Introduction

Artificial intelligence companies are businesses that create, sell, or use smart computer systems that learn from data to do tasks usually done by people. They build tools like chatbots, image and speech recognition, and recommendation engines, and offer them as apps, cloud services, or APIs. Some design special chips and platforms that run these systems faster. Others help clients set up AI, clean data, and connect it to work. These companies serve many fields like healthcare, finance, retail, transport, and more. They usually aim to cut costs, reduce errors, and speed decisions. Good AI firms also focus on safety, fairness, privacy, and use of data.

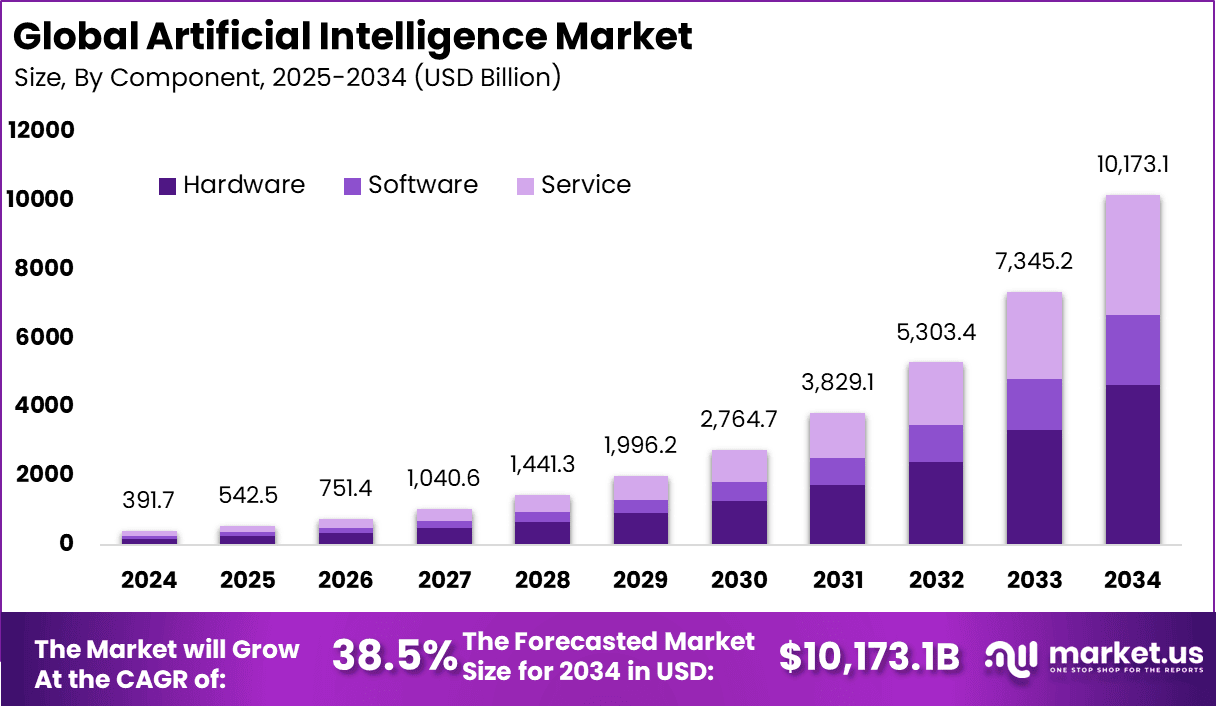

Artificial Intelligence Companies Market Size

- The hardware segment made up 45.6% of the global AI market.

- Cloud delivery was the most common way to use AI, holding a 67.8% share.

- Machine learning was the top AI technology, capturing a 43.5% share.

- Healthcare was the largest industry using AI, accounting for 25.7% of the market.

- One estimate valued the U.S. AI market at USD 4.67 billion in 2024 with a 13.7% CAGR.

- Another estimate put the U.S. AI market at USD 122.19 billion in 2024 with a 35.3% CAGR.

- North America led the world with a 34.6% market share.

- China showed strong adoption, with 58% of companies using AI and 30% testing it.

- In the U.S., 25% of companies had adopted AI and 43% were exploring use cases.

- The World Economic Forum expects AI to create 97 million new jobs, balancing automation losses.

- Accenture projects AI could add USD 3.8 trillion to manufacturing by 2035.

- A Forbes Advisor survey found 24% of business owners worry AI might reduce website traffic.

- In 2023, over 25% of U.S. startup funding went to AI, up from 12% during 2018–2022.

- OpenAI reportedly sought a valuation of about USD 90 billion in late 2023.

- About 20% of generative AI users are aged 25–34, showing strong use by younger professionals.

- The self-driving car market is expected to top USD 600 billion within five years.

- The U.S. startup scene and strong venture capital help speed AI innovation and commercialization.

- Friendly policies in the U.S. and Canada support AI research and adoption across the region.

- The U.S. National AI Initiative encourages teamwork among government, universities, and industry to stay competitive.

- In August 2025, the U.S. General Services Administration launched USAi to help federal agencies safely test and adopt generative AI at scale.

Artificial Intelligence Companies in the World

Creating a credible list of leading AI companies for 2025 requires using multiple yardsticks. Some rankings prioritize market capitalization, revenue, and investor activity, while others spotlight influential pure-play AI startups and well-funded challengers. The overview below combines these perspectives to give a balanced snapshot of the top AI players in 2025.

Most Valuable AI Companies Considering Market Capitalization

Big tech firms dominate the list because their scale and heavy spending power fuel unmatched AI research, talent, and infrastructure.

NVIDIA

| Field |

Details |

| Company Type |

Public company (NASDAQ: NVDA). |

| Parent organization |

None (independent public company). (No parent listed in SEC filings.) |

| CEO |

Jensen (Jen-Hsun) Huang, President & CEO. |

| Number of Employees |

Approx 36,000 employees across 38 countries (end of fiscal 2025). |

| Established (date & year) |

April 5, 1993. |

| Subsidiaries (examples) |

Mellanox Technologies Ltd.; NVIDIA Israel Ltd.; NVIDIA Ltd. (UK); NVIDIA International Holdings Inc.; NVIDIA Graphics Private Ltd. (India). |

| Products (high-level) |

GeForce RTX GPUs; Data-center platforms incl. Blackwell architecture; CUDA platform; Omniverse; NVIDIA DRIVE (autonomous vehicles). |

| Headquarters |

2788 San Tomas Expressway, Santa Clara, California, USA. |

| Geographical Presence |

Operations in 38 countries (global workforce footprint). |

| Website |

https://www.nvidia.com |

- NVIDIA’s data center revenue hit about USD 115.2 billion in FY2025, accounting for the vast majority of its USD 130.5 billion total revenue, as the segment grew about 142% year over year on surging AI demand.

- In the quarter ended July 27, 2025 (Q2 FY2026), NVIDIA reported USD 46.7 billion in total revenue, with Data Center at USD 41.1 billion; Blackwell data-center revenue grew 17% sequentially.

- NVIDIA says its developer ecosystem includes approximately 5.9M+ CUDA/developer-program users in its FY2025 10-K, “more than 6 million” by mid-2025, and about 7 million CUDA developers cited in October 2025.

- Blackwell set new benchmark marks: in MLPerf Training v5.0 it delivered up to 2.6× higher training performance versus H100; MLPerf Inference v5.0/5.1 showed major per-GPU throughput gains, including approx 5× over Hopper on the DeepSeek-R1 reasoning test.

- NVIDIA began shipping production Blackwell systems in Q4 FY2025, marking the architecture’s first revenue quarter.

- NVIDIA launched Lepton (May 19, 2025), a software marketplace to match developers with available GPU capacity across “neocloud” providers and others.

- NVIDIA unveiled DGX Spark (Oct 13, 2025), a compact Grace Blackwell system aimed at putting full-stack AI compute on every researcher’s desk.

- CUDA downloads surpassed 450 million by August 2025, underscoring the platform’s scale among AI developers.

- NVIDIA’s China market share for advanced AI accelerators fell from about 95% to about 0% in 2025 due to U.S. export controls, materially reshaping regional sales mix.

- FY2025 results highlight R&D investment of about USD 12.9 billion, reflecting heavier spend on compute, infrastructure and new AI product introductions.

Microsoft

| Field |

Details |

| Company Type |

Public company (NASDAQ: MSFT). |

| Parent organization |

Independent public company (no parent). |

| CEO |

Satya Nadella, Chairman & Chief Executive Officer. |

| Number of Employees |

About 228,000 worldwide (as of June 30, 2025). |

| Established (date & year) |

Founded April 4, 1975. |

| Subsidiaries (examples) |

LinkedIn Corporation; GitHub, Inc.; Activision Blizzard, Inc.; ZeniMax Media Inc.; Skype Global S.à r.l. |

| Products (high-level) |

Windows, Microsoft 365, Azure, Dynamics 365, Copilot, Surface, Xbox. |

| Headquarters |

One Microsoft Way, Redmond, WA 98052, USA. |

| Geographical Presence |

Operates in over 190 countries. |

| Website |

https://www.microsoft.com |

- Microsoft reported that its family of Copilot apps surpassed 100 million monthly active users, and AI features across its products now reach over 800 million monthly active users.

- In FY2025 (year ended June 30, 2025), Microsoft posted USD 281.7 billion in revenue, highlighting that “Cloud and AI strength” fueled results.

- Microsoft’s capital expenditures tied to AI and data centers totaled about USD 88.7 billion in FY2025, and management signaled USD 30+ billion of capex in a single upcoming quarter.

- GitHub Copilot reached more than 20 million all-time users, according to CEO Satya Nadella.

- Analysts estimated that Azure AI services contributed about19% of Azure’s growth in the June-quarter and generated over USD 3 billion in revenue that period.

- Microsoft began offering Copilot in Microsoft 365 consumer plans (with a USD 3 price increase option), extending generative AI beyond enterprises.

- Microsoft introduced Copilot Tuning and multi-agent orchestration at Build 2025 so organizations can create domain-specific agents that work together under human oversight.

- The company expanded Security Copilot with AI agents to triage phishing, prioritize incidents, and monitor vulnerabilities.

- GitHub announced a new AI coding agent that can autonomously fix bugs and add features inside a managed VM workflow for Copilot Enterprise/Pro Plus users.

- Microsoft released new Phi-4 reasoning small-language models (including Phi-4-mini-flash-reasoning) designed to run efficiently with long context and strong math/logic.

- Microsoft continued its on-device AI push with Phi Silica for Copilot+ PCs, enabling local AI features and a developer API.

- Microsoft AI unveiled MAI-Voice-1 (expressive speech generation) and MAI-Image-1 (its first in-house text-to-image model) for Copilot experiences.

- On Oct 23, 2025, Microsoft announced the Copilot Fall Release with upgrades aimed at making AI “more personal, useful, and human-centered.”

Alphabet (Google)

| Field |

Details |

| Company Type |

Public company (NASDAQ: GOOGL, GOOG). |

| Parent organization |

None (independent public company). |

| CEO |

Sundar Pichai, CEO of Alphabet and Google. |

| Number of Employees |

183,323 (as of Dec 31, 2024). |

| Established (date & year) |

October 2, 2015 (Alphabet formed via Google restructuring); Google founded September 4, 1998. |

| Subsidiaries (examples) |

Google LLC (largest), GV (Google Ventures), CapitalG, Waymo, Verily, Calico, X Development, Wing, Google Fiber, Isomorphic Labs. |

| Products (high-level) |

Search, YouTube, Android, Chrome, Google Cloud, Google Workspace, Maps, Ads, Pixel hardware, Gemini (AI). |

| Headquarters |

1600 Amphitheatre Parkway, Mountain View, California, USA. |

| Geographical Presence |

Area served: Worldwide. |

| Website |

https://abc.xyz (Alphabet) |

- Alphabet said AI is “positively impacting every part of the business,” with Q2 2025 revenue of USD 96.4 billion and Google Cloud up 32% to USD 13.6 billion.

- Google Cloud’s sales backlog reached USD 106 billion in Q2 2025, and the unit expects about USD 58 billion of that to convert to revenue over the next two years.

- AI Overviews in Search now have over 2 billion monthly users across 200+ countries and 40 languages, and they drive 10% more queries for queries that show them.

- AI Mode in Search has 100+ million monthly active users in the U.S. and India.

- The Gemini app has 450+ million monthly active users, with daily requests up 50%+ quarter-over-quarter.

- Google says 9 million developers have built with Gemini, and the company now processes about 980 trillion monthly tokens across its AI surfaces.

- At I/O and beyond, Google advanced the Gemini 2.5 family (including the Deep Think mode) and reported gold-medal–level performance on elite problem-solving benchmarks.

- Google’s sixth-generation Trillium (TPU v6e) claims greater than 4 × training performance, up to 3× inference throughput, and 4.7× peak compute per chip versus prior gen, with 67% better energy efficiency.

- Veo 3 video generation has produced 70+ million videos since May 2025, and Google Videos reached nearly 1 million monthly users.

- Waymo surpassed 100 million autonomous miles on public roads as Alphabet continues to scale AI-driven robo-taxis.

- AlphaFold continues to expand its scientific impact, with the public database getting a major October 2025 update synchronized to UniProt 2025_03 and new downloadable MSAs.

- Google reiterated a full-stack AI strategy—from TPUs and data centers to models and products—and said Cloud’s annual revenue run-rate exceeds USD 50 billion.

Amazon

| Field |

Details |

| Company Type |

Public company (NASDAQ: AMZN). |

| Parent organization |

None — independent public company (no parent listed in SEC filings). |

| CEO |

Andy Jassy, President & CEO. |

| Number of Employees |

~1,556,000 full- and part-time employees (as of Dec 31, 2024). |

| Established (date & year) |

Founded July 5, 1994; online store launched July 1995. |

| Subsidiaries (examples) |

Amazon Web Services, Inc.; Whole Foods Market; Twitch Interactive; Ring; Zoox; Audible; Amazon MGM Studios. |

| Products (high-level) |

E-commerce (Amazon.com), AWS cloud services, Prime (incl. Prime Video & Amazon Music), Devices (Echo/Alexa, Kindle, Fire TV), Advertising & more. |

| Headquarters |

410 Terry Avenue North, Seattle, WA 98109-5210, USA. |

| Geographical Presence |

Operations across Africa, Asia-Pacific, Europe, Latin America, the Middle East, and North America. |

| Website |

https://www.amazon.com |

- In Q2 2025, AWS revenue reached $30.9 billion (up 17.5% year over year) and AWS operating income was $10.2 billion, while Amazon’s total net sales were $167.7 billion.

- Amazon Bedrock reports “tens of thousands” of customers and a 4.7× year-over-year customer base increase as of December 2024.

- Amazon’s new Nova foundation-model family is already used by thousands of customers, with all Nova models available to AWS customers.

- Trainium2 (EC2 Trn2) is generally available and delivers 30–40% better price-performance than current-gen GPU P5e/P5en instances, along with major speed and efficiency gains over Trn1.

- AWS also announced P6 instances with NVIDIA Blackwell GPUs, slated for 2025 availability and expected to offer up to 2.5× faster compute than the prior generation.

- Amazon deepened its Anthropic partnership with a $4 billion investment and named AWS as Anthropic’s primary cloud provider, bringing Claude models to Bedrock.

- Alexa+ (the next-gen, generative-AI Alexa) was introduced in February 2025 and has been rolling out across Echo, Kindle, Ring, and Fire TV devices, with new features highlighted again in the fall devices refresh.

- Amazon Q Business is generally available with two tiers—Lite at $3/user/month and Pro at $20/user/month—for enterprise chat and agentic workflows.

- AWS added Nova customization in SageMaker AI so customers can pre-train, fine-tune, and align Nova Micro/Lite/Pro and then deploy to Bedrock.

- AWS doubled its Generative AI Innovation Center investment with an additional $100 million, expanding hands-on support for customers building GenAI solutions.

- Bedrock continues to expand supported models, including Amazon Titan (text, image, embeddings) and leading third-party models from Anthropic, Cohere, Meta, Mistral, and others

- AWS formed a new Agentic AI group in March 2025, led by Swami Sivasubramanian, to accelerate autonomous and multi-agent capabilities across its AI stack.

Meta Platforms

| Field |

Details |

| Company Type |

Public company; Class A common stock listed on Nasdaq under ticker META. |

| Parent organization |

None — independent public company. |

| CEO |

Mark Zuckerberg, Founder, Chairman & Chief Executive Officer. |

| Number of Employees |

74,067 (as of Dec 31, 2024). |

| Established date and year |

Founded February 4, 2004; incorporated July 2004 (Delaware); rebranded to Meta on October 28, 2021. |

| Subsidiaries (examples) |

Instagram, LLC; WhatsApp LLC; Meta Platforms Ireland Limited; Meta Platforms Technologies, LLC; Edge Network Services Limited; Siculus, Inc.; Facebook UK Limited. |

| Products (high-level) |

Family of Apps: Facebook, Instagram, Messenger, WhatsApp (and Threads); Reality Labs: Meta Quest headsets & Horizon; AI: Meta AI assistant; Models: Llama. |

| Headquarters |

1 Meta Way, Menlo Park, California 94025, USA. |

| Geographical Presence |

Global operations with offices across North America, Latin America, Europe/Middle East/Africa, and Asia-Pacific. |

| Website |

meta.com (corporate/consumer); about.meta.com (company info/news). |

- Meta said Meta AI now reaches more than 1 billion monthly active users, and it is focusing on making the assistant more personal and useful.

- Meta’s open-source Llama model family has been downloaded over 1 billion times since launch.

- The standalone Meta AI app surged to 2.7 million daily active users by October 17, 2025, after launching the Vibes short-AI-video feed.

- Meta reported that AI-driven ad recommendation upgrades lifted ad conversions about 5% on Instagram and about 3% on Facebook in Q2 2025.

- The same quarter, Meta said AI improvements to recommendations increased time spent approx 5% on Facebook and approx 6% on Instagram.

- Meta AI is available in 200+ countries and territories, with WhatsApp as the largest driver of queries so far.

- Meta’s in-house chip MTIA is deployed at scale in data centers to serve ads and recommendation inference with major efficiency gains.

- Meta guided $66–$72 billion in 2025 capital expenditures (to expand AI/data-center capacity), and it spent $17.01 billion in capex in Q2 alone.

- Meta also noted that 2026 capex is likely to grow significantly again as it aggressively adds AI compute capacity.

Taiwan Semiconductor Manufacturing Company (TSMC)

| Field |

Details |

| Company Type |

Public company; listed on TWSE: 2330 and NYSE (ADR): TSM. |

| Parent organization |

None – independent public company. (Listed entity with its own subsidiaries; no parent disclosed in filings.) |

| CEO |

Dr. C.C. Wei, Chairman & Chief Executive Officer (since June 2024 as Chairman; CEO since 2018). |

| Number of Employees |

About 83,000 worldwide (end of 2024). |

| Established (date & year) |

February 21, 1987 (incorporated); founded 1987. |

| Subsidiaries (examples) |

TSMC Arizona Corporation (US); TSMC Washington, LLC (US); TSMC China Company Limited (Shanghai/Nanjing); Japan Advanced Semiconductor Manufacturing, Inc. (JASM) — majority-owned. |

| Products (high-level) |

Dedicated semiconductor foundry services and wafer fabrication; advanced logic nodes (N3 in production; N2 planned 2025); 3DFabric advanced packaging (CoWoS®, InFO, SoIC®); Open Innovation Platform® (OIP) design enablement. |

| Headquarters |

8, Li-Hsin Rd. 6, Hsinchu Science Park, Hsinchu 300-096, Taiwan (R.O.C.). |

| Geographical Presence |

Global. Primary manufacturing in Taiwan, with fabs/operations in the U.S. (Arizona, Washington), China (Shanghai, Nanjing), and Japan (Kumamoto, via JASM); Germany fab construction began in 2024. Offices across North America, Europe, Japan, China, and South Korea. |

| Website |

https://www.tsmc.com |

- TSMC reported Q3 2025 revenue of $33.1B (+10.1% QoQ) with 59.5% gross margin; advanced nodes (7nm and below) made up 74% of wafer revenue and the HPC platform (AI-heavy) accounted for 57% of total sales.

- For 2025, TSMC now expects full-year revenue to grow close to the mid-30% range (USD) and CapEx of $40–$42B, with 10–20% earmarked for advanced packaging/testing.

- Management said N2 (2nm) is on track for volume production later this quarter (Q4 2025), with N2P and A16 (SPR) slated for 2H 2026, targeting smartphone and HPC/AI workloads.

- Analysts estimate CoWoS advanced-packaging capacity could reach ~70k wafers/month in 2025 and about 90k wpm by 2026, reflecting AI demand outpacing supply.

- NVIDIA noted its packaging needs are shifting to CoWoS-L for Blackwell while packaging remains a bottleneck, underscoring industry-wide constraints.

- TSMC raised its 2025 revenue guidance on robust AI demand and kept CapEx up to $42B, reinforcing confidence in the AI megatrend.

- In the U.S., Arizona Fab 1 is producing 4nm chips and TSMC is building an independent GIGAFAB cluster: Fab 2 (N3) targets 2028 volume and Fab 3 (N2/A16) is planned for later in the decade.

- In Japan and Europe, construction has begun on JASM’s second Kumamoto fab and on ESMC’s Dresden fab, broadening specialty/auto capacity that supports AI supply chains.

Top-Funded AI Startups (2025)

In 2025, cutting-edge AI startups and research labs are pushing the field forward with mega funding rounds, often anchored by strategic investments from global tech giants.

OpenAI

| Field |

Details |

| Company Type |

Private, capped-profit structure (OpenAI, L.L.C.) overseen by the OpenAI Nonprofit; plan announced in 2025 to transition the LLC to a Public Benefit Corporation while remaining under nonprofit oversight. |

| Parent organization |

OpenAI, Inc. . |

| CEO |

Sam Altman (reaffirmed May 7, 2025: “I remain the CEO of OpenAI”). |

| Number of Employees |

About 3,000+ (widely reported for 2025; public estimates vary). |

| Established (date & year) |

December 2015 (organization announced in 2015). |

| Subsidiaries (examples) |

OpenAI, L.L.C. (US); OpenAI Ireland Ltd; OpenAI UK Ltd; OpenAI France S.A.S. (local operating entities referenced in official policies/billing). |

| Products (high-level) |

ChatGPT and API; GPT-4o/o4-mini and GPT-5 models; DALL·E; Sora (video); enterprise offerings like ChatGPT Enterprise/Team and developer platform. |

| Headquarters |

San Francisco, California, USA (Mission Bay campus; address commonly listed as 1455 3rd St). |

| Geographical Presence |

Offices in London (first international), Dublin, and Tokyo (first Asia office); global operations and partnerships (e.g., UK strategic partnership). |

| Website |

https://openai.com |

- As of October 6, 2025, Sam Altman said ChatGPT reached 800 million weekly active users, marking a sharp jump in adoption this year.

- OpenAI confirmed that ChatGPT users now send about 2.5 billion prompts per day, with roughly 330 million coming from the U.S. alone.

- Reuters reported OpenAI’s annualized revenue run-rate hit USD 10 billion in June 2025 and rose to about USD 12 billion by late July.

- OpenAI introduced GPT-5 as its most advanced model to date, emphasizing enterprise productivity and stronger coding performance.

- The company rolled out GPT-5-codex in September 2025 and made it available in the Responses API for coding-focused work.

- ChatGPT Search became generally available to everyone in supported regions on February 5, 2025, expanding OpenAI’s search-style experience.

- OpenAI announced a multi-year collaboration with Broadcom to deploy 10 gigawatts of OpenAI-designed AI accelerators for next-gen clusters.

- In a September 2025 usage study, OpenAI highlighted large-scale consumer adoption, noting about 700 million weekly users at the time and analyzing 1.5 million conversations.

- At DevDay 2025, OpenAI launched apps inside ChatGPT, pushing the chatbot toward a more interactive, multifunction environment.

- On October 24, 2025, OpenAI teased major updates to the Sora app, including richer video editing features, reflecting rapid progress in generative video.

- In 2025 OpenAI reaffirmed nonprofit control while moving its commercial arm to a Public Benefit Corporation (PBC) structure to balance mission and capital needs.

Databricks

| Field |

Details |

| Company Type |

Private company. |

| Parent organization |

None – independent (no parent company). |

| CEO |

Ali Ghodsi, Co-founder & Chief Executive Officer. |

| Number of Employees |

8,000 employees across 23 countries (Mar 6, 2025). |

| Established (date & year) |

Founded 2013; incorporated May 31, 2013. |

| Subsidiaries / notable acquisitions (examples) |

MosaicML (2023); Arcion (2023); Okera (2023); Tabular (2024); Neon (agreement announced 2025). |

| Products (high-level) |

Data Intelligence Platform (Lakehouse); Unity Catalog (governance); Databricks SQL (data warehousing/BI); MLflow (ML/LLM lifecycle); Delta Lake (open-source storage layer); Delta Sharing (open data sharing); Mosaic AI (agents & evaluation). |

| Headquarters |

San Francisco, California, USA – corporate address: 160 Spear St, 15th Floor, San Francisco, CA 94105; new HQ at One Sansome Street announced Mar 6, 2025. |

| Geographical Presence |

Global operations; employees in 23 countries and offices across five continents. |

| Website |

https://www.databricks.com |

- Databricks said it surpassed a $4 billion revenue run-rate in Q2 2025 and its AI products crossed a $1 billion run-rate, alongside more than 50% YoY growth, positive free cash flow, and a $1 billion Series K at >$100 billion valuation.

- Reuters reported Databricks serves about 15,000 clients, has net revenue retention over 140%, and 650+ customers each spending over $1 million annually.

- The company notes it has around 8,000 employees in 23 countries, reflecting its expanding global footprint.

- Databricks highlights that more than 60% of the Fortune 500 rely on its platform and says it has 20,000+ customers worldwide.

- Databricks launched the DBRX open LLM family, claiming state-of-the-art performance across 30+ benchmarks versus leading open models.

- In May 2025, Databricks announced an agreement to acquire Neon for about $1 billion to add serverless Postgres for AI apps and agents.

- In March 2025, Databricks and Anthropic struck a multi-year partnership (reported as a five-year, $100 million pact) to help 10,000+ customers build governed AI agents with Claude on their data.

- In September 2025, Databricks announced a partnership with OpenAI to bring “frontier intelligence” to enterprises via Databricks Agent Bricks.

- Databricks is also expanding strategically; in September 2025 its ventures arm made a first Latin America investment by taking a stake in Indicium to deepen presence in the region.

- Reuters reported in August–September 2025 that Databricks planned to buy Tecton to boost real-time data for AI agents, continuing an acquisition streak (MosaicML 2023, Tabular 2024, Neon 2025).

Anthropic

| Field |

Details |

| Company Type |

Private Public Benefit Corporation (PBC). |

| Parent organization |

None – independent company. (CMA/Reuter’s coverage notes Anthropic maintains independence despite big-tech investments.) |

| CEO |

Dario Amodei, Chief Executive Officer. |

| Number of Employees |

1,300–1,500 (2025 est.). |

| Established (date & year) |

Founded 2021. |

| Subsidiaries / local entities (examples) |

Anthropic Limited (UK); Anthropic Ireland, Limited. |

| Products (high-level) |

Claude model family & apps (web/desktop), Claude Team/Enterprise & API, Claude Code (coding agent). |

| Headquarters |

500 Howard St., San Francisco, California, USA. |

| Geographical Presence |

U.S. (HQ); UK (London office); Asia expansion: Tokyo (opening), Bengaluru planned early 2026, Seoul planned early 2026. |

| Website |

https://www.anthropic.com |

- Anthropic raised USD 13 billion in a Series F round on September 2, 2025, valuing the company at USD 183 billion post-money.

- Reuters reports Anthropic’s annualized revenue run-rate was about USD 5 billion by August 2025, is nearing USD 7 billion in October 2025, and the company is targeting approx USD 9 billion by year-end 2025 and USD 20–26 billion in 2026.

- The company says it serves 300,000+ business and enterprise customers, with enterprise accounting for about 80% of revenue.

- On October 23, 2025, Anthropic announced a deal with Google for up to 1 million TPUs—tens of billions of dollars in compute—bringing more than 1 gigawatt of AI capacity online starting in 2026.

- Anthropic launched Claude 3.7 Sonnet, described as its first hybrid-reasoning model, and made it available via Amazon Bedrock for enterprise use.

- The firm rolled out a web app for Claude Code in October 2025, expanding access to its agentic coding assistant beyond the CLI to browser and mobile.

- Media coverage notes Claude Code is used extensively inside Anthropic and has seen a 10× usage surge since its public release in May 2025.

- Anthropic published its Economic/AI Usage Index in September 2025, analyzing Claude.ai usage across 150+ countries and all U.S. states.

- The company continues global expansion, announcing a Seoul office as part of its Asia-Pacific push, with South Korea now its most active market for Claude Code and Asia representing 25% of Claude Code usage.

- On AWS, customers can deploy the latest Claude 4.x family (e.g., Sonnet 4.5, Opus 4.1) designed for agentic workloads with near-instant or extended “long-thinking” modes.

xAI

| Field |

Details |

| Company Type |

Private company (Nevada corporation); initially formed as a public-benefit corporation, but dropped PBC status in 2024. |

| Parent organization |

None — independent company (no parent disclosed in official pages or major coverage). |

| CEO |

Elon Musk. |

| Number of Employees |

Approx 1,200+ (reported in early 2025). |

| Established date and year |

Incorporated March 9, 2023 (Nevada); publicly launched July 12, 2023. |

| Subsidiaries |

Not publicly disclosed by the company. |

| Products |

Grok AI assistant/models (e.g., Grok-2/2.5; Grok-3 announced in 2025), available on the web and integrated with X; enterprise/API access. |

| Headquarters |

Palo Alto, California, USA (company page references “our Palo Alto headquarters”). |

| Geographical Presence |

Offices/roles in Palo Alto, San Francisco, Seattle, Memphis (TN), and London (UK). |

| Website |

https://x.ai |

- xAI raised USD 6 billion in a Series B round in May 2024 at a USD 24 billion post-money valuation.

- xAI unveiled Grok 3 in February 2025, introducing beta “Think” reasoning models trained with large-scale reinforcement learning.

- xAI open-sourced Grok 2.5 in August 2025 and said Grok 3 would follow roughly six months later.

- Grok became available to all X users in December 2024 (free tier capped at 10 messages every two hours) and later launched an iOS app in January 2025.

- xAI operates the Colossus supercomputer in Memphis, which debuted with about 100,000 NVIDIA Hopper GPUs and is planned to expand toward 1 million GPUs.

- xAI says Colossus was built in 122 days, positioning it as the world’s largest AI training system at launch.

- In August 2025, TIME reported that 35 temporary gas turbines were used to power the Memphis site, drawing environmental scrutiny.

- Elon Musk stated xAI aims to reach compute on the order of 50 million “H100-equivalent” GPUs by 2030, with about 230,000 GPUs already in operation and a Colossus-2 build underway.

- Reuters reported in September 2025 that xAI raised about USD 10 billion at an Approximate USD 200 billion valuation, and in October 2025 it neared a USD 20 billion equity-plus-debt raise tied to GPU purchases.

- Reports in September 2025 said xAI laid off roughly 500 data annotators as it reorganized toward more specialized AI-tutor roles.

- xAI added new reasoning modes to Grok-3 (including “Big Brain”) and began rolling out a Deep Search agent to enhance retrieval and search experiences.

Scale AI

| Field |

Details |

| Company Type |

Private company (startup). |

| Parent organization |

None — independent; Meta holds a minority stake while Scale remains independent. |

| CEO |

Jason Droege (interim CEO, 2025); founder Alexandr Wang joined Meta and remains on Scale’s board. |

| Number of Employees |

About 1,000 (company site, 2025). |

| Established date and year |

2016 (founded). |

| Subsidiaries / platforms |

Remotasks; Outlier (owned/operated by Scale). |

| Products (high-level) |

Scale Data Engine; Scale GenAI Platform; Scale Donovan; evaluations & SEAL leaderboards; RLHF/fine-tuning and model safety services. |

| Headquarters |

San Francisco, California, USA. |

| Geographical Presence |

U.S. (San Francisco HQ; roles in New York and Washington, D.C.); EMEA HQ: London; global contributor networks via Outlier/Remotasks. |

| Website |

https://scale.com |

- Bloomberg reported that Scale AI generated about USD 870 million in revenue in 2024 and expects roughly USD 2 billion in 2025, more than doubling year over year.

- In June 2025, Scale said Jason Droege stepped in as interim CEO, following a leadership transition noted in his open letter to employees.

- Reuters (citing The Information) reported Meta was in talks to invest about USD 14.8-15 billion for a 49% stake, implying a ~USD 29 billion valuation; multiple outlets later described the deal as agreed and linked it to the CEO change.

- After the Meta investment news, Scale announced layoffs of ~14% (about 200 full-time employees) and 500 contractors as part of a restructuring of its GenAI division.

- Business Insider noted that Scale maintains one of the largest contributor networks, with hundreds of thousands of gig workers across Outlier and Remotasks platforms.

- Scale’s GenAI Platform is pitched for building and governing agentic solutions over enterprise data, and the Data Engine underpins RLHF, evaluations, safety, and alignment work used by leading model developers.

- For public sector and defense use cases, Scale promotes Donovan, a suite for deploying specialized AI agents for mission-critical workflows, with U.S. federal customers referenced on its site.

- In September 2025, Scale launched SEAL Showdown, a public LLM leaderboard based on real-user preferences, expanding its SEAL evaluation suite beyond private tests.

- Scale also introduced agentic leaderboards (e.g., SWE-Bench Pro and MCP Atlas) to gauge how well AI agents handle complex, multi-step tasks.

- Company pages highlight enterprise solutions (evaluation/monitoring, tool-use tests, and end-to-end deployment) as well as sector offerings like automotive/robotics (“Physical AI”) powered by the Data Engine.

- Scale’s customer roster spans major tech and industry names (and public sector logos), underscoring its role as an AI data and evaluation partner across domains.

Cohere

| Field |

Details |

| Company Type |

Private company. |

| Parent organization |

None – independent company. |

| CEO |

Aidan Gomez, Co-founder & CEO. |

| Number of Employees |

Approx 570 (Jul 2025 estimate). |

| Established (date & year) |

2019 (founded by Aidan Gomez, Ivan Zhang, Nick Frosst). |

| Subsidiaries / local entities (examples) |

COHERE UK, LTD. (London). |

| Products (high-level) |

Command family (incl. Command A), Rerank, Embed, and North (agentic/assistant platform). |

| Headquarters |

Toronto, Ontario, Canada; co-HQ/major office in San Francisco, California, US. |

| Geographical Presence |

Offices in Toronto, San Francisco, London, New York, Montreal (global operations). |

| Website |

https://cohere.com |

- Cohere raised $500 million in August 2025 at a $6.8 billion valuation to accelerate secure, enterprise-focused agentic AI.

- By May 2025, Cohere doubled its annualized revenue to about $100 million, with 85% of sales from private deployments that the company says carry 80% margins.

- Cohere launched North, its agentic AI productivity platform for general availability on August 6, 2025, enabling on-prem or private deployments for enterprises.

- The North launch emphasized data security and private deployment behind customer firewalls for governments and regulated industries.

- Cohere introduced Command A (March 2025), a 111-billion-parameter model with 256k context that delivers 150% higher throughput than its predecessor and can run on two GPUs.

- Oracle Cloud Infrastructure added Command A, Rerank v3.5, and Embed v3.0 multimodal, expanding Cohere model availability on OCI’s generative AI service.

- Cohere’s model catalog retired earlier Command R / R+ variants in September 2025 as the company shifted customers to newer releases.

- The company announced a Paris office in September 2025 to expand in Europe, alongside partnerships that include LG, Fujitsu, and Oracle.

- Cohere reported a workforce of 572 employees in mid-2025 as it scaled research, product, and go-to-market teams.

- Cohere and Royal Bank of Canada unveiled a January 2025 partnership to co-develop secure enterprise AI solutions.

- The Government of Canada signed an August 19, 2025 MOU with Cohere to help build Canada’s AI ecosystem and internal AI services.

Mistral AI

| Field |

Details |

| Company Type |

Private company; French simplified joint-stock company (SAS). |

| Parent organization |

None – independent company. |

| CEO |

Arthur Mensch, Chief Executive Officer. |

| Number of Employees |

200+ team members (company site); recent press reports 350 across six offices (Sep 2025). |

| Established (date & year) |

April 2023 (founded in Paris by Arthur Mensch, Guillaume Lample, Timothée Lacroix). |

| Subsidiaries / Local entities (examples) |

MISTRAL AI UK LTD (London). |

| Products (high-level) |

Le Chat assistant; La Plateforme (API); model families incl. Mistral Large 2, Mistral Small 3, Codestral (code), Pixtral (multimodal), Devstral (software engineering), and newer releases documented in model catalog. |

| Headquarters |

15 Rue des Halles, 75001 Paris, France. |

| Geographical Presence |

Paris HQ with international presence including Palo Alto (US) and London (UK); press notes six offices worldwide. |

| Website |

https://mistral.ai |

- In September 2025, Mistral AI raised €1.7 billion in a Series C at an €11.7 billion valuation, with ASML investing €1.3 billion and becoming the largest shareholder (About 11%).

- French press reported Mistral now has ~350 employees across six offices (Paris, London, Luxembourg, New York, Palo Alto, Singapore) and an annual contract run-rate of about €300 million with a multi-year backlog of approx €1.4 billion.

- Mistral released Mistral Medium 3 in May 2025, positioning it as state-of-the-art at up to 8× lower cost for simplified enterprise deployment.

- Its multimodal lineup expanded with Pixtral Large (124B open-weights) and the text flagship Mistral Large 2, adding stronger coding, math, reasoning and multilingual support.

- The Le Chat mobile app hit 1 million downloads within two weeks of launch and later added Memories plus 20+ enterprise MCP integrations.

- Mistral and ASML formed a strategic partnership to apply Mistral models to chipmaking tools and broader industrial AI use cases.

- A new sustainability tracker quantified Mistral Large 2’s footprint at approx 20.4 ktCO₂e and about 281,000 m³ of water, and the company signaled plans for a low-carbon data center in France.

- NTT DATA and Mistral announced a joint program to deliver private AI for regulated industries across France, Luxembourg, Spain, Singapore and Australia.

AI Leaders in Specific Sectors

Different companies take the lead in particular industries and in specific kinds of AI development, from healthcare and finance to robotics, vision, and generative models.

Palantir Technologies

| Field |

Details |

| Company Type |

Public company (Nasdaq: PLTR). |

| Parent organization |

None — independent public company. |

| CEO |

Alexander C. Karp. |

| Number of Employees |

3,936 full-time employees (as of Dec 31, 2024). |

| Established date and year |

Founded 2003; incorporated in Delaware in 2003. |

| Subsidiaries (examples) |

Palantir USG, Inc.; Palantir Technologies UK, Ltd.; Palantir Technologies GmbH; Palantir Technologies Singapore Pte. Ltd.; Palantir Technologies Japan G.K. |

| Products |

AIP (Artificial Intelligence Platform), Foundry, Gotham, Apollo. |

| Headquarters |

Denver, Colorado, USA — 1200 17th Street, Floor 15, Denver, CO 80202. |

| Geographical Presence |

Global across North America, Europe, and Asia-Pacific (offices listed via careers/contact pages; UK site confirms European presence). |

| Website |

https://www.palantir.com |

- In Q2 2025, Palantir posted USD 1.004 billion in revenue, up 48% year over year, with U.S. commercial revenue up 93% to USD 306 million, U.S. government up 53% to USD 426 million, and total U.S. revenue up 68% to USD 733 million.

- After the quarter, Palantir raised its full-year 2025 revenue outlook to USD 4.14–4.15 billion (Approx 45% YoY) and guided Q3 revenue growth to about 50% YoY.

- On Oct 23, 2025, Lumen Technologies and Palantir announced a multi-year partnership; Bloomberg reported Lumen will invest over USD 200 million in Palantir’s software over several years.

- AIP adoption is accelerating: an analysis of Q1 2025 showed U.S. commercial revenue up 71% YoY and 19% QoQ, with the segment crossing a USD 1 billion annual run-rate for the first time.

- AIPCon 8 (Sep 2025) featured 70+ customer speakers including American Airlines, Novartis, Waste Management, bp, Lumen, and others, highlighting production AI use cases.

- Palantir won an enterprise agreement with the U.S. Army valued up to USD 10 billion over 10 years, consolidating dozens of contracts and expanding access to AI-driven software.

- In October 2025, Palantir announced Model Studio (beta), a no-code workspace in Foundry to train and deploy machine-learning models more easily.

- Following the Lumen deal, CEO Alex Karp said Palantir is in an AI “arms race,” underscoring the pace of enterprise AI adoption.

- Palantir has been running AIP boot camps—five-day hands-on workshops—to take customers from zero to a working AI use case quickly, which the company credits for faster commercial wins.

Adobe

| Field |

Details |

| Company Type |

Public company (Nasdaq: ADBE). |

| Parent organization |

None — independent public company. |

| CEO |

Shantanu Narayen, Chair & Chief Executive Officer. |

| Number of Employees |

30,709 employees (as of Nov 29, 2024). |

| Established date and year |

December 1982 (founded by John Warnock and Charles Geschke). |

| Subsidiaries (examples) |

Adobe Systems Software Ireland Ltd.; Marketo, Inc.; MagentoTech Inc./LLC; Frame.io, Inc.; Workfront LLC; Adobe Systems India Pvt. Ltd.; Adobe Systems Japan (Adobe KK). |

| Products (high-level) |

Creative Cloud (e.g., Photoshop, Illustrator, Premiere Pro), Document Cloud (Acrobat, Acrobat Sign, Adobe Express, Firefly), Experience Cloud/Experience Platform. |

| Headquarters |

345 Park Avenue, San Jose, CA 95110-2704, USA. |

| Geographical Presence |

Global operations across the Americas, EMEA, and APAC; major facilities outside the U.S. include Bengaluru and Noida campuses in India. |

| Website |

https://www.adobe.com |

- Adobe reported USD 5.99 billion in Q3 FY2025 revenue, up 11% year over year, as AI-led products contributed to record results.

- Adobe says 99% of Fortune 100 companies have used AI in an Adobe app, and nearly 90% of its top 50 enterprise accounts adopted at least one AI-first innovation such as GenStudio, Firefly Services, or Acrobat AI Assistant.

- Creators have generated more than 24 billion assets with Firefly models since launch, spanning images, video, audio, and vector content.

- Adobe highlighted that AI-influenced ARR surpassed USD 5 billion and AI-first ARR exceeded USD 250 million, reflecting growing monetization of generative features.

- Adobe raised FY2025 guidance and reiterated that AI is central to strategy, lifting full-year revenue expectations to about USD 23.65–23.7 billion.

- Acrobat AI Assistant includes a concrete usage allocation, giving individuals 1,000 AI requests per user per month before potential throttling.

- In 2025, Adobe expanded Firefly with Image Model 4 and 4 Ultra, introduced a Video Model that generates 1080p clips, and added third-party models from OpenAI and Google into the Firefly app.

- An Adobe survey of creative professionals found over 65% believe gen-AI image quality improved in the past year, indicating rapid model progress.

- Ahead of the 2025 U.S. holiday season, Adobe Analytics projected AI-assisted online shopping to grow 520%, underscoring AI’s rising role in commerce.

- External coverage notes that 40%+ of Adobe’s top enterprise customers doubled recurring spend since FY2023, citing productivity gains from AI such as Firefly.

IBM

| Field |

Details |

| Company Type |

Public company; common stock listed on New York Stock Exchange (NYSE: IBM). |

| Parent organization |

None – independent public company (issuer of its own SEC filings). |

| CEO |

Arvind Krishna, Chairman, President & Chief Executive Officer. |

| Number of Employees |

270,300 (IBM & wholly owned subsidiaries) as of 2024; plus 8,900 in less-than-wholly-owned subsidiaries. |

| Established date and year |

June 16, 1911 (incorporated as C-T-R); renamed International Business Machines (IBM) in 1924. |

| Subsidiaries (examples) |

Red Hat entities; IBM (China) Co., Ltd.; IBM Japan, Ltd.; IBM Canada; IBM Argentina; IBM Australia; numerous country subsidiaries (per Exhibit 21). |

| Products (high-level) |

Hybrid Cloud & AI platform (e.g., watsonx), Red Hat OpenShift, IBM Cloud, IBM zSystems & Power infrastructure, IBM Consulting, data/security/automation software. |

| Headquarters |

1 New Orchard Road, Armonk, NY 10504, USA. |

| Geographical Presence |

Operates in more than 175 countries worldwide. |

| Website |

https://www.ibm.com |

- In Q3 2025, IBM reported revenue of USD 16.33 billion (up 9% year over year) and said its AI “book of business” reached USD 9.5 billion, with roughly 300 AI clients—about 80% of whom were new in the past two quarters.

- IBM raised its 2025 outlook to greater than 5% revenue growth and lifted free cash flow guidance to USD 14 billion, citing accelerating AI demand.

- The quarter’s mix showed software revenue up 10% to USD 7.2 billion and infrastructure up 17% to USD 3.56 billion, helped by AI-enabled mainframe demand.

- IBM launched Granite 4.0 (Oct 2, 2025), a new family of enterprise models using a hybrid Mamba/Transformer design to cut memory needs and lower run-costs without sacrificing performance.

- On Oct 20, 2025, IBM partnered with Groq to speed agentic AI in enterprises via watsonx Orchestrate and Groq’s inference technology.

- IBM added AI Guardrails to watsonx.governance (Oct 9, 2025), including filters for PII, topical alignment, and quality to help enforce responsible AI.

- Earlier in 2025, IBM expanded the Granite 3.2 model family, making it available under Apache 2.0 across watsonx.ai and popular developer platforms.

- IBM introduced Power11 chips and servers (July 2025) aimed at simplifying enterprise AI with strong security, minute-scale ransomware detection, and very high availability.

Advanced Micro Devices (AMD)

| Field |

Details |

| Company Type |

Public company (Nasdaq: AMD). |

| Parent organization |

None – independent public company (issuer of its own SEC filings). |

| CEO |

Dr. Lisa Su, Chair & Chief Executive Officer. |

| Number of Employees |

28,000 (as of Dec 28, 2024). |

| Established (date & year) |

May 1, 1969 (incorporated in Delaware). |

| Subsidiaries (examples) |

Xilinx, Inc.; Pensando Systems, Inc.; SeaMicro, Inc.; Solarflare Communications, Inc.; Silexica, Inc.; Mipsology, Inc.; NGCodec Inc. (from Exhibit 21 list). |

| Products (high-level) |

EPYC server CPUs; Ryzen client CPUs; Radeon graphics; Instinct data-center accelerators; Adaptive/embedded (e.g., Versal, Zynq); ROCm software platform. |

| Headquarters |

2485 Augustine Drive, Santa Clara, CA 95054, USA. |

| Geographical Presence |

Worldwide operations with corporate locations across the Americas, EMEA, and Asia-Pacific. |

| Website |

https://www.amd.com |

- In 2024, AMD’s Data Center segment revenue reached USD 12.6 billion, up 94% year over year, driven by the ramp of Instinct GPUs and EPYC CPUs.

- AMD posted a record USD 7.69–7.70 billion in Q2 2025 revenue; Data Center revenue was USD 3.2 billion (up 14% YoY), with MI308 shipments to China cited as a headwind.

- AMD announced Instinct MI350 (2025) and previewed MI400 (targeting 2026), projecting up to 10× inference gains versus MI355X in engineering estimates.

- AMD introduced the Helios AI server rack, designed around 72 MI400 chips per unit to compete with Nvidia’s NVL72-class systems.

- AMD launched ROCm 7 and the AMD Developer Cloud to give developers on-demand access to Instinct MI300 GPUs with pre-configured environments and credits.

- AMD states that 7 of the 10 largest model builders (including OpenAI, Microsoft, Meta, and xAI) are running production workloads on Instinct GPUs.

- On Oct 6, 2025, AMD announced a multi-year AI chip-supply deal with OpenAI, describing potential tens of billions in annual revenue and including a warrant allowing OpenAI to buy up to approximately 10% of AMD.

- AMD recorded an USD 800 million inventory write-off tied to MI308 units blocked by U.S. export rules yet still delivered its biggest quarter ever in Q2 2025.

- AMD’s guidance and commentary emphasize continued AI growth despite China restrictions, with EPYC CPU strength offsetting near-term accelerator mix.

- Historically, AMD projected about USD 4.5 billion in 2024 AI-GPU sales as MI300 ramped across major clouds (e.g., via Azure for OpenAI workloads).

Tesla

| Field |

Details |

| Company Type |

Public company (Nasdaq: TSLA). |

| Parent organization |

None — independent public company (issuer of its own SEC filings; subsidiaries listed under Tesla, Inc.). |

| CEO |

Elon Musk (CEO; “Technoking of Tesla”). |

| Number of Employees |

125,665 worldwide (as of Dec 31, 2024). |

| Established date and year |

Incorporated in Delaware on July 1, 2003; founded 2003. |

| Subsidiaries (examples) |

Tesla Energy Operations, Inc.; Tesla Motors Netherlands B.V.; Tesla Shanghai Co., Ltd.; Tesla Manufacturing Brandenburg SE; Tesla Insurance Company (CA). |

| Products (high-level) |

Electric vehicles (Model S/3/X/Y, Cybertruck); energy storage (Powerwall, Megapack); solar (Solar Roof/Panels); software (Autopilot / Full Self-Driving (Supervised)). |

| Headquarters |

1 Tesla Road, Austin, TX 78725, USA (Gigafactory Texas). |

| Geographical Presence |

Global operations; manufacturing in the U.S. (CA, NV, NY, TX) and internationally in China and Germany. |

| Website |

https://www.tesla.com |

- Tesla began deploying FSD (Supervised) v14 in October 2025, bringing much of its Robotaxi model to consumers with better handling of complex scenarios like road-debris avoidance and emergency-vehicle yielding.

- The company expanded its AI training compute to about 81,000 H100-equivalent GPUs (project “Cortex”) and announced a U.S. deal with Samsung to manufacture advanced semiconductors for AI inference and training.

- Tesla launched a Bay Area ride-hailing service using Robotaxi tech and broadened the Austin pilot; its Robotaxi iOS app is now open to everyone in the U.S. and Canada to join the waitlist.

- The Q3-2025 update shows cumulative FSD (Supervised) miles in the multi-billion range and accelerating since v12, indicating rapid real-world data collection.

- Tesla’s safety data reported one crash every 6.69 million miles with Autopilot engaged in Q2 2025, versus one every 963,000 miles without Autopilot.

- A subsequent Q3 2025 safety update cited one crash every 6.36 million miles with Autopilot, continuing to show lower crash frequency when Autopilot is used.

- Regulators gave Tesla its first CPUC permit step toward a California robotaxi service in March 2025 (additional permits are still required for commercial operations).

- Tesla also stated plans to remove robotaxi safety monitors in some areas by year-end and to expand to 8–10 U.S. states by end-2025, contingent on regulation.

- On the Q3 call, Elon Musk said TSMC and Samsung will work on Tesla’s next-gen AI5 chip, underscoring a continued push on in-house AI silicon.

- Tesla noted global FSD (Supervised) expansion, launching in Australia and New Zealand and preparing broader releases in China and Europe pending approvals.

- Looking ahead, Tesla reiterated the Cybercab robotaxi program with production now targeted for Q2 2026, following ongoing testing.

Tempus

| Field |

Details |

| Company Type |

Public company (Nasdaq: TEM). |

| Parent organization |

None – independent public company. |

| CEO |

Eric Lefkofsky, Founder, Chairman & Chief Executive Officer. |

| Number of Employees |

Aprox 2,300 (2024). |

| Established date and year |

Founded August 2015. |

| Subsidiaries (examples) |

Tempus Compass, LLC; Tempus Labs Singapore Pte. Ltd.; Tempus Labs Spain, SL; Arterys Inc. (US/Canada/France); Mpirik, Inc.; SEngine Precision Medicine, LLC. |

| Products (high-level) |

AI-enabled precision-medicine platform; comprehensive genomic profiling (e.g., xT CDx, xF liquid biopsy); hereditary/molecular tests; research solutions; Tempus One clinical assistant. |

| Headquarters |

600 West Chicago Ave, Suite 510, Chicago, IL 60654, USA. |

| Geographical Presence |

U.S. HQ with international entities in Singapore, Spain, France, Canada; joint venture SB TEMPUS to provide services in Japan. |

| Website |

https://www.tempus.com |

- In Q2 2025, Tempus’ revenue rose 89.6% year over year to $314.6 million, with Genomics at $241.8 million (+115.3% YoY), Data & Services at $72.8 million (+35.7% YoY), and gross profit at $195.0 million (+158.3% YoY).

- The company raised full-year 2025 guidance to approx $1.26 billion in revenue and projected positive adjusted EBITDA of about $5 million.

- Tempus reported delivering more than 212,000 NGS tests in the quarter as clinical volumes grew about 30%.

- Tempus reached a data milestone with connections to more than 40 million patient records (about 9 million de-identified), about 4 million samples sequenced, 4,500+ integrations, and a dataset of more than 350 petabytes.

- The xT CDx 648-gene test was launched nationally on Jan 15, 2025 following FDA PMA approval, and its category received CMS ADLT status in 2024.

- Tempus says its xR IVD (RNA) test was FDA-cleared in September 2025, expanding its companion-diagnostic portfolio.

- The company integrated its generative-AI clinical assistant (Tempus One/David) into EHRs, and in September 2025 Northwestern Medicine became the first health system to embed it.

- Tempus completed the acquisition of Ambry Genetics on Feb 3, 2025 and acquired Deep 6 AI on Mar 11, 2025, strengthening hereditary testing and AI-driven trial matching.

- In August 2025, Tempus acquired Paige to support AI pathology and model development.

- Tempus also launched “olivia,” an AI-enabled personal health app, which coincided with a sharp jump in the company’s share price.

- Internationally, SoftBank and Tempus formed SB TEMPUS in 2024, and on Oct 1, 2025 the JV acquired Konica Minolta REALM to accelerate AI-enabled precision medicine in Japan.

- Tempus employed about 2,400 people as of Dec 31, 2024, reflecting steady growth of its AI and genomics operations.

Joseph D'Souza

Joseph D'Souza founded ElectroIQ in 2010 as a personal project to share his insights and experiences with tech gadgets. Over time, it has grown into a well-regarded tech blog, known for its in-depth technology trends, smartphone reviews and app-related statistics.

More Posts By Joseph D'Souza

![]()