eToro Statistics By Revenue, Users ,Geography And Product (2025)

Updated · Jul 02, 2025

Table of Contents

Introduction

eToro Statistics: eToro has matured to become one of the most successful all-around trading platforms worldwide for both retail and institutional trading in stocks, cryptocurrencies, commodities, derivatives, and much more. Known for its social trading features, such as CopyTrader and Smart Portfolios, eToro has done great to democratise investing for millions of users all over the world.

More importantly, the year 2024 was a flagship year for the organisation in terms of synonymous growth both in revenue and the number of users and assets under management (AUM). This article accurately states the in-depth eToro statistics in terms of significant numbers and trends.

Editor’s Choice

- According to eToro statistics, eToro’s revenue in 2024 skyrocketed to US$931 million, which translates to an increase of about 48 percent from 2023, driven by strong trading activity in cryptocurrencies and equities.

- In 2024, eToro’s commission income increased to 45.6% year-over-year, where 38% comes from cryptocurrency trading and 38% from equities.

- This brings eToro’s net profit in 2024 to US$192 million, up from US$15.3 million in 2023.

- eToro’s funded accounts rose to a total of 3.5 million, representing 14% of last year’s figure, while its assets under management (AUM) increased by 73% to US$16.6 billion in 2024.

- eToro statistics show that more than 40% of eToro’s revenue will come from cryptocurrency trading in 2024, with more than 25% of that coming from the fourth quarter, partly due to the spike in Bitcoin.

- By 2024, eToro’s total global user base grew to over 30 million registered users as a result of more and more people being interested in its social trading features, such as CopyTrader and Smart Portfolios.

- eToro’s international presence is such that out of all the funded accounts, 70% are from Europe and the UK, 16% from the Asia-Pacific region, and only 10% from the Americas, including the U.S.

- There were considerable ups and downs in the valuation of this company, such as from US$0.8 billion in the year 2018 to US$10 billion in the year 2021, but it fell to US$3.5 billion in the year 2023 because of poor market conditions and shifting investor mindsets.

- eToro statistics reveal that of the total revenue, eToro earns about 87% from the fees for the spread, and primarily operates through the B2C model.

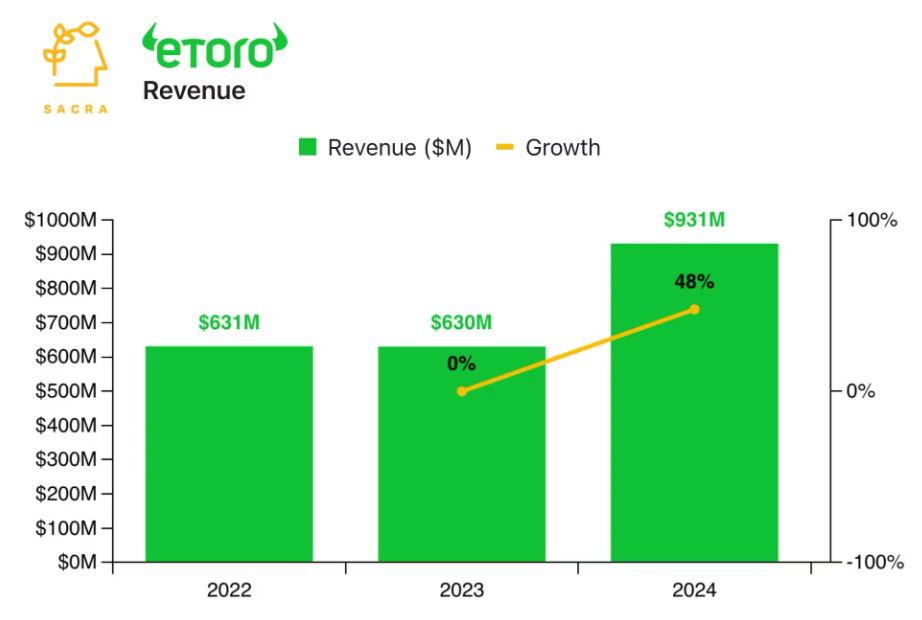

eToro Revenue

(Source: sacra.com)

- eToro’s revenue performance was depicted here for the last three years. Revenue in 2022 stood at US$631 million. In 2023, revenues went down to US$630 million, showing almost negligible growth.

- However, 2024 saw great recovery as revenues shot up to US$931 million, reflecting a robust 48% rise from the previous year.

- This surge hints at substantial momentum for the business, with activity likely driven by increased trading, especially in cryptocurrencies and equities, accompanied by growing user numbers.

eToro’s 2024 Financial Surge and IPO Ambitions

- In 2024, the Israeli fintech company eToro saw substantial financial growth and advanced a step closer toward an IPO.

- eToro statistics reveal that as per the latest IPO prospectus filed with the U.S. SEC, eToro had collected US$931 million worth of commission income, a 45.6% year-on-year growth.

- The income has come from a multitude of asset classes: 38% (US$353.8 million) arose from cryptocurrency trading; 38% (US$353.8 million) from equities trading; 20% (US$186.2 million) from commodities; and 4% (US$37.2 million) from currencies.

- In comparison, eToro’s commission income had grown steadily from US$639 million in 2023 and US$632 million in 2022.

- The last quarter of 2024 looked good for eToro, and surging commissions, which peaked at US$303 million, were directed chiefly by Bitcoin regaining its US$100,000 status.

- In terms of profitability, a whopping Pareto: from US$192 million profit in 2024, compared to US$15.3 million in 2023, and back from a loss of US$21 million in 2022.

- The platform registered strong user growth. The number of funded accounts amounted to 3.5 million, showing a 14% growth against the previous year, and assets under administration ballooned to US$16.6 billion, reflecting a 73% year-on-year increase.

- eToro’s IPO ambitions have found new winds. It has applied to go public on Nasdaq via the ticker “ETOR”, focusing on IPO proceeds of US$300-US$400 million at a pre-money valuation of about US$4.5 billion.

- As per media speculation, the final valuation may touch close to US$5 billion, owing to strong investor interest. This is not eToro’s first time trying to go public.

- A preplanned merger with a SPAC valued at US$10.4 billion was scrapped last year owing to market conditions.

- In 2023, the company raised US$250 million at a valuation of US$3.5 billion. The company’s plans were then somewhat hindered by regulatory scrutiny.

- In 2023, eToro’s UK unit settled with the SEC and paid a US$1.5 million fine for acting as an unregistered broker and clearing agency.

- As a result, cryptocurrency trading in the U.S. is currently limited to Bitcoin (BTC), Bitcoin Cash (BCH), and Ether (ETH).

eToro Registered Users

(Reference: statista.com)

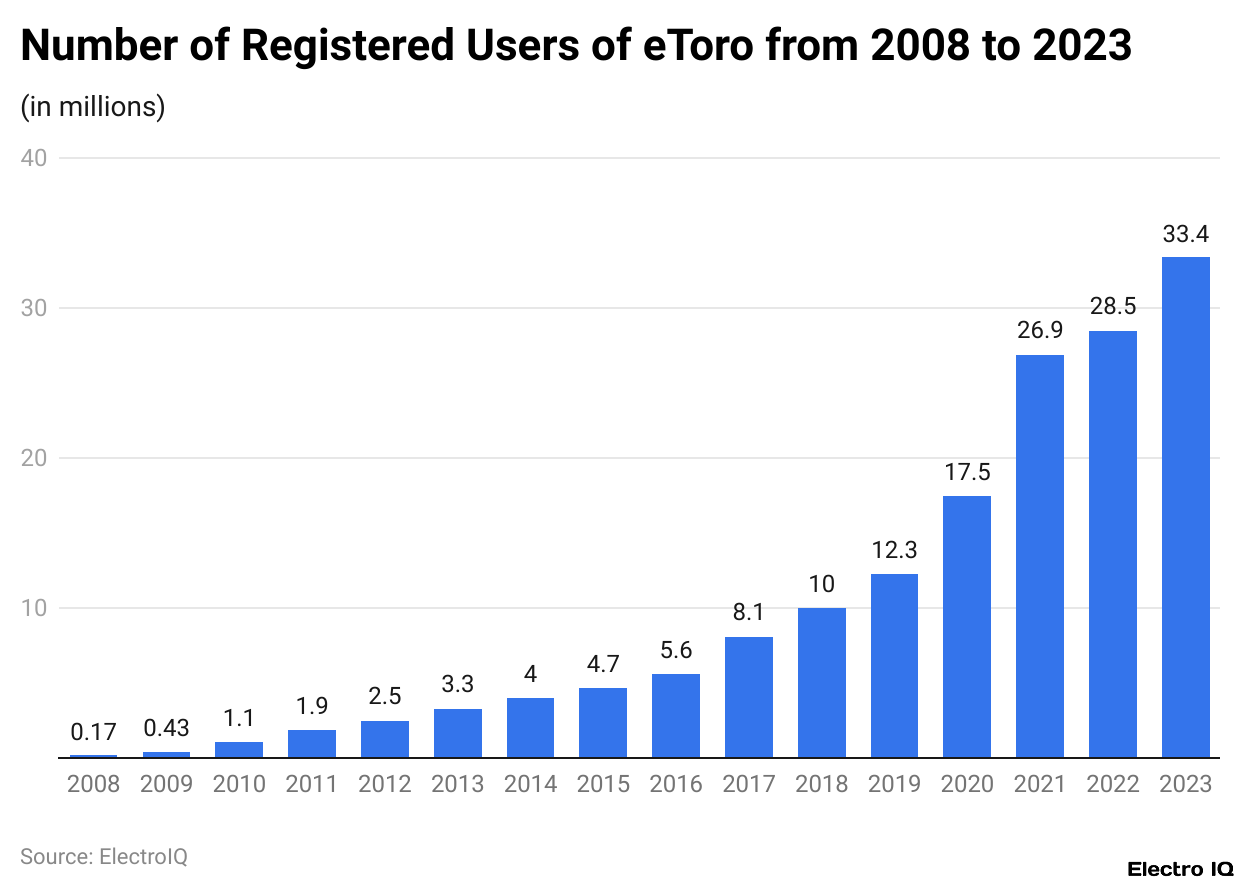

- Big milestone in 2010: eToro hit its million registered users mark. Significant considering it was still the beginning of online trading, and social trading was an emerging concept.

- Since then, the platform has undergone a consistent, substantial increase in its user base. From one year to the next, eToro enlarged its offering by adding stocks, cryptocurrencies, commodities, etc.

- It served a large number of people who were moved by the potential of global investing.

- The user base tripled due to the user-friendliness of the site, an innovative feature, CopyTrader, and more cohorts globally interested in online investing.

- eToro statistics show that the most recent figure is more than 30 million registered users worldwide.

- This growth indicates both the increasing trends of digital trading platforms and eToro’s ability to take itself to scale while appeasing all investor experience levels.

eToro Net Crypto Revenue

(Source: fxnewsgroup.com)

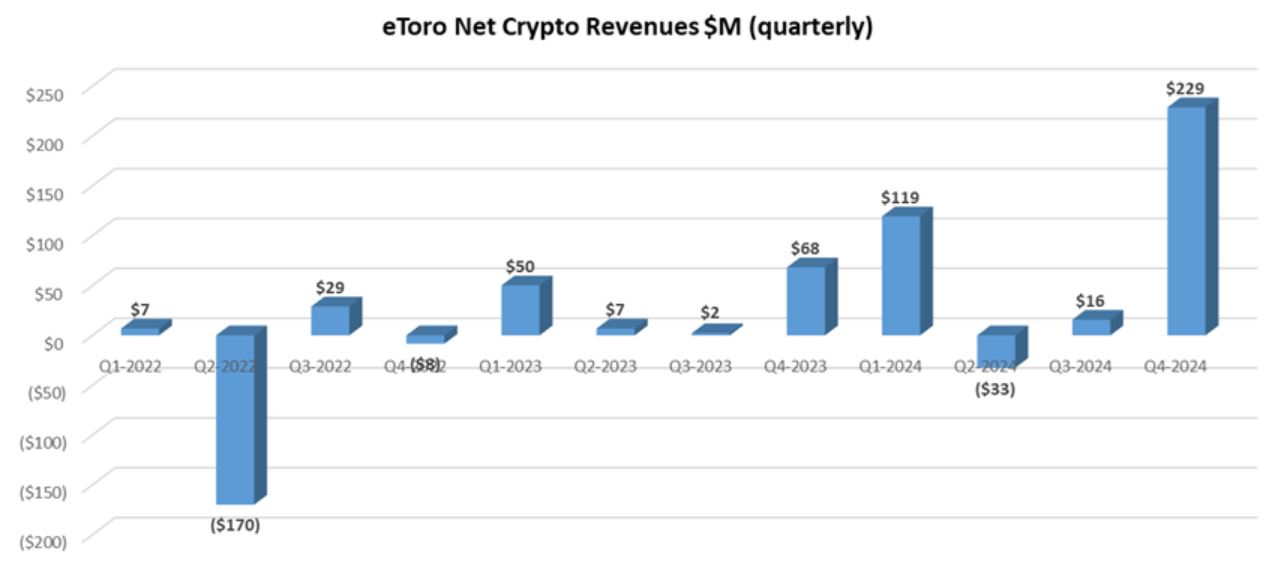

- eToro statistics indicate that in 2024, trading in cryptocurrencies was among the most important drivers for the growth of eToro’s revenue.

- Over 40% of the total company revenue for the year stems from crypto-related activities, thus emphasising the importance of digital assets for the platform’s business model.

- In sharp contrast, revenue in the “core” revenue model- client trading in traditional assets, including equities, commodities, and currencies- increased at a modest 7% compared to the previous year and even decreased compared to levels recorded in 2022. This shows that despite eToro’s core asset classes being relatively more famous, they did not significantly boost overall revenue growth.

- Quarter four of 2024 was particularly pronounced. It followed the election in November of U.S. President Donald Trump when the major crypto market saw a surge in all fronts, especially Bitcoin, which crossed US$100,000 in value.

- Therefore, more than 25% of the total annual revenue was derived from Q4 alone. This last quarter also most probably accounted for more than 100% of the net profit for the whole year of the company, suggesting that the profit from previous quarters could have been small or offset by expenses, and it was the year-end crypto rally that shot eToro into a solid profit allocation.

eToro Geography

(Reference: fxnewsgroup.com)

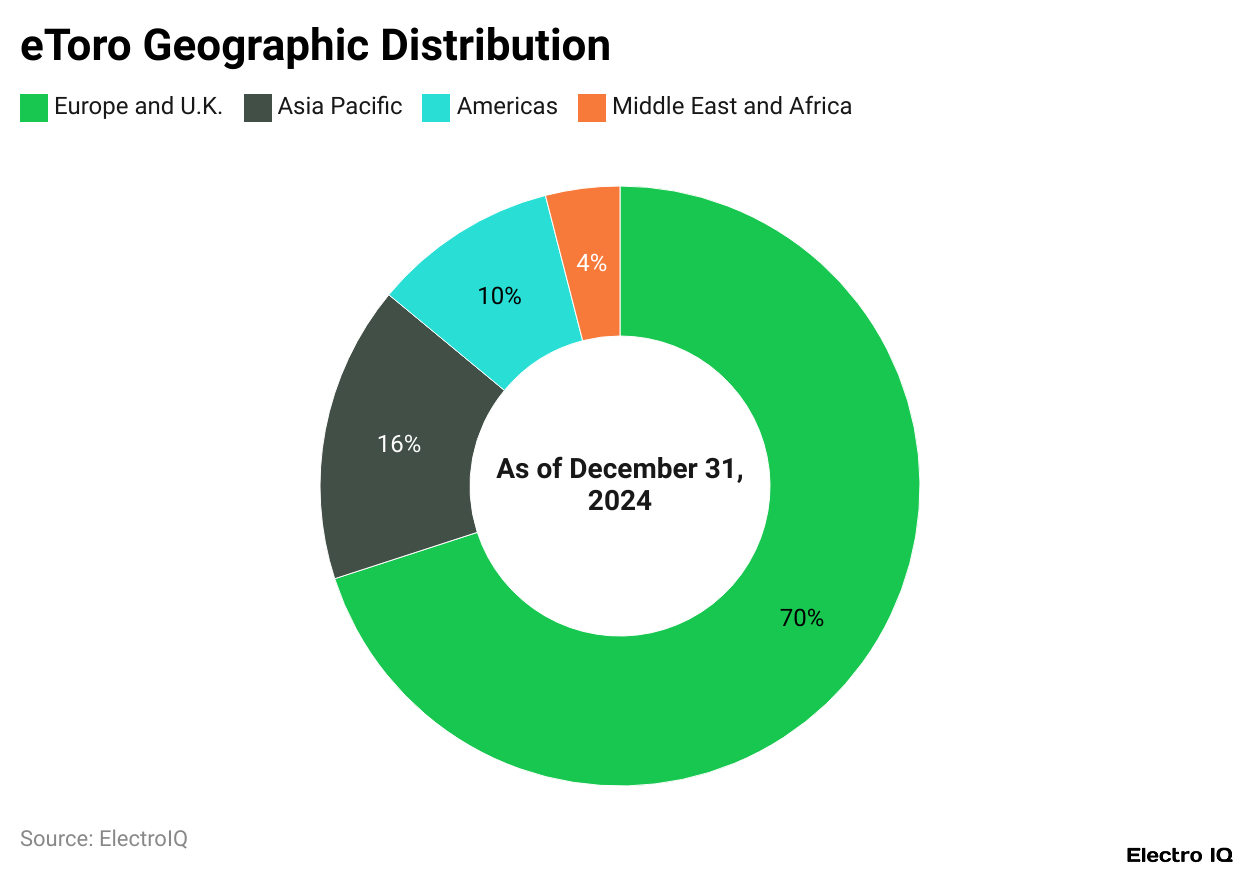

- eToro statistics show that eToro is continental, with about 70% of funded client accounts located in Europe and the UK. However, it still reflects an 80.0% presence in the customer base in the Asia-Pacific region, as only 10% of the funded clients come from the Americas, including the United States.

- This dispersion indicates that Europe is still the strongest market for eToro, but the company is busy working to bring itself up in other regions.

- Specifically, the company is investing massively in Asia-Pacific expansion. Having come into this area of that continent in 2016 when it opened in Australia, the company has continued looking towards building its brand and user base in this continent.

- In an attempt to consolidate its position, the company acquired the Australian investment app Spaceship, with the deal expected to close in November 2024. This acquisition is viewed as a strategic means of increasing its market share in Australia.

- Within Singapore, eToro has also gained In-Principle Approval for a Capital Markets Services license from the Monetary Authority of Singapore.

- Furthermore, the license will be activated in 2025 after completing some regulatory requirements as the company continues its progress to expand services in Southeast Asia.

- In the Americas, which includes both the U.S. and Latin America, eToro started its operations in 2019. Initially, its U.S. platform focused exclusively on crypto assets and social trading features such as copy trading.

- Since then, it has broadened such offerings to include equities, exchange-traded funds (ETFs), and options trading, showing a clear intention to compete more seriously in the North American market.

- eToro was also recently launched in the United Arab Emirates in November 2023 and plans to develop a much larger footprint in the Middle East region.

- This is an area that the company identified as having great possibilities for growth, and it is intensifying efforts to establish a stronger presence through localised services and regulatory engagement.

eToro Valuation

| Year |

Valuation ($bn)

|

| 2018 | 0.8 |

| 2020 | 2.5 |

| 2021 | 10 |

| 2022 | 8.8 |

| 2023 | 3.5 |

(Source: businessofapps.com)

- This is the value journey of eToro from the year 2018 up to the year 2023, which describes how market conditions and company performances affected investors’ perceptions during these years.

- Back in 2018, eToro was valued at US$0.8 billion, signifying its early-stage fintech. However, by 2020, the valuation blew up to more than thrice that amount, estimated US$2.5 billion, perhaps attributed to soaring online trading facilitated further by the pandemic and global user adoption.

- It peaked in 2021 when eToro reached US$10 billion, owing to a frenzy of fintech interest and a planned but later cancelled merger with a SPAC.

- The next year, it saw a little drop to US$8.8 billion, still echoing a strongly present market but also initial indications of cooling enthusiasm in the fintech space.

- eToro statistics show that the year 2023 saw a heavy decline, with a value indicating a 60%-plus drop from the 2021 peak to US$3.5 billion due to tightening global conditions that changed investor sentiments and the cautious clutch of funds across tech and crypto entities.

eToro Product Statistics

- One of them is eToro, which has a community investment feature that turns an isolated investment activity into something that a community can thrive on.

- So trading can now be done across different asset classes, including ETFs, stocks, cryptocurrencies, commodities, currencies, and options, as well as copying successful investors’ strategies automatically.

- CopyTrader first came up in 2010 at the center of eToro’s innovations. Users allocate a minimum amount of at least US$200; as such, the system automatically copies what top traders do in real time.

- The copier trades are essentially based on the investment amount, so if a trader buys Apple stocks, the same transaction takes place in the copier’s portfolio. This feature is available to people who have no deep financial knowledge, thus making advanced trading strategies accessible to newcomers without owning a defined portfolio.

- The next thing that goes along with eToro’s very successful trade copying is its highly social nature. Investors enter into a social feed, which is similar to the likes of Twitter, where opinions and insights about the market and what is happening with specific assets are shared.

- Someone interested in tech, for example, can follow traders who place trades on some stocks from technology and see their trades and commentary before deciding whether they would like to stop them.

- For those not too keen on the level of hands-on approach eToro provides, Smart Portfolios are also available. These have investment bundles constructed around specific thematic areas these days, like AI or green energy, and require entry into these portfolios at US$500 for minimum investments with a thematic investment strategy.

- eToro’s multi-asset offering allows users to invest in instant fractional shares of U.S. stocks commission-free, trade cryptocurrencies with a 1% spread fee, and access CFDs in non-U.S. markets for margin trading or short-selling.

eToro Business Model

- eToro is a B2C business model quite diversely drawn from monetising trading activity and developing strong network effects using its social investing features.

- eToro statistics reveal that, unlike other brokerages, which charge a flat commission per trade, most of eToro’s earnings—around 87%- come from spread fees, which are charges for the difference between the buyer (bid) and seller (ask) prices during trades over everything else.

- For cryptocurrency transactions, eToro applies a spread fee of 1%, and the rest of the structure varies with other asset types.

- All trades treated as crypto are required to be reported using the full value for the traded assets, not only the fee portion, as a condition of being subject to IFRS accounting standards, thus totaling US$12.6 billion by 2024. This accounting system may be problematic in comparing eToro figures.

- eToro sells itself mostly by charging additional fees for ongoing overnight or weekend holding of leveraged CFD enterprises, foreign exchange conversion fees ranging from 0.25% to 3%, a US$10 inactivity charge for dormant accounts monthly, and US$5 withdrawal fees.

- However, with rising interest rates, this condition has changed, and interest income on customer balances has also constituted a significant part of the total, up to US$50 million in Q4 2024 or 20% of total revenue for that quarter.

- A key competitive advantage of eToro is its Popular Investor Program, which works like a two-sided marketplace.

- They could earn up to 1.5% annually from the assets copied by others from the top-performing traders. Such a structure will ensure that efficient investors keep coming back to the platform because they attract those followers who trade and deposit more, further increasing eToro’s revenue. From the customer segmentation perspective, it is easy to find a subclass.

- The top level is called the “Diamond” tier, created from mainly Generation X investors aged close to 45, with average deposits of around US$478,000. This group is highly profitable and much more loyal, with a monthly churn rate of just 1.5%, in comparison to 2.8% for new low-tier customers.

- However, one of the biggest bottlenecks remains to convert users- just 6.4% of registered users were funded account holders in 2021. eToro’s business model has gradually evolved over the years.

Traditional Brokerages And Global Players

- According to eToro statistics, the old-fashioned brokerage firms such as Schwab and Fidelity do offer zero-commission trading, albeit with the panel of strength leveraged onto their balance sheet in the case of Schwab, which has about US$8.8 trillion in client assets compared with Robinhood’s US$118 billion.

- They earn greater interest income and cross-selling opportunities from this. These incumbents nearly all had high-value customers but lost low-balance accounts to mobile-first platforms, thereby bringing very little dent on their overall economics from the loss of commission revenue.

- Comprehensive product offerings, resource-intensive research, and an established reputation create significant barriers to be crossed for new platforms such as eToro.

- FOREX.com competes head-on with eToro in the forex and CFD market and operates a model focusing on currency and CFD trading in 180 countries; it intends to attract more professional traders, while eToro offers retail investors an opportunity.

- eToro has a more widespread global presence in 74 countries, which gives it a competitive advantage based on geographical diversity, decreasing dependence on a single market.

- Yet, it also comes with the challenge of navigating complex regulatory environments across multiple jurisdictions, a challenge that U.S.-focused competitors do not face.

eToro Key Risks and Challenges

- Historically, changes in market conditions have caused a marked influence on eToro’s financial performance. This is particularly strong in the case of the cryptocurrency market segments.

- For the extremes of that tendency, 2018-2019 provides the most powerful example, where EBITDA fell from US$193 million in the case of the company to just US$11 million, indicating very close exposure to declines in trading activity.

- A similar regression could very much repeat if there is a falloff in the excitement around crypto markets or if interest rates drop drastically from their current levels.

- In the U.S. market, hence, eToro has yet to make up a very large hurdle despite serious investments; it hardly entered the space offering actual stock trading in 2022, way behind well- established players like Robinhood, which already serve the strong competition of brand name recognition combined with user loyalty.

- It is even less than the growth impact of this late entry; eToro, with 3.5 million funded accounts, is no match to the 25.2 million of Robinhood.

- It is also another disadvantage to have only 10% of its user base from the Americas, although the U.S. constitutes the largest retail investment market in the world.

- eToro statistics reveal that operating in 74 different countries also presents considerable regulatory complexity. It would have had to comply with a range of legal and compliance requirements, meaning its operational costs would be high, and the manner under which it conducts its business would also be restricted.

- The newest findings at the SEC regarding broker-dealer obligations and handling accounts-in-use and capital requirements stress the real-time challenge of compliance here.

- The interesting thing is that eToro’s Russian shareholder, Sberbank, happens to be sanctioned globally. Hence, Sberbank cannot vote, sell shares into the account, or receive dividends and acquire new shares, adding to legal and governance complexities.

Conclusion

As per eToro statistics, the company held its position as a leading global online trading platform in 2024, offering a wide range of assets and features, such as CopyTrading, which attracts millions of users. With its continued revenue growth, a commendable increase in user activities, and a growing focus on cryptocurrencies and social trading, eToro is at the forefront of tomorrow.

The ability to adapt to online trading market trends and technologies will be eToro’s key to growth and preserving its position in the financial market.

FAQ.

In the calendar year 2024, eToro revenue jumped 48% to US$931 million on the back of increased trading activity arising from the firms’ focus on a myriad of investment instruments, especially cryptocurrencies and equities. In this context, let it be appreciated that the company derived—38% from cryptocurrency trading, the vast amount being attributed to the buoyant performance of Bitcoin in Q4.

The company operates a B2-C business model, focusing on capitalising on the users’ trading activity. Approximately 87% of eToro’s revenue is derived from fees on spread-the difference between the prices at which one can buy and sell each individual trade. eToro charges a 1% spread on cryptocurrency trades, with the spread on the rest of the asset types varying.

The company has witnessed staggering growth in its user base since its inception, touching over 30 million registered users around the world in 2024. It first went over the 1 million user mark in 2010 and has since expanded its service range to incorporate equities, crypto, and commodities appealing to all categories of investors.

eToro is present in 74 countries, with Europe being its largest market, where 70% of its funded accounts are located. The Asia-Pacific region comprises 16% of its clients, while only 10% comes from the Americas. eToro is actively expanding in Asia-Pacific and has taken recent steps, including acquiring the Australian investment app Spaceship and obtaining regulatory approval in Singapore. The company also aims to expand its presence in the Middle East, particularly in the UAE.

The company surely faces its fair share of risk, the major one being eToro’s sensitivity to market volatility, clearly seen in the cryptocurrency market. While a downturn in crypto trading would negatively impact revenues, the same could be said should an interest rate move occur. Internally, eToro has been facing hurdles while working in the US market since it perhaps entered the trading of stocks in this market late when compared to others, like Robinhood, which could inhibit its growth further.

Joseph D'Souza founded ElectroIQ in 2010 as a personal project to share his insights and experiences with tech gadgets. Over time, it has grown into a well-regarded tech blog, known for its in-depth technology trends, smartphone reviews and app-related statistics.