Smart Pills Statistics and Facts (2025)

Updated · Jan 31, 2025

Table of Contents

Introduction

Smart Pills Statistics: Smart pills, also known as digital drugs, ingestible sensors, or digital pills, are considered an innovation in medical technology as they combine the characteristics of pharmaceuticals with digital capabilities of monitoring. To achieve this purpose, minute sensors are integrated into these clever devices and communicate data like vital signs, drug ingestion-related vital signals, and adherence with drugs to an external computer or mainly to a smartphone.

These real-time visuals enable a caregiver to highly personalize and adjust treatment plans and step in quickly when needed. In this article, we will discuss the smart pills statistics trends.

Editor’s Choice

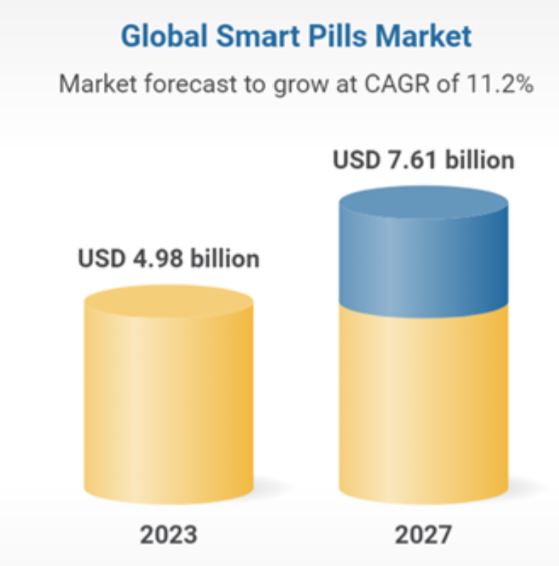

- According to smart pills statistics, the global smart pills industry at USD 4.98 billion in 2023 and is projected to cross USD 7.61 billion by 2027.

- It is foreseen that it will reach a worth of 8.3 billion dollars by 2028 with an estimated CAGR of 11.8% from 2023 to 2028.

- Capsule endoscopy, a method using capsule-sized camera pills, is performed on over 500,000 individuals every year worldwide.

- More than half of patients (50%) miss taking their medicines as per the doctor’s prescription.

- Young adult-smart pill most active users from 18 to 25 years.

- The senior-smart pill must be the least likely user, but its use increases.

- Smart pills statistics reveal that in 2022, Medtronic Plc took 30% of the market share. Both Proteus Digital Health (20%) and Otsuka Pharmaceutical Co. Ltd. (15%) are close competitors.

- Given Imaging held 10%, due to CapsoVision’s superior technological product, which is capturing a 5% market share.

- Medtronic acquired Digital Diagnostics early in 2024 to expand its AI-driven smart pill technology.

- The year 2023 saw the introduction of new smart pills by ePill to track medication adherence to mobile apps.

- Smart pills statistics state that Proteus Digital Health also raised the same amount in that year to boost smart technology. Smart Pills HQ3 secured USD 150 million from Series B investment for product development as well.

- The most significant improvement in real-time health monitoring and data accuracy is caused and further enhanced by the integration of AI and IoT.

- It is very important especially the introduction of the Abilify MyCite pill by the Food and Drug Administration in 2017, which is an intelligent pill designed to aid in observing the ingestion of antipsychotic medication.

Smart Pills Market Size

(Source: enterpriseappstoday.com)

(Source: enterpriseappstoday.com)

- Smart pills statistics reveal that the global smart pills market was valued at approximately USD 4.98 billion in 2023 and will reach an estimated USD 7.61 billion by the end of 2027.

- The global incorporation of smart capsules is rapidly growing; in 2023, over 500,000 capsule endoscopy procedures were conducted every year worldwide.

- Nonetheless, poor adherence to prescribed medications persists, reaching as high as around 50% of patients not adhering properly to the administration of drugs as advised by physicians in 2023.

- The value of the global smart pills market is estimated around USD 8.3 billion as of 2028 and is beaconed to expand at a CAGR of 11.8% from 2023 to 2028.

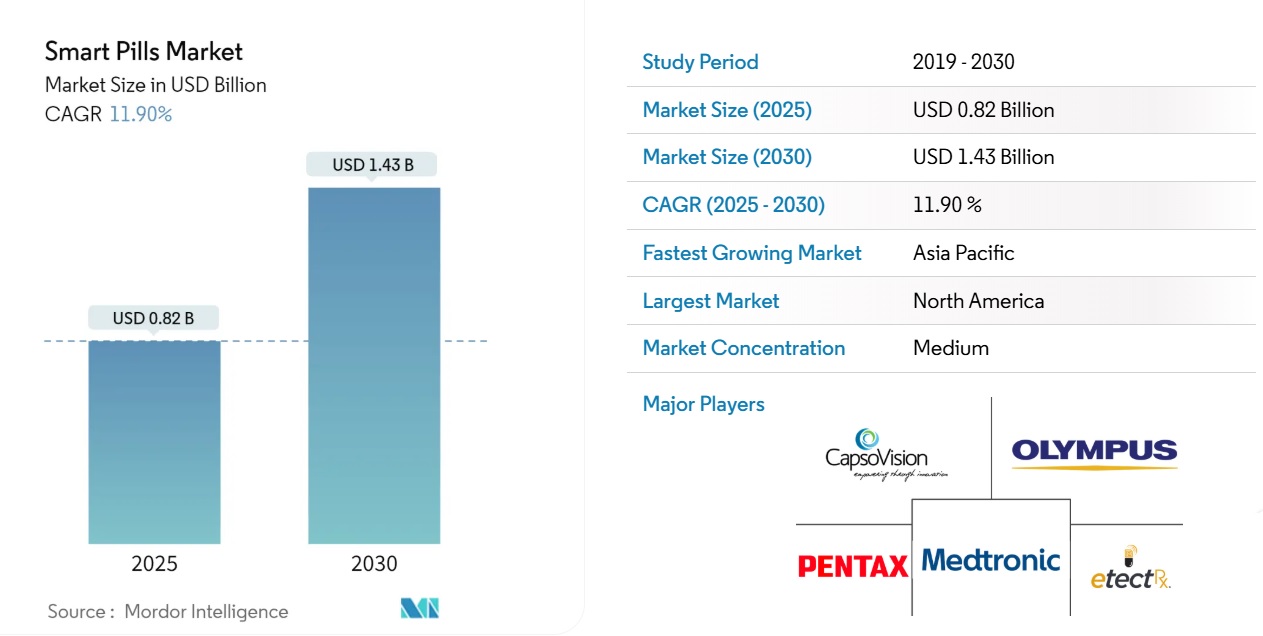

According to Mordor Intelligence

- The Smart Pills Market is expected to reach USD 0.82 billion in 2025.

- The market is projected to grow at a CAGR of 11.90% to reach USD 1.43 billion by 2030.

- The fastest growing market is the Asia Pacific region.

- North America is expected to dominate the market in terms of market share.

- The leading companies in the market include Medtronics, Capso Vision Inc., Olympus Corporation, Pentax Medical (Hoya), and etectRx.

- Capsule endoscopy is expected to witness high growth, driven by the need for advanced diagnostic tools for gastrointestinal disorders.

- Technological advancements, particularly in wireless capsule endoscopy, are enhancing diagnostic capabilities.

- The integration of smart pills with digital health platforms is enhancing functionality and market appeal.

- The market is supported by a preference for minimally-invasive devices in healthcare.

- The market size was USD 0.72 billion in 2024.

- The report covers the historical market size from 2019 to 2024 and forecasts for 2025 to 2030.

- In May 2024, Medtronic received FDA clearance for its PillCam Genius SB capsule endoscopy kit.

- AnX Robotica secured FDA clearance for its NaviCam ProScan in January 2024.

Smart Pills User Demographics

- Smart drugs and pills are thought to be increasingly in common usage for various clinical and non-clinical targets, and apparent aggressive consumer segments could comprise patients, clinical utility professionals, and sports professionals.

- Most people who are regularly in touch with smart drugs have diabetes, hypertension, or conditions related to the heart.

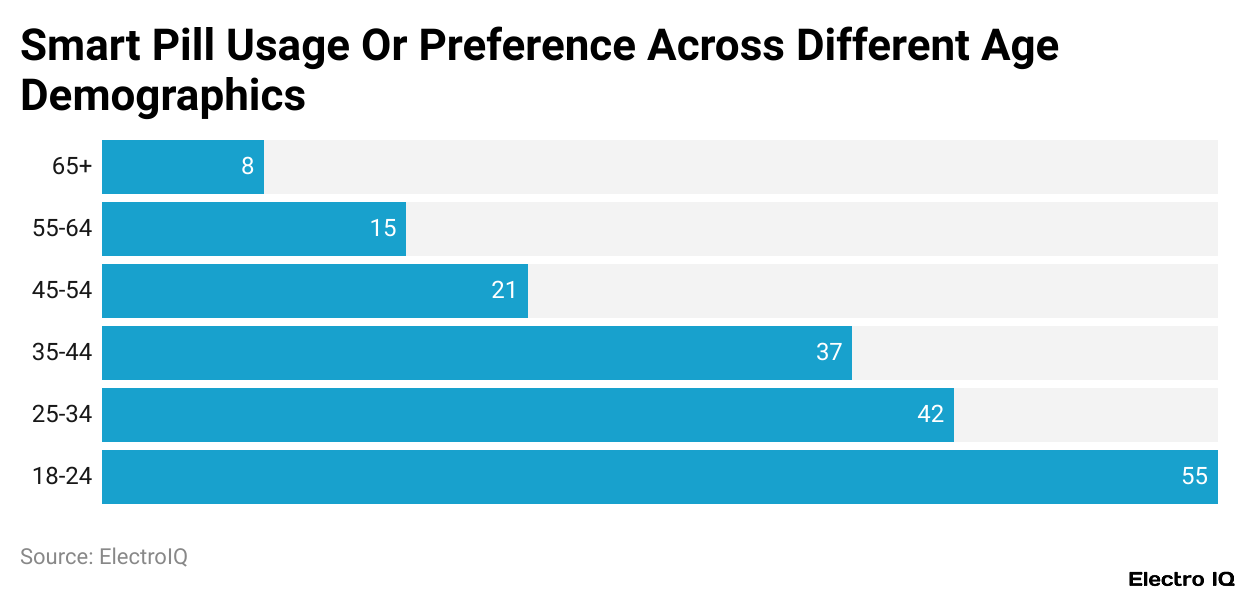

- Smart pills statistics state that a somewhat more tech-savvy population are young adults aged 18-25.

- They are likely to consume smart medications in larger numbers for different purposes than any other segment.

- In this respect, the age group of 26-40 comes in second and then the age group, 41-60.

- Even older people, aged 61 and above, are not really considering such pills, but their adoption has been blossoming over the last few years.

Top Smart Pills Manufacturers

- The larger part of the market is controlled by a few manufacturers, each of these manufacturers possessing a fair portion of the market.

- On the list lies Medtronic Plc. with a high yield of 30%.

- The market is leaderless except for Medtronic, and it is a fact that the company owns the most commanding share in it.

- Active research into smart pill devices leads Medtronic to make unparalleled advancements in technology and in the smart pill area.

- Smart pills statistics show that sitting close by is Proteus Digital Health with a 20% share of the market, showing significant breakthroughs in the potential for their digital health products and services, especially in compliance and incorporating with care providers to monitor their patients.

- Through ingestible sensors in their smart pills, they have found many to be useful in terms of bringing positive health outcomes.

- Otsuka Pharmaceutical Co. Ltd. has won a share worth 15% in the smart medicinal market. It might be positioned successfully, just as a groundbreaking player in the smart medicinal technology segment in the future.

- It is rather evident that it is able to move very swiftly toward achieving this status.

- A giant step has been achieved by the company in the integration of digital advances with pharmaceuticals, especially in terms of corporate treatment for psychiatric and chronic diseases.

- Given Imaging is a very recognizable name in the realm of capsule endoscopy, responsible for that 10% market share.

- Such companies are interested enough to make use of a smart pill proven to have as much effectiveness as the conventional pill, with less invasive means of diagnosis and treatment in patients.

- Smart pills statistics reveal that Another paid actor is CapsoVision with a share standing on a 5% market share. The company would come into perspective with geographic prices for very high-definition imaging capsules which are meant to be used in the diagnostic segment of the industry.

- Remnants (20%) are non-specific parts that refer to various other manufacturers. This part is expected to constitute a blend of developing enterprises and smaller contributors with regard to further innovation and expansion of these smart pill technologies.

Smart Pills By Region

- Smart pills statistics state that the United States was likely to dominate the global market in smart pills, holding 35.5% of the total industry that year, ahead of Europe where it had 28.7%.

- Europe is anticipated to show a CAGR growth of 11.5% during the period 2023-2028.

- As far as the greatest role will be played by other places in the market, the fastest-growing area is Asia-Pacific, where its CAGR is expected to be 22.6%, thereby capturing the potential growth areas of the future.

- In the Middle East and Africa, they have 3%, and Latin America came up to 18.7% in 2023.

- Clinically and non-clinically focused on the use of smart pills, the United States and Europe are still the biggest markets due to the high rate of adoption and technical advancements.

- However, the Asia-Pacific market is expected to see rapid growth in the coming years, primarily due to significant healthcare investments and demand for innovative medical solutions.

Recent Developments

- At the beginning of 2024, such an acquisition was noticed between Medtronic and Digital Diagnostics, where the latter mostly focuses on smart pill technologies driven by artificial intelligence.

- This acquisition enriches the Medtronic portfolio by further exploiting opportunities it sees in valuable innovation in smart pill technology.

- A similar move had also been made in mid-2023 by Boston Scientific which signed a strategic agreement to merge with Proteus Digital Health, another pioneer in smart pill technology, to build out their digital health solutions offerings.

- Significant advancements have also been seen in the industry by the launch of several products. ePill, for example, introduced a new range of smart pills in 2023, which they said could track the adherence of a patient to a set medication regimen.

- These pills are fully equipped with sensors for collection, which transfer to an app on a mobile in real-time to be tracked.

- Capsule Technologies also entered the competitive market by launching its new smart capsule in late 2023, which is loaded with sensors able to trace any gastrointestinal illness and even deliver medication immediately where necessary.

- Smart pills statistics show that more has thus been invested in smart pill technology when the USD 200 million round of investments was settled in favour of Proteus Digital Health in 2023, making it push a yard further to develop its smart pill among other possibilities to market.

- HQ3 Smart Pills, a startup firm that specializes in ingestible sensors for medication monitoring, entered series B funding and closed the round with USD 150 million in early 2024.

- It is for the development of valuable products and making it possible for them to enter the market.

- The future of medical care is being shaped by technologies such as connected drugs, with the integration of artificial intelligence and the Internet of Things boosting data accuracy and enabling real-time health monitoring.

- There are recent advances in biodegradable sensor technology through which smart pills are manufactured, which makes it more secure, and more sustainable, hence after the use, it can dissolve harmlessly in the body.

- In 2023, the FDA approved the smart pill; the Abilify MyCite, developed by Otsuka Pharmaceutical and Proteus Digital Health, became one of the first smart pills of its kind.

- This smart pill, or the technology in it, is designed to track the ingestion of aripiprazole, an antipsychotic drug used in treating various psychotic disorders.

- Many European companies also received CE Mark approval for their smart ingestible capsules in 2023, making the way for broader market adoption in the European Union.

Conclusion

One of the most significant drivers for growth in the smart pills market is that home health care now requires further developments in imaging and diagnosing diseases without any surgical access. This, coupled with the smart pills statistics that scientists and other doctors continue to develop better and less expensive diagnostic options for treating diseases, provides positive conditions that will encourage the purchase and use of drugs.

Sources

FAQ.

The global smart pills market was valued at about US$4.98 billion in 2023 and was projected to be valued at around US$7.61 billion by 2027, i.e., growing at around 11.8% CAGR, reaching approximately US$8.3 billion by 2028.

There are some big players in the market: Medtronic Plc., which holds 30% of the market; Proteus Digital Health has 20%; Otsuka Pharmaceutical Co. Ltd. has 15%; Given Imaging has 10%; and CapsoVision has 5%, whilst the remaining 20% is controlled by smaller players.

There is an increasing concern for neurological diseases in patients suffering from cancer and other chronic diseases such as diabetes, hypertension, and cardiovascular conditions, leading to demand for smart pills. Additionally, the increasing advancements in AI, IoT, and biodegradable sensors are making smart pills more productive and more widely adopted.

Smart pills can be used to help monitor patient medications, real-time patient monitoring, and aid in diagnostics, especially during capsule endoscopy (over 500,000 annually will be done). They also allow remote monitoring of patients, thus reducing the need for patients to present frequently at the hospital.

In the year 2023, Boston Scientific collaborated with Proteus Digital Health to expand digital health solutions. E-Pill and Capsule Technologies both released new smart pills that were aimed at improving medication frequency self-assurance and enriched methods of gastrointestinal monitoring. In 2023, Abilify MyCite, a smart pill for ingestion of an antipsychotic, was approved by the FDA. Proteus Digital Health raised US$200 million in 2022, and another US$150 million was invested by HQ3 Smart Pills in 2023 to allow for further development of the product.

Joseph D'Souza founded ElectroIQ in 2010 as a personal project to share his insights and experiences with tech gadgets. Over time, it has grown into a well-regarded tech blog, known for its in-depth technology trends, smartphone reviews and app-related statistics.