Dropbox Statistics By Revenue, Users, Adoption, Usage and Facts

Updated · Feb 27, 2025

Table of Contents

- Introduction

- Editor’s Choice

- Dropbox Revenue

- Dropbox Recurring Revenue

- Dropbox Customers

- Dropbox Business Adoption Statistics

- Dropbox Usage By Industries

- Dropbox Use By Countries

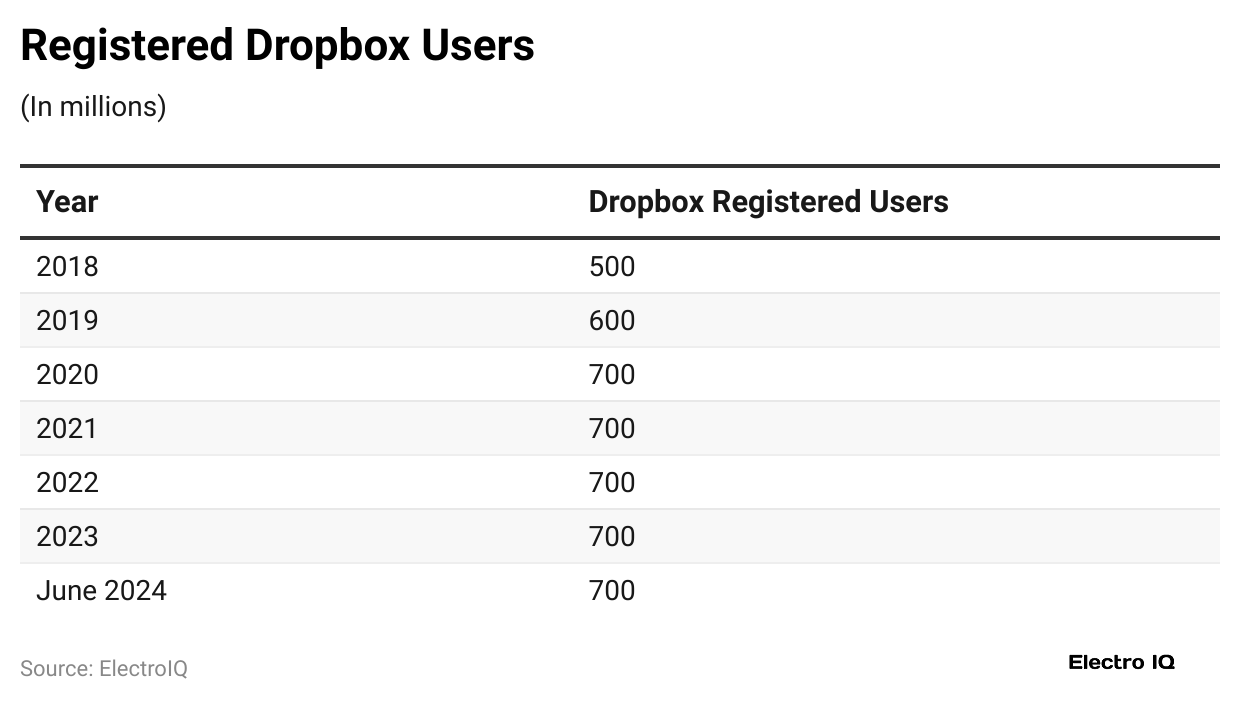

- Dropbox Registered Users

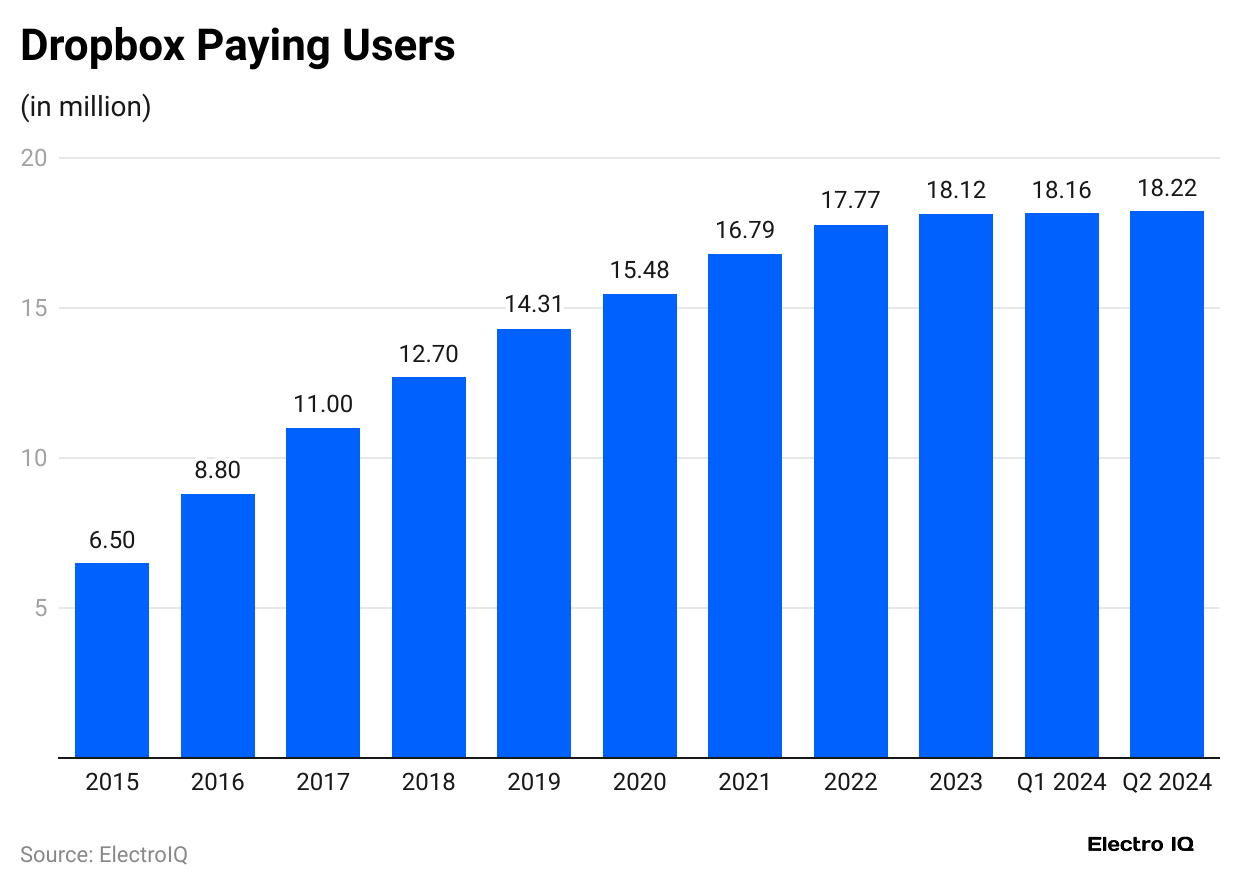

- Dropbox Paying Users

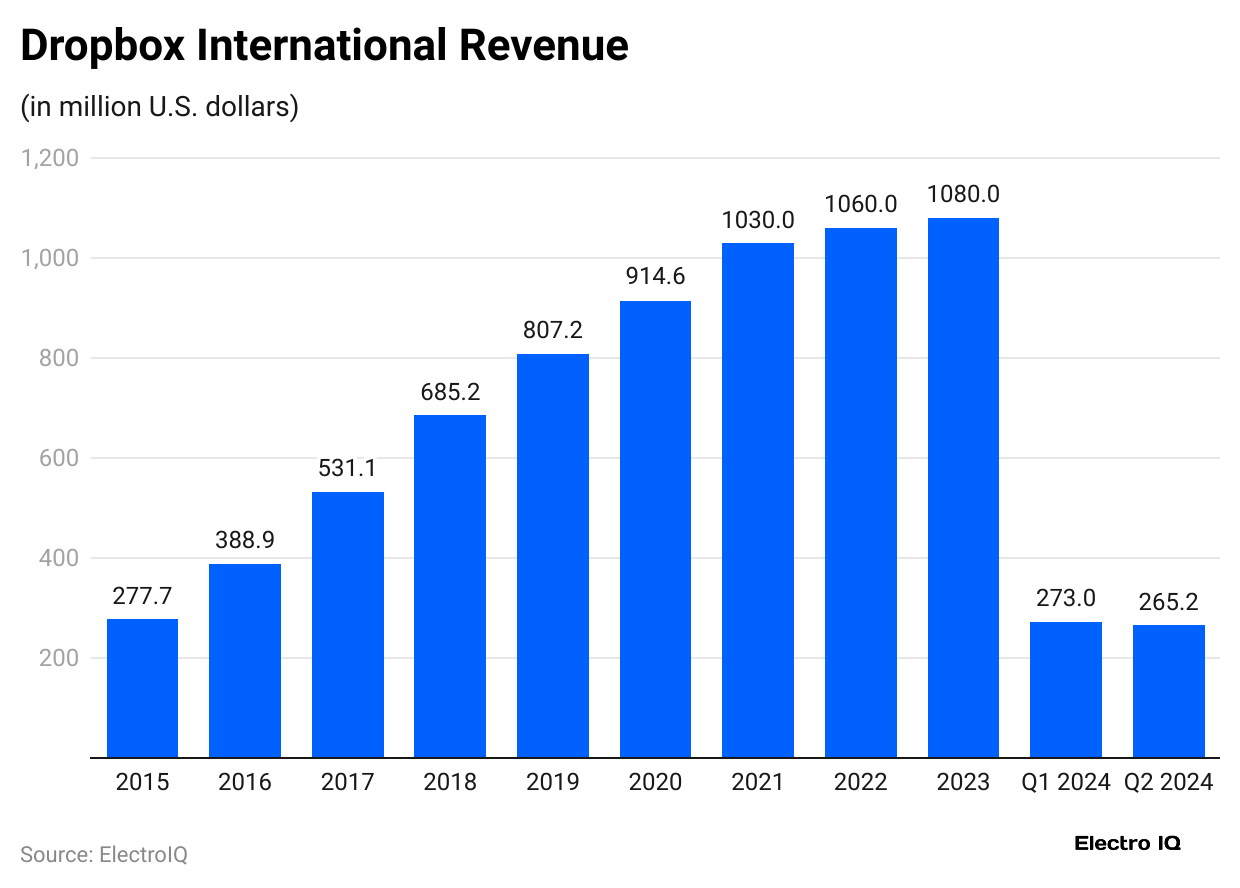

- Dropbox International Revenue

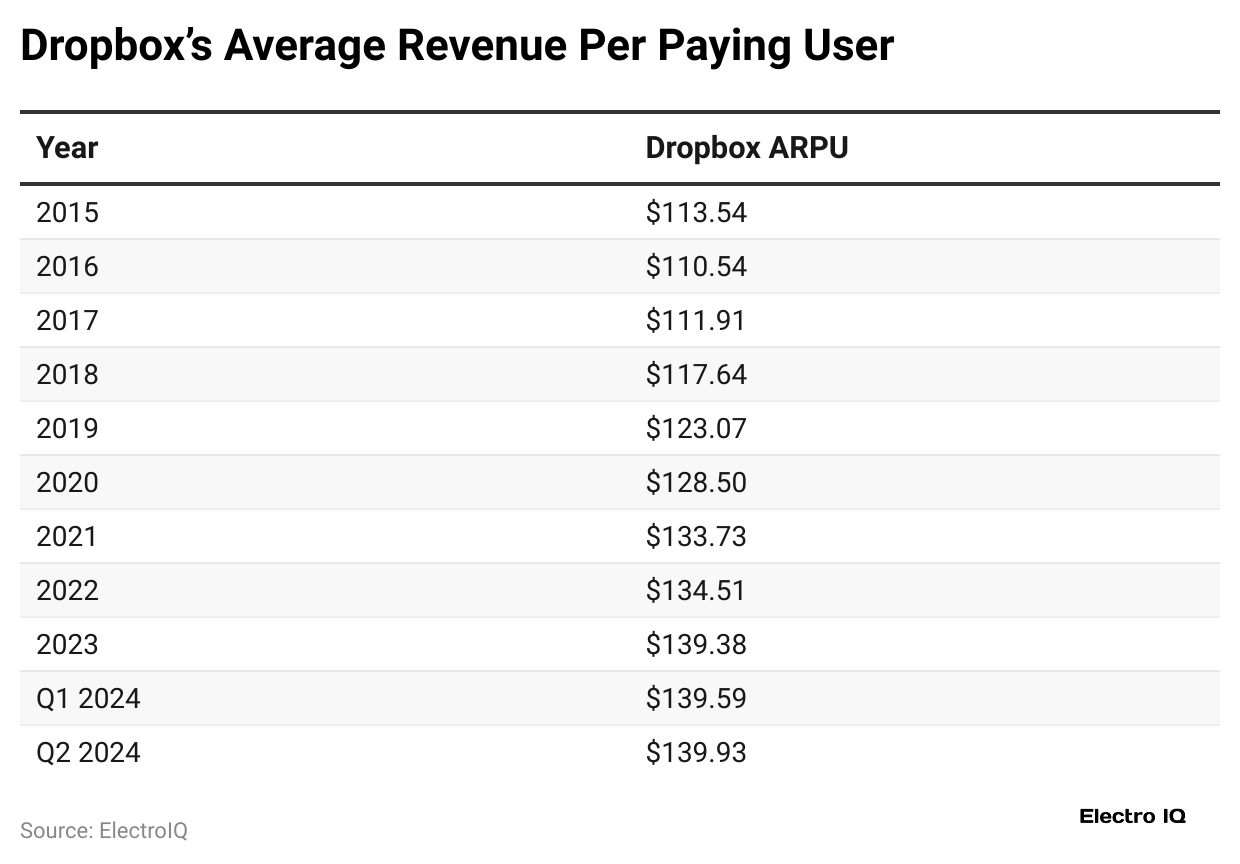

- Dropbox Average Revenue Per Paying User

- Dropbox Employees

- Dropbox Market Competitors

- Conclusion

Introduction

Dropbox Statistics: In the year 2024, Dropbox, a popular multimillion-dollar cloud-based storage and collaborative applications platform, will experience growth in revenues accompanied by minor workforce realignment and increased importance on artificial intelligence integration.

Here, one gets to detail Dropbox statistics to assess its user metrics, performance against its strategic measures, and future outlook, thus providing a comprehensive overview of the span of this organization.

Editor’s Choice

- In 2024, Dropbox garnered a USD 2.55 billion revenue collection, a USD 46.60 million growth, a modest increase of just 1.86%. Revenue growth has slowed considerably over the past years.

- Annual Recurring Revenue (ARR) was USD 2.58 billion, featuring only a 2.2% yearly slow growth. It’s an indicator of challenges in getting long-term commitments from clients.

- Dropbox statistics reveal that by the Home quarter, Dropbox had 18.24 million customers, barely an increase of 20,000 compared to the previous quarter, signifying a slowdown in customer acquisitions.

- 97% of the Fortune 500 use Dropbox services, including services of companies such as Infosys, Fujitsu, and Panasonic, as well as The North Face-it shows the adoption power in the enterprise.

- Commonly, Dropbox’s industries include Technology and Services (7%) and Computer Software (7%). Major sources of use originate from Marketing, Higher Education, Nonprofits, Construction, and Real Estate.

- Dropbox statistics state that 68% of companies that are using Dropbox are found in the United States. Others which follow are the UK (7%), Canada, Australia, France, and India.

- Registered users walked from 500 million in 2018 to 700 million by 2020, followed by a stall in 2021.

- Steadily, the number of paying users increased from 6.5 million in 2015 to 18.22 million in 2024, but the growth has been slowing in recent years.

- International revenues have steadily climbed to reach USD 1.08 billion in 2023, but the proportion it makes up of total revenues has fallen from 49.17% in 2018 down to 42.99% in 2024.

- Average Revenue per Paying User (ARPU) increased from USD 113.54 in 2015 to USD 139.93 in 2024, reflecting strong monetization.

- The top employment number was 3,118 in 2022 and was realized to have reduced to 2,693 in 2023 due to fluctuation in the employee base as necessitated by business realities.

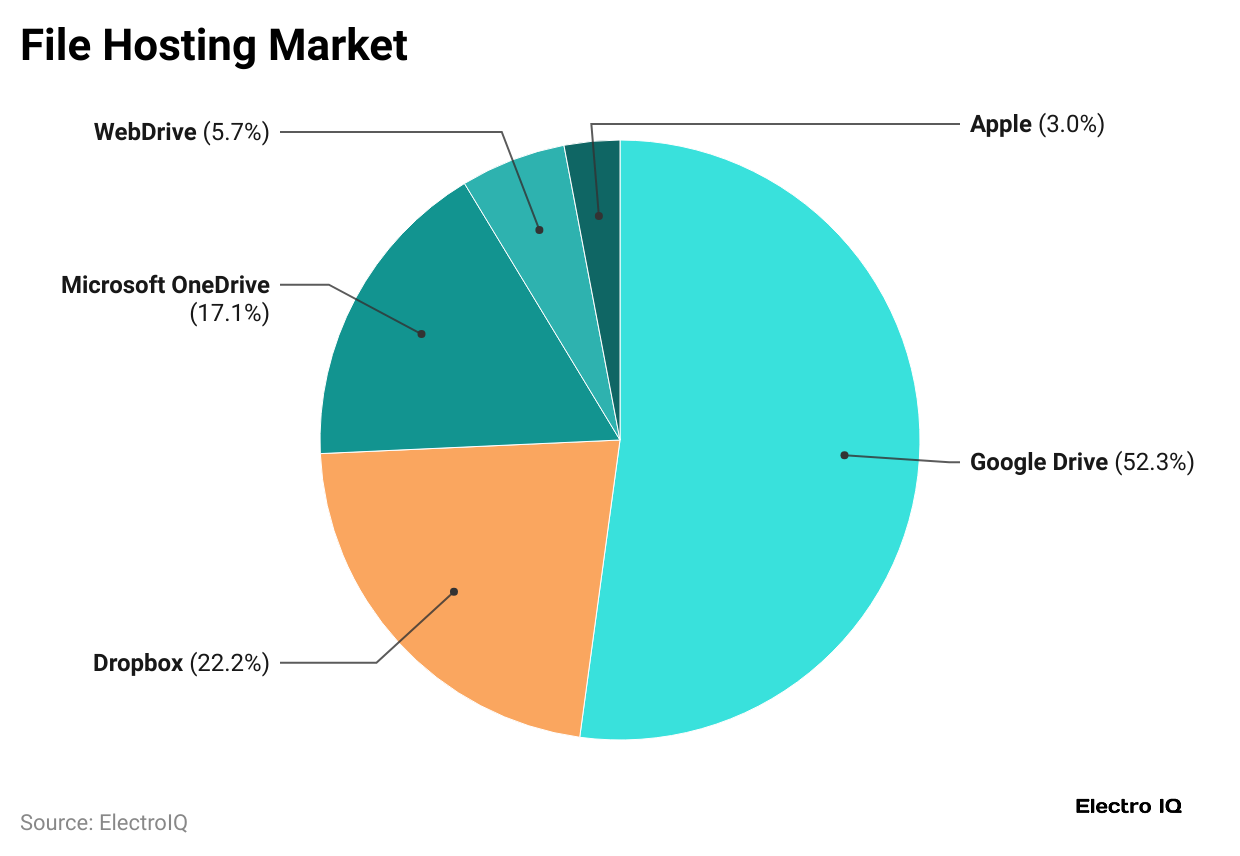

- Dropbox statistics show that Dropbox-chartered at 20.67% market share- sits below Google Drive at 48% to become the second-largest file hosting service.

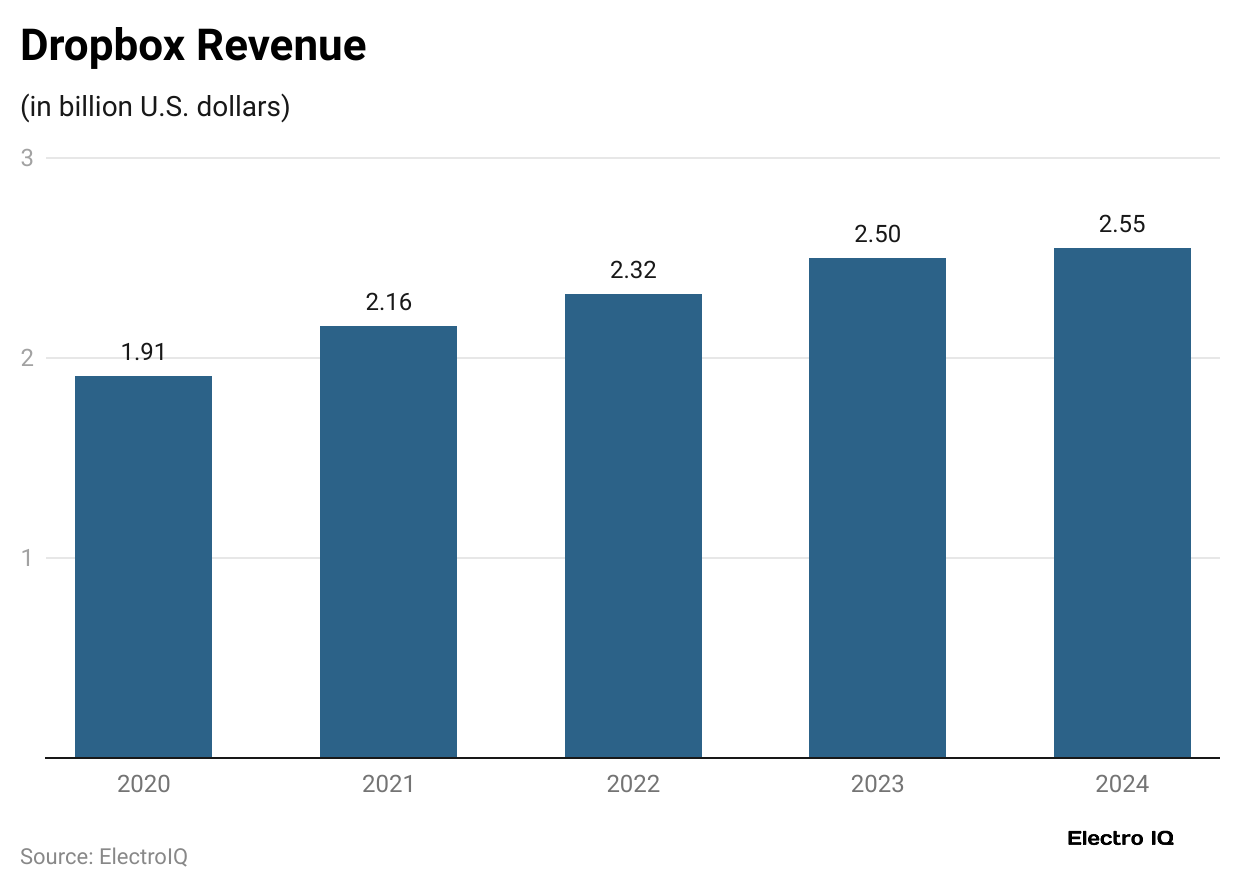

Dropbox Revenue

(Reference: stockanalysis.com)

(Reference: stockanalysis.com)

- In 2024, Dropbox’s total revenue was USD 2.55 billion, an increase of USD 46.60 million over the prior year, reflecting a small growth of only 1.86% in revenues.

- Dropbox statistics indicate a gross slowdown in revenue expansion.

- In noticeable contrast, revenue growth for the company during 2023 was well above that at 7.60%, in which total revenue reached USD 2.50 billion, translating into an increase of USD 176.70 million over 2022.

- Revenue in 2022 grew to USD 2.32 billion, with a growth rate of 7.74%, which was slightly better than in 2023.

- The revenue growth of USD 167 million in that period portrays very strong financial performance but with decreases in comparison to the prior year.

- Revenue for Dropbox in 2021 was USD 2.16 billion, and considering the growth rate of 12.75%, this makes a significant increase of USD 244 million as compared to 2020.

- Looking back to 2020, it was a very good year for Dropbox, with revenues of USD 1.91 billion, meaning an impressive increase of USD 252.60 million as compared to 2019, thus achieving a growth rate of 15.20%.

- This was the highest growth rate recorded in the five-year period. Over time, Dropbox’s revenue growth has entered a trend of decline, in which the rate of increase plummeted from 15.20% in 2020 to just 1.86% in 2024.

- While the firm is still expanding, its revenue growth is declining. The reasons behind this decreasing growth may be market saturation, competition, or changes in customer needs.

- In spite of this, Dropbox has been able to grow revenues from year to year, indicating that its operations are resilient and stable.

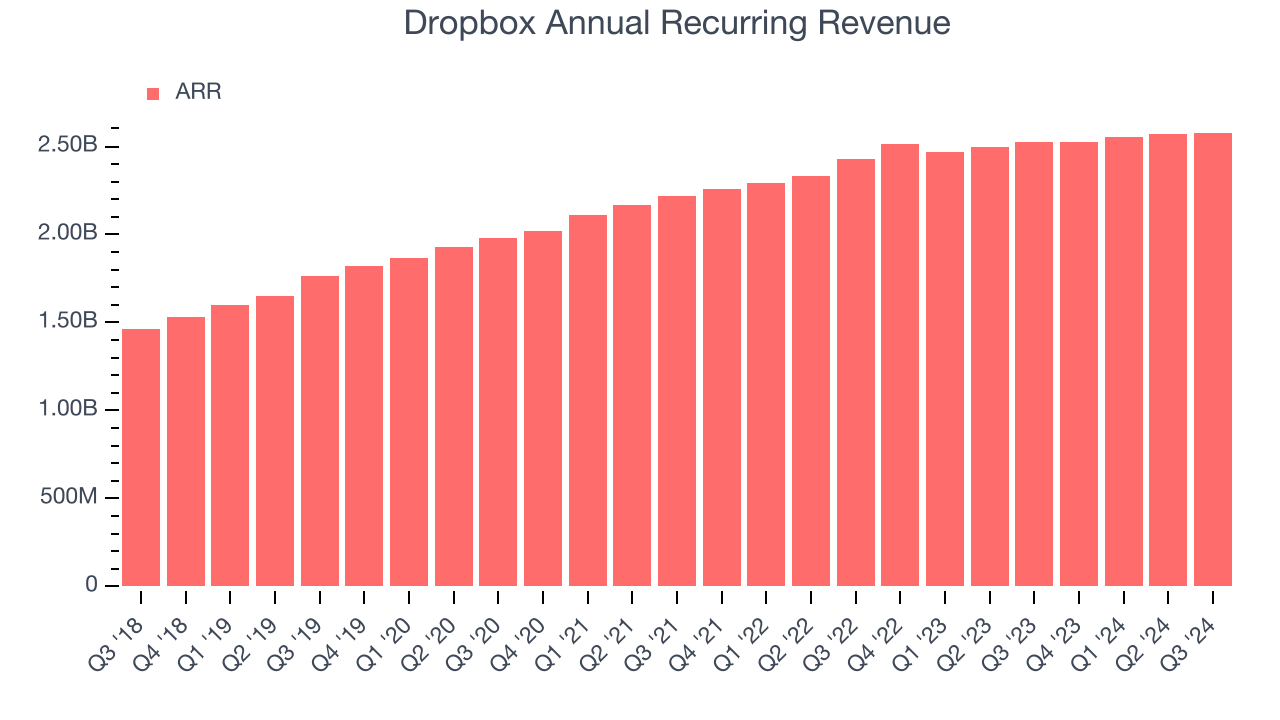

Dropbox Recurring Revenue

(Source: barchart.com)

(Source: barchart.com)

- Investors who are looking at Dropbox should consider its ARR, or Annual Recurring Revenue, along with the total revenue number it reports.

- ARR is important because it gives attention only to steady, predictable, and high-margin revenue from software subscriptions.

- Total revenue, on the other hand, may take in the setup or some implementation fees, which generate much less profit.

- In the last year, ARR growth for Dropbox has been extremely muted: barely 2.2%. In the last quarter, ARR came in at USD 2.58 billion, running closely parallel with the revenue numbers.

- This seemingly slow growth indicates Dropbox may be facing more competition, and securing long-term commitments from customers is getting tougher.

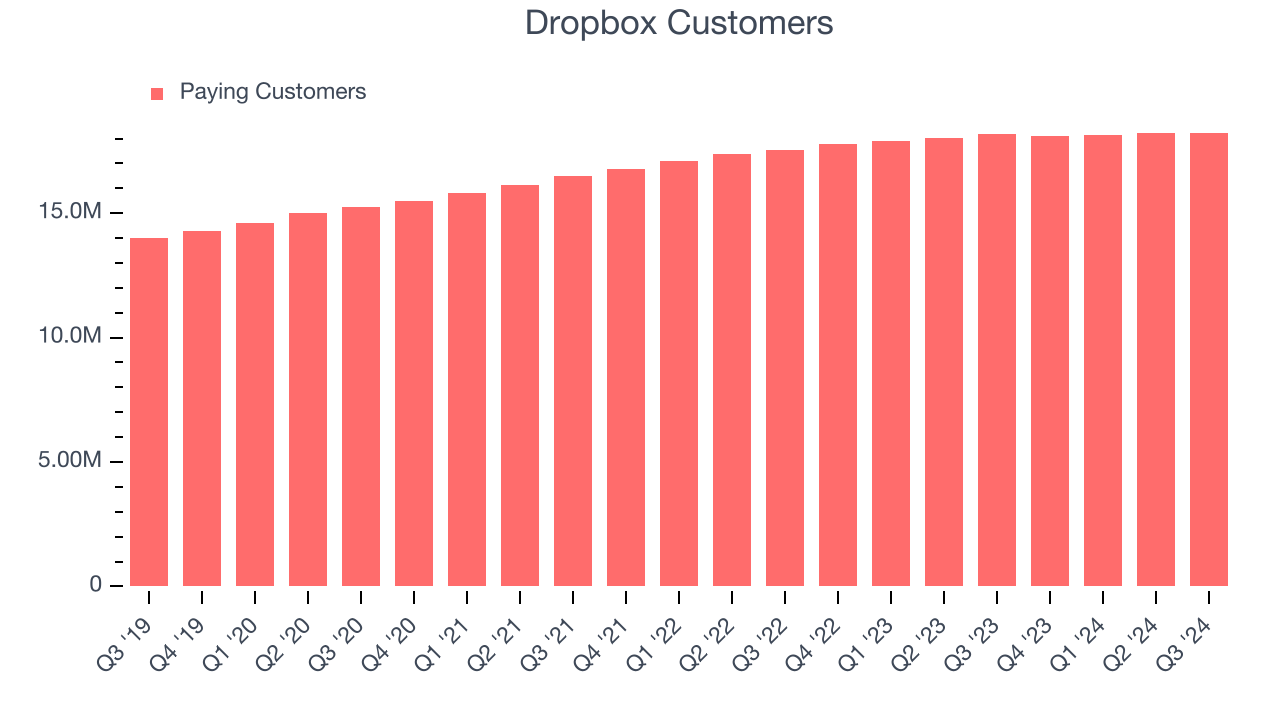

Dropbox Customers

- There were around 18.24 million customers at the end of the quarter, an increase of 20,000 from the previous quarter.

- However, the growth is smaller compared to past growth rates, signalling faster customer acquisition for Dropbox.

- This seems to indicate a slowing down in the company’s ability to attract new users.

Dropbox Business Adoption Statistics

- Dropbox is used by businesses worldwide, including companies among the giants. A blog post from Dropbox reported that at least 97% of Fortune 500 companies use the platform.

- This implies that almost all of the largest and most successful companies in the U.S. depend on Dropbox for their storage and collaboration needs.

- By name, we call out Dropbox users: Infosys Ltd from India, Fujitsu Ltd and Panasonic Corp from Japan, and The North Face from the U.S.

- The majors trust Dropbox to secure their files and data. Dropbox has a diversified clientele that includes individuals, families, teams, and businesses of all sizes.

- From freelancers and small businesses to large corporations, users hail from a dozen different industries, such as technology, media, education, retail, finance, etc.

- Businesses use Dropbox across departments: sales, marketing, product development, design, engineering, finance, legal, and HR. This indicates that the platform not only serves filing purposes but acts as an important enabler for collaboration and teamwork.

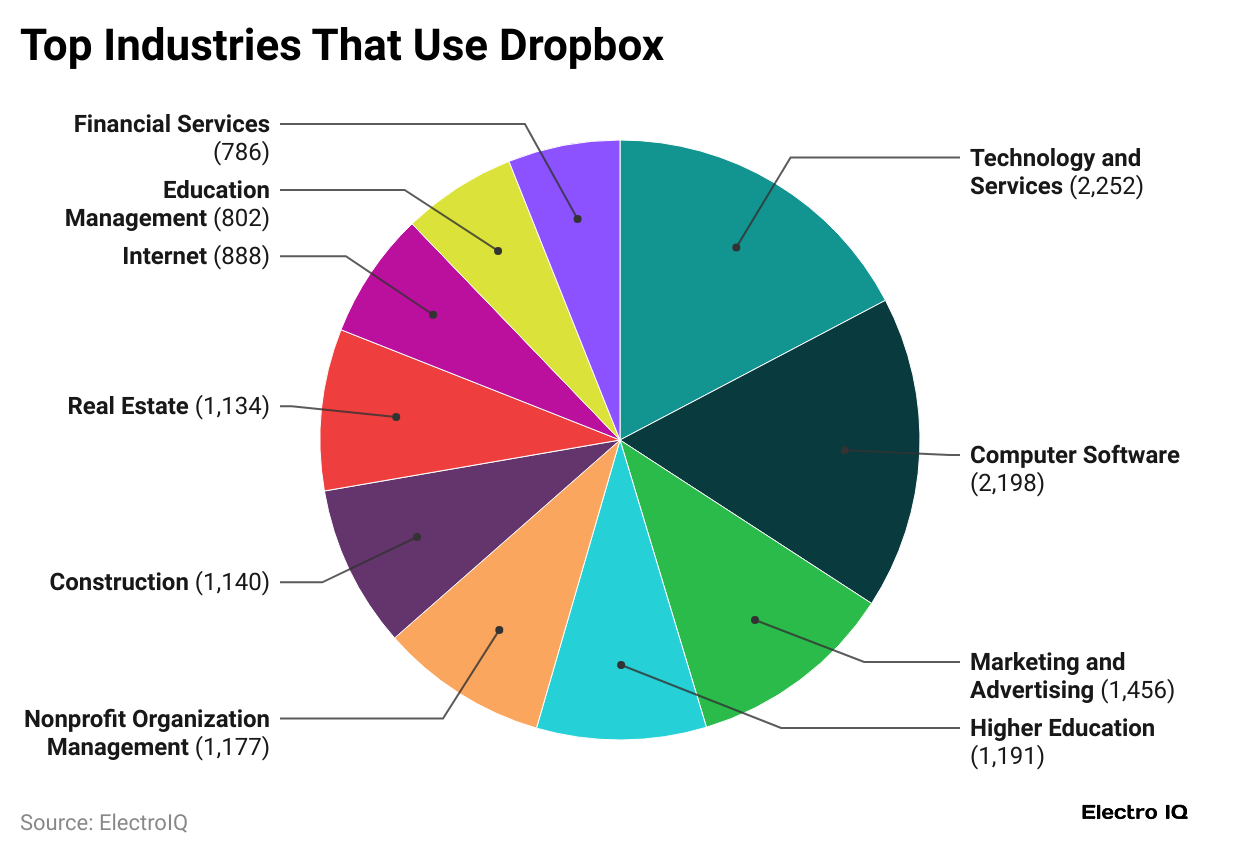

Dropbox Usage By Industries

(Source: skillademia.com)

(Source: skillademia.com)

- As per the Dropbox statistics released by Enlyft, Dropbox is currently permitted for use by 31,499 firms.

- In between these, the most common industries depending on Dropbox are Technology and Services and Computer Software which account for 7%.

- Further breakdown of this shows that 2,252 companies belong to the Technology and Services sector and have a direct tie to using Dropbox compared to 2,198 Computer Software companies.

- Other industries also share a significant number of companies that are relying on Dropbox as a tool within their industries.

- For example, 1,456 companies in Marketing and Advertising depend on it, while 1,191 other organisations within Higher Education also use it for their work.

- In, addition, 1,177 Nonprofit Organization Management companies, 1,140 Construction businesses, and 1,134 Real Estate firms are reliant on Dropbox for optimising their work.

- There are 888 from the Internet industry that use Dropbox, 802 for Education Management, and then 786 using the same platform for Financial Services.

- Dropbox statistics data really gives a clear idea about how hugely Dropbox is being applied in different activities and industries, with a strong frontline, specifically where technology meets education in business services.

Dropbox Use By Countries

- Dropbox will be used in more than 180 countries across the world. However, these countries have given birth to companies, mostly from the United States.

- In fact, all companies using Dropbox, which is about 21,413, are largely found in the U.S.

- In second place comes the United Kingdom, which showed a 7% use of Dropbox-that is, 2,076 companies.

- In third place is Canada, which has 1,348 companies. Other countries with a considerable number of companies that use Dropbox include Australia (636 companies), France (550 companies), and India (497 companies).

- Germany comprises 302, while the Netherlands has no better than 266 companies. Spain follows closely with 260 companies, while Brazil rounds out the top countries with 192 companies.

- This information depicts how Dropbox is most commonly found in the USA but also secondarily in the UK, the third being Canada, even as it stretches into many of the other countries in the world in great numbers.

Dropbox Registered Users

(Reference: backlinko.com)

(Reference: backlinko.com)

- Dropbox has seen a constant increase in its registered users from 2018 to 2020. In 2018, there were around 500 million registered users, which grew to 600 million by 2019.

- By 2020, this number reached 700 million. However, post-2020, there was a halt in growth, with the number of registered users remaining constant at 700 million for the next period.

- Further, analysis reveals that there has not been an increase in user registrations from 2021 to June 2024.

- These Dropbox statistics show that Dropbox witnessed an accelerated increase in its early days, and this rise now, appears to have plateaued.

- Possible reasons for this can be a saturation in the market because of stiff competition or change in the nature of users’ adoption of cloud storage.

Dropbox Paying Users

- According to Dropbox statistics, since 2015, the number of people paying for Dropbox has continued to increase each year.

- In 2015, there were 6.5 million paying users, which grew to 8.8 million in 2016 and further up to 11 million in 2017.

- By 2018, the number of paying customers steadily increased to 12.7 million.

- The trend continued into 2019 when the number of paying users totaled 14.31 million, and by 2020, the number reached 15.48 million.

- As of 2021, there were 16.79 million paying users for Dropbox, up to 17.77 million by 2022.

- The growth rate slowed a little bit in 2023, reaching 18.12 million users. In 2024, the number of paying users grew gradually.

- In the first quarter, it stood at 18.16 million paying customers, but with a slight rise to 18.22 million in the second quarter.

- This then indicates that even though Dropbox continues to gain new paying users, the rate of growth in recent years is slowing down compared to that of the previous years.

Dropbox International Revenue

(Reference: backlinko.com)

(Reference: backlinko.com)

In 2015, Dropbox made USD 277.7 million from international markets, which represented 46% of its total earnings.

- In 2016, international revenue from Dropbox grew to USD 388.9 million, accounting for 46.04% of the total revenue of the company.

- Following that, in 2017, international revenue grew to USD 531.1 million and accounted for 47.66% of the revenue of Dropbox.

- The increase persisted in 2018, reaching USD 685.2 million and contributing to 49.17% of the company’s revenue, the highest figure in the present dataset.

- In 2019, international revenue reached USD 807.2 million but the percentage dipped a little to 48.55% of total revenue.

- The pattern of greater revenue and a smaller percentage continued in 2020, with international revenue of USD 914.6 million, 47.68% of total revenue.

- By 2021, international revenue was well over the USD 1 billion mark, coming in at USD 1.03 billion, representing 47.63% of total revenue. Even after slight growth to USD 1.06 billion in international revenue in 2022, its share fell to 45.62% ofthe

- In 2023, the USD 1.08 billion revenue figure experienced a further drop to 43.26% share.

- To give a brief outlook for 2024, during Q1, international revenue stood at USD 273 million or 43.24% of total revenue.

- Second-quarter international revenues fell slightly to USD 265.2 million, with shares of total revenues also falling to 42.99%.

- To conclude, while Dropbox’s international revenues have continued to gain steady growth over the years, its share of total revenue has been slowly declining since 2018. This could indicate that growth rates in the U.S. have exceeded growth rates in other countries.

Dropbox Average Revenue Per Paying User

(Reference: backlinko.com)

(Reference: backlinko.com)

- The average revenue per paying user (ARPU) has indicated an increase in Dropbox over the years, meaning that the amounts that it earns from each customer have steadily risen.

- In 2015, the ARPU was USD 113.54 but slightly declined to USD 110.54 in 2016. After that, it resumed its upward trend, with an ARPU of USD 111.91 in 2017 and USD 117.64 in 2018.

- Starting from 2019, there has been a steady increase in the ARPU for Dropbox. It increased to USD 123.07 in 2019, USD 128.50 in 2020, and finally USD 133.73 in 2021.

- In 2022, the number reached USD 134.51, indicating marginal growth over the previous year’s USD 133.73.

- In the year 2023, Dropbox’s ARPU continued the increase, reaching USD 139.38.

- In the first quarter of 2024, this figure was USD 139.59 before climbing to USD 139.93 in the second quarter.

- Dropbox statistics suggest that, through active pricing efforts, the addition of features, and solutions aimed at achieving business goals, Dropbox has been very successful over the years in growing its revenue from paying users.

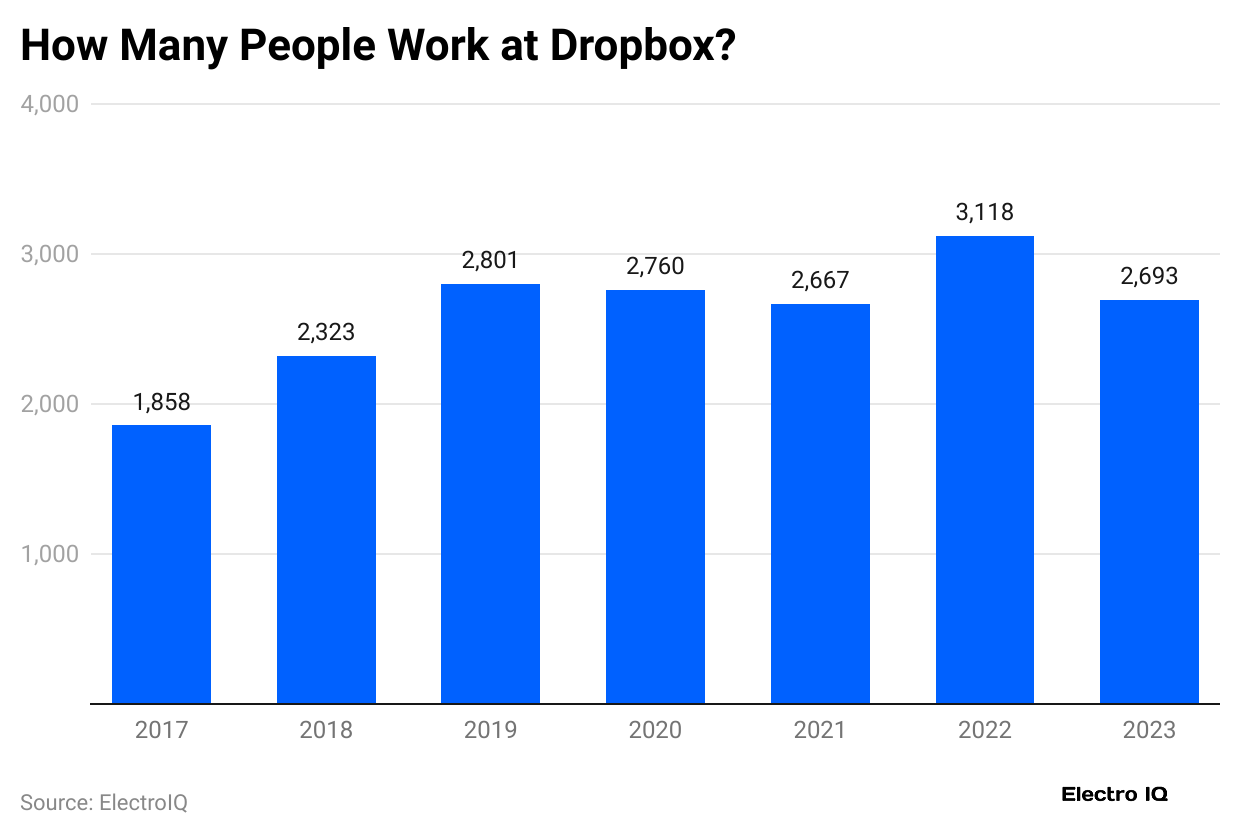

Dropbox Employees

(Reference: backlinko.com)

(Reference: backlinko.com)

- This would imply that in 2017, Dropbox employed 1,858 people. The number of employees grew continuously in the next few years, stabilising at 2,323 in 2018 and 2,801 in 2019.

- In 2020, there was a slight setback that brought the number to 2,760 employees. The downward trend continued in 2021 as the number fell to 2,667 employees.

- It was during 2022 that Dropbox witnessed a distinct increase, with all-time-high employment strength: 3,118 employees.

- However, by 2023, the number fell, yet again, to 2,693 employees.

- This proclaims that while at some loads Dropbox was increasing its workforce, it has also periodically reduced employment based on business needs and market conditions.

Dropbox Market Competitors

(Reference: skillademia.com)

(Reference: skillademia.com)

- Dropbox is one of the largest competitors in the file-hosting market, following Google Drive.

- As per Dropbox statistics, Google Drive has a major share of the market at 48%, with 74,059 companies operating on it.

- Dropbox, with nearly 20.67% of the market and 31,499 companies depending on its services, is second for file hosting services.

- On the other hand, Microsoft OneDrive stands in third position, with 15% of the market and 24,152 companies using it.

- WebDrive and Apple iCloud are far weaker, with each holding less than 5%.

- With regard to WebDrive, 8,071 companies are reported to be using it, and 3,850 companies are said to be using Apple iCloud.

- This statistic supports that Google Drive is really the most popular file hosting, followed by Dropbox as a strong runner-up.

- Microsoft OneDrive has a strong presence, while WebDrive and Apple iCloud are less popular among the surveyed businesses.

Conclusion

According to Dropbox statistics, Dropbox denotes its strategic transformation. As pointed out, even with the core business facing business challenges, the company went ahead to restructure its operations in an opportunistic manner while investing heavily in AI-led innovations to catch up with the changes in the market.

With a firm financial footing, loyal users, and a clear road to the integration of advanced technologies, Dropbox is ready to exploit the changing landscape of cloud services and remain one of the leaders in the industry.

FAQ.

In 2024, Dropbox’s revenue stood at US$2.55 billion, reflecting a paltry growth of 1.86% compared to 2023. This is an exceptionally slow growth vis-à-vis the prior years when the company had registered growth rates of 7.60% in 2023 and 12.75% in 2021.

As of the end of Q2 2024, Dropbox had 18.24 million paying customers, with only an increase of 20,000 paying customers from the previous quarter. The steady growth of only 20,000 pays seems to suggest that Dropbox is going through a rough patch in acquiring new customers at the same pace as before.

Dropbox is most widely adopted by Technology & Services and Computer Software at about 7% each. To make matters even better, an overwhelming 97% of Fortune 500 companies, including Infosys, Fujitsu, Panasonic, and The North Face, use Dropbox for storage and collaboration.

Dropbox is currently holding a 20.67% share of the market, being second to Google Drive with a whopping 48% market share. Microsoft OneDrive follows third with 15%.

From a meagre US$113.54 in 2015, Dropbox’s ARPU steadily surged, attaining US$139.93 in 2024. The increase is a testimony to the fact that Dropbox has effectively monetised its paying customers via pricing strategies and additional services.

Saisuman is a skilled content writer with a passion for mobile technology, law, and science. She creates featured articles for websites and newsletters and conducts thorough research for medical professionals and researchers. Fluent in five languages, Saisuman's love for reading and languages sparked her writing career. She holds a Master's degree in Business Administration with a focus on Human Resources and has experience working in a Human Resources firm. Saisuman has also worked with a French international company. In her spare time, she enjoys traveling and singing classical songs. Now at Smartphone Thoughts, Saisuman specializes in reviewing smartphones and analyzing app statistics, making complex information easy to understand for readers.