Alipay Statistics By Users, Demographics And Countries

Updated · Nov 27, 2024

Table of Contents

- Introduction

- Editor’s Choice

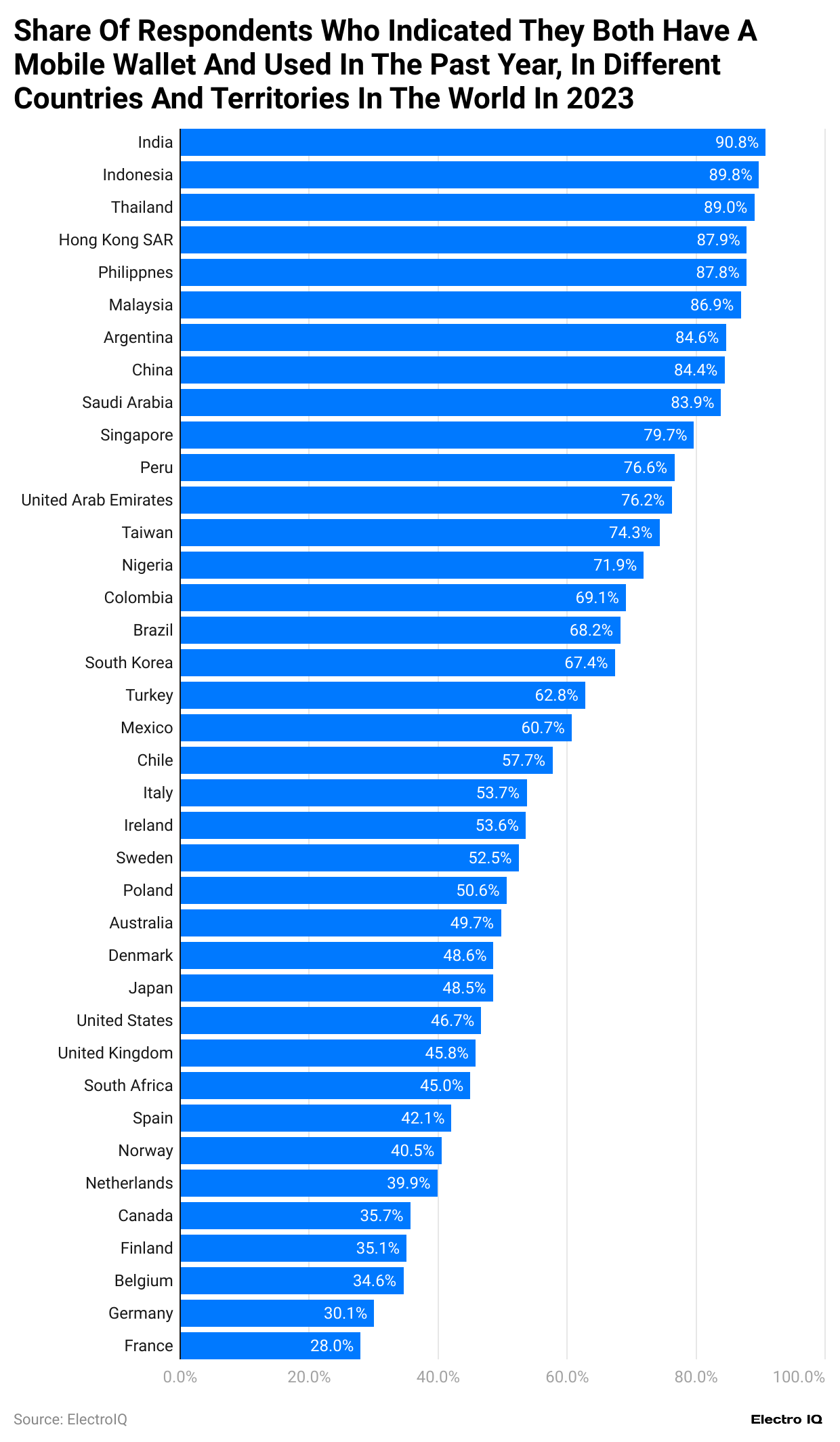

- Mobile Wallet Adoption By Countries

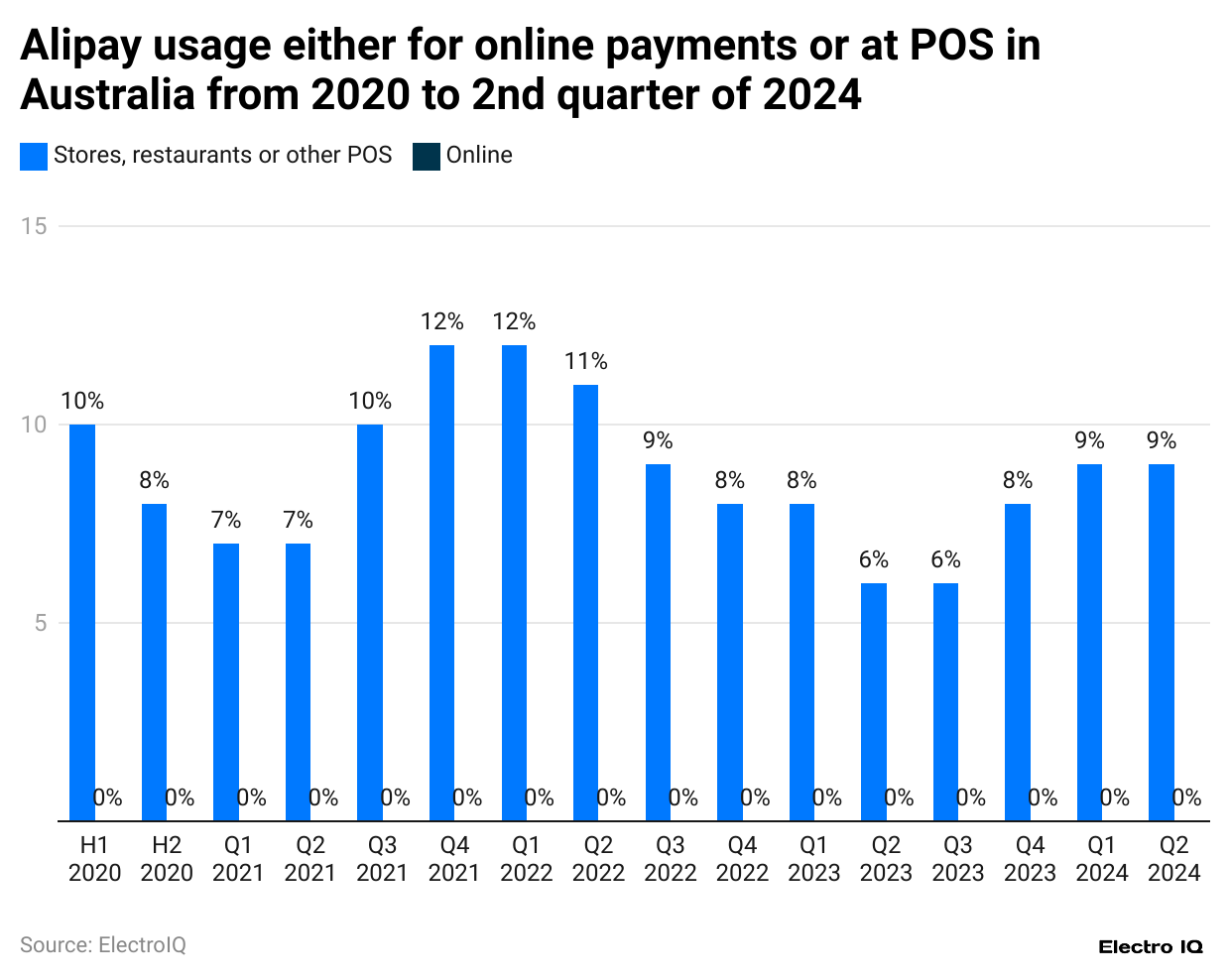

- Alipay User Penetration in Australia

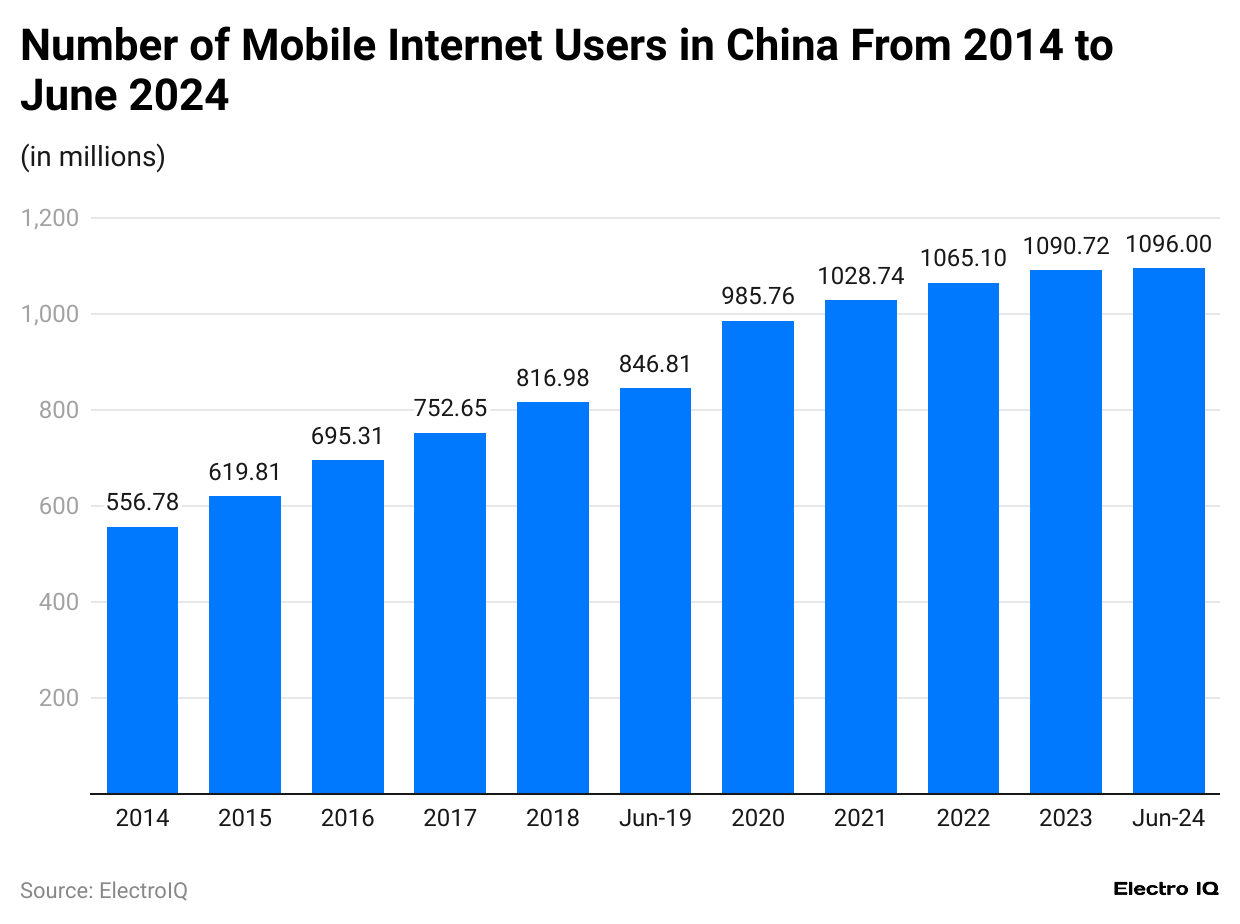

- Mobile Internet Users in China

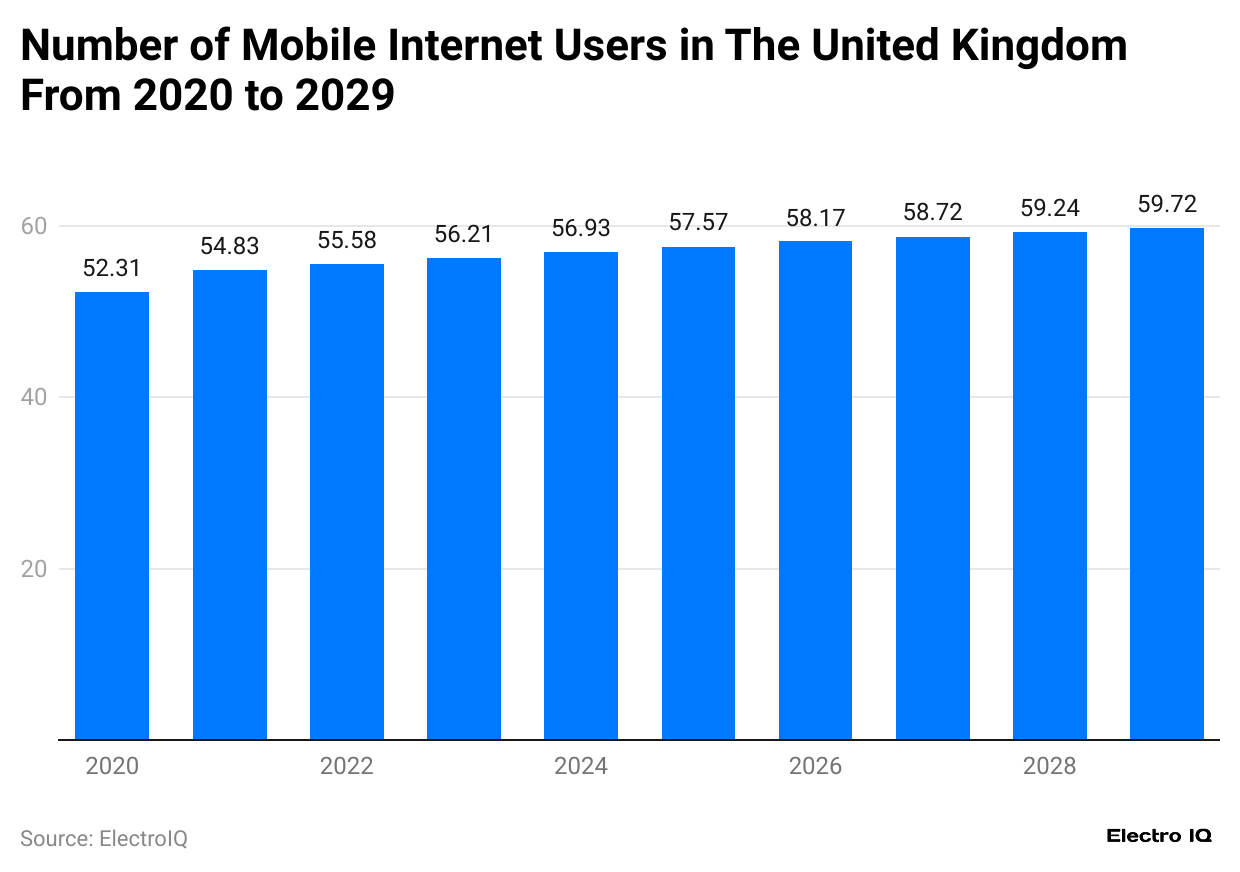

- Mobile Internet Users in The United Kingdom

- Mobile Users in France

- Mobile Wallet Usage in Vietnam

- Mobile Users in Spain

- Mobile Payment Users in China

- Active User of Alipay in China

- Alipay Audience Demographics

- Alipay Penetration in Finland

- Alipay Usage in Different Countries

- Alipay Overview

- Conclusion

Introduction

Alipay Statistics: Alipay is one of the prominent online payment platforms, and it has become one of the largest in the world. Accordingly, it is essential to go through Alipay Statistics to learn about the relevant properties and the success of this company.

Likewise, one can learn about measures that can propel business to unprecedented growth. By the end, we will learn about the company’s strategic international expansion and ability to adapt to regulatory changes while maintaining strong user growth and revenue generation.

Editor’s Choice

- India leads global mobile wallet adoption with 90.8% penetration rate

- Alipay’s user base reached 1.43 billion by mid-2024

- Transaction volume hit USD 18 trillion in 2023

- Monthly active users decreased to 659.53 million by February 2024

- 63% of Alipay users are aged 25-34

- China’s mobile internet users reached 1096 million by June 2024

- Alipay’s revenue reached USD 22 billion in 2023

- Profit margin increased to 19% by the end of 2024

- USD 2 billion allocated to regulatory compliance in 2024

- AI-driven fraud detection reduced fraudulent transactions by 15%

- Blockchain payment system attracted 10 million users in the first 6 months

- Revenue is projected to reach USD 25 billion by the end of 2024

- Mobile users in Spain expected to reach 44.82 million by 2029

- UK mobile users are projected to reach 59.72 million by 2029

- France’s mobile internet penetration is expected to reach 88.21% by 2029

Mobile Wallet Adoption By Countries

(Reference: statista.com)

- Alipay Statistics show that India is the leading country in digital mobile wallets, with 90.8%.

- Indonesia follows it with 89.8%, Thailand with 89%, and Hong Kong with 87.9%.

Alipay User Penetration in Australia

(Reference: statista.com)

- Alipay Statistics show that the penetration rate of this platform in Australia has been inconsistent over time.

- While in H1 2020, the penetration of stores was 10% while online was 0%, by the end of 2024, the penetration rate was 9% in stores.

- Between H1 2020 and Q2 2024, the highest penetration was witnessed in Q1 2022 at 12% in stores.

Mobile Internet Users in China

(Reference: statista.com)

- Alipay Statistics show that the number of mobile users in China has increased consistently.

- In 2014, the number of mobile users was 556.78 million, which was increased to 1096 million by the end of June 2024.

Mobile Internet Users in The United Kingdom

(Reference: statista.com)

- Alipay Statistics show that the number of mobile users in the United Kingdom has increased.

- In 2020 mobile users in the UK in 2020, there were 52.31 million mobile users, which increased to 55.58 million mobile by the end of 2023.

- By the end of 2029, the number of mobile users is predicted to be 59.72 million.

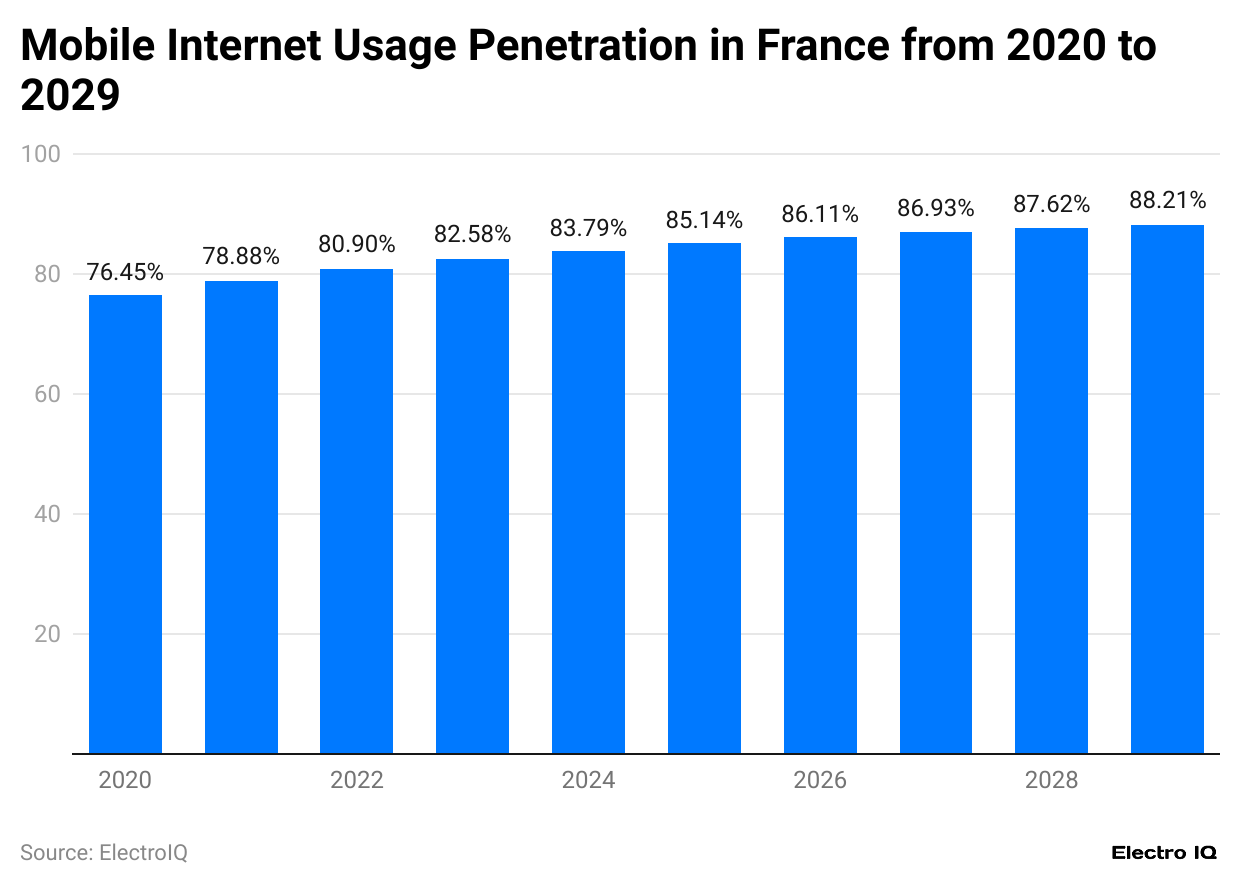

Mobile Users in France

(Reference: statista.com)

- Alipay Statistics show that mobile internet user penetration in France has increased consistently.

- In 2020, internet usage was 76.45%, which increased to 82.58% by the end of 2023.

- By the end of 2029, mobile user penetration usage is predicted to be 88.21%.

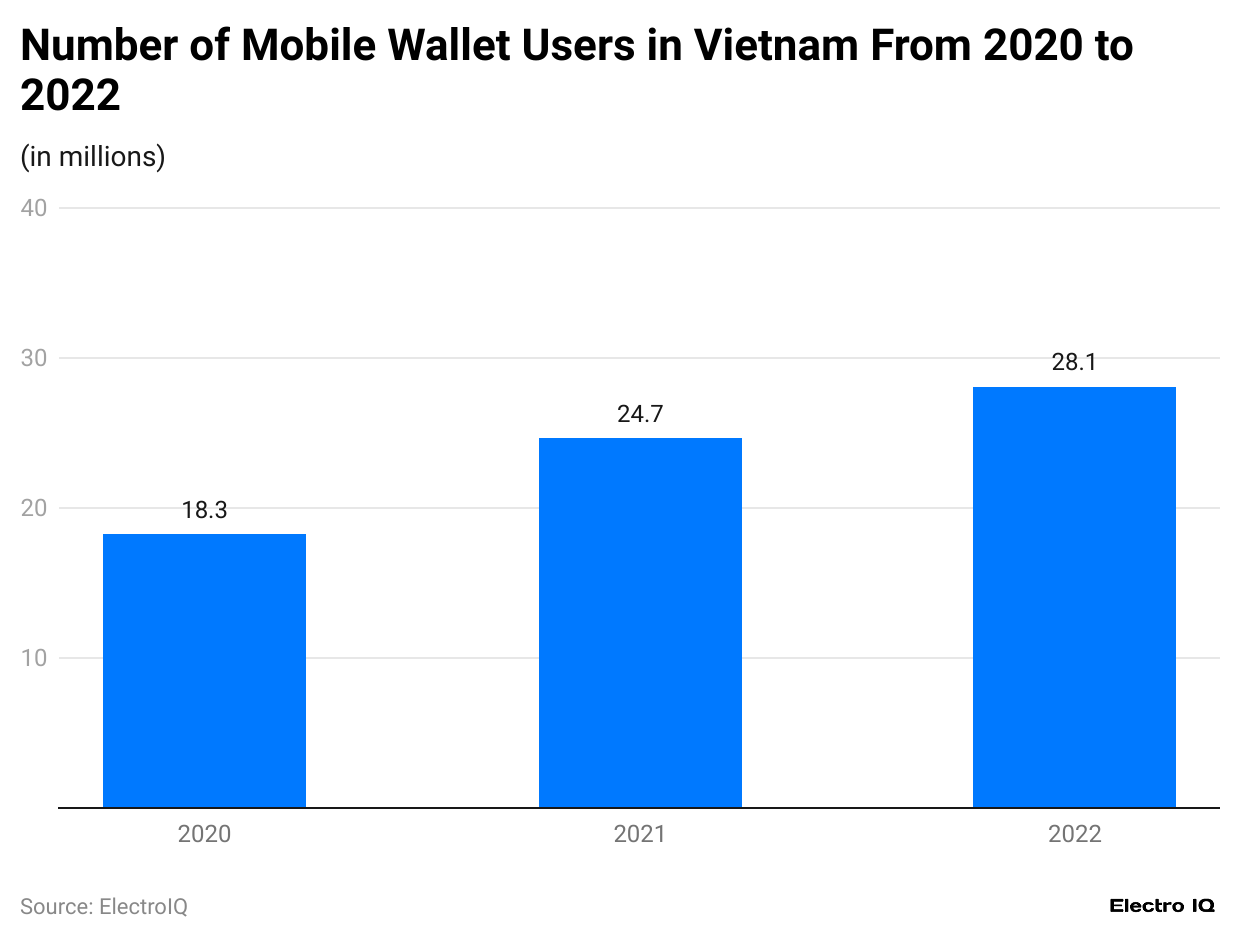

Mobile Wallet Usage in Vietnam

(Reference: statista.com)

- Alipay Statistics show that mobile wallet usage in Vietnam has increased consistently.

- In 2020, mobile wallet usage was 18.3 million, increasing to 28.1 million by the end of 2022.

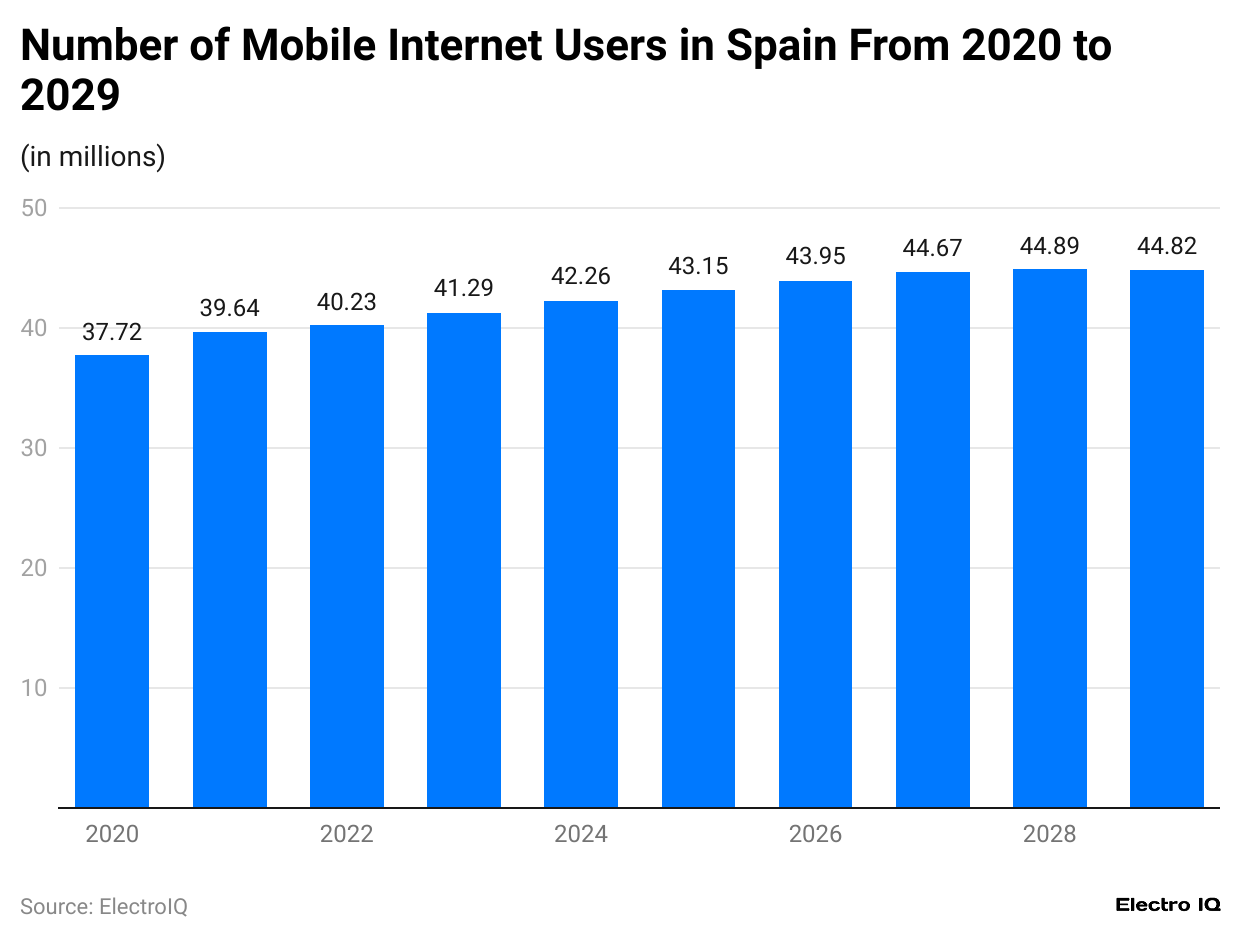

Mobile Users in Spain

(Reference: statista.com)

- Alipay Statistics show that the number of mobile users in Spain has increased consistently.

- In 2020, the number of mobile users in Spain was 37.72 million, which increased to 41.29 million by the end of 2023.

- It is estimated that by the end of 2029, the number of mobile users in Spain was 44.82 million users.

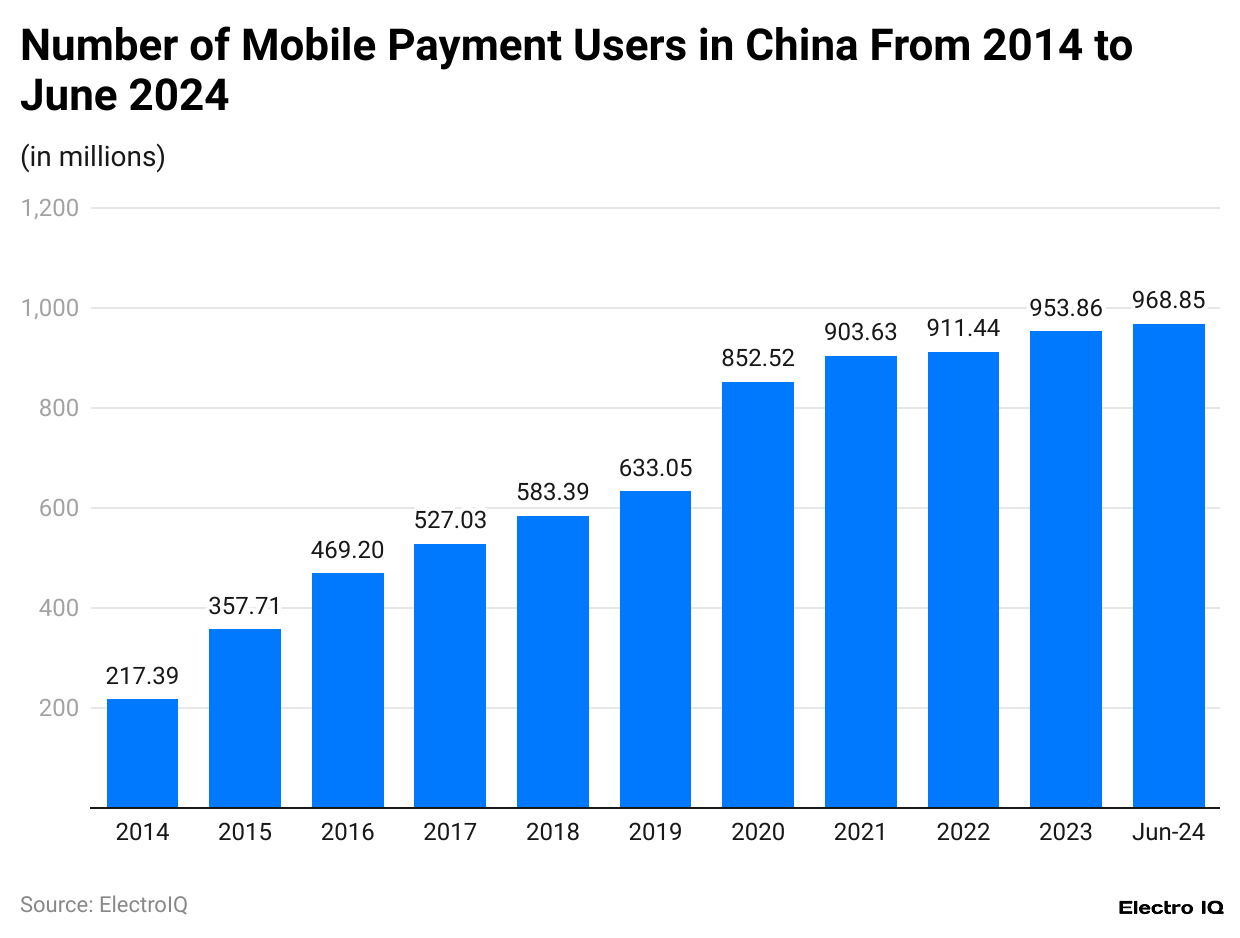

Mobile Payment Users in China

(Reference: statista.com)

- Alipay Statistics show that the number of mobile payment users in China has increased consistently.

- In 2014, the number of mobile payment users was 217.39 million, which increased to 968.85 million by the end of June 2024.

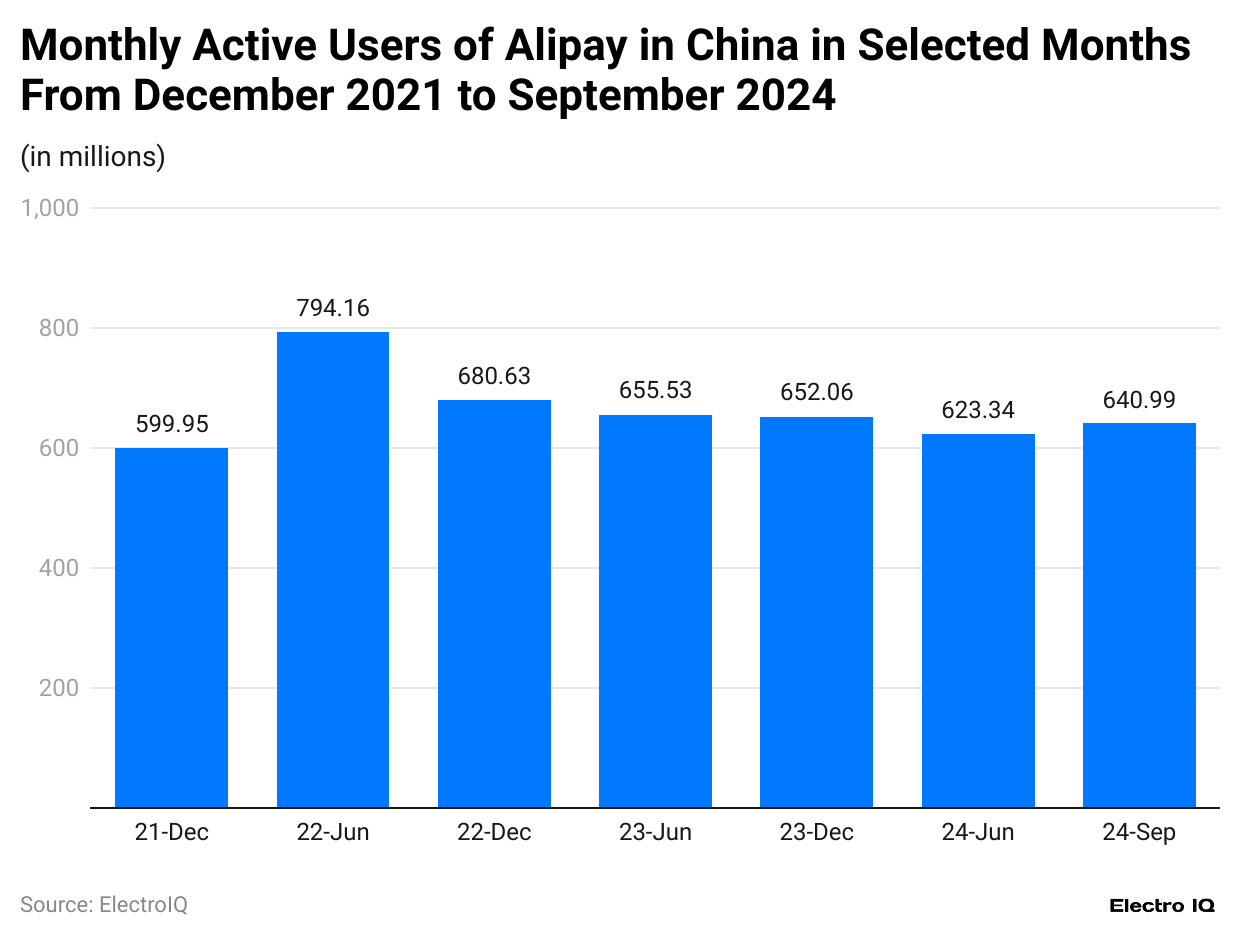

Active User of Alipay in China

(Reference: statista.com)

- Alipay Statistics show that the number of monthly active users has been decreasing consistently over time.

- In June 2022, the monthly active Alipay users were 794.16 million, which decreased to 659.53 million by the end of Feb 2024.

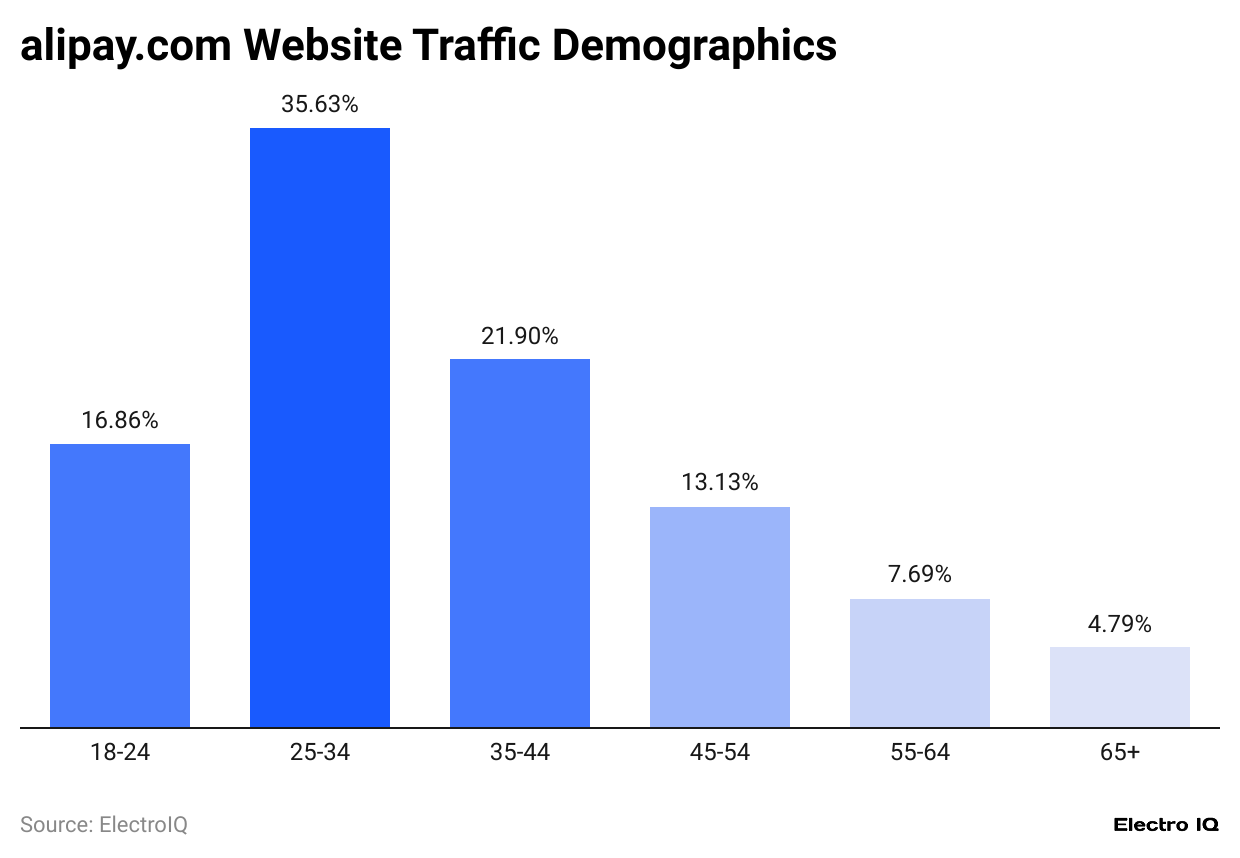

Alipay Audience Demographics

(Reference: similarweb.com)

- Alipay Statistics show that among the different age groups, Alipay users have the highest percentage in the age group 25 – 34, with 35.63% of the audience.

- It is followed by 18-24 with 16/86% and 45-54 with 21.90%.

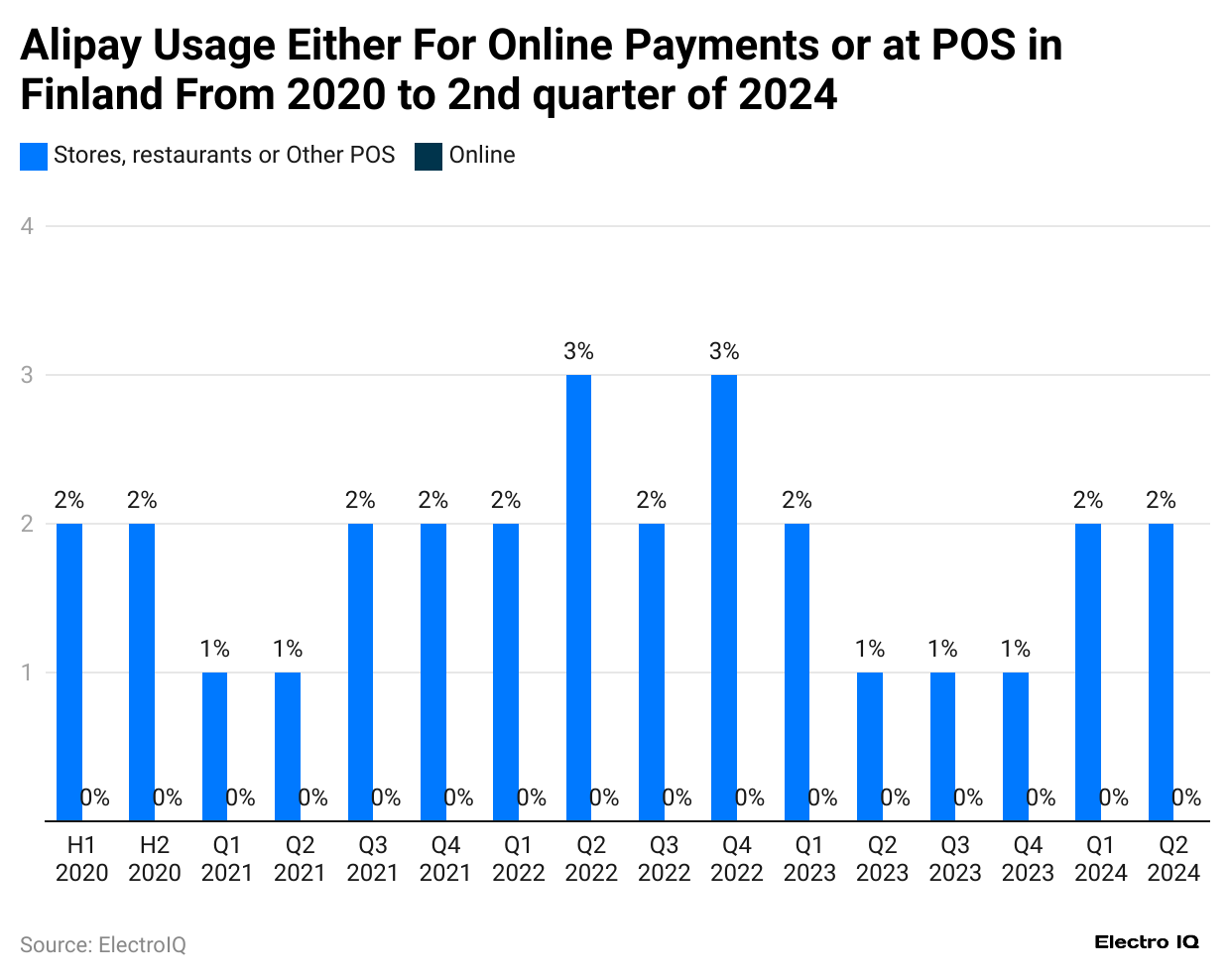

Alipay Penetration in Finland

(Reference: statista.com)

- Alipay Statistics show that the quarterly usage of Alipay for online payments in Finland has fluctuated over time.

- In H1 2020, the usage in stores was 2%, while the usage was also 2% in Q2 2024.

- Between H1 2020 and Q2 2024, the highest usage was recorded in Q2 2022 and Q4 2022, with 3% usage.

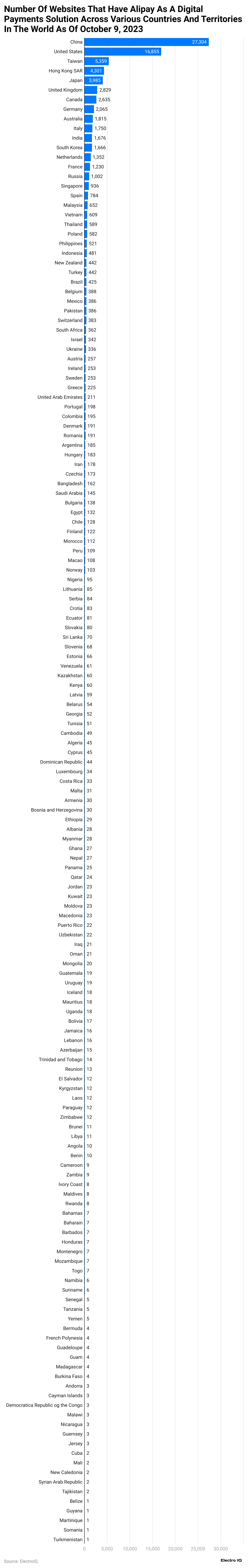

Alipay Usage in Different Countries

(Reference: statista.com)

- Alipay Statistics show that China is easily the leading country with the most Alipay-supporting payment solutions, with 27,304.

- It is followed by the United States with 16,855, Taiwan with 5,359, and Hong Kong with 4,301.

Alipay Overview

Alipay, one of China’s leading digital payment platforms, has become a significant part of the global fintech landscape. Established by Ant Group, Alipay is more than just a payment gateway. It offers users a comprehensive digital financial service, from peer-to-peer payments to insurance, loans, and wealth management. The rapid expansion of Alipay aligns with the growing shift toward cashless payments worldwide. In 2023 and 2024, Alipay’s market position strengthened further, showing considerable growth in user adoption, transaction volume, and revenue. In this report, we examine the Alipay Statistics from the perspective of market trends and provide data-driven insights.

#1. Alipay’s User Growth and Transaction Volume

Alipay experienced strong growth in its user base and transaction volume in both 2023 and 2024. By the end of 2023, Alipay recorded over 1.3 billion active users, making it one of the largest digital payment platforms globally. This number represented a 10% increase from the previous year, showing Alipay’s success in penetrating new markets. This trend continued in 2024, with Alipay adding around 130 million new users. As a result, Alipay’s total user base reached approximately 1.43 billion by mid-2024.

Transaction volume also increased significantly during this period. In 2023, Alipay processed transactions totaling around $18 trillion US dollars, a growth of 12% over 2022. This upward trend persisted into 2024, with estimates suggesting a 10% increase in transaction volume, reaching around $19.8 trillion US dollars by the end of the year. This growth reflects the rising acceptance of digital wallets among consumers and Alipay’s expanding influence in global markets.

#2. Revenue and Profit Margins in 2023 and 2024

The revenue generated by Alipay has been equally impressive. In 2023, Alipay’s total revenue reached approximately $22 billion US dollars, a 15% increase over 2022 figures. Alipay’s revenue model primarily involves transaction fees, commissions on services, and income from additional financial products offered on its platform, including insurance, wealth management, and loans. Alipay Statistics from 2024 indicate that the company continued on this growth trajectory, with revenue projected to rise to nearly $25 billion US dollars by year-end. This revenue growth is largely driven by a higher volume of transactions, increased user adoption, and the company’s ability to cross-sell financial products to its extensive user base.

Regarding profit margins, Alipay operates on a high-volume, low-margin model, allowing it to maintain competitive fees while generating substantial income. Alipay’s profit margin was estimated to be around 18% in 2023, producing a net profit of nearly $4 billion US dollars. Market researchers expect a slight increase in this margin in 2024 due to economies of scale and improved operational efficiencies. By the end of 2024, Alipay’s profit margin is anticipated to hover around 19%, with projected net profits reaching $4.75 billion US dollars.

#3. Expansion and Partnerships in 2024

Alipay’s expansion into international markets has been a strategic focus, aiming to capture the rising demand for cashless transactions worldwide. The Alipay Statistics 2024 reveals that Alipay has solidified its position in Southeast Asia, Europe, and North America through partnerships and collaborations with local banks, fintech firms, and e-commerce platforms. For example, Alipay has partnered with local payment providers in Southeast Asia to offer users seamless cross-border payments and transfer services. Alipay has partnered with several retail giants in Europe, allowing Chinese tourists to use Alipay services while traveling.

Alipay’s entry into newer markets and partnerships has added an estimated 5% to its overall transaction volume growth in 2024. This strategic expansion boosts Alipay’s revenue and enables it to stay competitive with other digital payment giants, such as PayPal and Apple Pay, in the global arena.

#4. Impact of Regulatory Changes on Alipay Statistics

The regulatory environment in China and globally has posed challenges and opportunities for Alipay. In 2023, stricter regulatory policies imposed by the Chinese government required Alipay to separate its financial operations from its digital payments business, impacting its short-term revenue growth. Despite this, Alipay adapted quickly by restructuring its operations and focusing more on user acquisition and product innovation.

In 2024, Alipay continued to adjust to regulatory pressures by investing in compliance and transparency. Alipay Statistics show that the company allocated approximately US$ 2 billion towards regulatory compliance and financial security measures, representing 8% of its total operating budget. This focus on compliance helped maintain trust among users and regulators, ultimately supporting Alipay’s long-term sustainability and growth.

#5. Innovation and Product Development in 2024

Innovation remains central to Alipay’s business strategy. In 2023, Alipay introduced new financial products, including investment options and micro-loans, to cater to diverse user needs. These products contributed to a 20% increase in the company’s financial services revenue in 2023. In 2024, Alipay focused on enhancing its user experience by leveraging artificial intelligence and blockchain technologies. For example, Alipay introduced an AI-driven fraud detection system that reduced fraudulent transactions by 15%, protecting both users and the platform’s integrity.

Furthermore, Alipay launched a blockchain-based cross-border payment system in early 2024, allowing users to make instant international transfers with minimal fees. According to recent Alipay Statistics, this new service attracted over 10 million users in the first six months of its launch, generating an estimated $1 billion US dollars in transaction value. These innovative products respond to increasing user expectations and competition in the digital payments industry.

#6. Competitive Analysis and Future Outlook

Alipay competes with global players like PayPal, Apple Pay, and WeChat Pay, particularly in Southeast Asia, where digital payment adoption is rising. While WeChat Pay is Alipay’s closest competitor in China, Alipay maintains a larger user base and higher transaction volume, especially in rural and international markets. Alipay Statistics from 2024 suggest that its continuous product development, strategic partnerships, and focus on user experience provide a competitive edge, positioning it strongly for future growth.

Market forecasts for Alipay are optimistic. By 2025, Alipay is projected to reach a user base of nearly 1.6 billion, with transaction volumes anticipated to grow by an average of 8-10% annually. Additionally, Alipay is expected to expand further into Latin American and African markets, where cashless transactions are still in the early adoption stage. Such expansions are anticipated to contribute an additional $2-3 billion US dollars in revenue by 2025, reinforcing Alipay’s global presence.

Alipay Statistics from 2023 and 2024 reflect a robust trajectory of growth driven by innovation, user adoption, and market expansion. Alipay’s strategic focus on compliance, user experience, and partnerships has solidified its position as a dominant player in global digital payments. As Alipay continues to scale its operations and introduce innovative financial products, it is well-positioned to capitalize on the growing demand for cashless transactions worldwide. Alipay’s commitment to regulatory adaptation and technological advancement is expected to sustain its competitive edge and ensure its success in both local and international markets.

Conclusion

Alipay’s growth story demonstrates its robust position in the global digital payments landscape, which is marked by significant achievements and strategic adaptations. Alipay Statistics show that despite facing regulatory challenges and experiencing some fluctuation in monthly active users, the platform has maintained strong growth in transaction volumes and revenue generation.

Alipay’s comprehensive financial services ecosystem and strategic focus on emerging markets position it favorably for sustained success. The platform’s ability to balance innovation with regulatory compliance while maintaining profitability demonstrates its resilience and adaptability in the dynamic fintech landscape.

Sources

FAQ.

Alipay is a comprehensive digital payment platform offering payment services, insurance, loans, and wealth management.

Alipay has approximately 659.53 million monthly active users as of February 2024.

Alipay generates revenue through transaction fees, service commissions, and income from financial products.

The 25-34 age group, representing 35.63% of Alipay’s user base, is the most active on the platform.

Alipay spends approximately USD 2 billion on regulatory compliance, representing 8% of its operating budget.

Alipay processed around USD 18 trillion in transactions in 2023, reflecting a 12% growth over 2022.

With a 90.8% adoption rate, India has the highest mobile wallet usage globally.

By the end of 2024, Alipay’s profit margin is approximately 19%.

Alipay has expanded through partnerships with local banks, fintech firms, and e-commerce platforms worldwide.

In 2024, Alipay introduced a blockchain-based cross-border payment system and AI-driven fraud detection technology

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.