Digital Wallet Adoption Statistics and Facts (2025)

Updated · Nov 24, 2025

Table of Contents

- Introduction

- Editor’s Choice

- Digital Wallets Market Share

- Digital Wallet Transaction Statistics

- Digital Wallet Adoption By Region

- Major Digital Wallet Players And Market Penetration

- Digital Wallet Adoption: U.S. Versus Global

- Innovations And Trends In Technology Impacting Digital Wallets

- Cryptocurrency Digital Wallets Statistics

- Security, Privacy, And Regulatory Landscape

- Challenges And User Experience With Digital Wallet Usage

- Recent Developments

- Conclusion

Introduction

Digital Wallet Adoption Statistics: A digital wallet (or mobile wallet) enables payments with a phone: App store card payments or sometimes paying with a QR code. By 2025, there will be nothing new about digital wallets: They are already one of the major methods in which people purchase things online and offline.

This article uses recent reports and survey data of digital wallet adoption statistics on the demographics of digital wallet users, markets in which these wallets grow fastest, money flow through these wallets, and the implications of these for users.

Editor’s Choice

- Digital wallets would hold 4.8 billion users by 2025, more than half the world’s population.

- In 2024, the value of global digital wallet transactions was US$10 trillion and will surpass US$17 trillion by 2029.

- Expected to cover more than 50% of the value of global e-commerce transactions by 2025, compared to 40% in 2021.

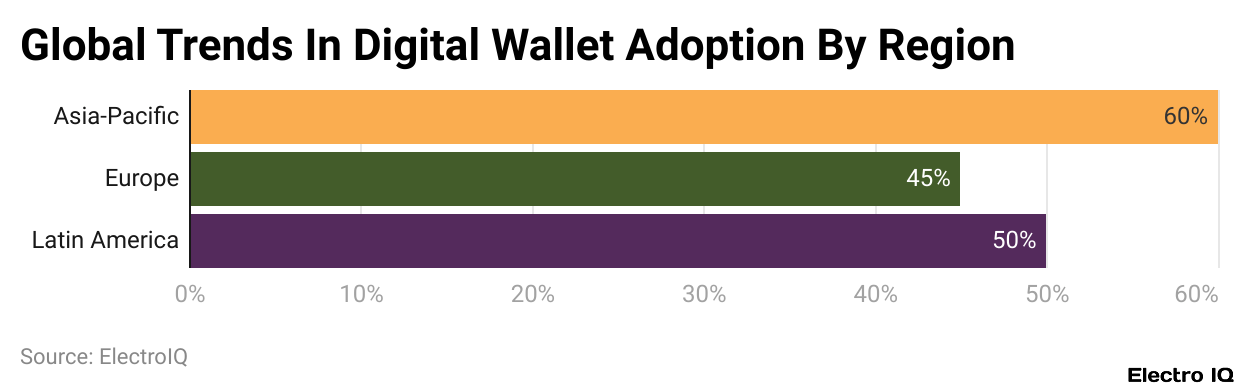

- Asia-Pacific leads with 60% of wallet users worldwide, while Sweden nears 80% adoption rates in Europe.

- U.S. adoption grows fast, with 56% of consumers using a wallet in a given month in 2023; Gen Z and Millennials made up 75% of users.

- QR code payments may reach US$5.4 trillion in 2025, making up 48.6% of wallet transactions.

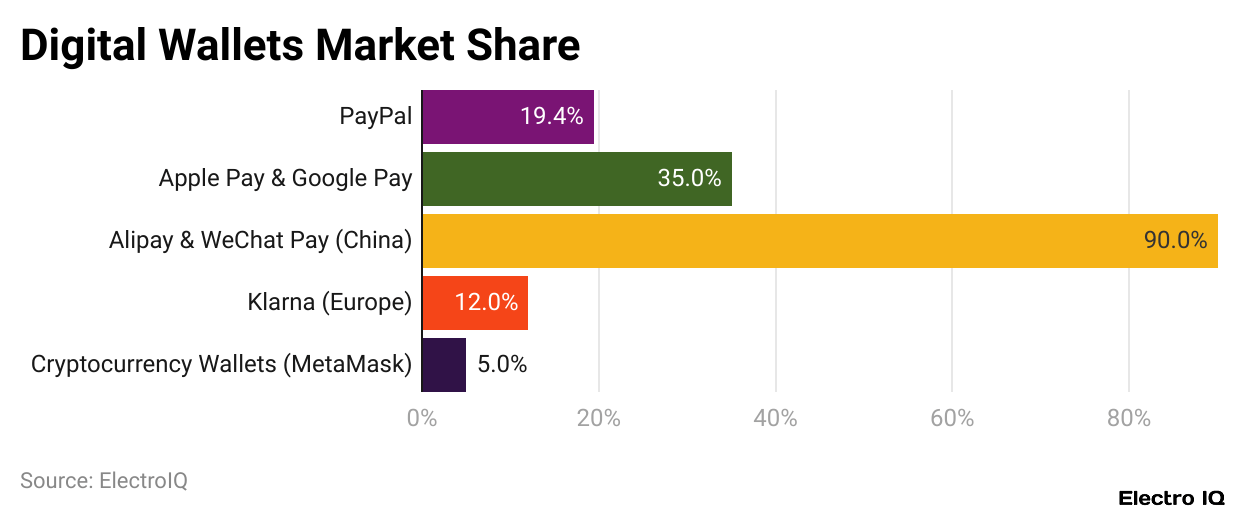

- PayPal accounted for 19.4% the worldwide market share, while Apple Pay led 48% of penetration in the U.S.; Alipay and WeChat Pay together control 90% of the Chinese market.

- PhonePe and Google Pay capture 75% of India’s wallet market; in Africa, M-Pesa keeps 50 million active users.

- Security concerns: 85% of users want strong protection; 95% of wallets use two-factor authentication; cases of fraud dropped by 35% in the U.S. after tighter regulations.

- Biometric authentication is used by 75% of wallets worldwide, whereas AI is assisting in fraud detection for 40%.

- The problem goes further: 27% claim interoperability issues, 35% find it difficult to recover wallets in case of loss of device, and 25% have no Internet access across developing sectors.

- Southeast Asia will see a 311% increase in adoption by 2025, driven by super apps and mobile-first economies.

- With US$10 trillion processed every year on the platform, Apple Pay has proven to be a true world leader.

(Reference: coinlaw.io)

- PayPal remains the world’s front-runner, holding a 19.4% worldwide digital wallet market share in 2023.

- Apple Pay and Google Pay make up the lion’s share of over 35% of mobile wallet transactions worldwide, a testimony to their dynamic presence outside the U.S. and Europe.

- In China, unlike basically other markets, international players do not have much say with Alipay and WeChat Pay combined owning over 90% local market share, making them almost universal there.

- In Europe, while PayPal is the leader overall, competition is intensifying, with Klarna rapidly reaching 12% of the market.

- Fintech startups are also catching on, as Revolut increased the number of users by 30% in 2023. In the meantime, cryptocurrency wallets have started carving out their own place.

- MetaMask now holds 5% of the global wallet market, indicating that digital assets continue to become important in customer payments.

- By the end of 2024, they were set to facilitate over 20% of global consumer spending, which indicates the speed at which wallets have moved from being a merely convenient option to the centre of everyday financial life.

Digital Wallet Transaction Statistics

- The rise of digital wallets in transaction activity is phenomenal, both online and at physical points of sale.

- With a total global value of US$10 trillion in digital wallet transactions, the year 2024 definitely proves the mainstreamness of the payment method.

- Predictions for 2029 are for the global total transaction value to rise by more than 70% to more than US$17 trillion, asserting that wallets are here to stay and specifying a long-term consumer behaviour shift.

- QR codes are the major factor in this growth. It is predicted that mobile payment over QR codes will reach US$5.4 trillion by 2025, rising some 48% to over US$8 trillion.

- In fact, it is forecast that QR codes will be the most popular form of digital wallet transactions worldwide, making up 48.6% in terms of transaction volume.

- In 2022, the average mobile wallet transaction was higher at US$92.50 relative to both debit card transactions (US$82) and cash (US$61.20), and it was just slightly lower in comparison to the average credit card transaction of US$95.10.

- Spending behaviour comparisons show that consumers using credit cards typically spend about 2.8% more than digital wallet users.

- However, digital wallet users spend 12.8% more on average than debit card users and a striking 51.1% more than cash users, highlighting how wallets encourage higher-value purchases compared to traditional payment methods.

- A wave of adoption was particularly noticeable in the U.S., and by 2024, mobile payment users in the country were supposed to spend an average of US$3,693 in transactions using the mode, having soared by a whopping 87% since 2020.

Digital Wallet Adoption By Region

(Reference: coinlaw.io)

- Well, digital wallet adoption doesn’t remain consistent throughout the world. Different regions have been moving at different paces.

- As per CoinLaw, digital wallet adoption statistics show that Asia-Pacific stands as the global leader with more than 60% of all digital wallet users, the dominance strengthened by strong infrastructure and relatively high technology adoption among the populace.

- North America has also seen a lot of impetus on this front: adoption has gone up 25%, specifically in e-commerce and contactless payments in stores.

- About 45% of adults in Europe are now users of digital wallets, but the rate of adoption varies greatly from country to country.

- In northern Europe, for instance, adoption in Sweden is almost 80%, showing how some markets have advanced.

- Sub-Saharan Africa follows a different model, with mobile money services such as M-Pesa pushing for a 34% increase in adoption, especially in locations where banking services were traditionally constrained.

- Latin America has quickly become a rising star with digital wallet adoption touching 50% in urban areas, much of it aided by innovative fintech startups.

- In the Middle East, it grew by 22% in 2023, with the UAE as a standout in wallet adoption.

- Zooming in on North America, the younger constituents of the U.S. market are the driving force behind this: Gen Z and Millennials account for 75% of all active digital wallet users in 2023.

- In Canada, growth is also steady, with digital wallet transactions increasing by 20%, led mainly by Apple Pay and Google Pay.

- In the end, emerging markets within Southeast Asia rank among the fastest-growing ones, with adoption projected to expand at an annual pace of 40%, courtesy of mobile-first economies where, essentially, a smartphone is all a person needs to access financial services.

Major Digital Wallet Players And Market Penetration

- Apple Pay leads in the wallets of the U.S. with 48% penetration, with PayPal and Google Pay coming in second and third.

- The Chinese market is a completely different story: Alipay and WeChat Pay rule over the market with over 90% control.

- PayPal takes a 25% market share in Europe, and online shoppers consider it one of their first choices.

- In India, PhonePe and Google Pay hold stanch fortunes to about 75% of the transactions, establishing the mobile-first nature of payments there.

- Samsung Pay stays popular in South Korea, covering 18% of the wallets in 2023. MercadoPago is the leader in Latin America, particularly with Brazil and Argentina as its leading markets.

- In Africa, meanwhile, there are an active 50 million users of M-Pesa, growing at a rate of 22% annually.

- Other leaders in the niche are CashApp-U.S. Gen Z customers represent about 64% of users-while crypto wallets like MetaMask and Trust Wallet saw a good 35% growth globally, essentially being powered by decentralised finance.

Digital Wallet Adoption: U.S. Versus Global

- In the United States, 56% of consumers were interacting with a digital wallet monthly in 2023, up from 48% in 2022.

- In this case, worldwide is a little bit higher; 51% of the population is utilising wallets, with outside-U.S. growth nearing the 10% annually mark.

- Compared globally, PayPal is the tool in the U.S. and has Alipay and WeChat Pay ruling outside-the-nations scenario, with 90%+ penetration into the Chinese population.

- Another category is crypto wallets that are just the converse of this set–just about half of the active wallets are located outside of the U.S.

- Different habits around the world: In Europe, 70% of all transactions are made contactless.

- In contrast, only 40% of transactions across the U.S. are contactless.

- QR code payments have taken over Asia, with 70% usage, but consist of barely 10% of U.S. transactions.

- Millennials and Generation Z, demographic-wise, account for about 75% of American users of digital wallets, 65% globally.

- Something peculiar happens to be that the U.S. ranks first in a digital wallet category: digital wallets integrated with loyalty programs.

- Roughly 65% of U.S. users are actually using the reward features, whereas other regions record lower shares.

- However, global markets are growing faster, with Southeast Asia and Africa reporting 40% yearly gains in adoption.

Innovations And Trends In Technology Impacting Digital Wallets

- Digital wallets have become smarter and safer. Biometric authentication is expected to reach global adoption of 75% by 2023, with the U.S. being ahead in fingerprint access authentication.

- Fraud detection methods associated with wallets incorporate AI in approximately 40% of instances, thereby mitigating risks.

- The cross-border payment sphere is improving as well, with 25% of wallets having a currency conversion provision and a 30% increase in integration with blockchains throughout 2023 stemming from increased crypto adoption.

- Regarding user experience, voice-command payments gained 20% adoption, mostly in the U.S. and Europe.

- Tracking carbon footprints is another emerging feature, available in about 15% of wallets around the globe.

- In the Asia-Pacific, super apps such as WeChat Pay and Alipay converted wallets into a multifunctional platform.

- Other features are on the rise: virtual card issuance grew by 28%, encouraging secure online shopping, while in 10% of the wallets worldwide, real-time peer-to-peer lending has been integrated, opening new avenues for microfinance.

Cryptocurrency Digital Wallets Statistics

- Cryptocurrency wallets, much like their digital counterparts, can store and manage cryptocurrencies.

- They also act as payment tools when linked to enterprises or financial services that accept crypto payments.

- For instance, there were 85 million unique wallets on Blockchain, one of the most popular crypto wallet providers in 2022, which was a drastic increase from the 66.2 million in 2021 by 28.4%, with more than double, 40.9 million in 2019.

- In terms of adoption, about 17% of Americans have at some point in their lives either invested in or at least used some form of cryptocurrency, with 61% of those entering the market currently holding some form of cryptocurrency.

- This illustration implies that traditional digital wallets are still very common, and crypto wallets are much less common, although the latter are steadily gaining ground with increasing interest in digital assets.

Security, Privacy, And Regulatory Landscape

- In security matters, nothing comes before most digital wallet users.

- Actually, 85% of the wallet users worldwide say security is of paramount importance when choosing their wallet.

- In response to this need, two-factor authentication (2FA) now comes standard on 95% of the major wallets, a stark contrast to just 80% in 2022.

- Also, from the angle of security, an arms race between governments and regulators has ensued.

- The Dutch regulations empowered under PSD2 demanded that all payment providers embrace stronger authentication measures beginning January 2023.

- Apparently, with stricter protocols in place, cases of digital payment fraud dropped 35% in the United States.

- About 60% want a wallet that asks for and shares as little personally identifiable information as possible.

- This resulted in a worldwide volume of US$1.2 billion invested last year in solutions enhancing wallet security, with particular attention to encryption and fraud prevention.

- Tokenisation has provided a major solution across the industry, since tokenisation masks the actual payment data and is used in 70% of wallets worldwide.

Challenges And User Experience With Digital Wallet Usage

- Digital wallets have always been rising fast; still, users face limited times at the hands of some issues.

- Globally, interoperability issues sit on the verge of 27% of user concern; users want their wallets to function across varying platforms and on an international scale.

- About 25% of the potential users in developing markets do not have access to the internet, another factor limiting adoption.

- Problems on the practical side arise, too: 35% of users faced problems recovering their wallets following a device loss, and cross-border users reported delays in transactions at a rate of 18%.

- For first-timers, 22% considered being onboarded to be overly complicated, while 5% encountered failed payments due to system outages.

- Costs and usability are major pain points. 15% of users will not install a wallet-based app for small purchases because of high transaction charges.

- 40% state that merchant acceptance is still largely seen in the big cities and less so in small towns.

- Then, education poses another barrier here: 20% of seniors in the U.S. reported that they had no idea how wallets work, thereby indicating that older generations are harder to reach.

Recent Developments

- Current statistics show just how big wallets have gotten. By the year 2025, it is hypothesised that digital wallets will account for more than 50% of the total sum of global e-commerce transactions, which was more than 40% in the year 2021.

- They continue growing concomitantly with vendors all over the globe: from being 2.7 billion in 2020 to an expected number of 4.8 billion by 2025, meaning over half of the world population would be using these.

- Regional growth is particularly sharp in Southeast Asia, where wallet adoption is expected to grow 311% by 2025, fueled by booming e-commerce and a surge in “super-apps” that blend payments, shopping, messaging, and transport.

- In market leader terms, Apple Pay is currently becoming a dominant force, processing an estimated US$10 trillion annually, as Google Pay, PayPal, Alipay, and WeChat Pay continue their global expansion.

- In February 2025, The Clearing House’s RTP® network managed a US$10-million instant payment in the United States highest ever within the country, setting a precedent for the symbiosis of digital wallets with real-time financial infrastructure.

Conclusion

Digital Wallet Adoption Statistics: In 2025, wallets will skyrocket to become one of the main financial mediums and, hence, finance people’s payments, savings, and transactions globally. There are now 4.8 billion users and an annual transaction volume of about US$10 trillion, showing their international domination over e-commerce and point-of-sale payments.

Regional champions like Alipay, WeChat Pay, Apple Pay, and PayPal still define the space. QR code and biometric technologies enrich its use. Challenges await, in terms of interoperability and internet accessibility, yet the exponential growth within Southeast Asia points toward an era in whereby digital wallets are considered the principal form of payment internationally.

Sources

FAQ.

The number of digital wallet users worldwide is expected to reach 4.8 billion by 2025-that is that more than half of the world population will have grown to use them on a regular basis for payments and financial transactions.

2024 reported US$10 trillion in worldwide digital wallet transactions, and forecasts see this number exceeding US$17 trillion by 2029, implying enormous long-term growth.

Asia-Pacific leads with more than 60% of global users. In Europe, Sweden is also close to an 80% adoption level. Sub-Saharan Africa, Latin America, and Southeast Asia are other regions rapidly picking up growth, heavily fueled by mobile-first economies.

Apple Pay, PayPal, Google Pay, Alipay, and WeChat Pay are the big names in the world. In India, PhonePe + Google Pay share 75% of the market, whereas M-Pesa is most popular in Africa, with its 50 million active users.

In essence, others have highlighted barriers such as interoperability issues (27%), wallet recovery issues upon loss of device (35%), poor access to the internet in developing regions (25%), and gaps in terms of merchant acceptance, especially in small towns.

I hold an MBA in Finance and Marketing, bringing a unique blend of business acumen and creative communication skills. With experience as a content in crafting statistical and research-backed content across multiple domains, including education, technology, product reviews, and company website analytics, I specialize in producing engaging, informative, and SEO-optimized content tailored to diverse audiences. My work bridges technical accuracy with compelling storytelling, helping brands educate, inform, and connect with their target markets.