Simulation Software Statistics By Usage, Segment And Facts (2025)

Updated · Sep 17, 2025

Table of Contents

- Introduction

- Editor’s Choice

- Global Simulation Software Market Trends

- Types of Simulation Software

- Simulation Software Segment Statistics

- Simulation Software Market Size Statistics

- United States Simulation Software Statistics

- Simulation Software Market Statistics By Component

- By Development

- By Type Analysis

- By Region

- By Industry Applications

- By Application

- By Region

- By Country

- Usage Statistics of Simulation Software Tools

- Top Simulation Software Companies Market Analysis, 2024

- Recent Developments of Simulation Software

- Conclusion

Introduction

Simulation Software Statistics: Worldwide, simulation software plays a vital role by allowing engineers and businesses to create digital models of real processes, test operations virtually, and analyse outcomes without the need for physical experiments.

This type of software is commonly used to design equipment, helping ensure the final product meets specifications while reducing costly changes during production. By using virtual simulations, companies can test designs, optimize operations, and reduce costly errors. This article explores the latest statistics on simulation software usage, market growth, and industry trends.

Editor’s Choice

- According to a report of scoop.market.us, the global market size of simulation software is expected to grow to almost USD 25.1 billion by 2025.

- In 2025, the Simulation Software market is projected to generate revenue of USD 17.6 billion from On-premise and USD 7.5 billion from Cloud-Based.

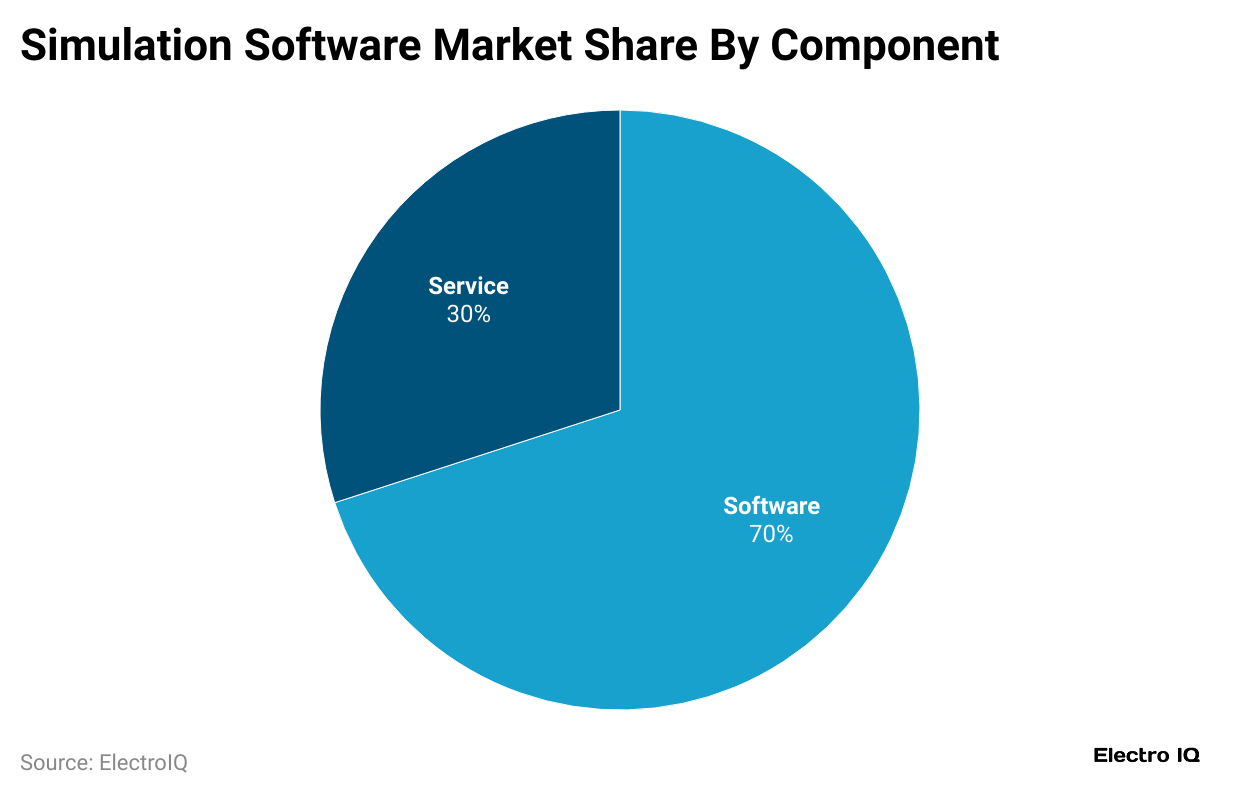

- Software solutions lead the global simulation software market, making up 70% of it.

- According to a report from mordorintelligence.com, the automotive sector made up 27% of the simulation software market in 2024.

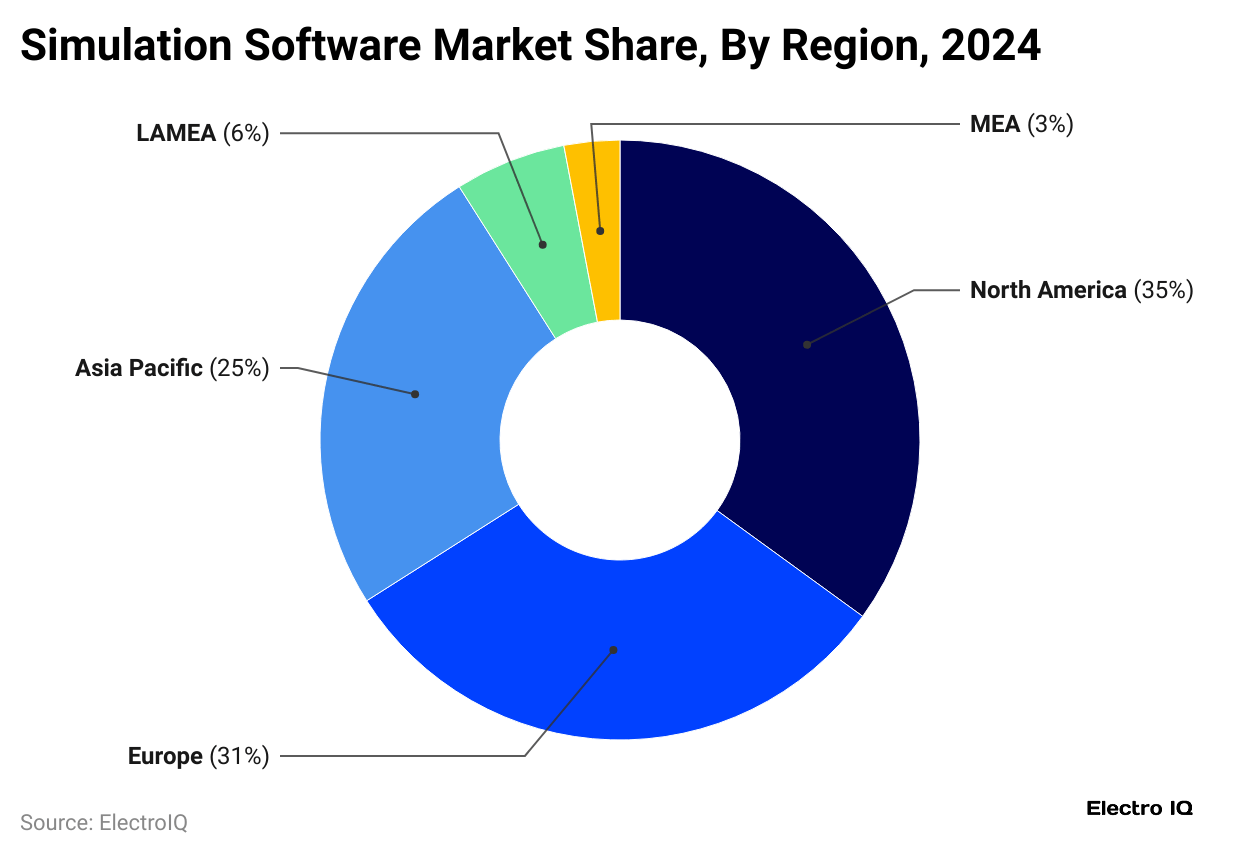

- In 2024, North America led the global market, holding the largest share at 35%, according to Precedence Research.

- By using simulation software, GM Holden Australia improved its throughput by 5% without spending more, as mentioned in scoop.market.us.

- In South Africa, Stillwater cut backfill time from 2 to 3 hours down to just 20 minutes.

- In Italy, Terminal San Giorgio Ports raised terminal throughput by 20% by combining simulation with AI.

Global Simulation Software Market Trends

- According to the Mordor Intelligence report analysis, cloud-native simulation adoption is a key driver that will increase at a 3.20% CAGR from 2025 to 2030.

- Automotive demand for virtual validation adds 2.80%, while rapid adoption of digital-twin initiatives contributes 3.50%.

- AI-driven generative simulation workflows increase growth by 2.10%, ESG-mandated virtual sustainability assessments by 1.80%, and 5G ORAN network-function virtualization testing by 1.40%.

Types of Simulation Software

- Discrete-Event Simulation (DES)

- Continuous Simulation

- Agent-Based Simulation (ABS)

- Monte Carlo Simulation

- Hybrid Simulation

- Virtual Reality (VR) and Immersive Simulation

- Digital Twin Simulation

Simulation Software Segment Statistics

- According to mordorintelligence.com, in 2024, the automotive sector accounted for a 27% share of the market of simulation software.

- In the same period, finite element analysis was the most used simulation type, capturing 32% of the market.

- Product design and engineering represented 35% of applications.

- Software licenses contributed 57% of total components, while North America led geographically with a 38% share.

Other segmental CAGRs are estimated in the table below:

| Metrics | CAGR (2025 to 2030) |

| By deployment type (Cloud-based) |

16.40% |

|

By end-user industry (Healthcare adoption) |

17.10% |

| By simulation type (Digital twin lifecycle management) |

15.30% |

|

By application area |

17.50% |

| By component (Services and consulting) |

16.30% |

|

By geography (North America) |

14.80% |

Simulation Software Market Size Statistics

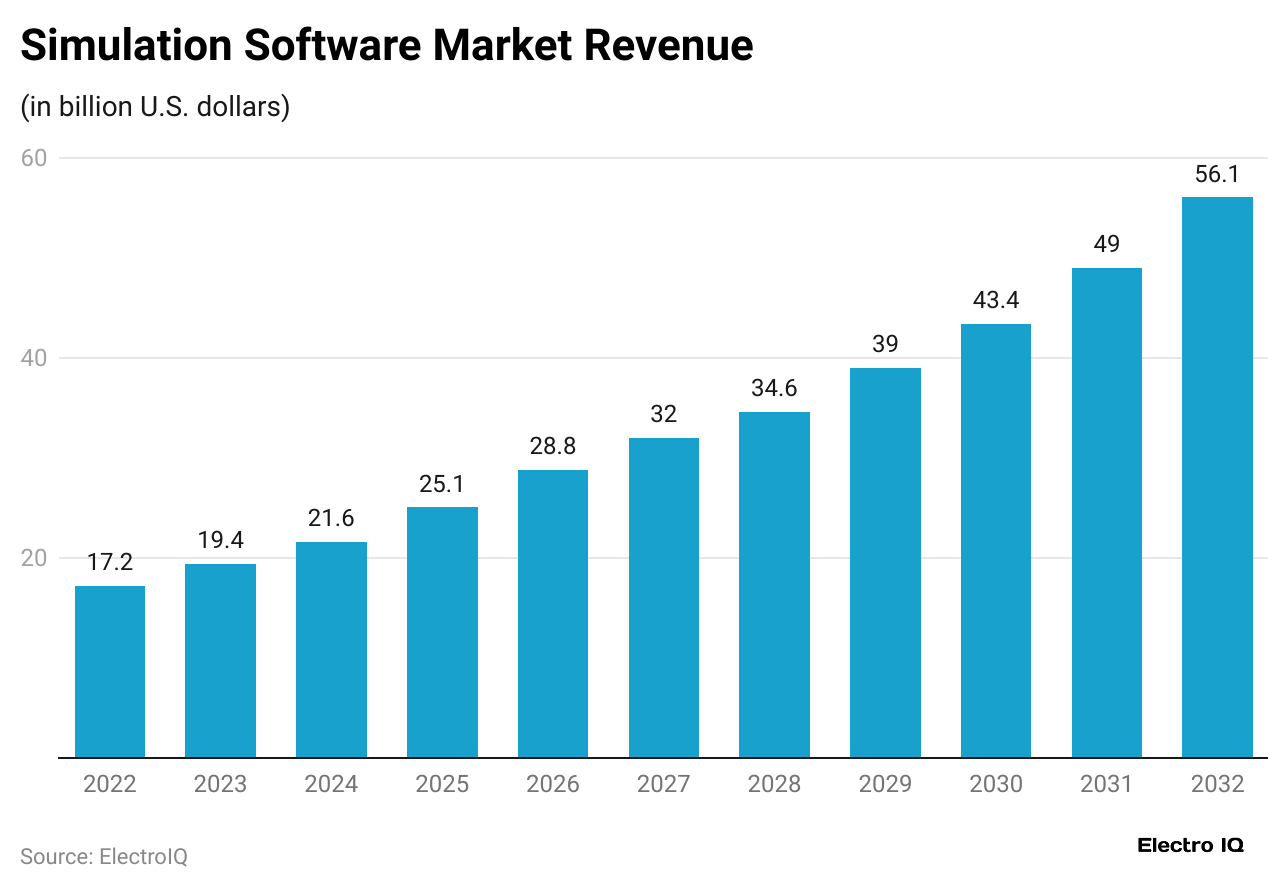

- By 2025, the global simulation software market is projected to reach USD 25.1 billion.

- The simulation software market size is projected to grow in the coming year, reaching USD 28.8 billion in 2026, USD 32 billion in 2027, USD 34.6 billion in 2028, USD 39 billion in 2029, USD 43.4 billion in 2030, USD 49 billion in 2031, and USD 56.1 billion in 2032.

- This market will grow at a 12.9% CAGR from 2025 to 2032.

United States Simulation Software Statistics

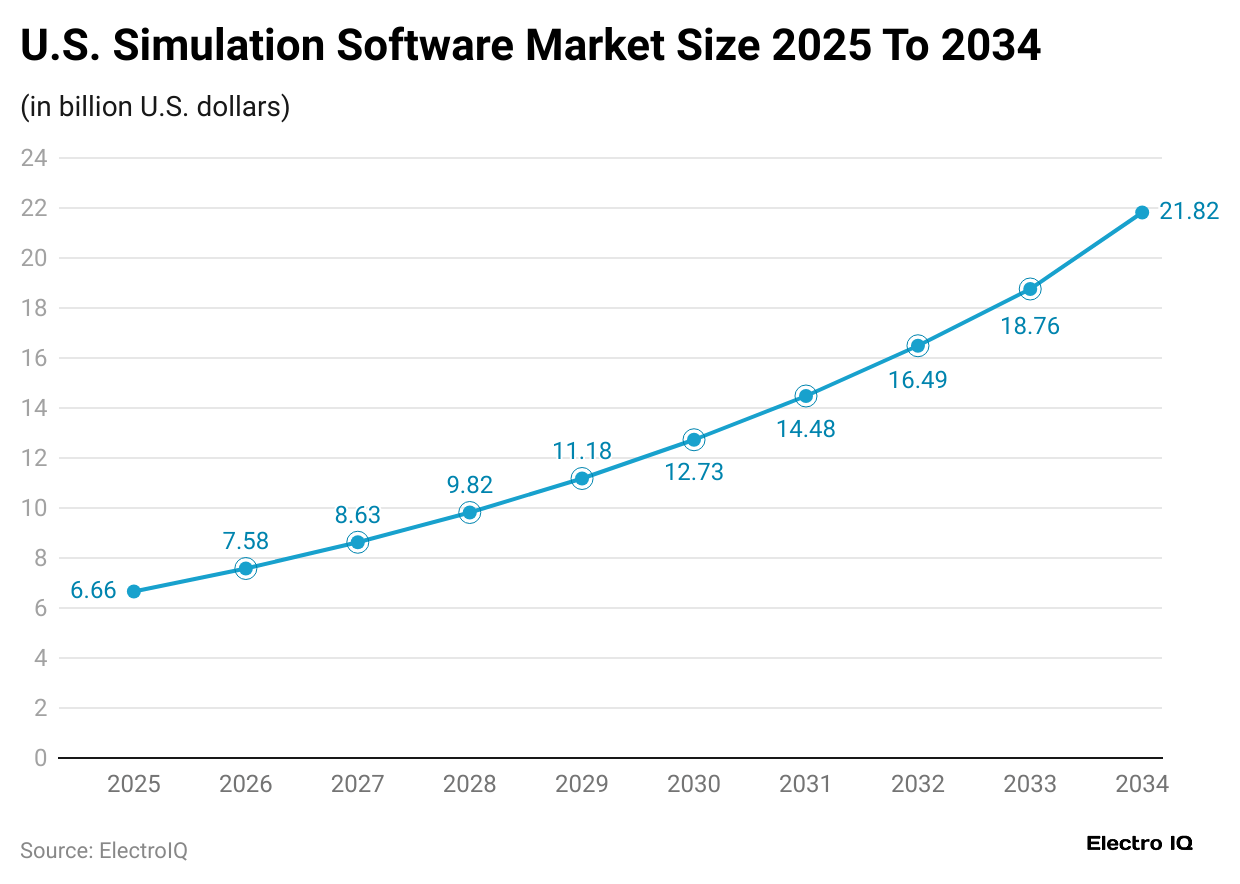

- The U.S. simulation software market is estimated at USD 6.66 billion by 2025.

- The market size will grow around USD 7.58 billion in 2026, followed by USD 8.63 billion in 2027, USD 9.82 billion in 2028, USD 11.18 billion in 2029, USD 12.73 billion in 2030, USD 14.48 billion in 2031, USD 16.49 billion in 2032, USD 18.76 billion in 2033, and reach USD 21.82 billion by 2034.

Simulation Software Market Statistics By Component

- In 2024, the Software solutions led the global simulation software market, making up 70% of it.

- Services make up the other 30% of the market alongside software solutions.

| Components | Market Size (USD million) | CAGR (2025 to 2030) | |

| 2024 | 2030 | ||

| Services | 7,280.9 | 17,038.5 | 15.4% |

| Simulation Development Services | 5,432.1 | 12,409.2 | 14.9% |

| Training And Support & Maintenance | 1,848.8 | 4,629.3 | 16.7% |

| Software | 16,275 | 34,069.6 | 13.3% |

By Development

| Components | Market Size (USD million) | CAGR (2025 to 2030) |

|

| 2024 | 2030 | ||

| On-premises | 16,695.1 | 34,708.9 | 13.2% |

| Cloud-based | 6,860.5 | 16,398.9 | 15.8% |

By Type Analysis

- According to the scoop.market.us report analysis, in 2025, the Simulation Software market is projected to generate revenue of USD 17.6 billion from On-premise and USD 7.5 billion from Cloud-Based.

In contrast, the expected Simulation Software types revenue structures are stated below:

| Year | On-premise | Cloud-Based |

| Revenue (USD Billion) | ||

| 2026 | 20.2 | 8.6 |

| 2027 | 22.5 | 9.5 |

| 2028 | 24.3 | 10.3 |

| 2029 | 27.4 | 11.6 |

| 2030 | 30.5 | 12.9 |

| 2031 | 34.4 | 14.6 |

| 2032 | 39.4 | 16.7 |

By Region

- A Precedence Research report analysis further depicts that in 2024, North America led the global market share of 35%, followed by Europe at 31%.

- The Asia Pacific region accounts for 25% of the market share.

- In contrast, the Latin America, Middle East, and African region market contributed 6% share, and the Middle East and African region accounted for the smallest share of 3%.

By Industry Applications

- Mordor Intelligence shows that in 2024, the automotive sector held a 27% share of the simulation software market.

- From 2025 to 2032, this segment will grow at a CAGR of 12.2%.

According to a report published by Grand View Research, the different end users’ market analysis is mentioned below:

| Metrics | Market Size (USD million) | CAGR(2025 to 2030) | |

| 2024 | 2030 | ||

| Aerospace & Defense | 4,302.7 | 9,069.1 | 13.4% |

| Electronics And Semiconductors | 4,129.4 | 8,997 | 14% |

| Industrial | 3,807.5 | 7,605.7 | 12.4% |

| Oil & Gas | 868.1 | 1,698.1 | 12% |

| Mining | 659.8 | 1,265.5 | 11.6% |

| Energy & Utilities | 1,923.9 | 3,990.4 | 13.1% |

| Automotive | 6,034.3 | 13,892.7 | 15.1% |

| Healthcare | 2,176.8 | 5,158.8 | 15.6% |

| Transportation & Logistics | 1,687.2 | 3,733.6 | 14.3% |

By Application

| Metrics | Market Size (USD million) | CAGR (2025 to 2030) | |

| 2024 | 2030 | ||

| Gaming and Immersive Experiences | 1,350.4 | 2,716.7 | 12.5% |

| Cyber Simulation | 630.1 | 1,342.2 | 13.6% |

| Engineering, Research, Modelling & Simulated Testing | 8,864.4 | 20,353.6 | 15% |

| Manufacturing Process Optimisation | 5,456 | 11,419.8 | 13.3% |

| AI Training & Autonomous Systems | 2,378.4 | 5,165.4 | 14% |

| High Fidelity Experiential 3D Training | 2,913.2 | 5,714.6 | 12.1% |

| Planning And Logistics Management & Transportation | 1,963.2 | 4,395.9 | 14.6% |

By Region

| Region | Market Size (USD million) | CAGR (2025 to 2030) | |

| 2024 | 2030 | ||

| Latin America | 1,618.2 | 2,735.6 | 9.1% |

| Middle East & Africa | 1,257.2 | 1,863 | 6.8% |

| Europe | 6,224.1 | 13,023.6 | 13.1% |

| North America | 8,072.8 | 17,690.5 | 14% |

| Asia Pacific | 6,383.6 | 15,795.4 | 16.3% |

By Country

| Country | Market Size (USD million) | CAGR (2025 to 2030) | |

| 2024 | 2030 | ||

| United States | 7,019.4 | 15,685.9 | 14.3% |

| Canada | 1,053.4 | 2,004.7 | 11.3% |

| United Kingdom | 1,644.1 | 3,630.7 | 14.1% |

| Germany | 1,891.6 | 4,114.8 | 13.8% |

| France | 1,227.8 | 2,524.7 | 12.8% |

| China | 2,381.6 | 6,564.5 | 18.4% |

| India | 1,201.5 | 3,108.8 | 17.2% |

| Japan | 1,630 | 3,857.8 | 15.4% |

| Brazil | 837.9 | 1,440.2 | 9.4% |

| Mexico | 515.2 | 903.9 | 9.8% |

Usage Statistics of Simulation Software Tools

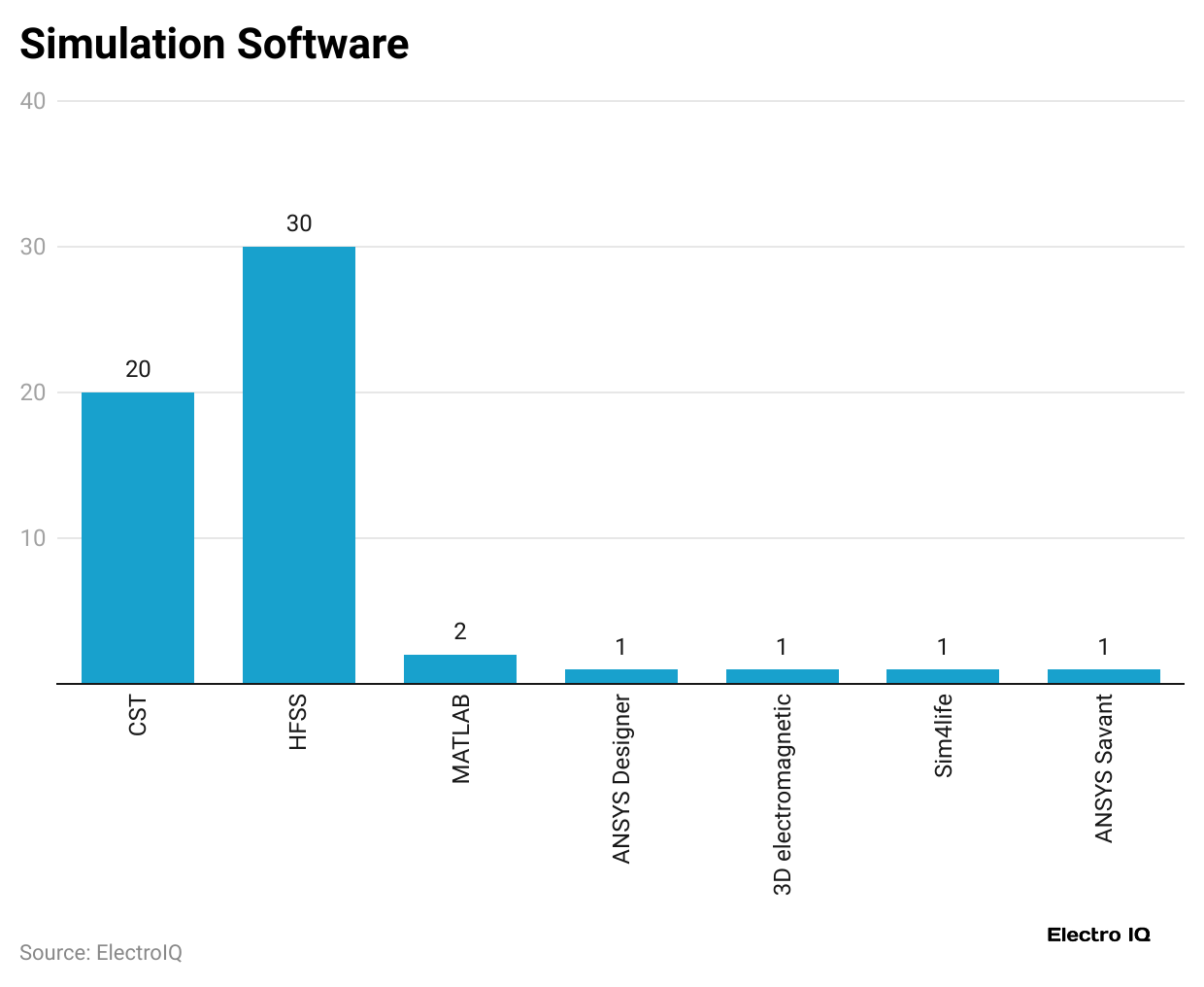

- According to the above chart, HFSS is the most widely used simulation software with 30 users, while CST ranks second with 20 users.

- In comparison, other programs like MATLAB have two users.

- Meanwhile, ANSYS Designer, 3D Electromagnetic, Sim4Life, and ANSYS Savant have minimal usage with one user.

Top Simulation Software Companies Market Analysis, 2024

| Company | Revenue (USD billion) | Market Share (Approx.) | Application Areas |

| Dassault Systemes | 1.47 | 25% | 3D design, PLM, digital twins, aerospace, automotive, healthcare (Dassault Systèmes) |

| Ansys | 1.7 | 20% | Finite element analysis, multiphysics, semiconductor, automotive, aerospace (Ansys) |

| Altair Engineering | 1 | 5% to 7% | MATLAB, Simulink, control systems, embedded systems, signal processing (Altair) |

| Rockwell Automation | 8.6 | Industrial automation, control systems, digital manufacturing (Rockwell Automation) | |

| The MathWorks | 1 | MATLAB, Simulink, control systems, embedded systems, signal processing (The MathWorks) | |

| Simulations Plus | 0.1 | 1% to 2% | Pharmaceutical modelling, drug development, and toxicology (Simulations Plus) |

| ESI Group | 0.3 | Virtual prototyping, automotive, aerospace, energy, defence (ESI Group) | |

| GSE Systems | 0.1 | Nuclear power simulation, training, energy systems (GSE Systems) | |

| Autodesk | 5.5 | 8% to 10% | CAD, BIM, architecture, construction, manufacturing (Autodesk) |

| Bentley Systems | 1.2 | 6% to 8% | Infrastructure modelling, civil engineering, smart cities (Bentley Systems) |

Recent Developments of Simulation Software

- In January 2025, digiM launched dissoLab, a groundbreaking dissolution simulation software.

- In November 2023, Mitsubishi Electric Corporation partnered with Finland-based Visual Components.

- Earlier, in July 2023, LiDAR software specialist Vueron teamed up with vehicle simulation software company Cognata.

- In May 2020, Altair renewed its original equipment manufacturer agreement with Cray Inc.

- During the same month, Persistent Systems expanded its collaboration with Dassault Systèmes, enhancing its digital transformation capabilities across Northern Europe.

Conclusion

In summary, simulation software is now a key tool for many industries, helping organisations test, analyse, and improve complex processes without real-world risks. This software is widely used in the fields of engineering, manufacturing, healthcare, and education for saving costs, boosting efficiency, and reducing errors.

Recent improvements, including AI simulations, real-time digital twins, cloud platforms, and better visualisation, are boosting simulation software, helping businesses make smarter decisions and innovate worldwide.

FAQ.

The different types of simulation software are Discrete-event simulation, Continuous simulation, Agent-based simulation, and Hybrid simulation.

The evolution is huge, like AI-driven simulations, real-time digital twins, increased visualisation, enabling accurate modelling and safe virtual training.

Simulation software helps reduce physical prototyping costs and time, improves decision-making through scenario analysis, enhancing product quality and efficiency, and enables safe virtual training environments.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.