Telecom Cloud Statistics and Facts

Updated · Mar 24, 2025

Table of Contents

Introduction

Telecom Cloud Statistics: The rapid transformation of cloud technology has driven significant changes in the telecom industry. Telecom cloud is known as cloud computing solutions used for the delivery of telecom services, where operators can increase their scalability, reduce operational costs, and provide innovative services to customers.

We can see reasonable growth in the telecom cloud space and increasing relevance to the telecommunications industry. In this article, we will discuss the statistics of the telecom cloud regarding its growth and development.

Editor’s Choice

- Telecom cloud statistics state that the telecom cloud market grew and was valued at around USD 22.1 billion in 2024, with a projection to reach USD 92.6 billion by 2030 at a CAGR of 27.0%.

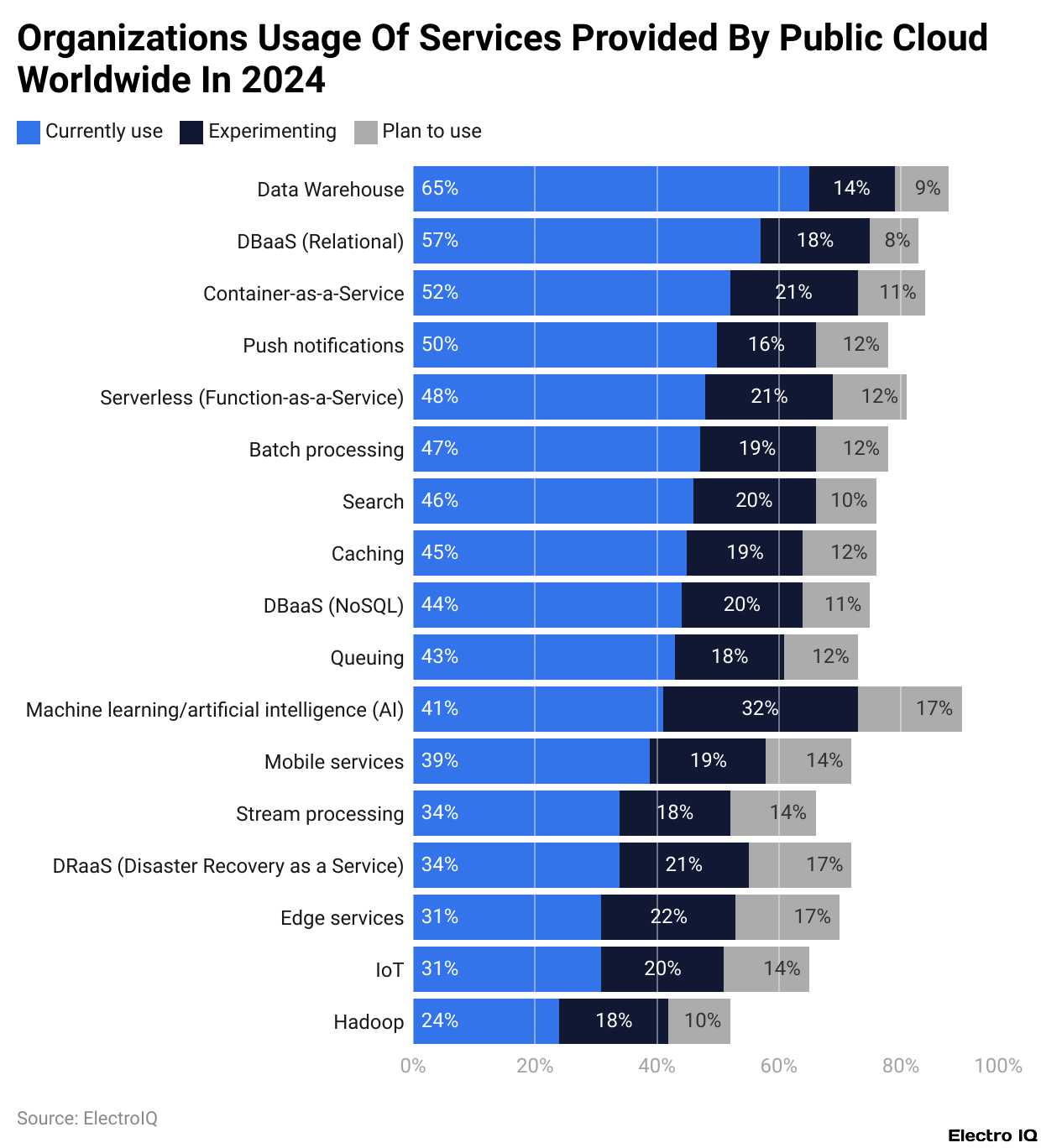

- Over 60% of enterprises worldwide have switched to relying on public cloud providers for data warehouse services.

- As for the AI-enabled application experimentation, 32% of enterprises expressed this use case, while 17% of organizations stated the intent to apply AI in conjunction with DRaaS and Edge computing solutions.

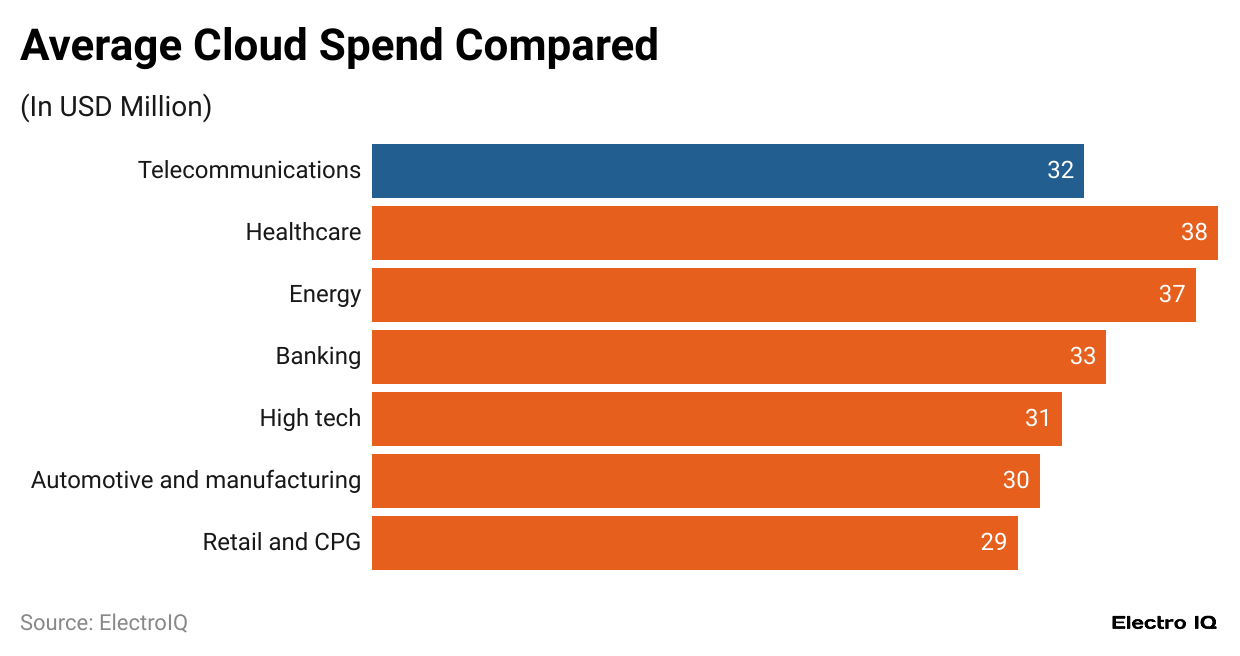

- Cloud expenditure remains variable across industries, with telecom averaging USD 32 million.

- Healthcare leads with USD 38 million, then energy at USD 37 million, banking at USD 33 million, high-tech at USD 31 million, and manufacturing at USD 30 million.

- Retail and CPG are at the bottom, averaging USD 29 million.

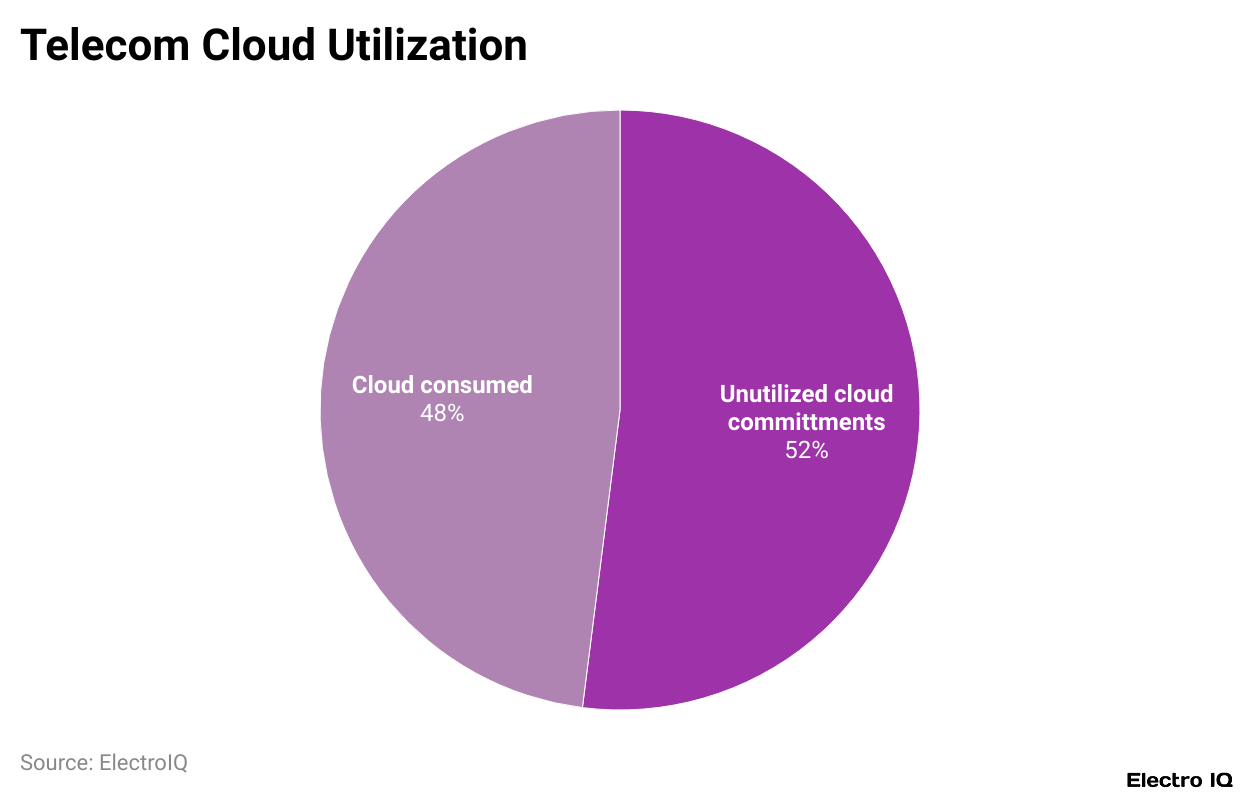

- Telecom cloud statistics indicate that in telecom cloud usage, 48% of cloud resources were consumed actively, while 52% were not utilized owing to overestimated resource requirements, slow cloud migration, and lack of integration.

- An average annual expenditure for telecom operators above USD 30 billion in revenues is estimated at around USD 348 million, while operators with revenues ranging between USD 21 and USD 30 billion spend around USD 306 million.

- Companies in the segment of USD 11 billion to USD 20 billion invest USD 155 million, while operators with revenues of USD 5 billion to USD 10 billion confer approximately USD 90 million.

- Telecom cloud statistics show that technologies like 5G are cutting-edge boosters for telecom cloud services, providing extremely high speeds (up to 100 times faster than the previous generation), low latency for real-time applications, and high capacities for IoT deployments.

- By the year 2025, it is estimated that there will be about 3.6 billion global connections for 5G.

- In the latest news, Telefonica Brasil’s iCloud reportedly bought IPNET and IPNET USA for around USD 41.29 million in July 2024 to further enhance cloud service offerings.

Global Company’s Utilisation Of Public Cloud Services 2024

(Reference: statista.com)

- Telecom cloud statistics reveal that more than 60% of enterprises globally now employ public cloud providers for data warehousing services, thereby instinctively signaling an overwhelming shift in the use of what was once on-premises data management.

- Such advancements signal the increasing need for scalable, efficient, and secure options to manage large volumes of business data.

- Along with the cloud, companies are also looking toward more advanced technology, such as artificial-generated machine learning and artificial intelligence; 32% of companies are already piloting applications equipped with AI.

- These are improving decision-making, process automation, and extraction of deeper insight from the data.

- In addition, 17% of organizations plan to couple these AI initiatives with disaster recovery as a service and Edge computing solutions in a move towards a more resilient and agile IT infrastructure.

- This hybrid solution establishes business continuity while enhancing real-time data processing capabilities at the network edge.

- The adoption of cloud services, DRaaS, and Edge computing reinforces the accelerated pace of digital transformation across the globe.

Average Cloud Spend Compared

(Reference: infosys.com)

- Average cloud expenditures vary by industry because of the diverse technology needs and digital transformations that are priorities among various industries.

- Telecom cloud statistics show that the telecommunications sector averages USD 32 million in cloud expenditures, which reflects its reliance on cloud infrastructure to attain network efficiency and service delivery.

- In healthcare, spending is highest, with an average of USD 38 million, due to the widespread adoption of electronic health records, telemedicine, and data storage.

- Following closely, energy is at USD 37 million, as the cloud is needed in the areas of cloud-based analytics, smart grid management, and predictive maintenance.

- Banking, being so highly regulated and relying on cloud computing for operating fraud detection, digital banking, and data security, registers an average cloud spend of USD 33 million.

- High-tech companies, including software and IT firms, spend around USD 31 million on cloud services, focusing on innovation and scalability.

- The automotive and manufacturing industries spend about USD 30 million on cloud technologies, applying them for automation, supply chain management, and product development.

- Retail and CPG companies spend the least, with an average cloud expenditure of USD 29 million on cloud solutions focused on e-commerce, customer insights, and inventory management.

- Telecom cloud statistics state that all industries have increased spending on the cloud; healthcare and energy are the two with the highest spending, while retail and CPG have the least spending. This situation points to a divergence in their respective cloud adoption priorities.

Telecom Cloud Utilization

(Reference: infosys.com)

- Telecommunication companies steadily integrate cloud technologies evaluated for enhanced efficiency, scalability, and affordability.

- Telecom cloud statistics indicate that the telecom cloud market recorded remarkable growth in 2024, with a value of nearly USD 22.1 billion, tipped to be USD 92.6 billion or above by 2030 at a CAGR of 27.0% forecasted.

- This is mainly being driven by the setting up of 5G networks, digital transformation, and seeking cost savings by telecom operators.

- One critical aspect of clouding telecom is resource utilisation. Recent statistics suggest that 48% of the cloud resources were utilized in the telecom sector, while the remaining 52% stood unused, indicating cloud resource allocation inefficiencies.

- Utilized resources contributed to network operations, data management, customer services, and other telecom functionalities.

- Accounts of unutilized commitments indicate prepaid cloud capacity from telecom enterprises that have paid for it but are not currently using it.

- This discrepancy often occurs due to wrong assumptions about requirements, lagging transition to cloud-native operations, or thorny integration issues with their existing infrastructure.

- Since the telecom cloud market is still on the rise, dealing with these inefficiencies becomes necessary.

- By putting into practice optimizing models for cloud resource allocation, flexible pricing arrangements, and improved cloud management strategies, telecom companies can maximize the returns on their investments and minimize waste.

- Thus, going forward, another key feature in ensuring sustainability and low-cost growth in telecom cloud services will be optimizing cloud utilization techniques.

Investments In Telecom Cloud Transformation

- These investments signal differing capabilities and priorities between telecom companies trying to establish a cloud-centric infrastructure in an increasingly digital telecommunications environment.

- Telecom cloud statistics reveal that major investments will be made by telecom companies exceeding USD 30 billion in revenues, with an average of USD 348 million annually set aside for telco cloud transformation.

- Between USD 21 billion and USD 30 billion, earners rank second, investing slightly lower but still sizable amounts, averaging USD 306 million per annum.

- Companies with revenue streams between USD 11 and USD 20 billion have the lowest investment in telco cloud transformation, averaging USD 155 million per year, indicating a more cautious approach to cloud adoption.

- Interestingly, in this same realm, companies with revenues of USD 5 billion to USD 10 billion would assign the lowest nominal average investment of USD 90 million in every fiscal year.

5G Technology Driving Growth In Telecom Cloud Statistics

- 5G networks are one of the most technologically disruptive phenomena in the telecom industry.

- Ultra-fast speeds, very low latency, and the ability to connect with a large number of devices will reshape connectivity and digital interaction with 5G.

- According to Telecom cloud statistics, Speeds up to 100 times faster than the previous generation means that one can stream seamlessly, download almost instantly, and game better with 5G: low latency allows real-time responsiveness that is critical for use cases such as self-driving cars and virtual reality.

- The ability of 5G networks to provide connectivity to many thousands of devices at the same time enables IoT on a large scale.

- It is estimated by Statista that by 2025, there will be almost 3.6 billion 5G connections worldwide, thus indicating the bright prospect of this next-generation technology.

Recent Industry Developments

- Telecom cloud statistics state that in July 2024, it was announced that TCloud, a subsidiary of Telefonica Brasil, closed on an acquisition pact for cloud service providers IPNET and IPNET USA for up to 230 million reais (approximately USD 41.29 million).

- The acquisition is aimed at broadening TCloud’s service portfolio, with an emphasis on enhancing managed and professional services and furthering their commercial activities.

- Collaboration with AWS: In December 2023, Alianza and Amazon Web Services (AWS) collaborated to accelerate the cloud transformation of every telecom core communication infrastructure.

- This enables Communication Service Providers (CSPs) to replace traditional softswitch VoIP networks and TDM hardware, paving the way for the new cloud-based UCaaS solutions.

- Investment in Gladia Series: Gladia, an AI-powered transcription and voicing intelligence company, secured USD 16 million in Series A funding as of October 2024.

- The company intends to build end-to-end audio infrastructure, starting with a real-time transcription and analytics engine that will drive advancing AI solutions for voice-first platforms, enhancing user experience across global markets.

Conclusion

Telecom cloud statistics show that the telecom cloud sector is rapidly growing with advancements in technology and changing consumer behaviour. Cloud solutions have become necessities for telecom companies worldwide, providing them with scalability and efficiency. The growth of 5G networks and the emergence of IoT applications highlight the importance of telecom cloud services to ensure connectivity with ease and spur digital innovations.

The increasing adoption of hybrid cloud models indicates the industry’s need for infrastructure solutions that are flexible and adaptable.

Sources

FAQ.

The telecom cloud market is estimated to be around US$22.1 billion in 2024 and is expected to grow beyond US$92.6 billion by 2030 at an impressive CAGR of 27.0%.

More than 60% of enterprises around the world have engaged with public cloud providers for data warehouse services, and 32% of organisations are piloting AI applications, with 17% planning implementation of AI with Disaster Recovery as a Service (DRaaS) and Edge computing.

Healthcare has the most cloud spending at US$38 million, followed closely by energy at US$37 million. The telecom sector, at US$32 million, is ahead of retail and consumer packaged goods (CPG), which are the lowest average cloud spenders at US$29 million.

In 2024, only 48% of cloud resources were in active consumption, while 52% remained unutilised because of overestimation of resource requirements, slow migrations, or integration complications.

5G offers an upsurge with 100 times greater speed when juxtaposed with previous generations, low latency for real-time applications, and support for large-scale IoT. By 2025, an approximation of 3.6 billion global connections is expected to be from 5G.

Joseph D'Souza founded ElectroIQ in 2010 as a personal project to share his insights and experiences with tech gadgets. Over time, it has grown into a well-regarded tech blog, known for its in-depth technology trends, smartphone reviews and app-related statistics.