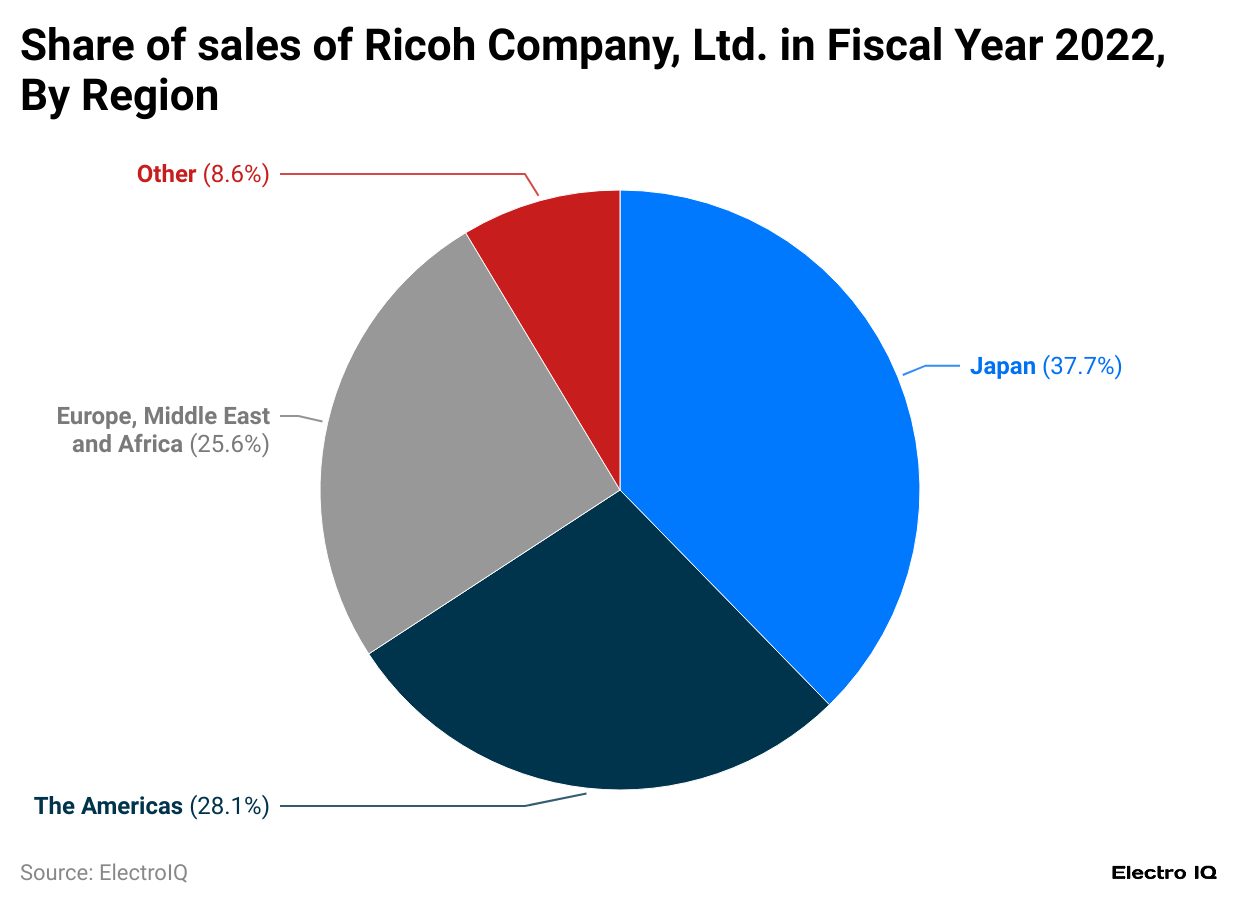

Ricoh Sales By Region

(Reference: statista.com)

- Ricoh Statistics show that the company’s sales can be categorized by Europe, the Middle East, Africa, Japan, the Americas, and other regions.

- Regarding the region’s total sales share, Japan has a 37.7% market share, The Americas has a 28.1% market share, Europe, the Middle East and Africa have a 25.6% market share, and others have an 8.6% market share.

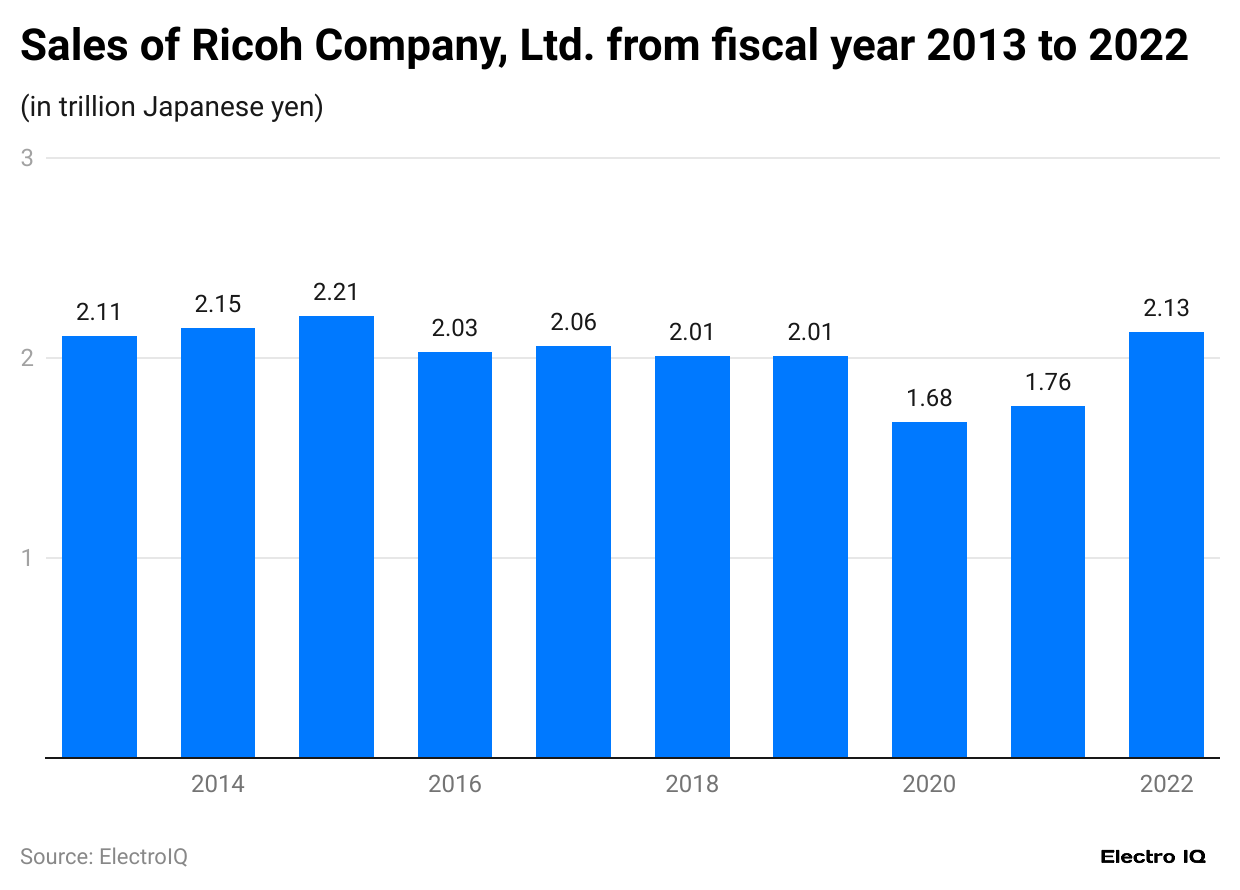

Ricoh Total Sales

(Reference: statista.com)

- Ricoh’s statistics show its highest sales were in 2015 at 21 trillion yen.

- Sales fluctuated slightly from 2016 to 2019, around 01 to 2.06 trillion yen.

- The lowest sales were in 2020 at 68 trillion yen, likely due to the impact of the pandemic.

- Sales recovered in 2021 to 76 trillion yen and increased to 2.13 trillion yen in 2022.

- Overall, the company saw a dip in sales during 2020, but sales began to rise again by 2022.

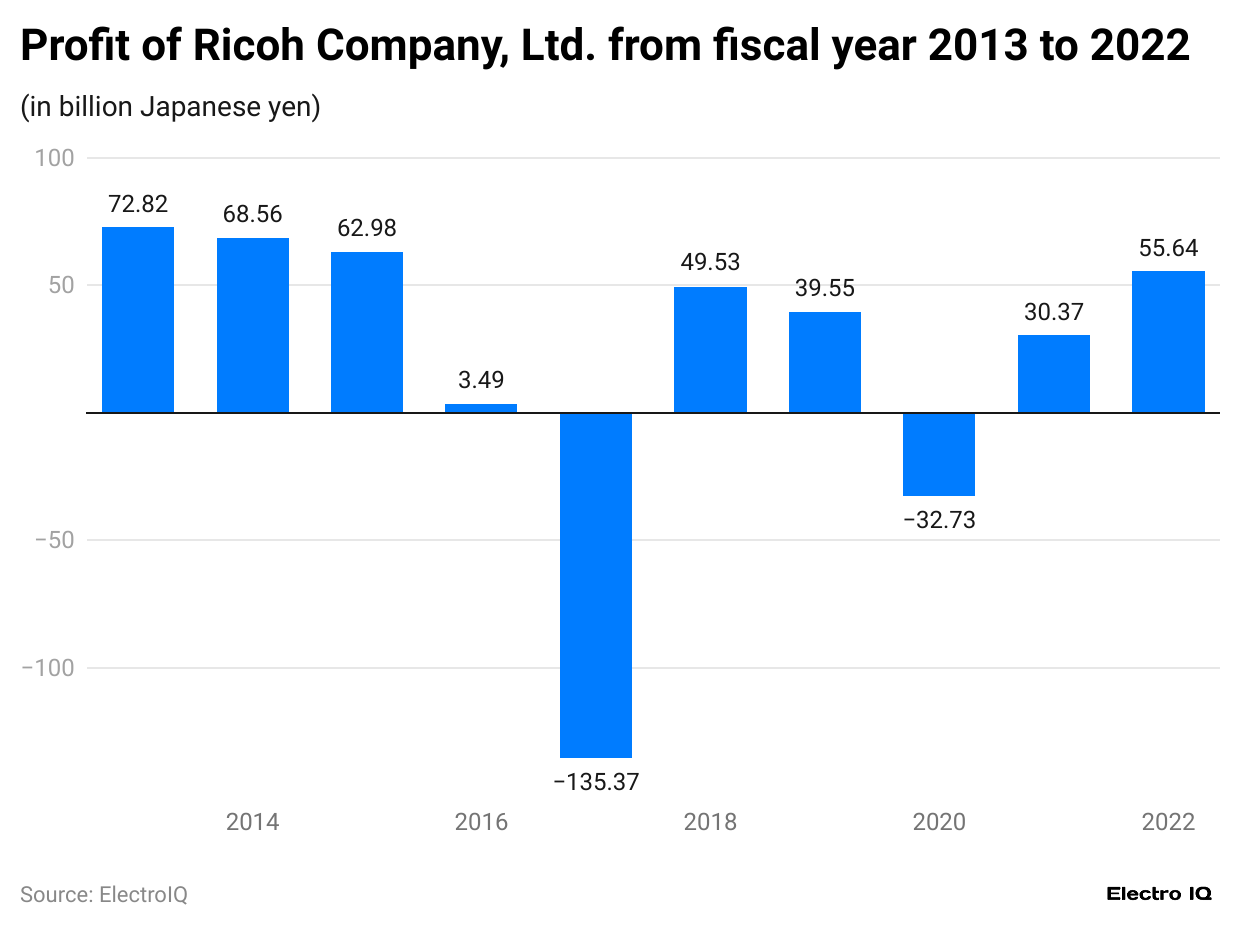

Ricoh Profit

(Reference: statista.com)

- Ricoh’s statistics show its highest profit was in 2013, with 82 billion yen.

- The company saw a significant loss in 2017 of -135.37 billion yen.

- Profits gradually recovered after 2017, reaching 53 billion yen in 2018 and 39.55 billion yen in 2019.

- Overall, the trend shows significant fluctuations in profits, with an enormous loss in 2017 and a recovery in the following years.

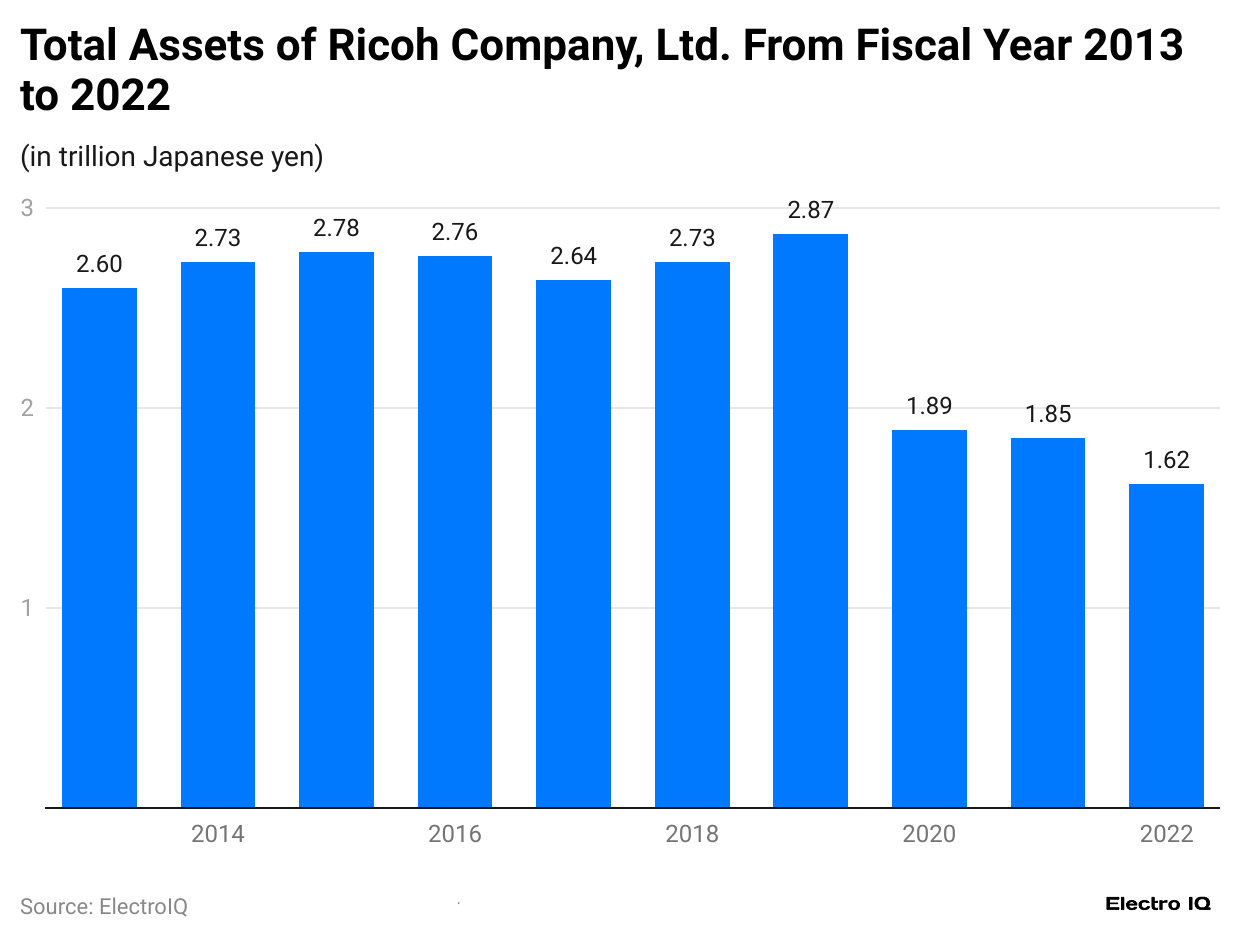

Ricoh Total Assets

(Reference: statista.com)

- Ricoh’s statistics show that its total assets peaked in 2019 at 87 trillion yen.

- Total assets remained stable between 2014 and 2016, averaging around 73–2.78 trillion yen.

- There was a decline in total assets from 2019 to 2022, dropping to 62 trillion yen in 2022.

- Overall, Ricoh’s total assets showed an upward trend until 2019, followed by a notable decline in the subsequent years.

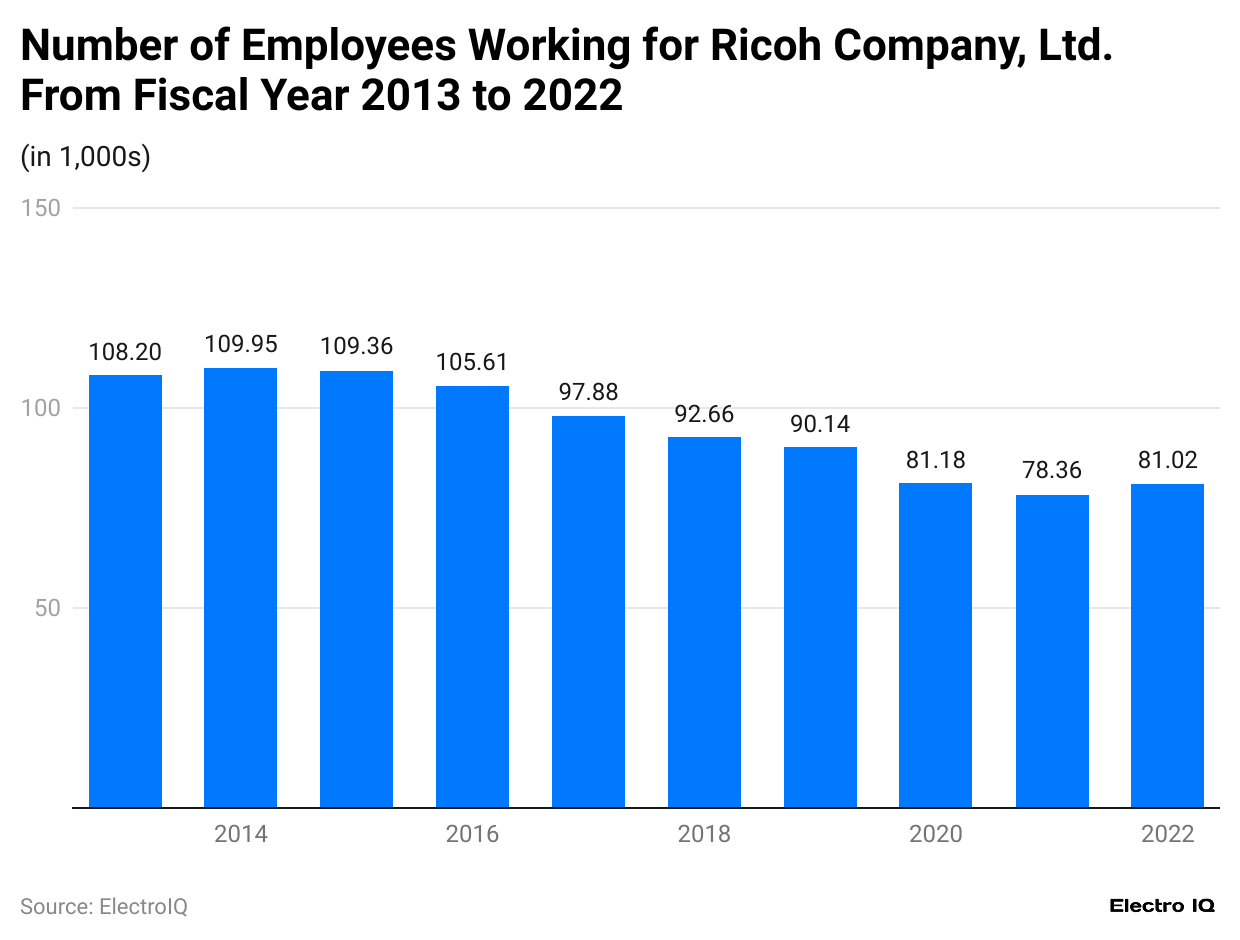

Ricoh Number of Employees

(Reference: statista.com)

- Ricoh Statistics show that the highest number of employees was in 2015, with 95 thousand employees.

- Ricoh’s employee count decreased steadily from 2016 (105.61 thousand) to 2020, reaching 36 thousand employees.

- There was a slight increase in the number of employees from 2021 (81.18 thousand) to 2022 (81.02 thousand).

- Overall, the company saw a consistent decline in its workforce after 2015, followed by stabilization in 2021 and 2022.

Product List

#1. Digital Cameras (Compact)

- Ricoh RDC-1 (1995, 0.41 megapixel)

- Ricoh RDC-2 (1996, 0.41 megapixel)

- Ricoh Theta (360-degree compact, 14.5 megapixels)

- Ricoh Caplio G3 (3.24 megapixel)

- Ricoh Caplio G4 (3.24 megapixel)

- Ricoh RDC-5300 (2.30 megapixel)

- Ricoh Caplio Pro G3 GPS Camera (3.24 megapixel, network ready)

- Ricoh Caplio RX (3 megapixel)

- Ricoh Caplio R1 (4 megapixel, also available as Rollei DR4)

- Ricoh Caplio R1v (5 megapixels, also available as Rollei DR5)

- Ricoh Caplio R2 (5 megapixel, larger screen, no viewfinder)

- Ricoh Caplio R3 (5 megapixels, 28–200 mm equivalent zoom)

- Ricoh Caplio R4 (6 megapixels, 28–200 mm equivalent zoom)

- Ricoh Caplio R5 (7 megapixels, 28–200 mm equivalent zoom)

- Ricoh Caplio R6 (7 megapixels, 28–200 mm equivalent zoom, larger screen, super slim)

- Ricoh Caplio R7 (8 megapixels, 28–200 mm equivalent zoom)

- Ricoh R8 (10 megapixels, 28–200 mm equivalent zoom)

- Ricoh R10 (10 megapixels, 28–200 mm equivalent zoom)

- Ricoh CX1 (9 megapixels, 28–200 mm equivalent zoom)

- Ricoh CX2 (9 megapixels, 28–300 mm equivalent zoom)

- Ricoh CX3 (10 megapixels, 28–300 mm equivalent zoom)

- Ricoh CX4 (10 megapixels, 28–300 mm equivalent zoom)

- Ricoh Caplio GX (5.1 megapixels, also available as Rollei DR5100)

- Ricoh Caplio GX8 (8 megapixels, 28–85 mm equivalent zoom with 22 mm optional adaptor)

- Ricoh Caplio GX100 (10 megapixels, 24–72 mm equivalent wide zoom with 19 mm optional adaptor)

- Ricoh GX200 (12 megapixels, 24–72 mm equivalent wide zoom with 19 mm and 135 mm optional converter lenses, replaced GX100)

- Ricoh Caplio 400G Wide (3.2 megapixel)

- Ricoh Caplio 500SE (8 megapixel, 28–85 mm equivalent zoom, GPS ready)

- Ricoh WG-M1

- Ricoh G700

- Ricoh WG-4

- Ricoh WG-20

- Ricoh WG-30

- Ricoh WG-30W

#2. GR Digital Series

- Ricoh GR Digital (8 megapixels, 28 mm equivalent prime lens with 21 mm optional adaptor)

- Ricoh GR Digital II (10 megapixels, 28 mm equivalent prime lens with 21 mm optional adaptor)

- Ricoh GR Digital III (10 megapixels, 28 mm equivalent prime lens, f/1.9 aperture)

- Ricoh GR Digital IV (10 megapixels, 28 mm equivalent prime lens, f/1.9 aperture)

- Ricoh GR (16 megapixel, 28 mm equivalent prime lens, f/2.8 aperture)

#3. GXR Interchangeable Sensor System

Film Cameras

- Ricoh 35 EFS

- Ricoh KR-10x SLR

- Ricoh 500 35mm Rangefinder

- Ricoh 500G 35mm Compact Rangefinder

- Ricoh Mirai (similar to Olympus AZ-4 Zoom)

- Ricoh Singles (Nikon F mount, made by Mamiya)

- Ricoh Singlex TLS (M42 lens mount)

- Ricoh Singles II (M42 lens mount)

- Golden Ricoh 16 (subminiature camera)

- Ricoh RZ-800

- Ricoh KR-5 (R-K mount)

- Ricoh KR-5 Super (R-K mount)

- Ricoh KR-5 Super II (R-K mount)

- Ricoh KR-10 (R-K mount)

- Ricoh KR-10 Super (R-K mount)

- Ricoh KR-30SP (R-K mount)

- Ricoh GR Film Cameras (GR1, GR1s, GR1V, GR10, GR21)

- Ricoh XR-1 (Pentax K mount)

- Ricoh XR-2 (Pentax K mount)

- Ricoh XR-2s (Pentax K mount)

- Ricoh XR7 (Pentax K mount)

- Ricoh XR-500 (R-K mount)

- Ricoh XR-10M (R-K mount)

- Ricoh XR-M (R-K mount)

- Ricoh XR-P (R-K mount)

- Ricoh XR-S (R-K mount)

- Ricoh XR-X (R-K mount)

- Ricoh FF-9D

- Ricoh RZ-800

#4. Multifunction Products/Printers

- Ricoh Aficio

- Ricoh Aficio MP C 2500

- Ricoh Pro

#5. Software as a Service (SaaS)

- DocumentMall (SaaS document management)

- Print&Share (output management and security)

- Streamline NX (print management and document-capture)

- GlobalScan (document-capture and distribution software)

#6. Projectors

- PJ X2130

- PJ WX2130

- PJ X3340

- PJ WX3340

- PJ WX3340N

- PJ X4240N

- PJ WX4240N

- PJ X3241

- PJ WX4141

- PJ WX4141N

- PJ WX4141NI

- PJ WX5361N

- PJ X537N

- PJ WX6170N

- PJ X6180N

#7. Unified Communication Systems

- P1000

- P3000

- P3500

- Ricoh UCS App (for tablets and smartphones)

#8. Interactive Whiteboards

- Ricoh Interactive Whiteboard D5500

Ricoh Overview

Ricoh Company, Ltd. is a global leader in office equipment, imaging, and document management solutions. Established in 1936, Ricoh has developed a strong presence worldwide, with a significant portfolio of products and services. The company’s performance has fluctuated in recent years, mainly due to changes in the global economic environment and technological advancements. This analysis provides a detailed overview of Ricoh’s performance using Ricoh Statistics from 2023 and 2024, looking into its financial standing, market share, and competitive positioning.

#1. Revenue and Profit Growth in 2023

Ricoh’s total revenue in 2023 was approximately 2.1 trillion yen, translating to roughly 15 billion US dollars. This figure shows a recovery from the pandemic-induced downturn in 2020 when revenues fell to 1.68 trillion yen. The resurgence in Ricoh’s business can be attributed to increased demand for its digital services, document management, and production printers. These services have become critical for companies adapting to hybrid work models post-pandemic.

In 2023, Ricoh’s operating profit stood at 78.74 billion yen, about 550 million US dollars. The company managed to maintain a strong profitability trend in 2023 after several volatile years. The fluctuation in profits from 2017 to 2020, including the significant losses of -135 billion yen in 2017, has stabilized. From a market researcher’s perspective, this steady recovery indicates Ricoh’s ability to adapt to changing market demands, notably by expanding its digital offerings and improving operational efficiency.

#2. Ricoh’s Focus on Digital Transformation

One key factor driving Ricoh’s improved performance is its strategic focus on digital transformation. According to Ricoh Statistics, Ricoh’s digital products and services accounted for a significant portion of the company’s revenue in 2023, with digital products contributing 440.3 billion yen (roughly 3 billion US dollars) to the overall sales. This digital expansion aligns with the increasing global demand for solutions that support remote work, digital document management, and workflow automation.

Ricoh’s services in this segment include cloud-based solutions, managed IT services, and innovative printing technologies. By focusing on these areas, Ricoh has captured market share and provided competitive solutions in an increasingly digital world. As the demand for digital services grows, especially in healthcare, education, and finance industries, Ricoh is well-positioned to capitalize on these emerging trends.

#3. Global Market Share and Regional Breakdown

Ricoh’s global market share in 2023 shows a strong presence across multiple regions. Japan remains the company’s largest market, contributing 37.7% of Ricoh’s total sales. The Americas follow with 28.1%, while Europe, the Middle East, and Africa collectively contribute 25.6% of the company’s revenue. Other regions account for 8.6% of sales.

From a market researcher’s perspective, this distribution highlights Ricoh’s reliance on mature markets such as Japan and North America. However, there is also potential for growth in emerging markets where digital transformation is accelerating. Ricoh could focus more on expanding its presence in Southeast Asia and Africa, where digital and document management solutions are becoming increasingly crucial for businesses and governments.

#4. Research and Development Investments

Research and development (R&D) have always been critical to Ricoh’s innovation strategy. In 2023, Ricoh invested approximately 107.7 billion yen (about 750 million US dollars) in R&D, consistently committing to developing new products and technologies. This investment represents an increase from 2020 when R&D spending dropped to 90.39 billion yen due to the pandemic.

Ricoh’s R&D focuses on several key areas: artificial intelligence, cloud computing, and cybersecurity. The company’s innovative solutions, such as its Ricoh Theta cameras, which offer 360-degree imaging, and its advanced multifunction printers with integrated cloud services, are some of the results of this sustained R&D investment. Looking ahead to 2024, Ricoh aims to increase its R&D spending to explore further digital transformation and sustainability opportunities.

#5. Sustainability Initiatives and Green Technology

Sustainability is becoming a central theme in the global business landscape, and Ricoh is no exception. The company has committed to reducing its carbon footprint and promoting eco-friendly products. By 2024, Ricoh aims to reduce greenhouse gas emissions by 30%, a key initiative in its corporate sustainability goals. According to Ricoh Statistics, the company has also invested heavily in recycling programs and energy-efficient production methods, which have become crucial in gaining the trust of environmentally conscious consumers.

Additionally, organizations looking to reduce their environmental impact have well-received Ricoh’s green technology, such as energy-efficient printers and sustainable document management solutions. These initiatives strengthen Ricoh’s brand image and provide the company with a competitive edge in markets where sustainability is a priority.

#6. Workforce Trends

Ricoh’s workforce has also evolved significantly over the past few years. As of 2023, Ricoh employed 81.18 thousand people globally. This number has declined from 109.95 thousand in 2015, mainly due to restructuring efforts and increased automation within the company. From a market researcher’s perspective, this decrease in headcount could be seen as Ricoh’s attempt to streamline operations and increase efficiency, aligning with its focus on digital transformation.

Looking forward to 2024, Ricoh is expected to maintain a workforce of around 80 thousand, with a continued focus on retaining talent in high-growth areas such as IT services and digital solutions. This shift reflects broader industry trends where automation and digitalization reduce the need for traditional labor while increasing the demand for skilled workers in technology and innovation.

#7. Outlook for 2024

As we look toward 2024, Ricoh’s market prospects appear promising. The company is expected to maintain stable revenue growth, driven by its digital transformation initiatives and strong demand for its digital products. Ricoh’s total assets in 2023 were 1.85 trillion yen (approximately 13 billion US dollars), and these are expected to stabilize around 1.9 trillion yen in 2024 as the company continues to invest in critical areas such as cloud services, cybersecurity, and sustainability.

According to Ricoh Statistics, the company’s profitability is expected to remain strong in 2024, with an anticipated operating profit of around 60 billion yen (roughly 425 million US dollars). The growth in digital services, ongoing sustainability initiatives, and expansion into emerging markets will likely contribute to Ricoh’s continued success in the coming years.

Conclusion

Ricoh’s journey through recent years reflects a company successfully navigating the challenges of digital transformation while maintaining its core strengths in imaging and document management. Ricoh Statistics show with digital services emerging as the primary revenue generator and consistent investment in R&D, Ricoh has positioned itself well for future growth in an increasingly digital marketplace.

The company’s strong presence across global markets, particularly in Japan and the Americas, provides a stable foundation for expansion. At the same time, its commitment to sustainability and innovation demonstrates foresight in addressing future market demands.

FAQ.

Japan leads with a 37.7% market share.

Ricoh recorded its most significant loss of -135.37 billion yen in 2017.

The Digital Services segment generates the highest revenue, with 1,650.4 billion Japanese yen.

Ricoh’s highest R&D spending occurred in 2015, at 118.78 billion yen.

The employee count has decreased from 109,950 in 2015 to around 81,000 in 2023.

Ricoh’s sales recovered from 1.68 trillion yen in 2020 to 2.13 trillion yen in 2022.

As of 2022, Ricoh’s total assets amount to 1.62 trillion yen.

The Americas represent 28.1% of Ricoh’s total sales.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.