Amazon Prime Video Statistics And Facts (2025)

Updated · Mar 13, 2025

Table of Contents

- Introduction

- Editor’s Choice

- Key Facts

- Amazon Prime Video Viewers

- Amazon Prime Video Market Share

- Amazon Prime Video Estimated Subscribers

- Amazon Revenue

- US Video Streaming App Market Share

- Amazon Prime Video Brand Profile In The United States

- Amazon Prime Video Demographic

- Amazon Prime Video Referrals

- Amazon Prime Video Website Traffic By Country

- Amazon Prime Video Subscription Revenue

- Conclusion

Introduction

Amazon Prime Video Statistics: Global entertainment preferences have now shifted toward legacies that allow more immediate access to the movie or TV show of choice. Professionals, such as theatrical constructors, marketers, and consultants, are speeding up their service and energising their work, two trends that had languished during the years of insistent restriction.

Amazon Prime ranks next to Netflix in the ranking of the world’s most widely used streaming sites. With the two services featuring similar characteristics, Prime Video shines above the rest due to reasonable pricing. This analysis yields insights on Amazon Prime Video statistics, its most important features, and comparisons with other SVOD.

Editor’s Choice

- According to Amazon Prime Video statistics, the largest market for Amazon Prime Video in 2024 continues to be the USA, with around 164 million watchers, whereas Netflix is ahead with 173 million watchers.

- Amazon Prime Video has a wider audience base in India, Germany, and Japan than its bush counterpart.

- In Q4 of 2024, Amazon Prime Video retained a market share of 22% in the United States SVOD market, slightly ahead of Netflix, which held a share of 21%.

- Streaming grew robustly during the COVID-19 pandemic, but its growth stalled in 2022 and 2023, with major platforms experiencing subscriber losses.

- As of 2025, Amazon Prime Video has 167.07 million subscribers, with estimates reaching 269 million by 2029.

- It had 116.86 million subscribers as of September 2020, thus ranking it the second-largest streaming service.

- For the first two quarters of 2024, Amazon Prime Video maintained its 22% market share in the U.S. video streaming application market.

- In the U.S., brand awareness of Amazon Prime Video stands at 92%, with 54% of video-on-demand users actively using it, and 48% loyal to it.

- The major Amazon Prime Video audience is aged 25-34 (32.63%), followed by 18-24 (29.16%) and 35-44 (17.24%).

- 70.87% of traffic to Amazon Prime Video comes from direct referrals, with 71.55% from YouTube as the top social media referral.

- Amazon Prime Video statistics show that it has 72.87 million users in India, 48.82 million in Brazil, 31.52 million in Mexico, and 23.85 million in Spain.

- In Spain (62.26%) and Italy (73.4%), desktop access still dominates traffic to the Prime Video website, while mobile use is higher in India and Brazil.

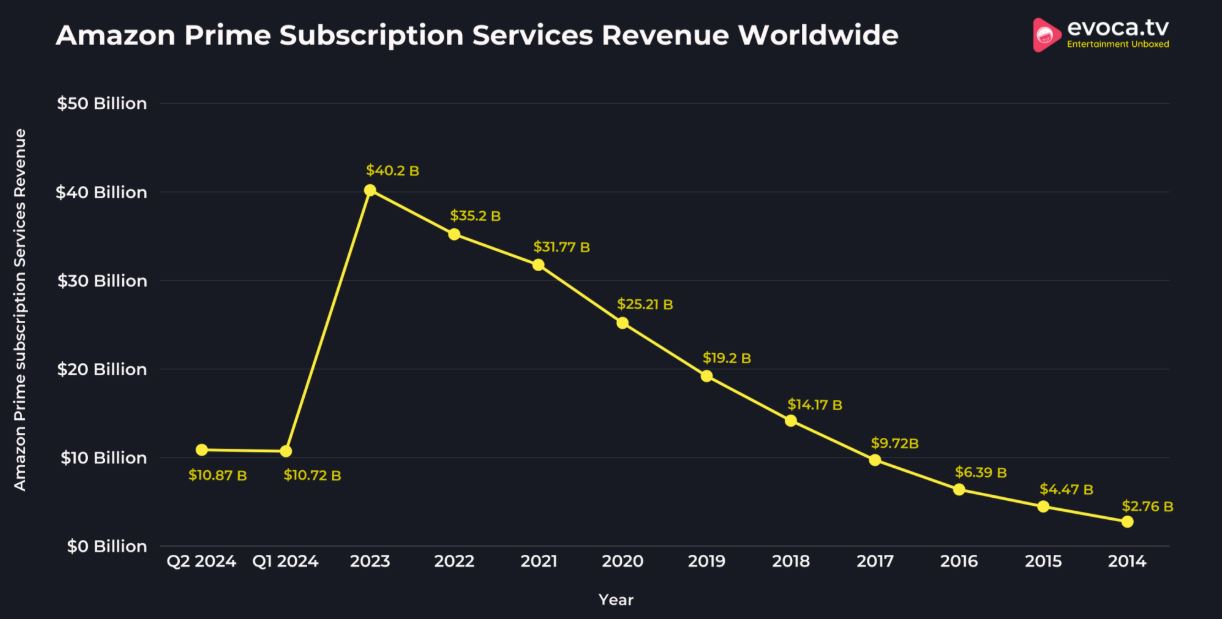

- Amazon Prime subscription services sales reached USD 10.87 billion in Q2 2024, following USD 10.72 billion in Q1.

- Revenue in 2023 was USD 40.2 billion, a 14.14% increase from 2022 (USD 35.22 billion).

Key Facts

- Because it is one of the last ad-supported platforms to join the fray, Amazon Prime Video is forecasted to be the foremost ad-supported streaming service by 2025.

- Amazon Prime Video statistics state that almost 60% of North American consumers used Amazon Prime Video in Q1 2024, giving it more weight in this region.

- For the third quarter of 2024, the platform captured 15.6% of new signups among subscription video-on-demand services, becoming the leading service in attracting new subscribers.

- Amazon has invested billions in content creation and acquisitions over recent years to compete globally with other streaming services.

- The platform has a huge content library, including blockbusters and television shows; it also produced high-budget originals like The Lord of the Rings: The Rings of Power.

- Amazon Prime Video has established itself in the sports broadcast arena and is continuously securing major media rights deals.

- For the 2024/2025 season, Amazon acquired a third of the UEFA Champions League broadcast rights in the UK and Italy.

- Live sports have started gaining traction with Prime Video viewers, with one in 10 consumers saying they are somewhat interested in watching sports programming on this platform.

- Adding Thursday Night Football has been a success. During the 2024 NFL season, the Amazon Prime Video platform averaged 13.2 million viewers, an increase of more than 10% from a year ago.

- Amazon Prime Video’s pricing strategy and broad range of content offerings continue to attract a wide audience, thereby propelling its growth and competitive positioning in the streaming industry.

Amazon Prime Video Viewers

(Reference: statista.com)

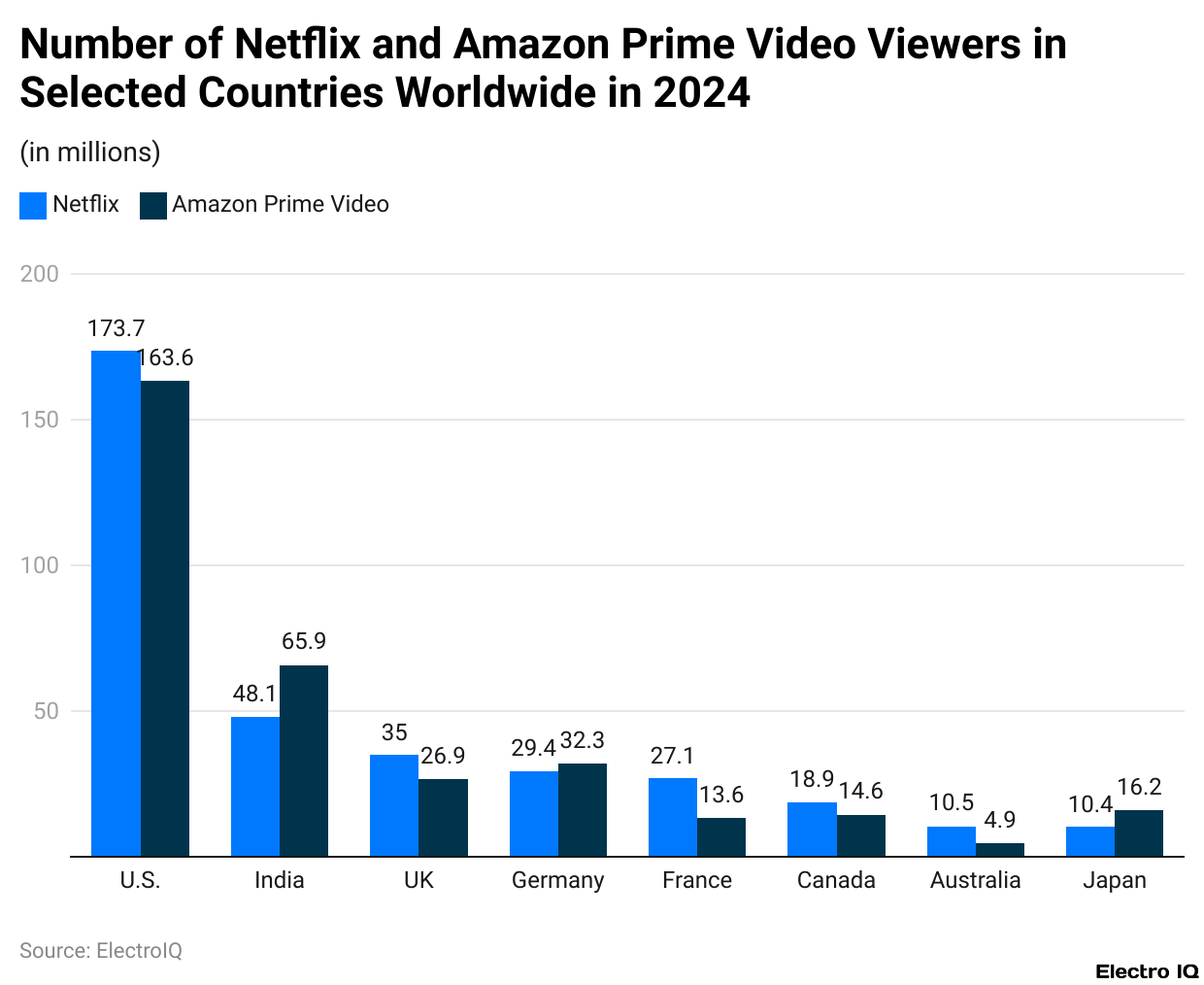

- When it comes to the viewership count, in 2024, the entire United States remains the leading territory in terms of Netflix and Amazon Prime Video subscribers.

- Over 173 million Netflix viewers and 164 million Prime Video users are expected from the country.

- While Netflix occupies a stronger standing than Amazon Prime Video in the U.S. and, of course, in the UK, France, Canada, and Australia, the case is different for other parts of the world. In countries like India, Germany, and Japan, Prime Video boasts a much larger audience through its content strategy and presence in the marketplace, which have resonated better with viewers.

- Amazon Prime Video statistics reflect how different platforms configure their offerings according to the particular tastes of their audience in the regions in which they operate.

(Reference: statista.com)

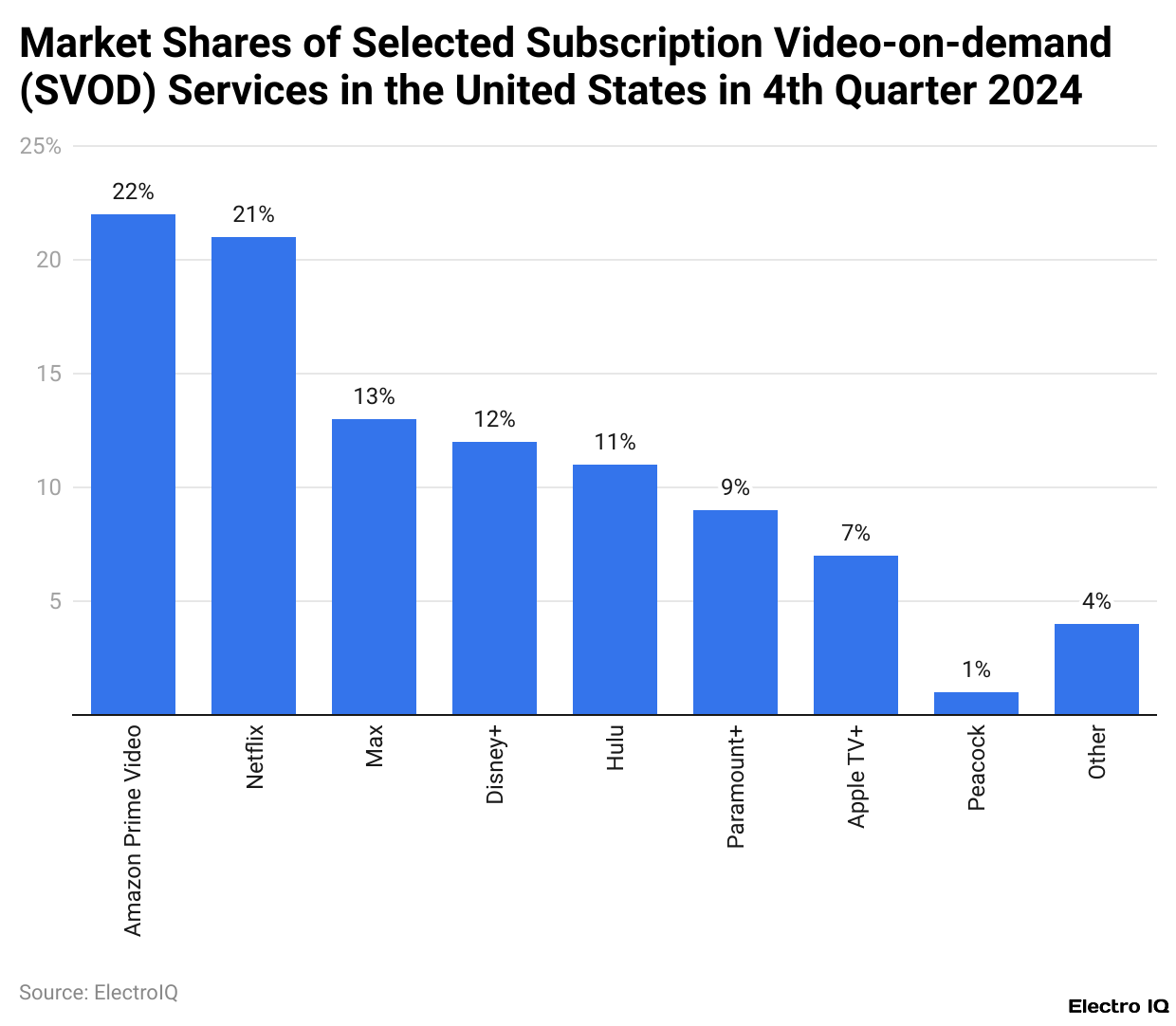

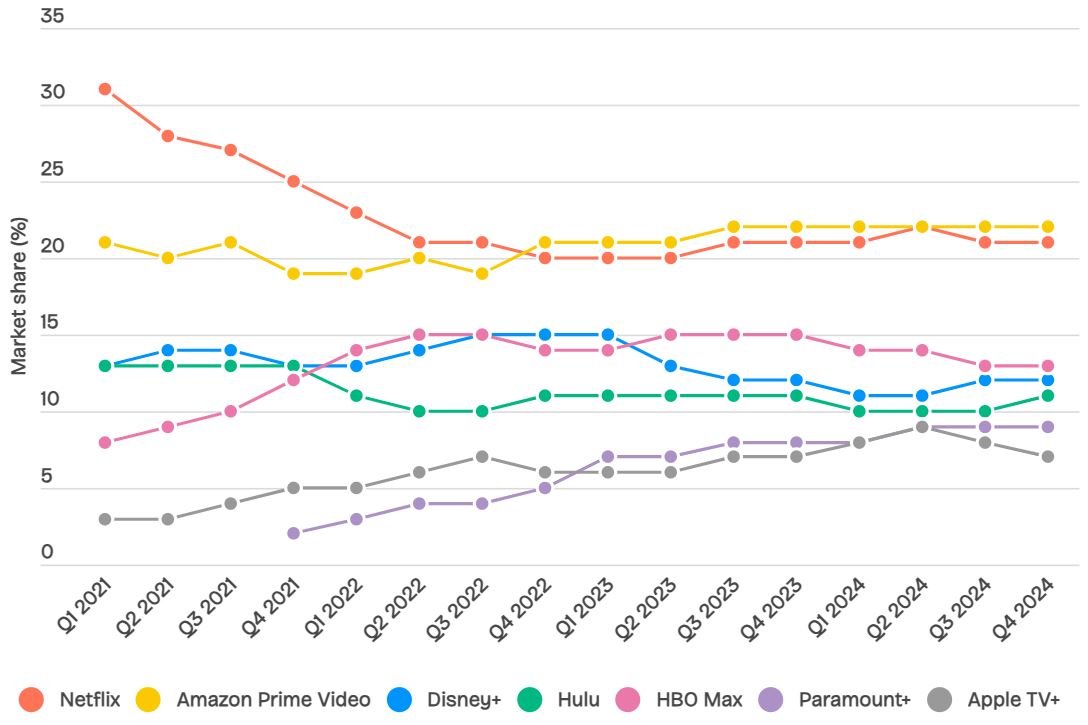

- Amazon Prime Video statistics state that, in the last quarter of 2024, according to the latest data surveys in the country, Amazon Prime Video was declared the biggest subscription video-on-demand (SVOD) service.

- This garnered 22% of the whole market coverage in the United States, while Netflix rounded out the reality by holding 21% share.

- This ranking was based on users’ interest in adding specific content to their watch lists across various streaming platforms.

- The subscription streaming market has faced major financial hurdles; as these services were added to increased subscriber growth in 2020 and 2021 due to imposed restrictions on movement during the COVID-19 pandemic, the trend was reversed in 2022 and 2023, with big losers being Netflix and Disney+.

- The major media companies that run DTC streaming services have continued to lose money, as inferred by Disney’s report in 2023 of a loss of 2.5 billion U.S. dollars for its streaming activities.

- Different measures have been adopted by streaming companies to reduce these losses.

- Most of them initiated ad-supported layers for additional revenue sources, tightened measures against credential sharing, reduced workforces, and slashed content spending.

- Of these companies, the Walt Disney Company’s special focus at present is making strides toward increasing DTC profit. The company expects profit gains by the end of 2024.

- To control costs, employee positions were reduced, less content was produced, and some TV shows and movies were removed from the streaming platforms.

Amazon Prime Video Estimated Subscribers

(Source: coolest-gadgets.com)

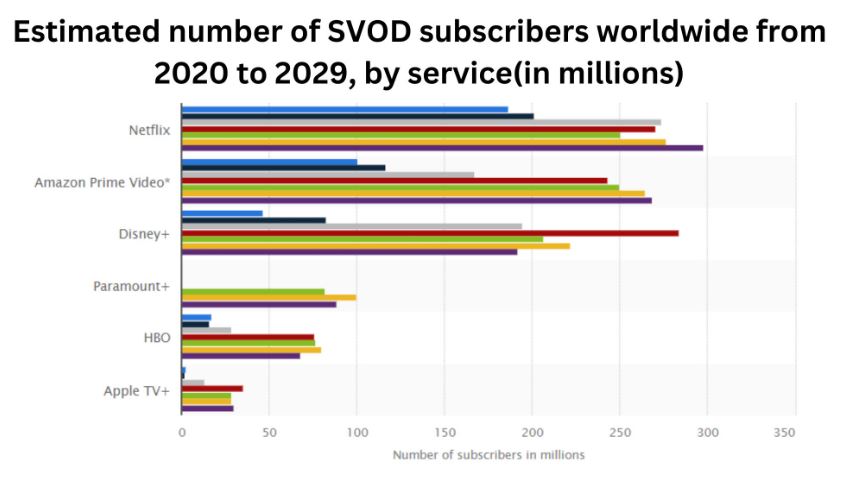

- Amazon Prime Video, the second-largest market streaming service, had 100.46 million subscribers in February 2020 and 116.86 million subscribers in September.

- Amazon Prime Video statistics expect that the estimated subscriber count will reach around 167.07 million by 2025.

- The platform’s growth is projected to continue in the following years, with the estimated number of subscribers anticipated to reach 243.4 million in 2026, 250 million in 2027, 265 million in 2028, and 269 million in 2029.

- Disney+ has grown fast, mostly because The Walt Disney Company acquired 21st Century Fox in 2018.

- This acquisition gave Disney control over Star India, which owns Hotstar, the most popular streaming platform in India. In 2020, Disney rebranded Hotstar as Disney Plus Hotstar in India and Indonesia, increasing its popularity.

- By 2026, the further transformation of the platform will extend to a significant number of other Asian countries.

- Yet, from an early boom in subscriptions, the service has seen a loss of subscribers, at least in the first two fiscal quarters of 2023, majorly due to subscriber losses from Disney+ Hotstar.

- The growth of the video-on-demand market is unbound, and over-the-top TV revenue surpassed 150 billion U.S. dollars in 2022. Subscription video-on-demand represented the biggest share of this revenue.

- Ad-supported video-on-demand, on the other hand, will witness the fastest growth; revenue is expected to more than double between 2022 and 2028.

Amazon Revenue

(Reference: demandsage.com)

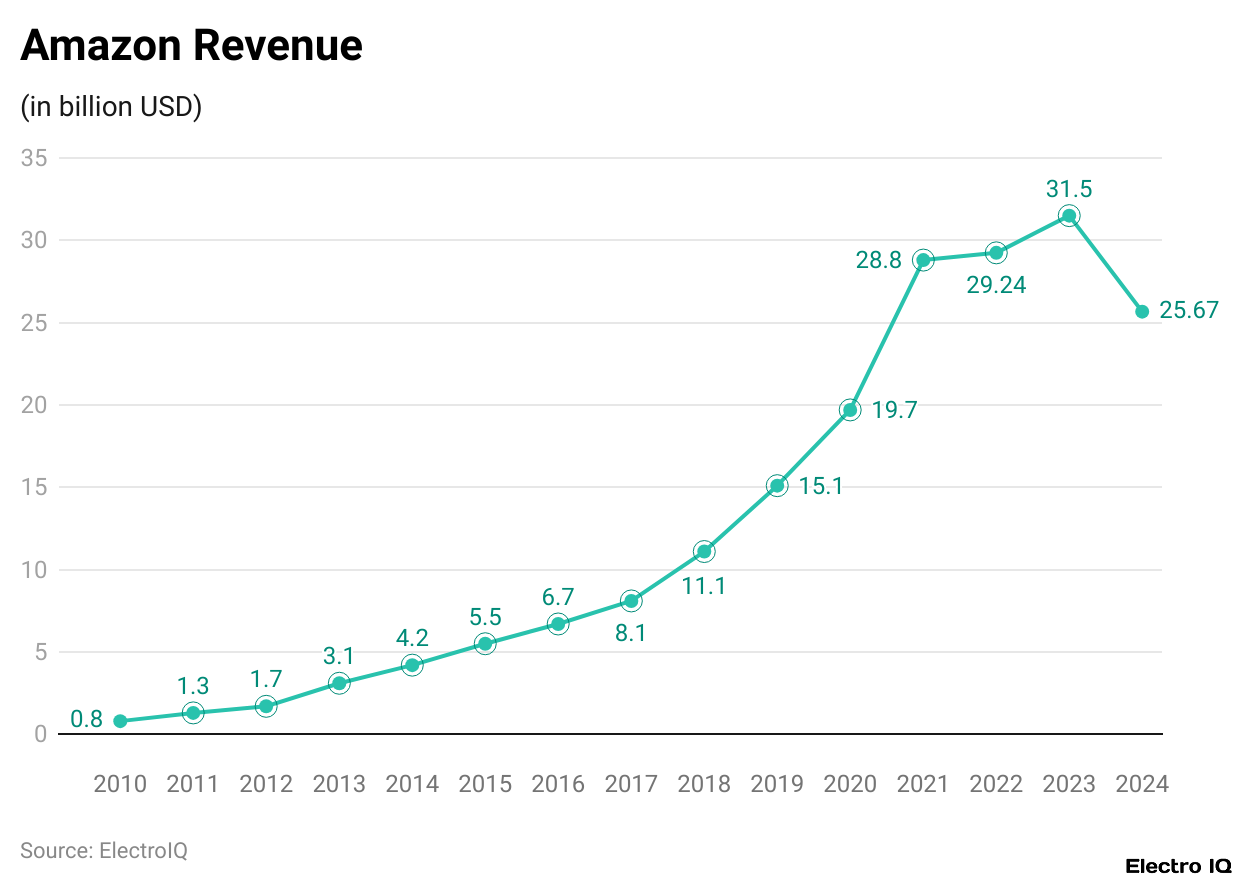

- YouTube’s advertisement revenues continue to swell at fantastic rates, putting it in direct competition with social media rivals and sealing its spot as the most dominant force in the digital market.

- Amazon Prime Video statistics show that YouTube’s ad revenue was USD 800 million in 2010, and that amount doubled to USD 1.7 billion in 2012. The revenue continued to climb, reaching USD 4.2 billion in 2014 and increasing further to USD 5.5 billion the following year.

- With the growing number of subscribers and advertisers, revenues rose further to USD 6.7 billion in 2016 and USD 8.1 billion in 2017 before crossing the USD 11 billion mark for the first time in 2018.

- This was further increased in 2019, with the platform making a total ad revenue of USD 15.1 billion. The biggest leap was in 2020, which also was propelled by the pandemic’s push of online viewing, when revenues leaped from USD 11 billion to USD 19.7 billion.

- Revenues continued on their upward trend in 2021, when ads generated USD 28.8 billion, and slightly increased to USD 29.24 billion in 2022. By 2023, YouTube achieved a staggering record ad revenue of USD 31.5 billion.

- By the end of the third quarter of 2024, the platform had already recorded USD 25.67 billion in net revenue, promising to surpass previous earnings by the end of the year.

- Thus, the continuous increase in revenues goes a long way in strengthening the growing importance of online advertising, which makes it quite a choice destination for users and advertisers within the global landscape.

(Source: businessofapps.com)

- In the first and second quarters of 2024, an approximate competitive share of 22% from Amazon Prime Video is still available.

- The previous year saw some changes when it came to market share. In 2023, it started out at 21% for both the first and second quarters before reaching 22% by the end of the third and fourth quarters.

- Amazon Prime Video statistics highlight that Amazon Prime Video streams have successfully sustained their presence in the streaming-crowned market, gradually strengthening their position among viewers.

Amazon Prime Video Brand Profile In The United States

(Reference: statista.com)

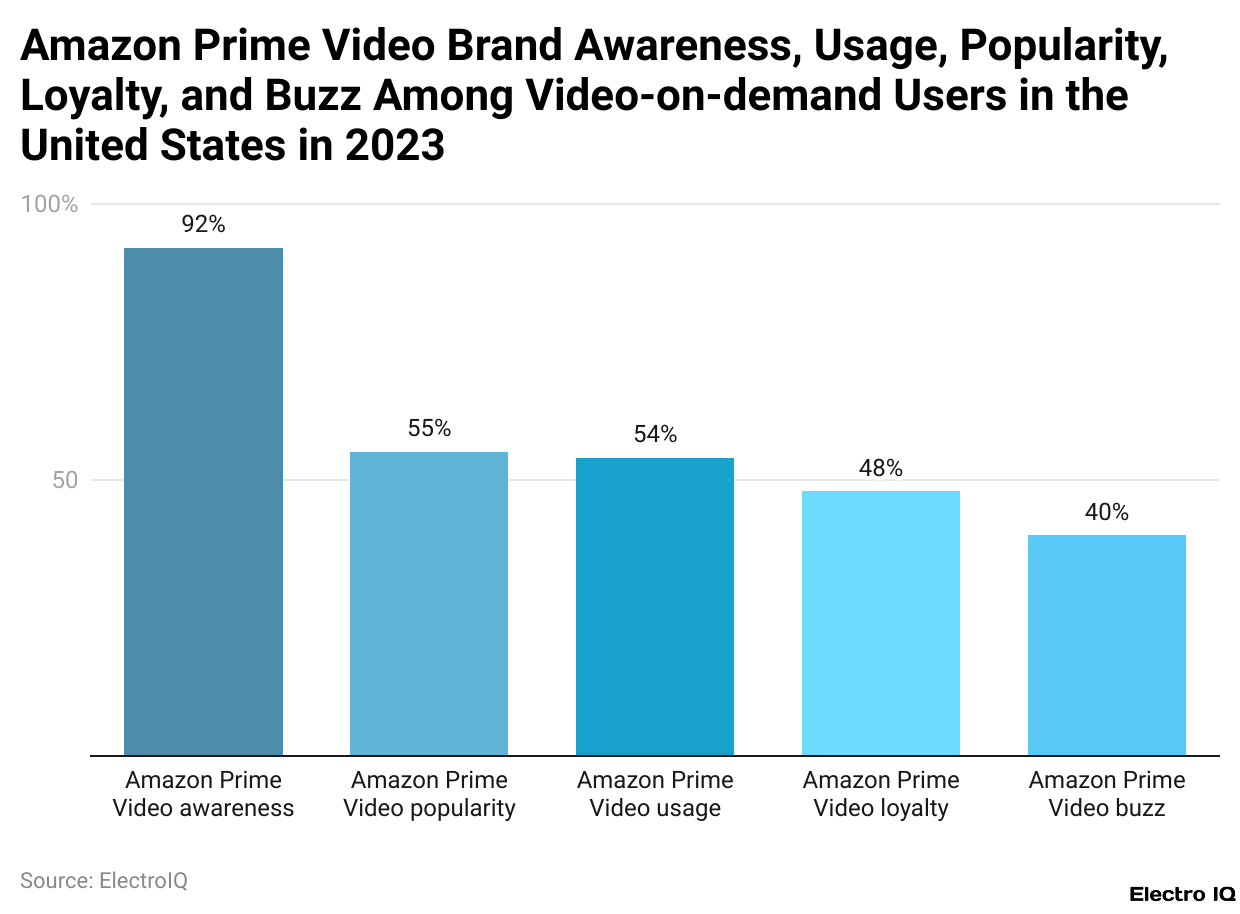

- Amazon Prime Video statistics reveal that Amazon Prime Video has about 92% brand awareness to video-on-demand users in the United States. This comes from a survey that was administered on aided brand recognition by showing the brand’s logos and names on paper to respondents.

- Popularity-wise, 55 % of video-on-demand users in the U.S. probably have a favorable impression of Amazon Prime Video. The actual usage indicates that 54% of video-on-demand users in the country are using the platform.

- Also, there is significant user loyalty, with about 48 % of users saying they will most probably continue using Amazon Prime Video in the future.

- The platform also has a strong media presence and advertising. Thus, in June 2023, about 40% of video-on-demand users in the USA mentioned they had seen or heard in the media, on social media, or through advertisements within the past four weeks. This expresses the consistency of visibility that contributes to its continuing impact on the streaming industry.

Amazon Prime Video Demographic

(Reference: enterpriseappstoday.com)

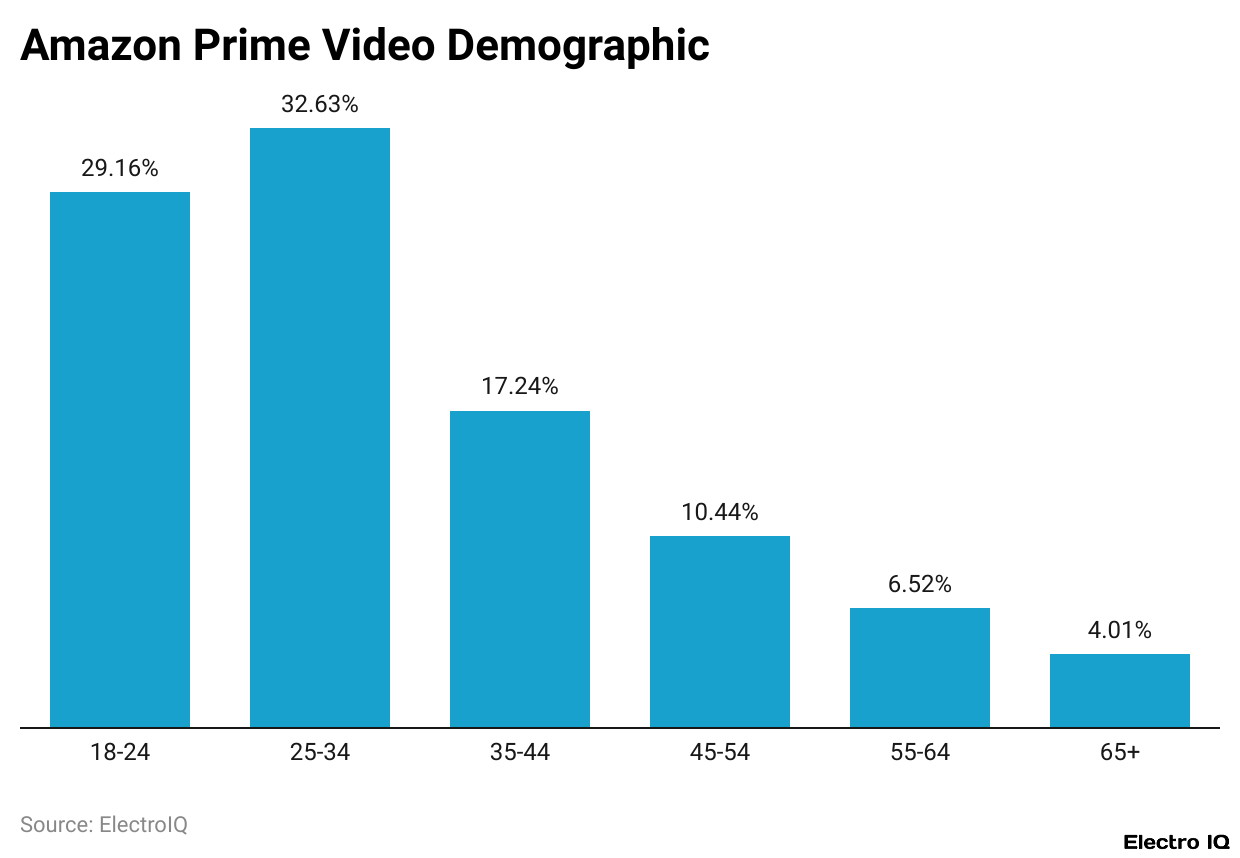

- According to Amazon Prime Video statistics, the platform’s largest customer base is made up of people between the ages of 25 and 34, who make up 32.63% of total Amazon Prime Video users. 18– to 24-year-old subscribers account for nearly 29.16% of the entire global user group, while the 35– to 44-year-old age group contributes 17.24%.

- In addition, the 45- —to 54-year-old and 55- —to 64-year-old age groups contribute around 10.44% and 6.52%, respectively.

- The smallest group of users includes baby boomers who are 65 years old and above, comprised only of 4.01% of the entire audience.

Amazon Prime Video Referrals

- Amazon Prime Video statistics indicate that about sources of referral, 70.87% of the traffic that reaches Amazon Prime Video is brought in directly.

- Referral sources include search engines, which account for 21.35%, mail, which accounts for 1.37%, and others, which account for 0.53%.

- Outside social media platforms, other marketplaces, and various external websites indicate referrals to Yahoo to Amazon Prime Video, for a total of 71.08% of referrals.

- Streaming and online TV services add another 14.81%, while non-Amazon e-commerce sites contribute 2.19% to recommendations.

- Adult sites have the remaining 1.52%. Amazon Prime Video possesses around 99.3 million backlinks.

- Regarding social media referrals, YouTube takes top marks with 71.55%, while Facebook yields 9.96% and WhatsApp 7.04%.

- This is followed by Twitter and Instagram, with referrals of 4.04% and 2.21%, respectively, while other social media networks contribute a total of 5.20%.

Amazon Prime Video Website Traffic By Country

(Reference: coolest-gadgets.com)

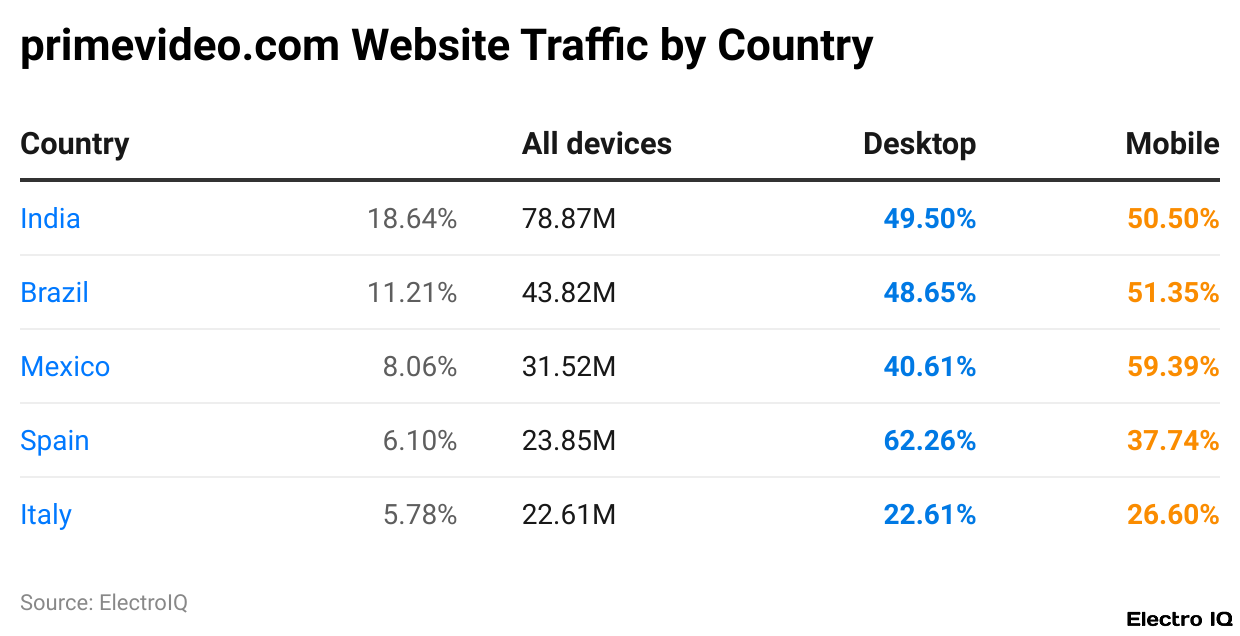

- Amazon Prime Video statistics show that traffic to Amazon Prime Video is dominated by desktop user visits. Within the total visits, desktop users have a 55.84% share, while those accessed by mobile devices create about 43.07% of the traffic.

- In India, there are around 72.87 million users of Amazon Prime Video, with about 18.64% of that total being through web visitors.

- Its access is also nearly split, with 49.5% of users using desktops and 50.5% using mobile devices. Brazil reported 48.82 million users on the platform, contributing to the website traffic throughput of 11.21%.

- Of the total users in Brazil, 48.65% accessed the service through desktop computers, while 51.35% did so via mobile devices.

- The top two ranked users were Mexico and Spain, which both measured approximately 31.52 million and 23.85 million, respectively. The respective contributions of these countries in total site traffic read 8.06% from Mexico and 6.1% from Spain.

- In Mexico, 40.61% accessed primevideo.com via mobile device,s while 59.39% accessed it using desktops.

- Meanwhile, in Spain, access was dominated desktop-wise at 62.26% as compared to 37.74% accessed via mobile.

- Italy had around 22.61 million people using the site, comprising 5.78% of the total usage. Among them, 73.4% used desktops to access the site, and 26.6% used mobile devices.

Amazon Prime Video Subscription Revenue

(Source: evoca.tv)

- Amazon Prime Video statistics state that the revenue of subscription services by Amazon Prime has grown steadily year on year. For 2024 Q2, revenues for the service stood at USD 10.87 billion, compared to USD 10.72 billion in the previous quarter.

- This earned Amazon Prime USD 40.2 billion from subscriptions in 2023-14, a rise of 14.14% from the previous year, 2022, when the amount reached USD 35.22 billion, a 10.86% increase compared to 2022.

- In 2021, revenue reached USD 31.77 billion, reflecting a 26.02% increase from the previous year’s earnings of USD 25.21 billion. The increase rate was 31.23% in 2021. This was more than the rate in 2020, during which the average earned by Amazon Prime in sales was USD 19.21 billion at a current growth rate of 35.57%.

- The revenue accrued in 2018 from the platform was USD 14.17 billion, with an increase of 45.78% from 2017, when the figure recorded was USD 9.72 billion.

- This trend was high not only in earlier years but also in 2016, where revenue figures showed the platform earned USD 6.39 billion-a-42.95% increase from that earned in 2015, when revenues were at USD 4.47 billion.

- In 2015, revenue was at its peak at 61.96% compared to 2014, where the recorded subscription revenue was USD 2.76 billion.

Conclusion

As per Amazon Prime Video statistics, the numbers for Amazon Prime Video are indeed impressive and testify to its strength in the global streaming industry. The company has a vast subscriber base, revenue board with increased growth year after year, and varying types of content; hence, it invariably offers its services per the varying needs of its viewers worldwide.

With integration into Amazon’s systems at a broader level, as well as a focus on technological advancement, it stands to gain an advantageous position in the market for growth and longevity.

FAQ.

Approximately 164 million viewers were counted by Amazon Prime Video in 2024 in the United States, holding second place in streaming in comparison to Netflix, with 173 million viewers. The platform maintains a large user base in India, Germany, and Japan, where Netflix does not remain its direct competition.

In 22% shares, Prime Video of Amazon secured a little more than Kukusandri with 21% shares. The share is steady between Q1 and Q2 of 2024.

At 116.86 million subscribers in September 2020, Amazon Prime Video had a subscriber forecast of being 167.07 million by 2025, with expectations for it to rise even higher to 269 million by 2029. It is one of the fastest-growing streaming platforms around.

The live sports content has been an important driver of Prime Video’s growth. The inclusion of Thursday Night Football during the NFL season in 2024 attracted an average of 13.2 million viewers, more than a 10% increase over the previous year. Amazon also acquired one-third of UK and Italian broadcast rights for the UEFA Champions League for the 2024-2025 season.

Revenue generation for Amazon Prime Video comes through subscriptions and a rapidly growing ad -supported tier. In the second quarter of 2024, revenue accrued from Amazon Prime subscription services was US$10.87 billion, as against US$10.72 billion in the first quarter. In 2023, total revenue reached US$40.2 billion, reflecting a 14.14% increase over 2022.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.