Rockwell Statistics By Sales, Revenue, Products And Services

Updated · Oct 14, 2024

Table of Contents

Introduction

Rockwell Statistics: Rockwell Automation stands as a pioneering force in industrial automation and digital transformation, revolutionizing manufacturing processes across the globe. As we go forward, looking at the Rockwell Statistics, we will learn how the company has evolved into a comprehensive solution provider for automation software, hardware, and services.

With a robust portfolio spanning intelligent devices, control systems, and lifecycle services, Rockwell serves diverse industries, including automotive, healthcare, and manufacturing. Their commitment to innovation and digital excellence has established them as a worldwide trusted partner in industrial automation.

Editor’s Choice

- Rockwell’s total revenue reached $8.68 billion in 2023, showing a 10.2% increase from the previous year.

- Software and digital services contributed 35% of company revenue in 2023, expected to reach 40% in 2024.

- North America remains the largest market, with 45% of total revenue ($3.9 billion) in 2023.

- Intelligent devices generated the highest sales at $3311.9 billion in 2021.

- Asia-Pacific market contributed $2.1 billion (24%) to total revenue in 2023.

- The automotive sector generated $1.7 billion in revenue for 2023.

- The company plans a $300 million investment in expanding production facilities in North America and Europe in 2024.

- Sustainability-focused projects contributed $1.2 billion to revenue in 2023.

- Earnings per basic share reached $8.83 in 2020.

- Share value reached $268.15 per share as of October 2024.

- Company sales volume grew from $4332.5 million in 2009 to $6997.4 million in 2021.

- Europe, Middle East, and Africa generated $1.8 billion (21%) in revenue for 2023.

- The projected total revenue for 2024 is $9.5 billion.

- The renewable energy sector is expected to grow by 15% in 2024.

- Automotive revenue will increase by 12% to $1.9 billion in 2024.

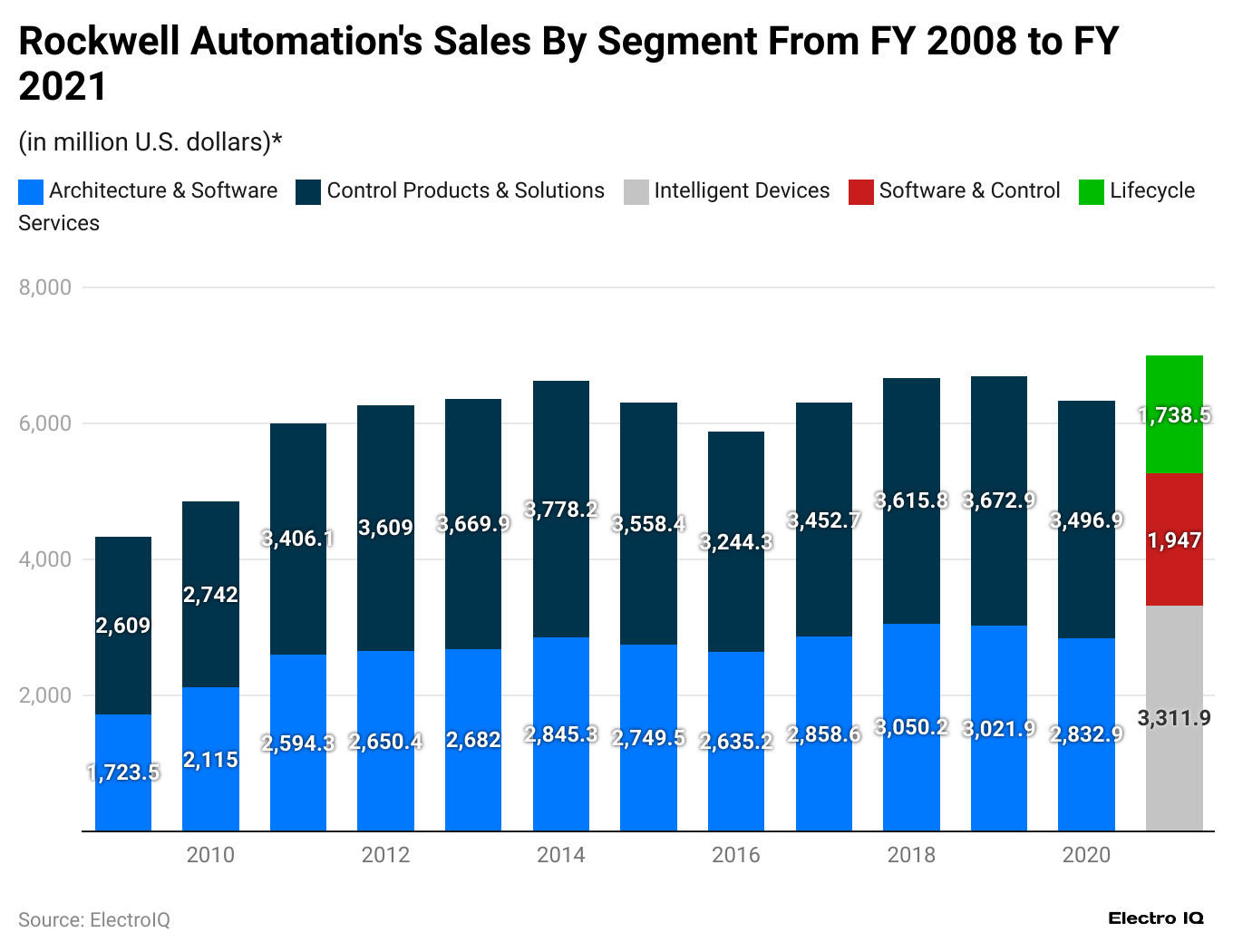

Rockwell Automation Sales By Segment

(Reference: statista.com)

- Rockwell Statistics showcases that Architecture & Software Control Products & Solutions, Intelligent Devices, and Software & Control Lifecycle Services are the different categories that have contributed to Rockwell’s sales.

- As of 2021, Intelligent devices have the highest sales with $3311.9 billion, followed by software & Control with $1,947 million in revenue, and Lifecycle Services with $1,738.5 million in revenue.

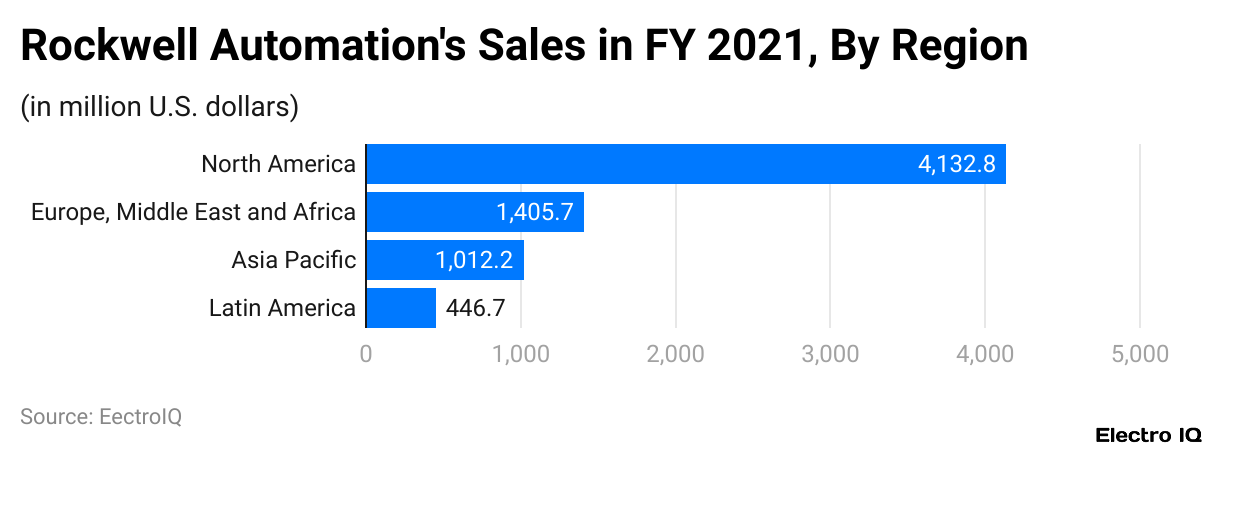

Rockwell Automation Sales By Region

(Reference: statista.com)

- Rockwell Statistics show that the Middle East and Africa, Latin America, Asia Pacific, North America, and Europe are the regions from which Rockwell automation sales are generated.

- North America has the highest revenue with $4132.8 million, followed by Europe, Middle East, and Africa with $1,405.7 million in sales, Asia Pacific with $1,012.2 million, and Latin America with $446.7 million.

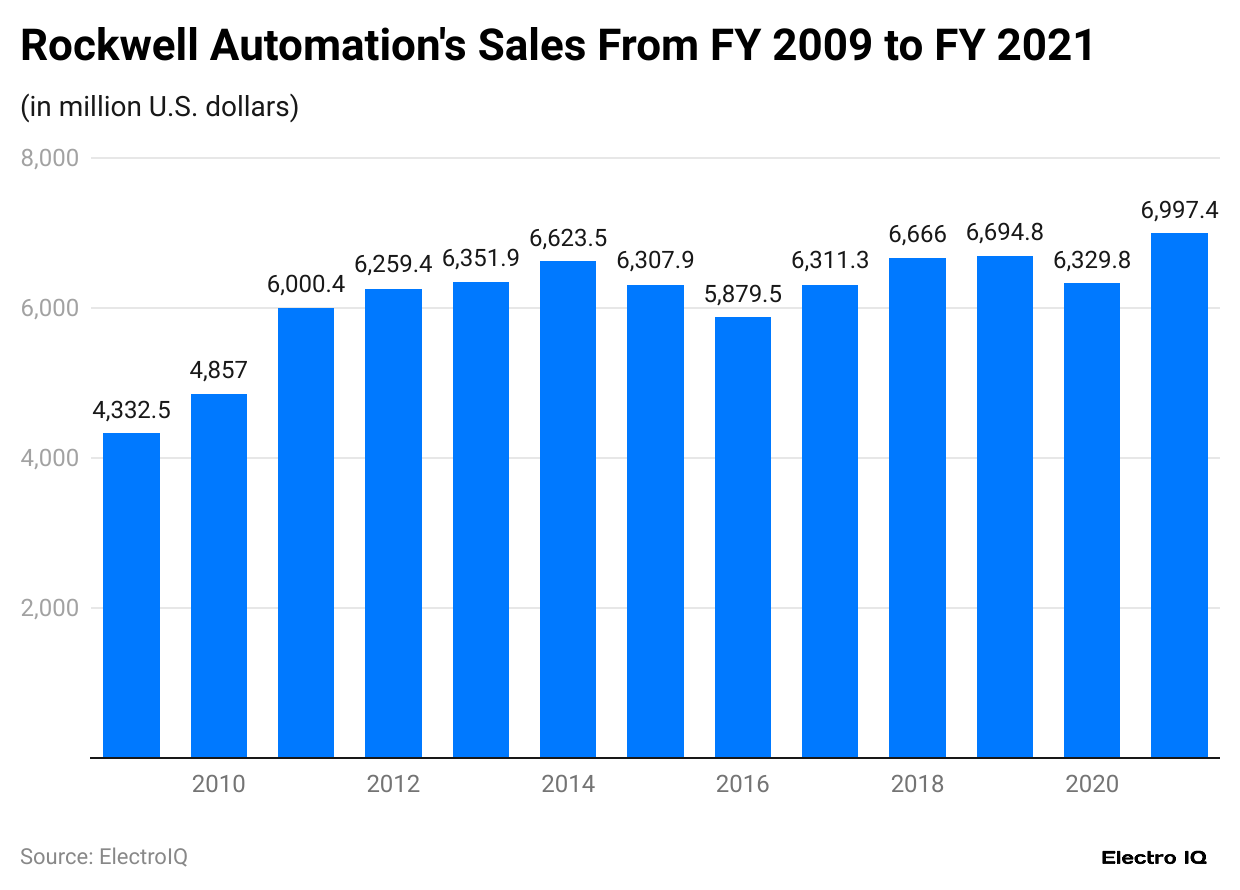

Rockwell Automation Overall Sales

(Reference: statista.com)

- Rockwell Statistics show that the company’s sales volume is consistently increasing.

- While in 2009, the sales volume was $4332.5 million, it increased to $6997.4 million by the end of 2021.

(Reference: statista.com)

- Rockwell Statistics show that revenue per share of the company can be categorized into Basic and Diluted.

- As of 2020, earnings per basic share is $8.83 per share, and diluted is $8.77 per share.

(Source: finance.yahoo.com)

- Rockwell Statistics show that the company's share value has been increasing consistently.

- As of October 2024, the share value is $268.15 per share.

Rockwell Products And Services

- PlantPAx

- Programmable Controllers

- Emulate3D Digital Twin

- Arena Simulation

- Fiix CMMS

- FactoryTalk Batch

- Connection Devices

- FactoryTalk Optix Software

- Independent Cart Technology

- Studio 5000

- FactoryTalk Metrics OEE

- Finite Scheduler

- FactoryTalk Logix Echo

- Relays & Timers

- FactoryTalk Historian

- Distributed Control Systems

- Input/Output Modules

- Push Buttons & Signaling Devices

- Lighting Control

- ThingWorx IIoT

- FactoryTalk Analytics

- Sensors & Switches

- Plex Quality Management System

- FactoryTalk Analytics GuardianAI

- Power Supplies

- Human Machine Interface (HMI)

- Network Security & Infrastructure

- FactoryTalk Energy Manager

- Plex Enterprise Resource Planning

- FactoryTalk Design Studio

- Arena Simulation

- Signal Interface

- Safety Instrumented Systems

- FactoryTalk Twin Studio

- Safety Products

- FactoryTalk View

- FactoryTalk Vault

- MES → Plex MES

- FactoryTalk Remote Access

- FactoryTalk DataMosaix

- Monitor

- PlantPAx

- FactoryTalk CPGSuite

- Condition Monitoring

- Plex Production Monitoring

- FactoryTalk Asset Performance Management

- FactoryTalk Transaction Manager

- Plex MES for Food & Beverage

- Motion Control

- FactoryTalk AssetCentre

- FactoryTalk Network Manager

- Drives

- FactoryTalk PharmaSuite

- FactoryTalk Edge Manager

- Cloud Software

- FactoryTalk Twin Studio

- Plex Asset Performance Management

- Safety Products

- Pre-Engineered Network Solutions

- Equipment Repair

- Safety Services

- Overview (Production Automation)

- Asset Optimization Services Overview

- Cybersecurity

- Equipment Remanufacturing

- Repair and Inventory Agreements

- Coordinated Drive System Solutions

- Remote Support & Monitoring

- Overview (Digital Thread)

- Industrial Network Infrastructure

- Integrated Service Agreements

- Training Services

- Onsite & Field Services

- Automotive & Tire

- Digital Thread

- Scalable Control & Visualization

- Oil & Gas

- Household & Personal Care

- Production Automation

- Water Wastewater

- Process Solutions

- Asset Management

- Entertainment

- Networks & Infrastructure

- Semiconductor

- Digital Transformation

- Power Generation

- Advanced Motion & Robotics

- Cement

- Mining

- Life Sciences

- Industrial Automation Control

- Sustainable Solutions

- Food & Beverage

- Marine

- Warehouse & Fulfillment

- Print & Publishing

- Workforce Enablement

- On-Machine Solutions

- Pulp & Paper

- OEMs

- Hydrogen

- Cybersecurity

- Safety Solutions

- Smart Manufacturing

- Data Operations & Analytics

- Fiber & Textiles

- Industrial Components

- Infrastructure

- Production Operations Management

- Metals

Source: https://www.rockwellautomation.com/en-in.html

Rockwell Overview

Rockwell Automation is a global leader in industrial automation and digital transformation solutions, providing advanced technologies to improve production efficiency and enhance operational safety. The company is renowned for offering automation software, hardware, and services to various industries, including automotive, aerospace, healthcare, and manufacturing. This article will explore key trends and insights into Rockwell's performance in 2023 and 2024, using available market data and highlighting growth factors and future opportunities.

#1. Overview of Rockwell’s Financial Performance

In 2023, Rockwell Automation achieved impressive financial results, driven by strong demand for its automation and digital solutions. The company reported total revenue of $8.68 billion, an increase of 10.2% compared to the previous year. This growth was mainly fueled by the increasing need for automation across industries as businesses sought to streamline operations and reduce costs amid ongoing economic challenges.

For 2024, projections indicate that Rockwell Automation is expected to achieve revenues of around $9.5 billion, reflecting an anticipated growth rate of 9.4%. This steady increase in revenue underscores the growing reliance on digital transformation and automation technologies. Rockwell Statistics shows this growth is primarily attributed to the company’s ability to capitalize on opportunities in emerging sectors such as renewable energy, smart manufacturing, and the Industrial Internet of Things (IIoT).

#2. Key Growth Drivers for Rockwell Automation in 2024

- Digital Transformation and Industry 4.0: Rockwell’s focus on digital transformation is a primary driver behind its success. As industries adopt intelligent manufacturing technologies, there has been a sharp rise in demand for automation and control systems. Rockwell’s FactoryTalk software suite, which offers real-time insights into production processes, has become a leading product in the automation market. In 2023, over 35% of the company’s revenue came from software and digital services, projected to increase to 40% in 2024.

- Sustainability Initiatives: The shift toward renewable energy and sustainability-focused projects has opened up new opportunities for Rockwell. In 2023, the company secured several high-profile contracts in the renewable energy sector, contributing $1.2 billion to its revenue. This figure is expected to grow by 15% in 2024 as more governments and corporations invest in clean energy technologies and decarbonization efforts. According to Rockwell Statistics, the company’s sustainability-focused solutions will play a crucial role in its future growth.

- Automotive Industry Automation: Rockwell Automation has a strong presence in the automotive sector, rapidly moving toward electric vehicles (EVs) and autonomous technologies. In 2023, Rockwell generated $1.7 billion from its automotive clients, making it one of the company’s most lucrative markets. With global EV production expected to rise significantly in 2024, Rockwell is projected to increase its automotive revenue by 12%, reaching $1.9 billion. Automation systems for assembly lines, quality control, and vehicle testing drive this growth.

#3. Regional Analysis of Rockwell Statistics

From a regional perspective, Rockwell Statistics show that North America remains the largest market for the company, accounting for 45% of total revenue in 2023, equivalent to $3.9 billion. The United States, in particular, has seen a surge in automation adoption as manufacturers seek to compete in a globalized economy. Rockwell’s focus on expanding its presence in the United States is expected to result in continued revenue growth in 2024, with projections estimating North America will generate $4.2 billion in sales.

Rockwell has experienced rapid growth in the Asia-Pacific region, especially in countries like China, Japan, and South Korea. In 2023, Asia-Pacific contributed $2.1 billion to Rockwell’s total revenue, representing around 24% of its business. This market is expected to grow further in 2024, with anticipated sales of $2.4 billion as more regional companies invest in industrial automation to increase productivity.

Europe, the Middle East, and Africa (EMEA) make up the third-largest market for Rockwell, generating $1.8 billion in revenue in 2023, or 21% of the company’s total. In 2024, revenue from the EMEA region is expected to rise to $2.0 billion, reflecting a growing demand for automation in the food and beverage, pharmaceuticals, and oil and gas industries.

#4. Challenges and Opportunities in 2024

Despite the positive outlook, Rockwell Automation may face several challenges in 2024. One of the key risks is the ongoing supply chain disruptions that have impacted the global semiconductor market. Like many other technology companies, Rockwell relies heavily on microchips and other electronic components for its automation solutions. In 2023, supply chain bottlenecks led to production delays, which may pose challenges in 2024.

However, these challenges also present opportunities for Rockwell. The company has announced plans to increase its investment in local manufacturing and sourcing to mitigate the risks associated with global supply chains. In 2024, Rockwell is expected to invest $300 million in expanding its production facilities in North America and Europe, which should help reduce lead times and improve product availability.

Additionally, Rockwell's rising adoption of 5G and edge computing technologies presents a significant growth opportunity. These technologies enable faster data processing and real-time analytics, crucial for advanced automation systems. Rockwell has been working on integrating 5G capabilities into its products, which is expected to be a significant growth driver in 2024.

#5. Future Outlook for Rockwell Automation

Rockwell Statistics indicate that the company is well-positioned for continued growth in 2024 and beyond. The increasing adoption of digital transformation solutions and rising investments in automation across industries will drive demand for Rockwell’s products and services. The company’s strategic focus on expanding its presence in high-growth markets like Asia-Pacific and sustainability-driven industries will likely result in sustained revenue growth.

2024, Rockwell is expected to maintain a solid competitive position in the global automation market, with a projected total revenue of $9.5 billion. The company’s continued investment in innovation and ability to navigate supply chain challenges will be critical factors in its future success.

In conclusion, Rockwell Statistics reveals that the company has a bright future in the automation industry. With substantial financial performance, a growing customer base, and a commitment to sustainability and digital innovation, Rockwell Automation is set to remain a leader in industrial automation and digital transformation. The company’s ability to adapt to market trends and seize emerging opportunities will ensure its long-term success in the evolving global market.

Conclusion

Rockwell Automation has demonstrated remarkable growth and resilience in the industrial automation sector, with impressive financial performance and strategic market positioning. Rockwell Statistics showcase that it is evidenced by its substantial revenue growth to $8.68 billion in 2023, with projections reaching $9.5 billion in 2024.

Their expansion into emerging technologies like 5G and edge computing, combined with their strong presence in traditional industrial automation, indicates a well-balanced approach to future growth. Rockwell Automation appears well-positioned to maintain its leadership role in the evolving global market.

FAQ.

A global leader in industrial automation and digital transformation solutions, providing automation software, hardware, and services.

Total revenue of $8.68 billion, showing a 10.2% increase from the previous year.

North America is the largest market, contributing 45% of total revenue ($3.9 billion) in 2023.

Architecture & Software Control Products & Solutions, Intelligent Devices, and Software & Control Lifecycle Services

Generated $1.2 billion from sustainability projects 2023, with 15% growth expected in 2024.

Rockwell Generated $1.7 billion from automotive clients in 2023, expected to reach $1.9 billion in 2024.

Share value reached $268.15 per share as of October 2024, showing consistent growth.

35% in 2023, expected to increase to 40% in 2024.

Rockwell contributed $2.1 billion (24%) to total revenue in 2023, expected to reach $2.4 billion in 2024.

Rockwell is Planning a $300 million investment in expanding production facilities in North America and Europe in 2024.

Saisuman is a skilled content writer with a passion for mobile technology, law, and science. She creates featured articles for websites and newsletters and conducts thorough research for medical professionals and researchers. Fluent in five languages, Saisuman's love for reading and languages sparked her writing career. She holds a Master's degree in Business Administration with a focus on Human Resources and has experience working in a Human Resources firm. Saisuman has also worked with a French international company. In her spare time, she enjoys traveling and singing classical songs. Now at Smartphone Thoughts, Saisuman specializes in reviewing smartphones and analyzing app statistics, making complex information easy to understand for readers.