Smart Sensors Statistics By Market Size And Types

Updated · Feb 10, 2025

Table of Contents

Introduction

Smart Sensors Statistics: Smart sensors stand in the form of very sophisticated devices that collect, process, and transmit data, enabling real-time monitoring and control of many industries. Smart sensors are the backbone of IoT, which, in this context, stands for automation and efficiency in fields like automotive, healthcare, consumer electronics, and industrial automation.

The growth of the global smart sensors market has rapidly increased due to technological advancement and a rising demand for connected devices. In this article, we will discuss the Smart sensors statistics and their growth.

Editor’s Choice

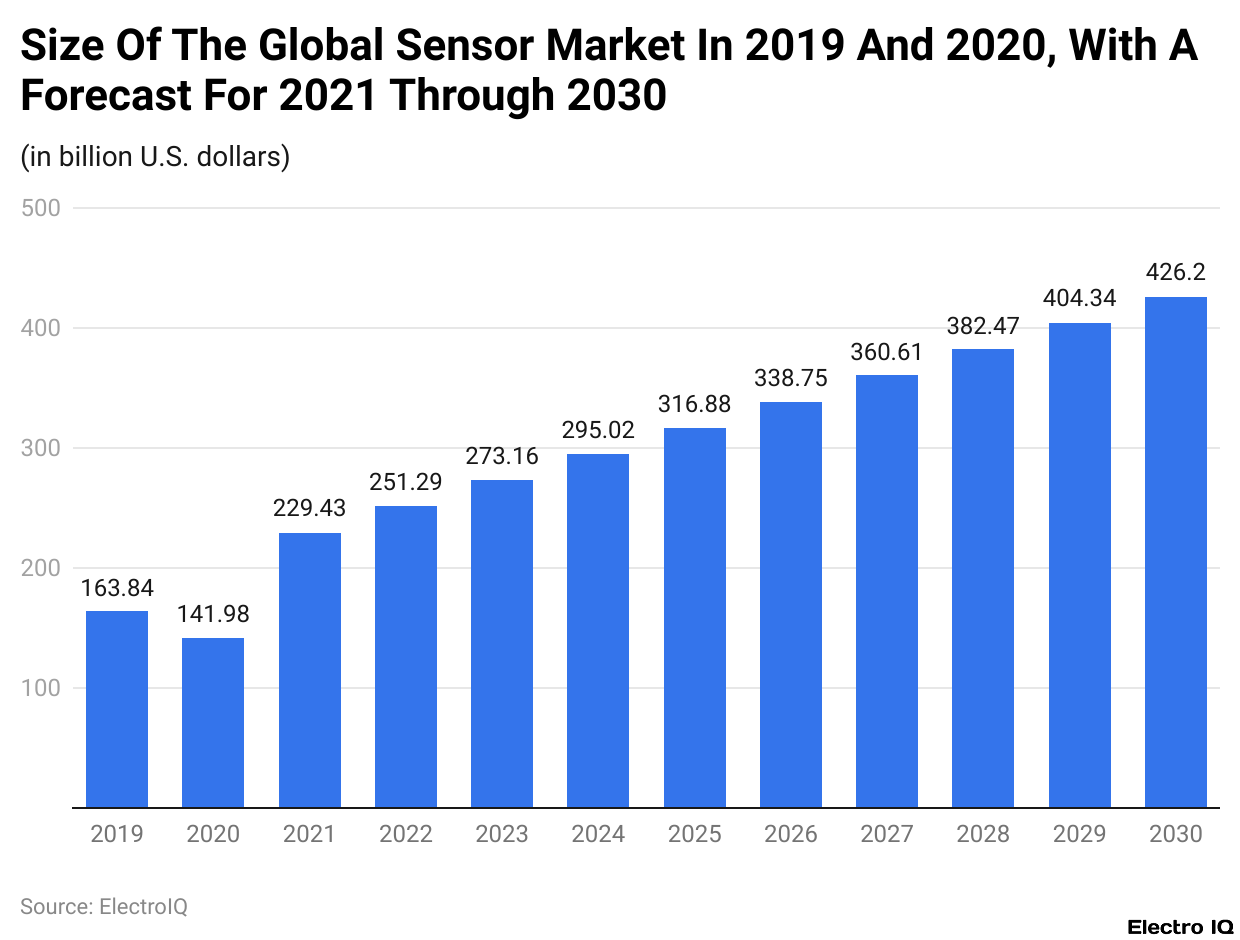

- According to Smart sensors statistics, the global sensor market was valued at USD 163.84 billion in 2019 and is projected to reach USD 426.2 billion by 2030, driven by increasing IoT adoption and demand for smart technology.

- The automotive sensor market was valued at USD 9.7 billion in 2021 and is predicted to grow at a CAGR of 6.7%, increasing from USD 47 billion in 2018 to USD 77.5 billion by 2024.

- The fingerprint sensor market was valued at USD 6 billion in 2022, and the market is estimated to grow to USD 13.7 billion by 2028, with capacitive recognition solutions accounting for 96.5% of smartphone applications.

- Smart sensors statistics reveal that the pressure sensor market accounted for USD 7.5 billion in 2016, with a considerable contribution from the Asia-Pacific region; the MEMS pressure sensor market for automotive applications is expected to reach USD 812 million by 2018.

- Among Americans, 31% of those earning USD 75,000+ use smartwatches and fitness trackers; nonetheless, only 12% of those earning under USD 30,000 do so.

- Women are more inclined to use wearable fitness technology than men (25% against 18 %); among adults, Hispanic adults are the most likely to use them (26 %), followed by Black (23%) and White adults (20 %).

- Smart sensors statistics state that among the survey, at different education levels, 15% of high school graduates use wearable. In comparison, 25% of respondents report their education level as some college and 27 % of college graduates do so.

- STMicroelectronics generated USD 9.56 billion in 2019; TSMC in Gallium Nitride technology in 2020; and 2016 for biometrics sensor collaboration with Valencell.

- NXP Semiconductors from the US and Netherlands earned USD 8.88 billion in 2019 and formed partnerships with Momenta on driver monitoring systems in 2019 and Tata Consultancy Services on IoT applications in 2018.

Global Sensor Market Size

(Reference: statista.com)

- The global sensors market is booming now and is expected to grow more than twice from 2019 to 2030. The market was valued at approximately USD 163.84 billion in 2019.

- Smart sensors statistics state that the growth of this market has been fuelled by the demand for smart technologies, IoT integration, and automation, which is expected to increase the market to around USD 426.2 billion by 2030.

- It only proves that sensors are increasingly considered vital tools in different industries, such as healthcare, automotive, industrial automation, and consumer electronics.

- The rapid acceptance of smart devices and real-time monitoring systems is helping the trend to unfold, while sensors remain foundational technologies for modern advancements.

Type of Smart Sensors

Automotive sensor

- Smart sensors statistics indicate that the automotive sensor market has been steadily growing, with global sales in 2021 approximating USD 9.7 billion. Its growth rate has been about USD 25.6 billion CAGR from 2017 to 2021.

- The automotive MEMS market alone was estimated to be valued at USD 4.5 billion in 2021. OEMs are expected to hold about 40% of the intelligent automotive tires and sensor market until 2024.

- The total market, valued at USD 47 billion in 2018, is expected to increase by 6.7% CAGR to reach USD 77.5 billion by 2024.

- Magnetic sensors are already being used significantly in modern vehicles, and their adoption rate should increase in autonomous vehicles, which demand extremely precise magnetic sensors.

- By 2030, the market for such sensors in the world is said to be USD 2.3 billion.

Fingerprint Sensor

- The fingerprint sensor market has seen exponential growth and was valued to be around USD 6 billion in 2022. The market is projected to grow to USD 13.7 billion by the year 2028.

- Smart sensors statistics show that for touch fingerprint sensors, the estimated market size was USD 8.91 billion in 2023. In smartphone technology, capacitive recognition solutions hold 96.5% of the applications used for fingerprint sensors.

- In 2017, fingerprint sensors were integrated into 55% of all smartphones shipped globally, whereas in 2016, this technology appeared in 45% of smartphones shipped.

- The key player in the market had a 60% share in 2014.

Pressure sensor

- There has been consistent growth in the pressure sensor market. In 2016, the global market was valued at about USD 7.5 billion.

- Smart sensors statistics state that for the same year, the market for the piezorespiratory pressure sensor segment in the Asia-Pacific region was estimated at USD 226 million.

- The overall pressure sensor market for the Asia-Pacific region was estimated to have been about USD 2.5 billion in 2016. In the automotive application area, the MEMS pressure sensor market is projected to reach USD 812 million in 2018.

Smart Sensors Of Watches And Fitness Tracker

![]() (Reference: pewresearch.org)

(Reference: pewresearch.org)

- The application of digital devices, including smartwatches and fitness trackers, is dependent on varying socioeconomic considerations.

- Smart sensors statistics show that about 31% of Americans in households earning USD 75,000 or more every year reported regularly using a smartwatch or fitness tracker, while this percentage was reduced to only 12% for individuals with an annual income of less than USD 30,000.

- The same trend holds for education, with higher adoption rates among college graduates than for those with a high school diploma or less, according to the results of a survey conducted with 4,272 adults in the U.S.

- Other demographic variables, namely gender, race, and ethnicity, exhibit smaller effects. Females are 25% more likely than males (18%) to use these devices regularly.

- Among racial and ethnic groups, Hispanic adults report the most frequent usage of fitness trackers at 26%, followed by Black adults at 23% and White adults at 20%.

- Fitness trackers collect and analyze various types of data regarding the user’s activities, while higher-end models provide more extensive features.

- Users manage and track their data on this app, and they can provide the app with personal and lifestyle information.

- Companies that make fitness trackers, therefore, can gather a vast amount of data on their users, which they can use in many different ways.

- The privacy policies of many fitness-tracking apps allow for data sharing with third parties, and some researchers are already making use of such data in health studies.

Smart Sensors By Education

![]()

- Smart sensor statistics highlight the usage of smartwatches and fitness trackers based on educational background. Among individuals with a high school education or less, 15% use these wearable devices. In comparison, those with some college education show a higher adoption rate of 25%.

- The highest usage is observed among individuals with a college degree or higher, at 27%.

- These figures reveal a connection between educational attainment and the adoption of wearable technology.

- Recognizing these trends is valuable for educators, technology manufacturers, and marketers, as it enables them to develop targeted educational strategies and product offerings that align with the preferences and needs of different demographic groups based on their educational backgrounds.

Top 5 Largest Sensor Manufacturers Globally

In recent years, advancements in the making of IoT have revolutionized the industry through the growth of automation, connectivity, and analytical capabilities. Smart sensors are utilized in the environment that allows their use to monitor business operations and some particular controlled variables of interest.

Industrial IoT applications involve monitoring temperature and humidity, activating alarms in warehouses, and data logging for quality assurance activities.

STMicroelectronics

- Smart sensors statistics state that STMicroelectronics is a major European electronics company that innovates solutions for the smart vehicle, smart home, smart city, and smart industry ecosystems.

- Their sensors include energy-efficient types for IoT applications, Industry 4.0, augmented reality/virtual reality (AR/VR), and smartphones.

- The company reported a revenue of USD 9.56 billion in 2019. In 2020, they joined forces with TSMC to drive the advancement of the Gallium Nitride technology.

- They entered a partnership with Valencell in 2016 to develop advanced biometric sensors for wearable and IoT applications.

NXP Semiconductors

- NXP Semiconductors is a semiconductor company with headquarters in both the U.S. and the Netherlands.

- Its semiconductor and software offerings cater to various industries, including mobile devices, automotive technology, and consumer electronics. Its sensors comprise motion, capacitive, pressure, touch, and magnetic sensors.

- In 2019, NXP reported revenues of USD 8.88 billion. In January 2019, they partnered with Momenta to develop driver monitoring systems for automotive applications.

- They also partnered with Tata Consultancy Services in May 2018 to develop applications in the automotive, security, and IoT domains.

Analog Devices, Inc. (U.S.)

- Analog Devices, Inc. is one of the most important and leading manufacturers of MEMS accelerometers, gyroscopes, and integrated subsystems that bundle multiple sensors suitable for high-end applications.

- The acquisition of Linear Technology in March 2017 for USD 14.8 billion was part of strengthening the sensor technology business. In 2019, Analog Devices, Inc. had nearly USD 6.0 billion in revenue.

Honeywell International, Inc.

- Honeywell International, Inc. provides one of the principal thrusts in sensor technology, with products related to over 50,000 sensors and switches related to position, speed, and airflow measurements.

- In 2018, the company achieved revenue of USD 41.80 billion, a 3.13% increase over the previous year.

- Smart sensors statistics reveal that to further expand and diversify its sensor product portfolio, in July 2016, Honeywell acquired Intelligrated for USD 1.5 billion in cash.

Sensirion AG

- Sensirion is a high-performance digital sensor manufacturer located in Switzerland. Flow sensors for gas and liquid, CO2 sensors, environmental sensors for humidity and temperature, and particulate matter sensors are among its products.

- Their sensors use CMOSens® Technology to offer faster and more accurate measurements.

- The company made USD 177.75 million in revenue in 2019, with 30% generated from the automotive sensor line.

- The acquisition of Auto Industrial Co.’s automotive division in September 2017, which specializes in sensors for auto defogging, air quality monitoring, and CO2 measurement, enhances the company’s automotive presence.

Conclusion

Smart sensor statistics present a brilliant prospect for growth with constant technology development and the growing demand for connected devices across targeted sectors. While challenges such as high costs and a lack of workforce will hinder growth, they also enhance the chances for innovations and developments over the coming years.

FAQ.

Employee referral programs usually simplify the hiring process and decrease recruitment costs by a mean value of US$3,000 per hire. Referrals also speed up hiring (29 days vs 39-55 days for non-referred hires) and ensure better retention, as referred hires stay longer (70%) than those who are not referred.

In 2024, employee referrals account for 17% of hires for companies with fewer than 1,000 employees. This statistic steadily decreases with the increase in size of companies, whereby large enterprises (50,000+ employees) see only 9% of hires referred to them.

Most of them (35%) are motivated by the desire to assist their friends in securing job opportunities, while 32% are looking to aid their company. About 26% wish to bolster their reputation with work colleagues, and a mere 6% are influenced primarily by cash incentives.

Well, approximately 69% of companies encourage employee referrals through a cash referral bonus ranging from US$ 1,000-US$5,000. Company-branded goodies come in second, with 27% of the companies opting for this. Other incentives include extra vacation days (15%) and prize drawings (54%).

Companies hiring via referrals tend to see profits up 25%, with referred employees working 33% better than non-referred hires. Furthermore, referral hiring lends itself to 20% less worker turnover and reduces hiring costs by 41%.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.