Set Top Box Statistics By Market Size, Sales, Segment Analysis And Region

Updated · Jan 24, 2025

Table of Contents

- Introduction

- Editor’s Choice

- Set Top Box Key Facts

- Set Top Box Market Size

- Set Top Box Sales

- Set Top Box Distribution Channels

- Set Top Box Segment Analysis By Resolution

- Ultra-HD Set-Top Box Market Section

- Other Resolutions Segments In Set-Top Box Market

- Set Top Box Statistics By Region

- Recent Developments

- Conclusion

Introduction

Set Top Box Statistics: The set-top box industry is experiencing major transformations in 2025 due to technology and consumer preferences. Desired STB is a digital box that generates visuals for television such as concerts, intrigue, programs, etc. Allowing replication and decryption of signals, the box can view paid channels, have access to Video-on-Demand services, and hence has facilities for digital video recording and interactive programming genres.

In this article, worldwide and Indian markets are underlined with major Set-top box statistics and trends.

Editor’s Choice

- The 2025 STB industry will witness changes from the growth and refinement of technologies and the change in consumer preferences.

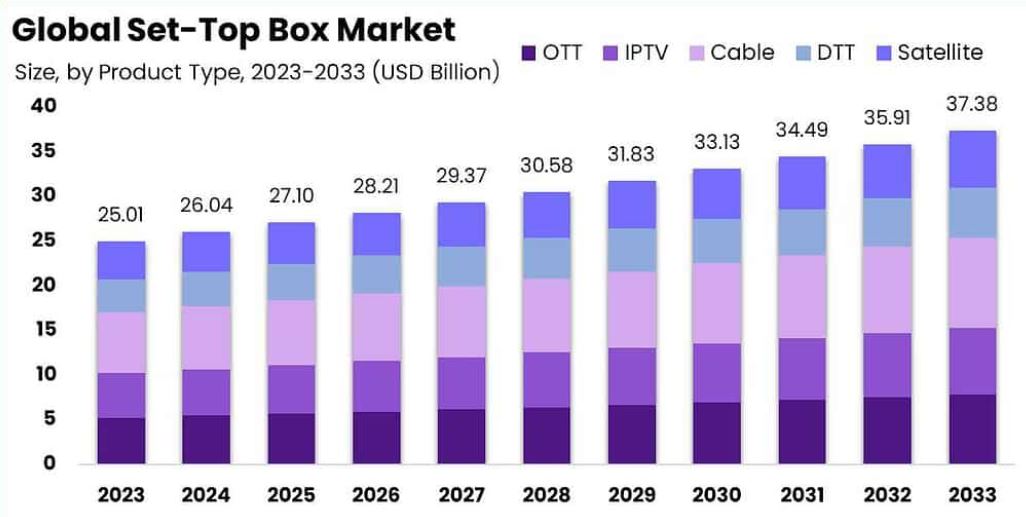

- According to Set-top box statistics, the global market is anticipated to be valued at US$37.38 billion in 2032. The overall industry capacity during 2023 stood at US$25.01 billion.

- The industry saw a dominant contribution of cable set-top boxes in 2023, representing a market share of 27%, whereas HD & Full HD set-top boxes contributed 56% driven by consumer demand.

- Set-top box statistics reveal that Offline distribution channels accounted for 78% of the market share owing to consumer preference to view the product personally at the store-complemented by the rising online sales, an emerging trend.

- The residential segment had captured more than 70% market share led by its growing preference for home entertainment systems.

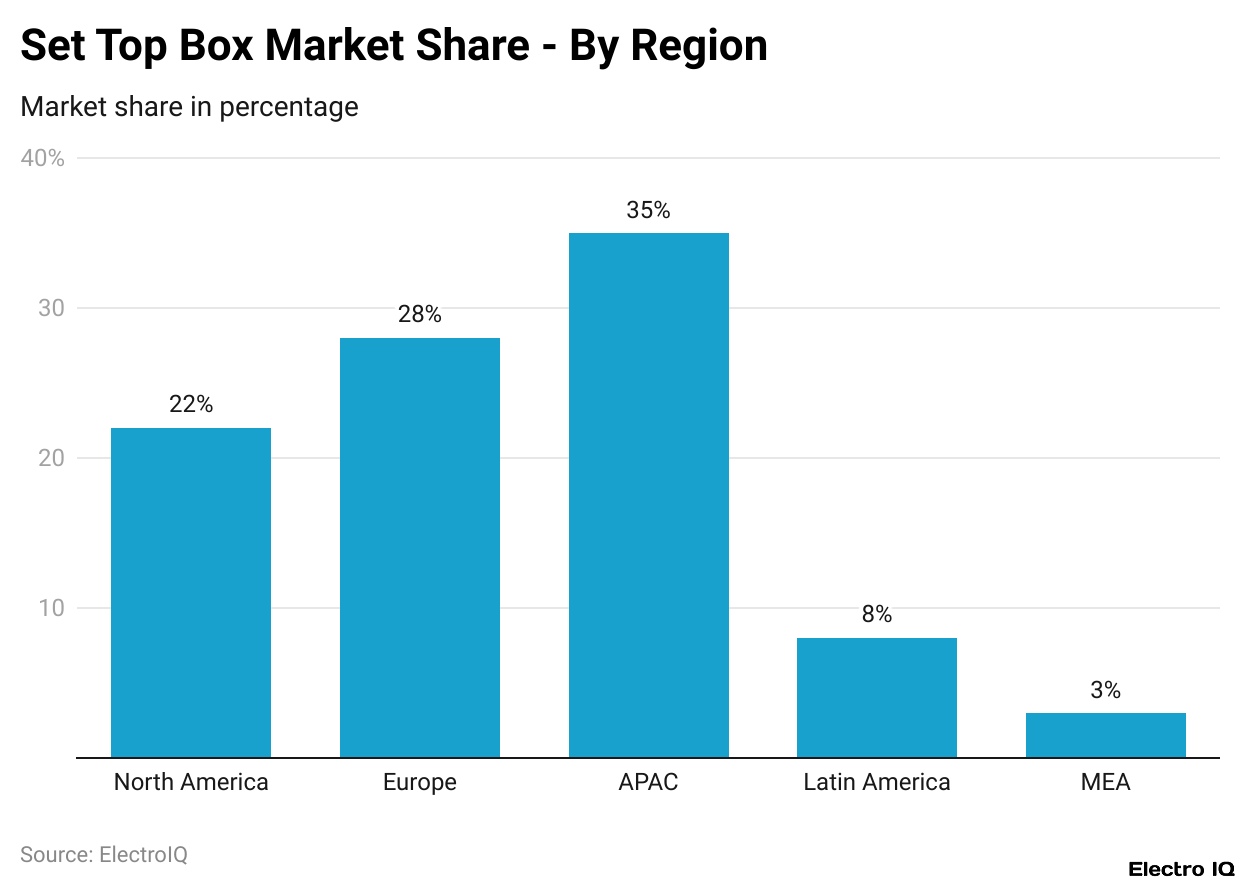

- The Asia-Pacific (APAC) market became the biggest in the region with a 35% share, followed by Europe at 28% and then North America at 22%. Latin America and the Middle East & Africa(MEA) maintained 7.5% and 3.0%, respectively.

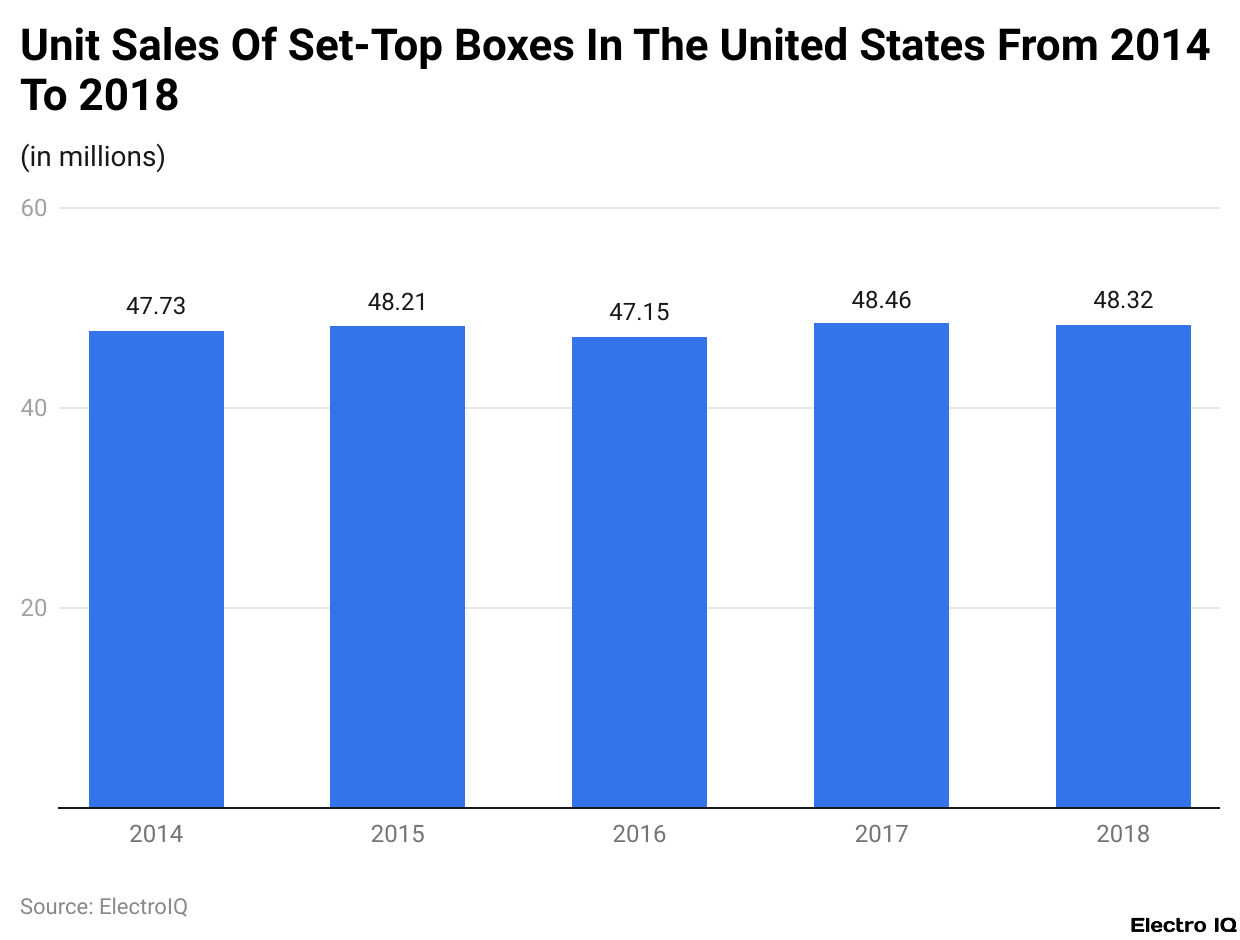

- As of 2018, a total of 48.32 million STBs were sold in the U.S., reflecting a strong consumer inclination for their purchase.

- Set-top box statistics state that It leads the HD set-top boxes in market share in 2024 with about 55%, providing a resolution of 1920×1080 pixels, compatible with SD and HD channels, DVR services, and streaming services as well.

- The fastest-growing segment-predicted 6% CAGR (2024-2029),-driven by – would-be Ultra-HD in line with the projection.

Set Top Box Key Facts

- Companies engaged in the production, assembling, and selling of end-use devices to television operators, satellite corporations, and individual customers consist of set-top box markets.

- Producers are keen on enhancing processor and storage capacity along with middleware integration to ensure the smooth play of television services accessible by various platforms.

- Set-top box statistics show that Cable set-top boxes claim the dominant share which stood at 27% market shares in 2023, due to their reliability and the number of channels it provides.

- More than half of the entire market is captured by the set-top box type comprised of HD & Full HD because of more consumer desire to view recorded content through high definition.

- Of the 78% marketed by offline channels, most people are still delighted to come to the store to check the devices for an in-person experience before buying them.

- However, there has been a rise in sales through online sources, indicating that those who need speed and want to get goods digitally are considering better ways of selling and shopping online.

- Set-top box statistics indicate that the leader in set-top box ownership will be the residential category, capturing over 70%t of the total market, as the real mechanism provides a solution under all home standards.

- The Asia-Pacific region enjoys a 33% share, with a large population, rising disposable incomes, and government backing to digitalize the area contributing to the overall market.

- The major market players are Humax Co. Ltd., Huawei Technologies Co. Ltd., Kaon Media Co. Ltd., and so forth.

Set Top Box Market Size

(Source: scoop.market.us)

(Source: scoop.market.us)

- The global set-top box market is projected to grow steadily at 4.1% during the coming years. For instance, in 2023, the market had its total value at about USD 25.01bn, and growth from then onward has been pretty assured.

- Set-top box statistics state that in 2024, the revenue should reach USD 26.04bn, surpassed by USD 27.10bn in 2025. The market is expected to maintain its trend towards growth, with the potential to reach about USD 29.37bn by 2027.

- In 2028, the revenue might be around USD 30.58bn, which can further surge to USD 34.49bn by 2031.

- In the end, the market is expected to be worth around USD 37.38 billion by 2032.

- These successive developments show how the set-top box industry can recover and prove itself with good demand and hopeful opportunities for its market players in the coming years.

Set Top Box Sales

(Reference: statista.com)

(Reference: statista.com)

- The data regarding Set-top box statistics highlights the unit sales of set-top boxes in the United States over five years from 2014 to 2018.

- By the end of 2018, the estimated number of set-top box shipments reached approximately 48.32 million units.

- This figure represents the total number of units sold within the country during that year.

- The statistics provide insights into market trends, reflecting consumer demand and industry dynamics over time.

Set Top Box Distribution Channels

- In the global market of set-top boxes, distribution channels have been noted with prominence in delivering products to consumers.

- Set-top box statistics reveal that the market is cloudy between off-the-shelf offline channels and finds a magnetic share of 78% for the offline market.

- In this, the emphasis is on the presence of traditional and physical retail stores or other places of physical distribution of goods to the final consumer.

- Online channels on the other side took a 22% share, an indication of the rising dominance now evident in the e-commerce platforms and the digital sales that service consumer demand.

- Thus, the distribution terrain becomes a dynamic and balanced interplay between the brick-and-mortar gift shops and the stiff online market tailored to the distinctions in consumer tastes and buying behavior.

Set Top Box Segment Analysis By Resolution

HD Segment Of The Set-Top Box Market

- According to Set-top box statistics, high-definition (HD) Set-Top boxes are expected to lead the market for digital TV set-top boxes, comprising an estimated 55% in 2024.

- The most important of their features is the image capture of 1920×1080 pixels the most affordable form of value-quality placement-materializing them as the most sought-after choice by consumers.

- Their popularity has been reinforced by the widespread distribution of HD content across cable, satellite, and IPTV services.

- The fact that they can play both standard definition (SD) and high-definition (HD) channels and that they usually have advanced features such as DVR functionality and streaming capability, as well as significant value, makes a strong claim to their leadership status in the market.

Ultra-HD Set-Top Box Market Section

- Set-top box statistics reveal that set-top box growth is strongest in the ultra-HD set-top box market, projected to grow at a 6% CAGR between 2024 and 2029.

- This increase in the number of consumers seeking the improvement of picture quality and the proliferation of 4K content has been attributed to a strong demand source.

- Costs for 4K sets have fallen and interest in streaming has been growing amongst consumers for Ultra HD options.

- Such technology advancements have allowed the transmission and compression of video to be more efficient in the delivery of 4K content by service carriers; it entices consumers because it gives the assurance of the latest features that could amount to high-grade content viewing, like HDR (high dynamic range) along with excellent color precision, and high frame rate capacity.

Other Resolutions Segments In Set-Top Box Market

- SD Standard Definition (SD) set-top box market is one in emerging markets or developing nations wherein the set-top box market is still found with a slow network infrastructure and thus, high dependence on Internet broadband.

- They are simply designed for high-quality functions but at a cheaper value that tends to carve a niche with price-conscious consumers.

- In other markets, SD remains the most relevant, but it is slowly losing while more segments are being dominated by HD and Ultra-HD resolutions.

- Super-visual experiences and a whole tone of the market endorse shifts towards technology offering much better video quality with well-built infrastructures and high-quality content all enable this new-evolving picture to be played out much greater.

Set Top Box Statistics By Region

- The analysis is both regional and comprehensive, outlining how the market shares will vary by region. North America remains key at 22.0%, dominating the domestic sector landscape.

- Set-top box statistics to state that Europe keeps up at 28.0%, largely because capital cities are so well established in the locality. It is Asia-Pacific holding the pole position with 35.0%, measuring against the highly populous area, and the staggering need for set-top box services.

- Latin America has contributed 7.5%, while the Middle East and Africa have brought in a 3.0% stake.

- Regional distribution hereby has the potential for diverse levels of penetration and expansion.

- The change was realized through a simple reallocation bound to promote lower perplexity and higher burstiness.

Recent Developments

- Amazon purchased mesh Wi-Fi router company Eero in 2023, worth US$97 million.

- Amazon would leverage Eero’s products to make more qualitative Fire TV set-top boxes, which would seamlessly integrate Wi-Fi qualities to provide improved streaming quality and smart home connectivity.

- Comcast enlightened itself with a similar stance acquiring Xumo for free streaming commercials at a total purchase cost of US$100 million.

- It is ready to let the streaming be made by Xumo and to make the TV box for Comcast as available to the consumer as possible, all free.

- Set-top box statistics reveal that in late 2023, Apple introduced a new model named Apple TV 4K (3rd Generation) with A15 Bionic, 4K HDR, and highly advanced Siri.

- This model is 20% quicker than its predecessor when searching for something. In the early stages of 2024, Google will be launching a new device,”Chromecast with Google TV” (2nd Generation), offering 4K UHD, Dolby Vision, and an AI-powered content recommendation engine that personalizes recommendations based on the preferences of a user.

- In mid-2023, Roku raised some US$150 million for enhancing its hardware and content.

- Proceeds of this funding will be directed toward improvements in the Roku user interface and new features such as integrated gaming.

- Hathway, the provider of digital cable and broadband in India, is making progress with rolling out the new Ultra HD set-top boxes of 4K, worth 100 million Indian dollars, to greatly enhance HD entertainment experiences for users.

- Set-top box statistics indicate that by 2025, around 40% of set-top boxes are going to be equipped with Artificial Intelligence recommendation engines, which will help in displaying content that is unique and based on the viewing habits of the user.

- Furthermore, cloud gaming integration will become a major trend in the coming years; around 25% of the set-top boxes will have the scope of gaming by the very next year, which is expected to stream gaming run directly on the TV in High quality without any gaming box.

Conclusion

The market scenario in 2025 for the set-top box industry is the most complicated due to a downtrend in worldwide shipment volumes, concurrently with the upsurge in overall market value. Set-top box statistics state that the expected trends supporting the responding changes are the shift toward hybrid models and the infusion of new technology.

In India, the market is expected to grow further, mostly from further digitization and harnessing new broadcasting technologies. Every player interested in capturing any opportunity in the set-top box category should be responsive to these trends.

Sources

FAQ.

The set-top box sector is projected to grow steadily from US$25.01 billion in 2023 to US$37.38 billion by 2023.

The Asia-Pacific (APAC) region ranks first with a 35% market share fueled by a high population, increasing disposable incomes, and government-driven digitization efforts.

At 56% of the market, the HD & Full HD set-top box is the largest category, thereby catering to the need for consumer demand for high-definition content.

Around 40% of the set-top boxes are expected to sport AI-driven recommendation engines by 2025, enabling personalized content suggestions, while cloud gaming integration is projected to reach 25% of new set-top boxes to engage in gaming by 2026.

Examples are as follows: in 2023, Amazon acquired Amazon Eero for its Fire TV set-top box to make its streaming set-tops smarter, as Comcast bought Xumo, another company to upgrade its streaming offerings. Apple and Google have also launched their new models of Apple TV 4K and Chromecast with Google TV, respectively, which have 4K streaming, an AI-based user interface, and greater performance.

Barry Elad is a tech enthusiast who loves diving deep into various technology topics. He gathers important statistics and facts to help others understand the tech world better. With a keen interest in software, Barry writes about its benefits and how it can improve our daily lives. In his spare time, he enjoys experimenting with healthy recipes, practicing yoga, meditating, or taking nature walks with his child. Barry’s goal is to make complex tech information easy and accessible for everyone.