Skyworks Statistics By Revenue, Assets, Market Capitalization and Facts

Updated · Oct 25, 2024

Table of Contents

- Introduction

- Editor’s Choice

- Skyworks Solutions’ Worldwide Revenue

- Assets Of Skyworks

- Skyworks Solutions Operating Income

- Research And Development Expenses Worldwide

- Skyworks Revenue By Country

- Skyworks Solutions' Market Capitalization

- List Of Skyworks Products

- List of Skyworks applications

- Skyworks Overview

- Conclusion

Introduction

Skyworks Statistics: Skyworks Solutions is an American semiconductor company headquartered in California. The company is known for offering low-noise and power amplifiers to various industries. It has emerged as one of the largest semiconductor companies globally.

Accordingly, one needs to go through the Skyworks Statistics to understand this company and how it will perform in terms of its different aspects. Moreover, we will go through the company’s product portfolio to gain a better understanding of the aspects that make it stand out among its competitors.

Editor’s Choice

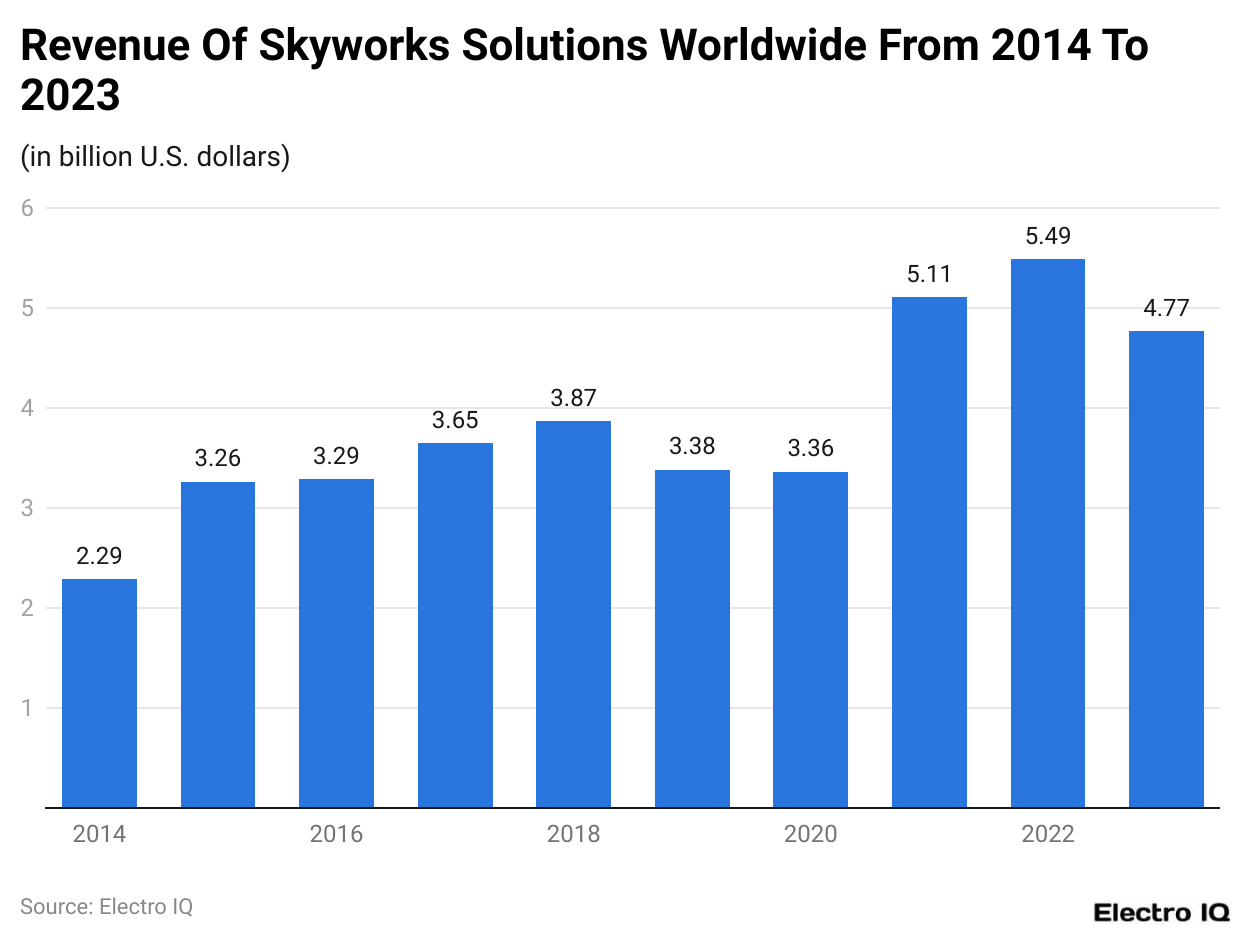

- Skyworks’ revenue peaked at USD 5.49 billion in 2022, showcasing recent growth.

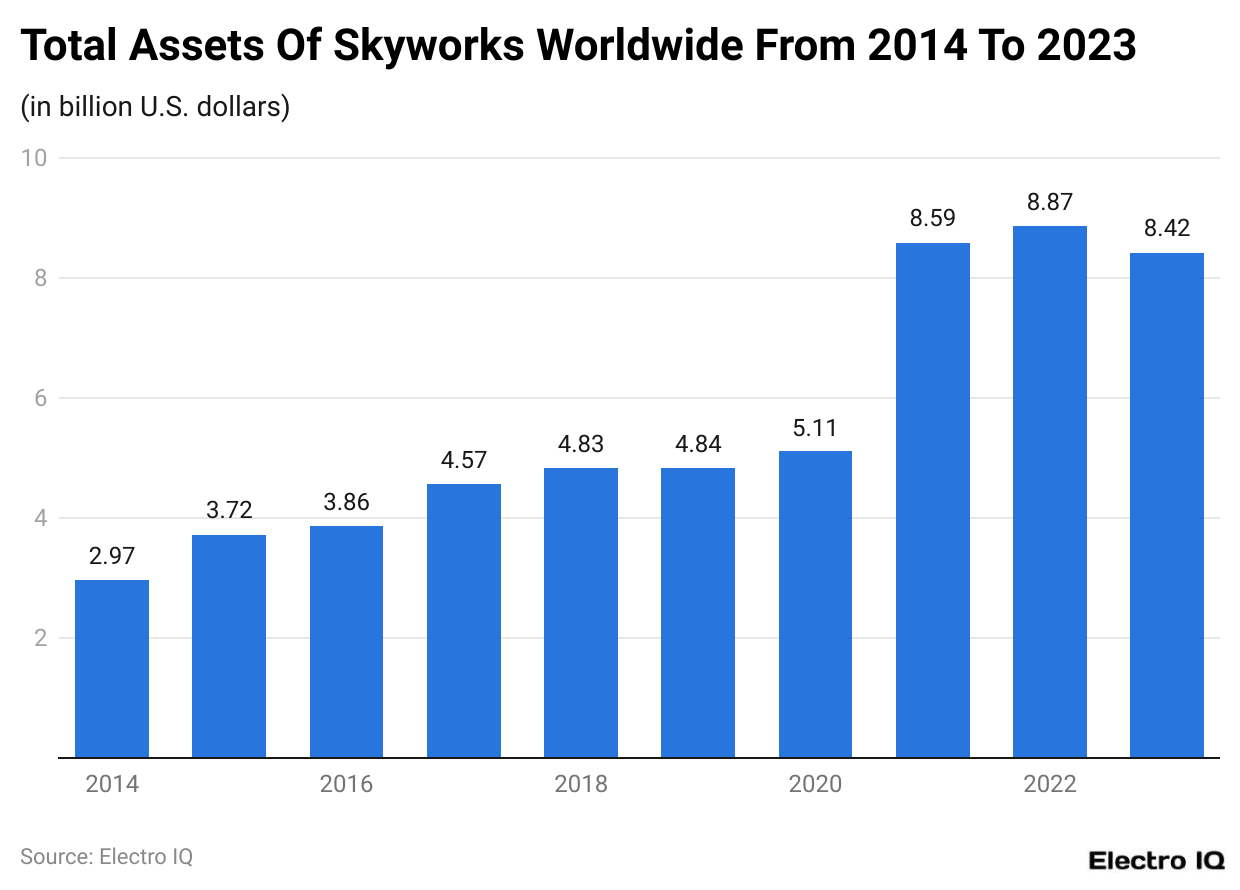

- The company’s assets reached USD 8.42 billion by the end of 2023, indicating financial stability.

- Skyworks’ highest operating income was USD 1.61 billion, demonstrating strong profitability potential.

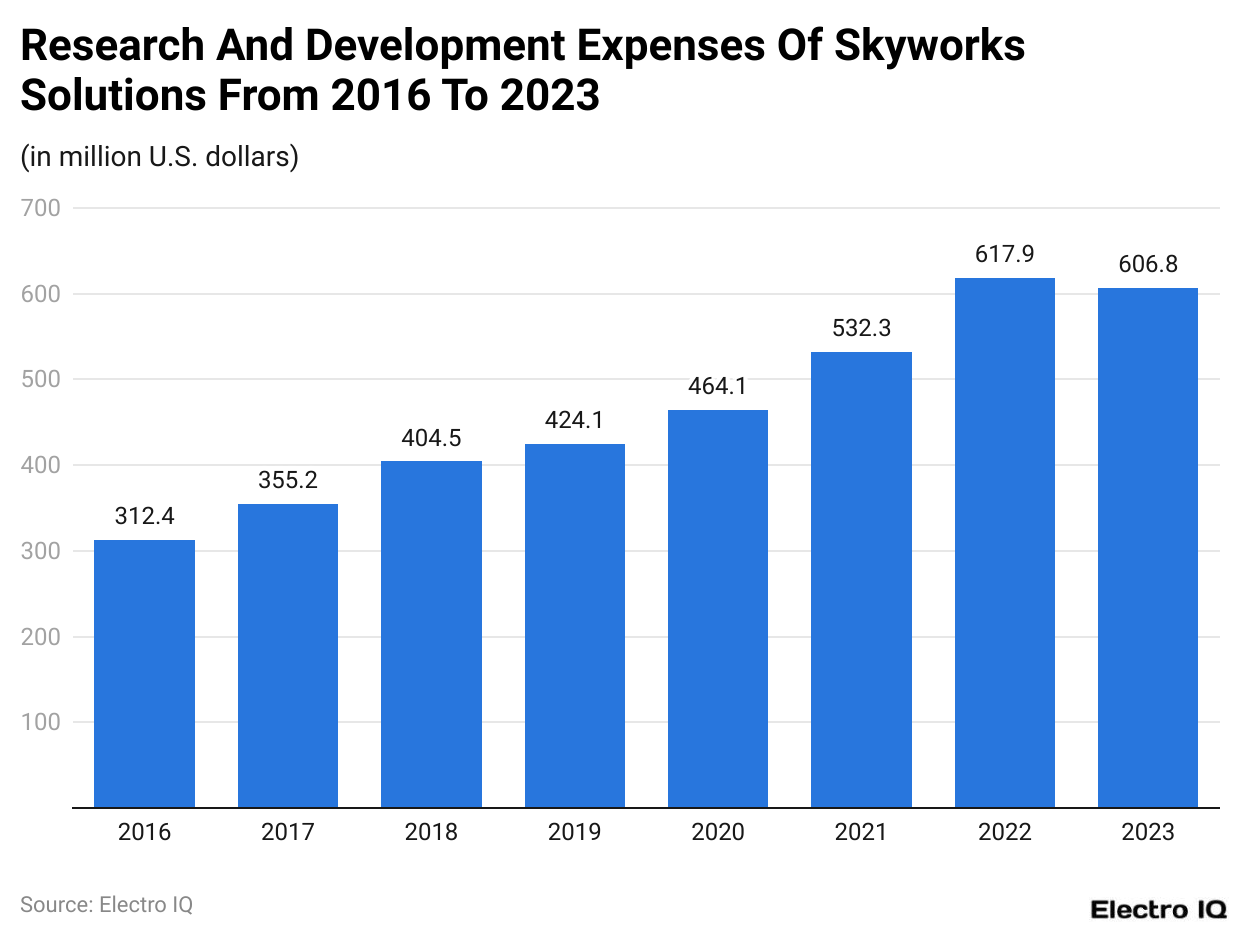

- R&D investment peaked at USD 617.9 million in 2022, highlighting commitment to innovation.

- The U.S. market contributed USD 2012.8 million to Skyworks’ revenue in 2023, leading all regions.

- Skyworks’ market capitalization reached its highest at USD 32.67 billion in 2021.

- The company’s product portfolio spans over 20 major categories, indicating diversification.

- Skyworks serves more than ten major application areas, from aerospace to wireless infrastructure.

- 70% of Skyworks’ 2023 revenue came from mobile communications, showing sector dominance.

- The remaining 30% of revenue was split between automotive, industrial, and other markets.

- Skyworks maintained a profit margin of approximately 21% in 2023 despite market challenges.

- Analysts project a 5% revenue increase for Skyworks in 2024, reaching around USD 5.8 billion.

- Skyworks had around USD 1 billion in cash reserves at the end of 2023, providing financial flexibility.

Skyworks Solutions’ Worldwide Revenue

(Reference: Statista.com)

- Skyworks statistics reveal that its revenue has been consistently increasing.

- Between the period (2014 – 2023), the highest revenue was recorded in 2022 at $5.49 billion.

- By the end of 2023, Skyworks Solutions generated revenue of $4.77 billion.

Assets Of Skyworks

(Reference: Statista.com)

- Skyworks statistics reveal that the value of assets has been increasing consistently.

- By the end of 2023, the assets of Skyworks were $8.42 billion.

- Between the period (2014 – 2023), the highest assets were recorded at $8.87 billion.

Skyworks Solutions Operating Income

(Reference: macrotrends.net)

- Skyworks statistics show that the company's operating income has been variable over the years.

- The highest net income recorded was 1.61 billion dollars.

- By the end of 2023, the operating income generated was $0.831 billion.

Research And Development Expenses Worldwide

(Reference: Statista.com)

- The Skyworks statistics reveal that the company has increasingly invested in research and development.

- Between the period (2016 - 2023), the company invested the highest in 2022 at $617.9 million.

- By the end of 2023, the company had invested $606.8 million.

Skyworks Revenue By Country

(Reference: Statista.com)

- The Skyworks statistics showcase that the country's revenue-generating regions are the United States, China, South Korea, Taiwan, Europe, the Middle East and Africa, and Other Asia-Pacific.

- By the end of 202, the United States had the highest contribution for Skyworks revenue with $2012.8 million, followed by China with $700.7 million, South Korea with $254.6 million, Taiwan with $240.4 million, Europe, Middle East and Africa with $122.9 million, Other Asia-Pacific regions with $24.3 million.

Skyworks Solutions' Market Capitalization

(Source: stockanalysis.com)

- As per Skyworks statistics, the market capitalization of Skyworks has seen a considerable level of ups and downs.

- The highest market cap Skyworks received was $32.67 billion in 2021

- As of September 2024, the market capitalization of Skyworks is $15.8 billion.

List Of Skyworks Products

As per the Skyworks statistics, here are the products that Skyworks offers

Amplifiers

- Cellular PAs: 5G, 4G/LTE, 3G (GSM/TD-SCDMA/WCDMA), 2G (GSM/GPRS/EDGE)

- Multiband (MMMB)

- Multimode (MMMB)

- Gain Block (General Purpose)

- Wi-Fi Connectivity

- BDS/GPS/GNSS

- Low Noise Amplifiers (LNAs)

- CATV

- Variable Gain Amplifiers (VGAs)

- Wireless Infrastructure and Small Cells

- Smart Energy: Connected Home and Automation 802.15.4, Zigbee, and ISM Zigbee

- 5G/NR Efficient Small Cell Power Amps

Audio and Radio

- Automotive Tuners

- Audio Data Drivers

- Consumer Digital Radios

- MultiBand Radios

- Automotive Digital Data Receivers

- Automotive Digital Radio Coprocessors

- FM Radios

- Evaluation Kits

Attenuators

- Digital Attenuators

- Fixed Attenuator Pads (ATN5XXX)

- Voltage Variable Attenuators (VVAs)

- Fixed Attenuator Pads (ATN25XXX)

Automotive Timing

- Automotive Clock Buffers

- Automotive PLLs/Clock Drivers

- Automotive PCIe Buffers (Clock Drivers)

- General Purpose Clock Buffers

- Low-power PCIe Buffers (Clock Drivers)

- CMOS/CMOS HCSL, LVDS, LVPPECL, PCIe Buffer/Driver SSTL/HSTL

Clock Generators

- CMOS General Purpose

- Low-Power PCIe

- Ultra-Low Jitter

Jitter Attenuators

- Wireless Jitter Attenuators

- Coherent Optical Clocks

- General Purpose Jitter Attenuators

- High-Performance Jitter Attenuators

SONET/SDH Clocks

- RF Synthesizers

- Evaluation Kits

IEEE 1588 and Synchronous Ethernet

- Network Synchronizer Clocks

- AccuTime IEEE 1588 Software

- Legacy Network Synchronizer Clocks

Power Management

- Display and Lighting

- Voltage Regulation

- Power Protection and Power Distribution

Diodes

- Limiter Diodes

- High-Reliability Diodes

- PIN Diodes

- Limiter Modules

- Schottky Diodes

- Varactor Diodes

Modems and DAAs

- Data and Voice Modems

- Fax Modems

Power Over Ethernet

- Powered Devices

- PSE Controllers (Power Sourcing Equipment)

- Class 3/4 Powered Devices

- Class 4/5/0 Powered Devices

- Evaluation Kits

- Multi-Port PSE Controllers

- Single-Port PSE Controllers

- Reference Designs

- PoE Training Videos

Front-End Modules

- Cellular: 5G/5G NR, 4G/LTE, 3G (GSM/TD-SCDMA/WCDMA), 2G (GSM/GPRS/EDGE)

- Multi-Carrier

- Cellular IoT and M2M

- Multi-Band

- Automotive

- BDS/GPS/GNSS

Wi-Fi Connectivity

- Wi-Fi 2.4 GHz

- Wi-Fi 5 GHz

- Wi-Fi 6 GHz

- Wi-Fi 6E

- Wi-Fi Multi-Band

- Diversity Receive

- Connected Home, Industrial, M2M, Medical, Smart Energy, and Automotive

- CATV

Isolation

- Automotive Isolation

- Industrial I/O

- Digital Isolators

- Isolated FET Drivers

- Isolated Gate Drivers

- Isolated Transceivers

- Isolated Analog and ADCs

- Evaluation Kits

Switches

- Antenna Swap Switches

- Smart Coupler

- Antenna Switch Modules

- Band Distribution and General Purpose Switches

- Antenna Tuning Switches

- Carrier Aggregation

- SPDT, SP3T, SP4T

- SP5T, SP6T

- SP7T, SP8T, SP9T

- Differential Receive Filter Switches

- High Power SPDT and SPST PIN Diode Switches

TV and Video

- Digital TV and Satellite Demodulators

- Evaluation Kits

- TV Tuners

Voice

- ProSLIC Voice Solutions

- Voice DAAs

- SI3200 Voice Codecs

RF Passives

- MIS Silicon Chip Capacitors

- Power Dividers/Combiners

- Couplers

Optocouplers

- Phototransistor Optocouplers

- Schmitt Trigger Optocouplers

- Linear Optocouplers

- Low Input Current Phototransistor Optocouplers

- Photovoltaic Optocouplers

- High-Speed Switching, High CMR Logic Gate Optocouplers

- High-Speed MOS-FET Driver Optocouplers

- Custom Solutions

(Source: skyworksinc.com)

List of Skyworks applications

Aerospace and Defense

- Avionics

- Communications

- Imaging and Radar

- Space

Automotive

- Infotainment Digital Cockpit Processing Units

- Radio Infotainment

- Traction Inverters

- Networking Gateways

- Battery Management

- ADAS and Automated Driving

- On-Board Chargers

- Lidar, Radar, and Camera Systems

- EV Main DC-DC Converter

- PTC Heater

- Cellular Telematics

- Cellular Compensator

- Remote Keyless Entry

- DSRC and V2X

Consumer

- Audio

- Video and Displays

- Routers, Gateways, and Access Points

- Gaming

- Set-Top Boxes

Data Centers

- PoE Routers/Switches

- Power Supplies

- Storage

- Servers

- Accelerator Cards

- Optical Modules

- SmartNICs

- Spine, Leaf, and ToR Switches

Industrial

- Factory Automation

- Motor Control

- Power and Energy

- Power Supplier

- Professional Audio/Video

Internet of Things (IoT)

- Asset Tracking

- Connected Home

- Cellular IoT and M2M

- Home Security/Automation

- Industrial IoT

- Lighting

- Smart Retail

- Smart City and Energy

- Wearables

Medical and Healthcare

- Hearing Aids

- Imaging and Diagnostics

- Portable Medical

- Biomedical Materials

- Ultrasound, X-rays, and CT Scanners

Mobile

- Smartphones

- Tablets

- Wearables

Optical Networking

- Switch/Router

- OTN/PTN

- Data Center Interconnect

- PON

- Campus/Branch Switch

- Network Security

Wireless Infrastructure

- Small Cell

- Macro Radio Unit

- Massive MIMO

- O-RAN

- Microwave/MmWave

- Baseband/DU

- Reference Designs

(Source: skyworksinc.com)

Skyworks Overview

Skyworks Solutions Inc., commonly referred to as Skyworks, is a key player in the semiconductor industry. The company focuses on providing products for wireless and connected devices, which are essential for smartphones, tablets, and other devices that connect to the internet. By 2024, Skyworks is expected to continue its strong position in the market, following its performance in 2023. Understanding Skyworks' financial performance, market trends, and growth prospects for 2024 is crucial for anyone following the semiconductor industry. This analysis will look into the key data for 2023 and the expectations for 2024.

Skyworks Financial Performance in 2023

In 2023, Skyworks generated a revenue of around US dollars 5.5 billion. This represented a slight decrease from previous years, as the company faced challenges due to fluctuating demand in the smartphone market. The demand for semiconductors was affected by global inflation and a slowdown in smartphone sales, especially in key markets such as the United States and China.

Skyworks' net income in 2023 was about US dollars 1.2 billion, translating to a profit margin of approximately 21%. Despite the challenges in the smartphone market, the company maintained a solid profit margin thanks to its diversified portfolio. It supplied components not only for smartphones but also for automotive and industrial applications, which helped stabilize the revenue.

Market Trends Impacting Skyworks in 2024

The semiconductor market is expected to see growth in 2024, driven by the increasing adoption of 5G technology and the expansion of connected devices in various industries. Skyworks is well-positioned to benefit from this growth, particularly because of its strong relationships with major smartphone manufacturers such as Apple. As more countries roll out 5G networks, the demand for components that Skyworks produces will rise.

Moreover, the automotive industry increasingly relies on semiconductors for electric vehicles (EVs), autonomous driving technologies, and advanced driver-assistance systems (ADAS). These trends are likely to contribute to Skyworks' growth in 2024, helping offset any potential slowdowns in the smartphone market.

According to Skyworks statistics, 70% of its revenue in 2023 came from the mobile communications sector, while the remaining 30% was split between automotive, industrial, and other markets. In 2024, this diversification is expected to continue, with a larger portion of revenue coming from the automotive and industrial sectors.

Growth Projections for 2024

Skyworks is projected to see moderate growth in 2024. Analysts estimate that the company's revenue could increase by 5%, reaching around US dollars 5.8 billion. This growth will likely come from increased demand for 5G components and expanding opportunities in the automotive and industrial sectors. Additionally, the company's strong cash flow and focus on innovation will help it stay competitive.

Regarding profitability, Skyworks' net income is expected to increase slightly, reaching approximately US dollars 1.3 billion in 2024. This translates to a profit margin of about 22%, reflecting the company’s ability to manage costs while growing its revenue. The anticipated rise in demand for its products will allow Skyworks to maintain healthy margins, even in the face of potential economic uncertainty.

Competitive Landscape

Skyworks operates in a highly competitive market. It faces competition from other semiconductor companies like Qualcomm and Broadcom. However, Skyworks has managed to differentiate itself by offering high-quality products and forming long-term relationships with its customers. In 2024, the company is expected to continue focusing on innovation and maintaining strong customer relationships, especially in the 5G and automotive sectors.

Another factor contributing to Skyworks' competitive edge is its strong balance sheet. The company had around US dollars 1 billion in cash reserves at the end of 2023, which gives it the flexibility to invest in research and development, make strategic acquisitions, or return capital to shareholders through dividends and stock buybacks.

Conclusion

Skyworks, as a semiconductor company, has established itself as one of the biggest names in the industry. The company has gone through challenges but Skyworks statistics show that it still has a strong financial position with revenues reaching $4.77 billion as of 2023.

Looking ahead to 2024, Skyworks is well-positioned to capitalize on emerging trends such as 5G technology adoption, the expansion of connected devices, and increasing semiconductor demand in the automotive and industrial sectors. Products of Skyworks, such as low noise power amplifiers, position it to become one of the largest names in the semiconductor industry.

Sources

FAQ.

Skyworks is a semiconductor company specializing in wireless and connected devices.

Skyworks generated revenue of $4.77 billion in 2023.

Key products include amplifiers, front-end modules, switches, and power management solutions.

The United States is the largest contributor to Skyworks’ revenue.

Skyworks invested $606.8 million in research and development in 2023.

Skyworks’ market capitalization is $15.8 billion as of September 2024.

Approximately 70% of Skyworks’ revenue came from the mobile communications sector in 2023.

Skyworks is well-positioned to benefit from 5G technology adoption, supplying key components.

Automotive, industrial applications, and the Internet of Things (IoT) are emerging markets for Skyworks.

Through innovation, strong customer relationships, and a diversified product portfolio.

Saisuman is a skilled content writer with a passion for mobile technology, law, and science. She creates featured articles for websites and newsletters and conducts thorough research for medical professionals and researchers. Fluent in five languages, Saisuman's love for reading and languages sparked her writing career. She holds a Master's degree in Business Administration with a focus on Human Resources and has experience working in a Human Resources firm. Saisuman has also worked with a French international company. In her spare time, she enjoys traveling and singing classical songs. Now at Smartphone Thoughts, Saisuman specializes in reviewing smartphones and analyzing app statistics, making complex information easy to understand for readers.