Toshiba Statistics By Revenue, Net Worth and Facts (2025)

Updated · Nov 02, 2025

Table of Contents

Introduction

Toshiba Statistics: Toshiba, the oldest among Japan’s tech giants, is expected to regain stability in 2025 after experiencing major upheavals over the past few years. It offers a vast range of products, from power systems and industrial machines to storage devices and printers. This publication presents Toshiba’s statistics for 2025, including revenue, profits, margins, free cash flow, business segment notes, employee count, share of overseas sales, and key trends to monitor.

Editor’s Choice

- Toshiba Tech’s financial year ended on March 31, 2024, and its gross revenues totalled US$3.52 billion (JPY 548.1 billion), representing a 7.3% increase from the previous year.

- The annual loss of the company was reduced to US$0.043 billion (JPY 6.7 billion), representing a 51% year-over-year improvement.

- The loss per share was US$0.977 (JPY 124) compared to US$1.59 (JPY 248) in 2023, indicating the company’s financial recovery.

- It is predicted that the company’s revenue will remain flat during the years 2025-2027, with a gross margin of approximately 40%, and will average around US$3.48-$3.52 billion.

- The revenue during FY2025 was JPY 577.02 billion, which is a 5.27% increase over FY2024, and the company continues its steady recovery trend from 2021.

- The peak of capital investment was at 24.5 billion in 2024, and then it was adjusted to 20.0 billion in 2025, while at the same time, depreciation and amortization increased to 18.0 billion.

- The R&D budget was set at 24.0 billion in 2025 after reducing it from 29.6 billion (2023) to 23.3 billion (2024).

- In FY2025, the company’s net sales fell to 121.4 billion yen, and operating profit was 2.1 billion yen, indicating the impact of short-term challenges on the company.

- Toshiba reduced its carbon footprint by 11% through the sale of 5 million green products and the recycling of 3 million used devices.

- Free cash flow ballooned to ¥14,898 million, compared to ¥3,276 million in the previous year.

- Toshiba ended FY2025 with a cash and cash equivalent balance of ¥47,933 million, indicating that the company is still very liquid.

Fun Facts About Toshiba

- Toshiba’s roots date to 1875, when inventor Hisashige Tanaka founded Tanaka Seisakusho, later part of the 1939 merger that created Tokyo Shibaura Electric. The company adopted the name Toshiba Corporation in 1978.

- Tanaka’s famed “Myriad Year Clock” of 1851 could display seven kinds of time and calendars and run for about a year on one winding; an original is displayed in Tokyo’s National Museum of Nature and Science.

- In the early Showa era, Toshiba manufactured Japan’s first electric washing machines and refrigerators in 1930, followed by the first domestic vacuum cleaner in 1931.

- Flash memory was invented at Toshiba by Dr. Fujio Masuoka; NAND flash was introduced at IEDM 1987, reshaping storage for cameras, phones, and SSDs.

- Toshiba’s T1100 (1985) is often called the first mass-market laptop, helping popularize truly portable IBM-PC-compatible computing.

- Toshiba co-developed the HD DVD format but officially ended HD DVD hardware in February 2008, effectively conceding to Blu-ray.

- The world-famous Taipei 101 skyscraper opened with Toshiba ultra-high-speed elevators running at 1,010 m/min (60.6 km/h), then the world’s fastest.

- Toshiba launched the SCiB (Super Charge ion Battery) in 2007, capable of recharging to 90% in under five minutes and designed for long life and safety.

- The firm’s heritage spans heavy electrical machinery and consumer electronics, from broadcast transmitters and X-ray tubes to rice cookers and transistor TVs in Japan.

- The “Toshiba” name itself is a portmanteau of Tokyo Shibaura Denki, reflecting the merger of Shibaura Seisaku-sho and Tokyo Denki.

History of Toshiba

- 1875: Hisashige Tanaka establishes a telegraph equipment factory in Tokyo that becomes Tanaka Seizo-sho, a forerunner of Toshiba.

- 1890: Ichisuke Fujioka founds Hakunetsu-sha to manufacture electric light bulbs in Japan.

- 1899: Hakunetsu-sha is renamed Tokyo Denki.

- 1930: Japan’s first electric washing machines and refrigerators are manufactured by the Tokyo Denki lineage.

- 1931: Japan’s first vacuum cleaners are released.

- 1939: Shibaura Seisaku-sho and Tokyo Denki merge to form Tokyo Shibaura Denki; the company becomes widely known as Toshiba.

- 1940s: Postwar recovery focuses on heavy electrical machinery, then a return to consumer products. Early items include Japan’s first fluorescent lamp and radar systems.

- 1978: “Toshiba Corporation” becomes the company’s official name.

- 1985: Launch of the Toshiba T1100, later recognized as the world’s first mass-market laptop and honored as an IEEE Milestone.

- 1987: NAND flash memory is introduced by a Toshiba team led by Fujio Masuoka, presented at IEDM 1987.

- 2008: Toshiba announces discontinuation of the HD DVD business, effectively ending the format’s competition with Blu-ray.

- 2015: Toshiba discloses significant accounting irregularities, triggering leadership changes and a prolonged restructuring period.

- 2018: Toshiba’s memory business begins operating under new ownership, setting the stage for a rebrand.

- 2019: Toshiba Memory is renamed Kioxia on October 1.

- 2020: Toshiba completes its exit from the laptop business, transferring the remaining 19.9 percent of Dynabook shares to Sharp.

- 2023: Following a successful tender offer led by Japan Industrial Partners, Toshiba is delisted from the Tokyo Stock Exchange on December 20.

- 2024: As a newly private company, Toshiba announces restructuring steps, including domestic workforce reductions, to improve profitability.

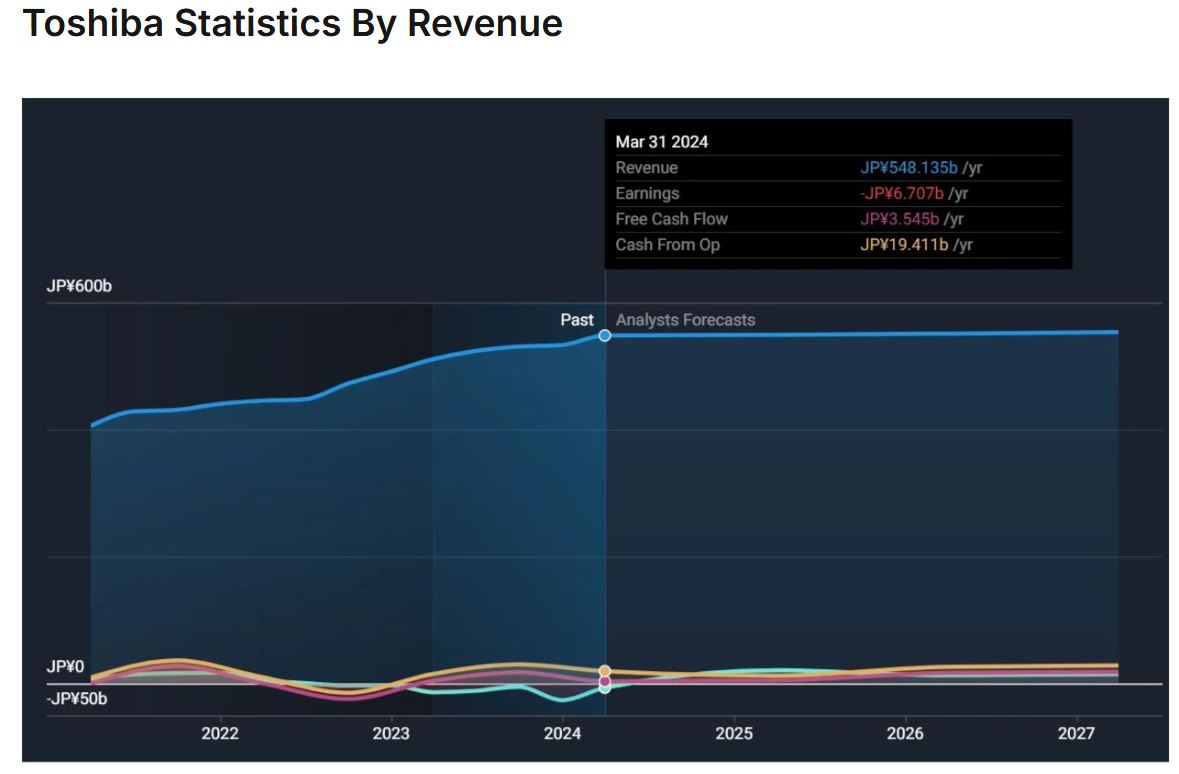

Toshiba Revenue

(Source: coolest-gadgets.com)

- On March 31, 2024, Toshiba Tech’s total annual revenue of US$3.52 billion (JPY 548.135 billion), which is a 7.3% increase over 2023, was the result of the company’s total annual revenue of US$3.52 billion (JPY 548.135 billion).

- Although revenue went up, the firm still experienced a yearly loss of US$0.043 billion (JPY 6.707 billion); however, this was 51% better than the previous year’s loss.

- The loss per share also showed improvement, reducing to US$0.977 (JPY 124) for 2024 from US$1.59 (JPY 248) for 2023.

- In the course of 2023, Toshiba’s quarterly revenue was on an ascending trend: US$3.28 billion in March, US$3.36 billion in June, US$3.41 billion in September, and US$3.42 billion in December.

- Looking to the future, Toshiba’s revenue is projected to be more or less the same with slight variations: US$3.48 billion in 2025, US$3.47 billion in 2026, and US$3.52 billion in 2027.

- The company is also anticipated to experience a gross margin of around 40%, with a range of 40.33% to 40.90% throughout the forecast period, thus eliminating the risk of consistent profitability decline due to financial difficulties in the past.

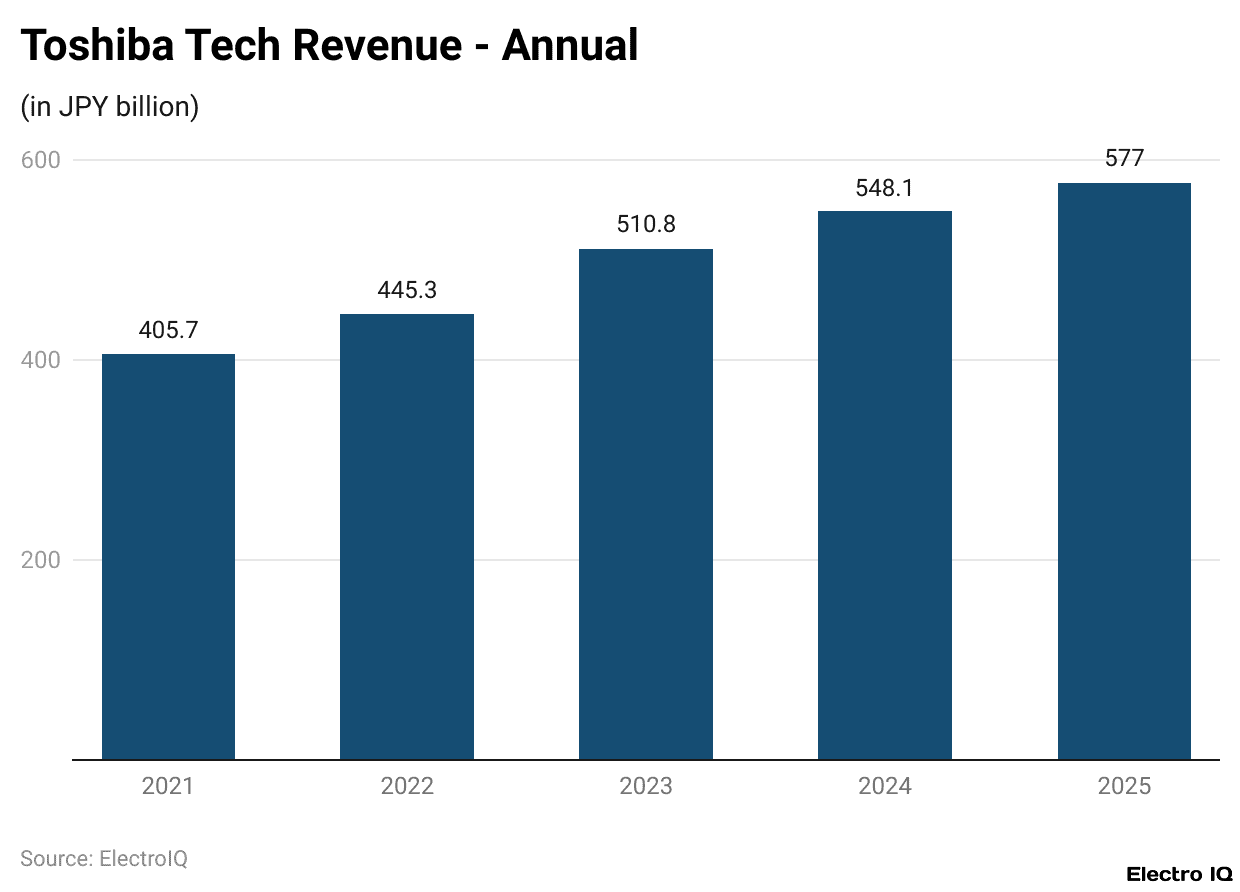

Toshiba Tech Annual Revenue

(Reference: stockanalysis.com)

- The figures illustrate the five-year revenue trend of Toshiba Tech, revealing a scenario where the company’s revenues first declined and then gradually recovered with the help of a constant growth cycle.

- For the fiscal year ending March 31, 2025, the company claimed revenue of JPY 577.02 billion, an increase of JPY 28.89 billion, representing a growth of 5.27% over 2024.

- The company’s revenue in 2024 was JPY 548.14 billion, an increase of 7.32% compared to 2023, when it reached JPY 510.77 billion.

- Toshiba’s recovery that year was dramatic, as seen by revenue that added up to JPY 65.45 billion, or r 14.7% increase, which followed the previous revenue decline of JPY 78.11 billion or -16.14%.

- After that, in 2022, the revenue increased to JPY 445.32 billion, which was 9.77% more than in 2021.

- But 2021 was not an easy year, with a fall in revenue to JPY 405.69 billion, a decline of JPY 78.11 billion, or -16.14%.

- The statistics suggest that after a radical drop in 2021, Toshiba Tech has been improving its financial performance steadily every year and thus has been able to maintain positive revenue growth till 2025.

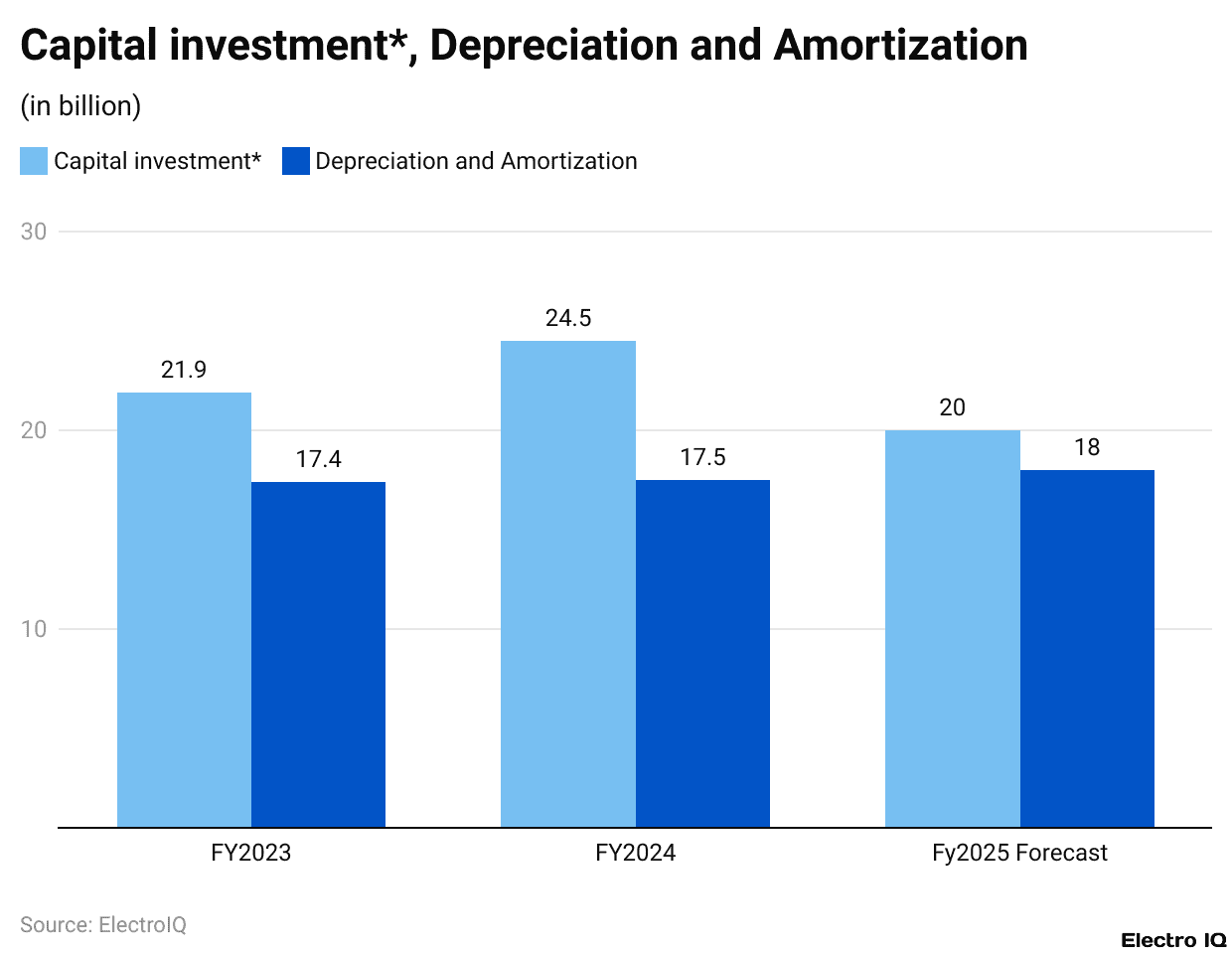

Capital Investment, Depreciation And Amortization

(Reference: toshibatec.com)

- The data delineates Toshiba’s capital investment and depreciation and amortization trends over three fiscal years, revealing the company’s shifts in spending and asset management.

- In FY 2023, Toshiba’s capital investment was 21.9 billion, while depreciation and amortization incurred were 17.4 billion.

- A year later, er in 2024, capital investment jumped to 24.5 billion, reflecting a heavier concentration on the asset’s expansion or modernization, while the depreciation and amortization expense slightly increased to 17.5 billion, showing that the assets were being used consistently.

- Contrarily, in 2025, the capital investment went down to 20.0 billion, which can be interpreted as a company’s decision to go for a more cautious approach in terms of new expenditures or project scaling, even though depreciation and amortization went up to 18.0 billion.

- This trend points out that Toshiba has cut back on new capital spending but has nevertheless recorded higher depreciation, which hints at the firm being more concerned with the proper maintenance and utilisation of the already existing assets efficiently rather than aggressively expanding the capital base.

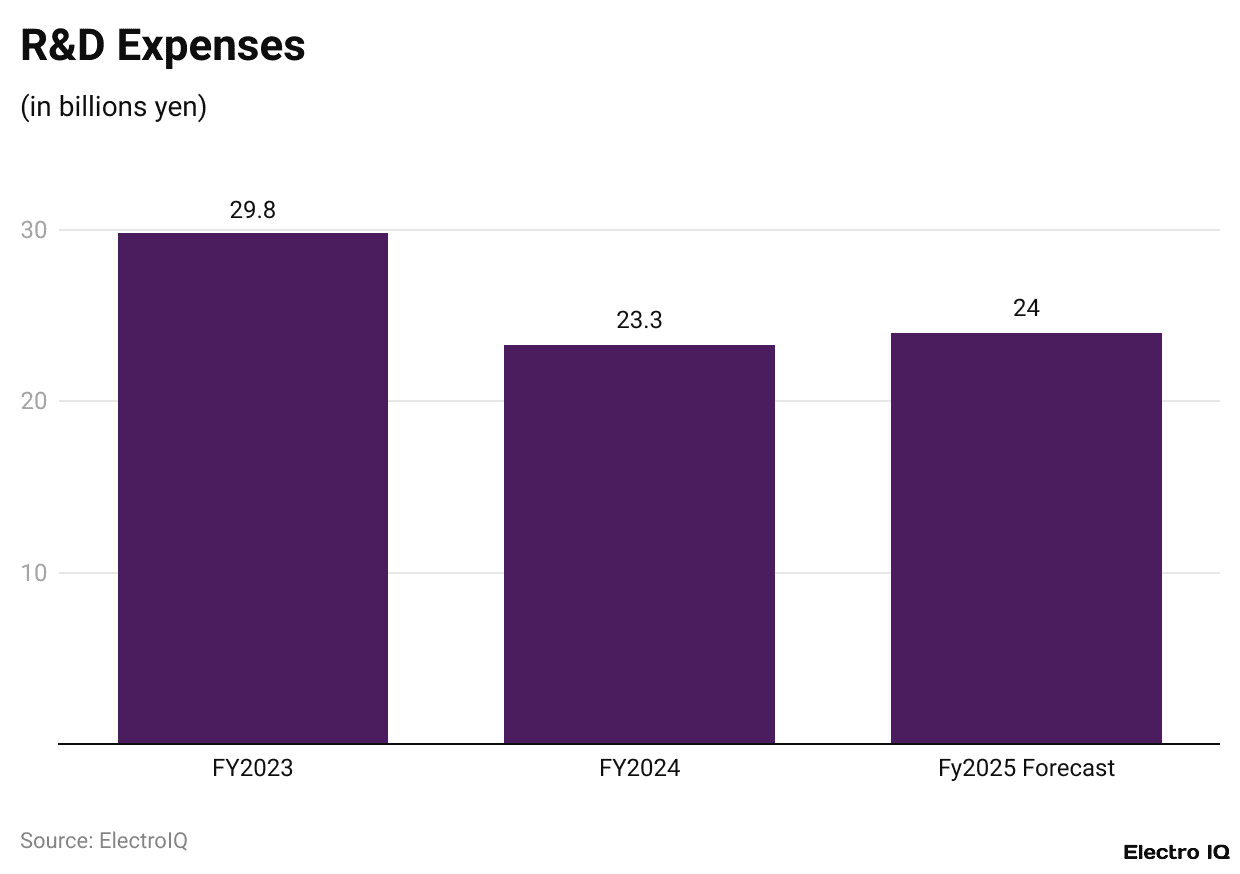

Toshiba R&D Expenses

(Reference: toshibatec.com)

- The diagram illustrates through three fiscal years the research and development (R&D) expenditures of Toshiba, with a small decline followed by a steady investment,nt being the trend shown by the data.

- The company invested 29.8 billion yen into R&D during the fiscal year 2023, which is a clear sign of its willingness to put in the effort and resources necessary for coming up with new products and making existing ones even better.

- But that drop of 2024 in R&D cost to 23.3 billion came as an indication of either the company’s running of major projects through and realizing the cost-saving measure, or just plain trimming down the budget for R&D.

- In 2025, the R&D expenditure was a bit higher than the previous year’s, as it reached 24.0 billion; thus, a balanced and cautious approach to innovation and product development was signalled, along with keeping a constant inflow of funds for technology growth in terms of both long-term and competitiveness.

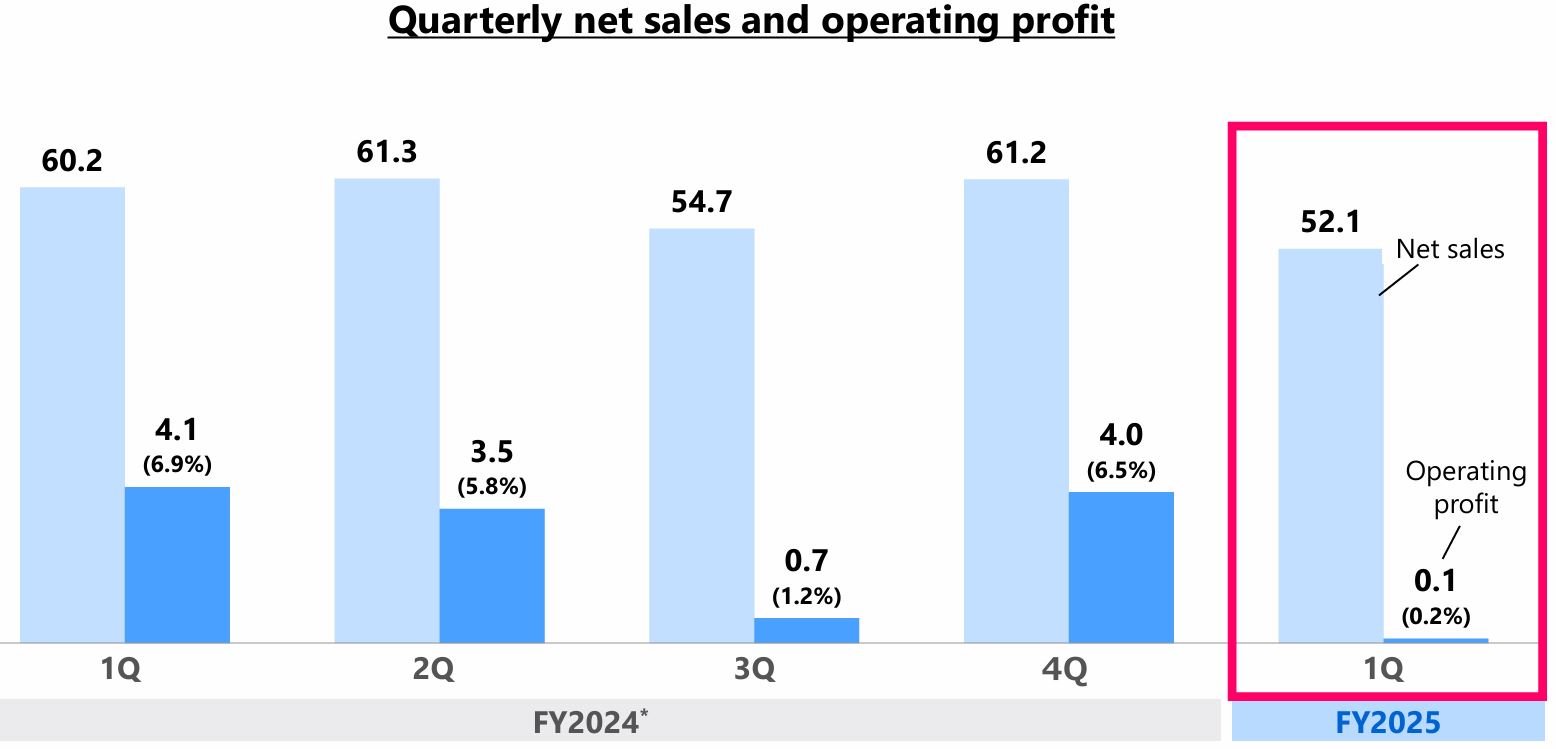

Toshiba Net Sales And Operating Profit

(Source: toshibatec.com)

- The fiscal years 2024 and 2025 for Toshiba are represented in the data with net sales and operating profits.

- The company managed to keep very stable sales and profits through the four quarters in 2024. Net sales for the company showed a considerable upward trend toward the end of the year, with the highest quarterly figure for the year being 151.5 billion yen in Q4 and the lowest being 136.3 billion yen in Q3.

- Operating profit was having a similar story, starting at 4.3 billion yen (3.1%) in Q1, raising to 5.2 billion yen (3.5%) in Q2, falling back to 2.3 billion yen (1.7%) in Q3, and finally reaching the highest point of the year at 8.5 billion yen (5.6%) in Q4, which was the best reflection of the company’s good performance in Q4.

- Though major to a lesser extent, in fiscal year 2025, sales of Toshiba fell dramatically to 121.4 billion yen. The company’s and quarterly averages for the previous year were all indicating a decline in revenue.

- As a result, the company’s operating profit fell to the much lower level of 2.1 billion yen, which is an indication of reduced profitability and possibly points to issues, market conditions, or lacking steps that slowed performance early in the year.

Toshiba Products Statistics

- In 2024, Toshiba proved itself as a classic tech innovator and a diverse product developer that can provide everything consumers need, including sustainable and smart devices, energy, and utility solutions, and the like.

- Toshiba’s electronic products for consumers also did well; the sales of laptops and computers managed to reach 4.5 million units, which is a 7% share in the total market, and made a revenue contribution of US$4.2 billion, which equals 12.4% of the company’s overall revenue.

- Televisions accounted for 3.2 million units sold and a market share of 5.5%, bringing in US$2.1 billion.

- Meanwhile, home appliances like washing machines and refrigerators accounted for the total of 6.8 million units sold, 6% market share, and US$3.5 billion in revenue.

- Toshiba’s nuclear power solutions were next in the energy sector with 15 active projects, 8.5% of the global market, and revenues of US$5 billion, while renewable energy solutions, such as solar and wind power, came in with US$3.8 billion from 25 projects and 11.2% of the total revenue.

- Hard drives and SSDs, which are classified as storage devices, continued to dwell with a total sale of 10 million uni, giving a 10.5% global market share and revenues of US$4.5 billion.

- Industrial solutions, which include power systems and automation, contributed US$2.7 billion and US$3 billion to the company’s revenue, respectively, with global market shares between 7% and 7.5%.

- IoT and smart home appliances pushed Toshiba’s smart devices segment up, which together earned if whopping US$3.5 billion in the company’s pocket via 32 projects and 2.5 million units sold.

- Sustainability initiatives were an important aspect of Toshiba’s environmental responsibility, with the company selling 5 million eco-friendly products, recycling 3 million devices, and reducing its carbon emissions by 11%, thereby proving its commitment to a green future.

Toshiba Cash Flow

- Toshiba’s fiscal year ended March 31, 2025, showed a very strong improvement in cash flow performance relative to the prior period.

- Net cash produced by operating activities was ¥24,886 million, an increase from the prior year’s figure of ¥19,411 million.

- This expansion was primarily supported by a profit before income taxes of ¥42,574 million, depreciation and anamortisation of ¥17,489 million, and an increase in trade payables of ¥10,185 million.

- Nevertheless, it was offset to some extent by a gain on change in equity of ¥21,151 million, a gain on the sale of businesses of ¥5,654 million, net other deductions of ¥7,678 million, and income taxes paid of ¥8,090 million.

- There was a net cash outflow of ¥9,987 million from investing activities, which was an improvement from the previous fiscal year’s outflow of ¥16,135 million.

- Part of this cash outflow consisted of acquisitions of property, plant, and equipment of ¥13,704 million and intangible assets of ¥3,241 million, which were partially covered by ¥6,750 million received for the sale of businesses.

- Hence, free cash flow rose to an inflow of ¥14,898 million, against the inflow of ¥3,276 million recorded in the previous year.

- Cash flows from financing activities showed a net outflow of ¥5,739 million, whereas the previous year’s outflow was ¥3,624 million.

- The largest contributions to the outflow were repayments of finance lease liabilities amounting to ¥3,865 million, repayments of long-term loans of ¥7,223 million, and dividend payments of ¥2,381 million, while the new long-term borrowings of ¥8,683 million accounted only partly for this.

- The Group ended FY2025 with cash and cash equivalents of ¥47,933 million, which was a decrease of ¥9,848 million that was mainly due to the consolidation exclusion of certain subsidiaries, and to a lesser extent, an increase of ¥9,200 million compared to the previous year.

Conclusion

Toshiba Statistics: The 2025 performance of Toshiba indicates a turnaround and realignment of the Company. The Company’s return to financial stability after years of restructuring is due to the steady revenue growth, improved profitability, and strengthened cash flow. The Company’s commitment to innovation, sustainability, and diversification across product segments —from energy and storage solutions to consumer electronics— underpins its long-term resilience.

Certain units experienced minor difficulties in the short run; however, the steady investment in R&D, green initiatives, and US$operational effectiveness signals that Toshiba is determined to stay competitive in global markets and to secure sustainable growth in the years to come.

FAQ.

In FY 2025, Toshiba Tech’s revenue amounted to JPY 577.02 billion (US$3.52 billion), reflecting a 5.27% increase from the previous year’s JPY 548.14 billion. The consistent growth of the company since 2021 is a clear indication of the company’s recovery and resilience post-financial challenges.

Toshiba has made considerable progress in its financial performance in different sectors. Free cash flow increased to ¥14,898 million, operating cash inflow went up to ¥24,886 million, and total cash and cash equivalents were ¥47,933 million. The company managed to strengthen its overall financial position despite a decrease in net sales and operating profit, thanks to prudent investments and expense control.

Toshiba kept a consistent R&D investment pace by designating ¥24.0 billion for the year 2025, which is just a little more than ¥23.3 billion for the previous year. The total capital investment of ¥20.0 billion showed the company’s commitment to a more selective approach to the use of its assets and installation of the new technology. As a result, depreciation and amortization grew to the level of ¥18.0 billion, which in turn pointed to the effective usage of current resources.

The highlight of performance was the energy sector, where nuclear power made US$5.0 billion and renewable energy accounted for US$3.8 billion. The computer and electronics area reported total sales of US$4.2 billion from laptops and desktops, plus storage devices generated US$4.5 billion of revenue.

Toshiba not only achieved its carbon footprint reduction target of 11% but also went a step further by selling 5 million eco-friendly products and recycling as many as 3 million old devices, which in turn cut down the company’s carbon emissions by that same percentage.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.