Top 10 Cloud Computing Companies in the World

Updated · Nov 10, 2025

Table of Contents

Introduction

Cloud computing companies are businesses that run powerful computers, storage, and software in their own data centers and let customers use those resources over the internet instead of buying and managing them themselves. These companies provide services like saving files, hosting websites, running apps, analyzing data, training AI, building online backups, and more. Customers usually pay only for what they use, like electricity or water. This makes it faster, cheaper, and easier for startups, schools, and large firms to launch ideas, grow, and stay online reliably without worrying about servers, hardware failures, security updates, maintenance, or expensive in-house IT staff.

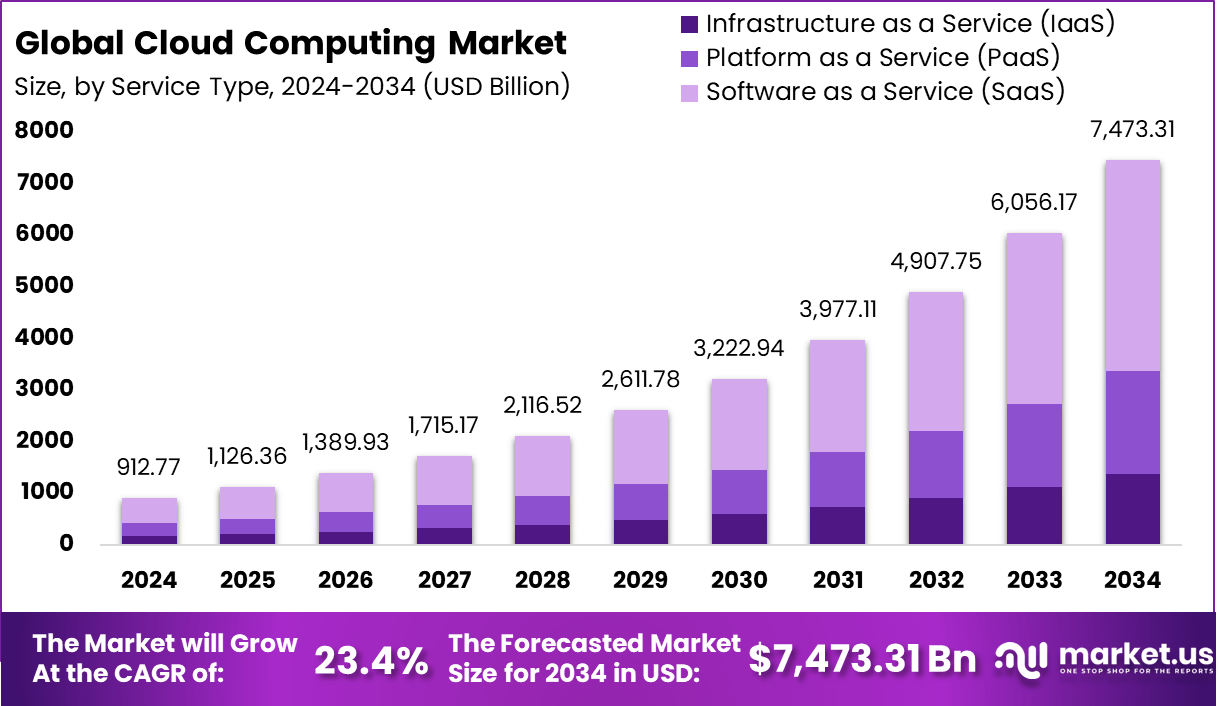

Cloud Computing Market Size

- The global cloud computing market was valued at approximately USD 912.77 billion in 2024.

- The market is expected to grow to approximately USD 1,126.36 billion by 2025.

- By 2034, the market is expected to reach about 7,473.05 billion US dollars.

- This growth from 2025 to 2034 represents an average yearly growth rate of approximately 23.40%, indicating very rapid expansion.

- By 2025, approximately 85% of companies plan to prioritise the cloud as their first choice when selecting new technology, rather than purchasing or building traditional in-house systems.

- Approximately 60% of business data is currently stored in the cloud, indicating that the cloud has become a primary location for storing and managing information.

- By 2025, about 51% of IT budgets are expected to move away from old style IT systems and toward cloud services, which means companies are putting more money into cloud tools than classic hardware.

- Many teams still lack a comprehensive understanding of cloud security, and 40% of IT decision-makers report needing outside vendors to help them maintain system security.

- A large share of technology leaders are open to moving sensitive records into the cloud, with 59% considering storing private customer data there and 52% considering moving financial data there.

- Managing cloud systems can be challenging, and 40% of IT leaders report needing assistance in keeping track of all their cloud assets and resources.

- Cloud usage is extremely common in certain industries, with the highest adoption rates in retail at approximately 96.9%, in media and entertainment at approximately 94.9%, and in finance and banking at approximately 92.8%.

- Almost one out of three organizations, or about 31%, expected that more than three quarters of their work would already be running in the cloud by the end of 2023.

- Microsoft Azure and Amazon Web Services are the most widely used cloud storage platforms, and together they are used by more than 73% of the companies that were surveyed.

- Software offered as an online subscription, also known as Software as a Service (SaaS), holds approximately 60.2% of the market, indicating the growing popularity of pay-as-you-go software.

- A mix of private and public cloud, also known as a hybrid cloud, accounts for approximately 45.7% of usage, indicating that many companies seek both flexibility and control.

- Large companies account for approximately 60.5% of cloud spending, as they invest heavily in digital transformation and advanced technologies.

- Banks, insurance firms, and other financial services organizations lead cloud use by industry with a 23.5% share, because they care about rules, security, and modern finance tech.

- In 2024, the cloud computing market in the United States was valued at approximately USD 306.46 billion and was growing at a rate of about 20.2% per year, indicating very strong demand.

- North America accounts for approximately 39.5% of the global cloud market, indicating that this region remains at the forefront of cloud adoption and innovation.

- The total cloud market is expected to reach approximately USD 947.3 billion by 2026, indicating that companies worldwide are rapidly adopting the cloud.

- Amazon Web Services is currently the largest cloud provider, with a market share of approximately 32%, followed by Microsoft Azure with a market share of about 21%, and Google Cloud with a market share of around 12%.

- Almost every company now utilises the public cloud, at approximately 96%, and most companies also employ private cloud services, at around 84%, which means hybrid setups are now the norm.

- The amount of data in the world is expected to reach approximately 200 zettabytes by 2025, and this significant growth in data is one of the primary reasons the cloud is so important.

- Controlling costs is challenging, and 82% of decision-makers report that keeping cloud spending under control is their biggest headache.

- After moving to the cloud, 94% of companies say their security actually improved, which helps build confidence in cloud migration.

- Money spent on Software as a Service is expected to reach close to 300 billion US dollars by 2025, which shows that subscription software is now standard for business.

- Spending on core infrastructure services is expected to increase by approximately 25% in 2025, while spending on platform services is projected to rise by around 22% in the same year.

- By 2025, approximately half of all IT spending, or roughly 51%, is expected to be allocated to cloud-based solutions instead of traditional tools.

- Three out of four large organizations, or about 75%, are now focusing on building applications in a cloud-native way, rather than building software the old way and moving it later.

- Almost all companies, or approximately 92%, are expected to use more than one cloud provider, which helps them stay flexible and avoid being locked into a single vendor.

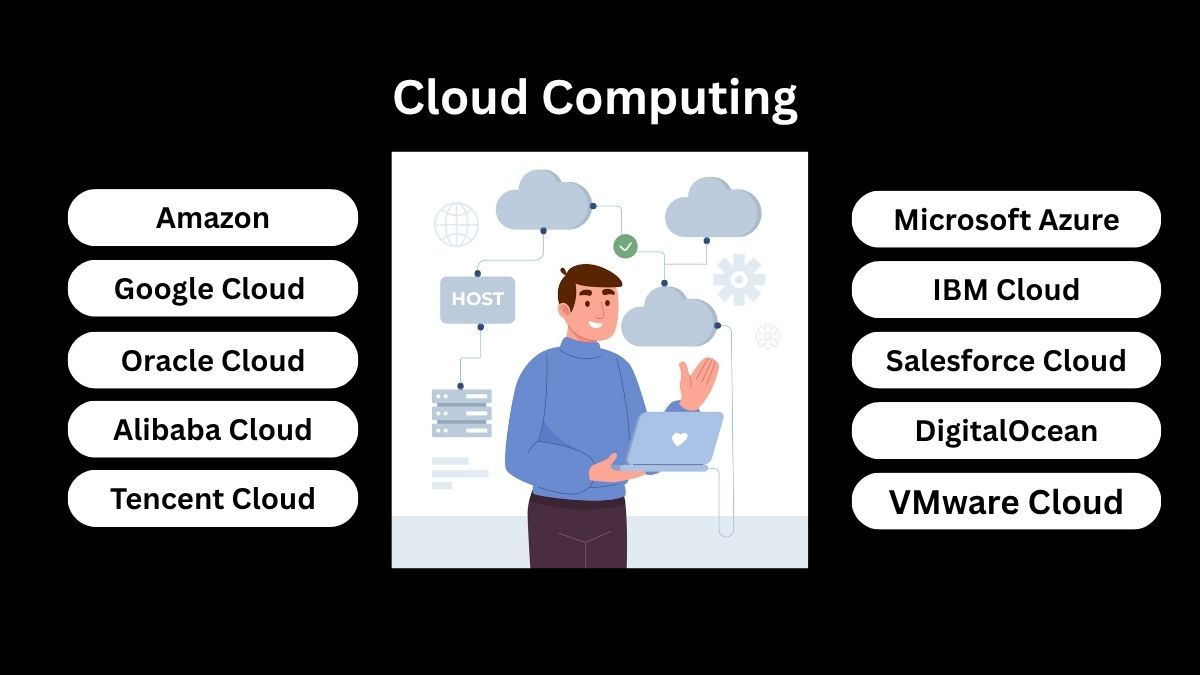

Cloud Computing Companies in the World

- Amazon.com, Inc.

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Cloud

- Oracle Cloud

- Salesforce Cloud

- Alibaba Cloud

- Tencent Cloud

- DigitalOcean

- VMware Cloud

Amazon.com, Inc.

|

Field

|

Details |

| Company Type | Subsidiary providing on-demand cloud computing platforms and APIs. |

| Parent organization | Amazon.com, Inc. |

| CEO | Matt Garman (serving since June 2024). |

| Number of Employees | AWS-specific headcount is not officially broken out; external estimates suggest about120,000–130,000+, and LinkedIn shows “10,001+.” |

| Established (date & year) | Commercial cloud services launched in 2006 (S3 in March; EC2 in August). |

| Subsidiaries (selected) | AWS Elemental (acq. 2015); NICE (2016); Thinkbox Software (2017); CloudEndure (2019); Wickr (2021). |

| Products (examples) | Amazon EC2, Amazon S3, Amazon RDS, AWS Lambda, Amazon DynamoDB, Amazon Redshift, Amazon SageMaker, Amazon CloudFront, Amazon EKS. |

| Headquarters | 410 Terry Avenue North, Seattle, Washington, 98109, United States. |

| Geographical Presence | Operates across 38 geographic Regions and 120 Availability Zones worldwide (with additional Regions announced). |

| Website | https://aws.amazon.com/ |

- As of Q2 2025, AWS held approximately 30% of the global cloud infrastructure market, maintaining its top spot ahead of its rivals.

- In Q3 2025, AWS segment sales totalled US$33.0 billion, up 20% year over year, with US$11.4 billion in operating income for the quarter.

- Over the last twelve months ended September 30, 2025, AWS generated US$121.9 billion in net sales with a quarterly operating margin of 34.6%.

- AWS’s annualised revenue run rate reached US$124B by Q2 2025, underscoring its scale.

- AWS operates 38 Regions and 120 Availability Zones worldwide, with more AZs and Regions announced.

- On Oct 2025, AWS launched its Secret-West Region, its second U.S. Secret-level cloud, expanding classified workload coverage.

- Amazon reported it added 3.8 GW of power capacity for AWS in the past 12 months to meet AI and cloud demand.

- At re:Invent 2024, AWS announced the Amazon Nova foundation models, availability of Trainium2, the Trainium3 roadmap, and new Amazon Q capabilities.

- In Mar 2025, AWS committed €15.7B to new data centers in Aragon, Spain, and launched an AI flood-risk initiative with local authorities.

- On Oct 20, 2025, AWS experienced a major outage centered on US-EAST-1, disrupting many popular online services before recovery.

- The cloud infrastructure market reached approximately US$99 billion in quarterly spend in Q2 2025, growing 24–25% year over year, providing a buoyant backdrop for AWS growth.

Microsoft Azure

|

Field

|

Details |

| Company Type | Public cloud computing platform offering IaaS, PaaS, and SaaS under Microsoft Azure. |

| Parent organization | Microsoft Corporation. |

| CEO | Satya Nadella (CEO of Microsoft). |

| Number of Employees | 228,000 worldwide (Microsoft total) as of June 30, 2025; Azure-specific headcount isn’t broken out publicly. |

| Established (date & year) | Launched commercially as Windows Azure on February 1, 2010; renamed Microsoft Azure on March 25, 2014. |

| Subsidiaries | Azure is a Microsoft product, not a separate legal entity; notable Microsoft subsidiaries integrated into Azure’s ecosystem include GitHub and Nuance, plus telecom-focused Affirmed Networks and Metaswitch. |

| Products (examples) | Azure Virtual Machines, Azure Blob Storage, Azure SQL Database, Azure Cosmos DB, Azure Kubernetes Service (AKS), Azure AI/ Azure OpenAI Service. |

| Headquarters | One Microsoft Way, Redmond, Washington, 98052, USA. |

| Geographical Presence | 70+ Azure regions and 400+ datacenters worldwide; organized into multiple geographies for data residency/compliance. |

| Website | https://azure.microsoft.com/ |

- In the September-quarter (fiscal Q1 FY26), revenue from Azure and other cloud services grew 40% year over year, leading Intelligent Cloud growth.

- Microsoft’s Intelligent Cloud segment delivered US$30.9 billion in revenue, while Microsoft Cloud revenue reached US$49.1 billion in the quarter.

- Management guided to about 37% Azure growth (constant currency) for next quarter and noted demand is capacity-constrained through FY26.

- Microsoft recorded US$34.9 billion in quarterly capital expenditures, with roughly half spent on GPUs/CPUs to meet Azure AI demand.

- Microsoft reported commercial remaining performance obligation (RPO) of US$392 billion, up 51% year over year, underscoring long-term cloud commitments.

- Canalys estimates that Azure held about22% of global cloud-infrastructure market share in Q2 2025, remaining the second-largest provider.

- Global cloud-infrastructure spending totaled US$95.3 billion in Q2 2025, providing a strong demand backdrop for Azure.

- Azure spans over 70 regions and 400+ data centres worldwide, giving it the broadest regional footprint among major clouds.

- Microsoft employed approximately 228,000 people company-wide as of June 30, 2025; the headcount for Azure-only roles is not disclosed.

- Recent development: Microsoft and OpenAI signed a new definitive agreement, with OpenAI contracting an incremental US$250 billion of Azure services, deepening Azure’s long-term demand pipeline.

- Recent development: Microsoft added DeepSeek R1 to Azure AI Foundry (and GitHub), expanding Azure’s model catalog beyond OpenAI with 1,800+ models available.

- Recent development: Azure OpenAI Service introduced GPT-realtime and GPT-audio options, enabling low-latency, voice-capable experiences for production apps.

Google Cloud Platform (GCP)

| Field | Details |

| Company Type | Public cloud computing platform offering IaaS, PaaS, and serverless services under Google Cloud. |

| Parent organization | Google LLC (a subsidiary of Alphabet Inc.). |

| CEO | Thomas Kurian, CEO of Google Cloud. |

| Number of Employees | Alphabet total: 190,167 (as of Sept 2025); Google Cloud–specific headcount is not disclosed publicly. |

| Established (date & year) | Origin of GCP with Google App Engine launch on April 7, 2008. |

| Subsidiaries (relevant acquisitions in Google Cloud) | Apigee (2016), Looker (2019), Mandiant (2022), Siemplify (2022). |

| Products (examples) | Compute Engine, Google Kubernetes Engine (GKE), Cloud Storage, BigQuery, Cloud SQL, Cloud Run, Vertex AI. |

| Headquarters | Googleplex, 1600 Amphitheatre Pkwy, Mountain View, California, USA. |

| Geographical Presence | Operates across 42 global cloud regions (with multiple zones per region). |

| Website | https://cloud.google.com/ |

- In the third quarter of 2025, Google Cloud revenue reached US$15.16 billion, up 34% year over year, and segment operating income was US$3.59 billion.

- Alphabet reported that Google Cloud ended the quarter with a US$155 billion backlog and raised 2025 capex guidance to US$91–US$93 billion to meet AI and cloud demand.

- Canalys data show Google Cloud held roughly 11% share of global cloud infrastructure spend in Q2 2025, growing 34% year over year as large deal sizes accelerated.

- Industry spending on cloud infrastructure climbed to about US$95.3 billion in Q2 2025, providing a favorable backdrop for Google Cloud’s growth.

- Google Cloud states it now operates 42 regions (and, per Google networking updates, 127 zones) connected by a global backbone with 200+ edge locations.

- Anthropic will expand on Google Cloud to up to one million TPUs—a deal worth tens of billions of dollars—bringing >1 GW of capacity online in 2026.

- OpenAI plans to add Google Cloud to meet surging compute needs, signaling rising multi-cloud AI workloads.

- Google introduced Ironwood, its seventh-generation TPU optimized for generative-AI inference, at Google Cloud Next ’25.

- Google Cloud announced Oracle Database@Google Cloud expansions, including more global locations and new capabilities like Cross-Region DR for Autonomous Database.

- The Vertex AI platform added new prompt management tooling and resolved a streaming API misrouting issue affecting certain third-party models.

- Google has launched its 42nd cloud region in Sweden, adding to new locations in South Africa and Mexico, and continuing its rapid regional expansion.

- Following earnings, multiple outlets highlighted Alphabet’s first-ever US$100 billion+ revenue quarter and emphasized cloud as a key growth driver.

IBM Cloud

|

Field

|

Details |

| Company Type | Public cloud computing platform offering IaaS, PaaS and SaaS with a strong hybrid-multicloud focus. |

| Parent organization | International Business Machines Corporation (IBM). |

| CEO | Arvind Krishna, Chairman & CEO of IBM. |

| Number of Employees | 270,300 (IBM and wholly-owned subsidiaries) in 2024. |

| Established date and year | Launched as “Bluemix” in 2014 (public beta February; GA July); rebranded to “IBM Cloud” in October 2017. |

| Subsidiaries | Key IBM subsidiaries/acquisitions aligned to IBM Cloud include Red Hat (closed 2019), SoftLayer (2013), and Cloudant (2014). |

| Products | Examples: IBM Cloud Kubernetes Service; IBM Cloud Object Storage; Virtual Servers for VPC; Red Hat OpenShift on IBM Cloud; IBM Cloud Code Engine; watsonx (AI); IBM Cloud Databases (e.g., MySQL/PostgreSQL/Cloudant). |

| Headquarters | 1 New Orchard Road, Armonk, New York 10504, United States. |

| Geographical Presence | 60+ IBM Cloud data centers across about19 countries; multizone regions include us-south (Dallas), us-east (Washington DC), eu-de (Frankfurt), eu-gb (London), eu-es (Madrid), jp-tok (Tokyo), jp-osa (Osaka), au-syd (Sydney); single-campus MZRs include Chennai and Montreal. |

| Website | https://www.ibm.com/cloud |

- In fiscal Q1 FY26, Oracle’s total cloud revenue (IaaS + SaaS) was US$7.2B, up 28% year over year; OCI (IaaS) revenue was US$3.3B, up 55%, and Cloud Applications (SaaS) were US$3.8B, up 11%.

- Oracle reported US$455B in remaining performance obligations (RPO), up 359% year over year, signaling a large backlog of contracted cloud business.

- Oracle guided for OCI revenue to grow about77% in FY26 to US$18B, with multi-year growth targets beyond; this outlook followed a quarter with multiple multi-billion-dollar contracts.

- Oracle reported that revenue from its multicloud database, which includes AWS, Google, and Microsoft, grew 1,529% year over year in Q1, reflecting the rapid adoption of its multicloud offerings.

- Oracle Cloud Infrastructure lists 51 public cloud regions across 26 countries, including EU Sovereign Cloud regions operated separately for compliance.

- Oracle made Oracle Fusion Cloud Applications available on the EU Sovereign Cloud, broadening compliant SaaS options for EU customers.

- Oracle introduced OCI Dedicated Region^25 to deliver 200+ AI and cloud services directly in customer data centers with a smaller footprint.

- At Oracle AI World 2025, Oracle unveiled the Oracle AI Database 26ai and a new AI Data Platform, adding embedded AI capabilities to its data stack.

- Oracle Database@Google Cloud added regions and new capabilities, with further expansion announced through 2025.

- Oracle Database@Azure expanded availability and features, with new regions coming and additional database services now offered on Azure.

- Oracle signed a deal to provide air-gapped cloud and AI services for Singapore’s defense technology arm, marking a notable government win in Southeast Asia.

- Independent trackers place Oracle at around 3% global cloud-infrastructure market share in early 2025, with steady gains as the market nears US$100B in quarterly spend.

Oracle Cloud

|

Field

|

Details |

| Company Type | Public cloud computing platform providing IaaS, PaaS and SaaS (Oracle Cloud Infrastructure and Oracle Fusion Cloud Applications). |

| Parent organization | Oracle Corporation. |

| CEO | Clay Magouyrk and Mike Sicilia (co-CEOs since September 22, 2025). |

| Number of Employees | about162,000 (Oracle companywide, FY2025). |

| Established (date & year) | Oracle Cloud brand introduced in 2012; Oracle Cloud Infrastructure (current platform) launched October 2016. |

| Subsidiaries (selected, cloud-relevant) | NetSuite (2016); MICROS Systems (2014); Dyn (2016); Aconex (2018); Cerner → Oracle Health (2022). (Oracle) |

| Products (examples) | OCI Compute & Containers/OKE; Object & Block Storage; Autonomous Database; Oracle Cloud VMware Solution; Cloud Guard (security); Fusion Cloud Apps (ERP, HCM, SCM, CX); Analytics. (Oracle) |

| Headquarters | World Headquarters: 2300 Oracle Way, Austin, Texas, USA (Oracle-listed HQ; Nashville campus announced as future HQ and under development). (Oracle) |

| Geographical Presence | Services delivered from 51 public cloud regions across 26 countries (plus dedicated/sovereign options). (Oracle) |

| Website | https://www.oracle.com/cloud/ |

- In fiscal Q1 FY26, Oracle’s total cloud revenue (IaaS + SaaS) was US$7.2B, up 28% year over year; OCI (IaaS) revenue was US$3.3B, up 55%, and Cloud Applications (SaaS) were US$3.8B, up 11%.

- Oracle reported US$455B in remaining performance obligations (RPO), up 359% year over year, signaling a large backlog of contracted cloud business.

- Oracle guided OCI revenue to grow approximately 77% in FY26 to US$18B, with multi-year growth targets beyond; this outlook followed a quarter with multiple multi-billion-dollar contracts.

- Oracle reported that revenue from its multicloud database, which includes AWS, Google, and Microsoft, grew 1,529% year over year in Q1, reflecting the rapid adoption of its multicloud offerings.

- Oracle Cloud Infrastructure lists 51 public cloud regions across 26 countries, including EU Sovereign Cloud regions operated separately for compliance.

- Oracle made Oracle Fusion Cloud Applications available on the EU Sovereign Cloud, broadening compliant SaaS options for EU customers.

- Oracle introduced OCI Dedicated Region^25 to deliver 200+ AI and cloud services directly in customer data centers with a smaller footprint.

- At Oracle AI World 2025, Oracle unveiled the Oracle AI Database 26ai and a new AI Data Platform, adding embedded AI capabilities to its data stack.

- Oracle Database on Google Cloud has added regions and new capabilities, with further expansion announced through 2025.

- Oracle Database on Azure expanded availability and features, with new regions coming online and additional database services now offered on Azure.

- Oracle signed a deal to provide air-gapped cloud and AI services for Singapore’s defense technology arm, marking a notable government win in Southeast Asia.

- Independent trackers estimate Oracle’s global cloud-infrastructure market share at around 3% in early 2025, with steady gains as the market approaches US$100 billion in quarterly spend.

Salesforce Cloud

|

Field

|

Details |

| Company Type | Public company providing cloud-based enterprise CRM (SaaS) and platform services (PaaS), marketed as the “#1 AI CRM.” |

| Parent organization | Independent public company — Salesforce, Inc. (no parent). |

| CEO | Marc Benioff, Chair & CEO. |

| Number of Employees | 76,453 employees (as of January 31, 2025). |

| Established date and year | Founded March 8, 1999. |

| Subsidiaries (selected) | Slack (completed Jul 21, 2021); Tableau (completed Aug 1, 2019); MuleSoft (completed May 2, 2018); Heroku (completed Jan 3, 2011); Demandware → Commerce Cloud (completed Jul 11, 2016). |

| Products (examples) | Sales Cloud, Service Cloud, Marketing Cloud, Commerce Cloud, Data Cloud; Einstein (AI); Agentforce; plus Tableau, MuleSoft, Slack, Heroku. |

| Headquarters | Salesforce Tower, 415 Mission Street, 3rd Floor, San Francisco, CA 94105, USA. |

| Geographical Presence | Global operations across the Americas, EMEA, and APAC; Hyperforce provides data residency/processing across many countries including the U.S., U.K., Germany, France, Ireland, Sweden, Switzerland, India, Japan, Singapore, South Korea, Australia, Indonesia, Israel, Canada, Brazil, and the UAE. |

| Website | https://www.salesforce.com/ |

- In the September-quarter (Q2 FY26), Salesforce reported US$10.2 billion in revenue (up 10% year over year), US$9.7 billion in subscription & support revenue (up 11%), a 22.8% GAAP and 34.3% non-GAAP operating margin, and US$29.4 billion in current RPO.

- For FY25, Salesforce disclosed Total RPO of US$63 billion (up 11% year over year) and US$13 billion in operating cash flow (up 28%).

- As of January 31, 2025, Salesforce employed 76,453 people worldwide, according to its Form 10-K.

- IDC ranked Salesforce the #1 global CRM provider for the 11th straight year with 21.7% market share in 2023.

- Salesforce said Data Cloud & AI ARR reached US$900 million in FY25 (up 120% year over year), surpassed 50 trillion records, and closed 5,000 Agentforce deals (over 3,000 paid) in Q4 FY25.

- Salesforce’s Hyperforce architecture provides data-residency options across the Americas, EMEA, and APAC, with locations listed on Salesforce Trust and Help sites (for example, the U.S., U.K., Germany, India, Japan, the Netherlands, and Sweden).

- Salesforce launched Agentforce 360 globally to power AI agents across its platform and said the product already has about 12,000 customers, while Slack added conversational AI features.

- Salesforce deepened AI partnerships with OpenAI and Anthropic to bring their models into Agentforce 360 and Slack, expanding customers’ model choices.

- Salesforce announced a US$15 billion, five-year investment in San Francisco to accelerate AI adoption, including a new AI incubator hub.

- Salesforce highlighted the ongoing availability of Einstein Copilot as its AI assistant for CRM workloads, following the achievement of its general availability milestone.

- Salesforce completed the acquisition of Bluebirds (an AI prospecting platform) in August 2025 to bolster Sales Cloud and Agentforce capabilities.

Alibaba Cloud

|

Field

|

Details |

| Company Type | Subsidiary public cloud provider offering IaaS, PaaS and SaaS under Alibaba Cloud. |

| Parent organization | Alibaba Group Holding Limited. |

| CEO | Eddie Yongming Wu, Chairman & CEO of Alibaba Cloud Intelligence. |

| Number of Employees | Alibaba Cloud does not publish a separate figure; Alibaba Group reported about 124,320 employees as of FY2025. |

| Established (date & year) | Founded in September 2009. |

| Subsidiaries / key cloud-related entities | Examples include Zhejiang Alibaba Cloud Computing Ltd. and Alibaba Cloud Computing Ltd. (PRC); Alibaba also acquired HiChina (2009) and data Artisans/Ververica (2019) feeding into cloud offerings. |

| Products (examples) | Elastic Compute Service (ECS), Object Storage Service (OSS), ApsaraDB/PolarDB, AnalyticDB/MaxCompute, Container Service for Kubernetes (ACK), Function Compute, CDN, Security services, AI/Model Studio. |

| Headquarters | Alibaba Group HQ: 969 West Wen Yi Road, Yuhang District, Hangzhou, China; Alibaba Cloud’s international operations are registered/headquartered in Singapore. |

| Geographical Presence | Operates across 29 regions with about92 availability zones worldwide. |

| Website | https://www.alibabacloud.com/ |

- In fiscal year 2025, Alibaba’s Cloud Intelligence Group generated RMB 118.0 billion (about US$16.3 billion) in revenue, up 11% year over year, with adjusted EBITA up 72%.

- In the March quarter of 2025 alone, Alibaba Cloud’s revenue reached RMB 30.1 billion (approximately US$4.15 billion), representing a 18% year-over-year growth, reflecting stronger demand for public cloud and AI services.

- Alibaba Cloud held about 4% of global cloud infrastructure spend in Q2 2025, keeping it the No. 4 provider worldwide.

- In Mainland China, Alibaba Cloud led with 33% market share in Q1 2025, ahead of Huawei Cloud and Tencent Cloud.

- Alibaba Cloud reports a footprint of 29 regions with about91 availability zones worldwide, serving customers across Asia-Pacific, the Middle East, Europe, and the Americas.

- As a backdrop, global cloud infrastructure spending reached USUS$95.3 billion in Q2 2025, underscoring the sector’s strong demand environment.

- Alibaba announced a RMB 380 billion (aboutUSUS$52–53 billion) investment plan over the next three years to expand AI and cloud infrastructure.

- Alibaba Cloud launched a second data center in Dubai during GITEX Global (October 2025) to meet rising regional AI and cloud demand.

- Alibaba Cloud unveiled international expansion plans to open its first data centers in Brazil, France, and the Netherlands, with additional sites planned in Mexico, Japan, South Korea, Malaysia, and Dubai.

- Alibaba Cloud rolled out Qwen model updates (including the Qwen3 family) and broader AI platform enhancements to power agent development and next-gen AI workloads.

- To strengthen its ecosystem, Alibaba Cloud committed over USUS$60 million in FY2026 to partner programs, marketing, rebates, and capability-building.

Tencent Cloud

|

Field

|

Details |

| Company Type | Subsidiary public cloud provider offering IaaS/PaaS/serverless under the Tencent Cloud brand. |

| Parent organization | Tencent Holdings Limited. |

| CEO | Dowson Tong – Senior EVP of Tencent and CEO of the Cloud & Smart Industries Group (which includes Tencent Cloud). |

| Number of Employees | 110,558 (Tencent group, as of Dec 31, 2024); Tencent Cloud–specific headcount not separately disclosed. |

| Established (date & year) | Official public launch in 2013. |

| Subsidiaries (examples) | Tencent Cloud International Pte. Ltd. (Singapore); Tencent Cloud Europe B.V. (Netherlands). |

| Products (examples) | Cloud Virtual Machine (CVM); Cloud Object Storage (COS); TencentDB (e.g., for MySQL); Tencent Kubernetes Engine (TKE); Serverless Cloud Function (SCF); Content Delivery Network (CDN); EdgeOne. |

| Headquarters | Tencent Binhai Towers, No. 33 Haitian 2nd Road, Nanshan District, Shenzhen, Guangdong, China. |

| Geographical Presence | Global footprint across China, APAC, North America, Europe, and South America; 64 Availability Zones across multiple regions (public cloud), excluding BM/Finance AZs. |

| Website | https://www.tencentcloud.com/ |

- Tencent Cloud held approximately 10% of Mainland China’s cloud infrastructure market share in Q1 2025, a quarter when China’s cloud spending reached US$11.6 billion and grew by about 16% year-over-year.

- Tencent Cloud reports a global footprint of 64 Availability Zones across 22 regions, serving customers across Asia-Pacific, the Americas, Europe, and the Middle East.

- Tencent’s Business Services segment (which includes cloud) grew at “teens %” year over year in Q2 2025, and management highlighted that international cloud revenue increased significantly year over year.

- Tencent boosted company-wide operating capex to RMB 17.9 billion in Q2 2025 (up 149% YoY) to scale AI and infrastructure that underpin cloud services.

- Tencent updated its Hunyuan AI family in mid-2025, noting improved rankings and efficiency, which it positions as a core capability offered through Tencent Cloud.

- Tencent Cloud launched a new cloud region in Saudi Arabia—its first in the Middle East—with availability zones slated to go live in 2025, expanding its international reach.

- Tencent Cloud announced Osaka as a new Japan cloud region with its third data center in the country, strengthening coverage for Japanese customers.

- Tencent announced a global rollout of scenario-based AI capabilities and an AI Agent Development Platform 3.0 for enterprises, delivered via Tencent Cloud.

- Tencent said it has adapted its AI infrastructure to support Chinese-designed chips, reducing reliance on Nvidia and signaling a strategic pivot for cloud-AI compute.

- Company commentary emphasized that international Tencent Cloud revenue rose significantly year over year, aided by migration tooling and database capabilities that help large enterprises move workloads to Tencent Cloud.

DigitalOcean

|

Field

|

Details |

| Company Type | Public cloud infrastructure provider (IaaS/PaaS) — ticker DOCN. |

| Parent organization | DigitalOcean Holdings, Inc. (independent public company; no external parent). |

| CEO | Paddy Srinivasan. |

| Number of Employees | About 1,210 companywide (as of Dec 31, 2024). |

| Established date and year | Founded 2011; first product launched in 2012. |

| Subsidiaries (selected) | Cloudways (acq. 2022), Paperspace (acq. 2023), Nimbella (acq. 2021), CSS-Tricks (acq. 2022). |

| Products (examples) | Droplets (VMs), Kubernetes (DOKS), App Platform (PaaS), Managed Databases, Spaces (object storage), Functions (serverless), Paperspace GPUs/Notebooks/Deployments. |

| Headquarters | 101 6th Avenue, New York, NY 10013, USA (corporate address on 10-K). |

| Geographical Presence | 13 DigitalOcean datacenters across 9 regions; 3 Paperspace datacenters across 3 regions. |

| Website | https://www.digitalocean.com/ |

- In Q2 2025, DigitalOcean reported US$219 million in revenue (up 14% year over year), US$37 million in net income (up 93% YoY, 17% margin), and 41% adjusted EBITDA margin.

- Annual run-rate revenue (ARR) ended Q2 2025 at US$875 million, growing 14% year over year.

- The company’s net dollar retention rate improved to 99%, and the average revenue per customer reached US$111.70, up 12% year-over-year.

- DigitalOcean stated that it serves more than 600,000 customers worldwide, underscoring its focus on digital-native businesses and developers.

- As of December 31, 2024, DigitalOcean employed 1,210 people, with 703 outside the United States.

- The platform operated 13 data centres across 9 regions, and Paperspace (part of DigitalOcean) operated 3 data centres across 3 regions.

- For full-year 2025, management guided to US$888–US$892 million in revenue, 39–40% adjusted EBITDA margin, and 17–19% adjusted free-cash-flow margin.

- DigitalOcean announced general availability of DigitalOcean Gradient™, a managed AI platform for building agentic apps with models from Anthropic, Meta, Mistral, and OpenAI.

- The company unveiled a collaboration with AMD to offer AMD Instinct™ GPUs as GPU Droplets and power the AMD Developer Cloud on DigitalOcean.

- At its Deploy conference (Oct 2, 2025), DigitalOcean launched multiple product updates across AI, Storage, Databases, Compute, and Networking to broaden its cloud portfolio.

- Paperspace is now presented as DigitalOcean’s AI & GPU cloud brand, with the site guiding new customers to the consolidated DigitalOcean AI offerings.

VMware Cloud

|

Field

|

Details |

| Company Type | Subsidiary cloud & virtualization software provider focused on hybrid/private cloud via VMware Cloud Foundation (VCF) and managed/partner clouds. |

| Parent organization | Broadcom Inc. (VMware acquired Nov 22, 2023). |

| CEO | Hock E. Tan, President & CEO of Broadcom Inc. (parent of VMware by Broadcom). |

| Number of Employees | VMware-specific headcount isn’t officially broken out post-acquisition; reporting indicates about 16,000 in 2025; Broadcom total about 37,000 in 2024. |

| Established date and year | VMware Cloud era marked by initial availability of VMware Cloud on AWS on Aug 28, 2017. (VMware’s earlier vCloud Air public cloud launched 2013/2014 and was sold in 2017.) |

| Subsidiaries (selected, cloud-relevant acquisitions) | CloudHealth (2018); Heptio (2018); Avi Networks (2019); Pivotal (2019); Carbon Black (2019); SaltStack (2020). |

| Products (examples) | VMware Cloud Foundation, vSphere, vSAN, NSX, VCF Operations/Automation (Aria), plus VMware Cloud on AWS. |

| Headquarters | 3401 Hillview Ave, Palo Alto, CA 94304, USA (VMware campus; Broadcom also lists Hillview Ave as corporate HQ). |

| Geographical Presence | VMware Cloud on AWS available in 17 global regions (service footprint; VCF itself deploys in customer or provider datacenters worldwide). |

| Website | https://www.vmware.com/ |

- Broadcom stated that over 87% of its 10,000 largest customers have adopted VMware Cloud Foundation (VCF), underscoring strong momentum in private cloud adoption.

- Broadcom’s infrastructure software revenue (which includes VMware) was US$6.6B in Q2 FY2025, up 25% year over year, reflecting conversion to VCF subscriptions.

- Broadcom reported Q3 FY2025 revenue of US$15.95B, highlighting continued strength from VMware within its software portfolio.

- VCF 9.0 was announced in June 2025, bringing major upgrades across deployment, operations, performance, and security for modern private clouds.

- VCF 5.2 release notes in March 2025 documented platform changes (for example, depot URL/auth updates and feature deprecations) as the stack evolved.

- Amazon Elastic VMware Service (EVS) launched GA on Aug 5, 2025 in six AWS Regions to run VCF inside an Amazon VPC, broadening hybrid options for VMware workloads.

- Amazon EVS expanded on Sep 30, 2025 to additional Regions in Singapore and London, increasing locality choices for regulated or latency-sensitive use cases.

- VMware confirmed the end of perpetual licenses and a move to subscription offers (VCF and vSphere Foundation), a shift first outlined on Jan 22, 2024.

- VMware announced the Cloud Services Portal will redirect to Broadcom’s Cloud Services Console on Oct 6, 2025, consolidating account and service access.

- Broadcom introduced an invite-only VMware Cloud Service Provider model effective Nov 1, 2025, significantly restructuring the partner ecosystem.

- In July 2025, the European cloud association CISPE challenged the EU’s approval of Broadcom’s acquisition of VMware, keeping regulatory scrutiny in view.

Sources

Joseph D'Souza founded ElectroIQ in 2010 as a personal project to share his insights and experiences with tech gadgets. Over time, it has grown into a well-regarded tech blog, known for its in-depth technology trends, smartphone reviews and app-related statistics.