Fujifilm Statistics By Segmental Revenue, Employee Count and Facts (2025)

Updated · Nov 05, 2025

Table of Contents

- Introduction

- Editor’s Choice

- History of Fujifilm

- Fun Facts About Fujifilm

- Fujifilm Financial Statistics

- Fujifilm Revenue By Segment

- Fujifilm Revenue By Region

- Fujifilm Operating Income

- Fujifilm Capital Expenditure And Depreciation, and Amortization

- Fujifilm R&D Expenses And SG&A Expenses

- Fujifilm Number Of Employees

- Conclusion

Introduction

Fujifilm Statistics: Consider a company that began producing films for photography but later evolved into a major player in technology and a diversified healthcare company spanning multiple fields, including electronics, biopharma, and digital solutions. That company is indeed Fujifilm.

In the fiscal period that ended on March 31, 2025, Fujifilm achieved its greatest success, marking a milestone where its legacy in imaging has converged with semiconductor materials, biomanufacturing, and digital solutions. Fujifilm statistics will show the development, shifting focus, and strategic moves in future markets.

Editor’s Choice

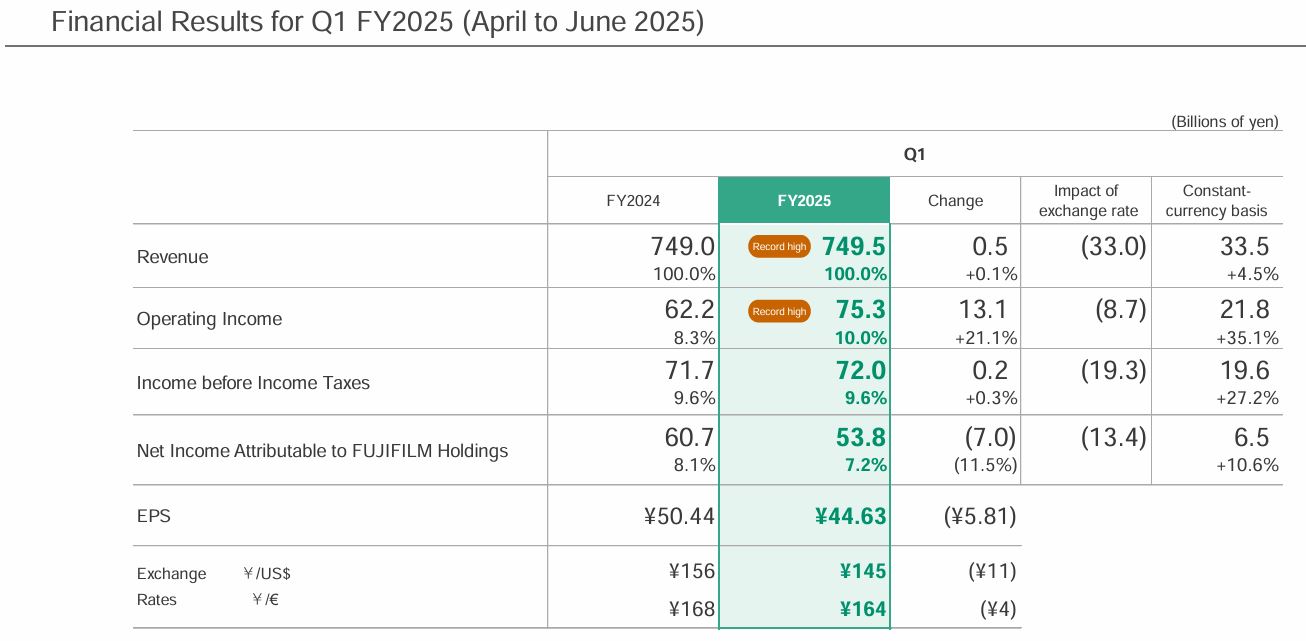

- Fujifilm saw its revenue soar to an all-time high of ¥749.5 billion in the first quarter of FY2025, representing a slight increase of +0.1% over the previous year and +4.5% on a constant-currency basis.

- Operating profit jumped to ¥75.3 billion, registering a remarkable increase of +21.1% and an even higher increase of +35.1% when taking into account currency fluctuations.

- Total capital expenditure (CapEx) amounted to ¥116.6 billion, with Healthcare taking the lead at ¥105.3 billion.

- CapEx for the full year is projected to be ¥462.0 billion, while Depreciation & Amortization is expected to be ¥188.0 billion.

- The amount allocated for R&D activities was ¥40.6 billion (5.4% of revenue), thus demonstrating consistent investment in innovation.

- SG&A expenses were reduced to ¥196.6 billion, thereby increasing efficiency as the revenue share decreased from 27.5% to 26.2%.

- The total number of employees increased from 72,254 in March 2024 to 74,534 in June 2025, representing a net addition of nearly 2,280 employees.

- Japan remained the largest market for Fujifilm, accounting for ¥1,099.3 billion (34.4%) of the company’s total revenue for fiscal year 2024.

History of Fujifilm

- 1934: Fuji Photo Film Co., Ltd. was established; Ashigara Factory began operations for film, print paper, and plates.

- 1938: Odawara Factory was established.

- 1944: Optical operations were consolidated as Fuji Photo Optical Co., Ltd.

- 1946: Natural Color Photography Co., Ltd. was established, later becoming Fujicolor Service.

- 1958: Subsidiary in Brazil was established, signaling early overseas expansion.

- 1962: Fuji Xerox was formed as a joint venture with Rank Xerox.

- 1965: Fujicolor Service name adopted; Fujicolor Trading split created to strengthen marketing.

- 1965–1966: U.S. organization set up in New York; European headquarters established in Düsseldorf.

- 1972: Yoshida-Minami Factory was established to expand manufacturing capacity.

- 1982–1988: European and U.S. manufacturing hubs were opened, including South Carolina; global production footprint scaled.

- 1988: FUJIX DS-1P, described by Fujifilm as the world’s first fully digital still camera using a memory card, was demonstrated.

- 1990–1997: Fuji Xerox broadened regional rights; acquisitions in medical imaging and European photofinishing expanded the portfolio.

- 1995–1996: China manufacturing in Suzhou and Hong Kong logistics entity were established to serve Asia.

- 1998: Instax instant cameras and film were introduced, later becoming a global youth and creator franchise.

- 2000–2001: Fuji Xerox gained China business rights and became a consolidated subsidiary with a 75% stake.

- 2003–2005: Group restructuring unified domestic imaging sales; microelectronics materials and ink businesses were acquired.

- 2006: The group shifted to a holding-company structure as FUJIFILM Holdings Corporation; new corporate brand introduced.

- 2007: Headquarters functions were relocated to Tokyo Midtown.

- 2008: FUJIFILM India Pvt. Ltd. was established; Toyama Chemical became a consolidated subsidiary, laying the base for favipiravir development.

- 2010: FUJIFILM North America Corporation was created by integrating U.S. units; multiple Fuji Xerox entities were launched in Asia.

- 2011: Biopharma manufacturing assets from MSD were acquired, forming the core of Fujifilm Diosynth Biotechnologies.

- 2012: SonoSite, a leader in point-of-care ultrasound, was acquired; regional subsidiaries were added in Africa and Asia.

- 2015–2018: Life-science capabilities expanded via iPSC leader Cellular Dynamics, Wako Pure Chemical integration, and cell-culture media businesses.

- 2019: Fujifilm moved to own 100% of Fuji Xerox, ending the long-standing joint-venture structure.

- 2020: Fuji Xerox acquired Australia’s CSG Limited and formed a records-automation joint venture with Ripcord.

- 2021: Hitachi’s Diagnostic Imaging business was acquired for about ¥179 billion; Fuji Xerox was renamed FUJIFILM Business Innovation.

- 2022–2023: Further additions included recombinant-protein maker Shenandoah, an Atara cell-therapy facility, and Entegris’ Electronic Chemicals business.

- 2025: Joint venture Global Procurement Partners Corp. was established with Konica Minolta to strengthen procurement.

Fun Facts About Fujifilm

- Founded in 1934 as Fuji Photo Film Co., Ltd., created to build a domestic photographic film industry in Japan.

- The company introduced the world’s first fully digital camera prototype at Photokina 1988: the FUJIX DS-1P, which saved images to a 2 MB semiconductor memory card.

- Fujifilm launched QuickSnap in 1986, widely recognized as the first one-time-use camera.

- The iconic Velvia slide film debuted in 1990, famous for very high color saturation and fine grain; Velvia 50 was reintroduced in 2007.

- Cumulative global sales of instax instant cameras and smartphone printers crossed 100 million units in April 2025.

- Fujifilm pioneered computed radiography (FCR), launching the world’s first digital X-ray diagnostic imaging system in 1983.

- The long-running Fuji Xerox joint venture was rebranded Fujifilm Business Innovation in April 2021.

- Fujifilm acquired Hitachi’s Diagnostic Imaging business, completed March 31, 2021, for about JPY 179 billion, expanding its healthcare portfolio.

- The company’s antiviral favipiravir (Avigan), developed by subsidiary Toyama Chemical, was approved in Japan for influenza in 2014 and studied during COVID-19.

- Fujifilm’s X-Trans image sensor uses a unique 6×6 color filter array to reduce moiré without an optical low-pass filter.

- The GFX100 mirrorless camera launched in 2019 with a 102 MP large-format sensor and in-body stabilization, marking a milestone in high-resolution imaging.

- Fujifilm and IBM demonstrated a prototype magnetic tape cartridge at 580 TB native capacity in 2020, a world record in tape storage density.

- Fujifilm leveraged film science to enter cosmetics with ASTALIFT, applying collagen and nanotechnology research to skincare.

Fujifilm Financial Statistics

(Source: ir.fujifilm.com)

- Fujifilm’s performance in the first quarter of the fiscal year 2025 was reported to be stable overall, with both a positive currency impact and challenges associated.

- The company achieved the highest revenue ever recorded at ¥749.5 billion, representing a slight increase of ¥ 0.5 billion, or +0.1%, over the revenue of ¥749.0 billion reported in Q1 FY2024.

- While the growth appears to be modest, on a constant-currency basis, the revenue rise was actually 4.5%, which signifies that there was good business activity underneath.

- The depreciation of the Japanese yen has created a negative impact on the exchange rate of ¥33.0 billion, thereby concealing what would have been a stronger growth report.

- Operating income increased significantly from ¥62.2 billion to ¥75.3 billion, representing a rise of ¥13.1 billion, or 21.1% year-over-year.

- On a constant-currency basis, the gain was even more pronounced—up a remarkable +35.1%—indicating that the company’s profitability was indeed enhanced in real terms.

- The operating margin also rose from 8.3% to 10.0%, which means Fujifilm had increased the profit it earned from each yen of sales.

- Before-tax income edged up from ¥71.7 billion to ¥72.0 billion, a mere ¥0.2 billion increase or a modest +0.3% rise.

- But on the constant-currency basis, this line surged by +27.2%, and it is again indicative of strong underlying operations while the forex effects brought down the reported figure. The negative impact of exchange rates on this line was ¥19.3 billion.

- The net income attributed to Fujifilm Holdings fell from ¥60.7 billion in Q1 FY2024 to ¥53.8 billion in Q1 FY2025, representing a decrease of ¥7.0 billion or –11.5%.

- The main reason for this drop was the unfavourable exchange rate fluctuations and an increase in costs in specific business segments.

- The impact of foreign exchange on net income was -¥13.4 billion, while the company on a constant-currency basis, net income increased by +10.6% ie, the company’s core profitability improved once currency effects are removed.

- The net income margin decreased from 8.1% to 7.2%.

- Earnings per share (EPS) decreased from ¥50.44 to ¥44.63, representing a decrease of ¥5.81 and aligning with the lower reported net income.

Fujifilm Revenue By Segment

(Source: ir.fujifilm.com)

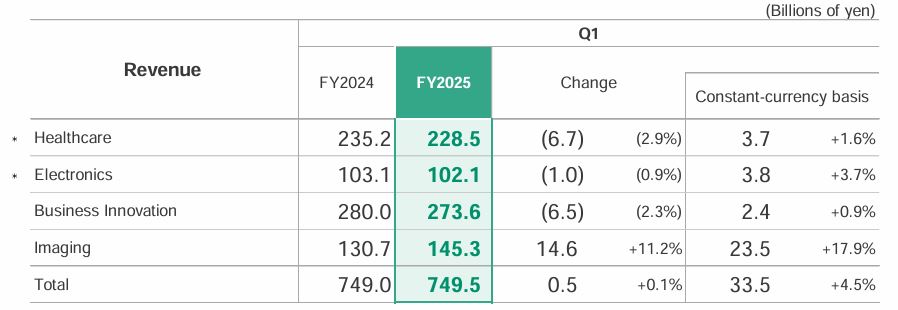

- Fujifilm’s total revenue in the first quarter of fiscal year 2025 amounted to ¥749.5 billion, representing a slight increase of ¥0.5 billion or +0.1% compared to ¥749.0 billion in the same period of FY2024.

- Nevertheless, when factoring in the fluctuating currencies, the total revenue became +4.5% which is a good indicator of strong business across all segments except the yen’s impact.

- In terms of business areas, the Healthcare segment reported revenues of ¥228.5 billion, representing a decrease of ¥6.7 billion, or –2.9% year-over-year.

- On a constant-currency basis, however, the segment recorded a +1.6% increase, indicating that medical systems, bio CDMO, and life science-related products demand was steady, but the exchange rate ate up part of the growth.

- The Electronics segment, which incorporates semiconductor materials and display-related products, generated ¥102.1 billion, just slightly lower than the ous year by ¥1.0 billion or –0.9%.

- However, after adjusting for currency effects, the segment recorded a 3.7% rise in sales, which reflects the ongoing strong demand for semiconductors and high-performance materials used in the AI and advanced technology industries.

- The Business Innovation Division (which includes printing and office solutions) reported earnings of ¥273.6 billion, a decrease of ¥6.5 billion, resulting in a 2.3% decline in reported numbers.

- The sales were essentially unchanged, but the yen’s appreciation and some slowdowns in demand for hardware in certain areas impacted the companies’ sales, resulting in a 0.9% increase at constant currency.

- The Imaging business segment was the main performer, with its revenue increasing to ¥145.3 billion from the previous year’s ¥130.7 billion, representing an annual gain of ¥14.6 billion, or 11.2%.

- If we take into account the currency effect, the increase was even greater at +17.9%.

- The powerful sales of digital cameras, particularly in the X-series and GFX models, combined with the global love for instant photo systems such as Instax, were the main drivers of the growth.

Fujifilm Revenue By Region

(Source: ir.fujifilm.com)

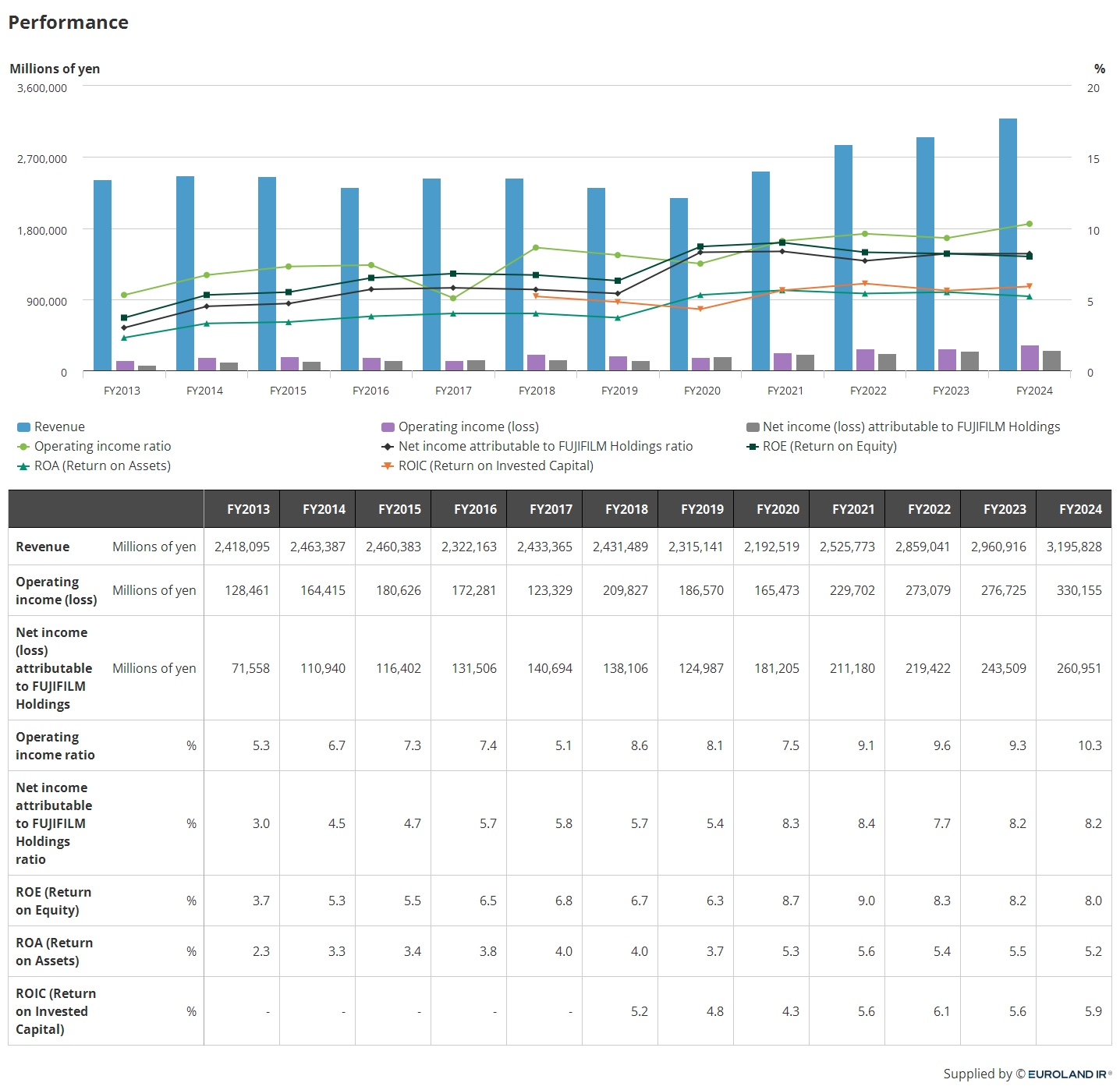

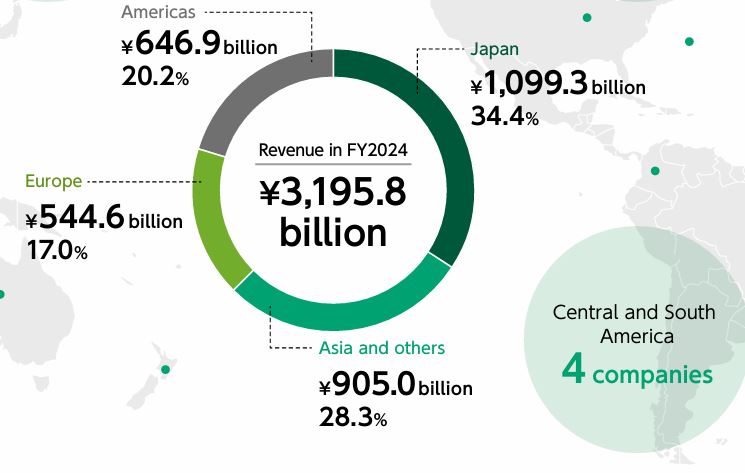

- Fujifilm sales for the fiscal year 2024 were ¥3,195.8 billion, with Japan as the primary market.

- The revenue from the country amounted to ¥1,099.3 billion, which was 34.4% of the total, demonstrating the company’s strong position in medical systems, business solutions, and imaging products.

- Asia and other regions accounted for ¥905.0 billion, representing 28.3% of the total, primarily due to increasing demand in emerging markets and strong sales in healthcare and semiconductor materials.

- America’s share was ¥646.9 billion, which represents 20.2% of Fujifilm’s total revenue, driven by growth in the bio-CDMO and imaging businesses.

- Europe closely followed with ¥544.6 billion, which was 17.0% of the total, due to steady performance in healthcare, office solutions, and imaging products.

- This regional sales distribution reveals that Fujifilm has a well-distributed global presence and approximately two-thirds of its revenue is generated outside Japan, thus showcasing its diverse international business structure.

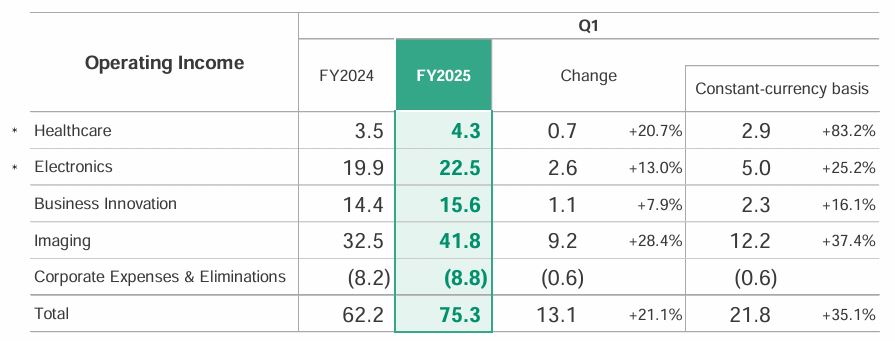

Fujifilm Operating Income

(Source: ir.fujifilm.com)

- In the first quarter of FY2025, Fujifilm’s total operating income increased by ¥75.3 billion, representing a 21.1% year-over-year growth of ¥ 13.1 billion compared to the same period in FY2024.

- In USD terms, operating income increased by 35.1%, indicating that the company successfully improved its profitability across almost all business segments, while the exchange rate had a particularly negative impact in one sector.

- The Healthcare division’s operating income totalled ¥4.3 billion, representing an increase of ¥0.7 billion, or 20.7% year-over-year.

- A constant currency basis operating profit rose by a remarkable +83.2%, which indicates that newly established facilities and cost cuts in the bio CDMO and medical systems areas not only helped to boost margins but also kept them on a modest growth trajectory.

- The selling and administrative expenses in Electronics increased from ¥19.9 billion to ¥22.5 billion, representing a rise of ¥2.6 billion or +13.0%.

- Currency adjustments put the rise at +25.2%, signalling strong continued demand for semiconductor materials and other premium electronic components.

- In the Business Innovation area, which encompasses printing and document solutions, operating income increased from ¥14.4 billion to ¥15.6 billion, a total increase of ¥1.1 billion or +7.9%.

- However, when calculated on a constant-currency basis, that growth turns out to be +16.1%, which is a sign of the company’s solid business operations and the efficiency improvements made in the department, despite lower overall revenue in yen terms.

- The Imaging department had the most remarkable change, with the profit from operations soaring from ¥32.5 billion to ¥41.8 billion, a rise of ¥9.2 billion or +28.4%.

- This increase was not only impressive, but also on a constant-currency basis, it reached +37.4%.

- The high profitability of Fujifilm’s imaging products, such as digital cameras and Instax instant photo systems, which remain the most preferred in the world, is the primary reason for the global demand.

- On the other hand, corporate expenses and eliminations went upward just a little from –¥8.2 billion to –¥8.8 billion, which was a nominal additional cost of ¥0.6 billion that slightly countervailed the operating segments’ gains.

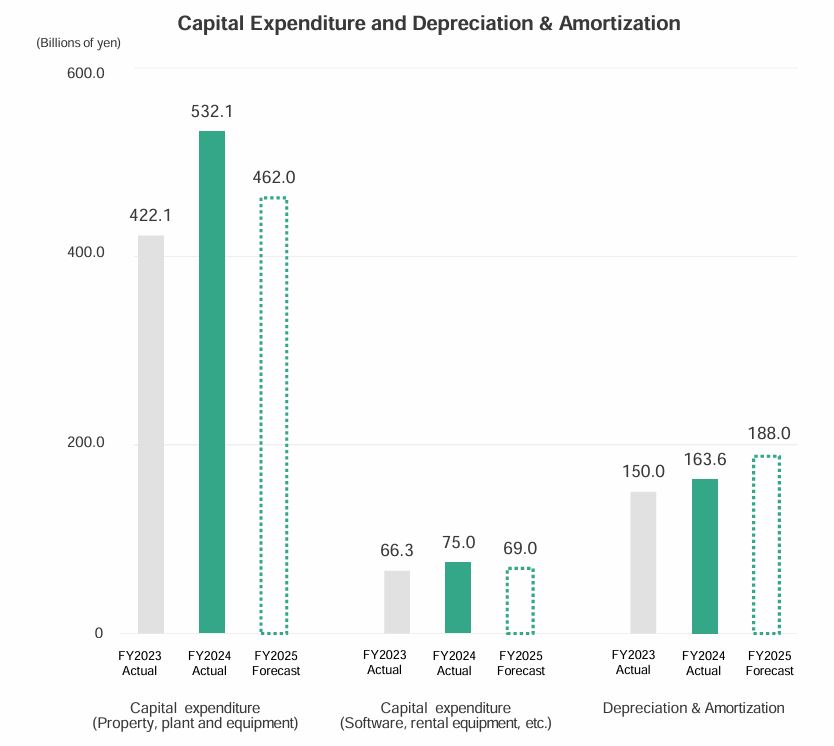

Fujifilm Capital Expenditure And Depreciation, and Amortization

(Source: ir.fujifilm.com)

- In Q1 FY2025, Fujifilm’s total capital expenditure on physical assets was ¥116.6 billion, which was a small decrease compared to the previous year’s ¥118.6 billion.

- The healthcare sector accounted for the largest share at ¥105.3 billion, while investments in electronics, business innovation, and imaging were equal at ¥4.4 billion each, and lighting was at ¥2.1 billion.

- The overall capex for FY2025 is predicted to be ¥462.0 billion, a decrease from the previous year’s ¥532.1 billion.

- The needed capital for software and rental equipment was ¥13.8 billion for Q1 and ¥69.0 billion projected for the year.

- Moreover, depreciation and amortization have slightly gone up to ¥40.9 billion in Q1 and are anticipated to be £188.0 billion for FY2025, which indicates continuous spending in the healthcare and electronics facilities.

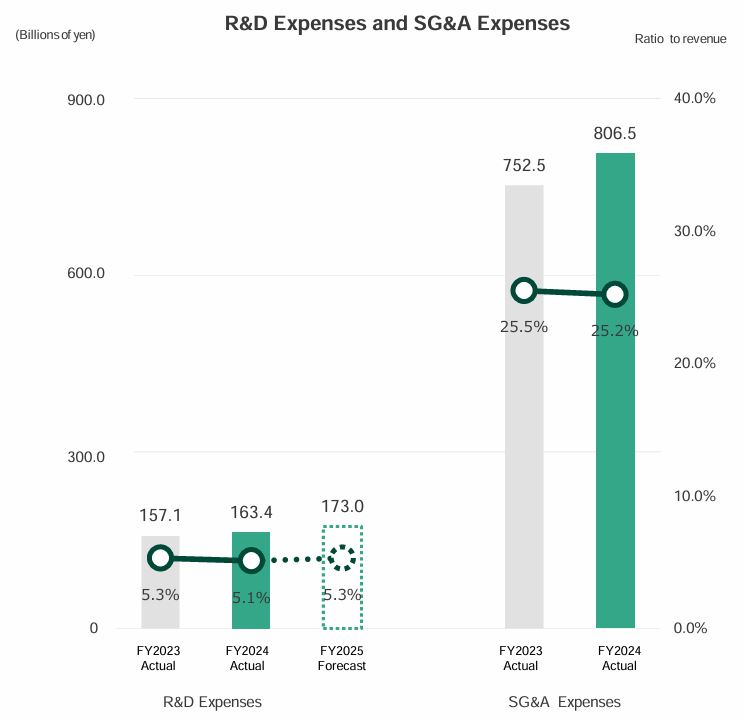

Fujifilm R&D Expenses And SG&A Expenses

(Source: ir.fujifilm.com)

- Fujifilm’s first quarter of the fiscal year 2025 saw a remarkably steady research and development (R&D) expense of ¥40.6 billion, which is nearly the same as that of the previous year, ¥40.3 billion.

- The percentage of R&D to total revenues has remained at 5.4% throughout the fiscal year, indicating the company’s consistent support for innovation.

- Healthcare was responsible for generating the highest R&D costs at ¥14.8 billion, followed by Business Innovation and Electronics at ¥14.0 billion and ¥7.0 billion, respectively. Imaging generated costs of ¥3.0 billion, and Corporate generated costs of ¥1.9 billion.

- R&D expenses are projected to reach ¥173.0 billion for the full year, which is slightly more than the previous year’s spending of ¥163.4 billion, indicating that investments in areas such as biotechnology, semiconductors, and digital imaging are expected to continue.

- The total selling, general, and administrative (SG&A) expenses in Q1 FY2025 amounted to ¥196.6 billion, which is a reduction from ¥206.1 billion the previous year — al, st ¥9.5 billion less or about –4.6%.

- This decline in SG&A resulted in a decrease in the SG&A-to-revenue ratio from 27.5% to 26.2%, indicating improved efficiency in cost management.

- Looking at the entire fiscal year, it is anticipated that Fujifilm’s SG&A will be approximately ¥806.5 billion, which aligns with the levels of previous years.

Fujifilm Number Of Employees

(Source: ir.fujifilm.com)

- Throughout the period, Fujifilm’s workforce experienced a slow but steady increase, which can be attributed to the expansion of business and new investments, primarily in healthcare and electronics.

- In March 2024, the company’s employee count was 72,254, and it saw a gradual increase to 929 in June and 72,989 in September 2024, thus reflecting the stable trend over the year.

- By December 2024, the number had decreased by a margin to 72,901, and it changed further to 72,593 in March 2025, which can be interpreted as minor seasonal or structural adjustments.

- However, by the end of June 2025, the total number of employees had increased significantly to 74,534, representing almost 1,941 more employees than in the previous quarter.

- This growth is likely a sign of hiring for increased operations, especially in areas where the company has been focusing the most, such as bio-CDMO facilities, semiconductor materials, and imaging technology, thus demonstrating Fujifilm’s persistent investment in its worldwide workforce.

- Fujifilm Holdings reported 75,474 employees in 2022, a 3% increase from 2021, according to official filings.

- Data shows that the company employed 75,474 permanent workers in 2021, whereas in 2020, there were 73,275 permanent employees.

- Approximately 48% of Fujifilm’s total workforce is based in Japan, underscoring its strong domestic presence.

- As reported by Fujifilm’s annual filings, employee distribution by region included 36,228 employees in Japan (48%), 7,547 in America (10%), 6,793 in Europe (9%), and 24,906 across Asia and other regions (33%).

- The workforce is divided into two main categories: managers and other employees. Approximately 13,507 (18%) of the total employees were managers, while 61,967 (82%) worked in other roles.

- Based on global segmentation, Japan had 22% managers, the Americas 17%, Europe 18%, and Asia & Others 12%, with a global average of 18% managers.

- Historical data reveals that Fujifilm’s workforce peaked in earlier years, reaching 81,691 employees in 2012 and gradually declining thereafter.

- In 2019, the company employed 72,332 people, increasing to 73,906 in 2020 and 75,474 in 2021 before experiencing moderate reductions in the following years.

- The company’s employee structure also included 9,568 temporary employees in 2021 and 9,731 in 2020, as per corporate reports.

- Fujifilm Holdings, headquartered in Tokyo, Japan, designs, manufactures, and markets healthcare solutions, material solutions, document solutions, and imaging systems.

- Its product portfolio includes color films, imaging devices, TV camera lenses, optical equipment, healthcare items, graphic systems, display materials, recording media, and industrial goods.

- The firm also provides pharmaceuticals, cosmetics, dietary supplements, and cell culture media, expanding its footprint in the healthcare and biotechnology sectors.

- According to company disclosures, Fujifilm serves a diverse customer base, offering document and imaging solutions for both small and large enterprises across the Americas, Europe, and Asia-Pacific.

- The steady employment pattern over the years reflects Fujifilm’s ongoing organizational restructuring and focus on high-value sectors such as healthcare and digital imaging technologies.

| Fujifilm Holdings Annual Employee Count | |

|---|---|

| 2025 | 72,593 |

| 2024 | 72,254 |

| 2023 | 73,878 |

| 2022 | 75,474 |

| 2021 | 73,275 |

| 2020 | 73,906 |

| 2019 | 72,332 |

| 2018 | 77,739 |

| 2017 | 78,501 |

| 2016 | 78,150 |

| 2015 | 79,235 |

| 2014 | 78,595 |

| 2013 | 80,322 |

| 2012 | 81,691 |

(Source: macrotrends.net)

Conclusion

Fujifilm Statistics: Fujifilm’s 2025 results reveal a company that has successfully transitioned from its photographic roots to become a globally recognised technology and healthcare giant. Nevertheless, the firm managed to pull off record-breaking sales and operating profits partly thanks to the currency complications but mainly due to its active rolrole innovation, cost-efficient practices, and international markets expansion.

Fujifilm has made it clear that it considers the healthcare and electronics sectors as its priority for long-term growth by continuously investing in R&D and capital projects. In the future, the company, due to its expanding workforce, regional income distribution, and strong financial position, will be able to capitalise on the digital, imaging, and biotech sectors.

Sources

FAQ.

The company Fujifilm has officially announced a record-high revenue of ¥749.5 billion in the first quarter of FY2025, which corresponds to a slight increase of +0.1% when compared to the previous year. Then again, if we take into account the currency adjustment, the growth rate would be +4.5%, which is a clear indication of the strong foundation of the underlying business performance across the company’s main divisions.

The Imaging segment surpassed all the other segments with an impressive revenue growth of +11.2% reaching the figure of ¥145.3 billion, and a constant currency growth of +17.9%. The growth was driven by the high demand for the Instax instant cameras and X-series digital cameras across the globe.

The operating income for the company rose from ¥62.2 billion to ¥75.3 billion, which is a +21.1% year-on-year increase. Moreover, on the basis of the constant currency, it was +35.1%, thus indicating that there was a significant enhancement of profitability in all business units.

The company Fujifilm, during the first quarter of FY2025, allocated a total of ¥40.6 billion for R&D, which is equivalent to 5.4% of its revenue, thus confirming that it still has the intention as one of its priorities. The company’s total capital expenditure (CapEx) was ¥116.6 billion, out of which the Healthcare segment received the largest part because of the major investments.

The market in Japan is still Fujifilm’s largest market, with the revenue of ¥1,099.3 billion (34.4%) for FY2024. Asia and others came next with 28.3%, the Americas with 20.2%, and Europe with 17.0%, indicating a very good distribution of the global revenue base.

I hold an MBA in Finance and Marketing, bringing a unique blend of business acumen and creative communication skills. With experience as a content in crafting statistical and research-backed content across multiple domains, including education, technology, product reviews, and company website analytics, I specialize in producing engaging, informative, and SEO-optimized content tailored to diverse audiences. My work bridges technical accuracy with compelling storytelling, helping brands educate, inform, and connect with their target markets.