WePay Statistics By Customers Geography, Product And Service

Updated · Feb 18, 2025

Table of Contents

Introduction

WePay Statistics: WePay is an online payment service provider headquartered in the United States of America. Making it possible for businesses on platforms such as crowdfunding sites, small business software companies, and marketplaces, WePay provides an all-in-one payment solution using its APIs, wherein clients can integrate and customize. In addition, fraud and risk protection are available for its partners.

In this article, we will discuss the WePay statistics about its market share and growth.

Editor’s Choice

- WePay statistics reveal that WePay slightly controls the 0.16% market share, while the winner is Shopify Pay at 66.93%.

- Such rivals are Square (US$17.5B revenue, 3,835 employees), Intuit (US$9.6B revenue, 10,600 employees), Stripe (US$7.4B revenue, 4,000 employees), and PayPal (US$27.5B revenue, 26,500 employ).

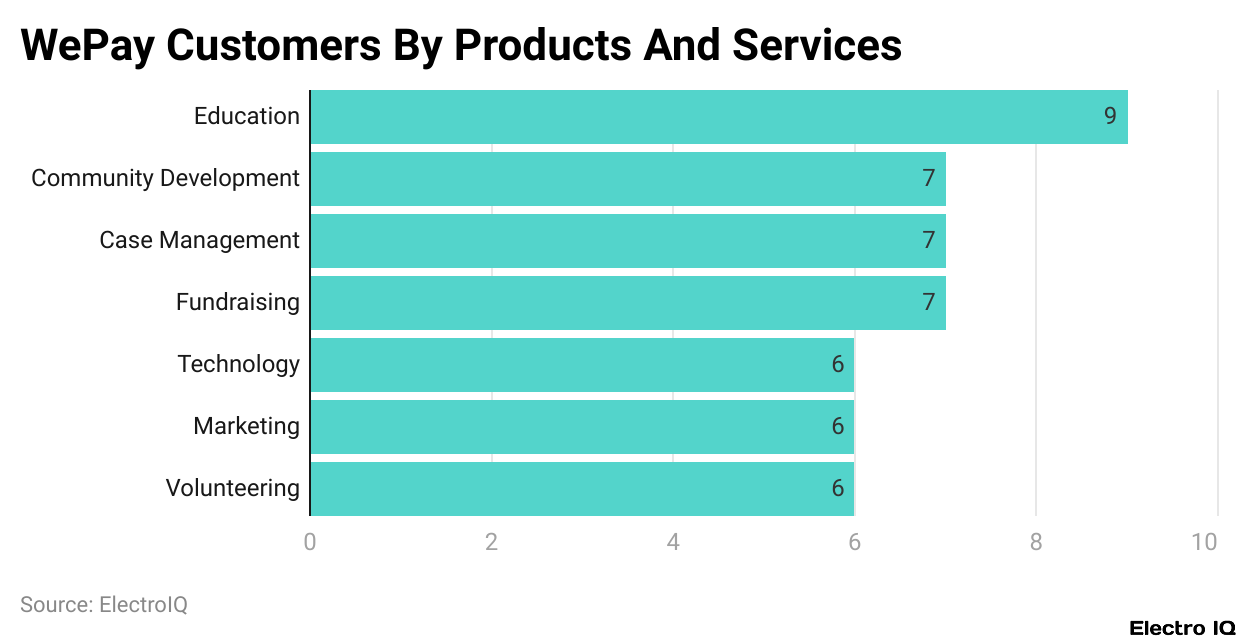

- There were 9 industries with the highest customer penetration among education customers, 7 each from community development, case management, and fundraising.

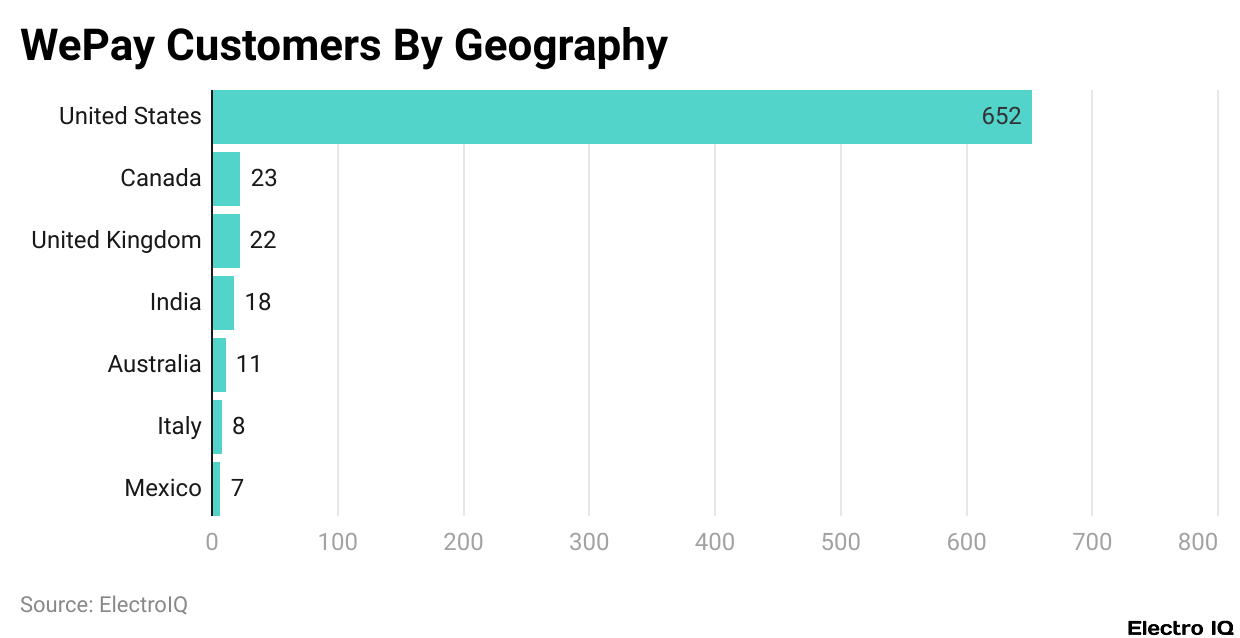

- WePay statistics state that the number of WePay users in the United States leads with 652, followed by 23 in Canada, 22 in the UK, and 18 in India.

- J.P. Morgan acquired WePay; it has grown from 200 employees to 250,000, which is a factor of 1,000, and a 50% increase in its workforce in the first year after the acquisition.

- Chase Merchant Services does approximately US$1.2 trillion a year on top of this processing US$6 trillion a day for JPMorgan.

- A 1,000-person campus in Palo Alto will be JPMorgan’s next foray into FinTech.

- WePay statistics show that Legally, the capital authorized in WePay is ₹3.00 crore, and the paid-up capital is ₹2.64 crore.

- The open charges are ₹17.22 crore, and satisfied charges are ₹96.57 crore, indicating a good repayment history with debts.

| Technology | Market Share (Est.) |

| WePay | 0.16% |

| Klarna | 6.21% |

| CardinalCommerce | 4.19% |

| Razorpay | 2.41% |

| Braintree | 2.35% |

| Stripe Payments | 2.07% |

| LawPay | 1.83% |

| Shopify Pay | 66.93% |

(Source: 6sense.com)

- WePay statistics show that WePay has a minuscule market share estimated to be around 0.16%, making it one of the least-used payment technologies.

- On the other hand, Klarna holds an impressive market share of 6.21%, and CardinalCommerce follows with 4.19%.

- Razorpay and Braintree can be compared closely, with respective market shares of 2.41% and 2.35%. Stripe Payments accounts for 2.07%, while LawPay has 1.83%.

- However, that delivers the bulk of the business over 66.93%, being the most commonly used payment solution among these technologies.

- This outlines a distribution that manifests the competition, with Shopify Pay leading on a significant margin while other providers hold lesser shares of the market.

WePay Competitors

| Company Name | Revenue | Employee Size |

| Square | US$17.5B | 3,835 |

| Intuit | US$9.6B | 10,600 |

| Palantir | US$1.9B | 2,000 |

| Crunchbase | US$9.3M | 238 |

| 500 Startups | US$68.0M | 1,695 |

| Stripe | US$7.4B | 4,000 |

| PayPal | US$27.5B | 26,500 |

| Yammer | US$50.0M | 85 |

| Twilio | US$3.8B | 6,000 |

| Xoom | US$159.1M | 200 |

(Source: zippia.com)

- According to WePay statistics, WePay caters to customers from the competitive financial industry technology, a competitive space with major players.

- Square is one of the biggest competitors, with US$17.5 billion in revenue and a staff of approximately 3,835.

- Intuit is another powerful driver in financial software, generating US$9.6 billion with 10,600 employees.

- Another player that has been mentioned is Palantir, which comes in with revenues of a smaller US$1.9 billion with around 2,000 employees.

- Crunchbase is an example of smaller companies making “US$9.3 million with 238 employees,” as well as “With revenues of US$68.0 million,” 500 Startups is a venture capital firm that employs 1,695 people.

- Stripe, which is another leading online payment processor, has an income of US$7.4 billion by employing 4,000 people.

- PayPal tops the competition in this space with an amazing US$27.5 billion in revenue and at least 26,500 employees.

- Yammer earns US$50 million with only 85 employees, while another significant competitor, Twilio, boasts US$3.8 billion and a 6,000-person workforce.

- Xoom, an online money transfer service, also generated US$159.1 million in revenue with 200 employees.

- Each of these competes with WePay in various aspects concerning financial services payment processing and financial software to money transfers and business financing.

WePay Customers Product And Service

(Reference: 6sense.com)

(Reference: 6sense.com)

- WePay statistics reveal that WePay functions in many industries, with higher participation by customers in education-9.

- Community development, case management, and fundraising have 7 customers each, hinting at WePay’s very many applications in social impact activities.

- Therefore, in the technology, marketing, and volunteer sectors, it has another 6 customers apiece, which indicates a good balance in presence among professional and service-based industries.

- This wide distribution proves that WePay can fit in various sectors-from being a financial management tool for education to an enabling technology for nonprofits.

WePay Customers Geography

(Reference: 6sense.com)

(Reference: 6sense.com)

- WePay statistics show that WePay serves customers from multiple countries, most of them being based in the United States, with 652 users there.

- This represents a stronghold in the home market, where it is widely accepted by both businesses and individuals.

- Canada comes second with 23 customers, indicating moderate usage in a nearby country.

- The United Kingdom has 22 customers similarly adopting the solution. In India, 18 WePay customers are indicative of a growing interest in digital payment solutions in that region.

- Eleven customers in Australia indicate a small but significant user base. Italy has 8 customers while Mexico has 7, suggesting a limited but increasing footprint in these countries.

- WePay is still a giant in the U.S. market but is increasingly gradually into the local market presenting different adoption rates across the various regions.

WePay’s Growth And Transformation

- WePay was brought under the umbrella of JPMorgan. It is one of those places that has 250,000 employees.

- WePay statistics reveal that in 2022, WePay had processed nearly 31.8 billion transactions.

- This was a major re-organization in the organization, and that much added to a larger organization but was independently operated.

- The employee morale was found on a roller-coaster ride where the initial thrill would last for about 72 hours, followed by a prolonged period of two to three months of unsteadiness, before finally reaching a status quo.

- Against this, there was a yearlong engagement plan announced by WePay where such events included bringing in the Golden State Warriors trophy.

- JPMorgan’s treasury management with US$6 trillion in daily transactions and an organization having such vast assets, besides asset centers, also has a real estate portfolio of which one in three buildings is owned by JPMorgan Asset Management in the Bay Area.

- The acquisition by JPMorgan Chase of WePay saw many organisational changes and many other lines being drawn in the growth of the company.

- This implies a 1000 times increase in the size of the company, which goes from 200 employees to 250,000 employees.

- In the first time after the acquisition, staff increased by 50% in the first year after the acquisition.

- WePay statistics indicate that Chase Merchant Services, the department where WePay integrated, already has a process throughput of US$1.2 trillion annually.

- WePay statistics state that JPMorgan Chase is a financial institution reporting US$100 billion in revenues and US$30 billion net income, serving 4 million small business customers and maintaining relationships with half of U.S. households.

- The institution has 250,000 employees, of which 50,000 are software engineers.

- WePay’s employee engagement scores improved in two studies conducted post-acquisition, and employee attrition decreased from the employee’s viewpoint.

- However, the leadership team claims that budgets, tools, and systems are usually retained to guarantee the operational independence of WePay in the larger institution.

- JPMorgan Chase is further expanding its footprint in FinTech with a FinTech campus for 1,000 employees in Palo Alto.

- Leadership at WePay believes that faster settlement and new financial services can be realized by combining product payment and banking services.

WePay’s Financial Overview And Capital Structure

- According to WePay statistics, WePay’s financial portfolio comprises some indicators through which one can gauge the financial health of the concern.

- As of January 19, 2025, the capital authorized for the company is ₹3.00 crore- the maximum amount of capital that the company can legally mobilize through the issuance of shares.

- The paid-up capital, which stands at ₹2.64 crores at the above-stated date and means the actual capital investment made by shareholders, signifies that nearly the entire authorized capital has been consumed.

- The most recent filing with the Registrar of Companies (ROC) occurred on March 31, 2023, proving the company’s compliance with the law and proper, timely financial reporting.

- In terms of financial commitments, WePay has open charges amounting to ₹17.22 crore on January 19, 2025.

- Open charges may refer to liabilities which are yet not paid or borrowings for the company. On the other hand, satisfied charges are worth ₹96.57 crore.

- They indicate the amount of money or liability that has been paid back to the company. This points to a strong history of repayment and stable financial health.

Conclusion

WePay, a JPMorgan Chase subsidiary, is still firmly within the niche category of payment processors. Even in the strangled face-off among giants such as PayPal, Stripe, and Square, WePay uniquely caters to different markets, especially education, community development, and fundraising. With this acquisition, WePay saw an expansion of workforce and integration into Chase Merchant Services (which processes US$1.2 trillion annually). According to WePay statistics, WePay is dominant in the U.S., with limited acceptances in Canada, the UK, and India.

The strong financial health of WePay is confirmed in that its income statement shows a stable repayment history and capital structure, positioning it for future growth within the broader FinTech strategy of JPMorgan.

Sources

FAQ.

Founded in the U.S., WePay is an online payment service provider that provides integrated and customisable payment solutions via APIs. It services platform businesses like crowdfunding sites, marketplaces, and small business software firms. It also provides partners with fraud and risk protection.

WePay has a tiny market share of 0.16; Shopify Pay has a 66.93% majority. Other competitors include Klarna (6.21%), CardinalCommerce (4.19%), Razorpay (2.41%), and Stripe Payments (2.07%). PayPal is leading in revenue with US$27.5 billion per annum.

WePay recorded increased growth after being acquired by JPMorgan, going from having a staff of 200 to 250,000. Engagement levels soared, and attrition was reduced while operational independence was still maintained. Chase Merchant Services, which, together with WePay, has a US$1.2 trillion annual processing value.

WePay is focused on industries such as education, community development, case management, and fundraising. Geographically, it is most prominent in the United States (652 customers), followed by Canada (23), the UK (22), and India (18), with slow international growth.

WePay had authorised capital of ₹3.00 crore and paid-up capital of ₹2.64 crore on January 19, 2025. Its unpaid liabilities also amount to ₹17.22 crore, while fully satisfied debts stood at ₹96.57 crore, which shows its excellent repayment history.

Saisuman is a skilled content writer with a passion for mobile technology, law, and science. She creates featured articles for websites and newsletters and conducts thorough research for medical professionals and researchers. Fluent in five languages, Saisuman's love for reading and languages sparked her writing career. She holds a Master's degree in Business Administration with a focus on Human Resources and has experience working in a Human Resources firm. Saisuman has also worked with a French international company. In her spare time, she enjoys traveling and singing classical songs. Now at Smartphone Thoughts, Saisuman specializes in reviewing smartphones and analyzing app statistics, making complex information easy to understand for readers.