Venmo Statistics And Facts (2025)

Updated · Apr 04, 2025

Table of Contents

- Introduction

- Editor’s Choice

- General Facts

- Leading Digital Payment Brands

- Venmo Revenue

- Venmo User Count

- Venmo Total Payment Volume

- Zelle, Venmo, And Cash App Users And Penetration

- Venmo User Demographics

- Venmo Market Position

- Venmo Market Share as Compared to Other Leading Digital Payment Brands

- Venmo Number of Employees

- Conclusion

Introduction

Venmo Statistics: Venmo has been revolutionising peer-to-peer (P2P) payments, where social payments and financial transactions are combined into one platform. The application was designed to perform simple money transfer tasks for individuals to easily move funds to one another.

Now, it has taken a modernised form for an individual whose activity has become inseparable from digital payments. As of 2024, the growth trajectory of Venmo is an indication of how well it is doing in terms of popularity and its integration into personal and commercial financial activities.

This article empirically charts the Venmo statistics, focusing on key user population-transaction volume income demographics and so forth.

Editor’s Choice

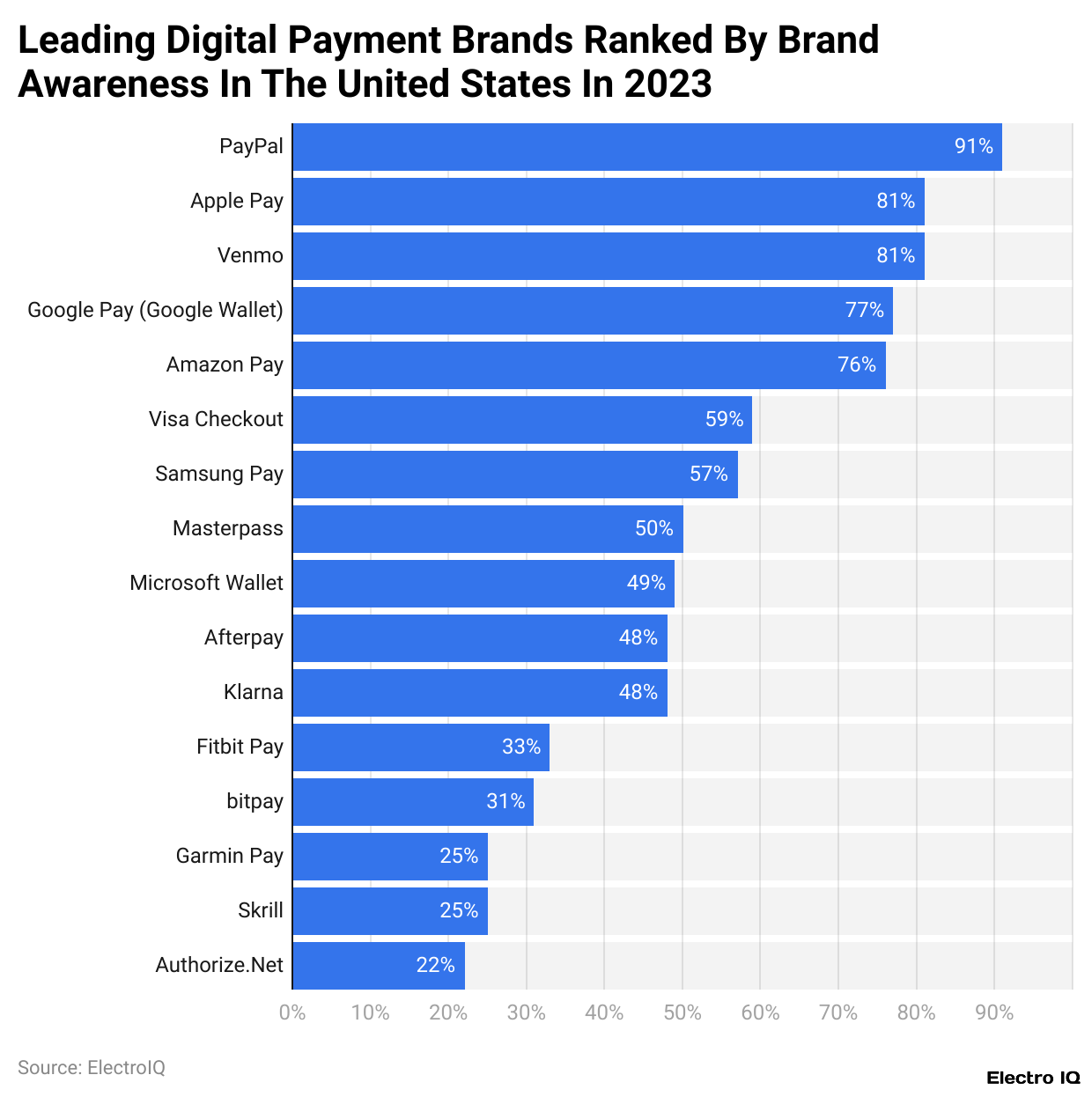

- According to Venmo statistics, PayPal is synonymous with digital payments in the US, given that 91% of Americans recognise the brand. The other two, Venmo and Apple Pay, draw 81% awareness apiece.

- Venmo’s revenues soared from US$160 million in 2017 to a projected US$1.4 billion in 2024.

- The number of Venmo users soared from 41.5 million in 2019 to nearly 97.1 million by 2025.

- Venmo processed transactions worth US$244 billion last year. The payment volume will thrash it all by 2023 at US$270 billion. In the first quarter of 2024, the amount touched US$69 billion.

- Venmo continues to dominate the market for P2P payment services, expanding its user database from 77.8 million in 2021 to a projected 107.6 million by 2025, amassing 61.8 % of the market share.

- Venmo is barely more famous among females (53.76%) than it is among males (46.24%). Technically, the top age group consists of 25 to 34-year-olds (26.24%).

- Venmo is branded 83% known, 36% popular, and 31% used, with 27% loyal users.

- PayPal owns 81% of the digital payment market while Venmo holds 38%, Apple Pay 34%, Google Pay 31%, and Amazon Pay 30%.

- Venmo’s internal employee strength has always been on the rise, from 500 employees in 2018 to around 793 in 2023.

General Facts

- Venmo plays an important role in online shopping, giving 92% of its users the opportunity to shop online in the past six months.

- This shopping activity involves quite a large slab of clothing and footwear, with 56% of users utilising the platform for related purchases.

- Venmo statistics reveal that the usage of the app is, however, quite diverse, with 113 million users participating in transactions with the education sector and 58 million with the advertising sector.

- Tipping is another big facet of Venmo usage, with 93% of customers claiming to have tipped in the last six months.

- That would draw even more users in 22 % more, to be specific. Venmo offers deferred payments for extended periods.

- Funny enough, emojis play a considerable role in the transactions whereby both men and women happily sprinkle Venmo with pizza slice and money stack with wings emojis when sending money.

- Venmo statistics state that Venmo hit another major milestone in its payment processing arena with a monthly payment volume of over US$1 billion in January 2016.

- Greater acceptance of Venmo has continued, with over 2 million merchants in the U.S. accepting the service as a mobile payment option.

- The QR code scan feature enjoys wide usage- at least 65% of the people on the platform have some sort of engagement with it.

- More than 9,000 businesses and 2 million sellers have adopted Venmo’s “Pay With Venmo” feature, paving the way for greater integration of Venmo into mainstream commerce.

Leading Digital Payment Brands

(Reference: statista.com)

- PayPal is probably the most popular digital payment service in America. 91% registered the brand. It means that PayPal is the option available to most people in the U.S. for paying purposes.

- Close to that is Venmo and followed by Apple Pay as the second-most acknowledged among U.S. respondents, each boasting an 81% awareness level as a digital payment brand. It means a considerable portion of the population is also aware of these two platforms, usually for peer-to-peer payments and mobile payments.

- After Venmo and Apple Pay, Google Pay ranks next in viewership, while the awareness %age isn’t listed. Amazon Pay comes in fifth place, rounding out the list of top digital payment brands in the U.S. Amazon Pay was launched in 2007; it’s been adorable since then, but it still ranks lower than the other payment services. These Venmo statistics symbolise a competitive environment in digital payments. PayPal by now rules the space, while others such as Venmo, Apple Pay, Google Pay, and Amazon Pay continue to gain visibility and usage.

Venmo Revenue

| Year |

Revenue ($mm)

|

| 2017 |

160 million

|

| 2018 |

200 million

|

| 2019 |

300 million

|

| 2020 |

450 million

|

| 2021 |

850 million

|

| 2022 |

935 million

|

| 2023 |

1100 million

|

| 2024 (Estimated) |

1400 million

|

(Source: prioridata.com)

- Venmo statistics show that Venmo’s revenues have grown remarkably over the years. They reflect the increased adoption of the money transfers app and its growing monetisation strategies.

- Venmo generated US$160 million in revenues in 2017. In the following year, that number climbed to about US$200 million.

- Revenues kept increasing in the entire year of 2019, stating the same trend of earning US$300 million- an uphill rate as more wide currents rushed to embrace the p2p business payments app. Revenues from Venmo rose to US$450 million in 2020, almost 50% more than the previous year.

- Venmo accelerated growth even further in 2021, when revenue almost doubled to US$850 million. Digital payment adoption, business transaction growth, and new provision of financial services are probably effects combining to propel this surge.

- In 2011, Venmo earned revenues of US$935 million, continuing its upward trend. In 2023, Venmo became, for the first time, a major bank by crossing the US$1 billion mark with US$1.1 billion in revenue. This milestone highlighted the platform’s growing role in the digital payments ecosystem.

- Analysts predict Venmo’s Russian revenues for 2024 will amount to US$1.4 billion, indicating an ongoing growth pattern primarily driven by an increasing user base, growing transaction volumes, and additional merchant and financial services integrations.

- The evolution of Venmo from merely a peer-to-peer payment app into a terrifyingly serious contender in the digital finance arena is demonstrated in this data.

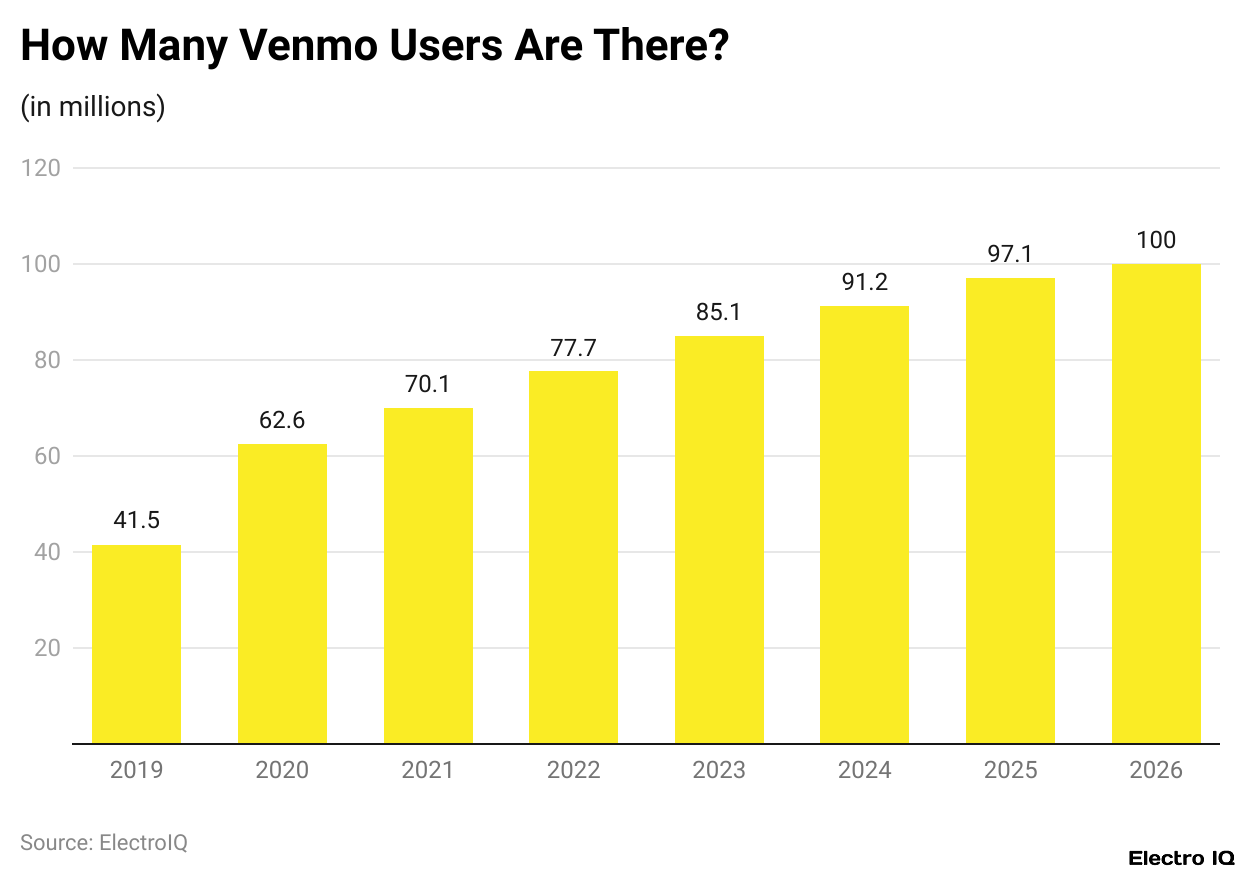

Venmo User Count

(Reference: doofinder.com)

- Heavily affixed for the past, Venmo also grew in its age. In 2022, Venmo showed news for 77.7 million active users across the U.S., which implied an increase of 10.8% compared with the preceding year. The bigger picture is exactly what has evolved in Venmo.

- As an example, back in 2019, there were already over 41.5 million users on the platform. An extraordinary 50.8% increase was enjoyed by Venmo within a single year in 2020, thus raising its user base to 62.6 million. This was made possible because of how the pandemic forced people to adopt more digital payments.

- Even in 2021, there was a 12% increase, bringing the whole number up to 70.1 million. Venmo is projected to keep on growing, but the rate will be slightly lower. In 2023, it was supposed to reach 85.1 million users, which was a 9.5% increase.

- Venmo statistics reveal that the following year, 2024, the site will increase again, with a 7.2% increase to 91.2 million users. This was continued until 2025 and will reach 97.1 million with an increase of 6.5%. The forecast goes beyond 100 million users by 2026, which can be attributed to an annual growth rate of 5.4%.

- Venmo, however, weighed on itself so much from 2020 to 2022, with the average annual growth rate of the company reflected as 24.6%.

- That would mean for the years 2023 to 2026, the average annual growth would be around 7.1%.

- The growing competition is likely to influence how Venmo acquires new users from now on. Venmo’s strong card is that it gains the acceptance of young adults.

- It has offered so far free peer-to-peer money transfer, which has drawn it to the younger crowd, who finds it convenient and has a social feature.

- The evolution of Venmo as a small payment service is into a power player in the digital finance space, which will soon have over 100 million users.

- While businesses and users adjust to the new way of digital transactions, they also view how big Venmo will involve all the people and their behavior.

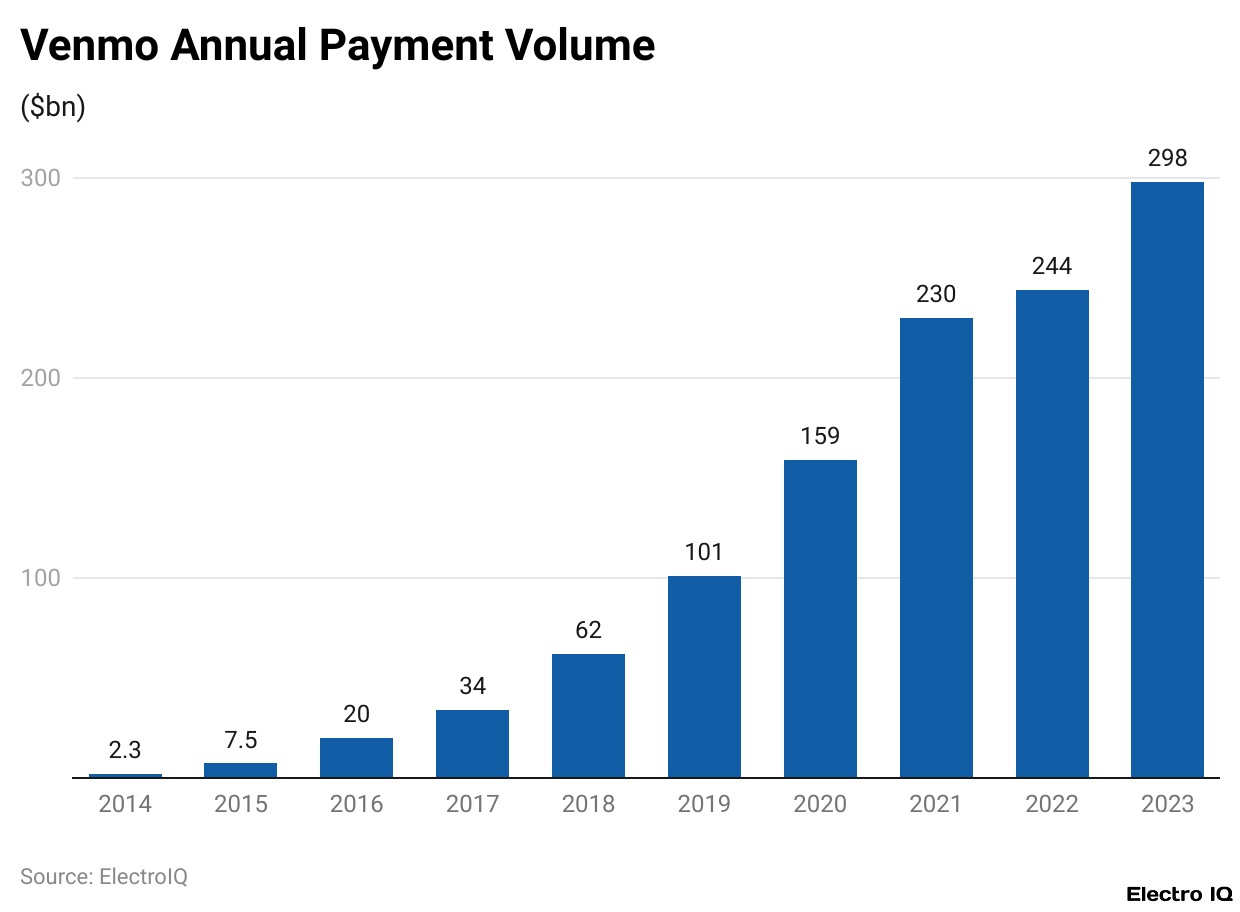

Venmo Total Payment Volume

(Reference: prioridata.com)

- The last decade has seen an unprecedented rise in Venmo’s payment volume. When the platform was just a toddler back in 2014, the volume of transactions processed through it was just US$2.3 and much to its adult status- by 2022, the span saw a whopping US$244 billion being processed through Venmo, over 100 times than in just the previous 8 years.

- According to Venmo statistics, Venmo is steadily gaining acceptance and greater importance in the field of digital payments. Venmo enabled around US$244 billion in payment volume in 2022- an almost 50% increase from about US$159 billion in 2021-which only underlined its momentum.

- There were also early projections on payment volume exceeding 20% growth in 2023 to around US$298 billion. However, updated estimates at the beginning of 2025 show that, in fact, real payment volume for Venmo in the year 2023 was evaluated at US$270 billion.

- That was a notch lower in comparison to projected, yet it still indicates considerable growth and re-emphasizes Venmo as one of the most pertinent platforms for peer-to-peer financial transactions.

- So far in 2024, the platform performance remains strong. Venmo processed payments of US$69 billion in just the first quarter and is well on track for another good year.

- Such continued expansion further testifies to the growing penetration of Venmo in digital finance, bringing in more and more users and transactions.

Zelle, Venmo, And Cash App Users And Penetration

(Source: yalantis.com)

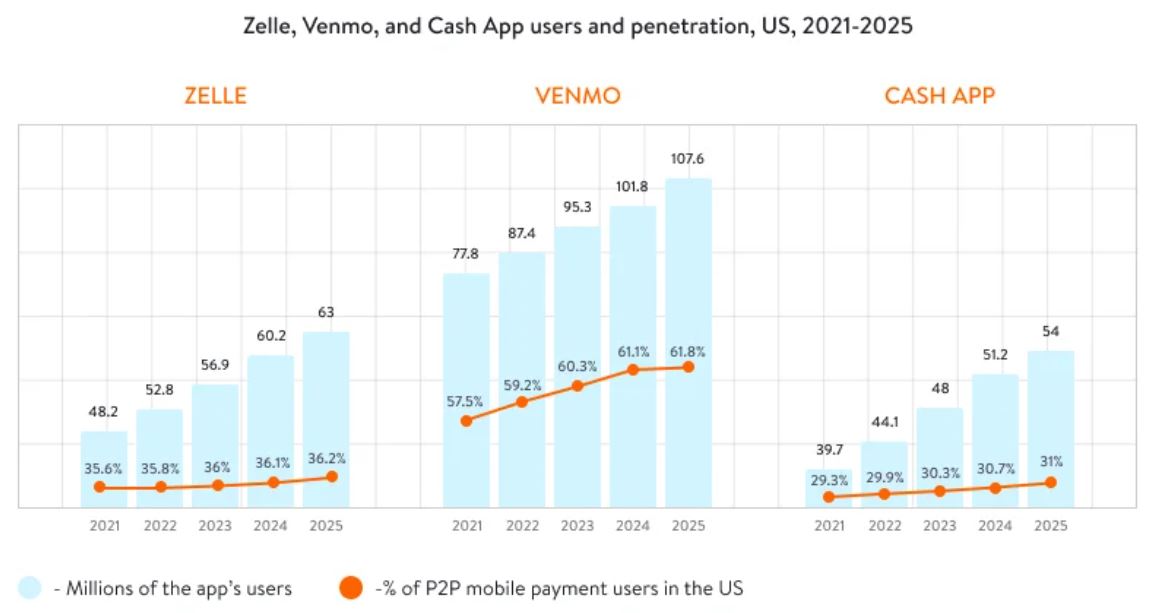

- Venmo statistics have illustrated app users vis-a-vis their P2P (peer-to-peer) payment market share between 2021 and 2025 for three major digital payments platforms: Zelle, Venmo, and Cash App.

- Indeed, Zelle has demonstrated gradual growth in its user base- from 48.2 million in 2021 to over an estimated 63 million in 2025. in total-number of shared users for P2P payment also increased marginally, going from 35.6 % in 2021 to 36.2% in 2025.

- Although its growing number of users reflects strong usage, the percentage of users has not dramatically changed but rather held steady with only marginal incremental growth positions annually.

- Venmo is far ahead of the other two applications in both total users and market share, as these numbers indeed indicate its supremacy in the P2P payment division. In 2021, it had 77.8 million users, climbing to 101.8 million as of 2024, with the sum nearing 107.6 million toward the end of 2025. Its total P2P market figure has also increased consistently, from 57.5% in 2021 to an expected 61.8% in 2025.

- This trend manifests strength in Venmo’s continued competition and attraction for consumers who choose online payment options.

- While the smallest of the three platforms in terms of users, Cash App has also shown a steady increase in its number of users, from 39.7 million in 2021 to an estimated 54 million by 2025. The P2P payment market share increased from 29.3 % in 2021 to 31 % by 2025. While its growth is not as phenomenal as that of Venmo, the user base continues to grow, and the platform maintains a solid position in the industry.

- In general, therefore, the data indicate that all three platforms are growing, with Venmo continuing to capture the largest market share, followed by Zelle and then Cash App.

- Zelle and Cash App grow at a steady rate, while Venmo has a further upsurge in user volumes and expands the dominance of P2P payment.

Venmo User Demographics

By Gender

(Reference: prioridata.com)

By Age

(Reference: prioridata.com)

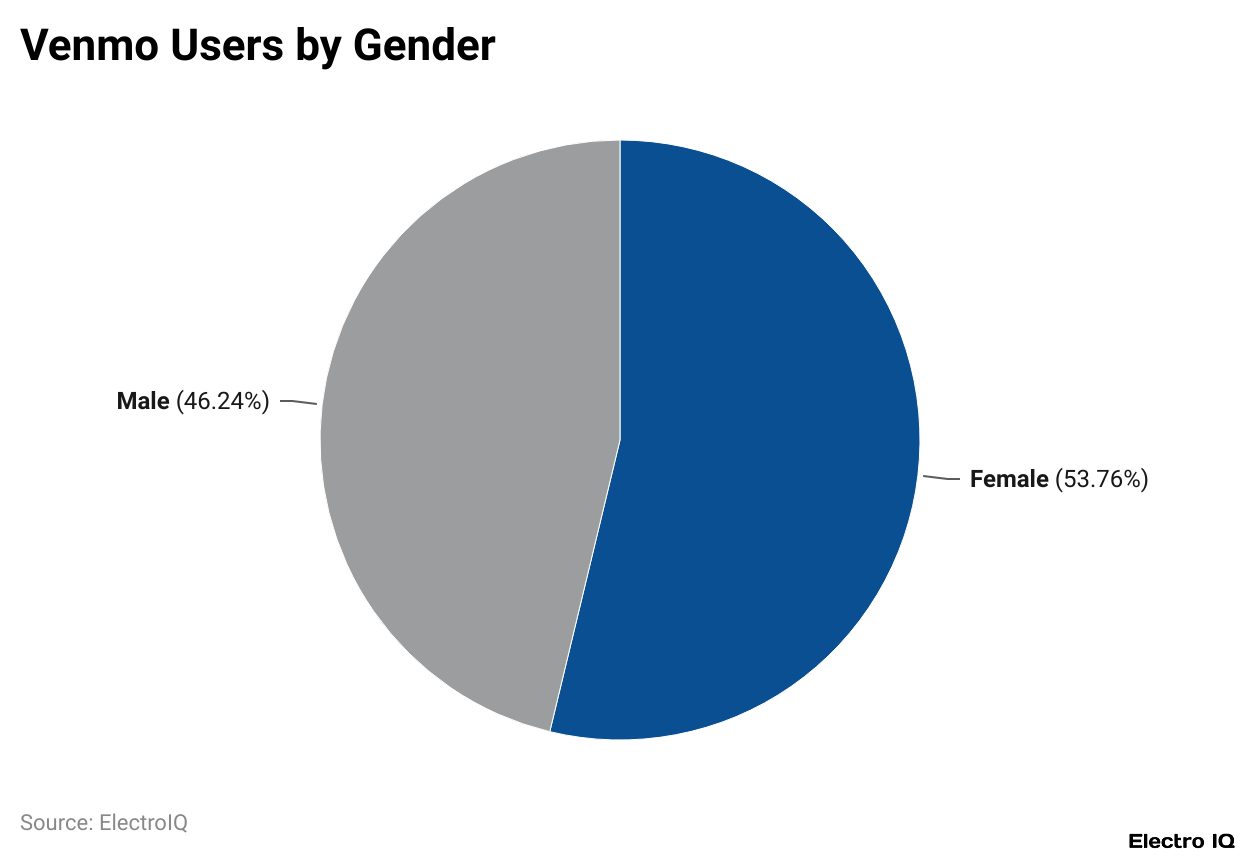

- The Venmo user demographics show about 53.76% of the user base are women compared to 46.24% who are men, thus pointing towards a more balanced gender distribution, with a slight tilt toward females.

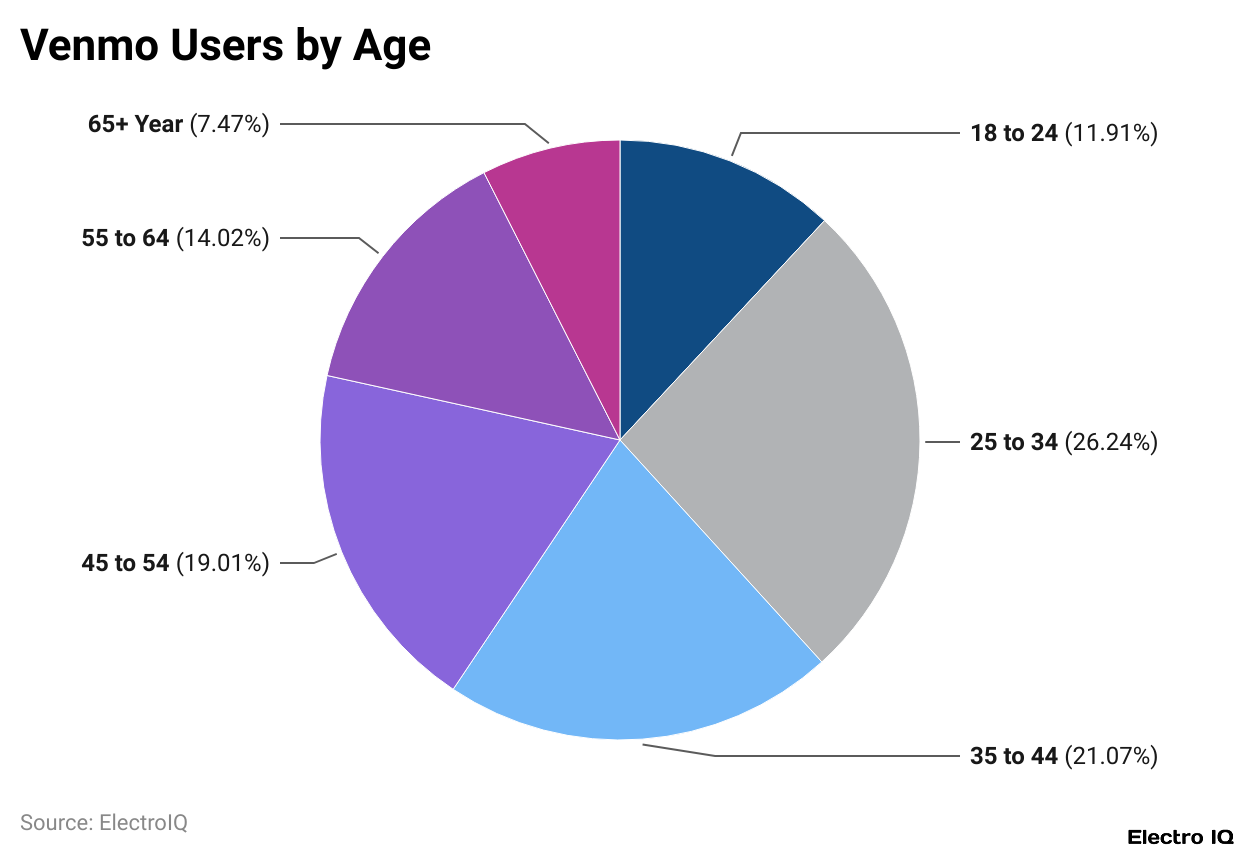

- Considering Venmo users by age, the largest proportion belongs to the age cohort between 25 and 34, which constitutes about 26.24% of all users.

- This is trailed by the cohort of 35-44, which makes up 21.07% and then the next older group aged 45-54, which accounts for 19.01%.

- In addition, 18-24-year-olds represent about 11.91% of its audience, while users aged 55 to 64 years constitute about 14.02%.

- Very few users aged 65 and older account for 7.47% of Venmo’s user base.

- Venmo statistics reiterate that Venmo is targeted towards younger and middle-aged adults, largely 25 to 54 years of age. While adoption of the application among older adults is limited, the application does enjoy some traction across all age groups.

Venmo Market Position

- Venmo statistics show that highly recognised among the population for its digital payment services, Venmo has proven itself in nearly all dimensions, be it awareness, high usage levels or loyalty by the Americans. Such is the brand acknowledgement that 83% of the population recognises Venmo.

- Sadly, out of the bunch, only 36% seem to care, that is, a little bit more than a third of the folks familiar with the highly buzzed-about services that claim to align it with usability. Realistically, though, it only reaches 31% of the population who use Venmo in real-life transactions, thus providing definitions for its practicality and everyday payment applications.

- At the same time, 27% of these users are paranoid about shifting away from Venmo and continuing to choose it without regard to possible competition benefits from other digital payment routes.

- In addition, Venmo generates a good amount of public activity and conversation, a 29% buzz rating: people normally talk about it and show interest towards it, thus marking its relevance in the fin-tech space.

- A combination of all those factors would be a testament to how Venmo has managed to take center stage in the U.S. market.

| Payment Methods |

Percentages

|

| PayPal | 81% |

| Venmo | 38% |

| Apple Pay | 34% |

| Google Pay | 31% |

| Amazon Pay | 30% |

| Afterpay | 17% |

| Visa Checkout | 16% |

| Klarna | 14% |

| Meta Pay (Facebook) | 12% |

| Mastercard Click to Pay (Masterpass) | 9% |

| Skrill | 4% |

| Other | 10% |

(Source: prioridata.com)

- In the digital payment sphere, PayPal is the reigning king, as it captures a whopping 81% market share, making it the most desired online payment service.

- Venmo statistics show that Venmo has closely followed its mother company, PayPal, at the second position, masking a high 38% regarding peer-to-peer transactions and daily payments.

- Laundering his power with the 34% share, his Apple Pay shows much interest among iPhone users in contactless and online payments.

- Google Pay follows closely behind with 31%, owing to its Android services and Google services complementing the functions.

- Amazon Pay has a 30% market share, both driven by its comprehensive e-commerce and online transactions: Among buy-now-pay-later services, Afterpay is at 17%, while Klarna is at 14%, further demonstrating the growing popularity of such incremental payment methods.

- Visa Checkout and Meta Pay (formerly Facebook Pay) have smaller market shares at 16% and 12%, respectively, indicating their niche battle arena.

Venmo Number of Employees

(Reference: prioridata.com)

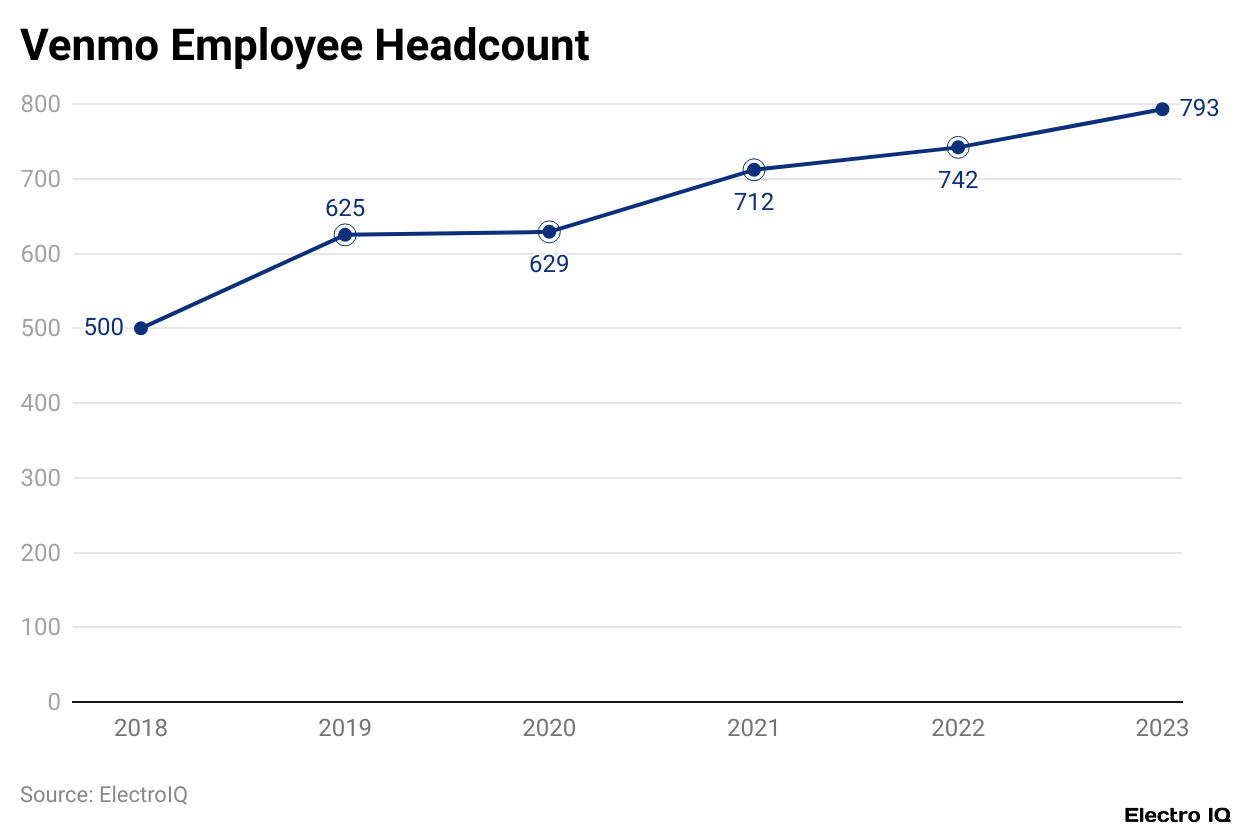

- According to Venmo statistics, Venmo has expanded its workforce significantly over the past few years in line with business growth, and therefore, demand for its services has been on the shoot at the very start.

- The number of employees then was 500 in 2018, while that increased to 625 in 2019. That trend continued with an increase in number up to 629 employees in the year 2020.

- 712 employees were reported at Venmo in 2021, as compared to 2020; hiring increased significantly in 2020.

- Moreover, Venmo’s employee headcount clocked another impressive jump in 2022, taking the figures to 742 employees.

- Projections predict that continuing expansion will be made in the company’s workforce, expecting 793 employees by 2023.

- This is a clear indication of Venmo’s ever-growing investment in talent and resources to support the expanding user base and continuous enhancement of services.

Conclusion

As per Venmo statistics, Venmo’s performance demonstrates once again its critical importance in the digital payment ecosystem. As it increases its user base, transaction volume, and revenue streams, Venmo effectively improves its services and strengthens its competitive position in the marketplace. Going ahead, Venmo will focus on user engagement, merchant integration, and service diversification to position itself for continued growth and to meet the fast-evolving needs of its users.

FAQ.

By the end of 2024, Venmo is expected to have around 91.2 million users, with estimates that this figure will go up to 97.1 million by 2025 and will exceed 100 million by 2026. The user base of Venmo has increased significantly, marking the rise in the preference of users towards digital payments, from 41.5 million in 2019 to 77.7 million in 2022.

In 2023, Venmo transacted US$270 billion as against US$244 billion in 2022. This was further supplemented by US$69 billion worth of payments in Quarter 1 of 2024, showing an unwavering surge in growth.

Venmo is about 38% of the whole market, second to PayPal’s 81%. Competing very closely against Apple Pay (34%), Google Pay (31%), and Amazon Pay (30%), it is a frontrunner in the peer-to-peer (P2P) payment space.

Venmo is slightly more popular among females (53.76%) than males (46.24%). Venmo’s largest age cohort is comprised of 25-34-year-olds (26.24%), followed by 35-44 (21.07%).

Venmo’s revenue increased from US$160 million in 2017 to an estimated US$1.4 billion in 2024. It reached US$1 billion in revenue in 2023, demonstrating its monetisation strategies and expanding services.

Saisuman is a skilled content writer with a passion for mobile technology, law, and science. She creates featured articles for websites and newsletters and conducts thorough research for medical professionals and researchers. Fluent in five languages, Saisuman's love for reading and languages sparked her writing career. She holds a Master's degree in Business Administration with a focus on Human Resources and has experience working in a Human Resources firm. Saisuman has also worked with a French international company. In her spare time, she enjoys traveling and singing classical songs. Now at Smartphone Thoughts, Saisuman specializes in reviewing smartphones and analyzing app statistics, making complex information easy to understand for readers.