Medical Devices Statistics By Market Share And Revenue

Updated · Aug 28, 2024

Table of Contents

Introduction

Medical Devices Statistics: The medical technology industry, also known as MedTech, focuses on companies that can develop systems for healthcare protection for activities such as patient healing and recovery. Medical devices have played a pivotal role in developing the healthcare industry, from bandaging a minor cut to working with complex chemotherapy sessions.

Likewise, it would be interesting to delve into Medical Devices Statistics to gain a holistic understanding of the marvels of healthcare equipment.

Editor’s Choice

- By 2024, the medical device sector is projected to bring in USD 509.90 billion in sales.

- The largest market category is cardiovascular devices, expected to generate USD 73.42 billion in revenue by 2024.

- In 2024, the US medical device industry is predicted to generate USD 179.80 billion in sales, making it the world’s leading country in this field.

- A compound annual growth rate (CAGR) of 5.71% is anticipated for the medical device industry between 2024 and 2029.

- With almost 20% of the market share, in vitro diagnostics (IVD) led the industry in 2023.

- With a CAGR of 8% from 2023 to 2024, the Asia-Pacific region is the market with the quickest rate of growth.

- The market for medical devices with AI capabilities was estimated to be worth US $5 billion in 2023 and is projected to reach USD 7 billion by 2024.

- The wearable medical device industry is expected to grow to USD 30 billion by 2024.

- In 2023, the combined sales of the top five medical device firms surpassed USD 150 billion.

- In 2023, the FDA authorized more than 350 new medical devices, a marginal rise from the 340 approvals in 2022.

- Based on Medical devices statistics in 2023, digital health solutions held a 15% share of the USD 75 billion medical device industry overall.

- In 2023, the market for sustainable medical equipment was estimated to be worth USD 20 billion, or 4% of the whole market.

History Of Medical Devices

- According to Medical Devices Statistics, the first equipment related to medical sciences can be traced back to 7000 BC in Baluchistan.

- During the 1800s, medical inventions and therapeutic devices paved the way for modern medicines.

- The Federal Food, Drug, and Cosmetic Act of 1930 standardized and regulated medical devices.

- By the end of the 20th century, medical devices such as defibrillators and dialysis medicine became mainstream in hospitals and similar healthcare facilities.

- As of August 2024, more than 2 million medical devices can be categorized into over 7000 groups.

The Medical Device Industry Worldwide

- According to Medical Devices Statistics, the industry is expected to generate an incredible $509.90 billion in revenue by 2024.

- Cardiology Devices are the largest market, with an estimated market volume of US$73.42 billion in the same year.

- The industry is anticipated to increase at a consistent pace of 5.71% per year (CAGR 2024–2029), with a predicted market volume of US$673.10 billion by 2029.

- With an expected revenue creation of US$179.80 billion in 2024, the United States will dominate the world in this regard when considering the global environment.

- Thus, the importance of the medical devices industry is emphasized worldwide. Globally, there is a growing need for medical equipment, with the US and Germany setting the standard for innovation and uptake.

Medical Device Revenue Worldwide

(Reference: Statista.com)

As per Medical Devices Statistics, medical device revenue is thriving significantly, as seen from the graph above.

Total Market Expansion:

- Between 2016 and 2028, the medical device market value increased steadily, from $346.49 billion to an expected $673.16 billion. This illustrates the medical device market’s steady rising trend throughout time.

Trends in Annual Growth:

- 2016–2018: $346.49 billion to $367.78 billion, then $385.77 billion, a moderate increase.

2018–2020: Growth continued, but a little more slowly, rising from $385.77 billion to $402.87 billion in 2018, with a minor decline to $379.86 billion in 2020, presumably due to external causes.

2020–2022: A notable comeback and rise, reaching $449.80 billion in 2022. - Market value is expected to expand rapidly between 2022 and 2028, from $449.80 billion in 2022 to $673.16 billion.

Medical Device Revenue

- Cardiology Devices: This category also exhibits steady growth, attributed to rising awareness of cardiovascular health issues and associated technical developments.

- Diabetes Care Devices: Consistent growth, perhaps due to the increased incidence of diabetes worldwide.

- Orthopedic devices have grown significantly, which is unsurprising given the aging population and orthopedic technological improvements.

- Diagnostic Imaging Devices: A notable increase in market share suggests a greater dependence on sophisticated imaging methods for diagnosis.

- Endoscopic devices: The development of less invasive surgical methods is also fuelling the growth of this industry.

- Dental devices: This is a smaller market but is growing gradually due to improvements in dental care technology.

- Ophthalmic Devices: Steady growth indicates a greater emphasis on eye health.

- Devices for General and Plastic Surgery: Consistent, demonstrating improvements in surgical technology and aesthetic operations.

Prospective Outlooks:

- 2024–2028: The market is anticipated to rise considerably from $478.54 billion in 2024 to $673.16 billion in 2028, indicating more significant investment and innovation in the medical device industry.

- Important Sectors: Cardiology, orthopedics, and diagnostic imaging equipment will probably continue to rise due to continuous developments and increasing demand worldwide.

(Source: Statista.com)

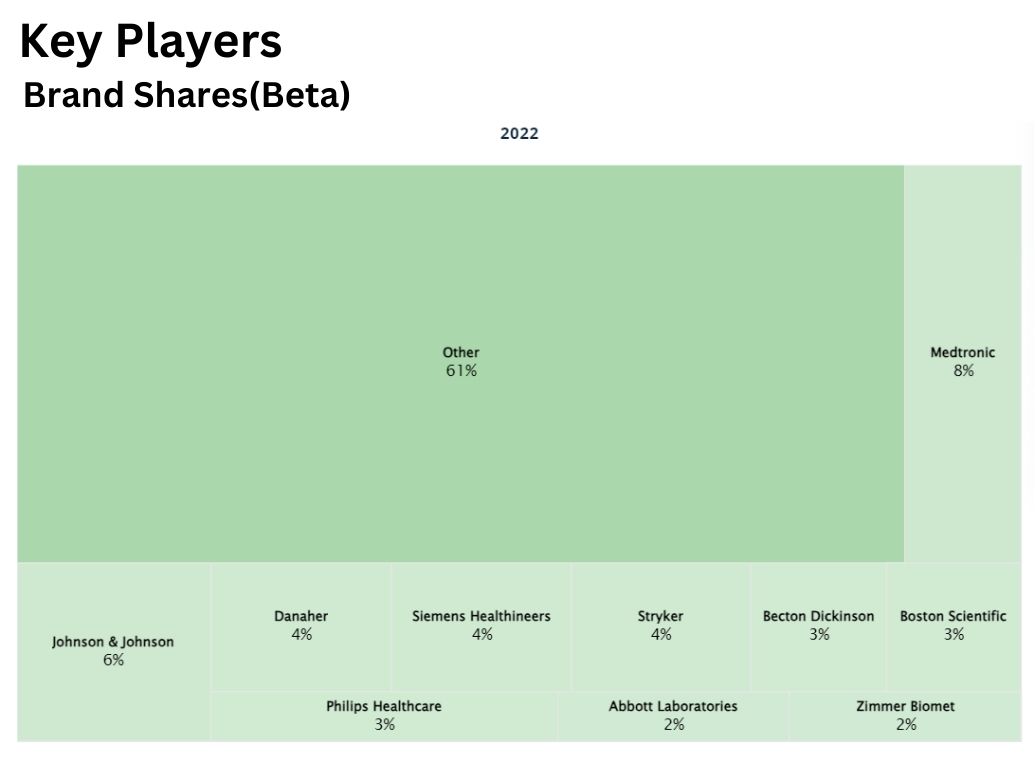

- As per the tree graph based on Medical Devices Statistics, different brands have a significant share of the medical device market.

- Medtronic has the highest share in the worldwide medical industry market with 8%.

- Johnson & Johnson and Danaher have 2nd and 3rd largest market share with 6% and 4%.

- Various other medical brands have a market share of 61%.

Worldwide Revenue Of The Medical Technology Industry

(Reference: Statista.com)

- Referring to Medical Devices Statistics, the revenue in medical technology has witnessed an unprecedented boom.

- In 2007, revenue in the medical device industry was $295 billion.

- By the end of 2024, the medical industry’s worldwide revenue is expected to reach $633 billion.

Revenue Of Medical Device Companies

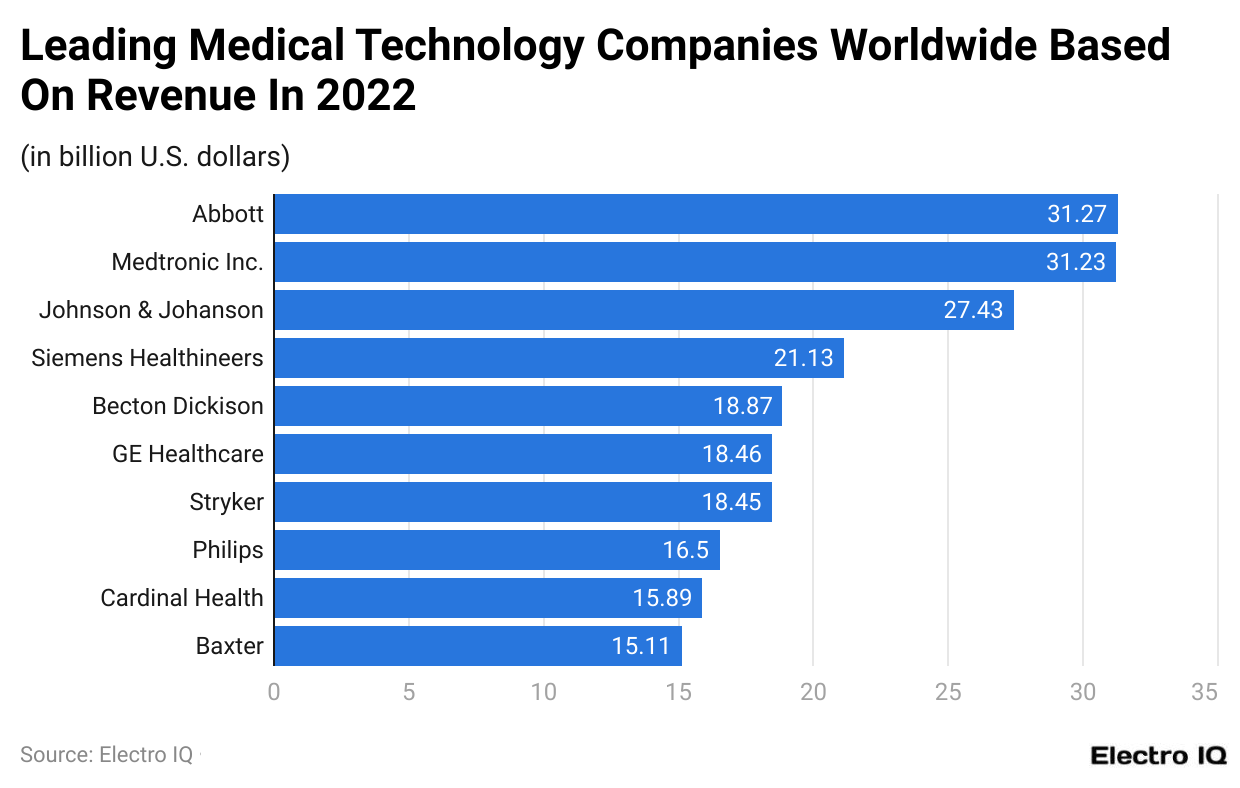

(Reference: Statista.com)

- As per medicine device statistics, Abbot has the highest revenue for medical device companies, with $31.27 billion.

- Medtronic and Johnson & Johnson follow it with $31.23 billion and $27.43 billion.

Medical Device Industry Overview

The global medical device market has continued multiplying in 2023 and 2024, driven by technological advancements, increased healthcare spending, and a rising prevalence of chronic diseases. The market’s expansion reflects a heightened demand for innovative devices that improve patient outcomes, support remote monitoring, and enable minimally invasive procedures. This report provides an in-depth analysis of the Medical Devices Statistics for 2023 and 2024, focusing on market size, growth trends, regional insights, and the financial aspects influencing the industry.

#1. Market Size and Growth

In 2023, the global medical device market was valued at approximately US $500 billion, representing a growth of about 5.8% from the previous year. This growth was propelled by the increasing adoption of digital health technologies, such as wearable devices and telemedicine solutions, which have become integral to modern healthcare delivery. By 2024, the market is projected to reach US $530 billion, with a compound annual growth rate (CAGR) of 6%. The steady growth underscores the market’s resilience and critical role in addressing global healthcare challenges.

#2. Segmentation by Device Type

The medical device market is segmented into various categories: diagnostic imaging, cardiovascular devices, orthopedic devices, in vitro diagnostics (IVD), and surgical instruments. In 2023, the in vitro diagnostics segment dominated the market, accounting for approximately 20% of the total market share, translating to US $100 billion. This segment’s growth is primarily attributed to the increasing demand for point-of-care testing and the rising prevalence of infectious diseases.

Cardiovascular devices, another significant segment, accounted for 18% of the market share in 2023, equating to US $90 billion. With the global burden of cardiovascular diseases rising, this segment is expected to continue its growth trajectory, reaching US $95 billion in 2024. Orthopedic devices, which include implants and prosthetics, held a market share of 15% in 2023, or US $75 billion, and are projected to grow to US $80 billion by 2024.

#3. Regional Insights

North America remains the largest market for medical devices, with a market share of 40% in 2023, valued at US $200 billion. The region’s dominance is due to a well-established healthcare infrastructure, high healthcare spending, and rapid adoption of advanced technologies. The United States alone contributed to nearly 35% of the global market, with a valuation of US $175 billion in 2023. This trend is expected to continue in 2024, with the market value projected to reach US $185 billion.

Europe, the second-largest market, accounted for 30% of the global market share in 2023, or US $150 billion. Countries like Germany, France, and the United Kingdom are significant contributors, with Germany leading the pack. In 2024, the European market is expected to grow to US $160 billion, driven by increased investments in healthcare and a growing elderly population.

The Asia-Pacific region is the fastest-growing market, with a CAGR of 8% from 2023 to 2024. In 2023, the market was valued at US $120 billion, representing 24% of the global market. By 2024, the market will reach US $130 billion. The growth in this region is fueled by the rising middle-class population, increasing healthcare access, and government initiatives to improve healthcare infrastructure. China and India are the key markets driving this growth, with China’s market alone expected to be valued at US $70 billion in 2024.

#4. Technological Advancements and Innovation

Technological advancements continue to be a significant driver of growth in the medical device market. In 2023, integrating artificial intelligence (AI) in medical devices became more prevalent, particularly in imaging and diagnostics. AI-powered devices can now provide more accurate diagnoses, reduce human error, and improve patient outcomes. The AI segment in the medical device market was valued at US $5 billion in 2023 and is expected to grow to US $7 billion by 2024, representing a 40% growth.

Wearable medical devices have grown significantly, with the market valued at US $25 billion in 2023. These devices, including fitness trackers, smartwatches, and continuous glucose monitors, are increasingly used for chronic disease management and remote patient monitoring. By 2024, the wearable medical device market is projected to reach US $30 billion, driven by the growing consumer interest in personal health monitoring.

#5. Financial Performance and Investments

The financial performance of companies in the medical device industry has been robust, with major players reporting significant revenue growth. In 2023, the top five medical device companies—Medtronic, Johnson & Johnson, Abbott Laboratories, Siemens Healthineers, and Philips Healthcare—collectively generated revenues exceeding US $150 billion. Medtronic, the most significant player, reported revenues of US $32 billion in 2023, with year-over-year growth of 5%. By 2024, these companies are expected to see continued growth, with a collective revenue projection of US $160 billion.

Investment in research and development (R&D) is a key factor driving innovation in the medical device industry. In 2023, global R&D spending in the sector reached US $40 billion, accounting for approximately 8% of the total market revenue. This investment is expected to increase to US $43 billion in 2024, reflecting the industry’s commitment to developing new and improved medical devices. The focus areas for R&D include AI integration, minimally invasive devices, and advanced imaging technologies.

#6. Regulatory Landscape and Compliance

The regulatory environment for medical devices has become increasingly stringent, with authorities such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) implementing rigorous standards to ensure the safety and efficacy of medical devices. In 2023, the FDA approved over 350 new medical devices, a slight increase from the 340 approvals in 2022. This trend is expected to continue in 2024, with an anticipated 5% increase in approvals, driven by the ongoing innovation in the sector.

The introduction of the European Union Medical Device Regulation (EU MDR) in 2021 has also significantly impacted the market. The regulation, which imposes stricter requirements for clinical evidence, post-market surveillance, and product labeling, has increased manufacturers’ compliance costs. In 2023, compliance-related expenses accounted for 10% of the total operational costs for European medical device companies, equating to US $15 billion. By 2024, these costs are expected to rise to US $16 billion as companies continue to adapt to the new regulatory framework.

#7. Challenges and Opportunities

While the medical device market has experienced robust growth, it is not without challenges. One of the primary challenges in 2023 was the supply chain disruption caused by geopolitical tensions and the lingering effects of the COVID-19 pandemic. These disruptions led to delays in the production and distribution of medical devices, impacting market growth. The supply chain issues are expected to persist into 2024, with companies focusing on diversifying their supply sources and investing in local manufacturing to mitigate risks.

On the other hand, the market presents significant opportunities, particularly in the emerging markets of Asia-Pacific and Latin America. These regions are experiencing rapid healthcare infrastructure development, increasing access to medical devices. In 2023, the Latin American medical device market was valued at US $40 billion, with a growth rate of 6%. By 2024, the market is expected to reach US $42.5 billion. Brazil and Mexico are the leading markets in this region, driven by government initiatives to improve healthcare access and the growing burden of chronic diseases.

#8. Impact of Digital Health

Integrating digital health technologies into medical devices has been a game-changer for the industry. In 2023, digital health solutions accounted for 15% of the total medical device market, valued at US $75 billion. These solutions include telemedicine platforms, mobile health apps, and digital therapeutics, which have become essential tools for healthcare providers and patients. By 2024, the digital health segment is expected to grow to US $85 billion, representing a growth rate of 13%.

The adoption of telemedicine, in particular, has accelerated due to the COVID-19 pandemic, with patients increasingly opting for remote consultations. In 2023, telemedicine devices generated revenues of US $10 billion, projected to rise to US $12 billion in 2024. The convenience and cost-effectiveness of telemedicine are expected to drive continued growth in this segment, particularly in rural and underserved areas.

#9. Sustainability and Environmental Considerations

Sustainability has become a critical focus area for the medical device industry, with companies increasingly adopting environmentally friendly practices. In 2023, the global medical device market saw a significant shift towards using recyclable materials and energy-efficient manufacturing processes. The market for sustainable medical devices was valued at US $20 billion in 2023, accounting for 4% of the total market. By 2024, this segment is expected to grow to US $24 billion, driven by increasing regulatory pressure and consumer demand for sustainable products.

Companies also invest in developing devices with longer lifespans and reduced environmental impact. In 2023, approximately 30% of new medical devices introduced to the market were designed with sustainability in mind, up from 25% in 2022.

This trend is expected to continue in 2024, with a projected 35% of new devices meeting sustainability criteria.

#10. Future Outlook and Trends

The medical device market is poised for continued growth and innovation. In 2024, the focus areas will include AI-powered devices, wearable health technologies, and advanced imaging systems. The market for AI-powered devices is projected to grow at a CAGR of 20% from 2023 to 2024, reflecting the increasing demand for precision medicine and personalized healthcare solutions.

Wearable health technologies will also continue to gain traction, with a growing number of consumers using these devices to monitor their health and manage chronic conditions. In 2024, the market for wearable health devices is expected to account for 6% of the total medical device market, valued at US $31.8 billion. Integrating AI and data analytics into these devices will further enhance their capabilities, enabling more accurate health monitoring and early disease detection.

The imaging systems segment is also expected to grow significantly, particularly in molecular imaging. In 2023, the market for advanced imaging systems was valued at US $50 billion, scheduled to rise to US $54 billion in 2024. The development of new imaging modalities, such as hybrid PET/MRI systems, will drive this growth, providing healthcare providers with more precise diagnostic tools.

Conclusion

The medical device market continues to be a dynamic and rapidly evolving sector with significant opportunities for growth and innovation. The market’s expansion in 2023 and 2024 is driven by technological advancements, increasing healthcare spending, and the rising prevalence of chronic diseases. With a projected market value of US $530 billion in 2024, the medical device industry is well-positioned to address the growing global healthcare needs.

However, the industry faces challenges, including supply chain disruptions and increasing regulatory pressures. Companies must navigate these challenges while continuing to innovate and develop sustainable, high-quality devices. Integrating digital health technologies and AI-powered devices will be critical growth drivers, enabling more personalized and efficient healthcare delivery.

As the market evolves, staying informed about the latest Medical Devices Statistics and trends will be essential for stakeholders, including manufacturers, healthcare providers, and investors. The data presented in this report highlights the critical role of medical devices in shaping the future of healthcare, underscoring the importance of continued investment in this vital industry.

In summary, the Medical Devices Statistics for 2023 and 2024 indicate a robust and growing market with significant opportunities for innovation and expansion. The industry’s future looks promising, with technological advancements and a focus on sustainability paving the way for improved patient outcomes and a healthier global population.

Sources

FAQ.

As per Medical Devices Statistics, the market revenue is expected to reach $530 by 2024.

North America has the largest market for medical devices, with a 40% market share in 2023.

Global R&D spending of the medical device sector is $40 billion in 2023.

Saisuman is a skilled content writer with a passion for mobile technology, law, and science. She creates featured articles for websites and newsletters and conducts thorough research for medical professionals and researchers. Fluent in five languages, Saisuman's love for reading and languages sparked her writing career. She holds a Master's degree in Business Administration with a focus on Human Resources and has experience working in a Human Resources firm. Saisuman has also worked with a French international company. In her spare time, she enjoys traveling and singing classical songs. Now at Smartphone Thoughts, Saisuman specializes in reviewing smartphones and analyzing app statistics, making complex information easy to understand for readers.