eSIM Statistics By Market Size, Popularity, Carbon Emission And Industries

Updated · Sep 19, 2024

Table of Contents

- Introduction

- Editor’s Choice

- eSim Market Size

- Revenue Of Smartphones Worldwide

- Smartphone Shipments Worldwide

- IoT Revenue Worldwide Globally

- Semiconductor Market Revenue Worldwide

- Advantages Of eSIM Based On The Mobile Network Operators

- Challenges With eSIM And IoT Adoption

- Consumer Expectations On eSIM Technology

- Consumer Popularity With eSIM

- SIM Vs eSIM Carbon Emissions

- Cost Spending Of eSIM, SIM, And iSUE In IoT Network

- Lifetime Spending Of eSIM, iSIM, And Physical SIM On All Technologies

- eSIM-Capable Device Shipments Worldwide

- Penetration Rate Of eSIM

- Top Industries For eSIM

- Future Plans For eSIM Adoption By Device Manufacturers

- Ranking Of eSIM Provider Companies

- IoT Devices Connected Worldwide

- No Connected Devices Globally

- Wide And Short-Range IoT Devices Worldwide Connection Increase

- eSIM Overview

- Conclusion

Introduction

eSIM Statistics: eSim is an embedded technology that has revolutionized mobile calling technology and how the calls are activated and transferred. For the most part, it functions as a digital sim synchronized with the mobile device instead of attaching a physical sim card to the phone. New smartphones are being developed to accommodate this electronic sim apparatus.

It is interesting to go through the eSIM Statistics and get essential information about the popularity of this technological apparatus.

Editor’s Choice

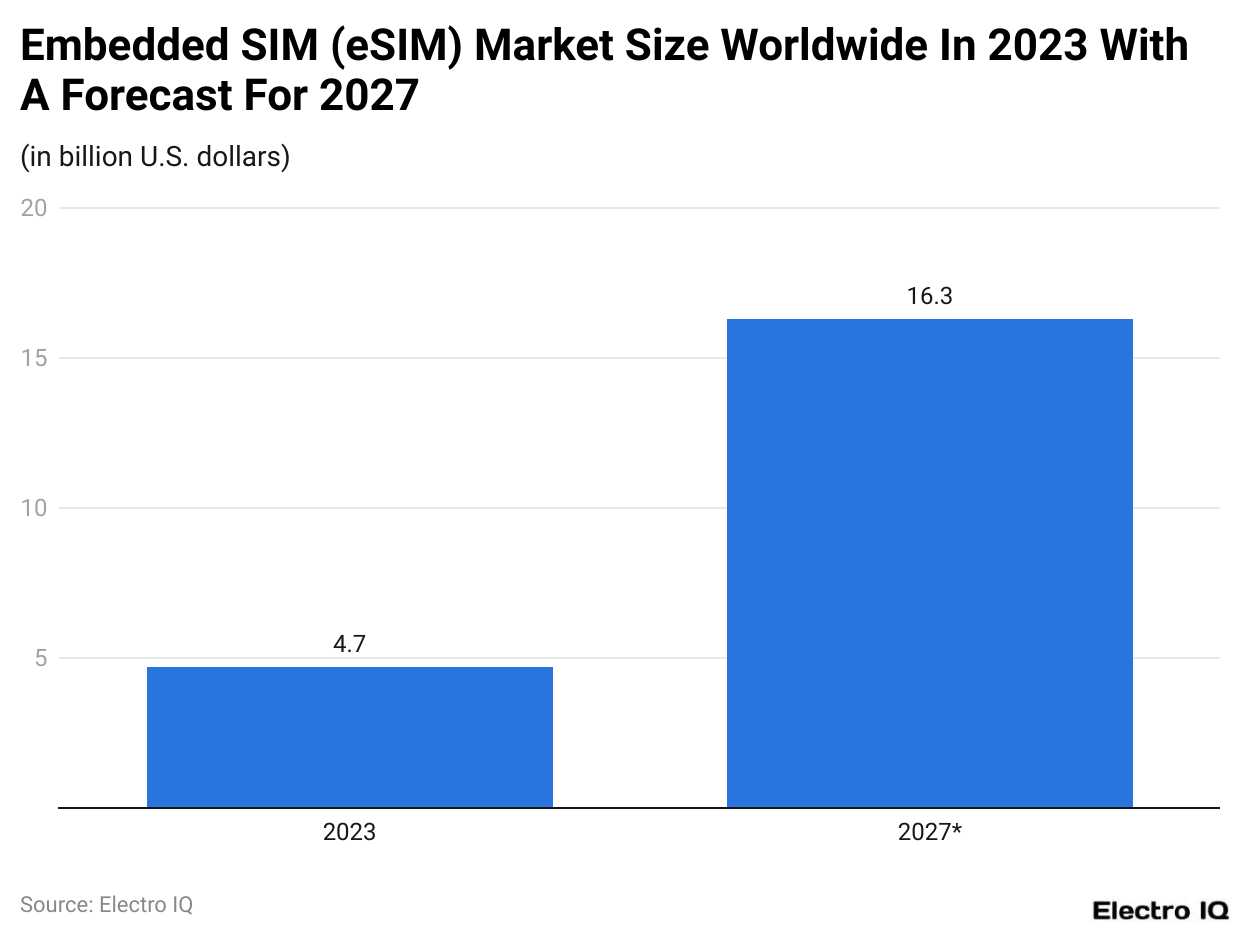

- The global eSIM market size is projected to grow from USD 4.7 billion in 2023 to USD 16.3 billion by 2027.

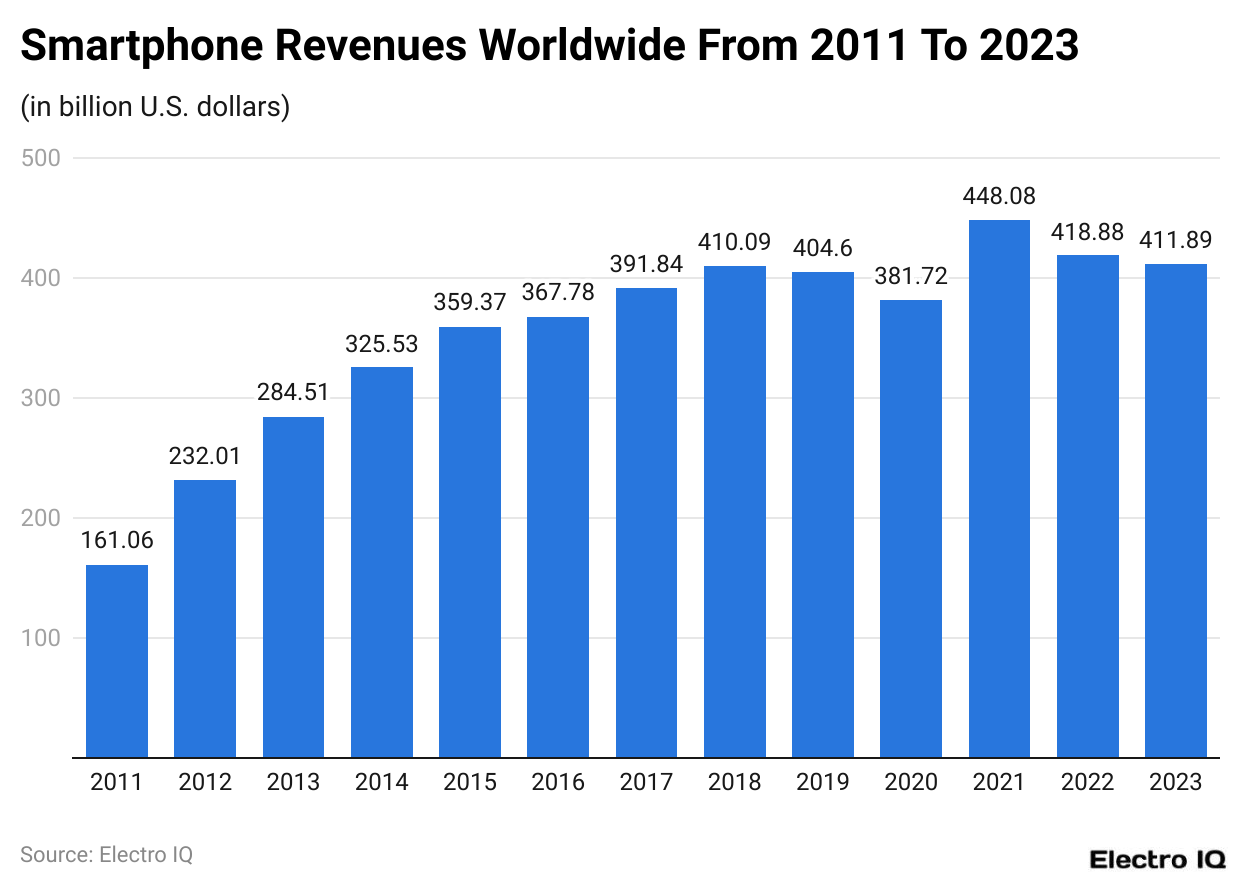

- Smartphone revenue reached USD 411.89 billion by the end of 2023.

- IoT annual revenue is expected to reach USD 621.6 billion by 2030.

- 50% of mobile network operators consider cost reduction an extremely important benefit of eSIM.

- 58% of respondents from the US, UK, and Australia are aware of eSIM technology.

- eSIM produces only 1g of CO2 emissions compared to 136g from physical SIM.

- eSIM technology is expected to reduce costs by an average of 15% over its lifetime.

- By 2030, 14 billion eSIM-capable devices are expected to be shipped.

- Drones and smartwatches are predicted to have 100% eSIM penetration by 2030.

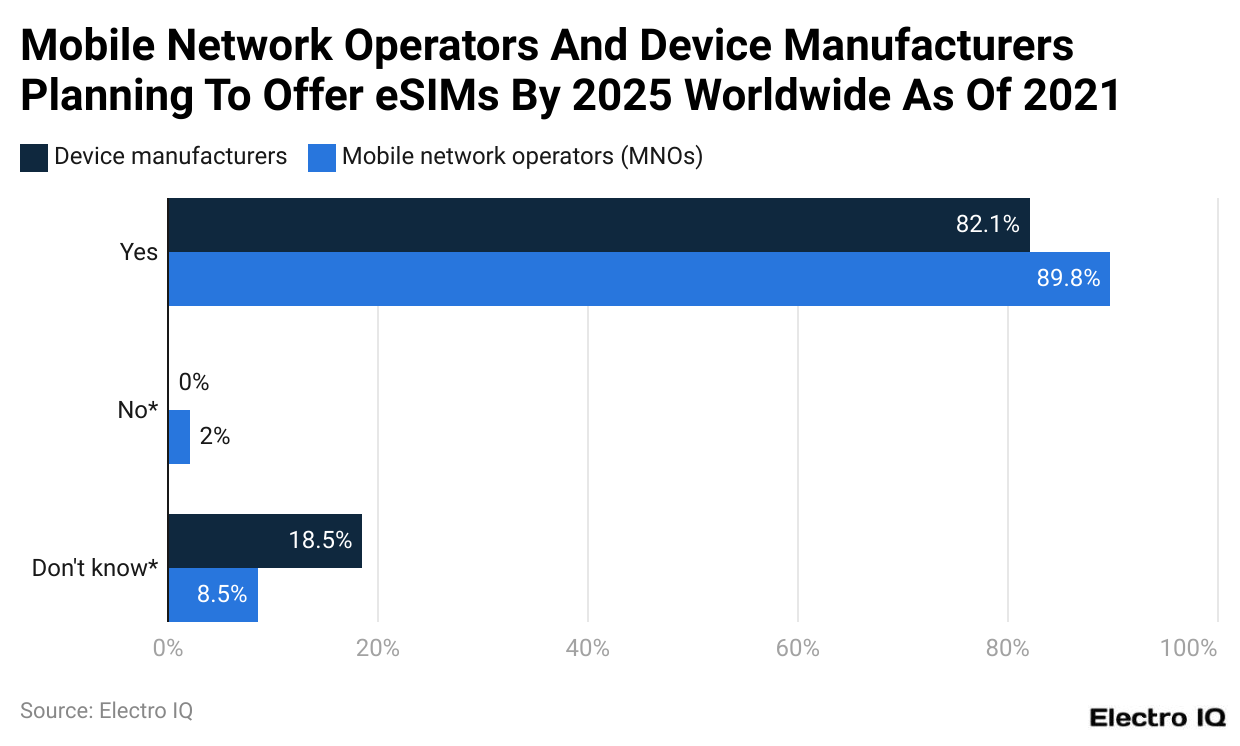

- 89.8% of mobile network operators plan to offer eSIM by 2025.

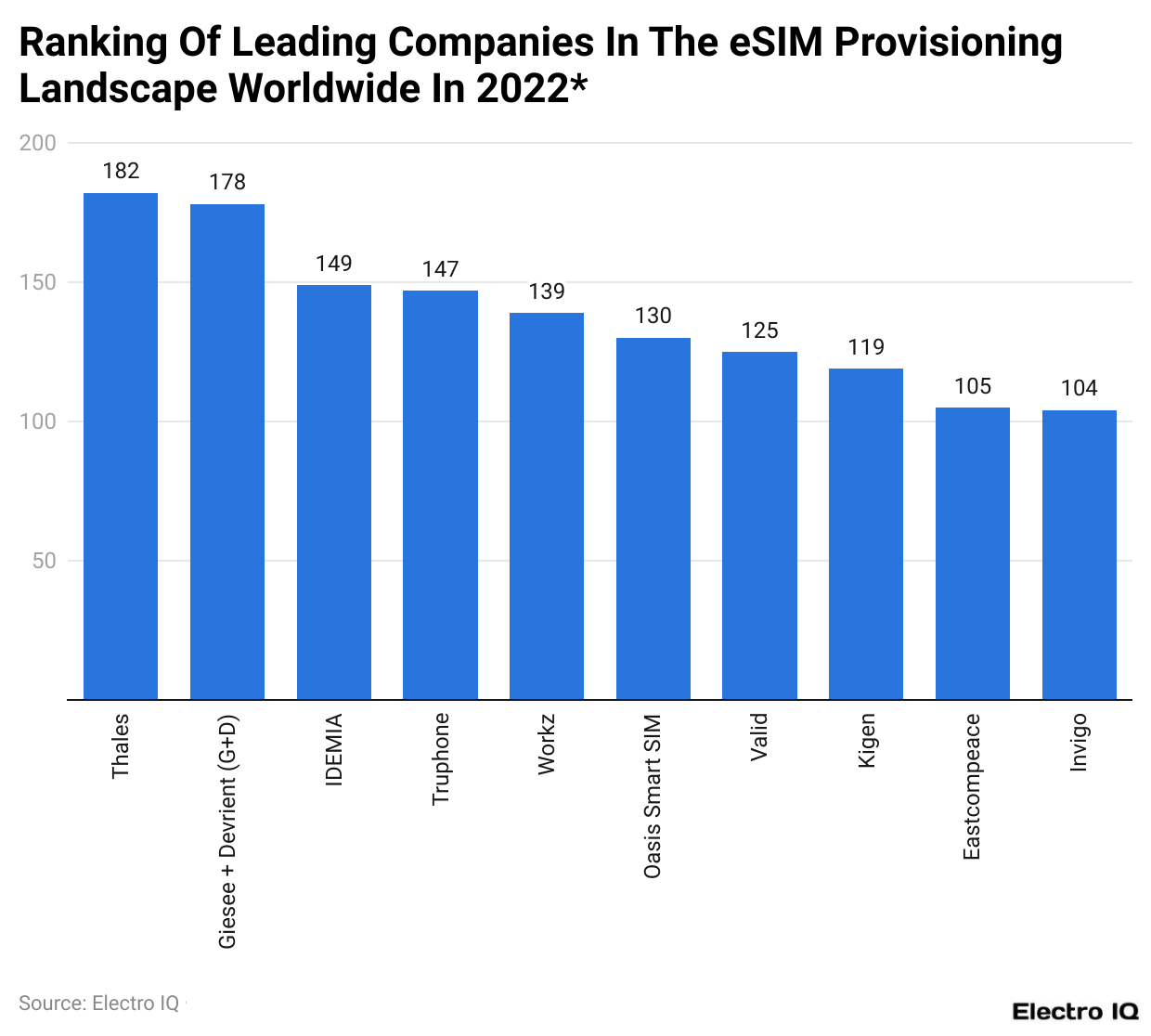

- Thales leads the eSIM provider rankings with a core rating of 182.

eSim Market Size

(Reference: Statista.com)

- eSim statistics showcase the gradual growth of the embedded sim market worldwide.

- In 2023, the eSIm market size was $4.7 billion.

- By the end of 2027, it is estimated that the eSim market will be worth $16.3 billion.

- Such figures showcase a positive and prosperous future for the eSim market.

Revenue Of Smartphones Worldwide

(Reference: Statista.com)

- The eSIM statistics showcase that the revenue of Smartphones is directly interlinked with the revenue of the eSIM industry.

- Between the period (2011 – 2023), the highest revenue was witnessed in 2021, at $448.08 billion.

- By the end of 2023, the revenue of Smartphones was $411.89 billion.

Smartphone Shipments Worldwide

(Reference: Statista.com)

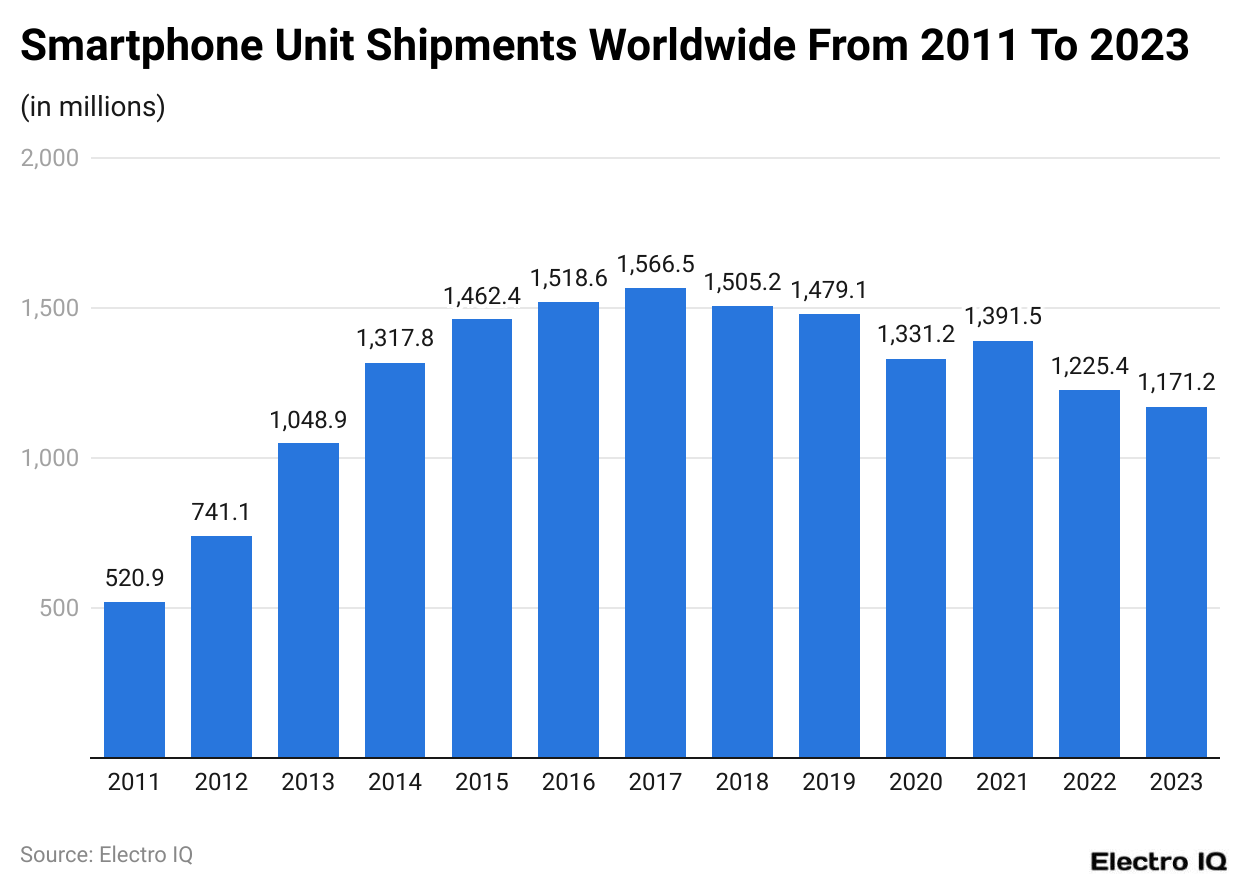

- The eSIM statistics show that smartphone shipments have been variable over the past 12 years.

- The highest number of shipments between the periods (2011 – 2023) was 1,556.5 million in 2017.

- By the end of 2023, the smartphone industry shipments were 1,171.2 million.

IoT Revenue Worldwide Globally

(Reference: Statista.com)

- IoT devices are gaining popularity and are often based on eSim-induced networks.

- According to the eSIM statistics 2023, the annual revenue from IoT was $293.2 billion, with the highest being $75 billion from Connected devices.

- By the end of 2030, it is predicted that the IoT industry will have an annual revenue of $621.6 billion.

Semiconductor Market Revenue Worldwide

![]()

(Reference: Statista.com)

- The eSIM industry relies on the electronic goods-based industry for its survival, hence the growth of the eSIM industry.

- The eSIM statistics for 2023 showcase that the semiconductor industry generated around $600 million in revenue overall.

- By the end of 2030, it is estimated that the semiconductor industry is expected to have around $700 billion in revenue, with smartphones having the highest revenue of $146 billion.

Advantages Of eSIM Based On The Mobile Network Operators

(Reference: Statista.com)

- The eSIM card has a wide variety of advantages that make it a popular choice among its clients.

- Based on the eSIM statistics, the biggest advantage that mobile network operators feel is that there is a streamlined logical cost reduction since no supplies are required for an eSIM purchase. In which 50% of the operators feel it is an extremely important benefit.

- The second most essential benefit experienced by mobile network operators is that the introduction of eSIM ensures that businesses have ample time to discuss new opportunities with digital services, which is attributed as 47% extremely important.

- Other potential benefits the mobile operator companies pointed out are Facilitating international roaming, increasing digital distribution usage, capturing IoT and digital-native consumer opportunities, enhancing mobile device integration with subscription plans, and improving customer experience by digitizing SIM-related operations.

Challenges With eSIM And IoT Adoption

(Reference: Statista.com)

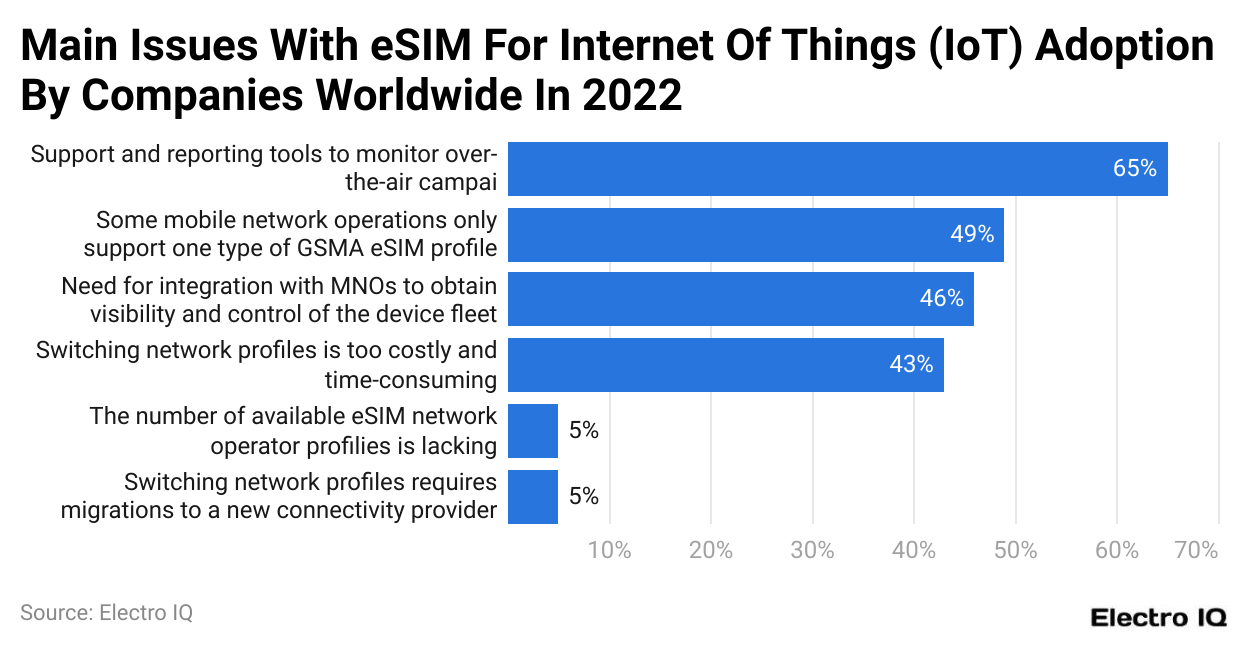

- The eSIM statistics showcase that there has been a fair share of issues with using eSIM for IoT adoption.

- eSIM statistics showcase the first major issue regarding support tools and monitoring over-the-air campaigns involving eSIMs, as conveyed by 65% of the respondents.

- 49% of respondents say that there is a major challenge because the network operators provide support to one type of eSIM only.

- Network integration challenges, switching network profiles, lack of eSIM operators, and issues while switching networks sum up the challenges based on eSIM that companies tend to face regularly.

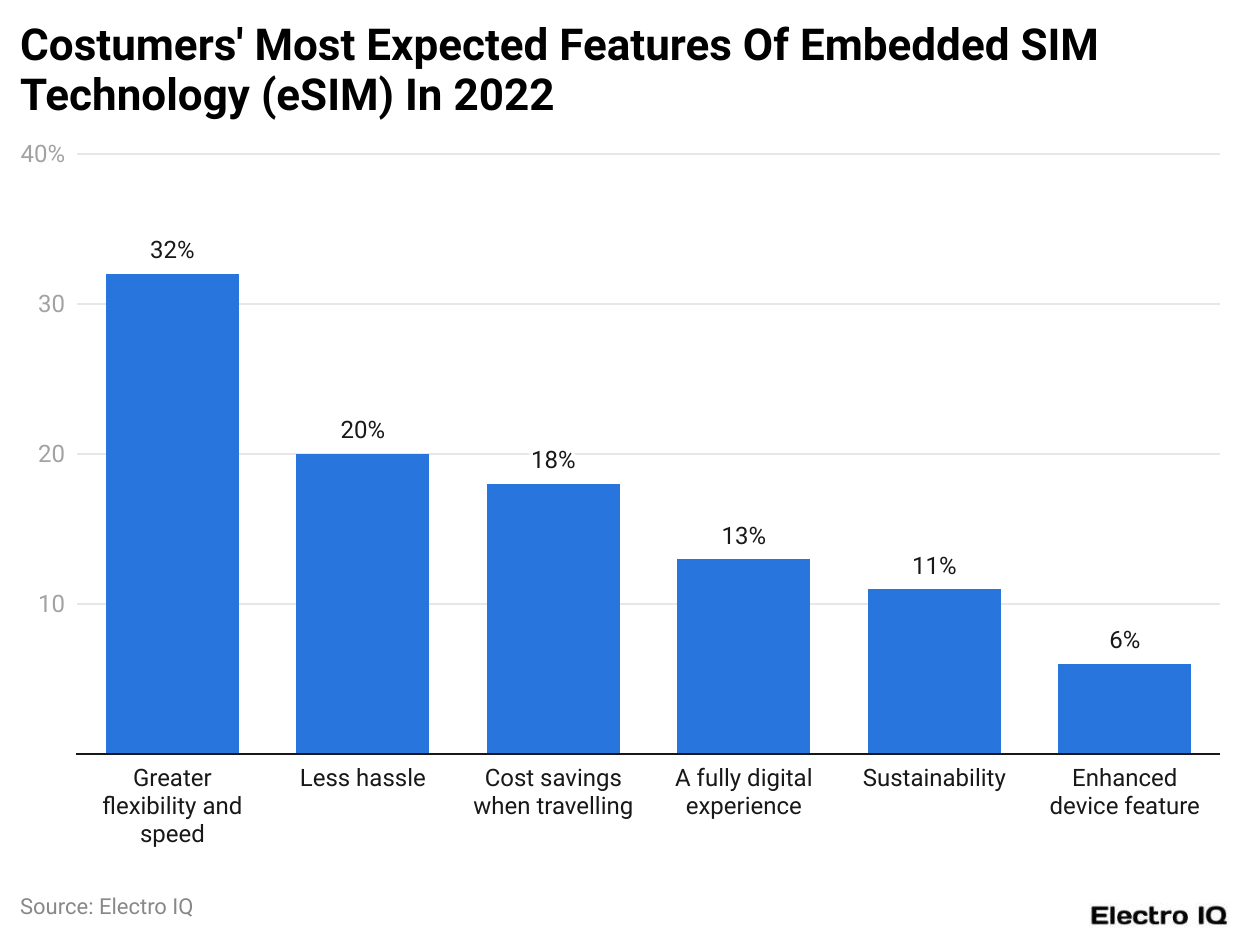

Consumer Expectations On eSIM Technology

(Reference: Statista.com)

- The eSIM statistics showcase that customers have various expectations when they choose to transition to eSIM from their usual physical SIM.

- 32% of the respondents have expectations that it would offer greater speed and flexibility.

- 20% of the respondents expect it to be less hassles.

- Cost savings, sustainable material, and digital features sum up the expectations of companies regarding eSIM technology.

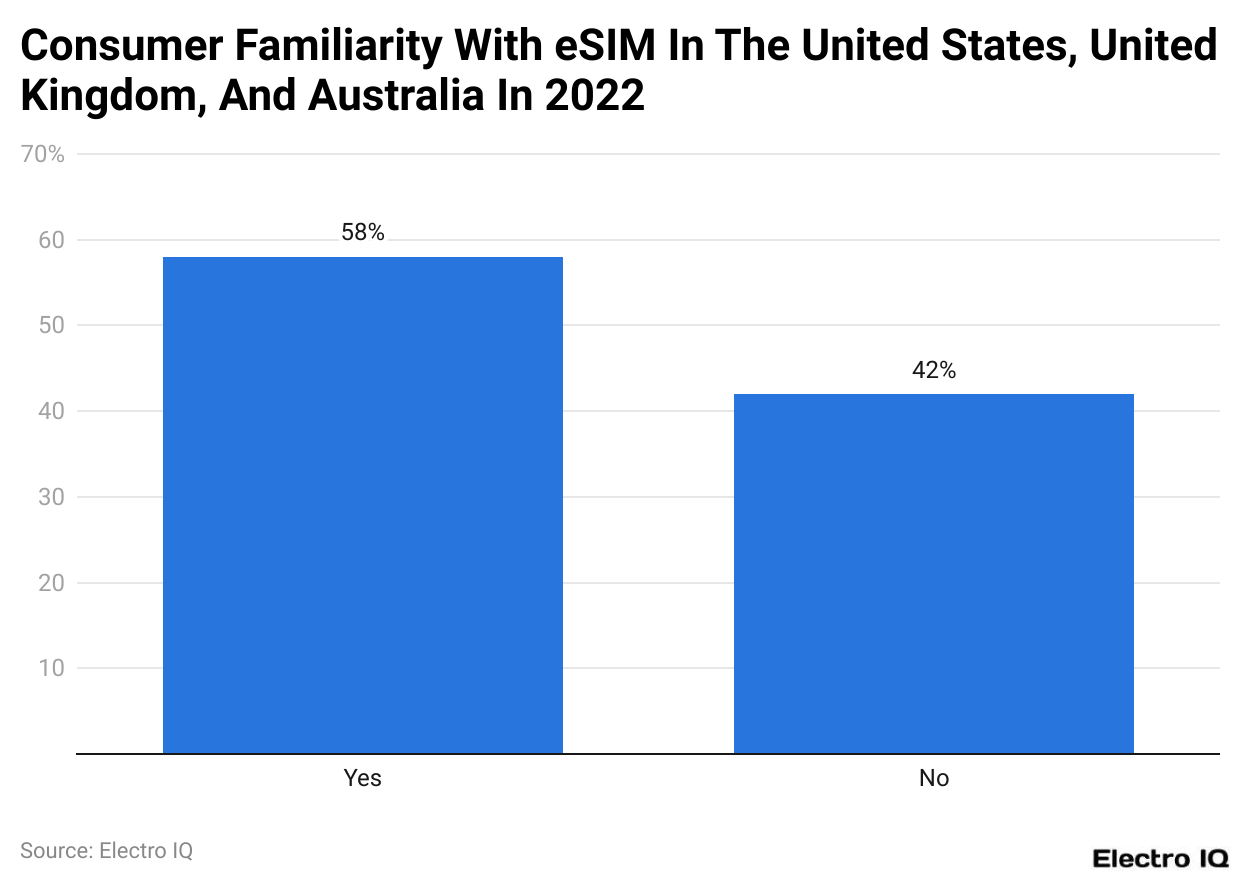

Consumer Popularity With eSIM

(Reference: Statista.com)

- Familiarity with a product serves as an essential metric that determines its success.

- eSIM statistics showcase that 58% of respondents from the US, UK, and Australia are aware of the eSIM facility as compared to 42% of them who are unaware.

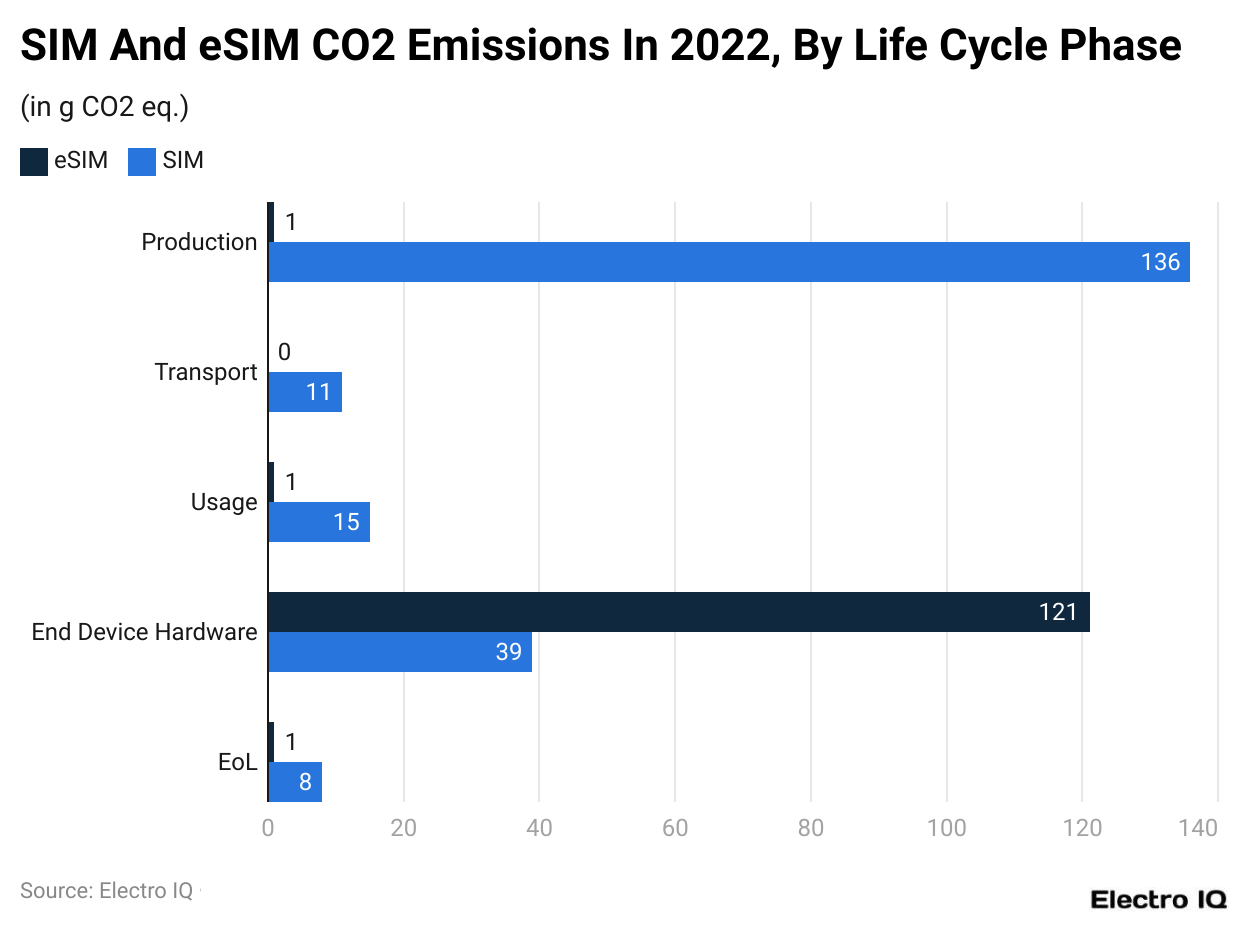

SIM Vs eSIM Carbon Emissions

(Reference: Statista.com)

- Sustainability of the environment serves as a usp of eSIM over physical SIM.

- As shown in the eSIM statistics, 136g of Co2 emissions are produced with physical sim, whereas there is 1 g of emission produced by eSIM.

- As eSIM is digitally available, there are no transportation issues available, whereas a physical SIM contributes 31g of C02 emissions.

- Only the emission caused by end device hardware by eSIM is a point of concern as it releases 121 gm C02 in comparison to the 39 g C02 by physical sim.

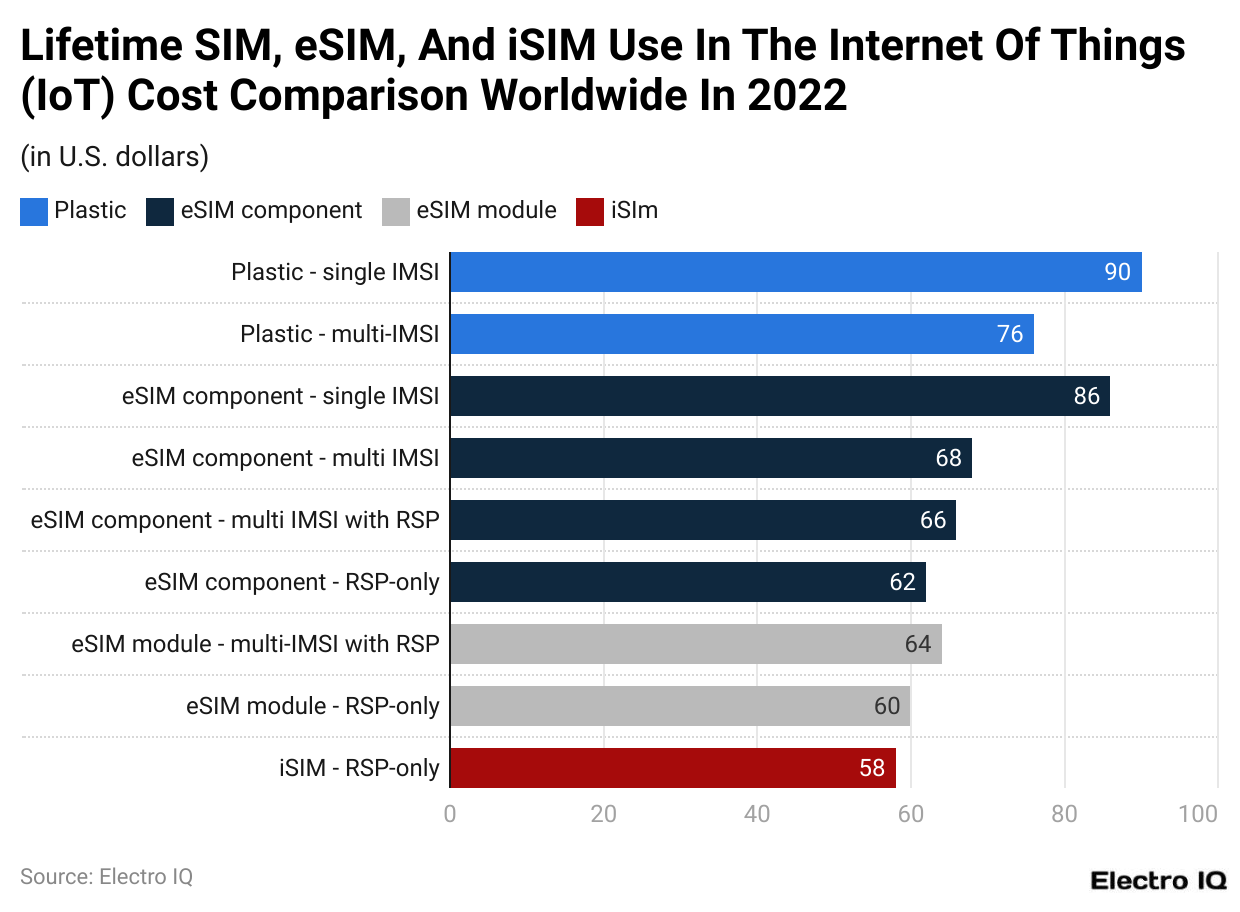

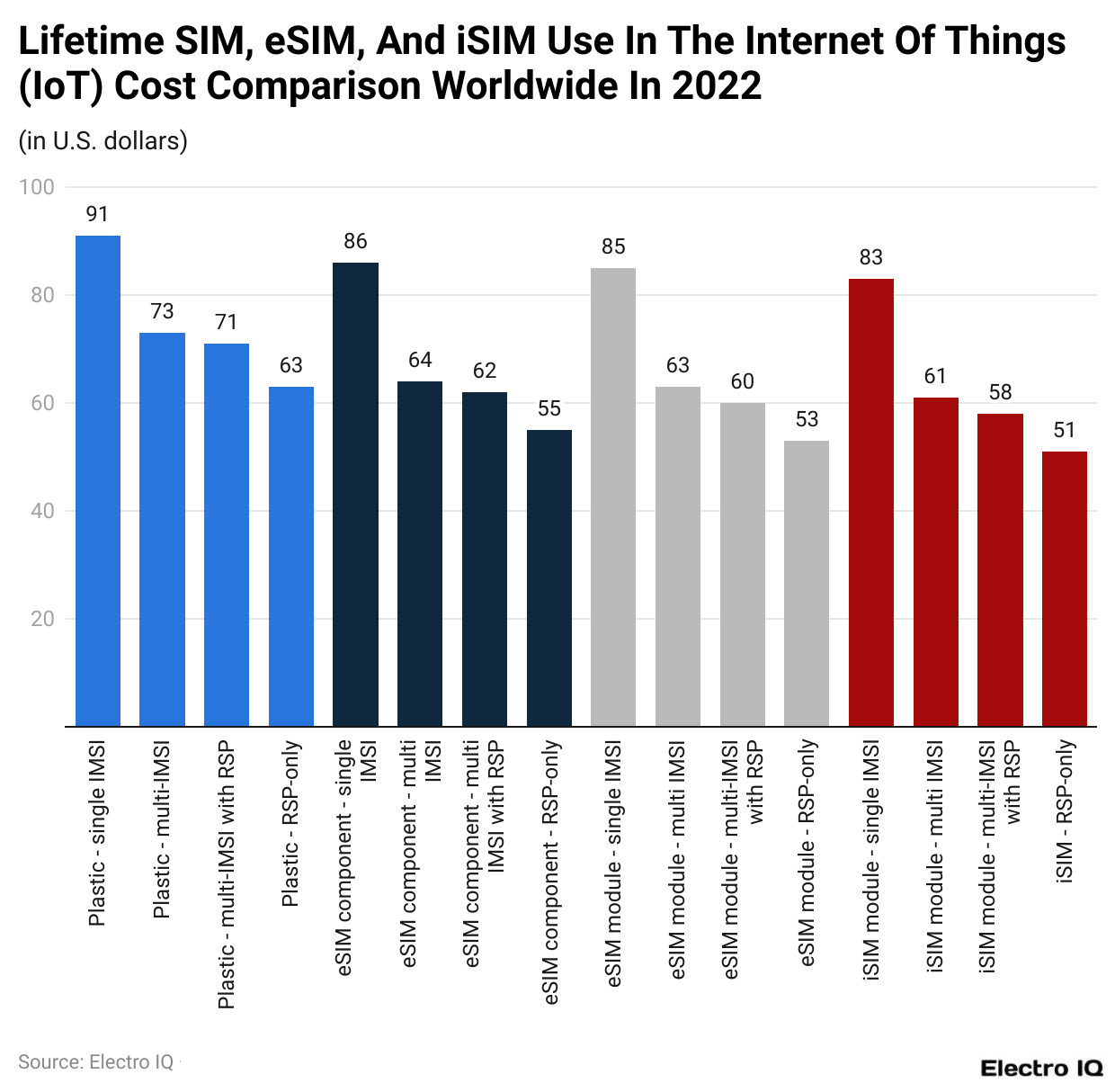

Cost Spending Of eSIM, SIM, And iSUE In IoT Network

(Reference: Statista.com)

- By gaining a proper understanding of the costs involved in the different types of sim in the IoT network, one can realize their cost-effectiveness.

- $90 is a lifetime spent on plastic based on a single IMSI.

- In comparison, there is $86 on eSIM components and modules.

- eSIM statistics showcase the low cost of plastic SIM getting canceled out with the cost savings that are associated with eSIM and iSim based on their lower network costs.

Lifetime Spending Of eSIM, iSIM, And Physical SIM On All Technologies

(Reference: Statista.com)

- The eSIM statistics showcase that there is widespread awareness about the overall benefits of eSIM technology.

- The utilization of eSIM is known to reduce costs by an average of 15%.

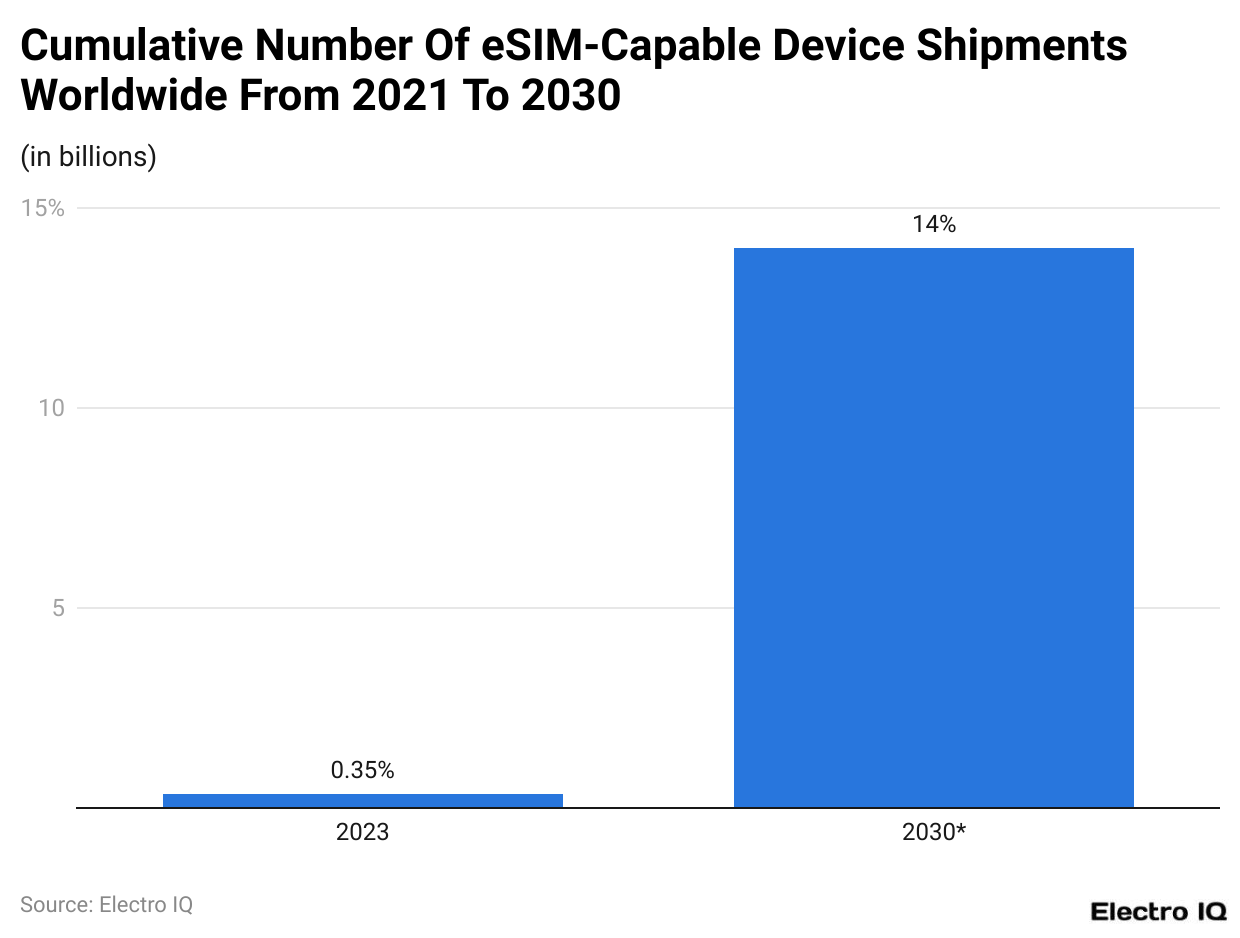

eSIM-Capable Device Shipments Worldwide

(Reference: Statista.com)

- The eSIM statistics showcase that the growth of eSIM-based devices is still low, but there is huge potential for development in the future.

- In 2021, there were 0.35 billion shipments of eSIM-capable devices.

- By the end of 2030, it is expected that around 14 billion eSIM-capable devices will be shipped.

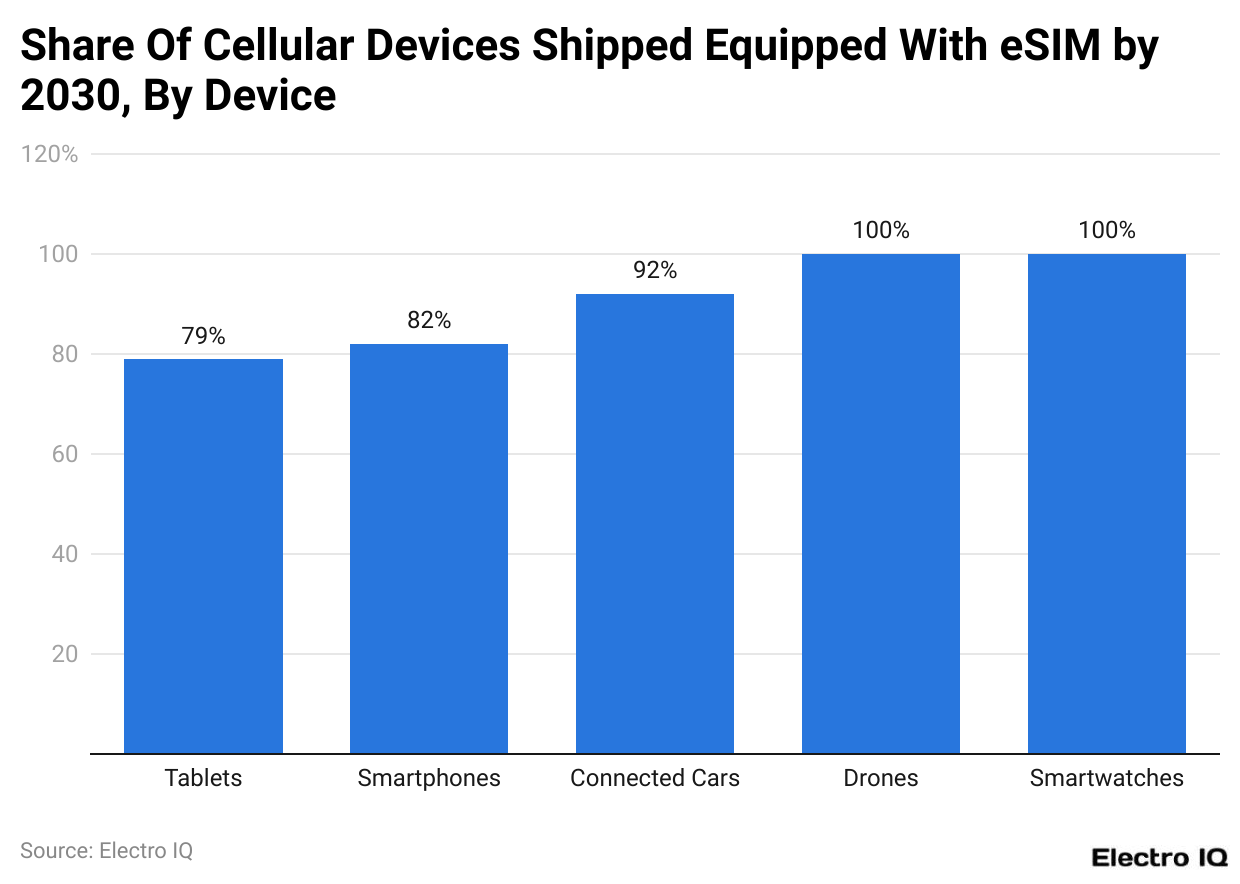

Penetration Rate Of eSIM

(Reference: Statista.com)

- The eSIM statistics showcase that devices of different types can be compatible with the eSIM technology.

- It is predicted that by the end of 2030, drones and smartwatches will have 100% penetration rates with eSIMs.

- While same-era cars, smartphones, and tablets are expected to have 92%, 82%, and 79% penetration rates.

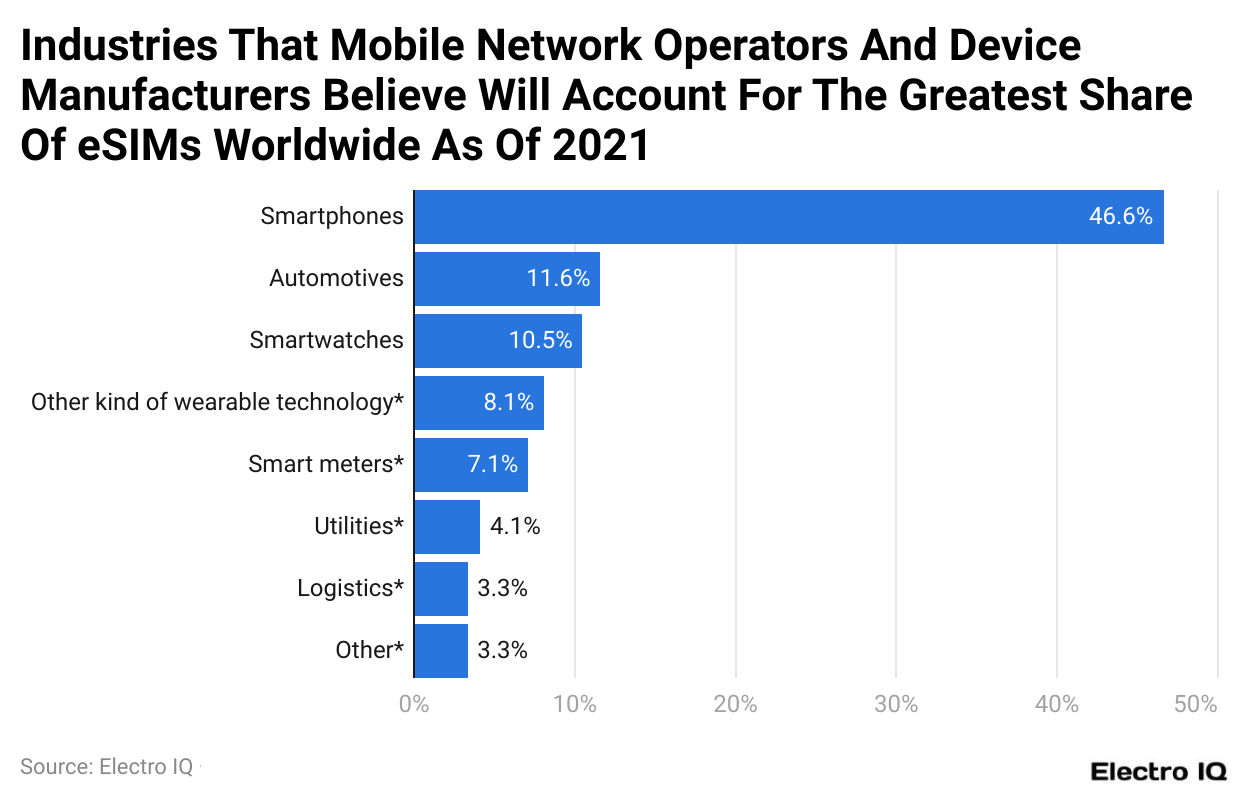

Top Industries For eSIM

(Reference: Statista.com)

- The eSIM statistics reveal that in 2021, Smartphone has the highest share of eSIMS as of 2021 with 46.6% share.

- It is followed by Automotive, smartwatches, other kinds of wearable technology, smart meters, utilities, and logistics.

Future Plans For eSIM Adoption By Device Manufacturers

(Reference: Statista.com)

- The prospect of the success of eSIM can be estimated by the potential witnessed by eSIM operators.

- The eSIM statistics show that 89.8% of mobile network operators are planning to offer eSIM by 2025, in comparison to 82.1% of device manufacturers.

- The idea of embedded SIM involves the process where eSIM is installed in the hardware during the manufacturing stage itself. Thus ensuring it is capable of hosting multiple profiles altogether.

Ranking Of eSIM Provider Companies

(Reference: Statista.com)

- The eSIM statistics show that Thales has the highest ranking among eSIM manufacturers, with an 182 core rating.

- It is followed by Giesecke+Devrient (G+D) with 178, IDEMIA with 149, Truphone with 147, Workz with 139, Oasis Smart SIM with 130, Valid with 125, Kigen with 119, Eastcompeace with 105, Invigo with 104 core rating.

IoT Devices Connected Worldwide

(Reference: Statista.com)

- The number of connections of IoT devices worldwide is directly related to the success of the eSIM network.

- The eSIM statistics show that in 2023, there will be 13,143 million connected IoT devices with Electricity, Gas, Steam and A/C industry-leading.

- By the end of 2030, it is expected that there will be 29,422.1 million IoT devices connected globally.

No Connected Devices Globally

(Reference: Statista.com)

- eSIM statistics showcase the rise in the number of connected devices globally.

- In 2023, there are 26.1 billion connected devices with 12.09 billion connected with IoT and 8.32 billion with mobile phones.

- By the end of 2030, it is predicted that there will be 50.32 billion devices connected in total. With 31.63 billion connected via IoT and 8.91 billion connected with the assistance of mobile phones.

Wide And Short-Range IoT Devices Worldwide Connection Increase

(Reference: Statista.com)

- The eSIM statistics reveal that there is a rise in the number of IoT devices which themselves can be categorized as short-range and long-range.

- As of 2023, 12,393 million short-range and 3,319 long-range devices are connected.

- By the end of 2027, it is predicted that there will be 25,150 short-range IoT and 5,423 long-range IoT devices connected worldwide.

eSIM Overview

- The adoption of eSIM technology has gained momentum in 2023 and is expected to grow significantly through 2024. eSIMs, or embedded SIMs, offer a convenient, digital alternative to physical SIM cards, allowing users to switch carriers without the need for a physical card. This shift is influencing various sectors, including mobile phone manufacturing, telecommunications, and IoT (Internet of Things) devices.

- In 2023, global eSIM adoption was driven by increasing smartphone penetration, with Apple, Samsung, and Google being the leading manufacturers supporting this technology. eSIM-compatible smartphones accounted for 25% of global shipments, and the number of active eSIM devices reached around 1 billion. The global eSIM market was valued at approximately 4.5 billion US dollars in 2023, with a projected compound annual growth rate (CAGR) of 20% from 2023 to 2028.

- In terms of regional adoption, North America and Europe led the market, with a combined market share of around 60%. North America alone contributed to 35% of the global market in 2023, largely due to the popularity of Apple devices in the region. Europe followed with 25%, benefiting from favorable regulatory environments that promote the use of eSIMs in both consumer devices and IoT applications. The Asia-Pacific region is rapidly catching up, with a market share of about 20%, fueled by the increasing demand for IoT-enabled devices and smartphones.

- By 2024, eSIM Statistics show that the global market is expected to surpass 5.4 billion US dollars. This growth is anticipated as more mobile network operators support eSIM technology, and an increasing number of smartphones, tablets, and wearables adopt eSIM functionality. The number of eSIM-enabled devices is forecasted to rise by 30%, reaching nearly 1.3 billion devices by the end of 2024. The Asia-Pacific region is expected to witness the highest growth, with its market share likely to grow to 25%, driven by expanding 5G networks and increased IoT deployments.

- One of the key drivers of eSIM growth is its integration into IoT devices. In 2023, eSIMs were integrated into more than 100 million IoT devices globally, accounting for 15% of the total IoT connections. By 2024, this figure is expected to grow to 150 million devices, making up 20% of IoT connections. This trend is being driven by industries such as automotive, healthcare, and logistics, which benefit from the seamless connectivity and remote management capabilities that eSIM technology offers.

Conclusion

The eSIM market is experiencing rapid growth owing to the rise in popularity and the logistical advantages it offers. eSIM statistics reveal that the market is projected to reach $16.3 billion by the end of 2027. For the most part, this growth is based on factors such as increasing smartphone adoption, IoT expansion, and the shift towards digital connectivity solutions.

As mobile network operators are realising the advantages of eSIM networks it is expected to have an unprecedented number of eSIM subscribers worldwide.

Sources

FAQ.

eSIM market is expected to be $16.3 billion by the end of 2027.

Smartphones, automotive, smartwatches, and IoT devices are the industries that are expected to be the leaders in eSIM adoption.

Streamlined cost reduction and new opportunities for digital services are some of the advantages of mobile operations that opt of eSIM.

Saisuman is a skilled content writer with a passion for mobile technology, law, and science. She creates featured articles for websites and newsletters and conducts thorough research for medical professionals and researchers. Fluent in five languages, Saisuman's love for reading and languages sparked her writing career. She holds a Master's degree in Business Administration with a focus on Human Resources and has experience working in a Human Resources firm. Saisuman has also worked with a French international company. In her spare time, she enjoys traveling and singing classical songs. Now at Smartphone Thoughts, Saisuman specializes in reviewing smartphones and analyzing app statistics, making complex information easy to understand for readers.