BOPIS Statistics By Sales, Grocery, Consumer Use and Preferences

Updated · Jul 11, 2025

Table of Contents

Introduction

BOPIS Statistics: In 2024, Buy Online, Pick Up In-Store (BOPIS) has come into its own as the omnichannel retailing linking together the virtual and physical stores. This hybrid model accommodates consumers who want time flexibility, cost savings, and instant gratification in getting products.

With the growth of e-commerce and shifting consumer behaviors, BOPIS became an important cog in the omnichannel retail wheel. This article delves into the latest BOPIS statistics, trends, and insights behind the environment in 2024.

Editor’s Choice

- With a market share of 10.2% globally in 2024, BOPIS has been showing steady growth and increasing adoption in the retail scene.

- Click-and-collect retail sale in the U.S. is expected to reach US$154.3 billion by 2025 at a CAGR of 16.1% for five years.

- In North America, BOPIS constitutes 10.3% of total e-commerce revenue, against 9.64% globally.

- 87% of merchants now offer BOPIS as one of their core fulfilment options.

- More than 67% of people who pick up their orders in stores buy something extra at the counter, increasing the store’s revenue.

- 84% of U.S. online grocery shoppers use the BOPIS option at least once per month, while 24.5% place orders multiple times a week.

- For groceries, one is 42.3% more likely to select BOPIS over curbside pickup. BOPIS is most often used for deli meat and cheeses (50%) and least for frozen foods (31%).

- Speed of order readiness (49%) and lack of space for in-store pickup (44%) top the list of difficulties for implementation by retailers.

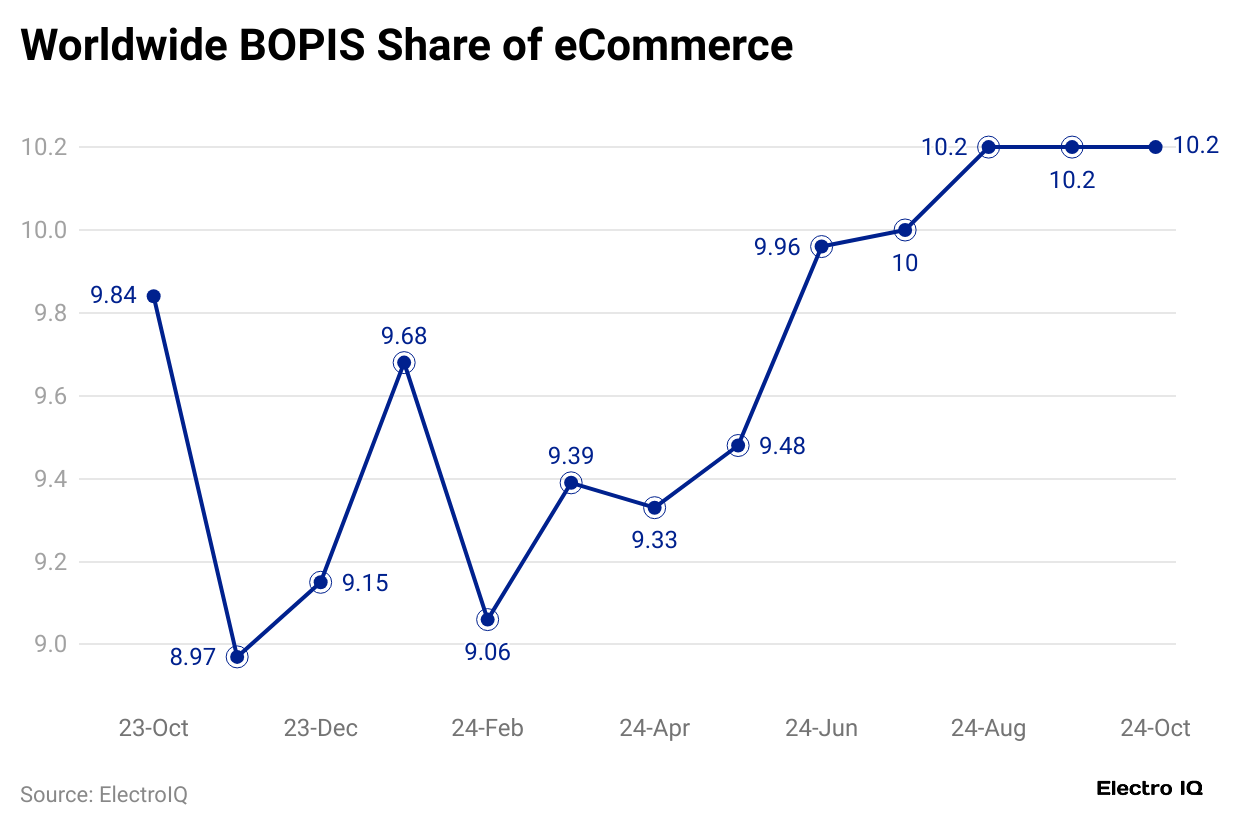

- As per Capitaloneshopping, BOPIS statistics data here compares the global shares for BOPIS from October 2023 to October 2024. This shows a gradual but steady increase in adoption.

- In October 2023, the share of BOPIS was 9.84%, falling to its lowest point in this period, 8.97% in November, possibly on account of seasonal behaviour change or other external factors affecting early holiday shopping attitudes in consumers.

- December recorded a slight recovery to 9.15%, as BOPIS was favoured by a greater number of consumers for last-minute holiday shopping.

- From January 2024, BOPIS share started increasing steadily, at 9.68%.

- February witnessed a slight fall to 9.06%, but the bigger picture from March to October 2024 remains one of growth and stabilisation.

- March recorded 9.39%, April 9.33%, and May 9.48%, followed by a huge spike to 9.96% in June. July marked the beginning of BOPIS getting into double digits at 10.0%, stabilising thereafter through August, September, and October at 10.2%.

- The trend can be argued as portraying growing confidence and reliance on BOPIS by the infrastructure set-up being better by retailers, the customers being more familiar, and the demand for such a flexible shopping option being continuous.

- The double-digit figures sustained in the past four months portray BOPIS as a new normal and strategic way of global retail experience.

BOPIS Sales Statistics

- The data throws into the limelight the fast-growing importance and rapid rise of BOPIS (Buy Online, Pick Up In-Store), click-and-collect in the retail and e-commerce scene, mostly in the United States. BOPIS channels continue their rise to acceptance at a much faster pace than overall e-commerce sales, suggesting that shoppers are indeed embracing this channel with fervour.

- In 2025, click-and-collect purchases in the United States are estimated to make up 10.5% of all e-commerce sales, which will increase to 13.5% by 2030.

- Globally, BOPIS accounts for 9.64% of total e-commerce revenue, and in North America, it has risen even higher to over 10.3%, suggesting that the region has become the hub of higher adoption.

- S. click-and-collect retail sales amount to US$154.3 billion in 2025, marking a 16.2% increase from the previous year, further demonstrating the growing consumer demand and adoption of the model.

- By 2030, the number will likely rise to US$335.9 billion, emphasising further growth and demand in the model.

- Another factor that proves sustained interest and investment in this channel is a five-year 16.1% CAGR for click-and-collect sales in the U.S. for the 2020-2025 period.

- Profoundly noteworthy is the 108.9% growth in BOPIS sales revenue from 2019 to 2020, largely powered by the pandemic-driven transformation in consumer behaviour.

- These growth rates show that BOPIS is on its way to becoming a well-established, long-term behavioural adaptation. Its retailer uptake is also considerable, with 87% of retailers now incorporating BOPIS into their fulfilment solutions.

- The channel’s growth is being fostered with wide implementation, offering customers much more flexible and efficient avenues to shop while giving retailers more options for increasing engagement both online and in the stores.

Click and Collect Retail Sales

- Retailers take click-and-collect very seriously insofar as the evidence of growth and strong acceptance is concerned, so much so that there’s no doubt about its continued proliferation and popularity.

- By 2025, click and collect is expected to account for 10% of physical retail sales, proving that this is not a fad but a permanent shift in consumer behaviour.

- In the US, 67% of consumers say they have tried click-and-collect at least once, denoting the widespread adoption.

- Currently, among retail eCommerce sales, click-and-collect accounts for 9.1%. There are concrete benefits for retailers as well: Since retailers have implemented click-and-collect, 34% have observed their in-store sales grow.

- An additional 67% of customers who went to the store to collect their orders ended up making extra purchases, underscoring the method’s effect on generating those impulse buys, thereby enhancing the basket size.

- In 2023 alone, U.S. shoppers spent US$113.19 billion on click-and-collect, an 18.1% increase even on an annual basis. That figure is expected to rise to US$154.30 billion by 2025, which clearly shows that the upward trend shall continue. Click-and-collect preference is, thus, growing.

- Approximately 23% of online shoppers worldwide now prioritise click-and-collect over home delivery, citing convenience and speed. 42% of consumers say they are more likely to use click-and-collect services than previously.

- May 2020 witnessed a sharp increase in in-store pickup, rising by more than 554% year over year, illustrating how external events such as the pandemic hastened adoption.

BOPIS Statistics By Consumer Use & Preferences

- In fact, consumer behaviour regarding BOPIS is ever-changing and increasingly flexible toward fulfilment options. Preferred by two-thirds of U.S. millennials, curbside pickup has, in recent times, become the most chosen way, way more so than the older generation, who use these options less often.

- Buyers in small numbers are using it to purchase a dizzying array of different items. Roughly one in four shoppers say that they use BOPIS mostly for non-grocery items, while around 22.6% of people also opt to pick up groceries purchased online, showing that click-and-collect extends over various retail categories.

- According to eMarketer’s latest BOPIS statistics forecast, click-and-collect inside pickup will be utilised by 64% of consumers by 2024, with curbside pickup picking up support by 48%.

- On top of that, latch or kiosk pickup might witness an increase, with about 38.3 million such orders predicted by year’s end, accounting for 25.4% of all click-and-collect transactions.

- Currently, only some 10% of consumers say that they actively want locker pickup despite the survey indicating much greater interest in the channel: 77% of online shoppers would “willingly” use locker pickup services for convenience.

- Of these, 53% are interested in locker pickup because the lockers are conveniently located, 50% like the flexible pickup hours, and 40% are simply trying to avoid waiting in line.

- The other factors cited include safe receipt of packages (35%) and contactless pickup (26%).

- Curbside pickup is still quite rare for returns, with only about 4.34% of shoppers reporting that they have returned an item using it. However, lockers have a much greater interest when it comes to returns.

- About 76% of consumers would consider using lockers for returns for similar reasons: 52% cited the convenience of locations, 46% the flexible hours, and 41% cited the avoidance of lines.

- Further, 41% feel more secure knowing that the return is received directly, and 27% prefer that the lockers provide a contactless experience. Speed of service is another driving factor for consumer gratification when it comes to BOPIS.

- A quarter of the buyers expect to be able to get their purchases within one to four hours after purchase.

- Some stores expect around 14% expect under two, whereas 20% can wait for more than eight hours.

- Such expectations tend to make retailers streamline fulfilment processes in order to stay competitive and fulfil the consumer demand for immediacy.

BOPIS Grocery Statistics

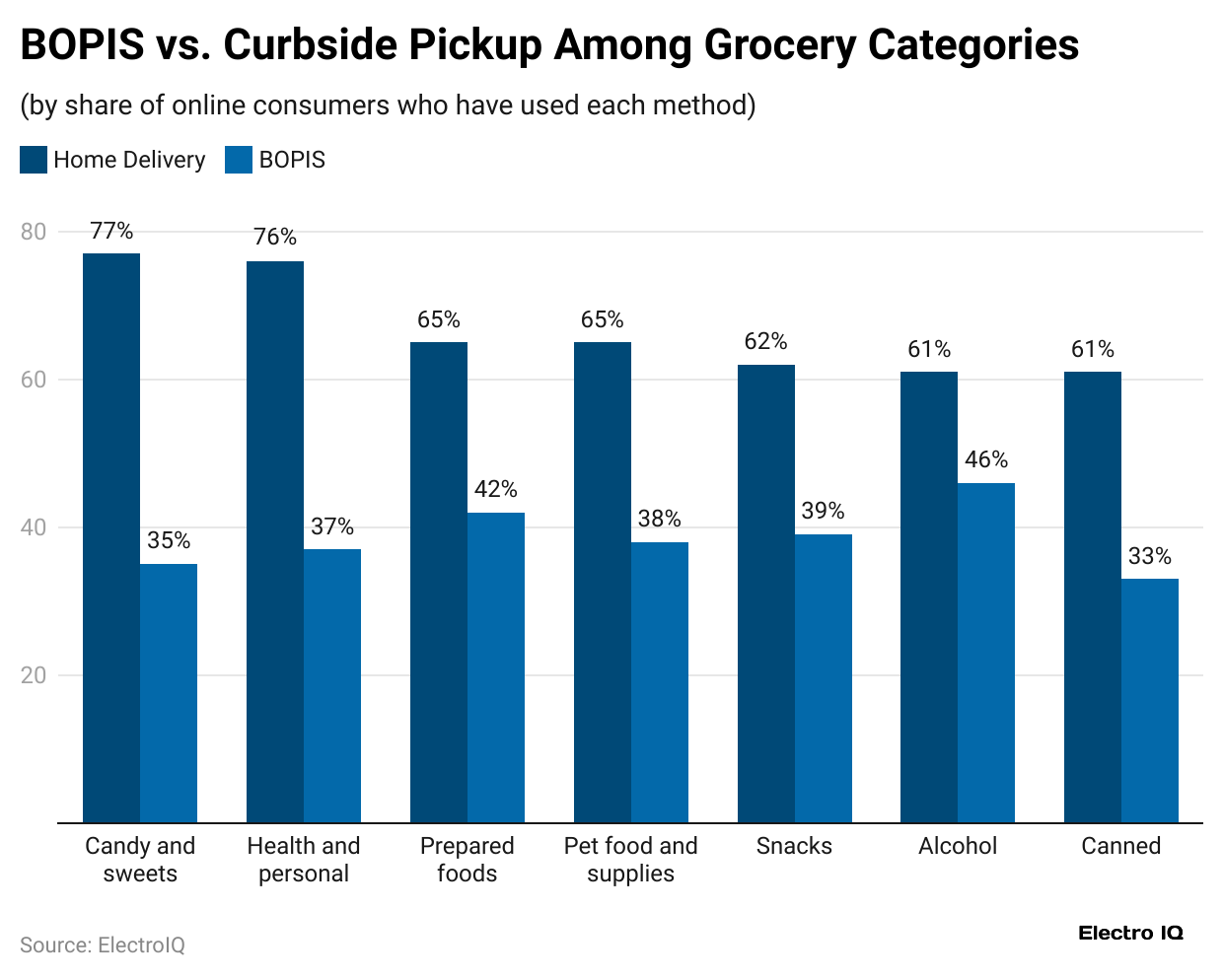

- BOPIS (Buy Online, Pick Up In-Store) has grown much in prominence in the online grocery shopping experience in the United States, though the most preferred fulfilment method is still home delivery.

- Despite this, BOPIS is far more used among grocery shoppers than curbside pickup, showing a clear inclination to physically enter the store for pickups.

- Up to 84% of online grocery shoppers in the United States used BOPIS at least once a month, as of 2024. The BOPIS frequency is also quite notable, with 53% of these shoppers using BOPIS at least once per week, and 24.5% multiple times per week. This means BOPIS is not a mere secondary convenience alternative but rather a primary routine for many shoppers. This model also creates incremental revenue for retailers.

- About 44% of grocery BOPIS consumers end up purchasing extra items on their trip. 24% of these people enjoy browsing the store while also purchasing incremental items, and, in contrast, the other 20% at times simply drop additional items into their carts as they pay at the counter without any strolling around the store.

- So there is a big BOPIS potential here to increase in-store sales beyond the original online order.

- In terms of so-called preferences, online grocery shoppers are 42.3% more likely to choose BOPIS over curbside pickup, though they remain 59.1% less likely to use BOPIS when compared to home delivery, which is still the biggest player in grocery fulfilment.

- Another factor influencing BOPIS use is product selection. BOPIS is most used to buy deli meat and cheese, with 50% of online shoppers going BOPIS in these two categories.

- At the other end of the spectrum for BOPIS is frozen food, with only 31% of online shoppers picking up frozen goods in the store.

- This possibly shows that the consumer is doubtful about the quality or logistics of picking up frozen goods, maybe due to concerns over temperature control or freshness.

BOPIS Implementation Challenges

- Implementing a BOPIS system comes with a range of operational and logistical challenges for the retailer.

- The most frequent problem, reported by 49% of the firms, is that orders take too long to be ready for pickup. The longer the wait, the less happy customers are and the less efficient the store is.

- Another big problem that 44% of retailers have cited is the lack of dedicated in-store space so that online orders can be dealt with and distributed.

- Some 36% of retailers find it difficult to synchronise the inventory systems of online and in-store. The consequence of stock misalignment leads to the inability to fulfil orders.

- Meanwhile, 31% have another problem: training their in-store staff to accept and fulfil online orders, meaning a clear need exists for a better employee onboarding program and support.

- 30% saying they aren’t sure enough people know about BOPIS options is yet another concern from the customer engagement aspect. Without much marketing or communication, customers may not even know this Convi option is there for them.

- Meanwhile, 28% say fraud risks increase because of the hybrid nature of the service, most notably with online ID verification happening face-to-face.

- Resistance from staff is another holdback; 23% report some pushback from store associates who may already feel overwhelmed or may be reluctant to follow new procedures.

- Another 22% of retailers view the lack of modern technology or proper IT systems as a major impediment; essentially, a legacy infrastructure does not support a smooth BOPIS operation.

- A few retailers, 19%, have to deal with low customer demand, meaning the service just might not be well enough accepted in some markets to justify a heavy investment.

- About 11% say they do not face any major challenges, suggesting that at least a handful have managed to implement BOPIS with no issues. The other challenges-these unspecified ones-came up in just 3%, so the largest bulk falls within the known operational categories.

Conclusion

BOPIS statistics: By 2024, BOPIS is very much alive as a key facet of retailing, promising consumers an interplay of online convenience with immediate access to their goods. Presently, with staggering market growth setting in, acceptance by retailers all over, and favourable customer behaviour, BOPIS should continue to grow. Retailers chosen to implement and optimise the BOPIS operations accordingly would possibly gain a competitive advantage, customer satisfaction, and sales performance.

FAQ.

As of 2024, BOPIS made out 10.2% share of e-commerce worldwide, with North America always slightly ahead of it at 10.3%. The U.S. has 87% of retailers able to offer BOPIS, and about 67% of consumers using it often make purchases while in-store. Its popularity is a reflection of the increasingly growing need of consumers for flexible, fast, and low-priced shopping.

Such retail on a click-and-collect basis will amount to US$154.3 billion by 2025, growing at a five-year CAGR of 16.1%. U.S. shoppers spent US$113.19 billion in 2023 alone, registering an increase of 18.1% from the year before. BOPIS makes 9.64% of worldwide e-commerce revenue, reflecting universal and rising adoption.

Both grocery and non-grocery items are picked up at BOPIS points. In the U.S., 84% of online grocery shoppers use BOPIS for pickup at least once per month, with 24.5% doing so multiple times per week. Consumers prefer BOPIS over curbside pickup for groceries by a margin of 42.3%, especially for items like deli meat and cheese (50%). Locker pickup is picking up interest, but only 10% presently use it regularly.

BOPIS provides an opportunity for up-selling in the store. Approximately 67% of shoppers tend to make additional purchases while picking up their orders, and 34% of retailers observe an increase in in-store sales after implementing BOPIS. BOPIS users tend to visit the physical stores 2.5 times more than those who do not use the service, increasing foot traffic and basket line size.

Retailers name a couple of operational challenges: fast preparation of orders (49%), existence of a dedicated pickup space (44%), and inventory sync between online and in-store systems (36%). Additional challenges are staff training (31%), low consumer awareness (30%), fraud concerns (28%), and aged tech (22%).

Joseph D'Souza founded ElectroIQ in 2010 as a personal project to share his insights and experiences with tech gadgets. Over time, it has grown into a well-regarded tech blog, known for its in-depth technology trends, smartphone reviews and app-related statistics.