BHIM App Statistics By Monthly Transactions, Volume And Product Value

Updated · Nov 29, 2024

Table of Contents

Introduction

BHIM App Statistics: The BHIM (Bharat Interface for Money) app, introduced by the Government of India, revolutionized digital payments, making UPI (Unified Payments Interface) transactions seamless and efficient. For the most part, it is effective in facilitating electronic payments in a direct form, thus ensuring seamless online transactions.

As we go forward and learn about BHIM App Statistics, we can obtain a holistic view of the digital payment infrastructure that has enabled it to become a convenient solution to ensure instantaneous monetary transfer between different financial entities.

Editor’s Choice

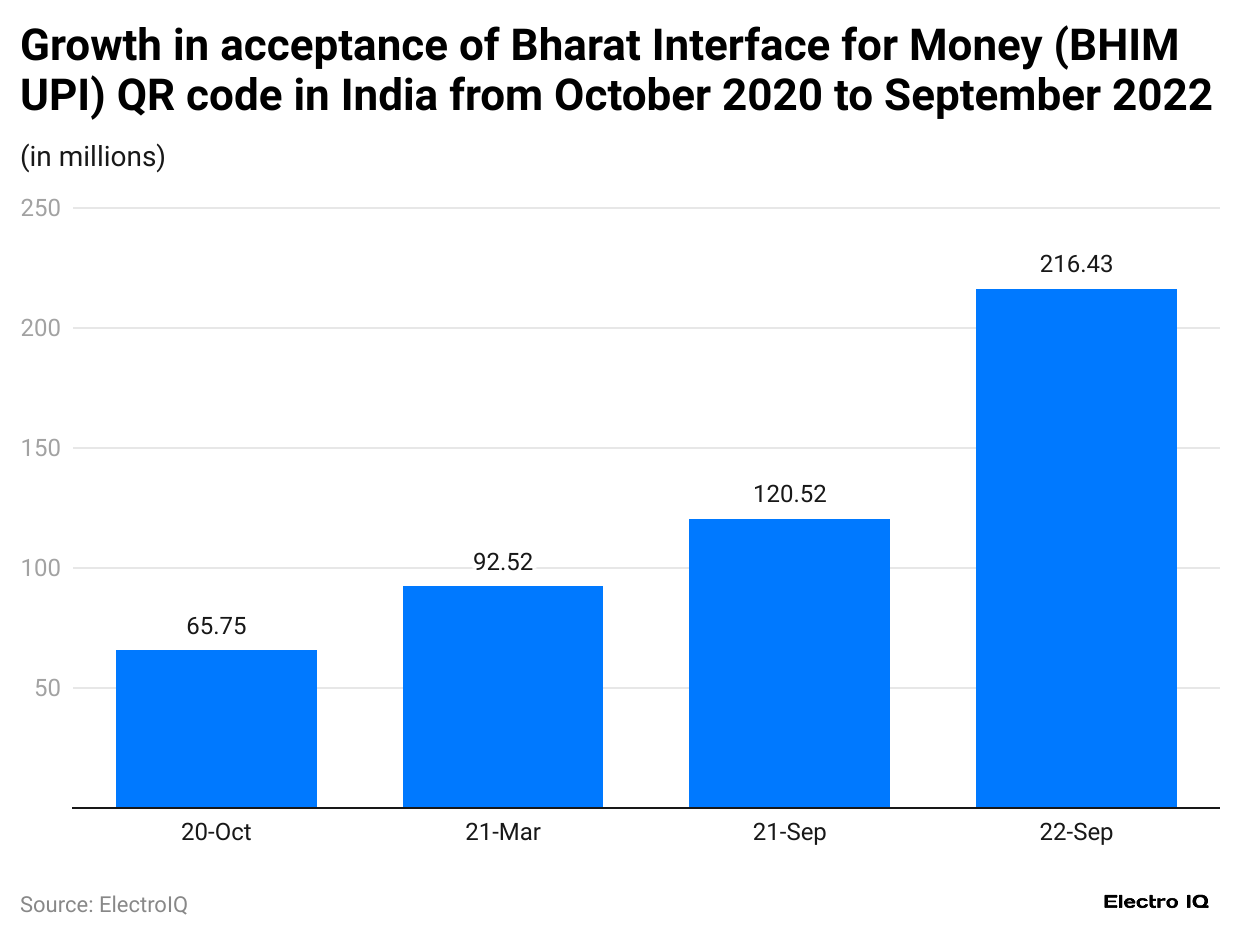

- BHIM UPI QR code usage surged from 65.75 billion in October 2020 to 216.43 billion by September 2022.

- Transactions grew from ₹0.02 billion in December 2016 to ₹72.59 billion in June 2023, peaking at ₹95.46 billion in May 2022.

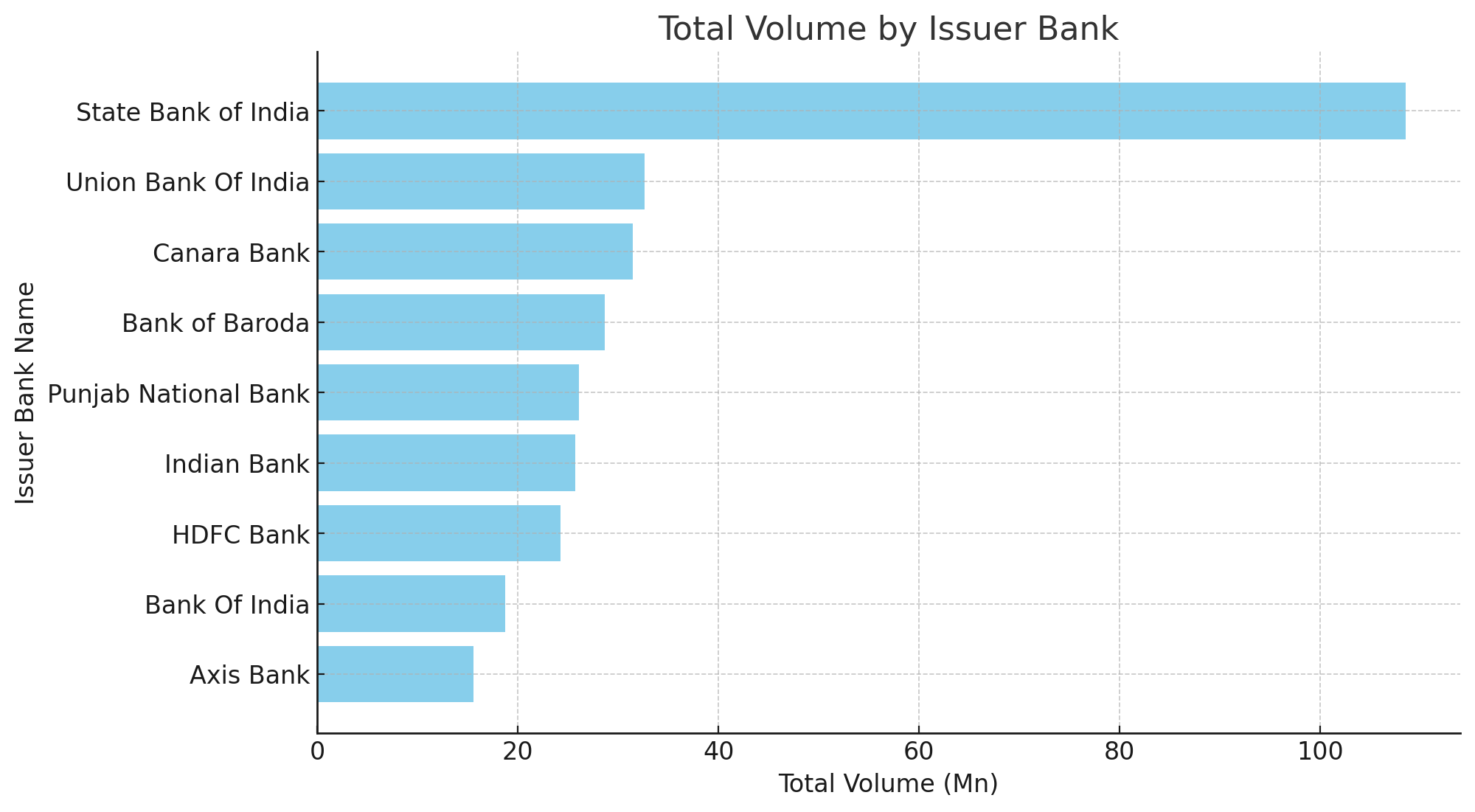

- State Bank of India led 108.54 million transactions, followed by Union Bank of India (32.65 million) and Canara Bank (31.44 million) as top banks using Bhim UPI.

- BHIM App Transaction Volume steadily rose, reaching 33.14 million transactions in October 2024.

- BHIM UPI commanded the highest market share of Payment Systems at 67.5% by financial volume.

- BHIM UPI held 0.83% of the UPI app market, with PhonePe leading at 49.07%.

- Over 100 banks, including State Bank of India, HDFC, and Axis Bank, partnered with BHIM.

- BHIM App Product value peaked at ₹9545.76 crore in May 2022 and was ₹8319.37 crore in March 2024.

- Small finance and cooperative banks like Tamilnad Mercantile Bank and Suryoday Small Finance Bank became active BHIM users.

BHIM APP Growth Acceptance

(Reference: statista.com)

- BHIM App Statistics show that the growth acceptance rate of the Bharatpe interface has been increasing consistently over time.

- In October 2020, the Bharat Pe QR had an acceptance rate of 65.75 billion.

- By the end of Sept 2022, the acceptance rate had increased to 216.43 billion.

Monthly Transactions in BHIM

(Reference: statista.com)

- BHIM App Statistics show that since December 2016, the monthly transactions in the application have increased significantly over time.

- In December 2016, the app transaction value was 0.02 billion Indian rupees.

- By the end of June 2023, the app transaction value was 72.59 billion Indian rupees.

- Between December 2016 and June 2023, the transaction value was highest in May 2022, at 95.46 billion Indian rupees.

Top UPI Supporting Banks

(Source: npci.org.in)

- BHIM App Statistics show that the State Bank of India has the highest volume of transactions per UPI app, with 108.54 million transactions.

- Union Bank of India has 32.65 transactions.

- Canara Bank has 31.44 transactions.

- Bank of Baroda has 28.66 transactions.

- Punjab National Bank has 26.07 transactions.

- Indian Bank has 25.70 transactions.

- HDFC Bank has 24.23 transactions.

- Bank of India has 18.72 transactions.

- Axis Bank has 15.60 transactions.

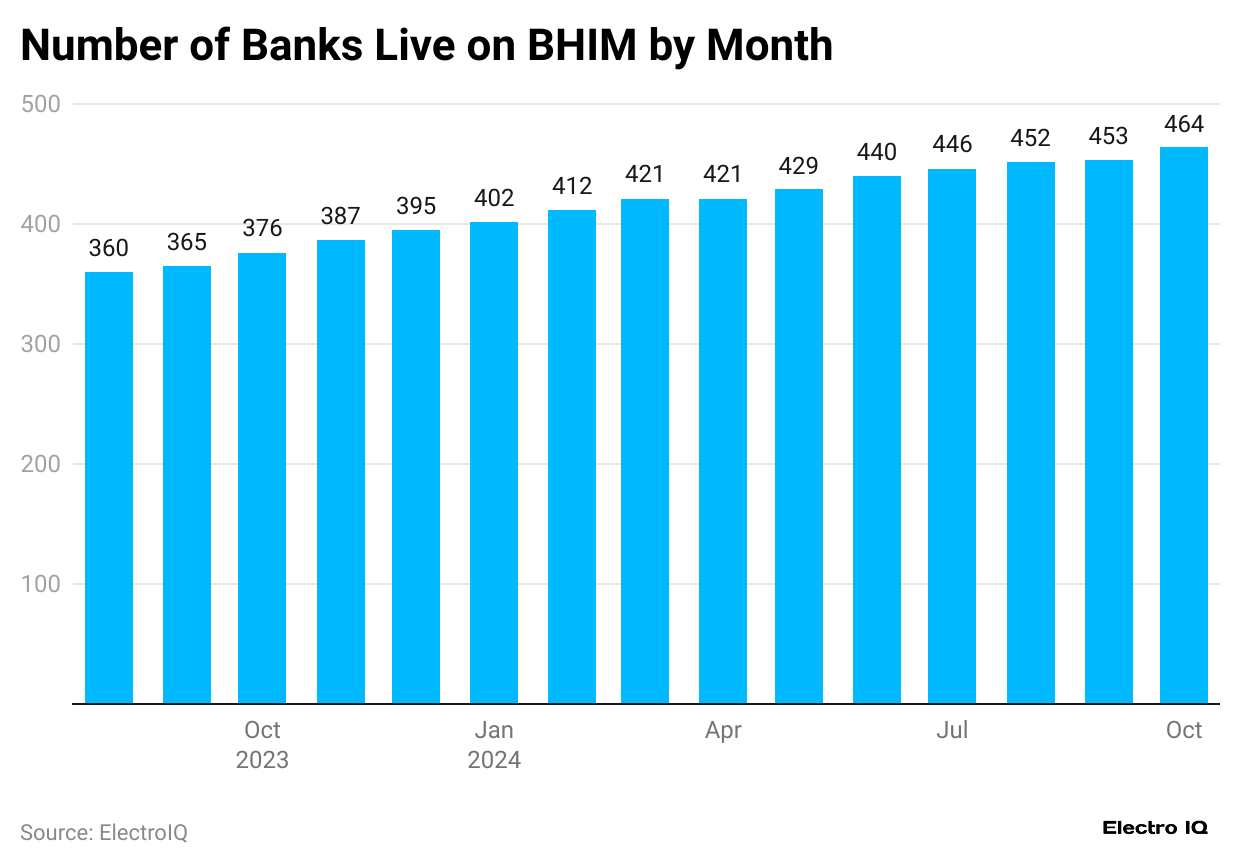

BHIM Banks Over Time

(Reference: npci.org.in)

- BHIM App Statistics show that BHIM-associated banks have increased over time.

- In August 2023, the BHIM bank associated with the app was 360

- In September 2023, BHIM Bank, associated with the app, was 365

- In October 2023, BHIM Bank, associated with the app, was 376

- In November 2023, BHIM Bank, associated with the app, was 387

- In December 2023, BHIM Bank, associated with the app, was 395

- In January 2024, BHIM Bank, associated with the app, was 402

- In February 2024, BHIM Bank, associated with the app, was 412

- In March 2024, BHIM Bank, associated with the app, was 421

- In April 2024, BHIM Bank, associated with the app, was 421.

- In May 2024, BHIM Bank, associated with the app, was 429

- In June 2024, BHIM Bank, associated with the app, was 440

- In July 2024, BHIM Bank, associated with the app, was 446

- In August 2024, BHIM Bank, associated with the app, was 452

- In September 2024, BHIM Bank, associated with the app, was 453.

- By the end of 2024, the BHIM app-associated banks were 464.

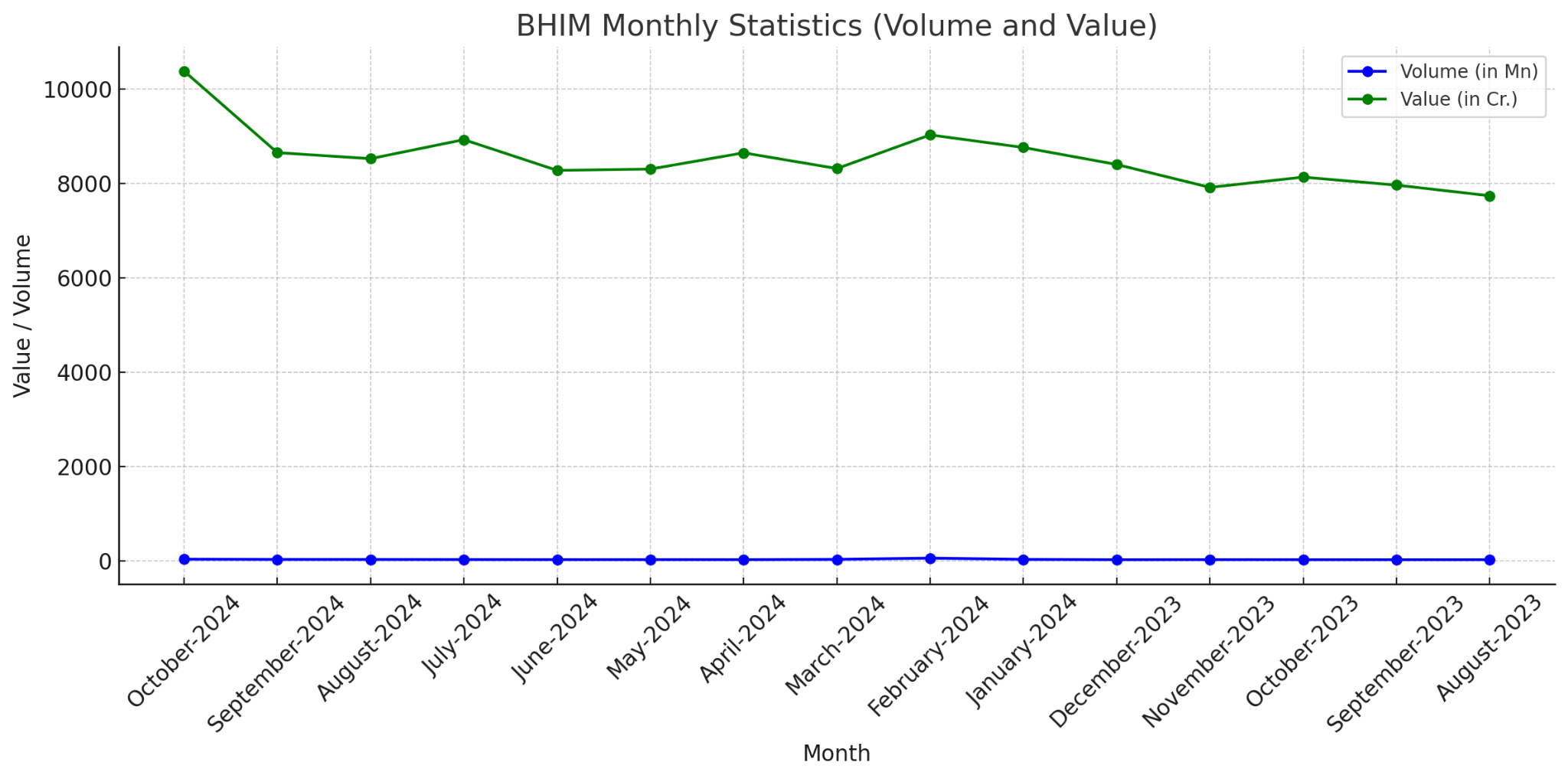

BHIM App With Volume

(Source: npci.org.in)

- BHIM App Statistics show that the number of applications has increased over time.

- In August 2023, the value of transactions was 7,742.34 crore.

- In September 2023, BHIBank's transaction volume associated with the BHIM app was 23.90 million.

- In October 2023, BHIM Ban's transaction volume associated with the BHIM app was 24.59 million.

- In November 2023, BHIBank's transaction volume associated with the BHIM app was 25.20 million.

- In December 2023, BHIM Ban's transaction volume associated with the BHIM app was 24.09 million.

- In January 2024, BHIM Banks transaction volume associated with the BHIM app was 29.79 million.

- In February 2024, BHIM Bank's transaction volume associated with the BHIM app was 55.99 million.

- In March 2024, BHIM Bank's transaction volume associated with the BHIM app was 29.87 million.

- In April 2024, BHIM Bank's transaction volume associated with the BHIM app was 25.23 million.

- In May 2024, BHIBank's transaction volume associated with the BHIM app was 25.78 million.

- In June 2024, BHIM Bank's transaction volume associated with the BHIM app was 25.52 million.

- In July 2024, BHIM Bank's transaction volume associated with the BHIM app was 26.89 million.

- In August 2024, BHIBank's transaction volume associated with the BHIM app was 28.28 million.

- In September 2024, BHIBank's transaction volume associated with the BHIM app was 29.07 million.

- In October 2024, BHIBank's transaction volume associated with the BHIM app was 33.14 million.

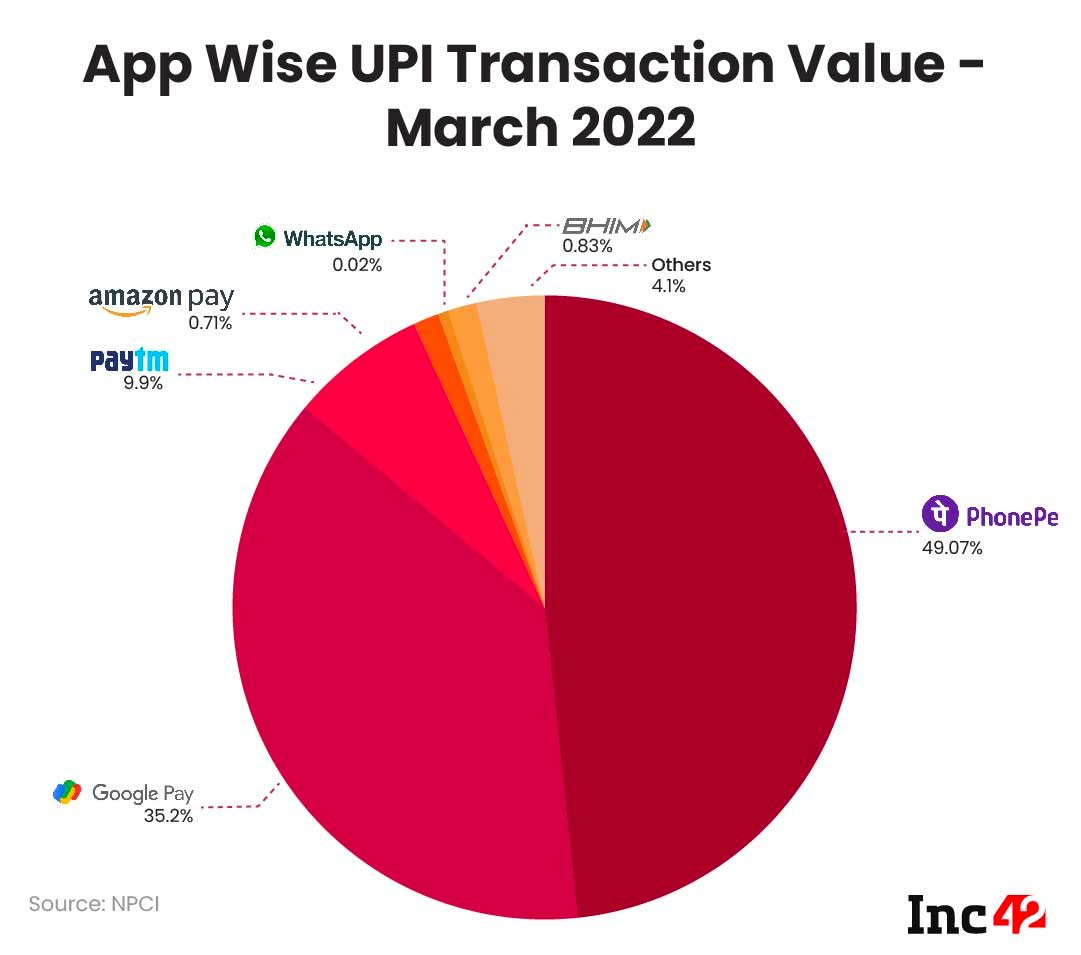

APP-Wise Transaction Value

(Source: inc42.com)

- BHIM App Statistics show that phone pay has the highest market share at 49.07%.

- BHIM UPI market share of UPI apps was 0.83%.

- Paytm's UPI market share among UPI apps was 9.9%.

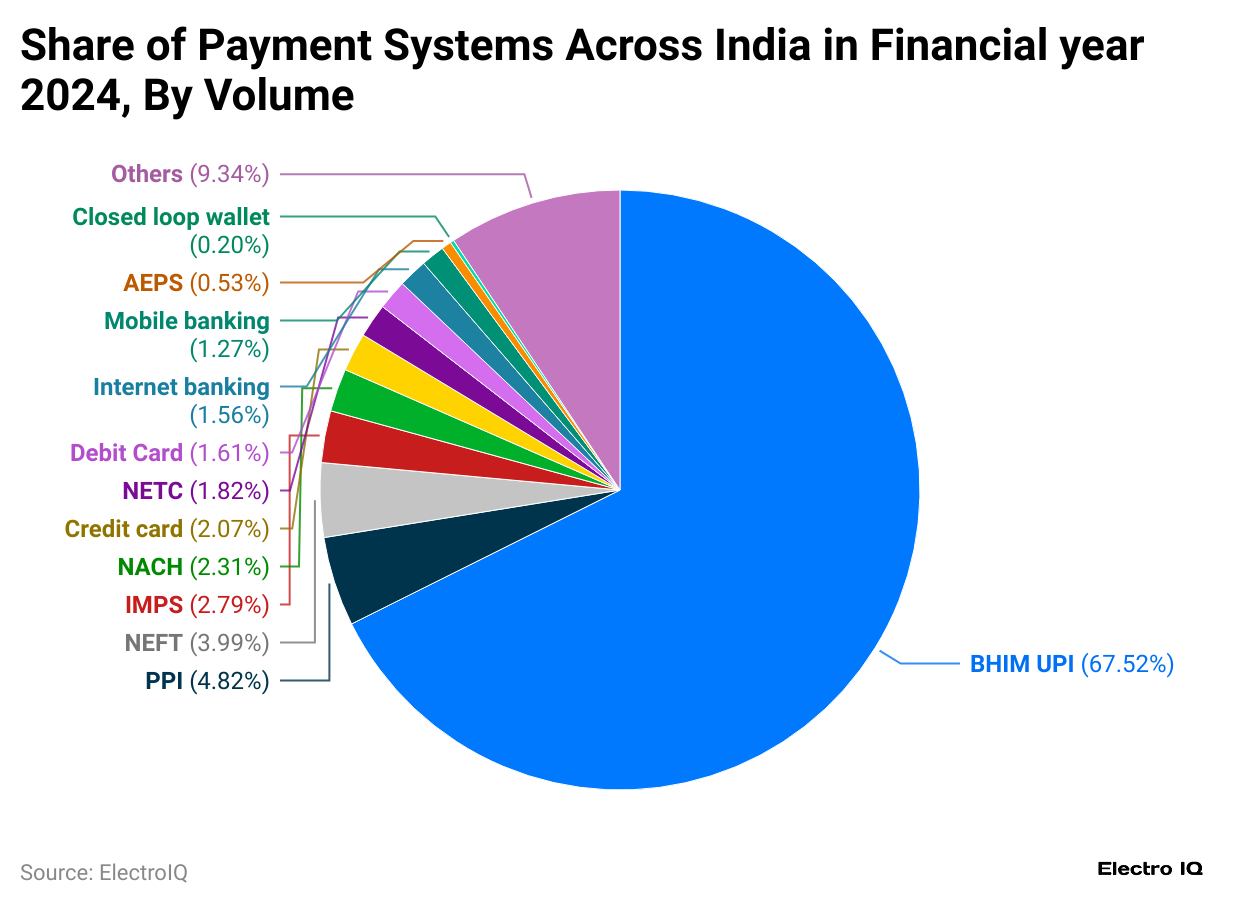

(Reference: statista.com)

- BHIM App Statistics show that BHIM UPI market share by financial volume is highest at 67.5%.

- PPI has a market share of 4.82% among financial systems in India.

- NEFT has a market share of 3.99% among financial systems in India.

- IMPS has a market share of 2.79% among financial systems in India.

- NACH has a market share of 2.81% among financial systems in India.

- Credit cards have a market share of 2.07% among financial systems in India.

- NETC has a market share of 1.82% among financial systems in India.

- Debit cards have a market share of 1.61% among financial systems in India.

- Internet banking has a market share of 1.56% among financial systems in India.

- Mobile banking has a market share of 1.27% among financial systems in India.

- AEPS has a market share of 0.53% among financial systems in India.

- The remaining major apps make up 9.34% of the market share of financial systems.

Live Banks of BHIM

- Suryoday Small Finance Bank Limited

- Tamilnad Mercantile Bank Limited

- AU Small Finance Bank

- India Post Payments Bank Limited

- Kotak Mahindra Bank

- Jana Small Finance Bank Ltd

- IDFC First Bank Ltd

- Central Bank Of India

- Kerala Gramin Bank

- The Bharat Co-Operative Bank Mumbai Ltd

- Sarva Haryana Gramin Bank

- Axis Bank

- CSB Bank Limited

- The Shamrao Vithal Cooperative Bank Ltd

- The Nainital Bank Ltd

- IndusInd Bank

- Ujjivan Small Finance Bank Limited

- The Cosmos Co-Operative Bank Ltd

- UCO Bank

- Janata Sahakari Bank

- Andhra Pragathi Grameena Bank

- The Jammu & Kashmir Bank Limited

- Aryavart Bank

- Hdfc Bank

- Saurashtra Gramin Bank-Imps

- RBL Bank Limited

- Bank Of India

- NSDL Payments Bank Limited

- Himachal Pradesh Gramin Bank

- Rajkot Nagarik Sahakari Bank Ltd

- AU Small Finance Bank (Erstwhile Fincare)

- Karnataka Bank

- ICICI Bank

- Mahanagar Co-Operative Bank

- Ahmedabad District Cooperative Bank

- Andhra Pradesh Grameena Vikas Bank - Imps

- The Surat District Cooperative Bank

- Federal Bank

- G P Parsik Sahakari Bank Ltd

- Punjab Gramin Bank

- Karnataka Vikas Grameena Bank

- Dhanalakshmi Bank

- The Kangra Central Co-Operative Bank Ltd

- Bank Of Baroda

- Punjab And Sind Bank

- Abhyudaya Co-Operative Bank

- The Himachal Pradesh State Cooperative Bank Ltd.

- Chaitanya Godavari Grameena Bank

- The Banaskantha District Central Co-Op. Bank Ltd.

- Canara Bank

- The South Indian Bank Limited

- Bank Of Maharashtra

- Tripura Gramin Bank

- Union Bank Of India

- Mehsana Urban Co-Operative Bank

- IDBI Bank

- Telangana Grameena Bank

- Karur Vysya Bank

- City Union Bank

- Airtel Payments Bank Limited

- Deutsche Bank Dba

- Yes Bank Limited Ybs

- Bangiya Gramin Vikash Bank

- Jammu And Kashmir Grameen Bank

- DCB Bank Ltd

- Bandhan Bank Limited

- DBS Bank India Limited

- Baroda Rajasthan Kshetriya Gramin Bank

- Apna Sahakari Bank Ltd

- Saraswat Co-Operative Bank

- Equitas Small Finance Bank

- TJSB Sahakari Bank Limited

- Standard Chartered Bank

- The Varachha Co-Op Bank Ltd, Surat

- State Bank Of India

- Indian Overseas Bank

- Chhattisgarh Rajya Gramin Bank

- Kalyan Janata Sahakari Bank

- The Burdwan Central Co-Op Bank Ltd

- IndusInd Bank M2p

- HSBC Bank

- Jharkhand Rajya Gramin Bank (Erstwhile Vananchal Gramin Bank)

- Baroda Gujarat Gramin Bank

- Indian Bank

- Maharashtra Gramin Bank

- Dombivli Nagarik Sahakari Bank

- Utkarsh Small Finance Bank Limited

- Bassein Catholic Co-Operative Bank Ltd

- ESAF Small Finance Bank Ltd

- Baroda U.P. Bank (Erstwhile Baroda Uttar Pradesh Gramin Bank)

- NKGSB Co-Operative Bank

- Karnataka Gramin Bank (Erstwhile Pragathi Krishna Gramin Bank)

- Uttarakhand Gramin Bank - Imps

- Punjab National Bank

- The Surat Peoples Coop Bank Ltd

- Tamil Nadu Grama Bank

- Assam Gramin Vikash Bank

- Fino Payments Bank Limited Fip

- Rajasthan Marudhara Gramin Bank

- The Kalupur Commercial Co-Op Bank Ltd

(Source: npci.org.in)

BHIM App Product Value

(Reference: 360analytika.com)

- BHIM App Statistics show that the product value of the application has been consistent over time.

- Between the period March 2017 - and March 2024, the company’s peak was reached in May 2022 with 9545.76 crore.

- As of March 2024, the app value is 8319.37 crore.

Conclusion

The BHIM app exemplifies India's digital payment revolution, delivering secure, user-friendly, and inclusive financial services.BHIM App Statistics show the company’s transaction value and volume growth due to partnerships with leading and regional banks. BHIM continues to play a pivotal role in fostering a cashless economy.

As India's reliance on digital payments grows, BHIM remains a cornerstone of financial inclusion, bridging the gap between traditional banking and modern fintech solutions. Furthermore, it is expected to remain pivotal in India’s digital transaction market.

FAQ.

The BHIM app is a UPI-based payment app that facilitates easy digital transactions.

Anyone with a smartphone, UPI-enabled bank account, and registered mobile number can use the BHIM app.

The BHIM app employs multifactor authentication and end-to-end encryption to ensure secure transactions.

BHIM APP is primarily for Indian users, but cross-border UPI initiatives may expand its scope.

1 Indian rupee lakh per transaction is the transaction limit while using the BHIM app.

Over 100 banks, including major and regional banks all over India, support the BHIM app feature.

Most transactions in the BHIM app are free, with minimal charges for specific services.

BHIM UPI has a 67.5% market share by financial volume.

While PhonePe and Google Pay dominate in volume, BHIM remains a secure government-backed alternative.

Cashback rewards and discounts for merchants and users are some of the attractive features for users of the BHIM app.

Saisuman is a skilled content writer with a passion for mobile technology, law, and science. She creates featured articles for websites and newsletters and conducts thorough research for medical professionals and researchers. Fluent in five languages, Saisuman's love for reading and languages sparked her writing career. She holds a Master's degree in Business Administration with a focus on Human Resources and has experience working in a Human Resources firm. Saisuman has also worked with a French international company. In her spare time, she enjoys traveling and singing classical songs. Now at Smartphone Thoughts, Saisuman specializes in reviewing smartphones and analyzing app statistics, making complex information easy to understand for readers.