ROHM Semiconductor Statistics By Revenue and Facts

Updated · Jan 28, 2025

Table of Contents

Introduction

ROHM Semiconductor Statistics: ROHM Co., Ltd., which is a crucial member of the Canadian marine industry, recently made public its financial performance as of the last day of the 2024 fiscal year, March 31. There were many factors that combined to bring sales and profitability down. Here is a precise overview of the financial situation of the Rohm statistics ratios hopefully giving a clear impression of the standing of the company.

Editor’s Choice

- In 2024, ROHM’s net revenue amounted to ¥467.78 billion or decreased by ¥40.10 billion (-7.90%) compared with FY2023, largely resulting from weaker semiconductor demand.

- Profit experienced a strong increase, and it resulted in 12.33% in the previous year, getting up to ¥507.88 billion, while an increase in demand took place in the automotive and industrial sectors.

- It exhibited a fluctuating trend in its revenue growth for the last five years, experiencing tremendous growth in 2022 (25.63%), followed by a contraction in 2020 (-9.05%)) and smaller in 2021 thereof (-0.83%).

- Rohm statistics show that the shareholding of the corporation has varied, with 36.38% foreign holdings, 28.54% holdings by banks, and 13.27% held by individuals.

- The first is The Master Trust Bank of Japan, Ltd., whose stake is 14.84%, and then comes the Rohm Music Foundation with a 10.76% stake.

- These 23,300 people were employed by ROHM in FY2023. That is down from over 400 employees in the previous year.

- Operating profit in FY2024 decreased significantly, falling by ¥58.3 billion. This reduction is attributable mainly to the increase in fixed costs, Forex, and the impact of increased labour and depreciation costs.

- Rohm statistics indicate that the major expenditure foreseen for FY2024 was ¥52.7 billion, much below what was originally stated (¥150 billion) with an emphasis on capacity increase and the acquisition of land and buildings.

- For ROHM, in FY2024, the sales of Integrated Circuits (IC) and Discrete semiconductors fell whereas the segments Modules and others showed a slight growth in sales as well as profits.

- ROHM had total assets amounting to ¥1,528,346 million as Q2 of FY2025, higher by ¥47,072 million from the immediate, preceding fiscal year in effect because there was a real increase in investment in property and equipment.

- The total liabilities have been elevated by ¥66,379 million, due mainly to the enhancement of long-term borrowings and bonds payable.

- Rohm statistics reveal that most of the decline in net assets to the tune of ¥19,308 million is due to the difference in shareholders’ equity, conversion in foreign currency, and the valuation of available-for-sale securities.

Rohm Revenue

(Reference: stockanalysis.com)

(Reference: stockanalysis.com)

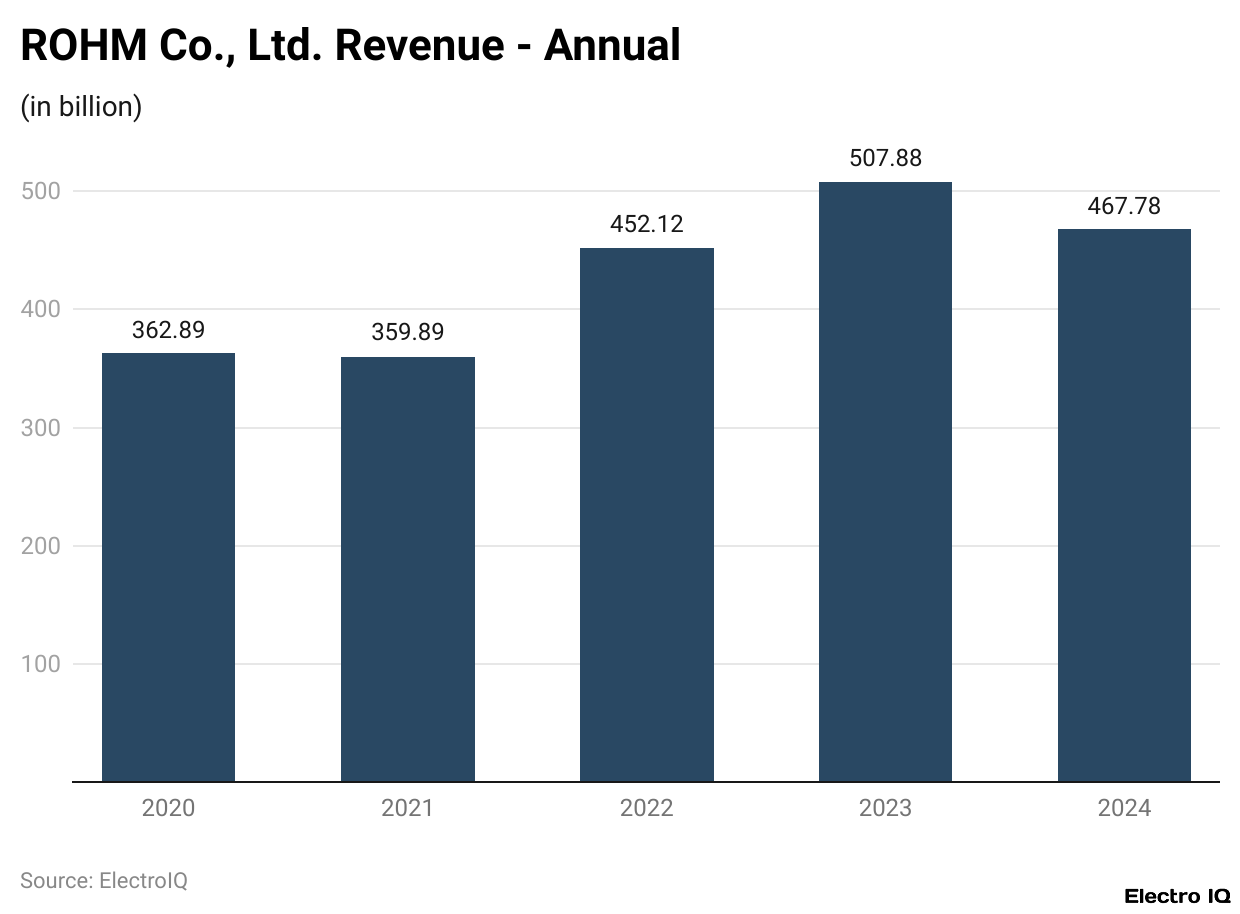

- Rohm statistics state that ROHM’s revenue in these five consecutive years shows some subtle annual fluctuations, which have been affected by market conditions and industry demand. In the most recent fiscal year ending March 31, 2024, ROHM reported revenue of ¥467.78 billion.

- Despite the fact that these are reduced by ¥40.10 billion from the previous year’s statistics, which turned out to be ¥507.88 billion, hence a red flag marking a negative growth rate of – 7.90%. This scrupulously the downturn is marked by weak demand in many sectors’ semiconductor market.

- This simply implies that whereas the fiscal year ending March 31, 2023, marked a period of very significant income growth for ROHM, the company realized revenue increased by ¥55.76 billion to ¥507.88 billion.

- This figure represents 12.33% revenue growth due to a significant demand spurt in semiconductor components used in automotive and industrial applications.

- This growth was inspired by the relatively even stronger peaks of revenues during the fiscal year to March 31, 2022, when an immediate improvement rose by ¥92.24 billion to ¥452.12 billion, reflecting a growth rate of 25.63%.

- This hike in revenue was certainly catalyzed by the post-pandemic recovery, which indicated increased investments in electronics, renewable energy, and industrial automation.

- However, during the fiscal year ending March 31, 2021, for the subject of changing fortunes, ROHM fell slightly by recording either ¥3.00 billion less or a total of ¥359.89 billion in revenue.

- The declining figure of -0.83% that year was mainly due to disruptions in the supply chain and uncertainties caused by COVID-19.

- A much larger drop was reported in the fiscal year ending March 31, 2020, when a decrease of ¥36.10 billion down to ¥362.89 billion was recorded to demonstrate that some growth in revenue was expected to hold a negative rate of about -9.05%.

(Reference: micro.rohm.com)

(Reference: micro.rohm.com)

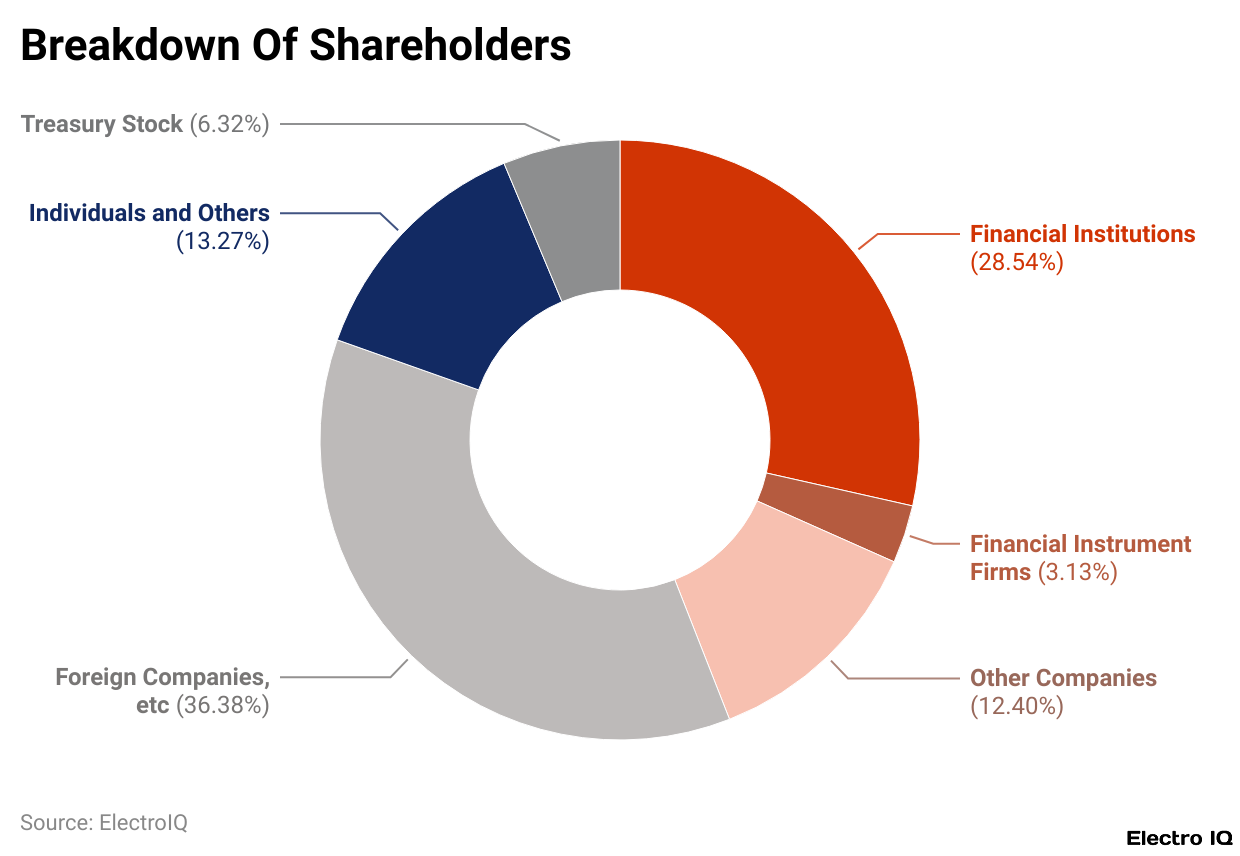

- ROHM’s shareholder base is unique – it is shared with various entities by varying proportions of the company stock.

- Rohm statistics show that Treasury stock amounts to 6.32% of the total equity. It refers to such shares as the compensated shares that are repurchased by the company but not reissued or retired.

- These shares are neither having voting rights nor entitlement to dividends, but they can be used for future corporate actions like stock-based compensations or mergers. Individuals and other investors collectively hold 13.27% of the shares.

- This mostly includes retail investors, small private investors, and company employees who own shares in the company.

- Such shareholders are typically assuming investments in ROHM for long-term growth or dividend returns.

- The institutions hold significant stakes in the stock of the company in terms of ownership, and their share is valued at 28.54%.

- They typically include banks, insurance agencies, and pension pools that have invested in ROHM as a strategy to diversify the pool.

- Large shareholding signifies that the companies are confident about the long-term stability and financial health of the company.

- The largest of the shareholding comes into the hands of foreign companies and other overseas investors, who have 36.38% of the total shares.

- These categories of investors are usually international firms, hedge funds and institutional investors that consider ROHM to be a key player in the global semiconductor market.

- Such an off-shore percentage signifies that the company has an excellent acceptance on the global platform or competitiveness to boot.

- The stock owned by ROHM stands at 3.13% since such ownership would be held by financial instrument firms, including investment firms and securities companies.

- These companies follow market-making activities; they are into trading and investment banking services. The presence of these companies solely suggests that the share of ROHM is actively traded in the financial market.

- According to another study done in 2013, however, 12.40% of the shares are owned by other companies exposed to other companies that engage in cross-shareholding relationships, those companies buy each other’s shares to enhance business relationships.

- These holdings may include other strategic alliances such as those taken up with suppliers, customers, or affiliated businesses that maintain an interest in the long-term success of the ROHM Company.

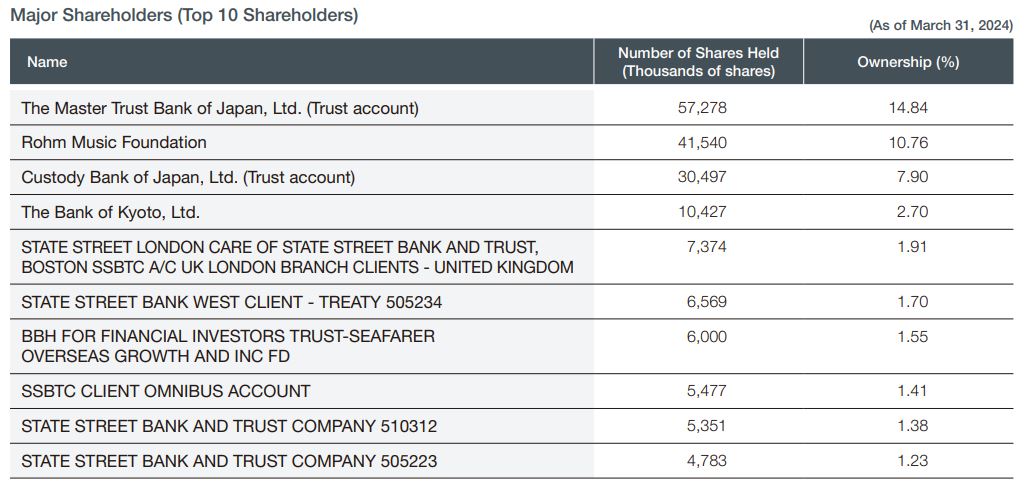

- Most of the business encompassed among ROHM’s largest shareholders are the institutions or foundations.

- Rohm statistics indicate that the largest stakeholder is reported to be The Master Trust Bank of Japan, Ltd. (Trust account), holding 57278,000 shares, which is equivalent to 1484%.

- The second-largest ownership belongs to Rohm Music Foundation holding 41540,000 shares with 1076% ownership. In effect, the Custody Bank of Japan, Ltd. (Trust account) holds 30,497,000 shares, representing 790%. The Bank of Kyoto, Ltd. has 10,427,000 shares, amounting to 2.70% firm ownership.

- Some big names in the international institutional investors group include STATE STREET LONDON CARE OF STATE STREET BANK AND TRUST BOSTON-SST BANKING AS AGENT FOR THE LONDON BRANCH CLIENTS – UK holding 7374 thousand shares (191%), and STATE STREET BANK WEST CLIENT-TREATY, with a stake in the company amounting to 6569 thousand.

- Greater than or equal to five million shares are owned by -BBH FOR FINANCIAL INVESTORS: A/C SEAFARER OVERSEAS GROWTH AND INC FD: 5477 thousand.

- A couple of State Street Bank and Trust Company accounts, 510312 and 505223, amount to 5361 thousand and 4783 thousand shares, respectively. Based on the above, the share distribution implies that the shareholder manifest comprises a mix of institutional investors.

Number Of Rohm Employees

(Reference: statista.com)

(Reference: statista.com)

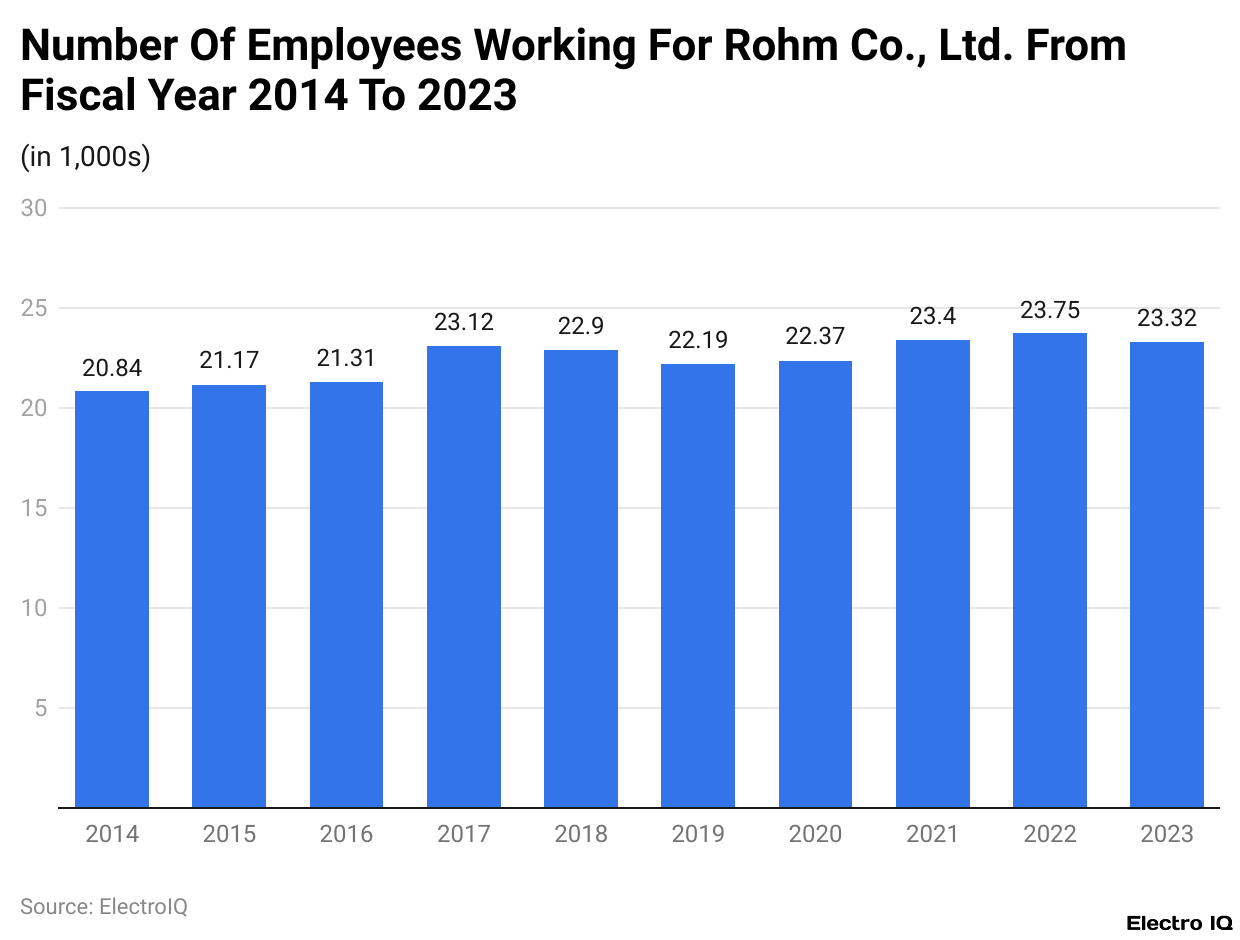

- Rohm Co., Ltd., had 23,300 employees by the end of fiscal year 2023, which was even fewer by more than 400 as compared with the previous year.

- This corporation manufactures integrated circuits and discrete semiconductor devices in the electronics field.

- Rohm was established in 1958 and is located in Kyoto, Japan. It has classified itself as one of several key players in the semiconductor market.

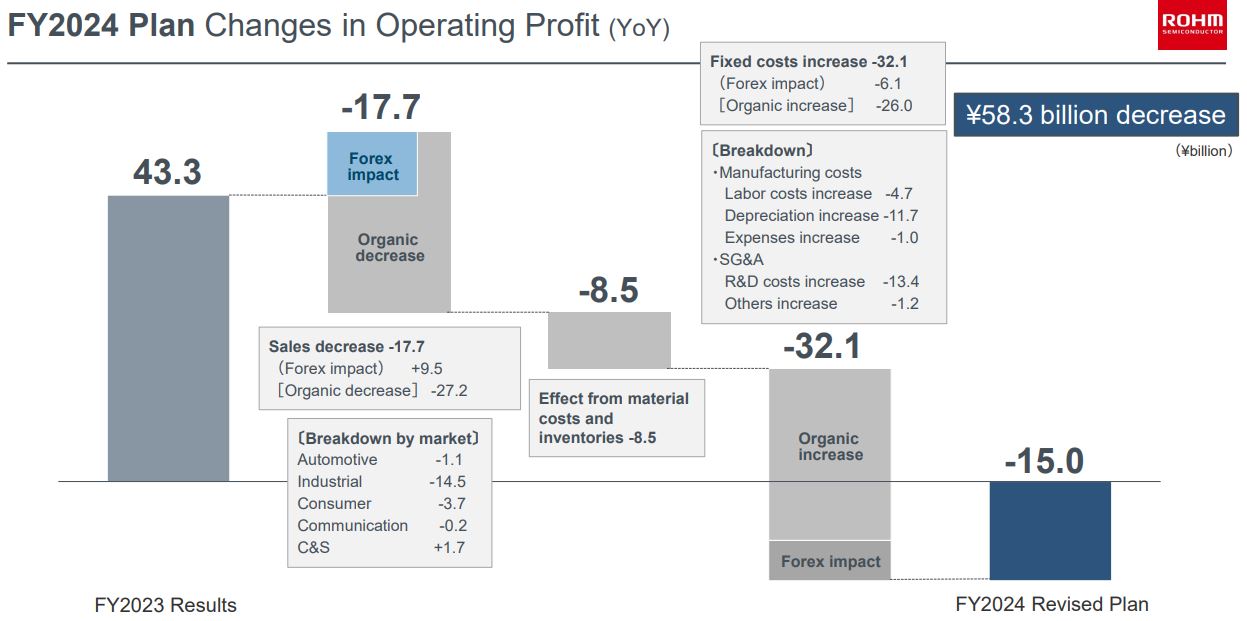

Changes In Rohm Operating Profit

(Source: micro.rohm.com)

(Source: micro.rohm.com)

- Rohm statistics reveal that the operating profit of ROHM fell significantly in total and available by ¥ 58.3 billion. A major factor among these is the foreign exchange (Forex) impact contributing to ¥17.7 billion in deflation.

- Moreover, an increase in fixed costs contributed to constriction in profitability up to a reduction of ¥32.1 billion.

- Within this, the Forex impact is ¥6.1 billion, whereas the addition in fixed costs is organic in nature and accounts for ¥26.0 billion.

- The major contribution to the decrease was the price of manufacturing, while labor costs escalated by ¥4.7 billion, and depreciation by ¥11.7 billion.

- General and research and development (R&D) costs led to other reductions, with R&D expenses going up by an additional ¥13.4 billion. More expenses came from miscellaneous expenses, creating another ¥1.2 billion of impact.

- The company also experienced a revenue decline, which further decreased its operating profit by ¥17.7 billion. But it was all supported by Forex, positively impacting sales up to ¥9.5 billion nine hundred thousand yen.

- Despite that, the further organic decrease in sales was ¥27.2 billion, which was higher than the Forex benefit.

- With respect to each market, the total organic decrease in operating profit was ¥32.1 billion. The automotive sector contributed a decrease of ¥1.1 billion, while the industries sector was impacted most with a decrease of ¥14.5 billion.

- A decrease of ¥3.7 billion was seen in the consumer segment and ¥0.2 billion in the communication segment.

- On the positive side, the C&S (Components & Systems) area was the only growth, with an increase of ¥1.7 billion, partially offsetting the overall decrease.

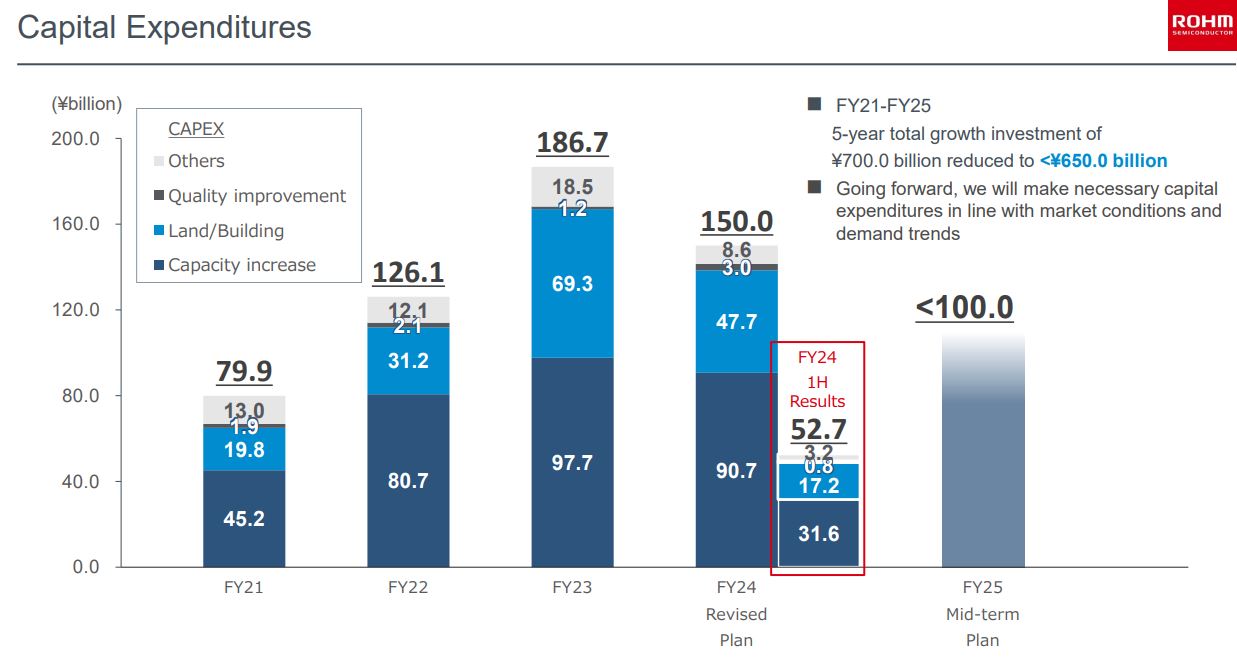

Capital Expenditures

- The corporate capex of Rohm shows the trend of the past few years and proves that aspect of the developmental strategy underway with investment.

- Rohm statistics demonstrate the Total capital expenditure in the financial year 2021 was at ¥79.9 billion, with distribution as follows: ¥45.2 billion for capacity increase, ¥19.8 billion for acquiring land and buildings, and here and there ¥1.9 billion and ¥13 billion for quality improvement and other expenses.

- The total expenditure was higher in FY2022, totalling ¥120.1 billion. Surely the capacity increase segment topped it because it grew to such heights at ¥80.7 billion, which was almost double that of the previous year.

- There was an increment in investing in lands and buildings that reached ¥31.2 billion. But, unfortunately, other expenses and quality improvement kept somewhat stable throughout at ¥12.1 billion and US$2.1 billion.

- The highest rate of the capex was registered in the financial year 2023- during any of the periods the presence of a total of ¥186.7 billion.

- The CAPEX for pursuing all these developments hit ¥97.7 billion only for an increase in capacity, and the building and related investments leapt to ¥69.3 billion.

- Other expenses increased to ¥18.5 billion and then fell to ¥1.2 billion for quality improvement investments.

- For FY2024, initially, the revised planned capital expenditure was recorded at around ¥150.0 billion.

- Out of this, ¥90.7 billion was budgeted for capacity increases, and ¥47.7 billion was allocated for land and buildings.

- The final outcome fell below expectations at ¥52.7 billion, where ¥31.6 billion investment produced only a few capacity expansions, while land and building investments item reduced to ¥17.2 billion.

- Other expenses and quality improvement investments were also cut to as low as ¥3.2 billion and ¥0.8 billion, respectively.

- The subsequent financial year, 2025, is also proposed to remain under ¥100 billion.

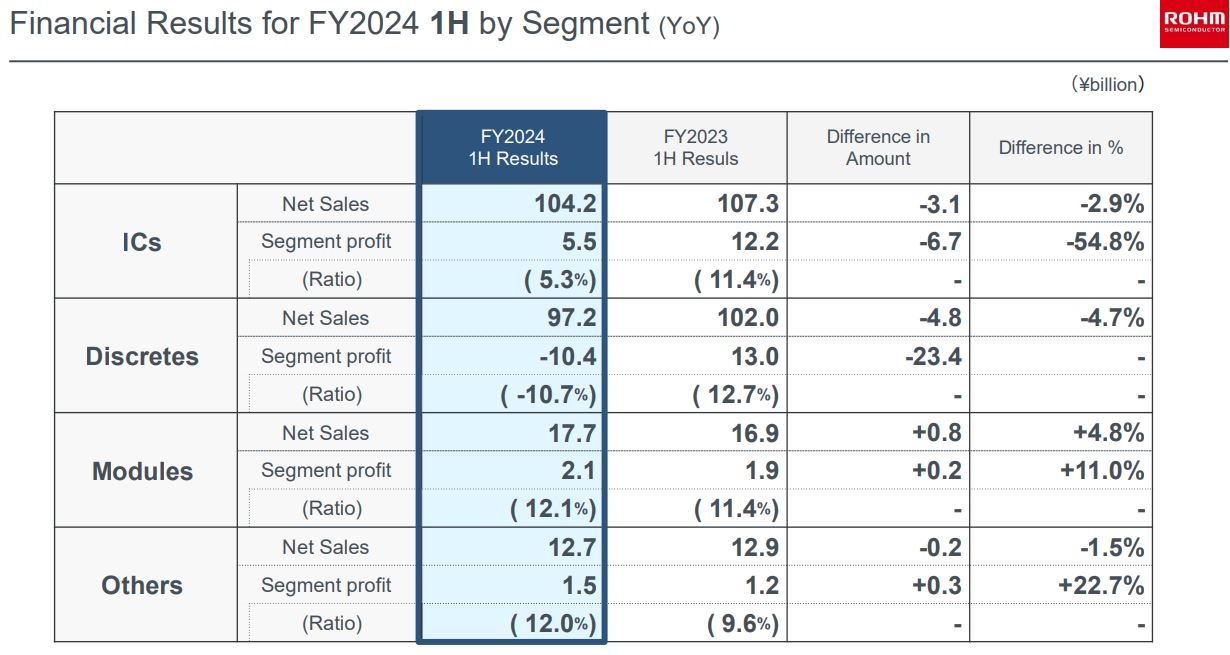

Rohm Net Sales By Segment

(Source: micro.rohm.com)

(Source: micro.rohm.com)

- Rohm statistics show that ROHM’s net sales by segment for FY2024 demonstrate varying levels of performance across different areas of business.

- The ICs segment recorded a net sales decrease of from ¥107.3 to ¥104.2 billion, a difference of ¥3.1 billion or 2.9% loss in FY2024 over 1H FY2023.

- The profit fell from ¥12.2 billion to a mere ¥5.5 billion- a massive drop amounting to ¥6.7 billion or about 54.8%- and, hence, tightening the profit margin from 11.4% in half of 1H FY 2023 to 5.3%.

- Discrete semiconductors also suffered a decline, with net sales of ¥97.2 billion, which is a decline of an impressive ¥4.8 billion (4.7%) as compared to the ¥102.0 billion in the first 6 months of FY23.

- Likewise, the profit margin in profit went down dramatically from a positive ¥13.0 billion to – ¥10.4 billion, or (-) 23.4 billion; hence it brought the profit rate to break even, as in just – 10.7% (from 12.7%).

- Modules were positioned as having historically performed well in the net with sales increase from ¥16.9 billion in 1H FY2023 to ¥17.7 billion in 2024, yielding a positive ¥0.8 bn increase or a 4.8% increase.

- It also marked the improvement in the segment’s profitability, as it had an increase in profit level, from ¥1.9 billion to ¥2.1 billion or 0.2 billion up, or 11.0%. The profit ratio also improved from 11.4% to 12.1%.

- “Others” recorded very good performance with an apparent decrease of ¥0.2 billion from ¥12.9 billion in the first half of FY2023 to reach ¥12.7 billion for the entire year 2024, a decrease of 1.5%, and a diffusion of profit from ¥1.2 billion to ¥1.5 total profit-an increase of ¥0.3 billion or 22.7% in rate, sharing profits raised from 9.6% to 12.0%.

Rohm Assets And Liabilities

- According to March 31, 2025, the total assets of ROHM stood at ¥1,528,346 million as of that quarter.

- This represented an increase of ¥47,072 million over the total assets of the company during the previous fiscal year.

- The increase was primarily due to a decrease of ¥14,480 million in investment securities and ¥7,406 million reduction in income taxes refundable, which were partly offset by an increase of ¥6,356 million in securities and a rise of ¥10,912 million in property, plant and equipment.

- However, a steep rise was witnessed in total liabilities totalling ¥579,551 million.

- Comparing this figure from the previous fiscal year, it was evident that there was indeed an increase of ¥66,379 million in liens.

- Obviously, the reason for this was the ¥200,000 million decrease in short-term borrowings as well as the ¥34,220 million decrease in accounts payable (other).

- In every situation, a raise of ¥200,000 million on long-term debt was countered as were additional bonds payable issues worth ¥100,000 million.

- Total net assets amounted to ¥948,794 million, which was less than ¥19,308 million.

- Among the most important causes for the decline in net assets, there was a ¥7,491 million reduction in shareholders’ equity resulting from the payment of dividends, a ¥6,304 million decrease in foreign currency translation adjustments, and a ¥5,704 million reduction in valuation differences on available-for-sale securities.

Conclusion

According to Rohm statistics, it is anticipated that ROHM will continue to see challenges for both global economic and semiconductor industries. The company forecasts a full-year sales decline to ¥450 billion due to an estimated decrease in operating and ordinary profit. In responding to these challenges, production adjustments would lead them to better align future production volume with customer demand, especially in products involving energy-saving solutions and advanced power devices.

In short, as the company had a difficult year marked by declines in terms of sales and profitability, strategic investments as well as consumer adjustments will put it in good shape to capture future growth opportunities in the semiconductor industry.

Sources

FAQ.

FY2024 observed a reduction in ROHM’s sales by ¥40.10 billion when it stood at ¥467.78 billion, a fall of 7.90%. Besides, a weakening of demand for semiconductors in a variety of fields, especially in the automotive industry, led to this market deceleration, thus contributing greatly to their lessened sales performance.

The capital investments for ROHM have had their highs and lows over the years, and in FY2024, they could have brought in ¥52.7 billion in the real value of the capital expended, which was much less compared to the initial estimate of ¥150 billion. This scenario has emerged with the change due to more frugal resource allocation in response to market meetings and will also carry out fewer investments in capacity expansion or land and buildings.

Shareholders of ROHM are institutional investors and foundations. The biggest ROHM shareholder is Master Trust Bank of Japan, Ltd. at 14.84% as well as Rohm Music Foundation at 10.76%. Others are the Custody Bank of Japan and the Bank of Kyoto, Ltd.

ROHM’s semiconductor business results for FY2024 were mixed. Integrated Circuits (IC) and Discrete semiconductors experienced deterioration in both revenues and profits. However, Modules were able to record increases in net sales and profits, reflecting the good performance in this category. Other categories provided stable results with some slight profit increases.

Per Fiscal Year 2023, there were approximately 23,300 employees of ROHM, presenting a difference of more than 400 from the previous year. Despite this decrease, the company remains an important player in the semiconductor industry, focused on keeping its workforce and adjusting to changes in the business environment.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.