Stripe Statistics By Revenue, Users, Usage and Facts (2025)

Updated · Jan 31, 2025

Table of Contents

Introduction

Stripe Statistics: Stripe cemented its position as one of the premier global payment processors in the year 2024 by accomplishing huge milestones in transaction volume, valuation, and user base extension. Its significant growth and market presence were a direct result of highly innovative and strategic moves made by the company.

In Stripe statistics, we will explore and highlight some of the salient products and benefits the company has offered. Also included is the discussion on Stripe’s overall market trends and statistics.

Editor’s Choice

- In 2023, Stripe’s valuation recovered due to a proposed USD 860 million share purchase by Sequoia Capital.

- By 2023, Stripe had processed over USD 1 trillion in transactions.

- Stripe currently accounts for 17% of global transaction processing, positioning it as the second-largest player, with a target of reaching 45% market share.

- Stripe serves over 4.5 million websites, with 1.5 million active users.

- North America dominates Stripe’s market share, holding 70.2%, followed by Europe at 15.8%, Asia-Pacific at 7.9%, and the rest of the world at 6.1%.

- Stripe’s estimated revenue for 2023 was over USD 16 billion, reflecting a 14.29% growth over 2022.

- Stripe’s API reported over 500 million API calls processed daily, accessible in 47 countries, which is expected to rise to 51 countries with the addition of Paystack.

- In 2023, 38.58% of interest in Stripe came from women, while 61.42% came from men, with 56.24% of the interest from individuals aged 25-34.

- Around 75% of large software companies with payment solutions use Stripe, populating the top 1% of websites.

- In the U.S., Stripe holds a market share of 18.7%, surpassing competitors like Square and Adyen.

- Stripe processed USD 18.6 billion in transaction volume during the 2023 Black Friday/Cyber Monday period.

Stripe VC Funding And Valuation

| Characteristic | Funds raised (in million U.S. dollars) |

Valuation (in million U.S. dollars)

|

| Mar 28, 2011 | 2 | 20 |

| Feb 9, 2012 | 18 | 100 |

| Jul 9, 2012 | 20 | 500 |

| Jan 22, 2014 | 80 | 1,750 |

| Dec 2, 2014 | 70 | 3,500 |

| Jul 28, 2015 | 100 | 5,000 |

| Nov 25, 2016 | 150 | 9,200 |

| Sep 26, 2018 | 245 | 20,000 |

| Jan 29, 2019 | 100 | 22,500 |

| Sep 19, 2019 | 250 | 35,000 |

| Apr 15, 2020 | 600 | 36,000 |

| Mar 15, 2021 | 600 | 95,000 |

| Mar 15, 2023 | 6,500 | 50,000 |

(Source: statista.com)

- Stripe statistics show that by 2024, Stripe had experienced a valuation recovery after a fall during 2023, but it has not increased to the highest value of 2021.

- Much boost to their valuation came via an offer made by Sequoia Capital in the summer of 2024, proposing to buy approximately USD 860 million of Stripe shares.

- Although long been talked about, the potential for an IPO of Stripe’s payment processing powerhouse with offices in Dublin and San Francisco is still in abeyance.

- While rumours continued to mill over, the company’s co-founders never denied an actual IPO agenda scheduled for 2024 or 2025.

- Stripe announced on March 2024 that total payments processing done by it had superseded USD 1 trillion in value by 2013, thereby indicating a significant point of continued expansion and continued dominance within the digital payments segment.

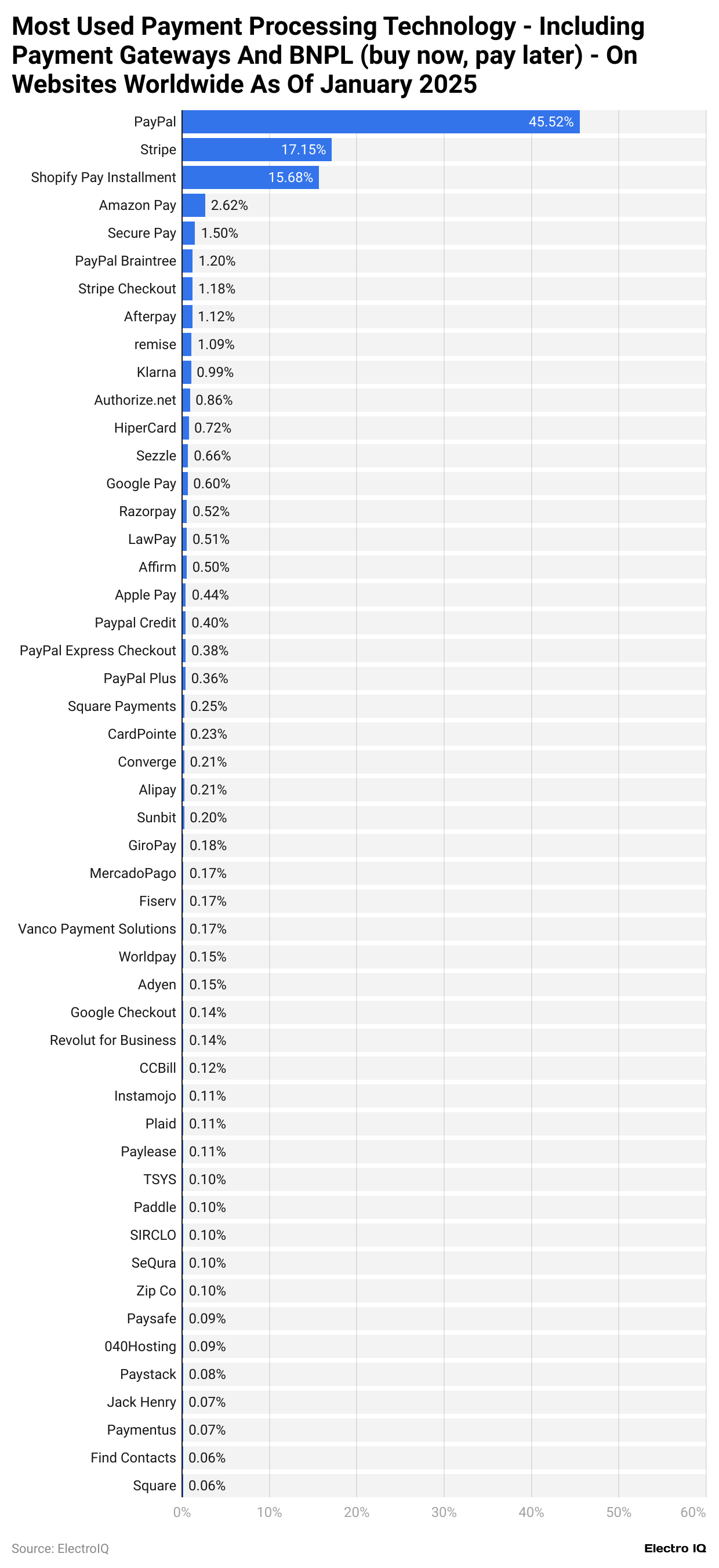

Most Used Payment Processing Technology

(Reference: statista.com)

(Reference: statista.com)

- According to stripe statistics, in August 2024, PayPal held the lion’s share of online payment processing, which was delegated at about 45%.

- In second place was Stripe, which had about 17% of the market share. Thus, their ranking occurred based on their use by businesses across the web domains of the world.

- No particular country of origin for these adopting companies was ever disclosed in the data.

- Due to the benefits of digital money, mass media has been super fast in its adoption. PayPal is sufficiently placed in online money services but is likewise placed at the forefront of e-commerce companies and systems.

- PayPal serves eBay and Amazon foremost well by the visits of its users from all over the globe, certifications of its right footing in the market.

- Since it is impossible to find a specific case of growth from just usage measurement in pertinent countries at any given time, the period of mass increase upon the emergence of digital money is not difficult to see: digital money provided 2020 and 2021 with a period of historical financial glory, resulting in quarterly revenues of more than 20%.

- PayPal’s substantial adoption in 2022 was also backed by Statista’s Global Consumer Survey, pinpointing Germany, the UK, Australia, and Austria as four significant countries where PayPal was the most in use.

- The digital payments sector is transitioning rapidly due to new regulations aimed at fostering innovations in financial technology (Fintech).

- As a result, traditional banks and card networks are reviewing and revamping their strategies.

- Consequently, banks are driving data payments to the top of their marketing agendas to support Fintechs to adapt to evolving consumer expectations and at the same time to find new sources of revenue streams in an increasingly digital financial landscape.

Strip Revenue

- Stripe statistics state that Stripe makes money by charging a fee on every transaction processed. The standard rate is 2.9% of the transaction amount, with a flat fee of 30 cents for each domestic card payment.

- For larger enterprise customers, Stripe offers a bespoke pricing model. Fraud protection via Stripe Radar is also taken care of, with a flat fee per screened transaction ranging from 5 to 7 cents.

- Stripe Atlas facilitates the registration of businesses from the payment aviation from the ground.

- The setup fee for Stripe Atlas is USD 500 (which covers government fees) with a yearly operations fee of USD 100.

- Stripe is exploring other earnings streams beyond such core offerings.

- Although detailed financials are not disclosed, co-founder John Collison said 2023 has been a fabulous year for the company since it achieved two exciting goals: processing more than USD 1 trillion in total payments and achieving cash flow positivity.

- The firm will have surpassed USD 16 billion in revenues for the year 2023, enjoying a respectable 14.29% growth over the USD 14 billion Stripe reported in 2022.

- Stripe has been building its business for several years. The company’s gross revenue was up 62% by 2021 and an astonishing 270% from 2020.

- The USD 2.5 billion net revenue for fiscal 2021 was the amount left after processing partner fees such as payments to Visa and Chase.

- In fiscal 2021, Stripe’s Dublin sales registered USD 2.255 billion, which demonstrated a year-over-year increase of 66% from the USD 1.358 billion the firm garnered in 2020.

(Reference: finmasters.com)

(Reference: finmasters.com)

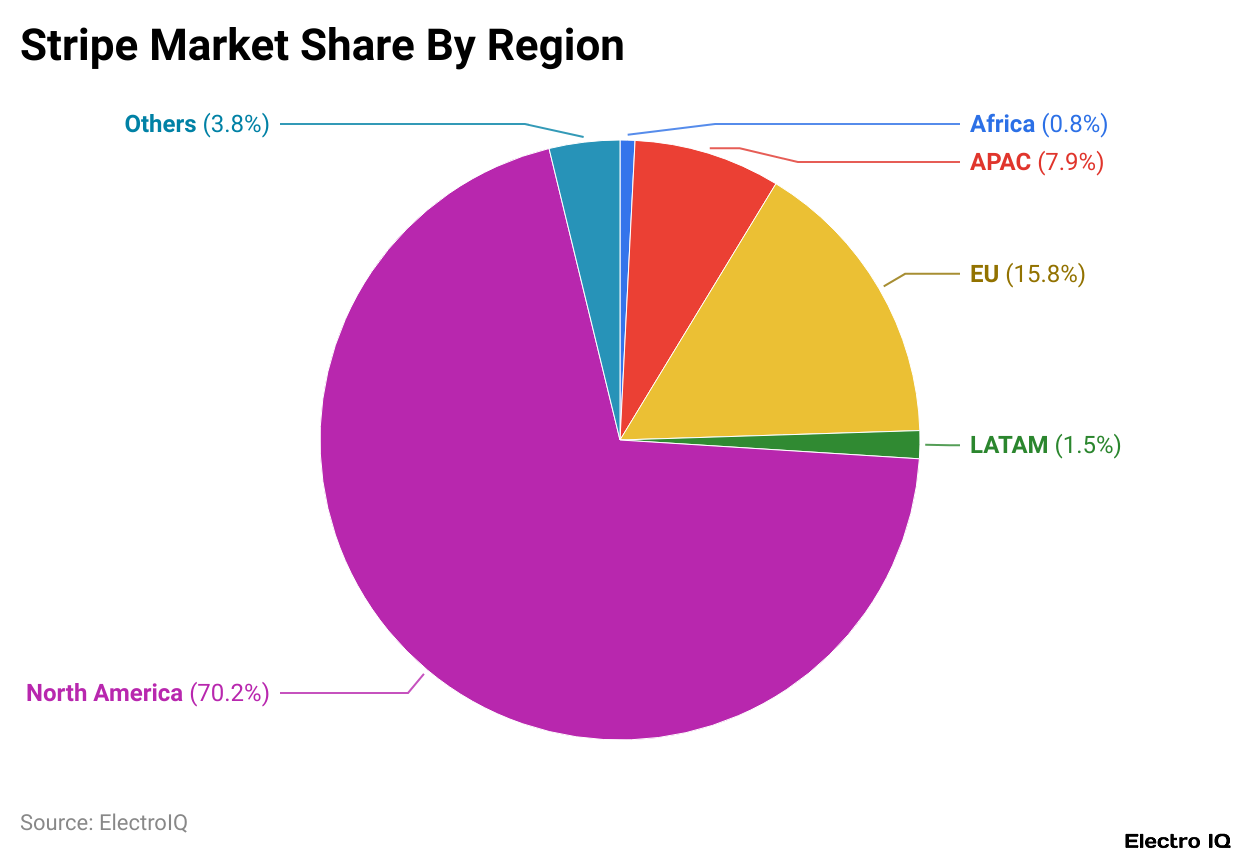

- Stripe statistics reveal that In North America, Stripe holds a major share of the market with 70.2% dominance and thereby leaves little competition for others, which are PNGs, AmazonPay, Cash Payment Providers, and Ignormarconmetiolandbankbros.

- The vast majority of Stripe’s transactions and widespread operations are all found within the borders of the U.S. and Canada. The company also commanded total coverage of 15.8% in an extremely better environment in Europe, plus its third-largest appearance on the continent.

- APAC, with 7.9% coverage, has found some significant success in countries including Australia, Japan, and Singapore.

- The adoption in other areas is unknown. Africa has only had a 0.8% market share, possibly because its users there haven’t adopted it as much as they have elsewhere for many reasons.

- Latin America failed even now to break through in any big way; considering newer players and trends, Stripe had barely secured a 1.5% market share at the time.

- In other sectors, 3.8% is usually just another category that does not fulfill the largest-newest subregional breakdown.

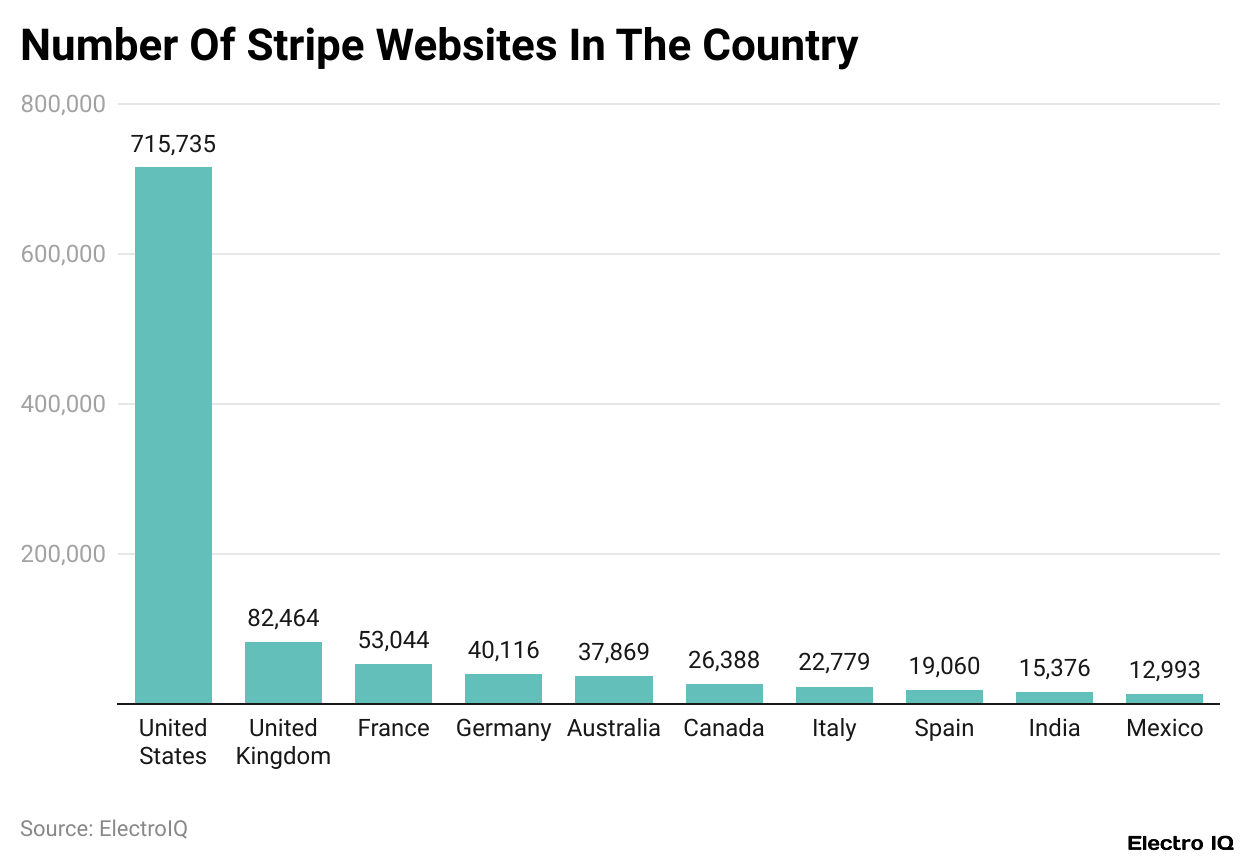

Number Of Stripe Websites In The Country

- Stripe statistics indicate that in 2022, Stripe operated Business in 47 countries around the planet, illustrating that its operations have expanded beyond North America with some other goal reviews.

- In 2018, Stripe added 21 countries to its lineup, moving it a step closer to being a global standard for payment.

- Adoption everywhere–up to USD 547 billion in 2020 generated from USD 41 billion in 2017 and USD 199 billion in 2019, with a total of 4,581,973 websites internationally–is big.

- Of such, 1,537,487 website users used the services to make payments–positive feedback on the list of needs for online business.

- Most Stripe users are from the USA itself, where the payment gateway managed about 715,735 websites with Stripe out of a universe of 4,581,973 venues in the world.

- Britain and Northern Ireland would have nearly 82,464 active websites that rely on Stripe, creating a substantial presence in important nations in the marketplace.

- Stripe is not as popular in smaller countries like Wallis, San Marino, British Virgin Islands, and Cuba, where only five e-commerce websites from each country use their services.

- Thus, as Stripe prepares to grow due to global trade changes, the likelihood that it would be adopted by a smaller, less digital and technological economy is relatively limited.

Stripe Usage Statistics

| Ranking | Company | 2023 Revenue |

| (In Billions) | ||

| 1 | Walmart | USD 638.1 |

| 2 | Amazon | USD 590.7 |

| 3 | Apple | USD 381.6 |

| 4 | Samsung | USD 201.1 |

| 5 | Walgreens | USD 144.6 |

| 6 | AliExpress | USD 131.2 |

| 7 | Target | USD 106.6 |

| 8 | Wayfair | USD 11.95 |

| 9 | Chewy | USD 11.24 |

| 10 | Etsy | USD 2.75 |

(Source: capitaloneshopping.com)

- Stripe is key to payment processing for companies of every size and shape. Many companies have made so much money by plugging into Stripe’s program.

- Stripe statistics state that the number of active users is the largest in the United States, where approximately 689,000 businesses account for 46.2% of the global user base.

- The breadth of acceptance becomes apparent in the shocking fact that one out of every ten people in the world facilitated a transaction through a business leveraging Stripe.

- Also, Characteristically, Stripe has its reputation in the broader community, as at least 75% of the most significant technology companies utilize payment processing from Stripe.

- Classified in ascending order after 2023 in revenues, number one is Walmart at USD 638.1 billion by far-USD 590.7 for Amazon; USD 381.6 for Apple; and USD 201.1 for Samsung; and fifth is Walgreens with USD 144.6 billion.

- The list continues with AliExpress being classified sixth at USD 131.2 billion, marginally ahead of Target at USD 106.6 billion.

- For large corporations, Wayfair came in at a comfortable revenue of USD 11.95 billion, Chewy at USD 11.24 billion, and Etsy at USD 2.75 billion, which indicates amazing capabilities for handling enterprises and small businesses across all transaction sizes.

- As of March 2024, a total of probably 1.4 million active websites were using Stripe all over the world, out of which 804,180 were unique domains.

- A total of 2.93 million websites would have included Stripe at some point.

Stripe Growth Statistics

- Stripe continued its rapid expansion post-unicorn status, attracting major clients such as Apple, Alaska Airlines, Best Buy, Lotus Cars, Microsoft, Uber, and Zara. It has evolved into one of the fastest-growing fintech companies in the world.

- Stripe statistics indicate that Currently, 1,066,944 active websites are utilizing Stripe for payment processing, with an additional 2,987,361 websites formerly having integrated the Stripe platform.

- Out of the top 1 million websites, 2.83% (or 28,335) rely on Stripe for handling transactions.

- The US remains the largest market at present and is home to nearly 56% of all Stripe-enabled websites as of January 2024, when there had been a notable 739,000 actively owned websites using Stripe.

- The United Kingdom sent its cheers a way off second place, with 77,792 actively known users.

- As of February 2024, the proportion of Swiss merchants with payment processing technology on their websites, which have also integrated Stripe, have just topped a little over 6%.

- Businesses linked to Stripe together contribute to about 1% of global GDP. Beyond that, more than one-half of tech companies that go public in 2021 count among Stripe’s users.

- Even 75% of the top Forbes Cloud 100 companies bank on Stripe.

- In 2023, the fintech industry leader witnessed a surge of 25% in payment volume that surpassed USD 1 trillion in total processed transactions (TPV).

- Stripe Connect boasts a high acquisition rate, with 75% of the world’s top marketplaces using it for service provider onboarding, payment management, and payouts.

- The company has gained a 21% share of USD 121.77 billion in the global payment-processing solutions industry, being the second most widespread global payment processor.

- As for the U.S., Stripe managed 18.7% of the market share, as compared to Square (0.32%) and Adyen (0.09%)—who did not come close enough.

- With a valuation of USD 65 billion, Stripe occupies the 5th position for being the largest unicorn among 1,200 in the world.

- The company processes more than 500 million API requests on a daily basis, and its API integration is so smooth that developers can start using Stripe’s services with just seven lines of code.

- Stripe has a reach extending to 47 countries, plus its subsidiary, Paystack, which adds four more nations a grand total of 51 countries on its service list.

- It is expected that Stripe’s revenue automation suite will fetch an annual run rate in excess of USD 500 million in the year ahead.

- Stripe had its highest processing day to date during Black Friday and Cyber Monday sales, with orders topping 300 million with a volume of USD 18.6 billion.

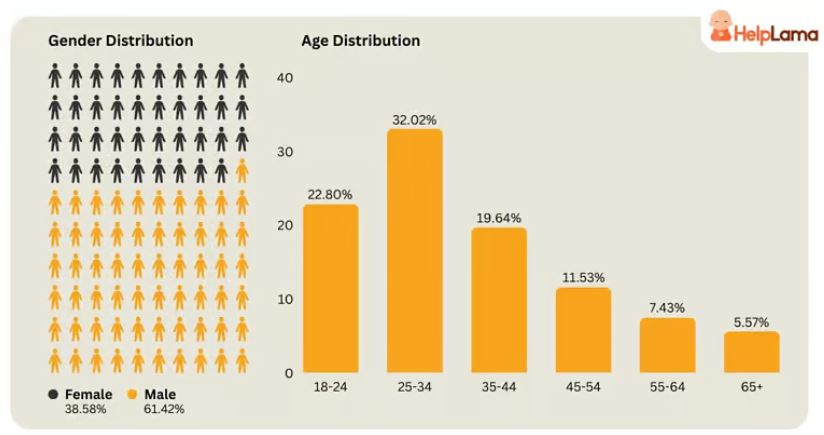

Stripe User Demographics

(Source: coolest-gadgets.com)

(Source: coolest-gadgets.com)

- Stripe statistics show that in 2023, among the Stripe users, 38.58% were females, compared to 61.42% male users.

- A majority of the users (32.02%) fell within the 25-to-34 age group, while 45%-54% was made up of 11.53% of users.

- By age range, among the users, 7.43% belonged to 55-64 years old, with 5.57% being high above 65 years.

- While Stripe users were heavily represented in the e-commerce-only segment at 87.55%, 4.93% was spent in the segments of computers, electronics, and technology, 2.78% in gaming, 2.46% in science and education, and 2.28% in arts and entertainment.

- For all purposes, Stripe is the star payment system, claiming a place of honour among the top ten locations visited globally by the 10,000, 100,000, and 1 million most-visited websites.

Conclusion

Stripe statistics throughout 2024, marked by its substantial increase in transaction volume and valuation and expansion of its user base, accompanied by strategic technological niceties and market traction, found its way into the hands of the global, progressively emerging digital payment landscape.

Sources

FAQ.

Stripe grabs around 17% of the global market share in payment processing, ranking second after PayPal, which is number one with a total of more than 45% of the world’s revenue share. Stripe takes over the North American market with a staggering percentage of 70.2%, followed by Europe with 15.8% and the Asia-Pacific region with 7.9%.

It is N/A information. For the year 2023, Stripe earned over US$16 billion in gross revenue as an uncalled-for 14.29% increase from 2022. The major source of Stripe’s earnings is transaction fees, which consist of a 2.9% charge for every transaction and from there a flat 30-cent fee. Additionally, Stripe has its earnings stream comprising the revenues generated from products such as Stripe Radar (fraud protection) and Stripe Atlas (business registration).

Stripe is using popular software firms across various industries, with over 75% of the big companies using its services. Walmart, Amazon, Apple, Etsy; just; are them-it is widely utilized by major firms. 87.55% of users are from e-commerce sites.

There are more than 4.5 million websites employing it in 2024, and the actual number of websites using it for payment processing will cross over 1.5 million. The foreign land most frequented by Stripe is the USA, where it has been deployed on approximately 715,735 websites, and the second-most used country is the United Kingdom, with 82,464 websites active.

Since its inception, Stripe has had sufficient growth that in 2023 their total payment processed has already crossed US$1 trillion. It has captured 21% of the worldwide payment processing market. It is expected that more than US$500 million will be made, annually, from the company’s revenue pump. Its API sees 500 million requests every day; in trading with 47 countries expansion is underway through its Paystack subsidiary.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.