Apple Pay Statistics By Revenue, Users, Security and Facts (2025)

Updated · Sep 24, 2025

Table of Contents

Introduction

Apple Pay Statistics: Apple Pay emerged as one of the most dominant forms of contactless payments in the world. Available on all current iPhone models, it functions both in offline stores and in apps and websites, and is accepted in the vast majority of stores in the United States.

This piece provides the Apple Pay statistics 2025 figures and insights related to Apple Pay—number of users, rate of adoption, market share, amount spent through the platform, and its position in Apple’s ecosystem.

Editor’s Choice

- Touch and pay transactions have assumed increasing importance globally, with Apple Pay being one of the most widely accepted contactless payment methods since 2014.

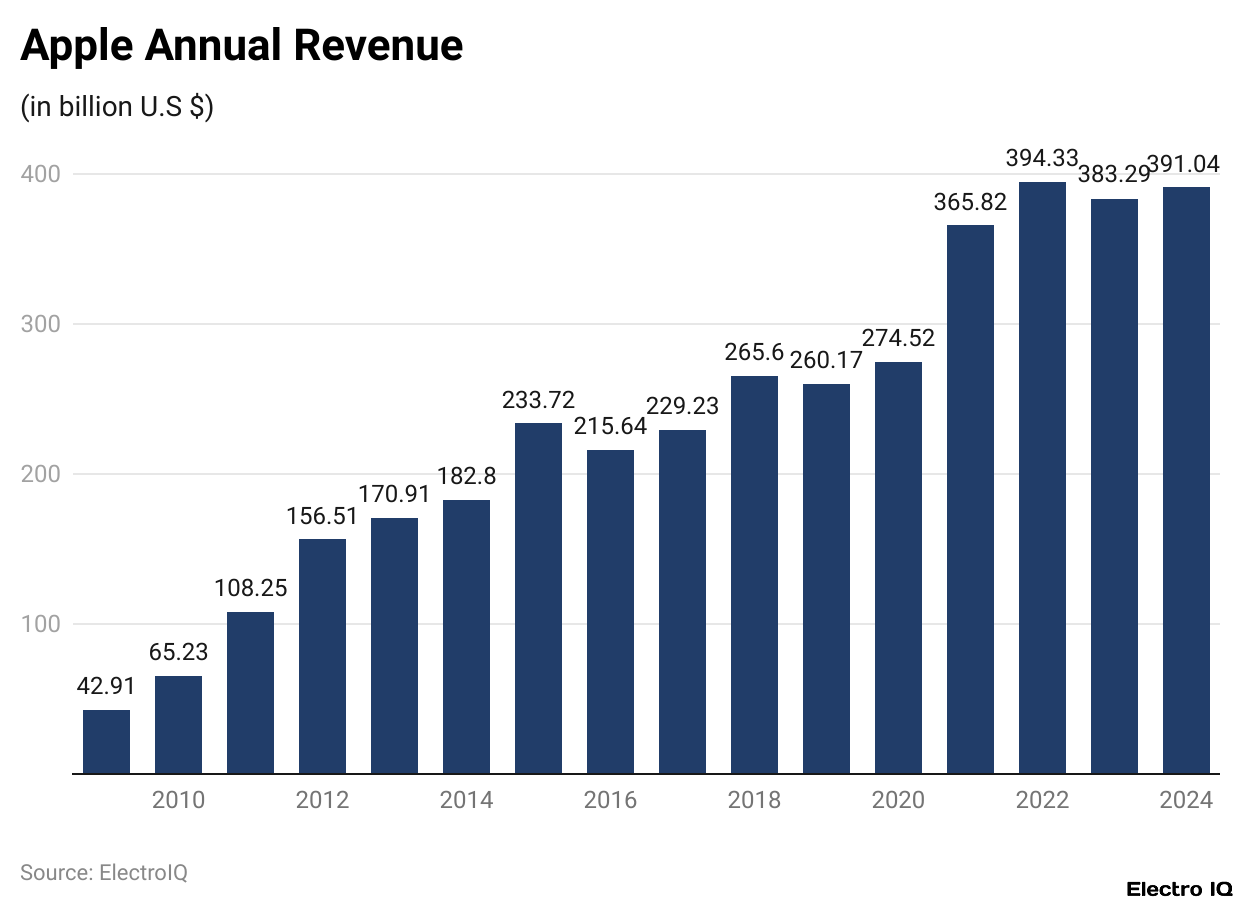

- Fueled by the growing popularity of iPhone, Mac, iPad, and Services, Apple’s revenue nearly exploded between 2009 and 2024, rising from US$42.91 billion to US$391.04 billion.

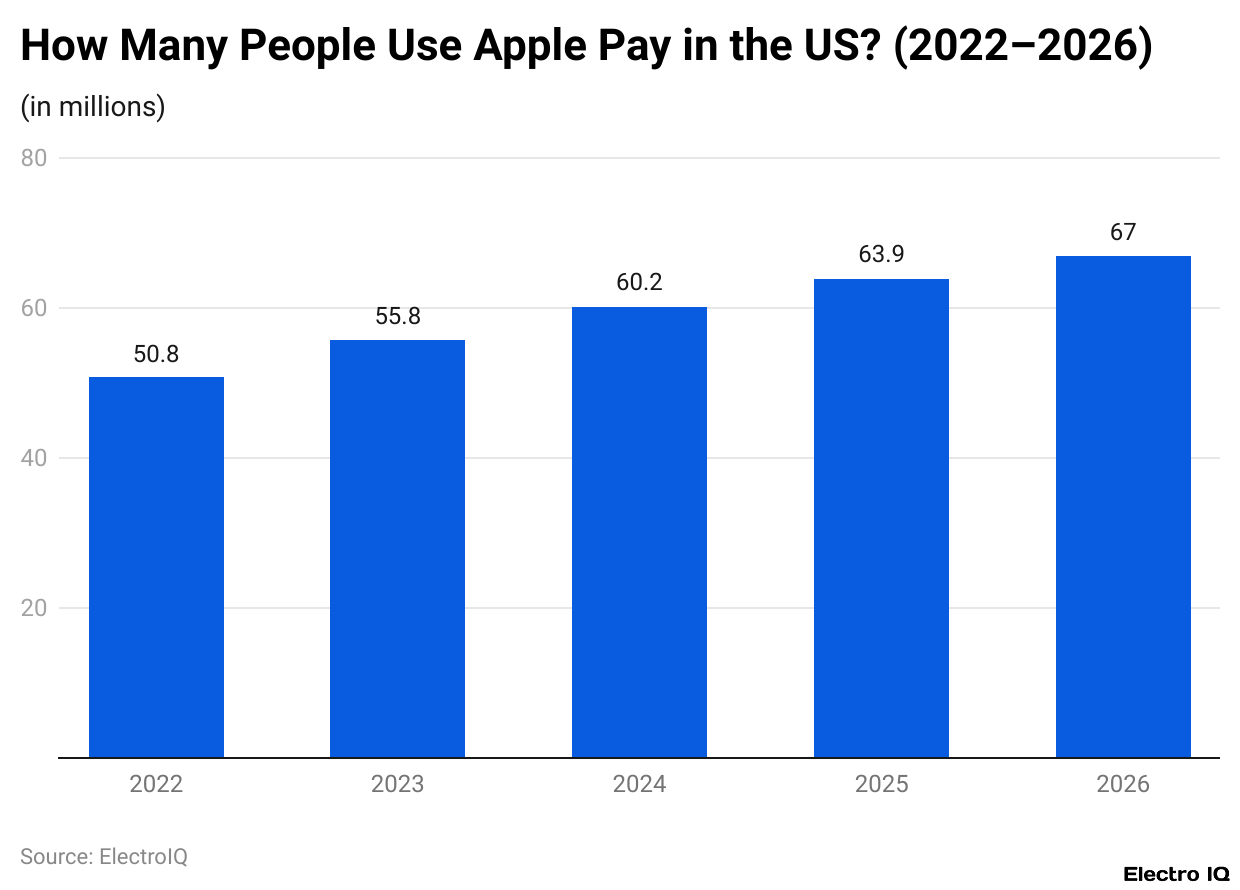

- The number of Apple Pay users in the U.S. is projected to reach 60.2 million in 2024, showing a 7.9% increase from 2023, accounting for 21.2% of the population.

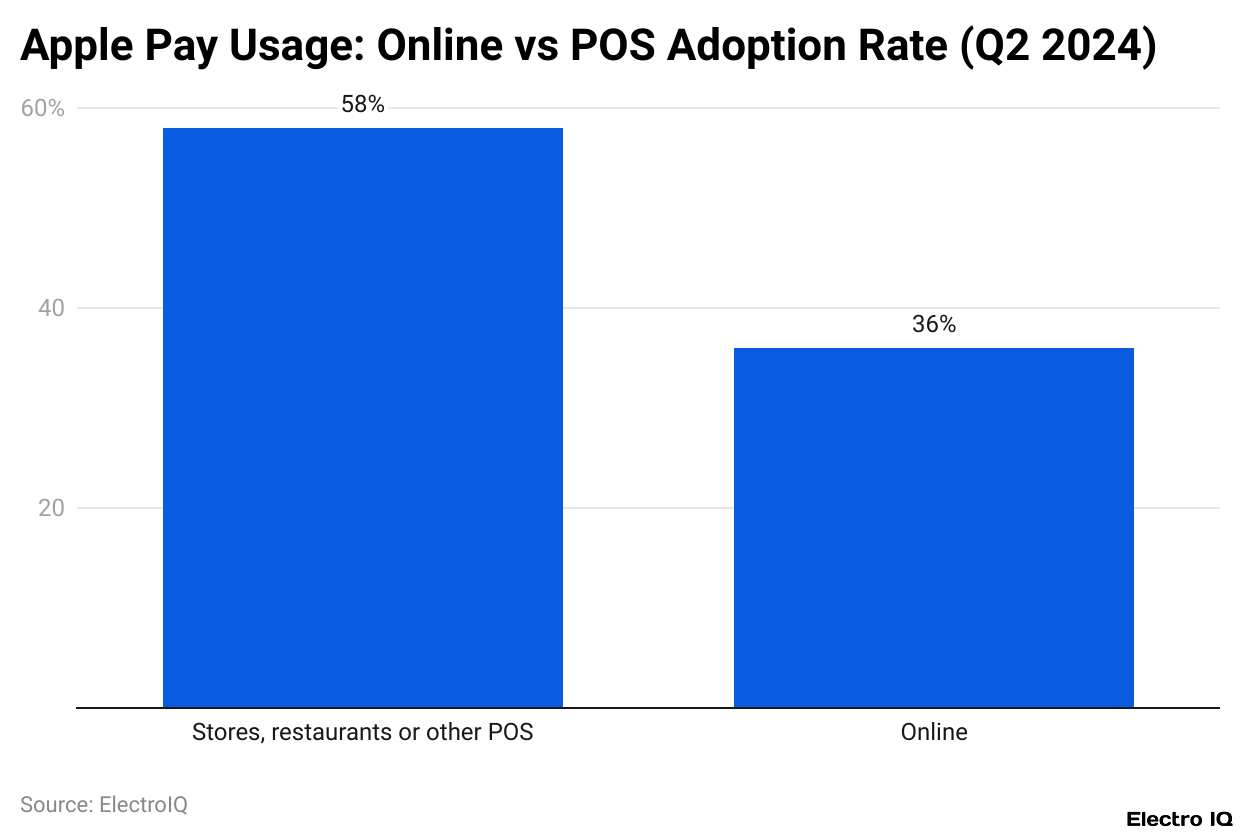

- Apple Pay’s in-store transactions (58%) outnumber its online purchases (36%), while online adoption is steadily gaining traction.

- The UK is in first place in terms of in-store adoption with 67%, followed by Canada with 65%, the United States with 60%, and France with 59%. In terms of online usage, the UK, U.S., and Australia lead with 40%, 38%, and 39%, respectively.

- The greatest concentrations of use, in terms of both user count and frequency, come from Generation Z and Millennials. In the younger cohort, Generation Z, 73.1% of digital wallet holders use Apple Pay every week, while 51.1% of Millennials do the same. Among the higher income earners (greater than US$100,000), 57% of digital wallet holders use Apple Pay every week.

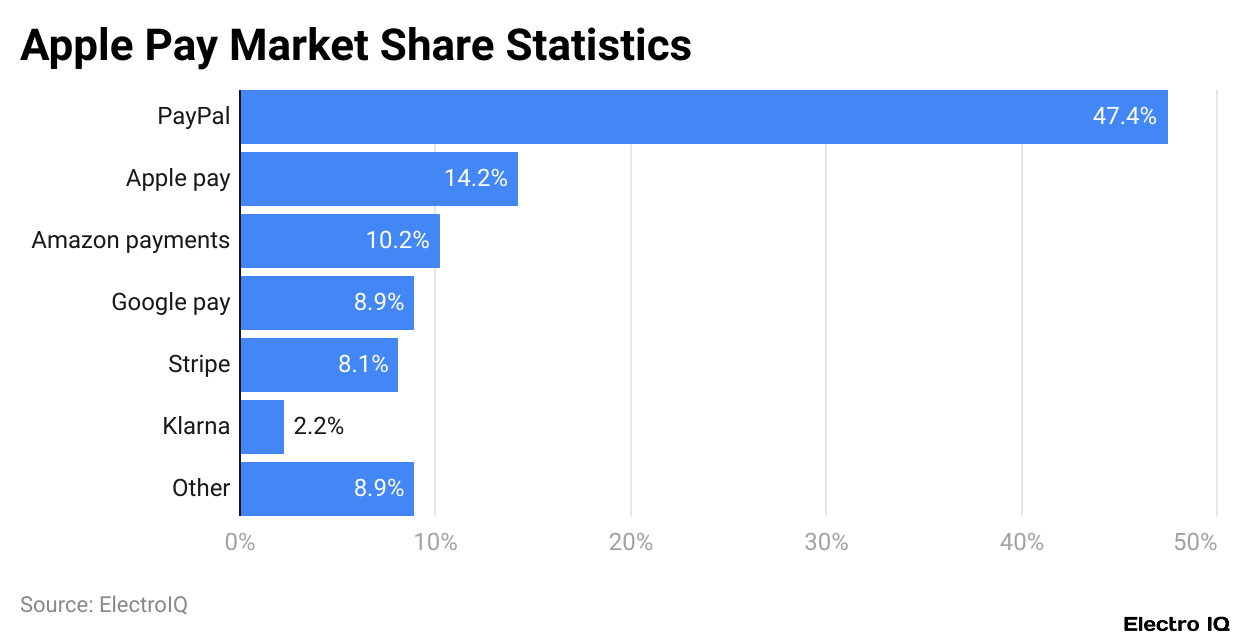

- From 92% of market share in 2020, in 2024, Apple Pay only has 14.2%, while PayPal takes the front seat with 47.4%, and Amazon Payments is at 10.2%.

- Apple Pay revenue exploded from US$998 million in 2019 to an estimated US$4 billion in 2023, with projections of US$4.23 billion for 2024 and US$4.45 billion for 2025.

General Notes

- Apple stopped offering its own Apple Pay Later service as of June 2024 and started offering third-party Buy Now Pay Later (BNPL) services offered by companies like Affirm.

- Before discontinuing their service, almost 20% of U.S. BNPL users were on Apple Pay Later, marking a strong early adoption.

- Analysts expect this change to help increase merchant acceptance of companies like Affirm, though the switch to third-party BNPL is believed to be a result of difficulties managing instalment loan balance sheets.

- For the EU, Australia, Brazil, Canada, Japan, New Zealand, the UK, and the U.S., Apple released NFC and secure element APIs to third-party developers in 2024, enabling payment services such as PayPal and Shopify to function on iPhones.

- For a long time, Apple Pay was the only contactless payment system available on iPhones globally, allowing Apple to have a monopoly on mobile proximity payments.

- In English-speaking countries, Apple Pay adoption is the highest, with the UK being the leader, and in other markets, it faces competition from other payment methods such as PayPal and Venmo, and Zelle in the United States.

- In 2024, the Netherlands had the highest merchant acceptance of Apple Pay among the 24 countries surveyed.

- The open NFC access and third-party BNPL in 2024 change to strategic ones are projected to greatly affect the mobile proximity payment growth and adoption in various markets in 2025.

Apple Revenue

(Reference: backlinko.com)

- The revenue trends of Apple since 2009 illustrate the transformative evolution of the company from a reputable technology firm to a behemoth in business.

- In the year 2009, the revenue stood at US$42.91 billion, but the release of the iPhone 4 and the expansion of the App Store catalysed growth to US$65.83 billion in 2010 and further to US$108.25 billion in 2011.

- The combination of the iPhone 5 and the iPad saw even more impressive numbers in 2012, US$156.51 billion, and climbing to US$170.91 billion in 2013.

- In 2014, Apple exceeded the US$182.8 billion mark and then jumped to a record US$233.72 billion in 2015, largely due to the iPhone 6 era, which achieved phenomenal sales worldwide.

- The revenue then began to fluctuate as it fell to US$215.64 billion in 2016 and then climbed back to US$229.23 billion in 2017.

- The release of the iPhone X and sustained demand for the iPhone contributed to Apple hitting US$265.6 billion in 2018. However, in 2019, there was a slight drop to US$260.17 billion.

- Apple’s revenue in 2020 notched US$274.52 billion, a recovery fueled in part by the iPhone 11, in addition to the growth in services during the pandemic.

- That momentum carried into 2021, when Apple made one of its largest jumps, reaching US$365.82 billion, which is an increase of US$91 billion in year-over-year growth in 2021.

- In 2022, revenue reached US$394.33 billion, which is the highest revenue Apple has had in a single year at that point.

- Following the high, there was some decline in 2023 to US$383.29, which can be attributed to slower iPhone sales in certain regions, as well as global economic issues.

- Apple then made a slight recovery in 2024, with revenue of US$391.04 billion, exhibiting steady demand for the iPhone, Mac, and iPad, as well as in Services, where it is much stronger.

- Apple’s revenue from 2009 to 2024 increased by US$348.5 billion, which is a spectacular increase in 15 years and is a reflection of the company’s takeover in the world of hardware and services.

Apple Pay Users

(Reference: oberlo.com)

- As per Oberlo, Apple Pay statistics show that passing another important milestone in 2024 is the growth of Apple Pay’s users in the United States.

- The users will reach a forecast number of 60.2 million, which means that for the first time, over 60 million users will have contacted and paid with Apple’s payment system.

- For this analysis, the mobile phone users in the U.S. who are 14+ years old and who purchase monthly using Apple Pay are considered.

- This 21.2% figure is 7.9% higher than that of 2023 and is equivalent to the U.S. population.

- Simply put, the number of Americans using Apple Pay on a regular basis has now soared to more than five to one.

- Apple Pay usage is projected to grow, but at a slightly slower pace in the coming years.

- The user base is expected to increase by 6.1% to 63.9 million (or 22.3% of the population) in 2025.

- The forecast for 2026 depicts the user base increasing to 67 million, or 23.3% of the population, equaling almost a quarter of the U.S. population.

- Looking at the forecast even further in the future, it is expected that Apple Pay adoption will continue to increase every year, and that by 2030, Apple Pay users will hit 75.4 million, marking more than a quarter of the U.S. population.

Apple Pay Usage – Online And POS Adoption

(Reference: oberlo.com)

- Looking at the data from 2024 highlights Apple Pay’s in-person usage edge over online.

- Over the second quarter of the year, nearly 58% of U.S. buyers stated having used Apple Pay at a physical location such as a retail shop or restaurant in the previous 12 months.

- On the other hand, only 36% said that they used Apple Pay for online shopping.

- In the years leading up to 2024, the use of Apple Pay for online shopping has seen steady growth.

- The use was at 21% in 2018, and it even saw a slight dip to 19% in early 2021.

- Since 2021, a turnaround has been witnessed with online payments increasing for Apple Pay.

- It indicates that the strongest and dearest use of Apple Pay is for in-person tap-to-pay transactions, as the device is also gaining traction for online shopping year after year.

Apple Pay Usage By Country

| Country | In-Store Payments |

Online Payments

|

| United Kingdom | 67% | 40% |

| Canada | 65% | 34% |

| United States | 60% | 38% |

| Australia | 52% | 39% |

| France | 59% | 19% |

| Sweden | 47% | 29% |

| Switzerland | 43% | 31% |

| Austria | 53% | 19% |

| Netherlands | 46% | 25% |

| Germany | 43% | 17% |

| Finland | 39% | 17% |

| Italy | 39% | 15% |

| Spain | 30% | 15% |

(Source: grabon.com)

- The adoption of Apple Pay differs considerably by country, with the United Kingdom emerging as the frontrunner.

- At the beginning of 2024, approximately 67% of UK consumers indicated that they use Apple Pay for in-store shopping, outperforming the United States, where 60% of people use it, and leaving every other market behind.

- Canada also displays notable usage, as 65% of its consumers use Apple Pay in stores, while 59% is reported in France, which means that six out of every ten people depend on it to shop or dine.

- Australia, with 52%, and Austria, with 53% are other countries with remarkable usage in stores.

- In contrast, usage is lower in countries like Spain, with a mere 30%.

- Although the figures are lower for online transactions, they are still significant. In the U.K., 40% of shoppers utilise Apple Pay for online transactions, whereas the U.S. records 38%— in-person and digital shopping are well equated in both countries.

- Australia is slightly behind at 39%, and Canada is at 34%.

- With regard to France, their online usage is much lower at 19%, and this is also the case in Austria at 19%, Germany at 17%, Finland at 17%, Italy at 15%, and Spain at 15%, which is in contrast to their strong in-store usage.

- The data at large shows Apple Pay is preferred for in-person transactions in almost all regions.

- However, transactions performed over the internet are continuously increasing, especially in the United States, the United Kingdom, and Australia.

Apple Pay Customer Segments

- Younger individuals, including Generation Z and Millennials primarily use Apple Pay. In the age group of 1997 to 2012, a larger share of 2.5% are Apple Pay users.

- Around 73.1% of Gen Z digital wallet holders use Apple Pay for payments every week, indicating strong loyalty and habitual usage.

- Millennials, born between 1981 and 1996, have a slightly greater adoption of 4.0%. Among Millennial digital wallet holders, a bit more than half, 51.1%, are weekly users of Apple Pay.

- Among Gen X users, born from 1965 to 1980, there is a mere 1.1% adoption rate, yet those who use Apple Pay tend to be more active, with 52.4% of Gen X wallet users paying weekly.

- Use is even scarcer for Baby Boomers and the Silent Generation, for which Apple Pay use is close to 0.2%, and only 43.9% of wallet users from their generation employ it every week.

- For people earning above US$100,000 annually, 3.2% of consumers use Apple Pay, and 57% of digital wallet users in that income group pay with it weekly.

- This further indicates that Apple Pay is especially popular among Apple users who are younger and relatively affluent. Older users adopt it less, but those who do are consistent in their use.

(Reference: grabon.com)

- Back in 2020, Apple Pay had the lion’s share of mobile payments with 92% of the market, blowing Samsung Pay and Google Pay out of the water.

- The landscape has changed significantly with the rise of more encompassing online payment methods.

- PayPal has now taken the lead at 47.4% of the global online payment market in 2024.

- Apple Pay holds 14.2%, which, although considerably smaller than PayPal’s, still places it among the top contenders worldwide.

- They are also slightly above Amazon Payments, which owns 10.2% of the market.

- This shift underscores how the payment ecosystem has grown beyond mobile wallets, with digital payment services like PayPal and Amazon directly competing for users’ online expenditure.

Apple Pay Security And Technology

- The security features of Apple Pay have made it a model to follow for modern payment solutions.

- It makes payments safer by avoiding the use of card details and instead uses tokenisation.

- Biometrics must face ID or touch ID, and are used in 99% of payments, making the process quick and easy.

- Apple Pay requires biometrics and uses them for payment authorization.

- Apple Pay fares much better in fraud statistics, with a rate of 0.01% fraud, which is lower than the one for traditional credit card payments.

- Apple Pay can be deactivated remotely in case a device was stolen or misplaced, keeping the users’ Apple Pay accounts safe.

- Additionally, Apple enhances the security of its users’ accounts by requiring two-factor authentication (2FA) during setup.

- On the compliance side, Apple Pay adheres to PCI DSS standards, the global benchmark for secure handling of payment data.

- Apple Pay’s transactions maintain a high security level as the information concerning the transactions is encrypted end-to-end.

- For all the security features Apple Pay implements, these are the reasons Apple Pay is one of the most secure and trusted digital payment methods.

Apple Pay Revenue

| Year | Annual Revenue |

| 2019 | $0.998 billion |

| 2020 | $1.05 billion |

| 2021 | $1.00 billion |

| 2022 | $1.90 billion |

| 2023* | $4.00 billion |

| 2024* | $4.23 billion |

| 2025* | $4.45 billion |

(Source: grabon.com)

- As per Grabon, Apple Pay statistics state that ever since Apple Pay was launched, its revenue has steadily climbed up the ladder.

- In 2019, Apple Pay raked in US$998 million, which modestly increased to US$1.05 billion by 2020.

- There was a slight revenue decline to US$1.00 billion in 2021, but things picked up after that.

- In 2022, Apple Pay nearly doubled its revenue and earned US$1.90 billion.

- The most notable increase took place in 2023, where the revenue doubled for a second time and reached the estimated mark of US$4.00 billion.

- This increase is quite significant, standing at a 110.5% year-over-year rise.

- More adoption in the United States and expansion overseas, coupled with the usage of Apple Pay Cash and Apple Card, are the main reasons, according to the analysts.

- Although revenue is expected to increase, it is not expected to increase as much as it did in 2023.

- A revenue of US$4.23 billion is expected for 2024 and US$4.45 billion for 2025, assuming the average spending per user is constant and the increase in user count is steady.

Apple Pay Benefits

- Accepting Apple Pay benefits merchants both in their physical stores and in their online shops.

- One notable advantage is the speed of the transactions; they are completed significantly earlier as compared to traditional methods.

- This is important, especially because Apple Pay has been proven to reduce checkout time by 30%, which in turn helps in reducing the queues of waiting customers.

- This ease of use with Apple Pay tends to increase sales; there is an average reported increase of 15% in revenue once Apple Pay is enabled.

- The impact is just as strong for online retailers, with merchants reporting an 18% increase in cart conversions; Apple Pay streamlines the checkout process and reduces cart abandonment.

- Apple Pay also benefits merchants because of its global reach. Apple Pay gives merchants access to over 500 million users.

- Customers benefit as well; 80% of customers rate their experience as extremely satisfying. This makes Apple Pay one of the most favoured payment methods.

- This exceptional satisfaction improves brand loyalty and incentivises customers to make more purchases.

- The Apple Pay method aligns perfectly with consumer trends. Since the pandemic, shoppers have inclined towards contactless payments, and Apple Pay indeed caters to that requirement.

- In addition to this, merchants have enhanced security and peace of mind. Apple Pay utilises tokenisation, encryption, and biometric authentication.

- These methods not only lessen the risk of fraud but also cut down the liability of the business, making it a secure and profitable option for the merchants.

Recent Achievements

- In 2025, Apple Pay gained further functionalities as well as integrations.

- The new features of Apple Pay Later further grew, funded by buy now pay later payday across millions of stores, giving users more payment methods of payments.

- Apple’s Savings Account also expanded to US$16.5 billion in deposits, with the competitive 4.15% APY Apple offers, motivating users to engage with Apple’s financial ecosystem.

- In public transit, Apple Pay rolled out to 12 more transit systems, including Sydney’s Opal and the Mexico City Metro, streamlining commutes for users worldwide.

- Improved voice-activated payment features were made accessible to 1.2 million users with visual impairments.

- Apple Pay’s integrations continued to bolster e-commerce, especially with Shopify, which was instrumental in facilitating a 28% increase in transactions for small and medium-sized businesses.

- The increase in adoption of these solutions, catering to the needs of small and medium-sized enterprises, has improved by 32%, strengthening the position of Apple Pay in the retail industry.

- Security improvements were also essential. Globally, the rest of the users also benefited from the increase in trust and safety as AI-driven fraud detection tools improved the suspicious activity by 42%.

Conclusion

Paying with Apple introduced Apple Pay, evolving it from a simple, contactless payment method to the world’s leading mobile transaction method. Improvements in technology, security, and accessibility have continuously strengthened its position as a reliable method of payment. With the continuing spread to different devices, markets, and payment methods, Apple Pay is set to become an integral and core feature of digital payments for a long time, and will influence the world of commerce, for both enterprises and shoppers, in the upcoming days.

FAQ.

Apple Pay users in the U.S. are expected to total 60.2 million in 2024, or 21.2% of the population. The number of users is likely to increase to 63.9 million in 2025 and 67 million in 2026, which would be close to 25% of the US population.

In the United States, the use of Apple Pay for in-store purchases is predominant, with 58% of the population using it in 2024. This figure is considerably higher than the 36% usage of Apple Pay for online shopping, which, however, is an increase from 19% in early 2021, indicating the growing popularity of digital payments.

The United Kingdom Apple Pay usage leads with 67% of consumers using the payment system in stores. Canada follows with 65%, the U.S with 60%, and France with 59%. The UK (40%), the U.S. (38%), and Australia (39%) mark the highest online usage, while the rest of the countries have lower rates.

Transactions made through Apple Pay are secured with tokenisation and are further protected by Face ID or Touch ID alongside end-to-end encryption. The chances of committing fraud using this method stand at 0.01%, and devices that have been reported lost can be disabled remotely. Moreover, the usage of two-factor authentication, as well as the compliance with PCI DSS, further adds to the protection of the users and makes it arguably one of the most secure mobile payment methods.

Merchants enjoy quicker checkouts (less 30%), increased sales (plus 15%), and better conversion rates (plus 18%) online. Alongside that, they get to market to over 500 million users, enhance customer satisfaction (80% of whom are highly satisfied), and lower the risk of fraud, which is made possible through security features offered by Apple Pay.

I hold an MBA in Finance and Marketing, bringing a unique blend of business acumen and creative communication skills. With experience as a content in crafting statistical and research-backed content across multiple domains, including education, technology, product reviews, and company website analytics, I specialize in producing engaging, informative, and SEO-optimized content tailored to diverse audiences. My work bridges technical accuracy with compelling storytelling, helping brands educate, inform, and connect with their target markets.