AMD Statistics By Revenue, Processors Companies And Energy Consumption

Updated · Aug 28, 2024

Table of Contents

- Introduction

- Editor’s Choice

- Growth Of The Semi-Conductor Industry

- Leading Semiconductor Companies

- AMD Worldwide Revenue

- AMD Revenue By Segment

- AMD Revenue In Recent Years

- AMD Energy Consumption

- Popular AMD Processors

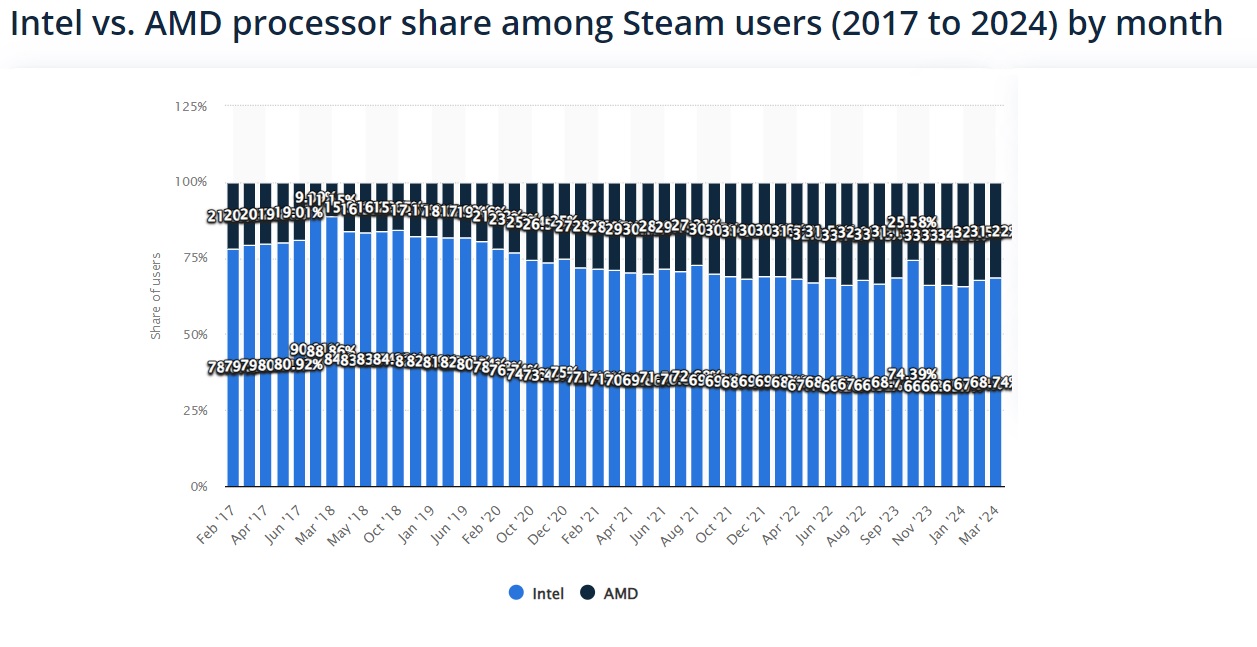

- Monthly Intel vs. AMD Processor Share on Steam

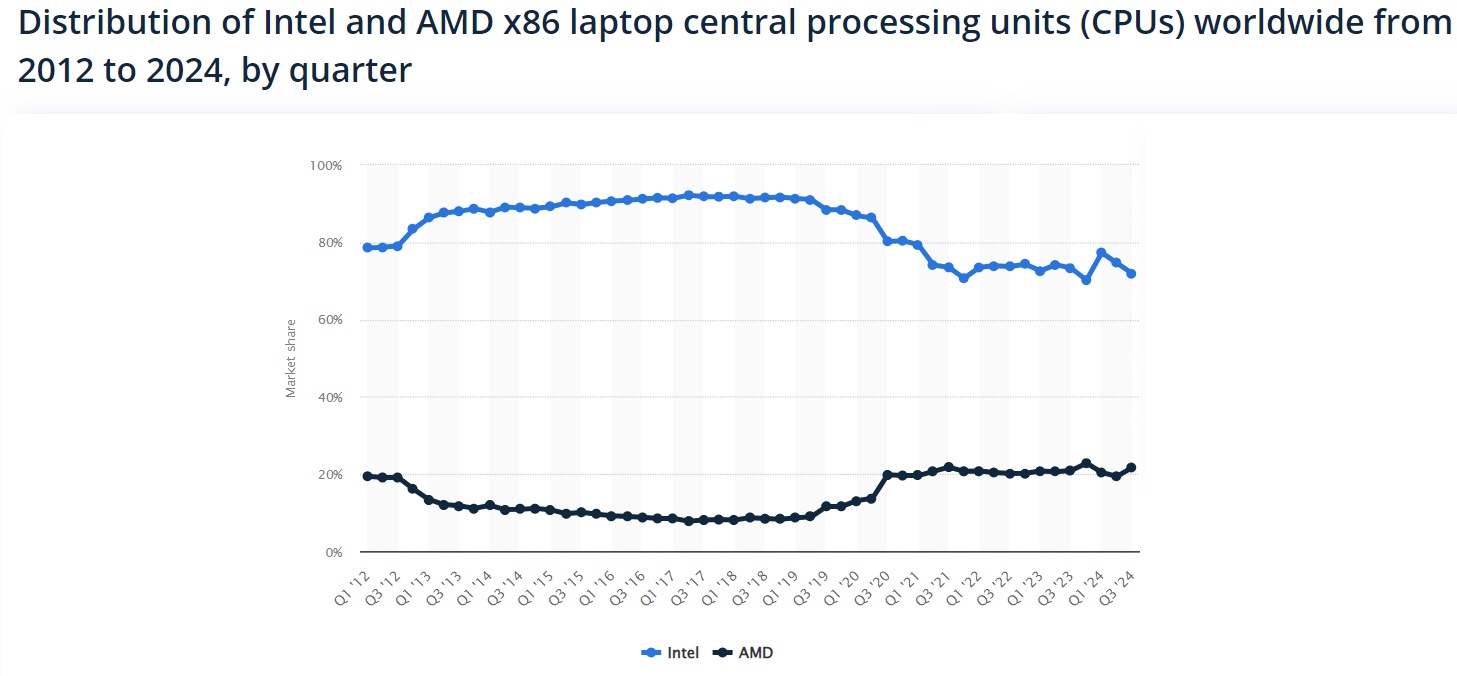

- Quarterly Distribution of Intel vs. AMD x86 Laptop CPUs

- AMD's Vs Intel CPU Market Share

- AMD General Statistics

- Conclusion

Introduction

AMD Statistics: AMD is a multinational semiconductor manufacturer based in Santa Clara, California. It was founded in 1969 by Jerry Sanders and other technology professionals. AMD’s processors are used in various devices, such as data centers, gaming consoles, and high-tech computing systems. They are mainly used to meet the needs of different business and consumer markets.

With technological advances, AMD has consistently worked to meet the demands of upcoming technological requirements. The company aims to develop high-performance and adaptive computing technologies to improve lives. It would be exciting to see AMD rise as a tech powerhouse.

Editor’s Choice

- AMD’s Market Capitalization: As of June 2024, AMD’s market value stands at USD 268.58 billion.

- Projected Revenue Growth: AMD’s revenue for 2024 is expected to grow by 6% compared to 2023.

- R&D Investment: AMD plans to invest USD 3.5 billion in research and development in 2024.

- Ryzen 8000 Series Launch: The Ryzen 8000 series, a highly anticipated processor lineup, is scheduled for release in the last quarter of 2024.

- Semiconductor Industry Revenue: In 2023, the semiconductor industry generated USD 630.9 billion in revenue, with Nvidia leading the market with a valuation of over USD 3 trillion.

- AMD’s Mobile CPU Market Share: In 2023, AMD captured a 24% share of the mobile CPU market.

- AMD’s Revenue: AMD’s total revenue in 2023 was USD 22.7 billion, a decrease from USD 23.6 billion in 2022. In the fourth quarter of 2023, AMD generated USD 6.2 billion in revenue, showing an increase from the previous quarter.

- Operating Income: In 2023, AMD’s operating income was USD 401 million, down from the previous year.

- Net Income: AMD’s net income for 2023 was around USD 854 million, a decrease from USD 1.32 billion the year before.

- R&D Spending in 2023: AMD spent USD 5.8 billion on research and development in 2023, an increase from USD 5 billion.

- Employee Growth: As of 2024, AMD has approximately 26,000 employees, reflecting a 4% increase from 2023.

- Highest Revenue Source: In 2023, AMD’s Data Center division generated the highest revenue, amounting to USD 6.49 billion.

- Share Ownership: In 2023, about 36.24% of AMD’s shares were owned by public companies and individual investors.

- Data Center GPU Revenue: The revenue from AMD’s Data Center GPUs is projected to reach USD 2 billion by the end of 2024, with USD 400 million expected in the fourth quarter alone.

- Website Traffic: In March 2024, AMD’s website, amd.com, received 13.2 million visits, a 4.02% increase from the previous month, with a bounce rate of 49.87%.

- Steam Platform Processor Usage: As of March 2024, 31.22% of Steam users reported using AMD processors, while 68.74% used Intel processors.

- Laptop CPU Market Share: In the third quarter of 2024, AMD processors accounted for 21% of laptop CPU benchmark tests, while Intel processors made up 71%.

- Overall CPU Market Share: In the second quarter of 2024, Intel processors accounted for 64% of benchmark results across all computer CPUs.

Growth Of The Semi-Conductor Industry

![]()

(Reference: Statista.com)

- The semiconductor industry has witnessed significant growth in the past 12 years.

- As per AMD statistics, the industry witnessed revenue of $630.9 billion.

- A significant growth in the semiconductor industry was witnessed during 2021. It witnessed growth of $595 billion in 2021, a substantial growth of $470.89 billion from 2020.

Leading Semiconductor Companies

![]()

(Reference: Statista.com)

- As of June 2024, Nvidia has the highest market capitalization with $ 3,011 billion.

- Based on AMD statistics, the market capitalization of AMD is $268.58 billion as of June 2024.

- The above graph showcases the broad and complex nature of the semiconductor industry and portrays firms from different parts of the chip ecosystem.

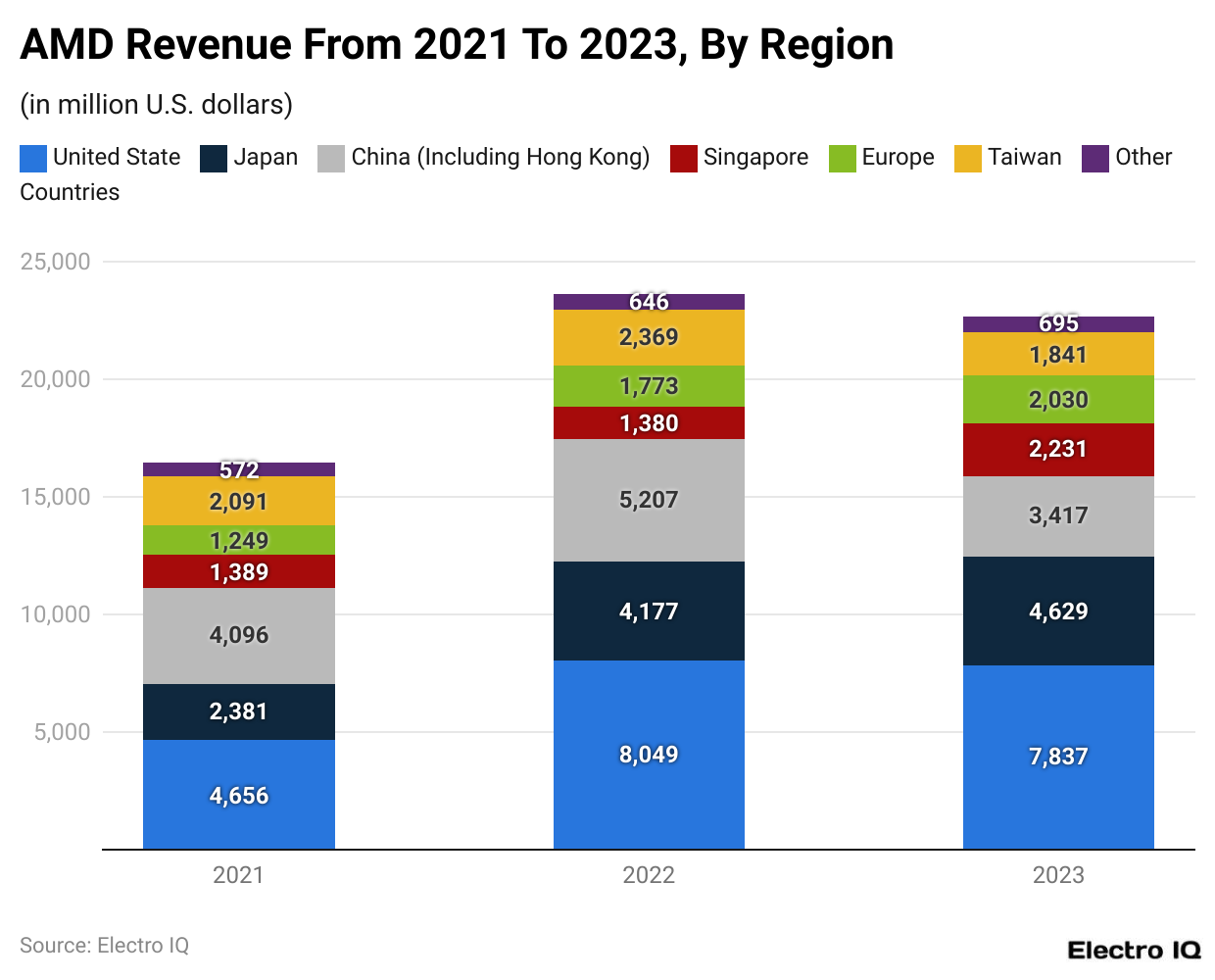

AMD Worldwide Revenue

(Reference: Statista.com)

- Based on AMD statistics, the United States has the most significant revenue in terms of region.

- In 2023, the US amounted to $7,837 million in revenue.

- Japan is the close second as it amounts to $4,629 million in revenue in 2023.

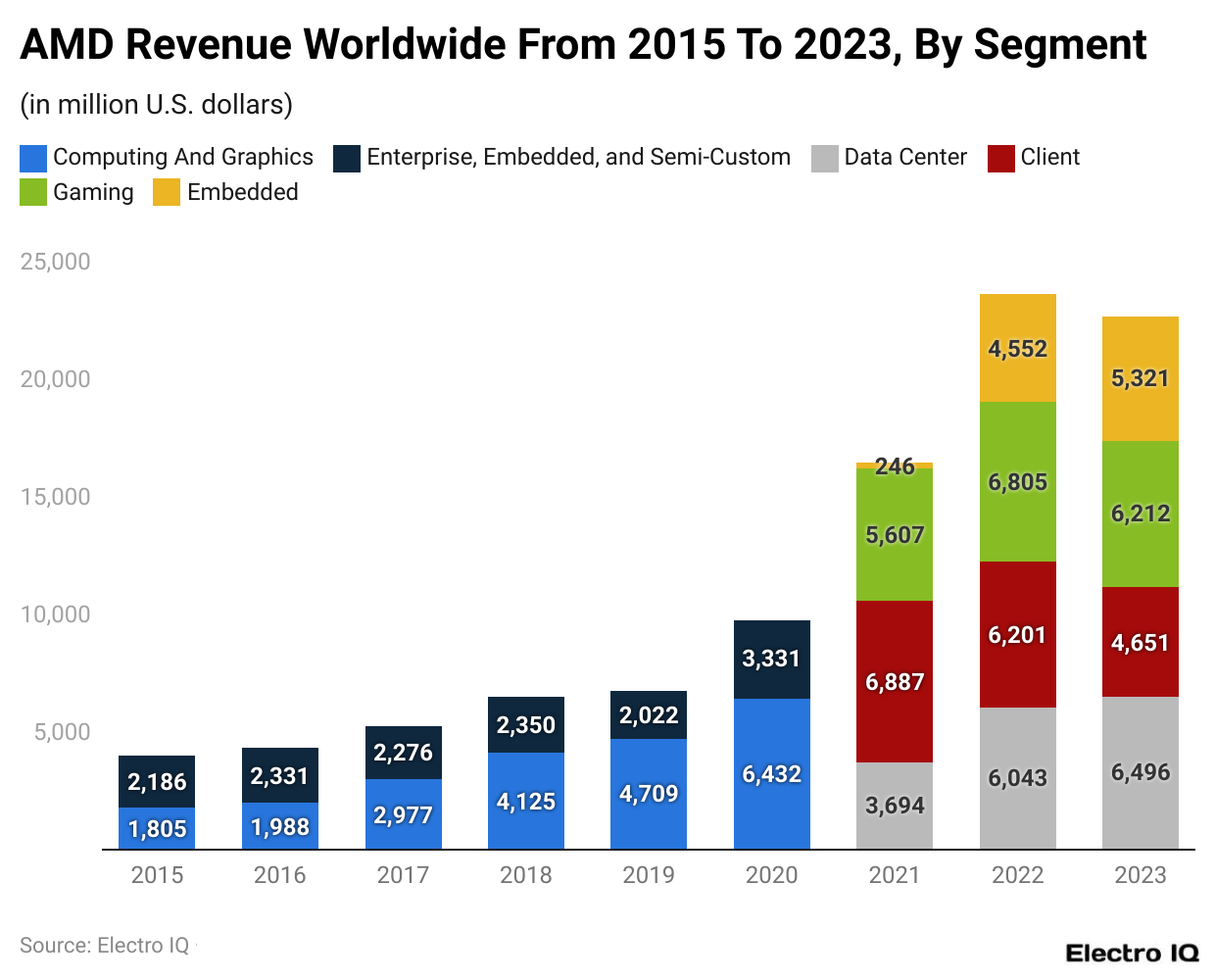

AMD Revenue By Segment

(Reference: Statista.com)

- According to AMD statistics, Computers and Graphics, enterprise-enabled systems remained a significant source of revenue for businesses until 2020, recording an income of $6,432 million in computers and $3,331 million in Enterprises.

- As of 2023, data centers have the highest revenue of $6,496 million.

- The data center revenue has witnessed an unprecedented increase of almost $500 million from 2022. The revenue of data centers was around $6,043 million in 2022, a comparison of 6,496 million in 2023.

AMD Revenue In Recent Years

(Reference: Statista.com)

- As per AMD statistics, the company has generated substantial revenue in the past two decades.

- In 2022, AMD generated a peak revenue of $23,601 million.

- As of 2023, AMD generated revenue of $22,680 million.

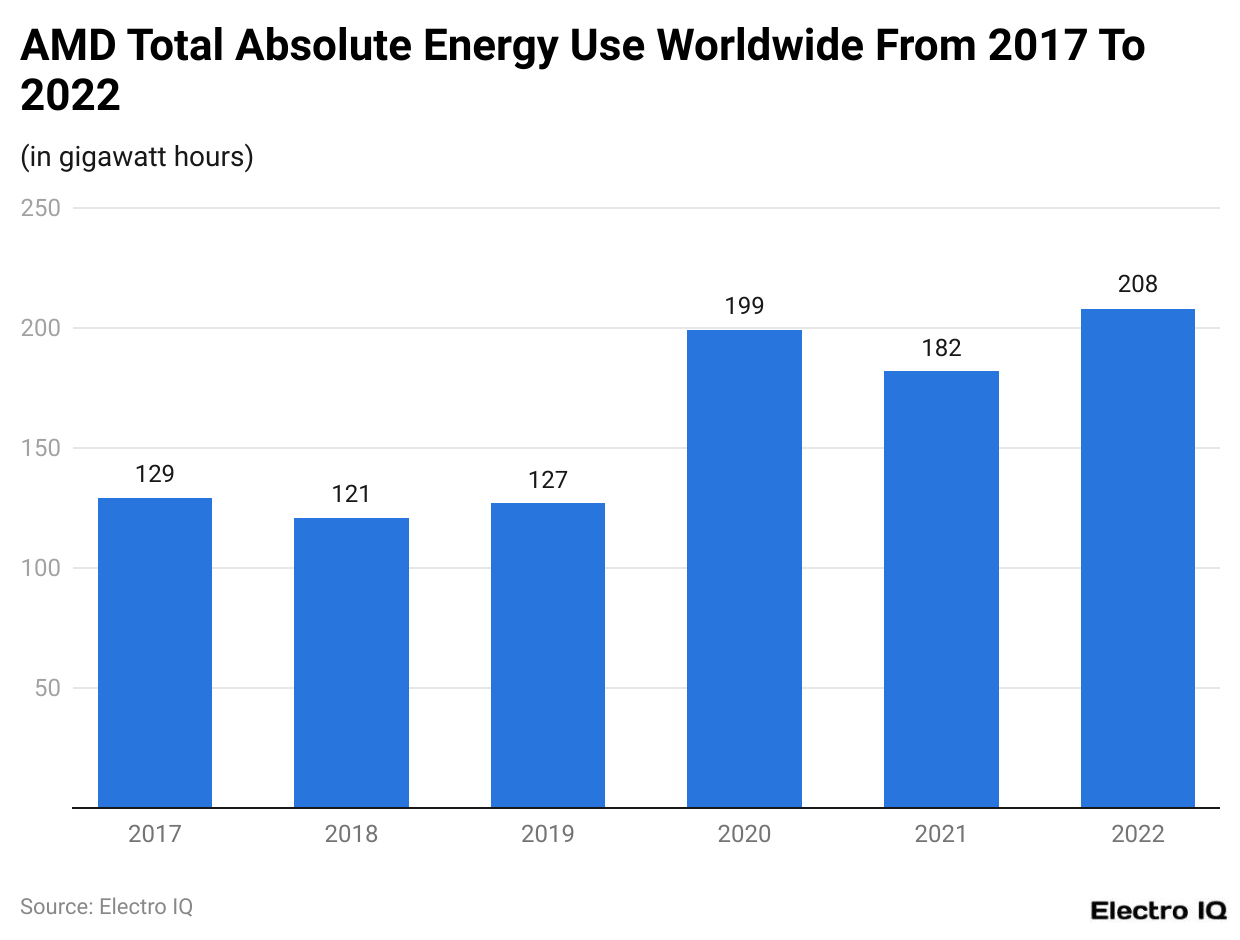

AMD Energy Consumption

(Reference: Statista.com)

- The energy utilization by AMD has increased gradually in recent years.

- Based on AMD statistics, the energy consumption between the period (2017 to 2022) was highest in 2022 with 208 gigawatt hours.

- In 2018, the energy consumption by AMD was 121 gigawatt hours, which was the lowest during the period (2017 to 2022).

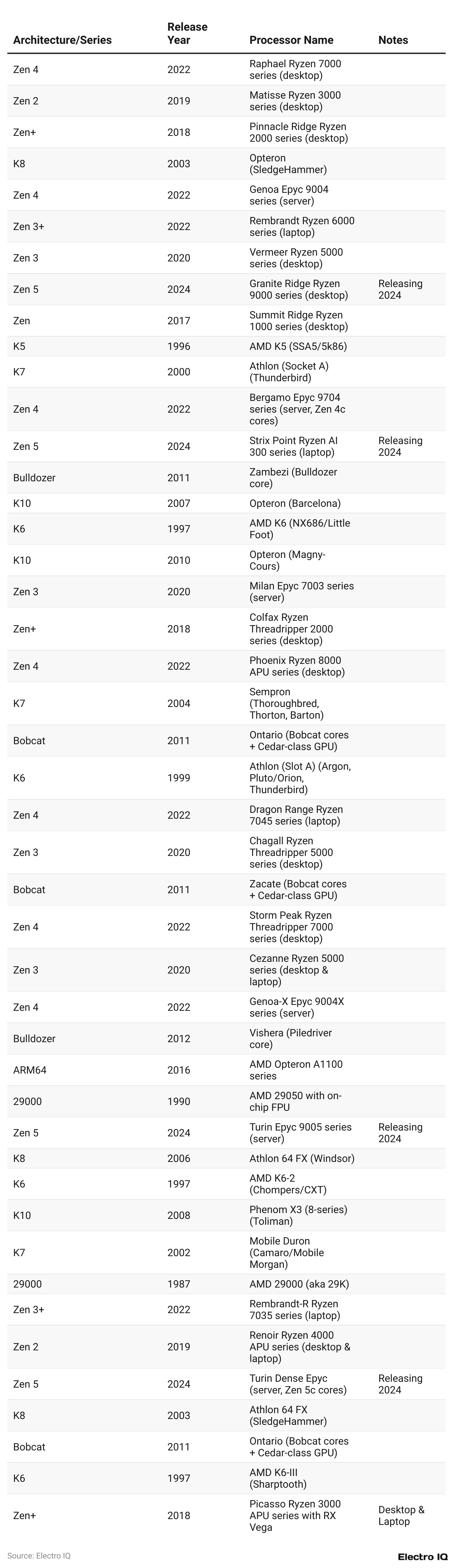

Popular AMD Processors

(Reference: wikipedia.org)

(Source: Statista.com)

- In March 2024, most Steam users (68.74%) were using Intel processors.

- A smaller portion of Steam users (31.22%) were using AMD processors in the same month.

Quarterly Distribution of Intel vs. AMD x86 Laptop CPUs

(Source: Statista)

- In the third quarter of 2024, 71% of laptop central processing units (CPUs) were found to be powered by Intel processors in test benchmark results. This marked an increase from earlier quarters, but it was still slightly lower than the previous quarter. AMD processors accounted for 21% of the laptop CPUs detected in these tests. When considering CPUs in all types of computers, Intel's share was slightly lower at 64% in the second quarter of 2024.

- For many years, the x86 processor has been the primary hardware platform used in laptops, desktops, and servers globally. Both Windows and Mac laptops have traditionally relied on x86 chips. Apple initially used PowerPC microprocessors in their Mac products but began transitioning to Intel's x86 architecture in 2005. The first Intel-based Macs were released in 2006, and this partnership continued until 2020. In 2020, Apple announced it would start moving from Intel CPUs to its own custom ARM-based chips. This move was aimed at unifying the CPU architecture across all Apple devices, including iPhones, iPads, and Macs, with the transition expected to take around two years.

- In recent times, Intel has faced challenges in manufacturing its own chip designs, leading to public apologies from the company. Unlike many of its competitors, Intel both designs and manufactures its chips. In contrast, companies like Taiwan Semiconductor Manufacturing Company (TSMC) focus solely on manufacturing chips designed by other companies, such as AMD and Apple.

- AMD reached a new record in the x86 CPU market in 2023, gaining against Intel, particularly in the PC and server segments.

- AMD's CPU market share grew by 0.5%, reaching 31.1%, while Intel's share dropped to 68.9%.

- AMD's success was largely due to a smaller decline in CPU shipments for servers, PCs, and embedded/IoT segments compared to Intel.

- Both AMD and Intel saw an increase in CPU shipments for servers and PCs in the fourth quarter of 2023, following a period of excess inventory reduction.

- Despite this, AMD's overall CPU market share fell by 2.1% in the fourth quarter to 28.6%, largely due to declining shipments of chips for gaming consoles like Sony’s PlayStation 5.

- When excluding semi-custom, embedded, and IoT segments, AMD's CPU market share actually increased by 0.7% to 20.4% in the fourth quarter, a 3.2% improvement over the previous year.

- AMD grew its share in the PC CPU market in the fourth quarter, increasing by 0.8% sequentially and 3% year-over-year, reaching 20.2%.

- In the mobile CPU segment, AMD's share rose by 0.9% sequentially and 3.9% year-over-year to 20.3%, driven by strong sales of Ryzen 7040 processors with AI capabilities and lower-end Ryzen/Athlon 7020 chips.

- AMD also gained 0.6% share in desktop PCs, bringing its total to 19.8%, a 1.2% increase from the previous year.

- Intel managed to make a slight gain of 0.2% in the server CPU market, reaching 76.9%, while AMD held 23.1%.

- Intel's small gain in the server segment was the first time in nearly five years that the company saw an increase in this area.

- Both AMD and Intel experienced significant growth in data center CPU products, including Intel’s Xeon and AMD’s EPYC processors.

- AMD’s success in the server market was attributed to its processors’ higher core counts and new features like AVX-512 instructions, which are beneficial for AI, HPC, and analytics workloads.

- Intel's latest Xeon processors have also made performance gains, which have kept some customers loyal to the brand.

- Nvidia GPUs are gaining significant interest in the market, with businesses investing heavily in them for AI and other demanding tasks, even more so than in CPUs.

AMD General Statistics

Financial Performance

- In 2023, AMD reported revenues of approximately $23.6 billion, marking an increase of 9% from 2022. This growth was primarily driven by the strong demand for AMD’s processors and graphics cards. By the first half of 2024, AMD had already achieved revenues of $12.1 billion, positioning the company for another solid year. Analysts predict that AMD's total revenue in 2024 could surpass $25 billion, reflecting a further growth rate of around 6%.

- The company’s operating income in 2023 was $5.4 billion, substantially increasing from $4.9 billion in 2022. For 2024, AMD's operating income is projected to rise to around $5.8 billion, driven by continuous gross margins and operational efficiency improvements.

Market Share

- AMD’s market share in the CPU market has been particularly noteworthy. In 2023, AMD held a 37% share of the desktop CPU market, up from 34% in 2022. This gain reflects AMD's competitive advantage in producing high-performance, cost-effective processors that appeal to many consumers and businesses.

- In the mobile CPU market, AMD's share reached 24% in 2023, compared to 21% in 2022. This growth is expected to continue in 2024, with projections suggesting AMD could achieve a 40% market share in the desktop segment and 27% in the mobile segment by the end of the year.

- The graphics processing unit (GPU) market also saw significant shifts in 2023. AMD’s market share increased to 21% from 18% in 2022. The company’s innovative Radeon series has been well-received, contributing to this upward trend. In 2024, AMD is expected to capture 23% of the GPU market as it continues to compete with other major players like NVIDIA.

Product Developments

- AMD's product line-up in 2023 included the launch of the Ryzen 7000 series processors, which have been a game-changer in performance and energy efficiency. The company also introduced new Radeon RX graphics cards, which have been competitive in price and performance. These products have contributed significantly to AMD's revenue and market share growth.

- In 2024, AMD plans to continue its product innovation by releasing the Ryzen 8000 series processors and new RDNA 3.5 architecture-based GPUs. These advancements are expected to strengthen AMD’s market position further and drive revenue growth. The anticipated impact of these new releases is reflected in the optimistic revenue forecasts for 2024, which are expected to increase by 7% compared to 2023.

R&D Investment

- AMD has consistently invested in research and development (R&D) to maintain its competitive edge. In 2023, the company allocated $3.2 billion to R&D, accounting for approximately 13.6% of its total revenue. This investment has been critical in driving innovation and product development.

- For 2024, AMD has planned an R&D budget of around $3.5 billion, representing about 14% of the projected revenue. This continued investment underscores AMD's commitment to staying at the forefront of technological advancements in the semiconductor industry.

Stock Performance

- AMD’s stock performance has been robust, reflecting the company’s vital financial health and growth prospects. In 2023, AMD's stock price saw a 20% increase, with shares closing the year at around $100 per share. Solid quarterly earnings and positive market sentiment supported this growth.

- In 2024, the stock price is expected to continue its upward trajectory, with analysts predicting a potential increase of 15%, which could see the stock trading at around $115 by the end of the year.

Competitive Landscape

- AMD faces intense competition from other semiconductor giants such as Intel and NVIDIA. However, AMD’s ability to innovate and deliver high-performance products at competitive prices has steadily gained market share.

- In 2023, Intel's market share in the desktop CPU market decreased by 3%, which AMD primarily captured. Similarly, NVIDIA saw a 2% drop in GPU market share, benefiting AMD's position in this segment.

- For 2024, AMD is expected to further consolidate its market presence, especially with the anticipated launch of new products. The company’s strategy of focusing on high-growth areas such as cloud computing, gaming, and data centers will likely yield positive results, further enhancing its competitive position.

Conclusion

AMD has showcased significant growth in recent years, sustaining its position in the highly competitive semiconductor industry. From its beginning from 1969 till 2024 the company has undergone significant changes owing to growing business requirements. The company is focused on developing semiconductor chips for data centers and computer graphic solutions.

FAQ.

Based on AMD statistics, it currently ranks among the top IC providers globally.

AMD Ryzen processor, AMD Radeon Graphics and EPYC server processors are considered as marquee products of AMD.

As per AMD statistics, they invested $3.2 billion in 2023, which comprises 13.6% of their total revenue.

Joseph D'Souza founded ElectroIQ in 2010 as a personal project to share his insights and experiences with tech gadgets. Over time, it has grown into a well-regarded tech blog, known for its in-depth technology trends, smartphone reviews and app-related statistics.