Amplitude Statistics By Revenue, Growth, Business Metrics, Innovation, Recent Development, Trends and Facts (2025)

Updated · Nov 03, 2025

Table of Contents

Introduction

Amplitude Statistics: Amplitude is a leading digital analytics platform that helps businesses understand user behaviour, optimise product experiences, and drive growth through data. Founded in 2012 and headquartered in San Francisco, the company enables organisations to analyse how customers interact with their products, identify engagement trends, and make data-driven decisions.

In the continuous transformation of digital analytics, Amplitude Analytics has become a powerful competitor by providing companies with the means to discern the activities of users and fine-tune their product offerings. A detailed examination of the Amplitude statistics in 2025 will uncork primary indicators, growth patterns, and the company’s strategic moves that have helped it gain such a foothold in the market.

Editor’s Choice

- Amplitude’s dollar-based net retention rate (NRR) soared to 104% in Q2 2025, a significant rise from 96% in Q2 2024, thereby registering improvement for three consecutive quarters.

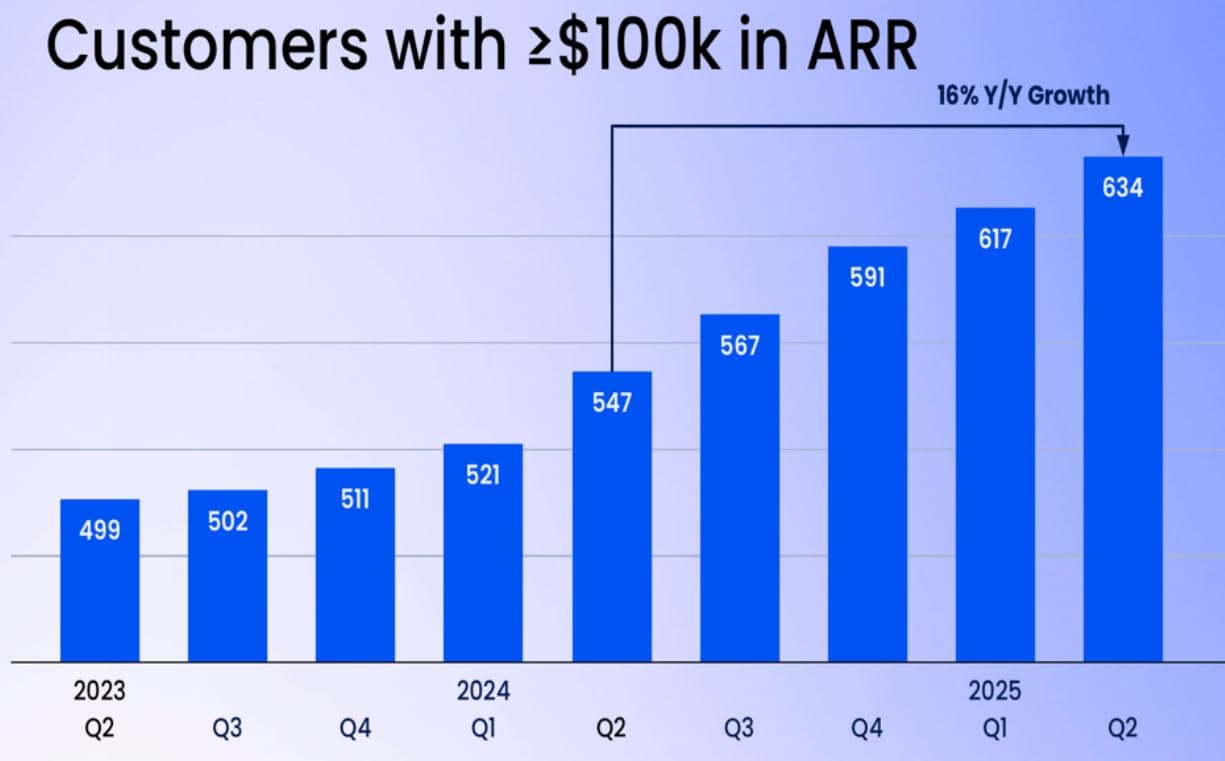

- The number of enterprise clients of the company whose annual revenue was over US$100,000 rose to 634, which is a 16% increase compared to the previous year, and this was the year-over-year increase of 16%.

- The cash flow that Amplitude could use was increased to US$18.2 million in Q2 2025, while in Q2 2024 it was only US$6.8 million.

- Giving a strong balance sheet picture, Amplitude had cash and investments of US$288 million.

- The Annual Recurring Revenue (ARR) figure in Q2 2025 was US$335 million, which was a 16% increase from the previous year, going up from 12% growth in Q1 2025 before that.

- The NRR that was measured gradually from March 2024 at 97% to June 2025 at 104% indicated that there was a powerful customer retention and expansion.

- Amplitude’s revenue in Q2 2025 was estimated to be between US$80.3 million and US$82.3 million, while the revenue for the entire year was expected to range between US$329 million and US$333 million.

- The estimated non-GAAP net income per share for 2025 was in the range of US$0.05 and US$0.10.

- An issue of US$0.19 per share under GAAP was reported by Amplitude in Q2 2025, which was similar to that in Q2 2024, but the company already had non-GAAP net income of US$0.01 per share.

- The US$1.32 billion was the market cap of the company on the date of October 2025 (mid-month).

- The stock had a Relative Strength (RS) Rating of 90, indicating the strong performance of the stock among others (Investors).

- Digital adoption was the driving factor behind the product growth of 18% in Australia, which, along with the Asia-Pacific region’s 15% share in global revenues, accounted for the 18% product growth in Australia.

Amplitude Revenue

(Source: investing.com)

- As per Inverting.com, Amplitude’s statistics show that Amplitude made remarkable strides in its main performance indicators in the second quarter of 2025.

- This is a huge increase from 96% during the same quarter in 2024.

- A higher net retention rate suggests that not only are the existing customers sticking with the company, but they are also spending more over the period, which in turn shows successful customer expansion and less churn.

- This improvement is very significant, especially because it is the third quarter in a row that Amplitude has increased this metric, showcasing consistent growth and stronger customer ties.

Expanding Enterprise Growth And Financial Strength

(Source: investing.com)

- In the year 2025, Amplitude not only scaled up but also continued to build up its customer base with larger enterprise clients.

- The count of customers who are contributing more than US$100,000 in annual recurring revenue (ARR) went up to 634, which is a 16% rise with respect to the same period of 2024.

- This steady growth in high-value clients is an indication that, over time, more organisations are gradually depending on Amplitude’s analytics solutions at a very large scale.

- Besides gaining new customers, the firm, i.e., Amplitude, has also sharpened its financial efficiency.

- Free cash flow for Amplitude in Q2 2025 was US$18.2 million, a tremendous leap from US$6.8 million in the year-ago quarter.

- The increase in free cash flow signifies operational efficiency and cost control in sales and related areas.

- Moreover, Amplitude holds a prime financial footprint with US$288 million in cash and investments.

- Such a well-equipped balance sheet affords the company stability as well as the ability to spur adoption of innovation through investment in future growth strategies and initiatives.

Annual Recurring Revenue

(Source: investing.com)

- Amplitude’s annual recurring revenue (ARR) has been increasing at a quicker rate recently.

- Its ARR reached US$335 million by the second quarter of 2025, a 16% rise over that quarter of the previous year.

- This indicates that the business is earning more of its revenue through subscriptions that are reliable and predictable.

- Even more impressive is the fact that the company’s growth rate has improved—ARR in Q1 2025 was up by 12%, hence, the jump to 16% in Q2 signifies higher customer thirst and better performance of the business.

Amplitude’s Key Business Metrics

(Source: amplitude.com)

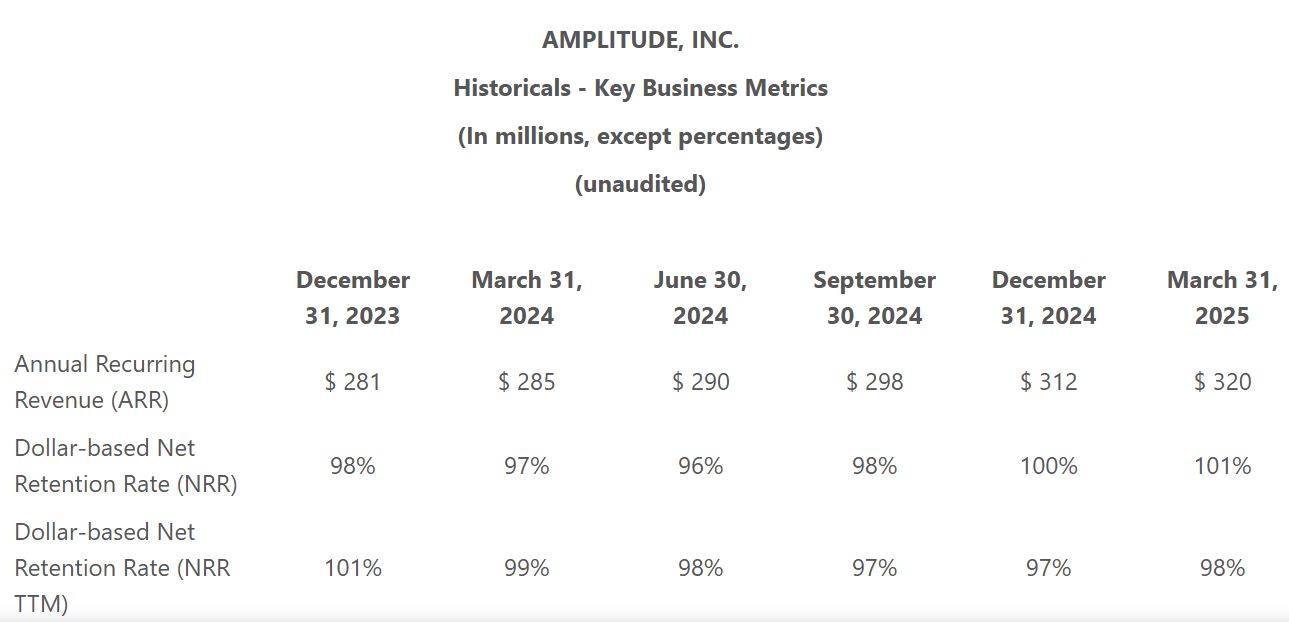

- The historical data of Amplitude reveals a strong and stable business performance from the start of 2024 to mid-2025.

- One of the major indicators, Annual Recurring Revenue (ARR), has shown a steady increase throughout this time. ARR was US$285 million in March 2024, and it climbed to US$335 million by June 2025—US$50 million of new recurring revenue had been added by Amplitude in just 15 months, which equals to remarkable 17.5% hike.

- The quarter-to-quarter growth has been consistent, showing that not only are more customers taking up Amplitude’s platform, but also the existing customers are using it for more usage.

- The Dollar-Based Net Retention Rate (NRR) is another crucial metric that tells how much of the recurring revenue Amplitude retains and even grows from its clientele annually.

- In March 2024, the NRR was 97% and it slightly fell to 96% in June 2024, but from then on the trend took a significant upward turn.

- By June 2025, the NRR had gone up to 104% which means that the current customers were not only retained but also were spending more on Amplitude’s services — an unmistakable indicator of customer contentment with the product and its value.

- The TTM NRR was 98% on average and thus a very reliable indicator of Amplitude’s performance, and it even pointed to a long-term trend of strong customer loyalty and retention of revenue over the entire duration of the period.

- The company’s strengthening of customers, its invasion of the existing market, and its future revenue growth have all been indicated by the continuous rise in ARR and the continuous improvement in NRR.

Amplitude’s Financial Outlook For Q2 And Full Year 2025

(Source: amplitude.com)

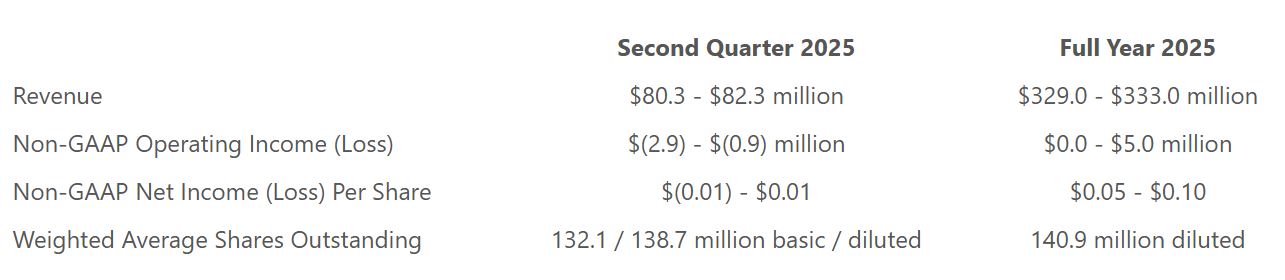

- Amplitude’s 2025 financial guidance reflected consistent growth and enhanced profitability.

- For Q2 2025, it forecasted revenues of US$80.3-US$82.3 million, a huge increase over the previous quarters.

- The company expected a non-GAAP operating loss of US$2.9 million to US$0.9 million, an indication that the firm is drawing nearer to operational break-even.

- Based on its non-GAAP net income (loss) per share, the company foreshadowed results that lay between US$(0.01) and US$0.01, which implies that it could report a very modest profit depending on the final numbers.

- In the quarter, the weighted average shares outstanding were 132.1 million (basic) and 138.7 million (diluted), signifying the total number of shares used for calculating earnings per share.

- For the year 2025, Amplitude projected US$329 million to US$333 million in total revenue, which is in line with the company’s annual growth trend.

- Additionally, it revealed a non-GAAP operating income forecast of US$0 to US$5 million, which indicates the first stage of profitability might be the first time of transition into the company’s history.

- The expected non-GAAP net income per share was in the range of US$0.05 to US$0.10, based on the 140.9 million diluted shares used in the computation.

Amplitude Profitability Metrics

- The profitability measures of Amplitude in 2025 show a company that is gradually enhancing its financial efficiency and, at the same time, has a strong growth momentum.

- Amplitude even suffered a GAAP net loss of US$0.19 per share in Q2 2025, the same as in Q2 2024, even though its revenue was on the increase.

- However, the firm, excluding some accounting expenditures, attained a non-GAAP net income of US$0.01 per share, which displayed movement towards profitability.

- The upward trend implies that Amplitude is operating more efficiently and getting closer to the point of breakeven for GAAP.

- The operating cash flow in Q2 2025 soared to US$20.1 million, a year-over-year increase of US$10.9 million, which is a signal of effective cost management and customer collections going up.

- The free cash flow also escalated dramatically — reaching US$18.2 million, a hike from the US$6.8 million of the same quarter a year ago.

- This spurt in free cash flow is a sign of the company’s better financial condition and its capability of cash generation from core operations, which in turn gives the company more room for investment and expansion.

- Approximately US$1.32 billion is the market capitalisation of the company in October 2025, per StockAnalysis.

- The performance of its stock has been robust, indicated by a Relative Strength (RS) Rating of 90, which means that Amplitude’s stock has been among the top 10% of all stocks in terms of appreciation over the last year (Investors).

- Amplitude has been taking advantage of artificial intelligence (AI) in a very active manner and has done so strategically in order to enhance both the functionality and the user experience of its platform.

- The acquisition of Command AI has allowed the company to provide AI user assistance, which includes features such as personalised onboarding and interactive guides, as reported by The Australian newspaper.

- Users not only gain more from the platform due to this integration, but it also boosts Amplitude’s position in the rapidly growing analytics software market because of the enhanced product competitiveness.

- To cover up for the lack of technology investments, besides Amplitude, is moving in the direction of having more customers, quite notably in the Asia-Pacific region, where global revenue has increased by about 15%.

- The company has experienced an 18% growth in product sales in Australia, which is a result of the digital transformation and the increased use of analytics tools in the area.

Journey of Innovation

- According to Amplitude, the company started in 2012 with the belief that the best products come from a deep understanding of customer behavior across different functions.

- In 2014, it officially launched as a real-time mobile analytics platform after operating in stealth mode.

- By 2016, Amplitude gained recognition as a Forbes Cloud 100 Rising Star and secured $15 million in Series B funding from Battery Ventures.

- In 2018, the company raised $80 million in Series D funding led by Sequoia Capital and introduced the Amplitude Startup Scholarship to support new startups.

- That same year, it grew internationally by opening offices in London, Paris, Singapore, and New York City.

- In 2019, Amplitude released new analytics tools within its Product Intelligence platform and earned AWS’s digital experience competency.

- During the same year, it offered startups one year of free access through its scholarship program and held the first Amplify conference, presenting the world’s first Product Intelligence platform.

- In 2020, Amplitude bought Clearbrain, a predictive analytics company, and raised $50 million in Series E funding led by GIC, reaching a $1 billion valuation.

- Also in 2020, it co-founded the Tech for Black Founders program and expanded to serve more than 1,000 enterprise clients, including 25 from the Fortune 100 list.

- In 2021, G2 ranked Amplitude as the top company in product analytics and among the top 25 software products overall.

- That same year, it launched the industry’s first Digital Optimization System to help product and marketing teams create better personalized experiences.

- In 2022, Amplitude again earned the top spot for product analytics and ranked third for all software products on G2.

- The company introduced digital analytics tools for full customer journey insights and launched Amplitude Experiment and CDP.

- In 2023, it continued its success, ranking first in product analytics and nineteenth among all software products on G2.

- The same year, it was recognized by TrustRadius as a Top Rated Company and received awards for best value, feature set, and customer relationships.

- Amplitude introduced Warehouse Native Amplitude, allowing users to activate insights directly from their data warehouse, and added AI-powered data assistant features to strengthen data governance.

- In 2024, G2 again placed Amplitude at number one for product analytics and among the top 100 software products overall.

- In 2025, the company introduced the AI Agents Beta.

- That same year, Forrester named Amplitude a Leader and Customer Favorite in The Forrester Wave™: Digital Analytics Solutions, Q3 2025.

Recent Development

- According to SiliconANGLE, Amplitude has launched its new MCP and AI Agents designed to automate behavioral data analysis, helping companies better understand user actions through smarter and faster insights.

- According to MarketBeat, Wilson Asset Management International PTY Ltd. has purchased shares of Genius Sports Limited ($GENI), showing growing investment interest in technology-driven companies.

- According to MarketBeat, Voya Investment Management LLC increased its holdings in OUTFRONT Media Inc. ($OUT), reflecting confidence in the firm’s advertising and media operations.

- According to MarketBeat, Ardsley Advisory Partners LP bought 135,000 shares in Amplitude, Inc. ($AMPL), strengthening institutional confidence in Amplitude’s market performance.

- According to MarketBeat, Kodai Capital Management LP invested $1.41 million in Amplitude, Inc. ($AMPL), signalling a growing trend of institutional investor backing.

- According to SiliconANGLE, Amplitude expanded its Web Experimentation platform by adding self-service features, enabling users to run and manage website tests without requiring extensive technical support.

- According to MarketBeat, Informed Momentum Co LLC made a new investment in Amplitude, Inc. (NASDAQ: AMPL), reflecting continuous interest from investors in the company’s growth and analytics innovations.

- According to ES Del Latino, Amplitude acquired Kraftul to enhance its customer comments analysis, aiming to deliver more accurate insights from user feedback through advanced technology.

Conclusion

Amplitude Statistics: The results for Amplitude in 2025 present a picture of a company that is increasingly consolidating its place in the digital analytics industry. Continuous revenue growth, customer base expansion, and better profitability already indicate the company’s operational discipline and strategic focus. Amplitude is thus positioning itself for the long term in terms of resilience and competitiveness by not only improving product capabilities through AI integration but also by securing a stronghold in international markets.

The company’s ongoing improvements in customer retention and financial efficiency reflect its dedication to growth that is both sustainable and customer-centred, with product innovation being at the heart of its strategy.

Sources

FAQ.

In the second quarter of 2025, Amplitude’s Dollar-Based Net Retention Rate (NRR) increased to 104%, compared to 96% during the same quarter in 2024. This number indicates that the current customers are not just renewing their subscriptions but are also purchasing more of Amplitude’s products.

From March 2024 to June 2025, Amplitude’s Annual Recurring Revenue (ARR) increased by US$285 million to US$335 million, or a 17.5% growth over 15 months. The company had a 16% year-over-year ARR growth rate in Q2 2025, up from 12% in Q1, indicating strong momentum.

Amplitude made considerable strides towards profitability in 2025. It faced a GAAP net loss of US$0.19 per share for Q2 2025 (similar to 2024), but the company operated with a non-GAAP net income of US$0.01 per share, indicating an improvement in operations. Operating cash flow reached US$20.1 million, which was an increase of US$10.9 million over last year, while free cash flow rose to US$18.2 million from US$6.8 million the previous year.

Amplitude’s guidance for Q2 2025 included a revenue range of US$80.3 million to US$82.3 million, and a non-GAAP operating loss of US$2.9 million to US$0.9 million, signalling the company moving closer to breakeven. For the entire year 2025, the company expected revenue to be between US$329 million and US$333 million, which is indicative of continuous growth.

Amplitude made a major step forward in its operations by acquiring Command AI, which is an AI-driven innovation and a global expansion. Furthermore, Amplitude is expanding its operations in the Asia-Pacific region, which now makes up 15% of global sales and has an 18% increase in product demand in Australia.

Aruna Madrekar is an editor at Smartphone Thoughts, specializing in SEO and content creation. She excels at writing and editing articles that are both helpful and engaging for readers. Aruna is also skilled in creating charts and graphs to make complex information easier to understand. Her contributions help Smartphone Thoughts reach a wide audience, providing valuable insights on smartphone reviews and app-related statistics.