Beauty Industry Statistics By Market Size, Revenue, Country, Manufacturers and Brand Value

Updated · Dec 10, 2024

Table of Contents

- Introduction

- Editor’s Choice

- Beauty Industry Statistics

- Cosmetic Market Growth

- Cosmetic Industry Growth Rate

- Prestige Cosmetics Revenue Per Capita

- Colour Cosmetic Industry By Country

- Global Cosmetics Revenue By Segment

- Skincare Industry Growth

- Skincare Products Statistics

- Cosmetic Industry Market By Region

- Beauty Marketing and Social Media Statistics

- Beauty eCommerce and Technology Statistics

- Beauty and Personal Care Market Revenue By Region

- Top Beauty Manufacturers Worldwide

- Personal Care Company Brand Value

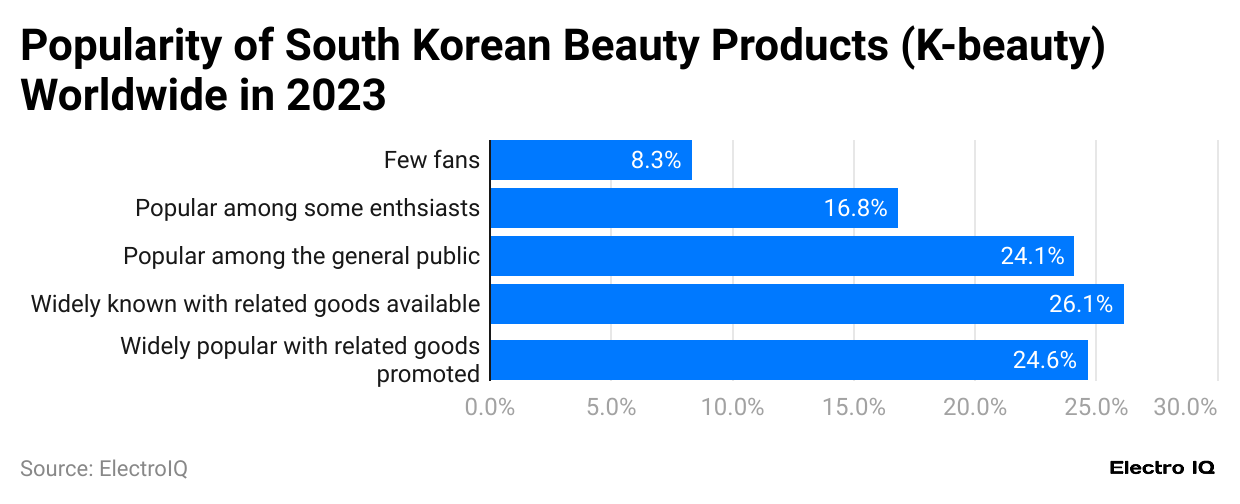

- Korean Beauty Product Popularity Growth

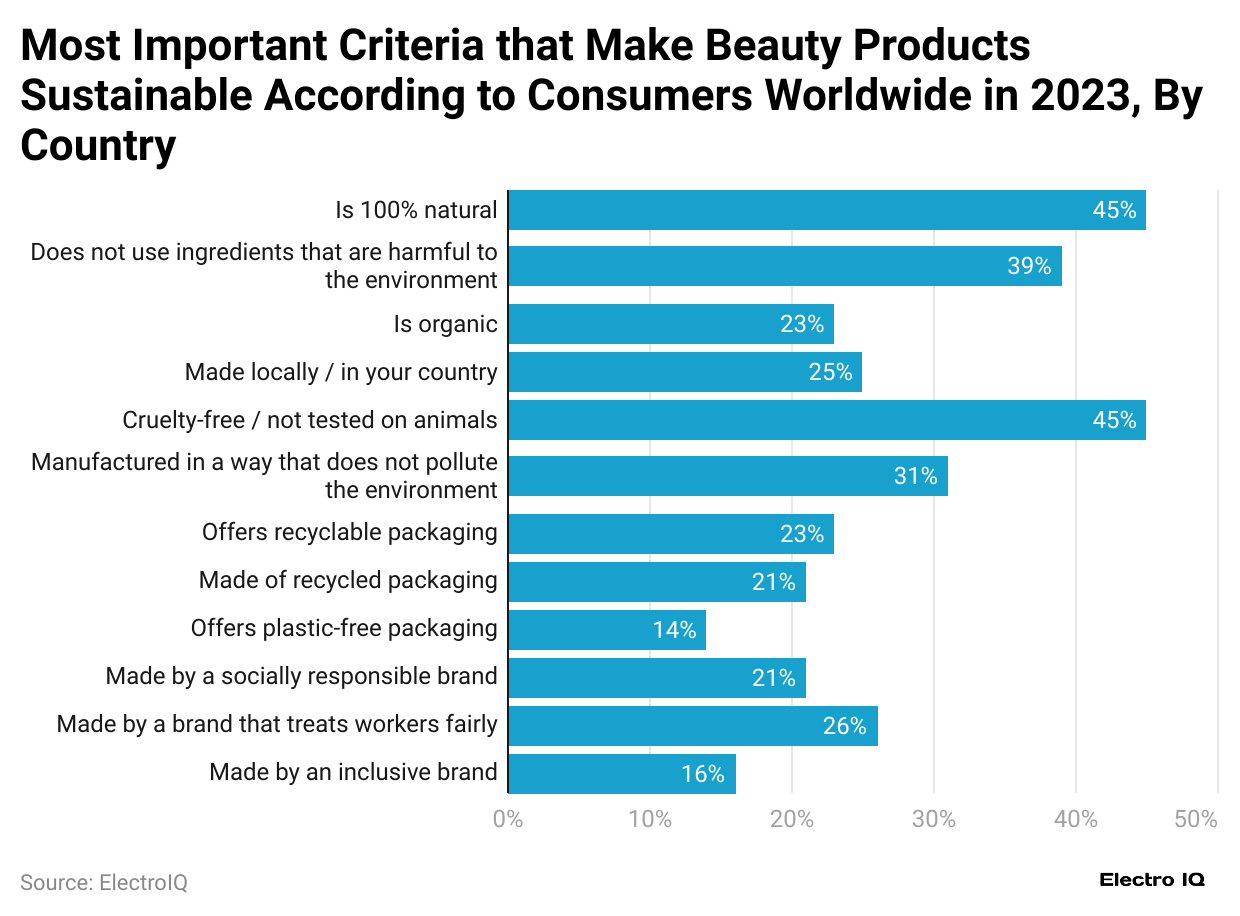

- Essential Criteria For Sustainable Beauty Products

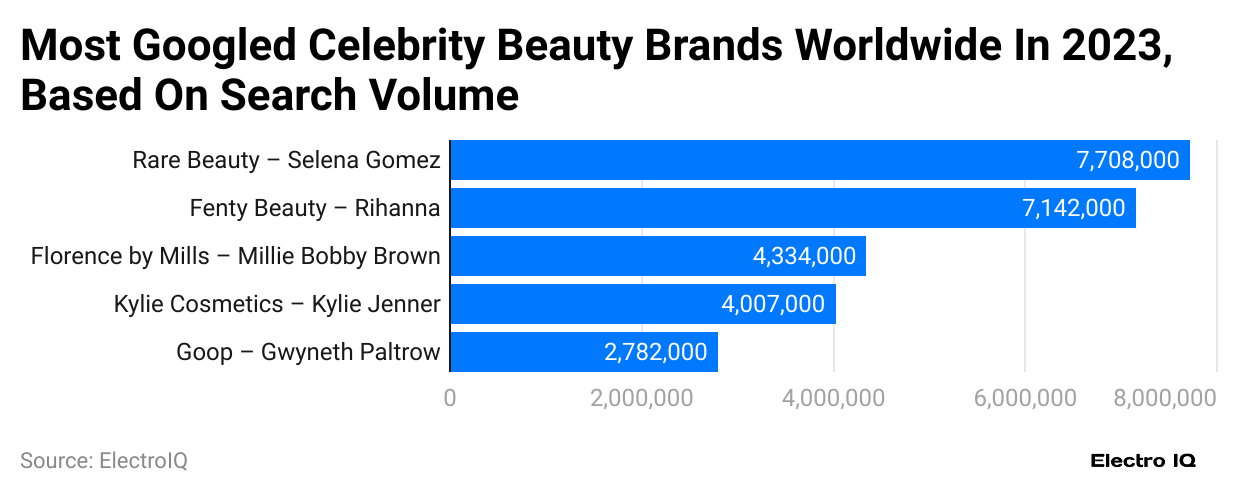

- Most Googled Beauty Brands

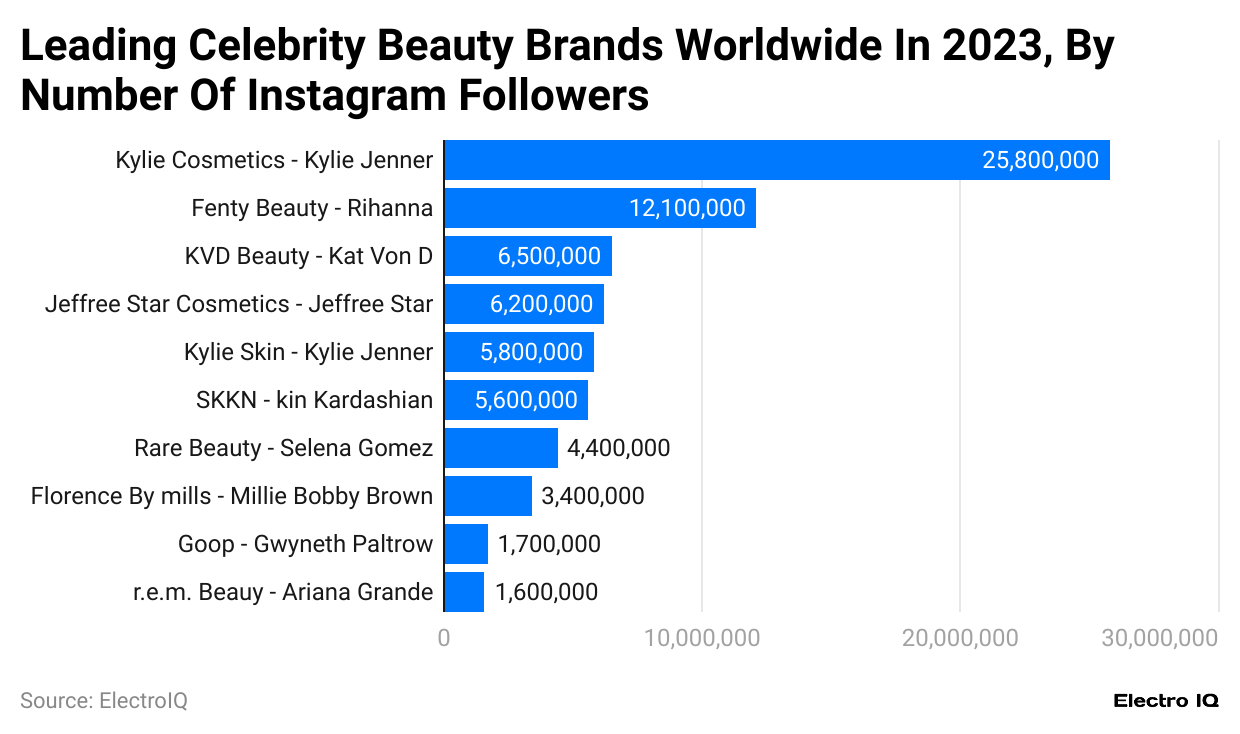

- Beauty Brand By Instagram Followers

- Top Beauty Companies

- Conclusion

Introduction

Beauty Industry Statistics: The beauty industry is dedicated to providing cosmetic products that enhance individual beauty. It is an inclusive sector that caters to a diverse range of consumer needs and preferences. Historically, this industry was dominated by multinational corporations; however, the 20th century saw the rise of smaller players who have since become significant contributors.

As the global focus on self-care and wellness increases, the cosmetics industry continues to thrive. Although the COVID-19 pandemic caused a temporary decline in 2020, the market has shown consistent growth since 2004. By 2029, the global cosmetics market is projected to generate revenues of nearly 132 billion United States dollars.

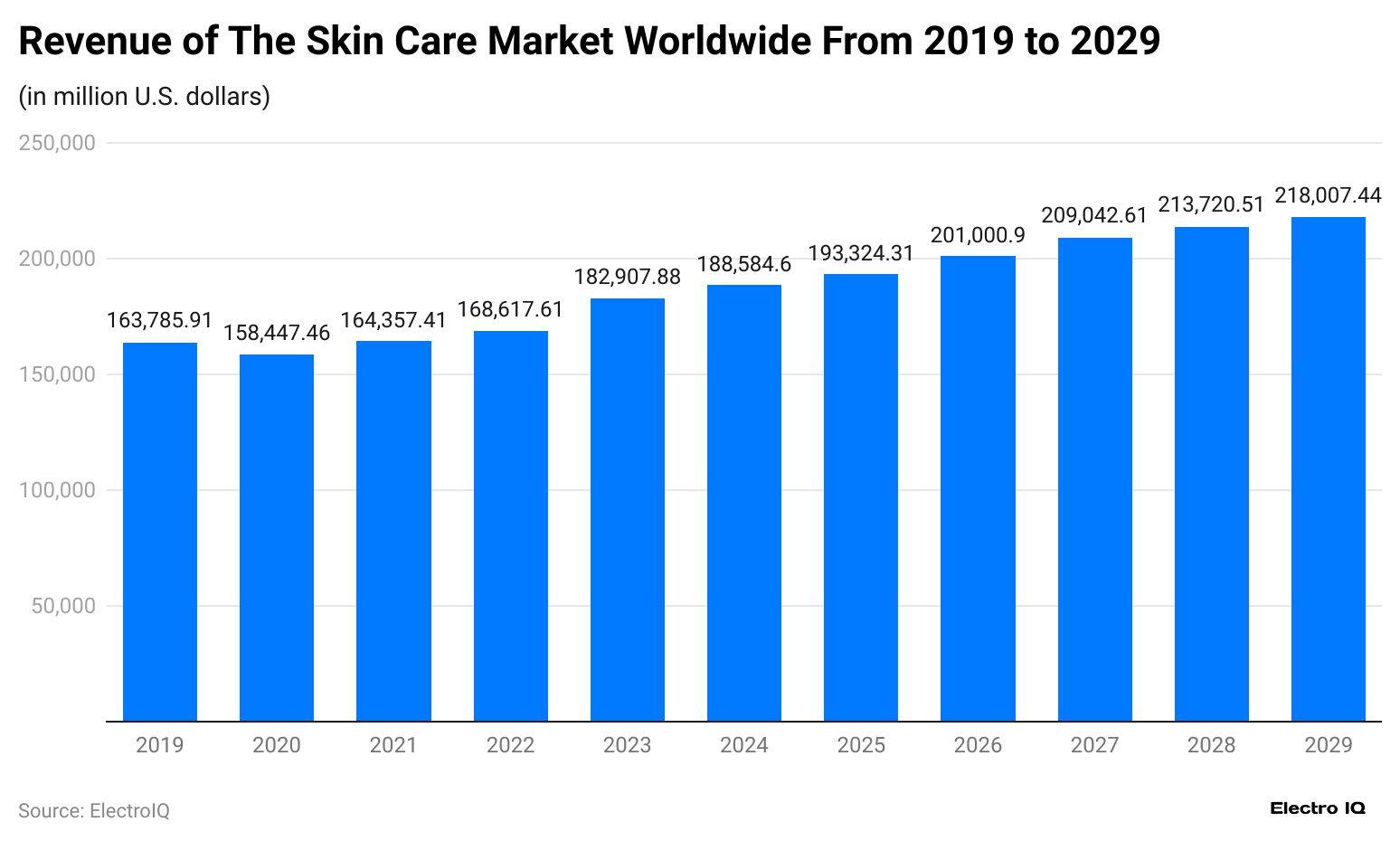

This industry is characterized by evolving trends and innovations, with skincare emerging as a dominant segment. In 2023, skincare held a market share of 40 percent and is expected to generate approximately 218 billion United States dollars in revenue by 2029. Trends such as “skinification” highlight the growing consumer interest in multifunctional products that combine skincare benefits with personal care and makeup.

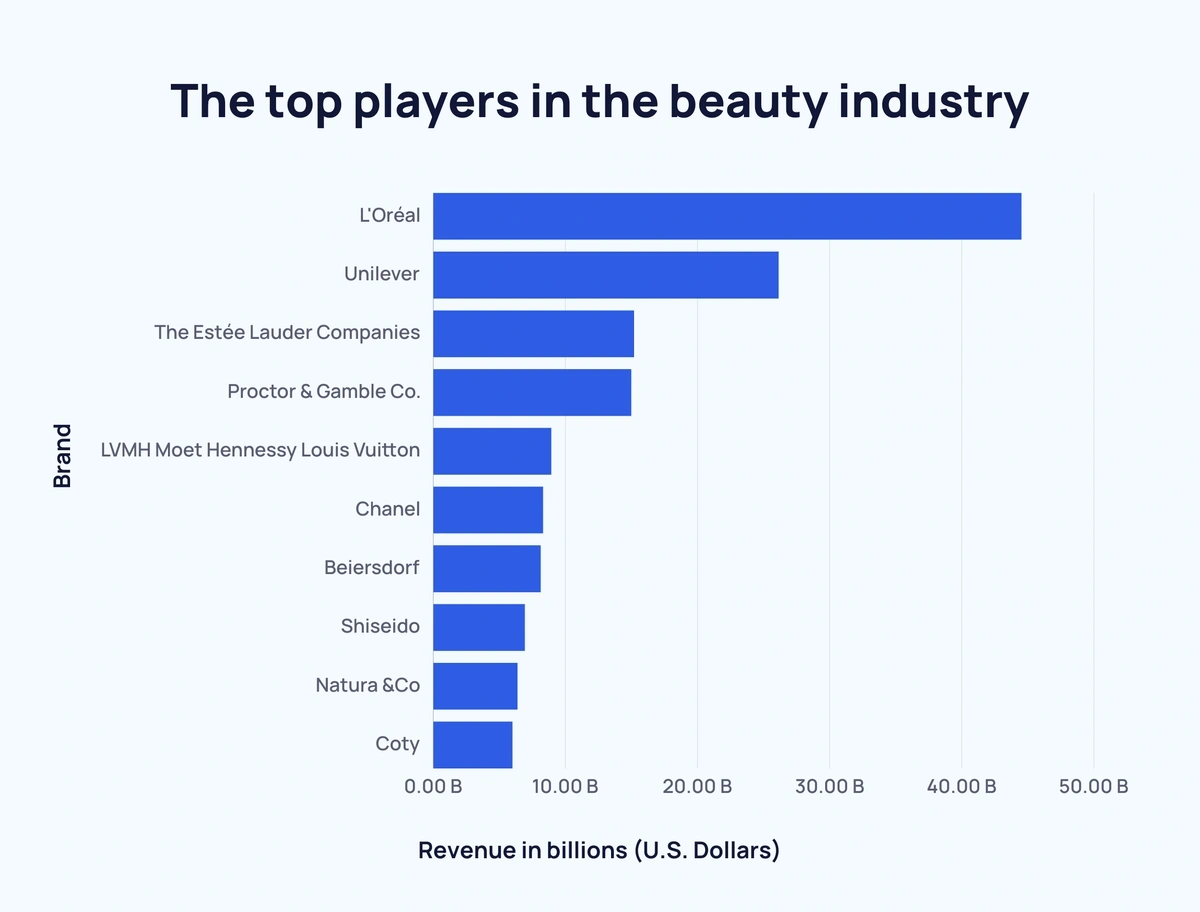

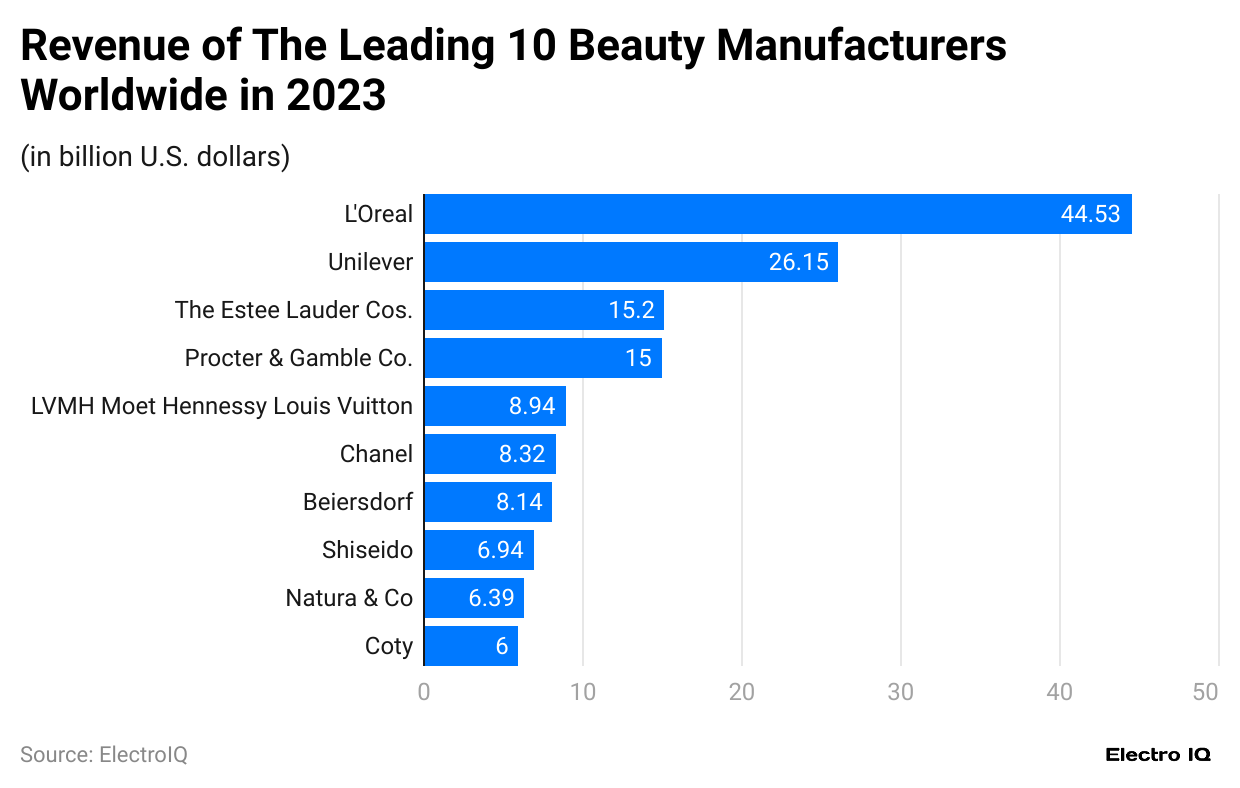

Major multinational corporations lead cosmetics production, including L’Oréal, Unilever, Procter & Gamble, The Estée Lauder Companies, Shiseido, and Beiersdorf. In 2023, L’Oréal became the top beauty manufacturer, with revenues exceeding 44 billion United States dollars. The company’s flagship brand, L’Oréal Paris, was valued at nearly 40 billion United States dollars in 2024.

Social media platforms like Instagram and YouTube have greatly influenced the cosmetics industry, driving demand and connecting brands with consumers. These platforms, along with advancements in beauty technology such as try-on apps and personalized skincare solutions, are expected to play a crucial role in shaping the future of the cosmetics industry. Additionally, the integration of social commerce further solidifies the industry’s position in the retail market.

Editor’s Choice

- The global cosmetics industry is expected to reach USD 132.35 billion by 2029, with a growth rate of 2.68%.

- Skincare is projected to generate up to USD 177 billion by 2025 and USD 218 billion by 2029.

- The men’s personal care market is forecasted to reach USD 276.9 billion by 2030.

- The beauty industry generates over USD 100 billion in global revenue annually.

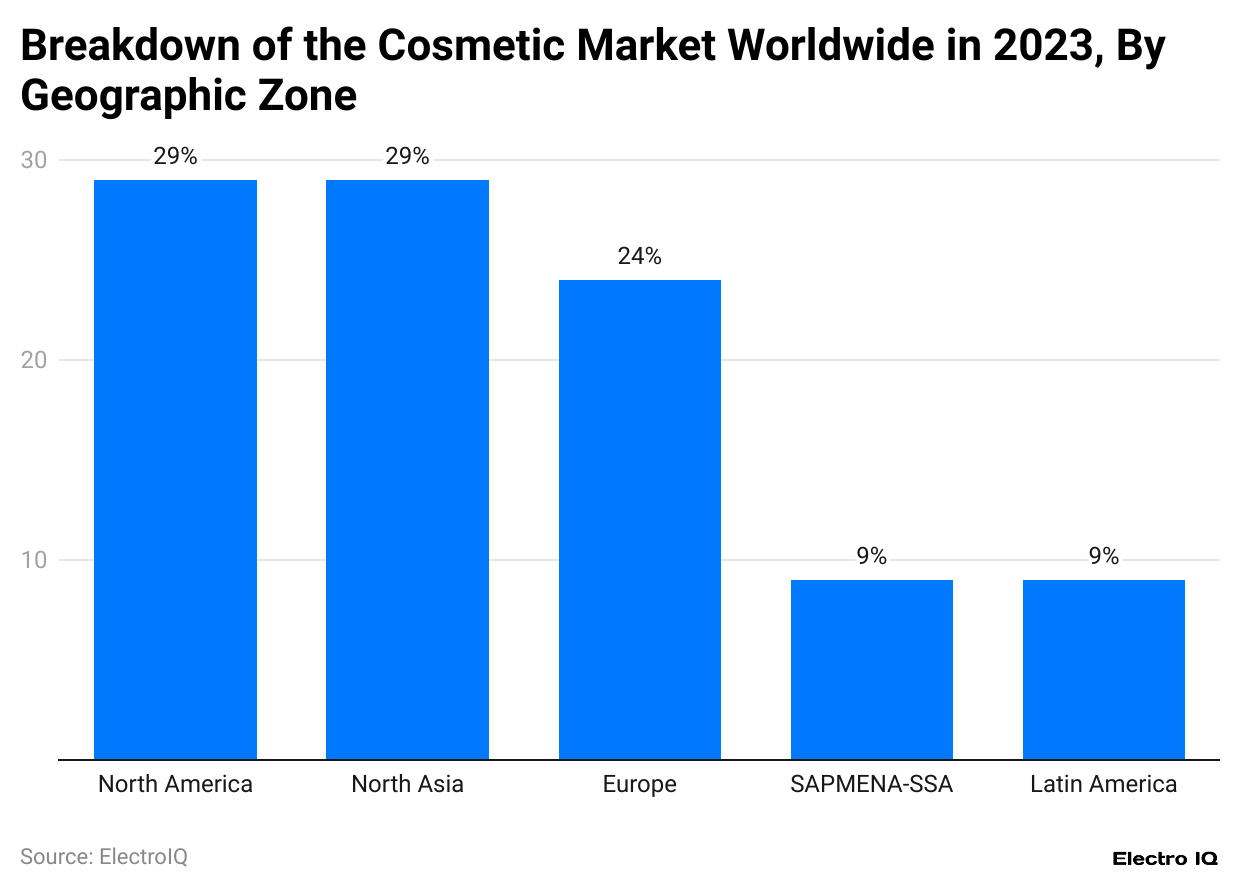

- North America and North Asia lead the market with a 29% share each.

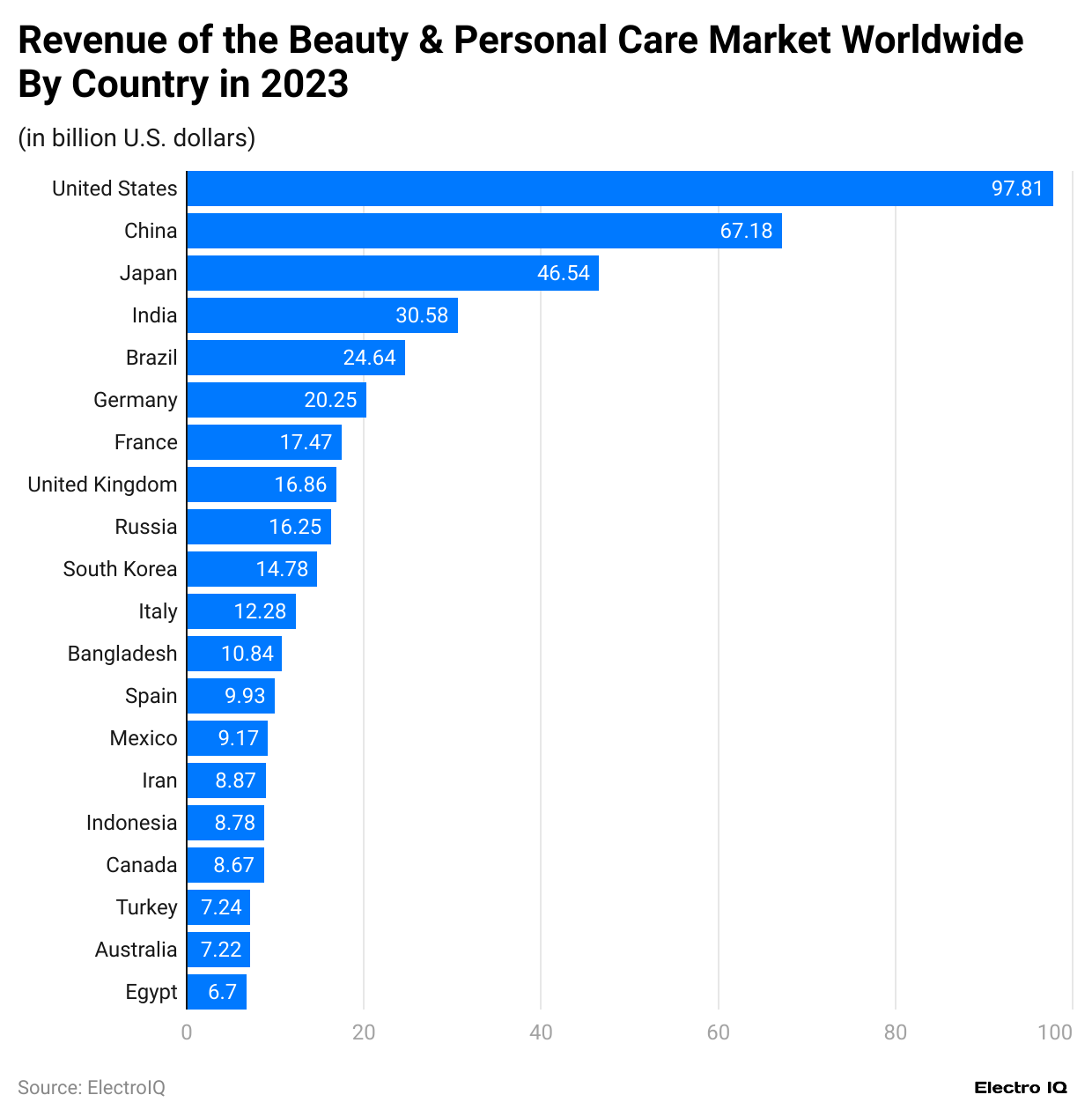

- The United States beauty market generated USD 97.81 billion in revenue.

- L’Oréal leads beauty manufacturers with revenues of USD 44.53 billion.

- The top 10 beauty manufacturers collectively generate over USD 140 billion in revenue.

- Rare Beauty ranked as the most Googled beauty brand in 2023, with Fenty Beauty ranking second.

- Kylie Cosmetics has 25.8 million Instagram followers.

- Approximately 45% of consumers prioritize 100% natural and cruelty-free products.

- Sustainability has become a crucial consideration for beauty consumers.

- The online beauty channel in the United States grew by 5.6% in 2020, with e-commerce penetration expected to reach 48% by 2023.

- Cosmetic retailers reported USD 17.09 billion in online sales.

- Beauty companies spent an estimated USD 7.7 billion on advertising in 2022, with digital advertising accounting for 34.1% of total ad spend.

- The face segment generated USD 31.14 billion in revenue.

- Prestige cosmetics are expected to achieve per capita revenue of USD 3.59 by 2029.

- Korean beauty products continue to gain global popularity.

- Despite the rise in online purchasing, 46% of consumers still prefer to see beauty products in-person before buying.

Beauty Industry Statistics

- The beauty industry generates over USD 100 billion in global revenue annually.

- It is expected that global beauty industry revenue will surpass USD 120 billion by 2025.

- The COVID-19 pandemic led to an 8% decline in the global cosmetics market in 2020.

- North Asia represents 35% of the global beauty market, making it the largest regional market.

- North America accounts for 26% of the market, while Europe has a share of 22%.

- L’Oréal is the leading beauty company, boasting global sales of USD 44.53 billion, outpacing Unilever’s USD 26.15 billion and Estée Lauder’s USD 15.2 billion.

| Brand | Beauty Sales |

| L’Oréal | USD 44.53 billion |

| Unilever | USD 26.15 billion |

| Estée Lauder | USD 15.2 billion |

| P&G | USD 15 billion |

| LVMH | USD 8.94 billion |

| Chanel | USD 8.32 billion |

| Beiersdorf | USD 8.14 billion |

| Shiseido | USD 6.94 billion |

| Nature & Co | USD 6.39 billion |

| Coty | USD 6 billion |

- Other top beauty manufacturers include P&G (USD 15 billion), LVMH (USD 8.94 billion), Chanel (USD 8.32 billion), Beiersdorf (USD 8.14 billion), Shiseido (USD 6.94 billion), Nature & Co (USD 6.39 billion), and Coty (USD 6 billion).

(Source: Exploding Topics)

- China leads North Asia’s beauty market and significantly contributes to the region’s dominance.

- During the pandemic, 22% of women altered their skincare routines, investing more time and money in skincare products.

- The usage of facial skincare products increased, with 40% of users reporting more frequent use of cleansers, moisturizers, exfoliators, and scrubs.

- On average, women use five skincare products daily, spending about USD 3,756 per year on beauty products and services.

- Men spend an average of USD 2,928 per year on personal care, including haircuts, skincare, and grooming products.

- The men’s personal care market is projected to grow at a compound annual growth rate (CAGR) of 8.6%, reaching USD 276.9 billion by 2030.

- The beauty industry encompasses 15 subcategories within three main segments: personal care and maintenance, personal enhancement, and services.

- Haircuts, makeup, and skincare are the top spending categories for American consumers, averaging USD 85 per month.

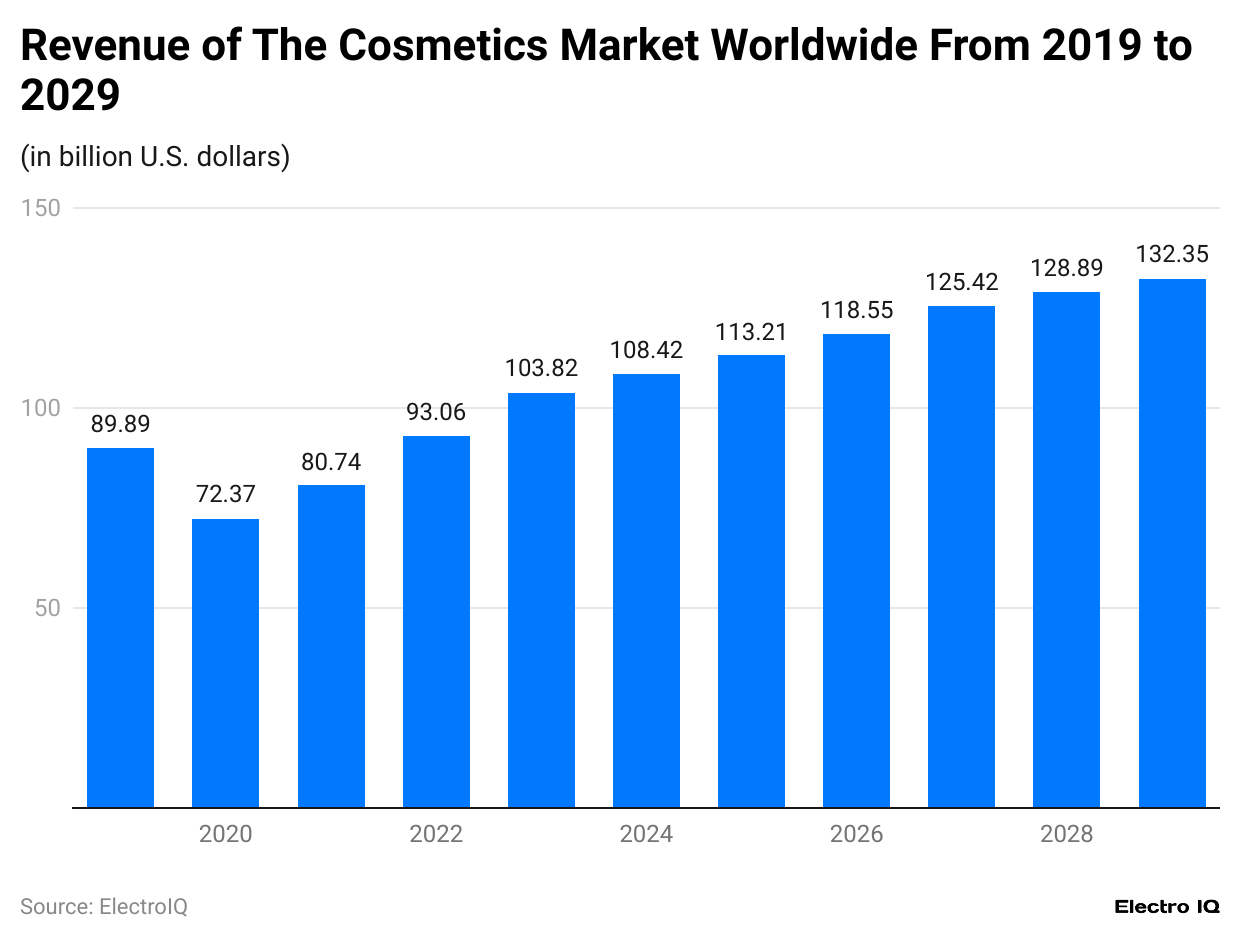

Cosmetic Market Growth

(Reference: statista.com)

- Beauty Industry Statistics show that the industry has grown consistently over time.

- In 2019, the beauty industry’s revenue was 89.89 billion USD.

- By the end of 2023, the cosmetic industry’s revenue increased to 103.82 billion USD.

- The cosmetic industry’s revenue is estimated to be 132.35 billion USD by the end of 2029.

Cosmetic Industry Growth Rate

(Reference: statista.com)

- Beauty Industry Statistics show that the growth rate of the cosmetic industry has been consistently steady over time.

- As of 2020, the cosmetic industry’s growth rate was -19.49%.

- By the end of 2023, the growth rate of the cosmetic industry was 4.42%.

- By the end of 2029, the cosmetic industry’s growth rate is estimated at 2.68%.

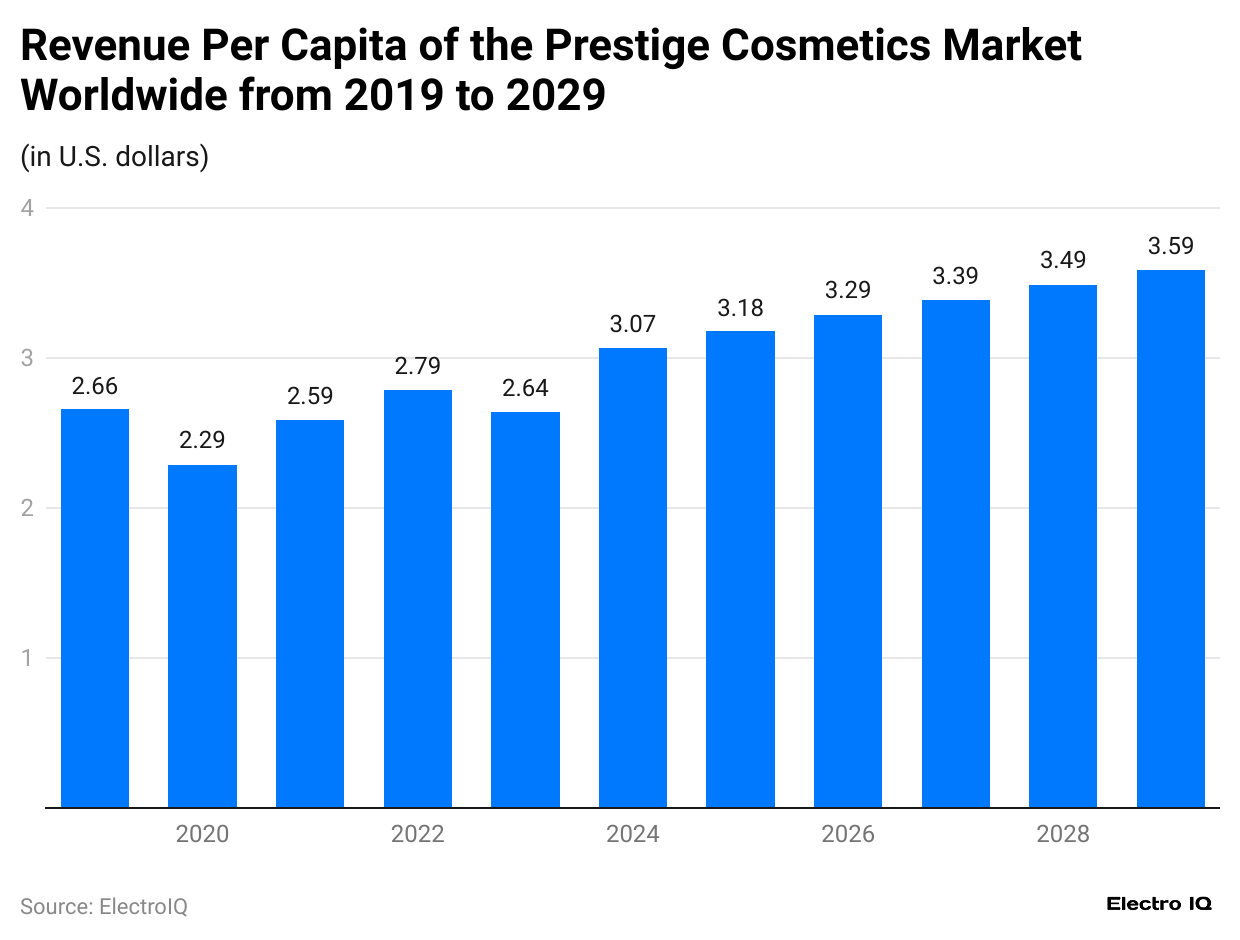

Prestige Cosmetics Revenue Per Capita

(Reference: statista.com)

- Beauty Industry Statistics show that revenue per capita of the prestige cosmetic industry has been consistently increasing over the years.

- In 2019, the prestige cosmetics industry's revenue per capita was 2.66 USD.

- By the end of 2023, the revenue per capita of the cosmetics industry was 2.64 USD.

- It is estimated that by the end of 2029, the prestige cosmetics industry will have a revenue per capita of 3.59 USD.

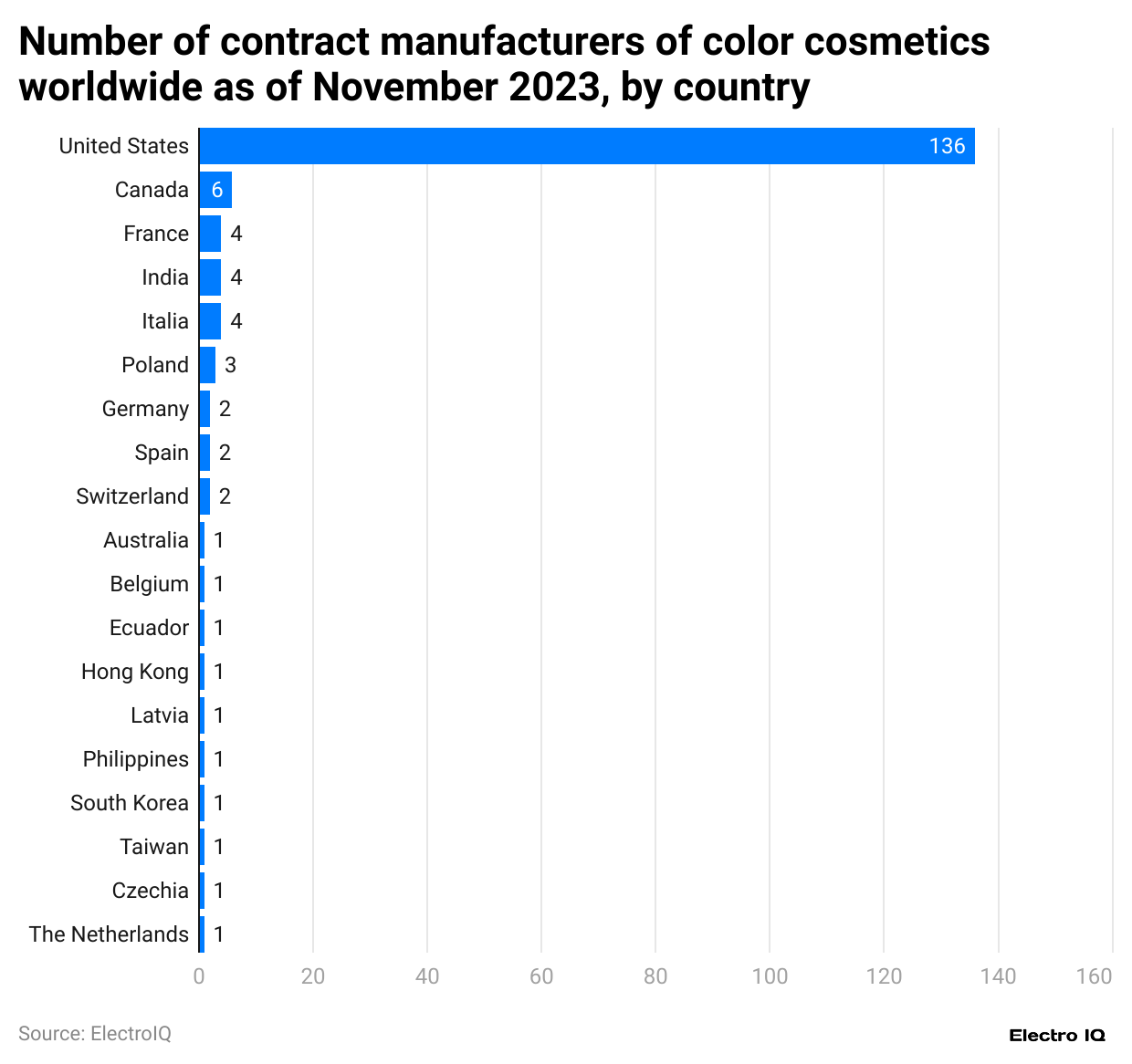

Colour Cosmetic Industry By Country

(Reference: statista.com)

- Beauty Industry Statistics show that the United States has been a leading contract manufacturer with 136.

- Canada has six contact manufacturers of colour cosmetics.

- France has four contact manufacturers of colour cosmetics.

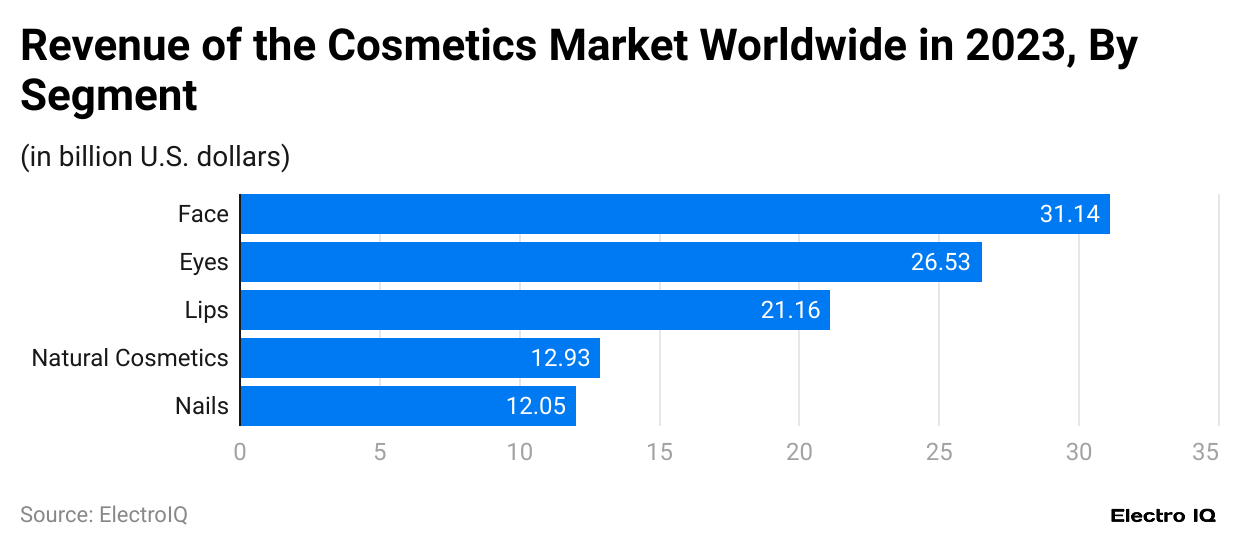

Global Cosmetics Revenue By Segment

(Reference: statista.com)

- Beauty Industry Statistics show that the face segment has 31.14 billion USD.

- The eyes segment has a revenue of 26.53 billion USD.

- The lips segment has a revenue of 21.16 billion USD.

- The natural cosmetics segment has a revenue of 12.93 billion USD.

- The nails segment has a revenue of 12.05 billion USD.

Skincare Industry Growth

(Reference: statista.com)

- Beauty Industry Statistics show that the skincare market has grown consistently.

- In 2019, the skincare market’s revenue was 163.785 million USD.

- As of 2023, the revenue of the skincare market was 182907.88 million USD.

- The revenue of the skincare market is predicted to be 218007.44 million USD by the end of 2029.

Skincare Products Statistics

- The global skincare industry is valued at approximately USD 180.3 billion.

- Skincare accounts for 42% of the market share in the beauty industry, surpassing hair care (22%) and makeup (18%).

- Skincare is projected to generate up to USD 129 billion by 2028.

- The Asia-Pacific region leads the global skincare market, holding over 40% of the market share.

- Estée Lauder reports annual skincare sales of USD 7.4 billion.

- Around 2 in 5 consumers in the United States use cleanser products regularly.

- Over one-third of cleanser users report using products multiple times per day.

Cosmetic Industry Market By Region

(Reference: statista.com)

- Beauty Industry Statistics show that North America and North Asia have the highest market share of the cosmetic market, with 29% each.

- Europe makes up 24% of the cosmetic market.

- The SAPMENA-SSA region makes up 9% of the cosmetic market.

- The Latin American region makes up 9% of the cosmetic market.

Beauty Marketing and Social Media Statistics

- Beauty companies spent an estimated USD 7.7 billion on advertising in 2022, with a 2.2% annual growth rate in advertising expenditure.

- Digital advertising accounts for approximately 33% of the total ad spend in the beauty industry.

- One-third of beauty product buyers engage with brands on social media.

- YouTube is the top source of beauty content for women aged 18-54, with watch times for "makeup transformation" videos doubling annually.

- Around 80% of beauty shoppers use Instagram daily, making it a key platform for brand engagement and loyalty building.

- Approximately 67% of beauty shoppers rely on influencers to discover new products.

- Influencer marketing is highly impactful, with 42% of consumers stating they would purchase a product promoted by an influencer, while 43% remain unsure.

- The average cost-per-click (CPC) for beauty and personal care ads is USD 1.68.

- Kylie Cosmetics is the most-followed beauty brand on Instagram, with over 25 million followers, while Kylie Jenner's personal account exceeds 300 million followers.

- Influencer Susan Yara's cosmetics brand, Naturium, receives over 110,000 monthly searches, reflecting an 8,600% increase over five years.

- Videos showcasing sustainable and eco-friendly products are increasingly popular, aligning with growing consumer interest in sustainability.

- Marketing emails achieve an 11.5% open rate in the beauty industry.

- Influencers like Nikkie de Jager, with 14 million YouTube subscribers, and Huda Kattan, with over 50 million Instagram followers, demonstrate the significant reach of social media influencers in the beauty market.

Beauty eCommerce and Technology Statistics

- eCommerce sales for health and beauty products are projected to grow by 77% between 2021 and 2026.

- By 2026, beauty eCommerce sales are expected to reach USD 358.4 billion.

- Before the pandemic, 85% of beauty products were purchased in-store, highlighting the industry's reliance on physical retail spaces.

- Despite the rise of online shopping, 46% of consumers still prefer to see beauty products in person before making a purchase.

- Approximately 18% of shoppers seek guidance from in-store professionals, which brands are replicating online through virtual consultations and tools.

- Cosmetic retailers currently generate USD 17.09 billion in online sales.

Consumers who receive personalized recommendations are 75% more likely to make a purchase, with 78% willing to pay more for a personalized shopping experience. - Hosting product reviews on company websites makes 74% of consumers more likely to make a purchase, with social proof being a significant driver of consumer loyalty.

- Around 60% of consumers prefer brands that feature user-generated content, such as photos and videos, on their websites.

- Interactive quizzes are offered by 65% of beauty retailers to help customers select products, increasing user engagement and satisfaction.

- Six percent of consumers use augmented or virtual reality tools when purchasing cosmetics, offering an alternative to in-store trials.

- Virtual tools like augmented reality try-ons and color-picker apps have been adopted by brands to simulate an in-store experience online, enhancing customer satisfaction.

Beauty and Personal Care Market Revenue By Region

(Reference: statista.com)

- United States: The beauty and personal care market generated USD 97.81 billion in revenue.

- China: The market revenue was USD 67.18 billion.

- Japan: The beauty and personal care market revenue was USD 46.54 billion.

- India: The market revenue reached USD 30.58 billion.

- Brazil: The beauty and personal care market revenue stood at USD 24.64 billion.

- Germany: The market generated USD 20.25 billion in revenue.

- France: The beauty and personal care market revenue was USD 17.47 billion.

- United Kingdom: The market revenue reached USD 16.86 billion.

- Russia: The beauty and personal care market revenue was USD 16.25 billion.

- South Korea: The market generated USD 14.78 billion in revenue.

- Italy: The beauty and personal care market revenue stood at USD 12.28 billion.

- Bangladesh: The market revenue reached USD 10.84 billion.

- Spain: The beauty and personal care market revenue was USD 9.93 billion.

- Mexico: The market generated USD 9.17 billion in revenue.

- Iran: The beauty and personal care market revenue stood at USD 8.87 billion.

- Indonesia: The market revenue reached USD 8.78 billion.

- Canada: The beauty and personal care market revenue was USD 8.67 billion.

- Turkey: The market revenue stood at USD 7.24 billion.

- Australia: The beauty and personal care market generated USD 7.22 billion in revenue.

- Egypt: The market revenue reached USD 6.7 billion.

Top Beauty Manufacturers Worldwide

(Reference: statista.com)

- Beauty Industry Statistics show that L’Oreal has the highest revenue, with 44.53 billion USD.

- Unilever posted a revenue of 26.15 billion USD.

- The Estée Lauder Cos. posted a revenue of 15.2 billion USD.

- Procter & Gamble Co. posted a revenue of 15 billion USD.

- LVMH Moet Hennessy Louis Vuitton posted a revenue of 8.94 billion USD.

- Chanel posted a revenue of 8.32 billion USD.

- Beiersdorf posted a revenue of 8.14 billion USD.

- Shiseido posted a revenue of 6.94 billion USD.

- Natura &Co posted a revenue of 6.39 billion USD.

- Coty posted a revenue of 6 billion USD.

Personal Care Company Brand Value

(Reference: statista.com)

- Beauty Industry Statistics show that L’Oreal Paris has the highest brand value among personal healthcare brands, with 39510 million USD.

- Lancome posted a revenue of 17,741 million USD.

- Colgate (Colgate-Palmolive) posted a revenue of 17,483 million USD.

- Pampers (Procter & Gamble) posted a revenue of 17,348 million USD.

- Gillette (Procter & Gamble Co.) posted a revenue of 15,021 million USD.

- Garnier (L'Oréal) posted a revenue of 11,031 million USD.

- Estée Lauder posted a revenue of 8,002 million USD.

- Nivea (Beiersdorf) posted a revenue of 7,267 million USD.

- Clinique (Estée Lauder) posted a revenue of 6,655 million USD.

- Dove (Unilever) posted a revenue of 6,477 million USD.

- Maybelline (L'Oréal) posted a revenue of 6,466 million USD.

- Huggies (Kimberly-Clark) posted a revenue of 6,009 million USD.

- Pantene Pro-V (Procter & Gamble) posted a revenue of 5,537 million USD.

- Olay (Procter & Gamble) posted a revenue of 4,927 million USD.

- Bath & Body Works posted a revenue of 4,885 million USD.

Korean Beauty Product Popularity Growth

(Reference: statista.com)

- Beauty Industry Statistics show that Korean Beaty products are widely popular, according to 26.1% of respondents.

- 6% of respondents feel Korean beauty products are popular, along with related goods that are promoted.

- 1% of respondents believe beauty products are popular among the general public, indicating widespread appeal.

- 8% of respondents feel beauty products are popular among some enthusiasts, showing moderate interest.

- 3% of respondents think beauty products have only a few fans, suggesting limited popularity.

Essential Criteria For Sustainable Beauty Products

(Reference: statista.com)

- 45% of respondents prioritize beauty products that are 100% natural and not animal tested.

- 39% of respondents emphasize the importance of avoiding environmentally harmful ingredients in beauty products.

- 31% of respondents consider non-polluting manufacturing processes crucial for sustainability.

- 26% of respondents highlight fair treatment of workers by the brand as a significant sustainability factor.

- 25% of respondents value products made locally or within the country as an important sustainability criterion.

- 23% of respondents consider recyclable packaging a key feature of sustainable beauty products.

- 23% of respondents emphasize the importance of organic beauty products for sustainability.

- 21% of respondents find the use of recycled packaging an essential characteristic of sustainable products.

- 21% of respondents believe that being made by a socially responsible brand is important for sustainability.

- 16% of respondents prioritize products made by inclusive brands as a key sustainability feature.

- 14% of respondents emphasize the significance of plastic-free packaging in sustainable beauty products.

Most Googled Beauty Brands

(Reference: statista.com)

- Beauty Industry Statistics show that Rare Beauty from Selena Gomez is the most popular Google beauty brand in 2023, with 7,708,000 Google searches.

- In 2023, Fenty Beauty from Rihana had 7,142,000 Google searches.

- 2023 Florence by Mills from Millie Bobby Brown had 4,334,000 Google searches.

- In 2023, Kylie Cosmetics from Kylie Jenner had 4,007,000 Google searches.

- In 2023, Goop from Gwyneth Paltrow had 2,782,000 Google searches.

Beauty Brand By Instagram Followers

(Reference: statista.com)

- Kylie Cosmetics by Kylie Jenner leads with 25.8 million Instagram followers in 2023.

- Fenty Beauty by Rihanna has 12.1 million Instagram followers in 2023.

- KVD Beauty by Kat Von D has 6.5 million Instagram followers in 2023.

- Jeffree Star Cosmetics by Jeffree Star has 6.2 million Instagram followers in 2023.

- Kylie Skin by Kylie Jenner has 5.8 million Instagram followers in 2023.

- SKKN by Kim Kardashian has 5.6 million Instagram followers in 2023.

- Rare Beauty by Selena Gomez has 4.4 million Instagram followers in 2023.

- Florence by Mills by Millie Bobby Brown has 3.4 million Instagram followers in 2023.

- Goop by Gwyneth Paltrow has 1.7 million Instagram followers in 2023.

- e.m. Beauty by Ariana Grande has 1.6 million Instagram followers in 2023.

Top Beauty Companies

- Coppertone (sunscreen)

- Lime Crime

- Tati Beauty

- Jaclyn Hill Cosmetics

- SK-II

- Anastasia Beverly Hills

- Sea & Ski

- Rare Beauty

- Dermacol

- Yves Saint Laurent (fashion house)

- Avon Products

- Glossier

- Sol de Janeiro

- Tarte Cosmetics

- Cover FX

- Jo Malone London

- Good Glamm Group

- Haus Labs

- Morphe Cosmetics

- Fabergé (cosmetics)

- Chanel

- Charlotte Tilbury Beauty

- Glow & Lovely

- Lunar Beauty

- Clarins

- Pedro del Hierro (brand)

- ColourPop Cosmetics

- Neutrogena

- Forest Essentials

- 7 (brand)

- Mane 'n Tail

- Benefit Cosmetics

- Tropez (self-tan brand)

- Inglot Cosmetics

- Bobbi Brown

- Sa Sa International Holdings

- Beautycounter

- Rimmel

- Eisenberg Paris

- MAC Cosmetics

- BITE Beauty

- NK

- DHC Corporation

- Fenty Beauty

- L'Oréal

- IsaDora cosmetics

- Halo Beauty

- Parachute (brand)

- Pechoin

- Surya Brasil

- Soap & Glory

- Fourth Ray Beauty

- Imedeen

- Laura Mercier Cosmetics

- Lime Crime

- Rare Beauty

- Trixie Cosmetics

- Holo Taco

- Angellift

- Simple Skincare

- OPI Products

- O Boticário

- Madara Cosmetics

- Revlon

- Huda Beauty

- Origins (cosmetics)

- Shiseido

- Charlotte Tilbury Beauty

- Bondi Sands

- Tropic Skincare

- Dm-drogerie markt

- Valmor Products

- Madara Cosmetics

- Trixie Cosmetics

- Lime Crime

- Aquanet

- Fabergé (cosmetics)

- Lunar Beauty

- Rare Beauty

- NARS Cosmetics

- Boots (company)

- Florence by Mills

- Uoma Beauty

- Bayankala (skincare)

- Tropic Skincare

- Fenty Beauty

- Hada Labo

- Avon Products

- Bobbi Brown

- Princess Pat (brand)

- Yves Saint Laurent (fashion house)

- Tropez (self-tan brand)

- Tati Beauty

- Jeffree Star Cosmetics

- Clarins

- Soap & Glory

- Fabergé (cosmetics)

- Sol Body

- Bain de Soleil

- Pedro del Hierro (brand)

- Sea & Ski

(Source: wikipedia.org)

Conclusion

The beauty and personal care industry demonstrates remarkable resilience and adaptability, characterised by consistent growth, technological innovation, and increasing consumer consciousness. The Beauty Industry Statistics show that as market dynamics evolve, sustainability, digital engagement, and personalisation emerge as critical drivers of future success.

Brands prioritising natural ingredients, ethical manufacturing, and authentic digital storytelling are positioned to thrive in this competitive landscape. Consumers increasingly seek products that align with their values, demanding transparency, innovation, and social responsibility from beauty brands holistically.

Sources

FAQ.

The cosmetic industry is projected to reach $132.35 billion in revenue by 2029.

The United States leads with $97.81 billion in beauty and personal care market revenue.

Skincare and natural cosmetics are experiencing the most significant growth.

45% of consumers prioritise natural, cruelty-free products with environmentally responsible practices.

Rare Beauty, Fenty Beauty, and Kylie Cosmetics lead in Google searches and Instagram followers.

Europe comprises 24% of the global cosmetic market.

The United States leads with 136 contract manufacturers.

Face ($31.14B), eyes ($26.53B), and lips ($21.16B) segments lead revenue generation.

Over 26% of respondents consider Korean beauty products widely popular.

Being 100% natural, not animal-tested, and avoiding environmentally harmful ingredients top the list.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.