eDiscovery Statistics By Market Size and Facts (2025)

Updated · Nov 04, 2025

Table of Contents

Introduction

eDiscovery Statistics: The trend of increased growth in electronic discovery (eDiscovery) continued in 2024. More advanced data sets (including email, Slack, Teams, and mobile) became available for legal teams, and they had to meet increasing demands for speed and accuracy.

At the same time, scrutiny of budgets increased, so offers had to include known pricing and guaranteed ROI. Below is a detailed, numbers-driven snapshot of the eDiscovery statistics in 2025.

Editor’s Choice

- Between 2023 and 2028, the global eDiscovery market is projected to grow from US$15.09 billion to US$22.65 billion (CAGR 8.46%).

- The rise of automation and analytics redefined workflows, accelerating software adoption, which surged from US$5.28 billion to US$9.06 billion (CAGR 11.40%).

- Cloud-based offerings lead, growing from 68% to 73% of market share, with spending increasing from US$3.59 billion to US$6.61 billion by 2028.

- Even though the U.S. market share is projected to fall from 70% to 65%, the absolute spending is expected to rise from US$10.57 billion to US$14.72 billion (≈39% increase).

- Spending from non-government organisations is rising from US$8.30 billion to US$13.59 billion, increasing to 60% of the market, driving adoption.

- In terms of tasks, Review is still the largest, with spending increasing from US$9.81 billion to US$13.59 billion, though its share declines slightly.

- By the year 2028, organisations will spend US$4.53 billion on data capture—a substantial leap from the US$2.26 billion they spent in 2023—as this area continues to grow in importance.

- By 2026, it is anticipated that data volumes worldwide will exceed 221,000 exabytes, a remarkable increase from the mere 0.1 zettabytes recorded back in 2005.

- Alongside this, an astounding 65% of companies have been the target of at least one cyberattack in the last two years, galvanising the drive for stronger compliance measures and security.

- In relation to this, GDPR fines amounting to €4.4 billion have been issued in nearly 2,000 cases as of January 2024.

eDiscovery Market

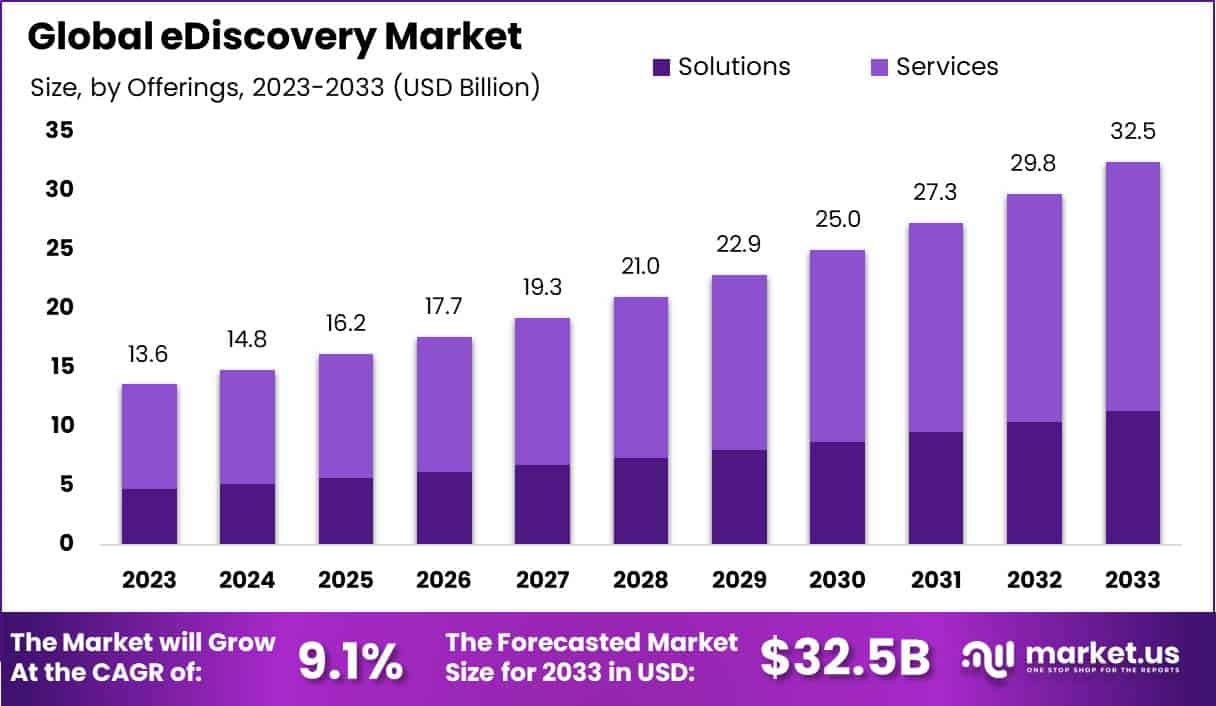

- According to Market.us, the Global eDiscovery Market is projected to reach USD 32.5 billion by 2033, growing from USD 14.8 billion in 2024 at a CAGR of 9.1% between 2025 and 2034.

- In 2024, North America led the market with more than 38.9% share, generating about USD 5.4 billion in revenue.

- Fortune 1000 companies spend between USD 5 million and USD 10 million annually on e-discovery activities, as noted by the RAND Corporation.

- Annual data creation and replication were expected to reach 50 zettabytes by 2020, increasing the need for e-discovery solutions.

- Deloitte reported that by 2024, over 70% of eDiscovery projects will adopt technology-assisted review (TAR) tools to improve document analysis.

- Exterro highlighted that by 2024, more than 75% of law firms will implement bring-your-own-device (BYOD) policies for eDiscovery purposes.

- Relativity found that by 2024, more than 70% of projects will involve data stored in cloud-based applications and systems.

- In 2023, the services segment dominated the market with over 65% share.

- Cloud-based deployment held a strong lead in 2023, with more than 65% share of the market.

- Large enterprises accounted for over 70% of eDiscovery spending in 2023.

- The banking, financial services, and insurance (BFSI) sector captured about 35% of the market in 2023.

- A 40% increase in the adoption of TAR tools was recorded between 2022 and 2024, highlighting the rising role of technology in case preparation.

- Around 55% of legal experts expected greater use of predictive coding and continuous active learning (CAL) in eDiscovery by 2024.

- The use of mobile device data in eDiscovery grew by about 35% between 2022 and 2024.

- Nearly 60% of legal professionals anticipated handling larger volumes of data for eDiscovery by 2024.

- By 2024, over 60% of law firms were expected to use cloud-based eDiscovery platforms, up from about 45% in 2022.

- The use of artificial intelligence (AI) and machine learning (ML) in eDiscovery was projected to expand by about 30% annually from 2022 to 2024.

- By 2024, more than 50% of Fortune 500 legal departments were expected to establish dedicated eDiscovery teams to manage growing complexities.

eDiscovery Software and Services Market

(Reference: complexdiscovery.com)

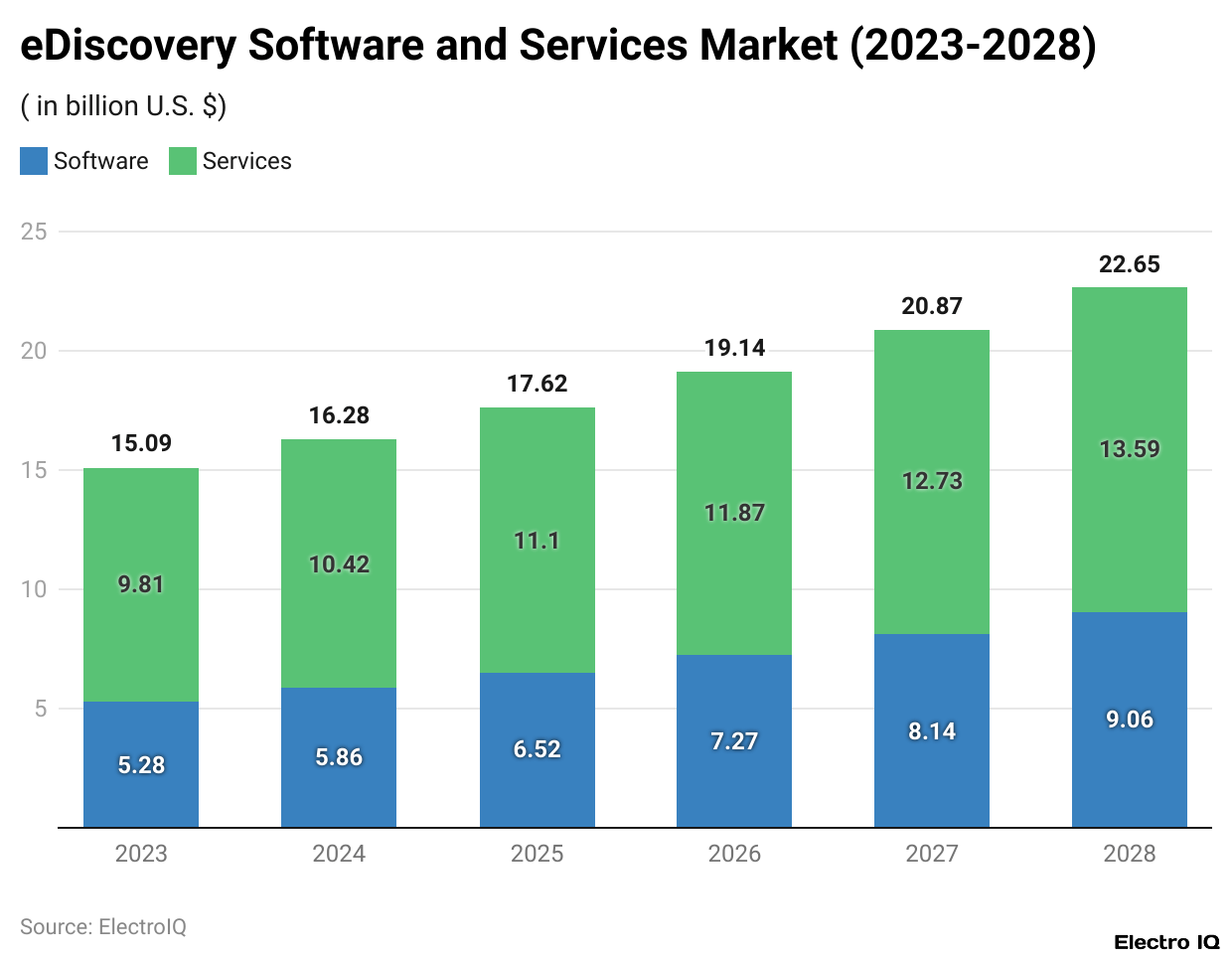

- As per Edrm, eDiscovery statistics show that between 2023 and 2028, the eDiscovery market will expand steadily, growing from US$15.09 billion to US$22.65 billion.

- It reflects a steady 8.46% CAGR, indicating the rising dependence on eDiscovery for legal, corporate, and government functions.

- This growth is primarily driven by the increasing volume of data that organisations need to handle and the growing need to derive insights from data quickly.

- The software sector within this market is the fastest-growing. eDiscovery software, which starts at US$5.28 billion in 2023, is expected to reach US$9.06 billion by 2028, experiencing a stellar CAGR of 11.40%.

- These technologies employ analytics, artificial intelligence, and machine learning to make the review and analysis of massive datasets faster and more accurate.

- The demand for such advanced platforms is the reason for this rapid surge.

- The growth of the services segment, which includes consulting, managed services, and support, is slower, with a CAGR of 6.73%.

- Even so, it continues to be the larger portion of the market, growing from US$9.81 billion in 2023 to US$13.59 billion in 2028.

- Enterprises are continually dependent on specialist services and fully managed services to cope with the escalating compliance and legal framework.

- In terms of the overall market composition, software is expected to increase its share from 35% in 2023 to 40% in 2028, while services are expected to decline slightly from 65% to 60%.

- This change indicates that the market is becoming more focused on technology as users increasingly depend on automated tools to perform the complicated activities of eDiscovery.

eDiscovery Software Market

(Reference: complexdiscovery.com)

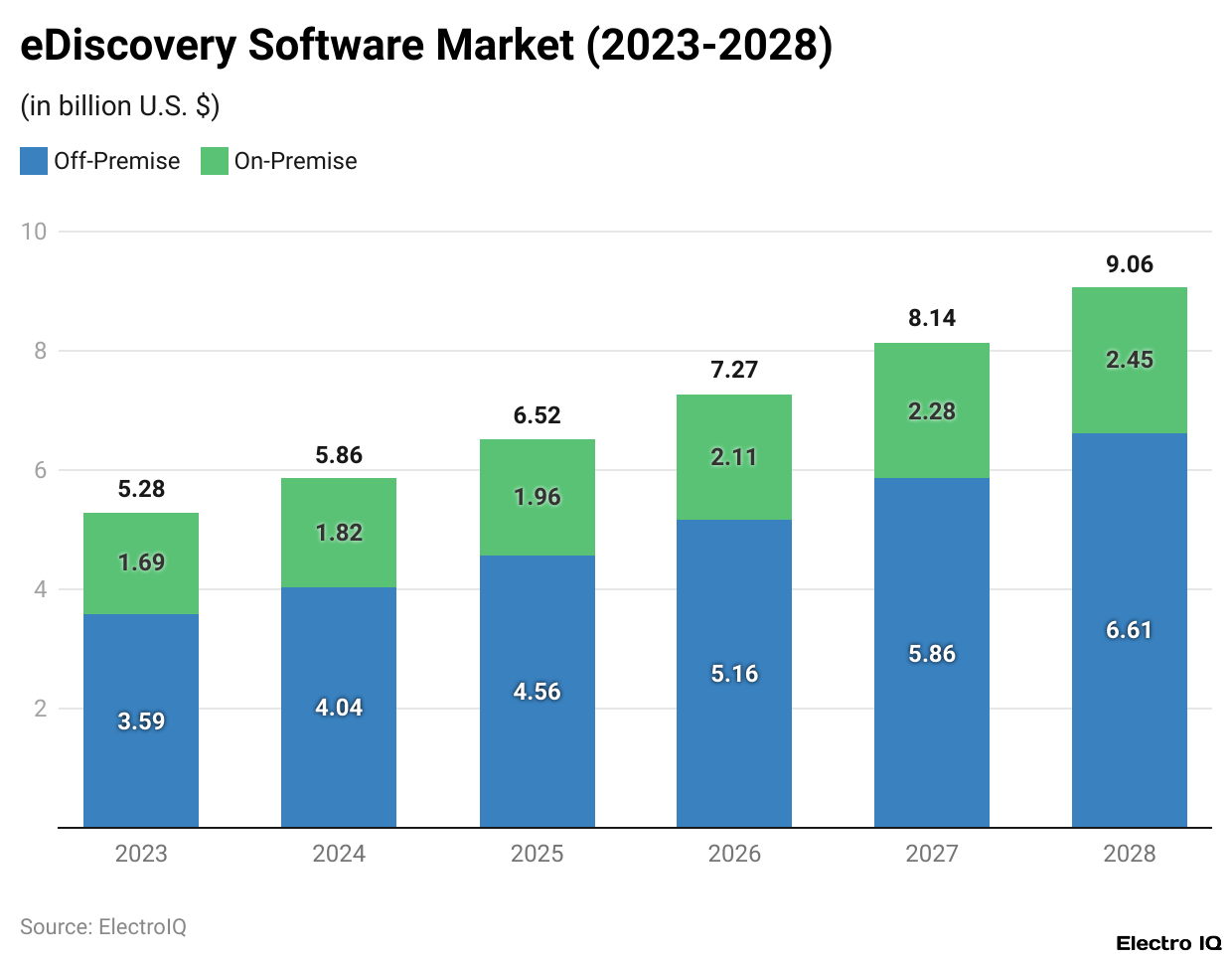

- As of 2023, EDRM-compliant eDiscovery software deployed on local IT infrastructure accounted for 32% of the market.

- However, by 2028, an expected drop to 27% is foreseen.

- Simultaneously, the share of outsourcing or cloud-based eDiscovery solutions is set to increase from 68% in 2023 to 73% in 2028.

- These numbers capture the inclination of modern businesses to opt for eDiscovery in the cloud as services, because cloud eDiscovery services as a category provide better scalability, pricing, and cloud trust value as compared to legacy solutions.

- The overall expenditure for eDiscovery as a service based on legacy infrastructure is still bound to grow in 2023, shrinking in share as they do, from US$1.69 billion in 2023 to 2.45 billion in 2028.

- The growth in eDiscovery as a service for cloud infrastructure is bound to surge from US$3.59 billion in 2023 to US$6.61 billion in 2028.

- This leap of nearly US$3 billion in just 5 years is the clearest indicator of the industry adopting the cloud, leaving behind stiff resistance from legacy vendors to embrace flexibility and efficiency.

eDiscovery Market By Geography

(Reference: complexdiscovery.com)

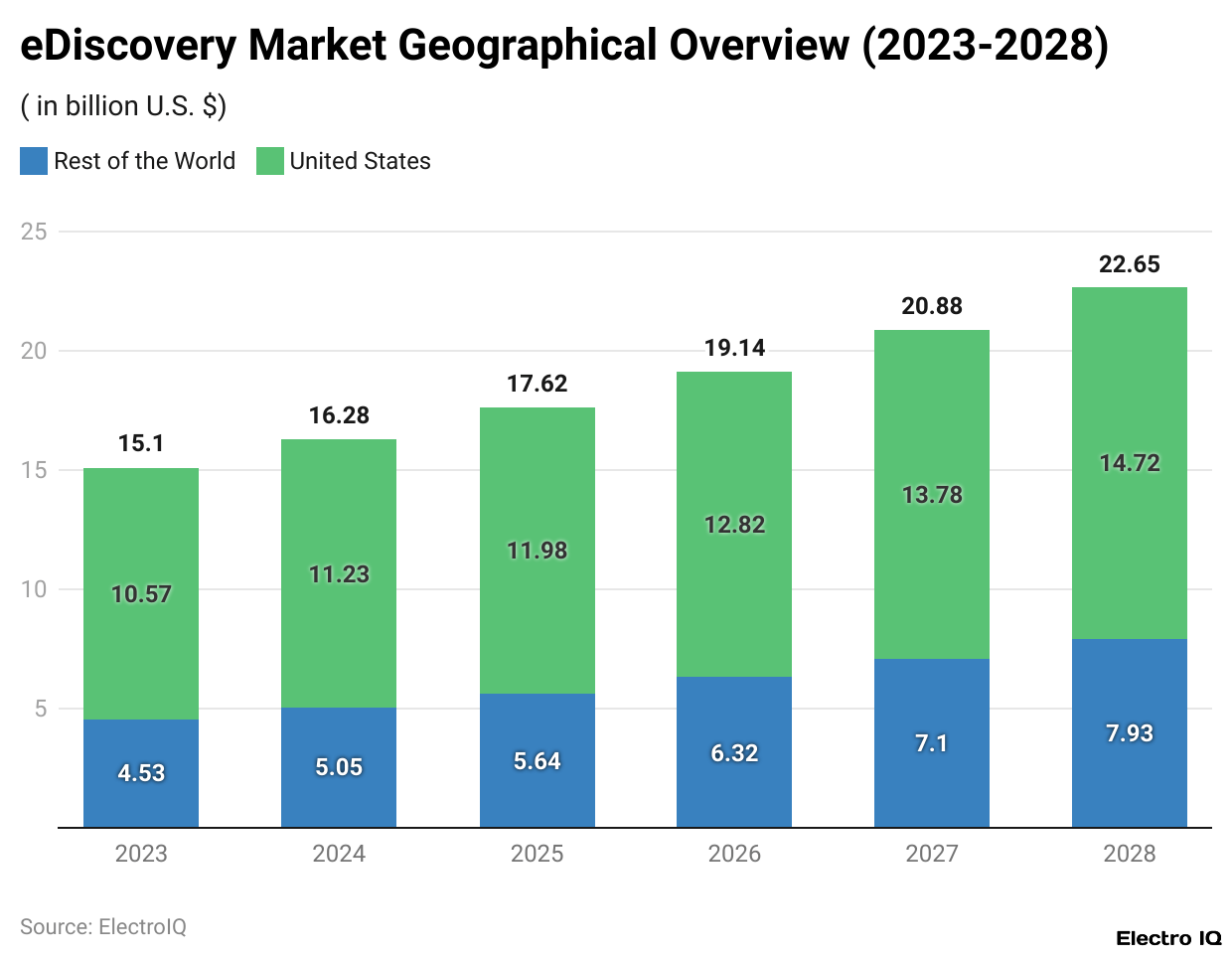

- In terms of its regional distribution, the eDiscovery market is shifting noticeably.

- Though in 2023 the United States had a commanding 70% share of the market, it is anticipated to gently fall to 65% by 2028.

- This decrease indicates a maturing and potentially oversaturated U.S. market, in which services are already widely available.

- In contrast to the U.S., other regions’ markets are planned to grow their share from 30% in 2023 to 35% in 2028, which reflects the globalization of legal services and the spread of eDiscovery adoption in international markets.

- The new data regulations, increase in cross-border disputes, and escalated litigation in emerging markets are fueling this expansion.

- Although the U.S. is expected to lose some of its market share, the eDiscovery market in the country is still forecasted to grow substantially in absolute figures.

- It is projected to grow from US$10.57 billion in 2023 to US$14.72 billion in 2028, recording nearly 39% growth.

- The forecasts indicate that eDiscovery demand in the U.S. is not shrinking.

- Instead, it is driven by the increasing case complexity, data volume explosion, and adoption of artificial intelligence and machine learning in legal workflows.

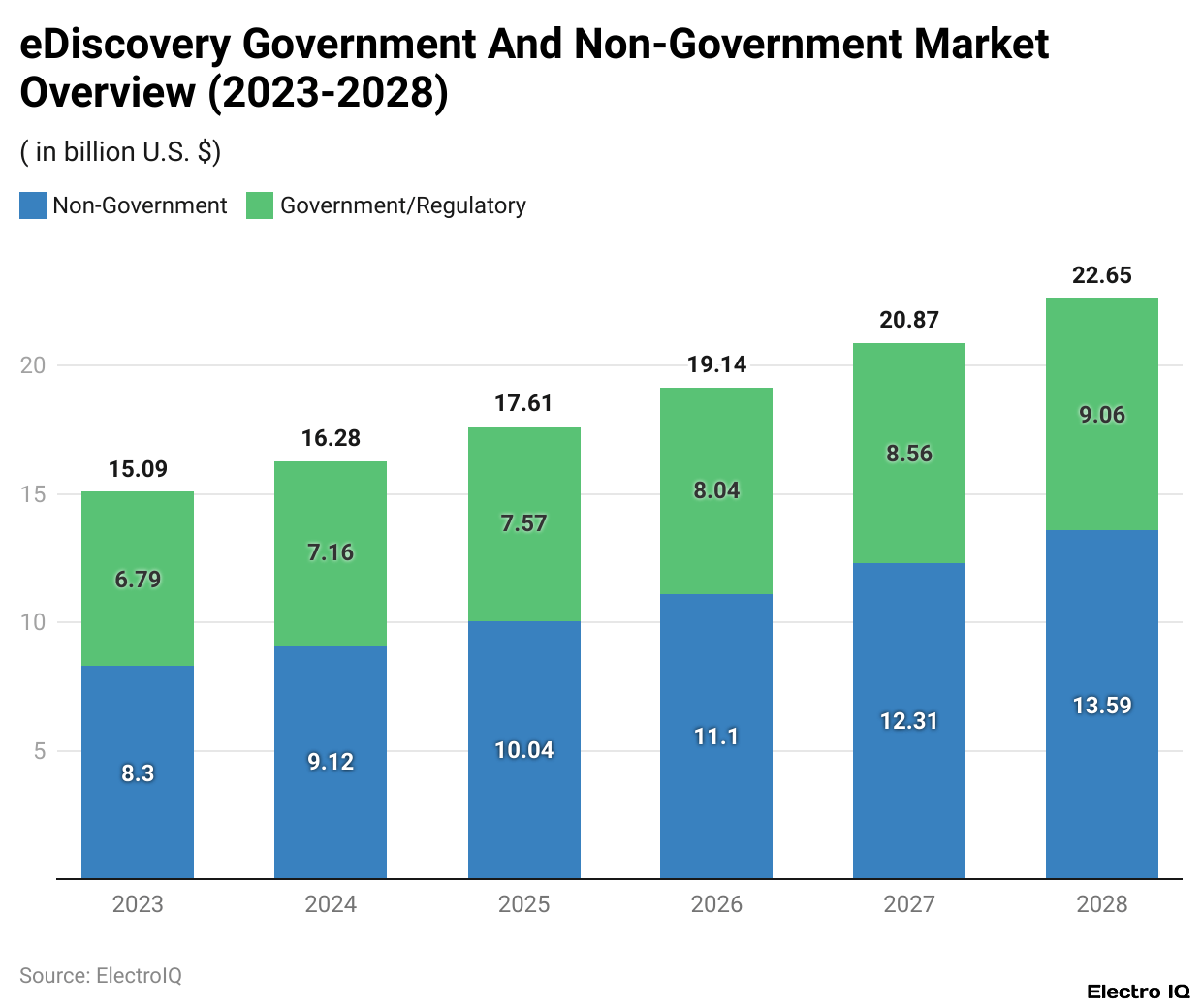

eDiscovery Market By Government And Non-Government Markets

(Reference: complexdiscovery.com)

- The eDiscovery market is split between the government and regulatory agencies on one side and the non-government sector on the other, each with its own unique expansion trends.

- In 2023, government and regulatory entities accounted for 45% of the market, but this share is projected to decrease to 40% by 2028.

- While its proportion is decreasing, actual expenditure within this sector continues to rise, increasing from US$6.79 billion in 2023 to US$9.06 billion in 2028.

- This steady increase underlines the growing amount of data associated with regulatory investigations and litigation, along with heightened compliance requirements and the continued modernisation of government IT infrastructures.

- In contrast, the non-government side is growing at a faster rate. Its share of the market is projected to increase from 55% in 2023 to 60% by 2028, while total spending is expected to escalate from US$8.30 billion to US$13.59 billion.

- This rapid growth is fueled by corporations adopting eDiscovery solutions for litigation, internal investigations, and regulatory compliance.

- As businesses embrace digital workflows and confront multifaceted legal challenges, their need for sophisticated eDiscovery solutions increases exponentially.

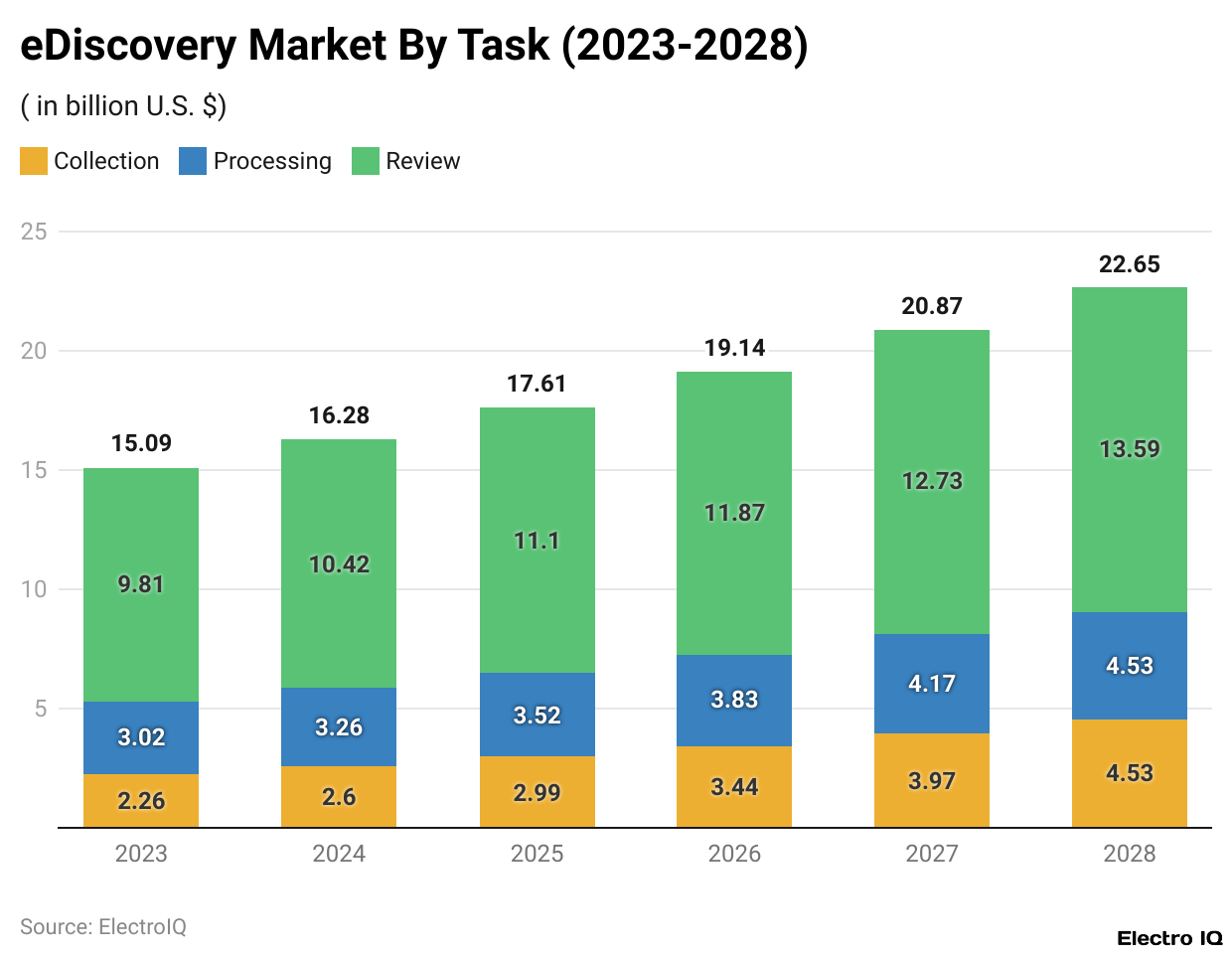

eDiscovery Market by Task

(Reference: complexdiscovery.com)

- Spending in the eDiscovery market varies by task, with review, processing, and collection each taking their own slice.

- As is the case in most other markets, review consumes the largest piece of the pie—amounting to 65% in 2023, with a slight dip to 60% anticipated for 2028.

- Even with the percentage decline, the absolute figure for review shows significant growth from US$9.81 billion to US$13.59 billion.

- This suggests that while technology may be alleviating review’s burden proportionally, data volumes and complexity are increasing sufficiently to increase absolute review expenditures.

- Processing makes up 20% of the expenditures as a whole, consistently, throughout the forecast period. In figure terms, this means an increase from US$3.02 billion in 2023 to US$4.53 billion in 2028.

- The consistent proportion underscores the important function in getting data ready for review, especially given the rise of diverse and complicated data formats.

- Collection, conversely, is anticipated to increase in both market share and spending.

- It is projected to grow from 15% in 2023 to 20% in 2028, and total spending is expected to double, from US$2.26 billion to US$4.53 billion.

- The increase indicates the growing significance of effective collection practices as institutions manage an increasing number of data sources from various platforms and devices.

eDiscovery Trends

- As per Veritas’s report on eDiscovery statistics state that the data indicates that there is a tremendous surge in the amount of digital data.

- It is expected that worldwide data volumes will exceed 221,000 exabytes by 2026.

- As an example, the entire data universe was about 100,000 petabytes, or 0.1 zettabytes, in 2005.

- As cyber threats are becoming ubiquitous, 65% of institutions in an international study declared they had at least one successful data breach within the last two years.

- The pressure from regulations is intense too, especially under the GDPR, where accumulated fines amounted to €4.4 billion by January 2024, distributed over nearly 2,000 distinct penalties since the start of enforcement.

- With the March 2023 release of GPT-4, AI tools have increasingly begun performing tasks once the domain of trained professionals, with AI even scoring in the 90th percentile on the bar exam.

- From a product feature perspective, Veritas is able to ingest data from well over 120 unique data sources through its proprietary eDiscovery platform, Alta™.

- On a broader product and market perspective, Veritas caters to over 80,000 clients, including 91% of the Fortune 100, with technologies that interface to over 800 data sources, 100 operating systems, and 1,400 storage targets.

- This further illustrates the scale and market coverage Veritas operates in.

Conclusion

eDiscovery Statistics: The world of eDiscovery is set to grow even faster in 2024 with the increase in data volume, new regulations, and new technology. Organisations are now resorting more and more to software and cloud-based AI-enabled solutions in order to fulfil their legal and compliance obligations, in particular within the expected US$15.09 to 22.65 billion market opportunity between 2023 and 2028.

While the U.S. is still the largest market, other countries are catching up, with the nongovernment sector leading the adoption. Although review spending continues to be the largest part of the spending, spending on collection is increasing. As a whole, organisations are adopting eDiscovery solutions to meet the legal challenges in today’s world, which has shifted to a digital basis.

Sources

FAQ.

The eDiscovery market is on a steady growth trajectory, with an anticipated increase from US$15.09 billion in 2023 to US$22.65 billion in 2028, at a CAGR of 8.46%. This growth is largely caused by the explosive growth of digital data and the need for eDiscovery tools to efficiently fulfil legal and regulatory compliance.

The use of cloud technology in eDiscovery is gaining dominance. Its market share is projected to grow from 68% in 2023 to 73% in 2028. Furthermore, the spending on eDiscovery is expected to increase from US$3.59 billion to US$6.61 billion.

The eDiscovery market continues to be the largest in the United States, and while its share will decline slightly from 70% to 65%, its market will increase in size from US$10.57 to US$14.72 billion between 2023 and 2028, marking approximately 39% growth. At the same time, international markets increase their share from 30% to 35%, driven by new regulations, cross-border disputes, and adoption in emerging markets.

The Review task accounts for the most eDiscovery spending, which increases from US$9.81 billion in 2023 to US$13.59 billion in 2028, while its percentage drops from 65% to 60%. Processing remains at 20% of the spending, increasing from US$3.02 billion to US$4.53 billion. Collection is growing the fastest, with its percentage increasing from 15% to 20% and spending more than doubling from US$2.26 billion to US$4.53 billion.

There are a number of critical issues that define eDiscovery in 2024. For one, global data volumes are projected to exceed 221,000 exabytes by 2026, presenting huge problems for legal departments. 65% of companies have acknowledged a successful cyberattack on them in the last two years, indicating a greater need for compliance and security measures. The threats posed by regulatory fines worsen the situation—GDPR fines reached €4.4 billion by January 2024.

I hold an MBA in Finance and Marketing, bringing a unique blend of business acumen and creative communication skills. With experience as a content in crafting statistical and research-backed content across multiple domains, including education, technology, product reviews, and company website analytics, I specialize in producing engaging, informative, and SEO-optimized content tailored to diverse audiences. My work bridges technical accuracy with compelling storytelling, helping brands educate, inform, and connect with their target markets.