Cypress Statistics By Operating Income, Revenue, Assets And Expenditure

Updated · Sep 18, 2024

Table of Contents

- Introduction

- Editor’s Choice

- Revenue Of Cypress Semiconductor

- Cypress Total Assets

- Revenue Of Cypress Semiconductor By Region

- Cypress Semiconductor Corporation’s Revenue

- Cypress Global’s Operating Income

- Revenue Of Cypress Semiconductor Corporation

- Cypress Semiconductor’s Global Revenue

- Revenue Of Infineon

- Number Of Infineon Workers

- Revenue Of Infineon Worldwide

- Revenue Of Infineon By Region

- Infineon Operating Income Worldwide

- Infineon Research And Development Expenditure

- Market Share Of Automotive Sensors Worldwide

- Automotive Semiconductor Market Share

- Revenue Of The MOSFET Semiconductor

- Global Automotive MCU Market Share

- Semiconductor Company Market Share

- Cypress Semiconductor Company Overview

- Conclusion

Introduction

Cypress Statistics: Cypress Semiconductor Company is an American multinational company that provides various flash memories, RAM devices, and microcontrollers. It is headquartered in San Jose, California, and aspires to become a leading force in the semiconductor industry. Reviewing Cypress Statistics is essential to having a holistic overview of the organization and learning how effective the company is in becoming a top name in the industry. Join us as we review the company information comprehensively.

Editor’s Choice

- Cypress’s revenue peaked at USD 2,483.84 million in 2018 before acquisition.

- Infineon’s revenue reached 16,309 million euros in 2023 post-Cypress acquisition.

- Cypress’s most significant markets were China, Taiwan, and Hong Kong, generating USD 829.52 million in 2019.

- Infineon’s employee count hit a record 50,288 in 2021 after acquiring Cypress.

- Infineon’s automotive segment revenue soared to 8,242 million euros in 2023.

- R&D expenditure by Infineon increased to 1,985 million euros in 2023.

- Infineon holds a 15.5% market share in automotive sensors as of 2023.

- The global automotive microcontroller market will reach USD 15.7 billion by 2028.

- Infineon’s net income grew to 3,137 million euros in 2023.

- China remains Infineon’s largest market, contributing 4,124 million euros in revenue in 2023.

- Infineon held a 12.7% market share in automotive semiconductors in 2021.

- The MOSFET semiconductor market saw Infineon with a 24.4% share in 2020.

- Cypress’s operating income recovered from -$608.74 million in 2016 to USD 123.26 million in 2019.

- Infineon’s market share in standard power MOSFET peaked at 27.7% in 2018.

- Intel leads the overall semiconductor market with a 9.1% share in 2023.

Revenue Of Cypress Semiconductor

![]() (Reference: Statista.com)

(Reference: Statista.com)

- The Cypress statistics showcase that between the period (2015 -2019), the highest revenue was $2,483.84 million in 2018.

- In 2019, the revenue was $2,205.31 million.

- In 2020, Infineon conducted an acquisition of Cypress in 2020 for $9.78 billion.

Cypress Total Assets

![]()

(Reference: Statista.com)

- Cypress statistics showcase that in 2015, the company’s total asset value was $ 4,004.26 million.

- By the end of 2019, Cypress SemiConductor’s asset value was $3,556.11 million.

- With the acquisition of Cypress in 2019 by Infineon in 2020, the total assets of Cypress post-2019 included Infineon’s financials.

Revenue Of Cypress Semiconductor By Region

![]()

(Reference: Statista.com)

- The cypress statistics show that China, Taiwan, and Hong Kong consistently have the highest market share worldwide.

- As of 2019, revenue in China, Japan, and Hong Kong was $829.52 million. Japan followed this with $574.79 million, Europe with $293.65 million, the Rest of the world with $294.54 million, and the United States with $212.81 million.

Cypress Semiconductor Corporation’s Revenue

![]()

(Reference: Statista.com)

- The Cypress statistics showcase that between the period (2015 to 2019), the company had a record-breaking net loss of $683.88 million in 2016.

- In 2018, the company showed good signs of recovery with $354.83 million in revenue; however, in the following year, the net profit significantly reduced to $40.41 million.

- These low-performing finances served as one of the primary reasons why the company was acquired by Infineon in 2020 for $9.78 billion.

Cypress Global’s Operating Income

![]()

(Reference: Statista.com)

- The Cypress statistics show a gradual increase in Cypress Semiconductor’s operating income.

- In 2016, the operating income was at a record low of $-608.74 million.

- In 2019, the operating income was $123,26 million.

Revenue Of Cypress Semiconductor Corporation

![]()

(Reference: Statista.com)

- The Cypress statistics showcase the semiconductor company’s revenue, which can be divided into three categories: IoT, Automotive, and Legacy.

- In 2017 and 2018, the legacy section of the company contributed the highest revenue, with $823.9 million in 2017 and $827.46 million in 2018.

- In 2019, the company’s automotive section had the highest revenue, with $829.49 million, followed by the IoT section, which had $822.55 million, and then the legacy section, which had $553.28 million.

Cypress Semiconductor’s Global Revenue

![]()

(Reference: Statista.com)

- As showcased in the Cypress statistics, the semiconductor industry’s revenue wing can be divided into two categories: the Microcontroller and connectivity division and the Memory product division.

- Between the period (2015 – 2018), the microcontroller product division had a comparatively higher share of revenue, the highest being in 2018 at $1474.44 million.

- In 2019, the microcontroller division’s revenue was $1476.66 million, compared to $728.66 million for the memory product division.

Revenue Of Infineon

(Reference: Statista.com)

- As revealed previously, Infineon acquired Cypress in 2020; hence, it would be interesting to see how the company has fared since then.

- Cypress statistics reveal that the company’s revenue has been increasing consistently since 2020, reaching 16,309 million euros in 2023.

- This statistical data showcases how valuable Cypress Semiconductor is.

Number Of Infineon Workers

(Reference: Statista.com)

- Since it acquired Cypress, it has been natural for the number of Infineon employees to increase adequately.

- Cypress statistics showcase that in 2021, the number of employees of Infineon was 50,288, which is a record high, showcasing the rise in popularity of Infineon as a company and how Cypress has made a valuable contribution to it.

Revenue Of Infineon Worldwide

(Reference: Statista.com)

- As showcased in Cypress statistics, its acquisition has drastically changed the company’s respective revenue segments.

- In 2020, the company’s automotive component generated 3,542 million euros, with power and sensor systems coming second with 2650 euros in revenue.

- This trend continued as in 2023, the revenue in the automotive sector was 8,242 euros, and power and sensor systems had 3,798 million euros as revenue.

Revenue Of Infineon By Region

(Reference: Statista.com)

- After Infineon acquired Cypress, the overall category revenue in terms of regions remained consistent compared to pre-acquisition.

- The Cypress statistics showcase that in 2021, Infineon’s revenue was highest in China, at 1,744 euros, followed by the EMEA region, at 1,495 million Euros.

- As of 2023, China remains the region with the highest revenue, with 4,124 million Euros.

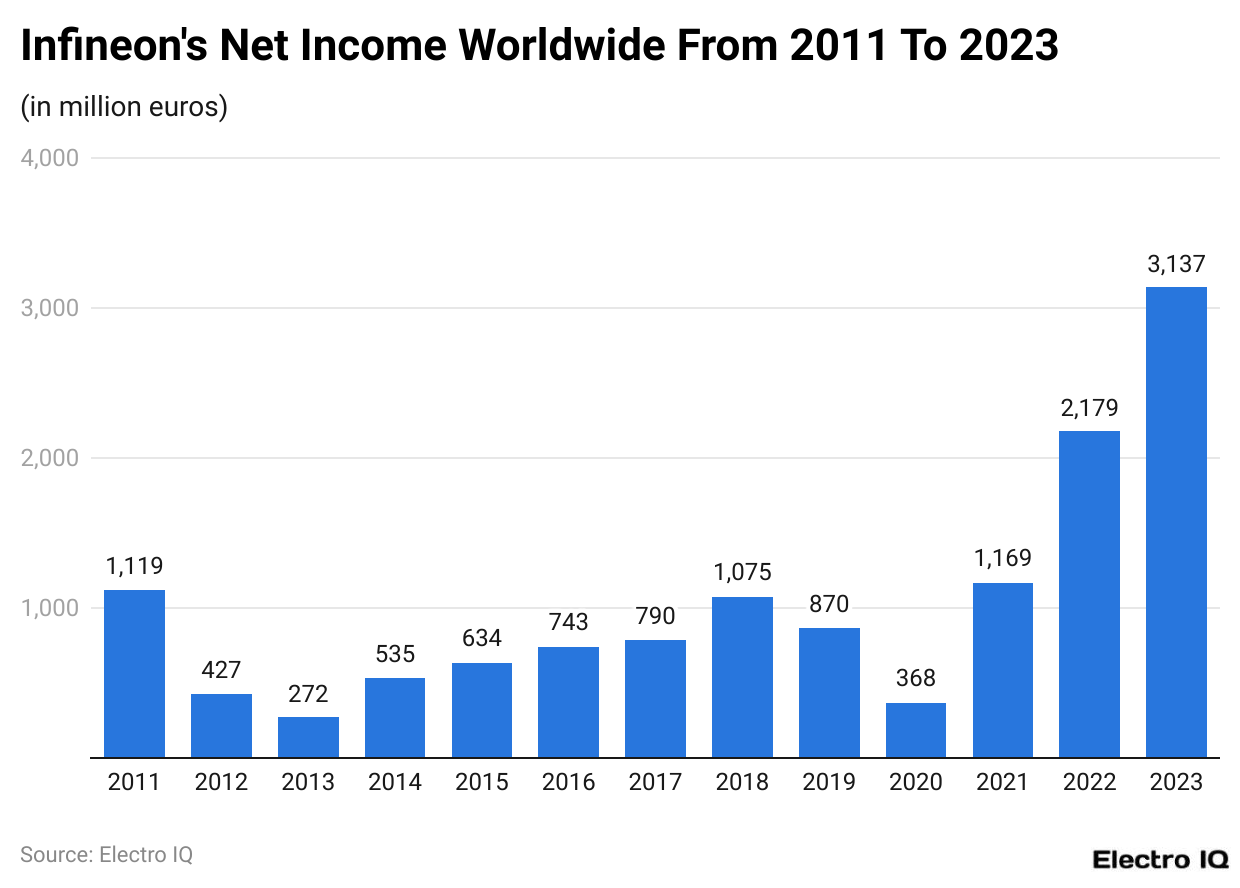

Infineon Operating Income Worldwide

(Reference: Statista.com)

- Since the acquisition of Cypress by Infineon in 2020, the company’s net income has increased significantly.

- In 2021, Infineon’s operating income was 1,169 million Euros.

- Cypress statistics reveal that by the end of 2023, Infineon’s net income was 3,137 million euros.

Infineon Research And Development Expenditure

(Reference: Statista.com)

- Going through the Cypress statistics, one can witness that since the acquisition of Cypress by Infineon, the company’s expenditure on research and development has been increasing consistently.

- In 2021, the company’s investment in research and development was 1,448 million euros.

- Since then, the company has witnessed significant growth in its expenditure on research and development, which reached 1,985 Million Euros by the end of 2023.

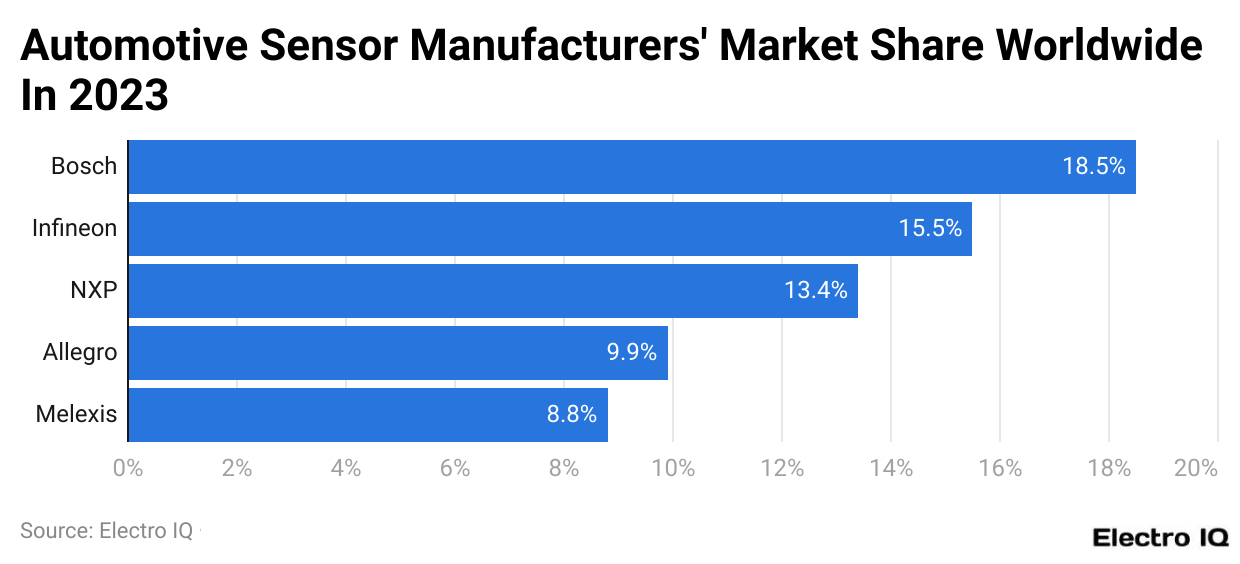

(Reference: Statista.com)

- As showcased in the Cypress statistics, Infineon’s acquisition of Cypress significantly contributed to the company’s becoming one of the largest manufacturers in the automotive sensor market in terms of market share.

- As of 2023, Bosch has the highest market share, with 18.5%.

- Infineon follows it with 15.5%, NXP with 13.4%, Allegro with 9.9%, and Melexis with 8.8% market share.

![]()

(Reference: Statista.com)

- Cypress statistics showcase that the company Infineon, which acquired Cypress, is a leader in the automotive semiconductor market.

- In 2020, Infineon had a 13.2% market share.

- By 2021, Infineon’s market share was 12.7%, making it consistently a market leader in this segment.

- NXP is Infineon’s closest competitor in the segment, with a 10.9% market share in 2020 and an 11.8% share in 2021.

Revenue Of The MOSFET Semiconductor

![]()

- The MOSFET is an essential transistor component of the semiconductor industry.

- The Cypress statistics showcase that Infineon has the highest market share in the period (2014 – 2020), with the highest being 27.7% in 2018.

- In 2020, the acquisition of Cypress Infineon had a market share of 24.4%.

(Reference: Statista.com)

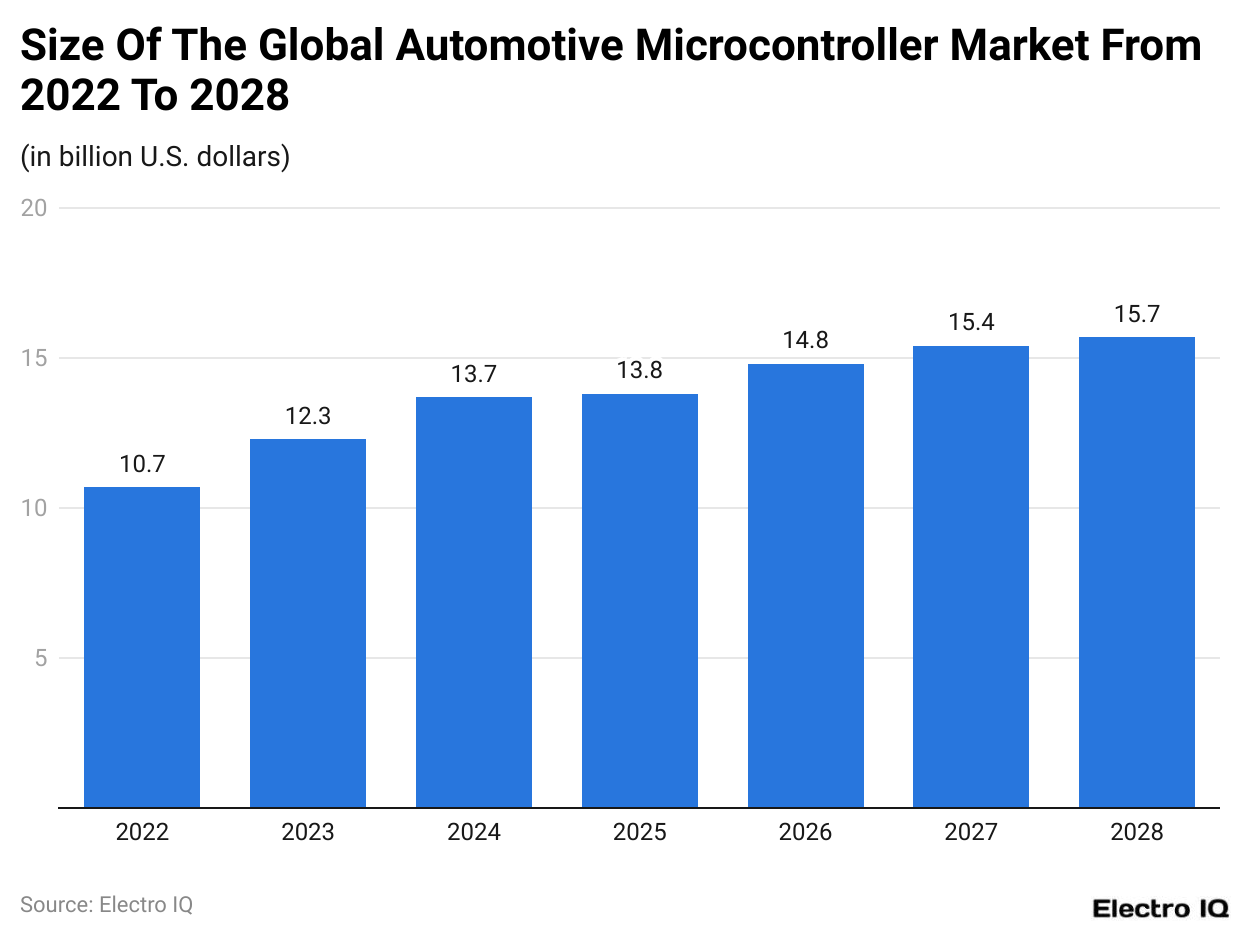

- The Cypress statistics showcase that the semi-conductor market size is growing significantly.

- In 2023, the semiconductor market size was $12.3 billion.

- It is predicted that the global microcontroller market size will be $15.7 billion by the end of 2028.

(Reference: Statista.com)

- The Cypress statistics showcase that in 2023, Intel has the highest market share of 9.1%.

- Samsung Electronics follows it with a 7.5% market share, Qualcomm with a 5.4% market share, Broadcom with 4.8% market share, Nvidia with 4.5% market share, SK Hynix with 4.3% market share, AMD with 4.2% market share, STMicroelectronics with 3.2% market share, Apple with 3.2% market share, Texas Instruments with 3.1% market share, Others with 50.7% market share.

Cypress Semiconductor Company Overview

Cypress, a popular tool for automated testing of web applications, has gained significant traction in recent years. As of 2023, Cypress commands a notable portion of the test automation market, especially among companies prioritizing continuous integration and delivery (CI/CD) pipelines. In 2023, the global market size for test automation tools, including Cypress, was estimated to be worth approximately US $15.5 billion, showing a 13% increase from the previous year. Cypress contributed around 8% of this market, highlighting its importance.

Cypress Statistics for 2023 indicate that the adoption rate of the tool continues to rise, especially among mid-sized and large enterprises. In 2023, about 35% of companies involved in web development used Cypress as their primary testing tool. This marks a growth of 5% compared to 2022. By 2024, this figure is projected to increase to 40%, driven by the tool’s ease of use, quick feedback cycle, and efficient debugging features. The tool’s user base grew by 12% in 2023; a similar growth trajectory is expected for 2024.

From a financial standpoint, Cypress saw revenue growth aligned with the rising demand for test automation tools. In 2023, Cypress’s revenue was around US $120 million, representing an increase of 15% compared to 2022. The revenue growth can be attributed to an expanding customer base and premium features that appeal to enterprise clients. By 2024, Cypress is expected to generate US $140 million in revenue, reflecting a year-over-year growth of 17%.

Cypress Statistics for 2023 show the tool has strong adoption in North America, Europe, and Asia-Pacific. In 2023, 45% of Cypress users were based in North America, 30% in Europe, and 15% in Asia-Pacific. North American companies alone contributed to US $55 million of Cypress’s total revenue in 2023. By 2024, growth in Asia-Pacific is expected to increase significantly, with this region contributing up to 20% of the tool’s global user base. Europe is also expected to grow steadily, with user adoption rising 8% in 2024.

Cypress faces intense competition from Selenium, another popular test automation tool. However, Cypress offers a more modern, user-friendly interface and native support for JavaScript frameworks. In 2023, while Selenium held a market share of 35%, Cypress secured 20% of the test automation market. By 2024, Cypress’s share is projected to grow to 22% as more organizations shift from traditional testing tools to more efficient and user-centric solutions like Cypress.

One of Cypress’s key strengths is its active open-source community. In 2023, the Cypress GitHub repository had over 35,000 stars and 1,200 contributors, reflecting the vibrant community behind the tool’s development. This is a 10% increase in contributors from 2022. In 2024, Cypress is expected to gain more community support, with contributions projected to rise by 12%, further driving its innovation and feature updates.

Looking ahead to 2024, the future of Cypress appears bright. With the increasing importance of web development and automation testing, Cypress is well-positioned to maintain its growth momentum. By the end of 2024, the tool will serve over 45% of mid-sized and large companies involved in web application development. Additionally, with its revenue projected to hit US $140 million, Cypress will remain a strong competitor in the test automation market.

Conclusion

Cypress Semiconductor Corporation has emerged as one of the most prominent players in the semiconductor industry. The company’s financial performance between 2015 and 2019 showcased fluctuation, with a peak revenue of $2,483 million in 2018. Since the acquisition of Cypress by Infenion, the company has shown remarkable growth in recent years.

Regionally, China is the largest Infineon market, contributing towards 4,124 million euros in revenue in 2023. The Cypress statistics show that its parent company, Infenion, is expected to remain a significant force in the semiconductor industry.

Sources

FAQ.

Infineon acquired Cypress in 2020 for $9.78 billion.

Cypress’s highest revenue was $2,483.84 million in 2018.

Infineon’s revenue in 2023 is 16,309 million euros.

Infineon’s market share in automotive sensors 2023 was 15.5%.

Infineon spends 1,985 million euros on R&D in 2023.

China, Taiwan, and Hong Kong contributed to Cypress’s revenue with $829.52 million in 2019.

Infineon’s net income is 3,137 million euros in 2023.

The automotive segment has 8,242 million euros.

The projected size of the global automotive microcontroller market is $15.7 billion by 2028.

Intel, Samsung Electronics, Qualcomm, and Broadcom are the main competitors in the semiconductor market.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.