Corsair Statistics By Revenue, Cash And Debt (2025)

Updated · Nov 20, 2025

Table of Contents

Introduction

Corsair Statistics: Corsair is recognised as a brand name that caters to both gamers and creators: its products include not only PC parts (like memory and power supplies) but also complete gaming systems, keyboards, mice, and headsets. After the difficult years of the 2022-2023 cycle, in 2025, Corsair was able to showcase its recovery and better profit margins.

This article presented Corsair’s financial statistics for 2024 and 2025, including revenues, growth rates, margins, stock price, and revenue sources.

Editor’s Choice

- The revenue from peripherals in Q3 2025 increased by about USD 10.7 million compared with the same quarter of the previous year, showing steady demand for Corsair’s accessory products.

- The revenue from components and systems in Q3 2025 grew by about USD 30.9 million, reflecting stronger sales in higher value hardware categories.

- The total revenue for full-year 2025 reached USD 345 million, rising from USD 304.2 million in 2024, which showed a healthy year-over-year improvement.

- The revenue for the nine-month period rose by USD 132.9 million, driven mainly by stronger performance in components and systems.

- The quarterly gross profit improved by USD 23.4 million, and the nine-month gross profit increased by USD 61.9 million, indicating better cost control and stronger sales mix.

- The gross margin increased from 22.9% to 26.9% in Q3 and from 24.3% to 27.2% across the nine-month period, showing more efficient operations.

- The operating loss in the quarter improved from USD minus 20.9 million to USD minus 5.6 million, and the nine-month loss decreased from USD minus 55.9 million to USD minus 24.8 million, reflecting significant progress in managing expenses.

- The adjusted operating income reached USD 13.5 million for the quarter and USD 40.8 million for the nine-month period, showing stronger underlying operating performance.

- The stock price of Corsair between November 12 and 14, 2025, moved downward, closing at USD 6.07 on November 14, with trading volumes fluctuating throughout the period.

- At the end of Q3 2025, Corsair held USD 64.4 million in cash, while total debt was USD 123.4 million, resulting in a net debt position of USD 59.0 million, indicating moderate leverage.

History of Corsair

- 1994 – Corsair Microsystems is founded in Fremont, California by Andy Paul, Don Lieberman, and John Beekley.

- 1996–1997 – Following Intel’s Pentium Pro integrating L2 cache, the company pivots from COASt cache modules to DRAM, initially for servers.

- 2002 – DRAM modules aimed at PC enthusiasts and overclockers begin shipping, establishing the brand in performance memory.

- 2003 – High-speed enthusiast memory lines such as TwinX and XMS gain coverage in the press, reinforcing Corsair’s overclocking reputation.

- 2006 – Entry into the power supply market with HX-series PSUs marks diversification beyond memory.

- 2007 – The company is reincorporated in Delaware, continuing expansion across components and peripherals.

- 2009 – First PC chassis, the Obsidian 800D, launches and Corsair forms a long-term liquid-cooling partnership with CoolIT.

- 2016 – Ten-year PSU milestone is celebrated, noting more than ten million PSUs sold globally.

- 2017 – EagleTree Capital agrees to acquire a majority stake in Corsair for about $525 million, with founder Andy Paul remaining CEO.

- 2018 – Acquisition of Elgato Gaming expands Corsair into streaming gear.

- 2019 – Acquisitions of Origin PC and SCUF Gaming extend into custom PCs and console controllers.

- 2020 – Corsair completes its initial public offering on Nasdaq under ticker CRSR at $17 per share.

- 2021 – The company announces relocation of headquarters from Fremont to Milpitas with a new lease effective in March 2022.

- 2023 – Corsair acquires assets of Drop, the mechanical-keyboard community and brand, to deepen peripherals customization.

- 2024 – Corsair signs and then closes a deal to acquire the Fanatec sim-racing product line from Endor AG; workforce changes include approximately 90 layoffs in August.

- 2025 – Founder Andy Paul’s planned retirement is announced with Thi La appointed CEO effective July 1, 2025; Corsair reports integration progress of Fanatec and improved quarterly performance.

Fun Facts About Corsair

- Corsair was founded in 1994 in Fremont, California, by Andy Paul, Don Lieberman, and John Beekley as Corsair Microsystems, initially focusing on memory technology.

- The company originally produced level-2 cache modules known as COASt modules for PC manufacturers before shifting its focus to DRAM modules when Intel integrated cache into the CPU.

- Corsair became popular with PC enthusiasts in the early 2000s by launching high-performance DRAM specifically designed for overclocking, including its well known Dominator and Vengeance lines.

- Corsair is now headquartered in Milpitas, California, and operates manufacturing and assembly facilities in locations such as Taoyuan City in Taiwan, with distribution across North America, Europe, and Asia.

- The company completed its initial public offering in September 2020, listing on the NASDAQ under the ticker symbol CRSR at an IPO price of USD 17 per share.

- In 2024, Corsair generated net revenue of about USD 1.32 billion, following net revenue of approximately USD 1.46 billion in 2023, reflecting a large and diversified business in gaming and creator gear.

- Although revenue remained above USD 1.3 billion in 2024, the company reported a net loss of roughly USD 99 million, underlining heavy investment and competitive pressure in the gaming hardware market.

- Corsair employed about 2,567 people in 2024, showing how a small memory maker from the 1990s has grown into a global employer serving gamers and content creators worldwide.

- Private equity firm EagleTree Capital holds a majority stake of roughly 56.8% in Corsair, which is relatively unusual among gaming hardware brands that are publicly traded.

- Corsair has built a multi-brand ecosystem by acquiring Elgato in 2018, Origin PC in 2019, SCUF Gaming in 2019, Drop in 2023, and the Fanatec product line in 2024, extending from PC parts into streaming, custom PCs, controllers, keyboards, and sim racing gear.

- The company benefited strongly from the COVID-19 lockdown period, when increased time spent at home and rising interest in PC gaming supported a sharp short-term jump in Corsair’s revenue around 2020–2021.

- Corsair’s products have expanded far beyond memory to include PC cases, power supplies, cooling systems, SSDs, keyboards, mice, headsets, capture cards, lighting, and full gaming PCs, making it a one-stop ecosystem for enthusiasts.

- The brand has become deeply embedded in esports and streaming, with Elgato’s Stream Deck and capture devices widely used by creators, and with dedicated coaching, gear, and software designed for competitive gamers.

- Corsair is part of the S&P 600 index, which indicates that it is recognized as an established small-cap public company within the broader United States equity market.

- In 2024 and 2025, Corsair announced multi-year cross-brand partnerships with the Call of Duty franchise, using the Corsair, SCUF, Elgato, Origin PC, Drop, and Fanatec brands to launch themed controllers, peripherals, PCs, and streaming gear.

Total Revenue

(Source: corsair.com)

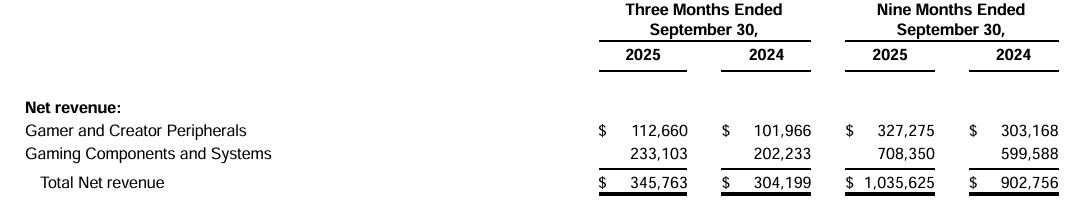

- The table illustrates the income generated by Corsair from its two major business segments during the three-month and nine-month periods ending September 30, respectively, in 2025 and 2024.

- The values are given in thousands of dollars.

- Over the three months, Corsair’s revenue from gamer and creator peripherals in 2025 was USD 112,660, up from USD 101,966 in 2024.

- This indicates a category’s growth of approximately USD 10.7 million, which reveals the stronger demand for keyboards, mice, and headsets, etc.

- The revenue from gaming components and systems increased to USD 233,103 in 2025 and USD 202,233 in 2024.

- This increase amounts to approximately USD 30.9 million, thus making it the greatest contributor to the overall growth.

- When both categories are added together, Corsair’s total revenue for the quarter was USD 345,763 in 2025 compared to USD 304,199 in 2024, hence the overall increase of around USD 41.6 million.

- In the case of the nine months, peripherals earned USD 327,275 in 2025, whereas USD 303,168 was earned in 2024 — an increase of about USD 24.1 million.

- On the other hand, components and systems together generated USD 708,350 in 2025, which is a significant leap from USD 599,588 in 2024; thus, the figure is approximately USD 108.8 million.

- The total revenue from both segments is USD 1,035,625 in 2025, which is an increase from USD 902,756 in 2024. The nine-month period has seen an increase of about USD 132.9 million.

- In simplified terms, all areas of Corsair’s business experienced a year-over-year performance boost, though most of it was due to the components and systems division.

Corsair Gross Profit

(Source: corsair.com)

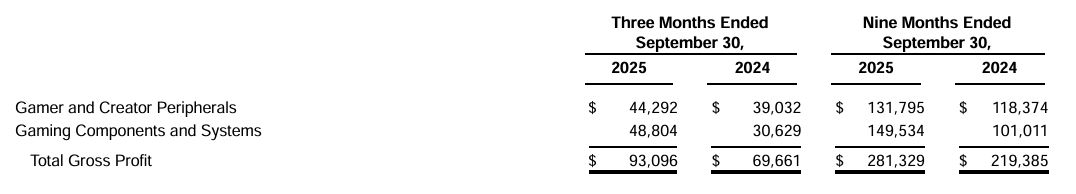

- The figures represent the gross profit generated by Corsair across its business segments for the three- and nine-month periods ended September 30 in both 2025 and 2024.

- Over the three months, the gross profit from gamer and creator peripherals reached USD 44,292 in 2025, up from USD 39,032 in 2024.

- Thus, the profit in that segment went up by slightly more than USD 5.2 million every year.

- The gross profit from gaming components and systems was USD 48,804 in 2025, up from USD 30,629 in 2024, indicating a whopping USD 18.2 million increase.

- The total gross profit for the quarter was calculated at USD 93,096 in 2025, up from USD 69,661 in 2024, reflecting an overall increase of around USD 23.4 million.

- For the nine months, the revenue of gamer and creator peripherals raised gross profit of USD 131,795 in 2025, which is an increase from USD 118,374 in 2024, an increase of approximately USD 13.4 million.

- On the other hand, gaming components and systems accounted for USD 149,534 in 2025, up from USD 101,011 the previous year, a nearly USD 48.5 million increase.

- Thus, the total gross profit after combining the two was USD 281,329 in 2025, which is a rise from USD 219,385 in 2024 — an increase of about USD 61.9 million.

- In total, both segments witnessed improvement over the previous year; however, the biggest gains came from gaming components and systems.

Corsair Gross Margin

(Source: corsair.com)

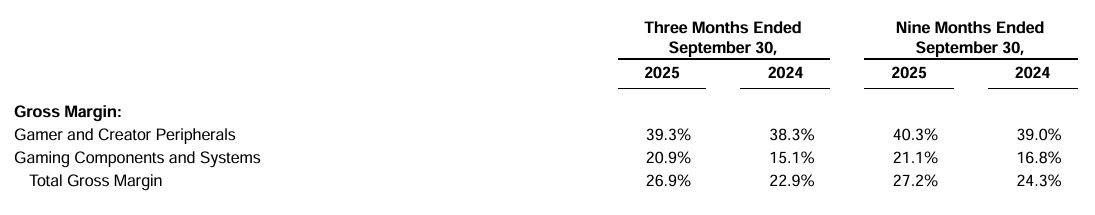

- The numbers indicate how Corsair’s profit margins improved when 2025 was compared with 2024 for both the three-month and nine-month periods ending September 30.

- Initially, looking at the three months, the margin on gamer and creator peripherals was 39.3% in 2025, showing a slight increase over 38.3% in 2024.

- The margin on gaming parts and systems saw a much steeper rise, going up from 15.1% in 2024 to 20.9% in 2025.

- If the two areas are combined, the gross margin of the company for the quarter increased from 22.9% in 2024 to 26.9% in 2025.

- This also indicates that Corsair was able to hold more of its revenue as profit than it did in the same quarter last year.

- For the nine months, the margin of peripherals was 40.3% in 2025 and 39.0% in 2024, thus reflecting a very small but positive improvement.

- Margins for components and systems were increased from 16.8% in 2024 to 21.1% in 2025. Thus, the total gross margin was increased from 24.3% in 2024 to 27.2% in 2025.

- In general, both lines have gained, and margins on components and systems have increased the most, which has contributed to Corsair’s overall profitability.

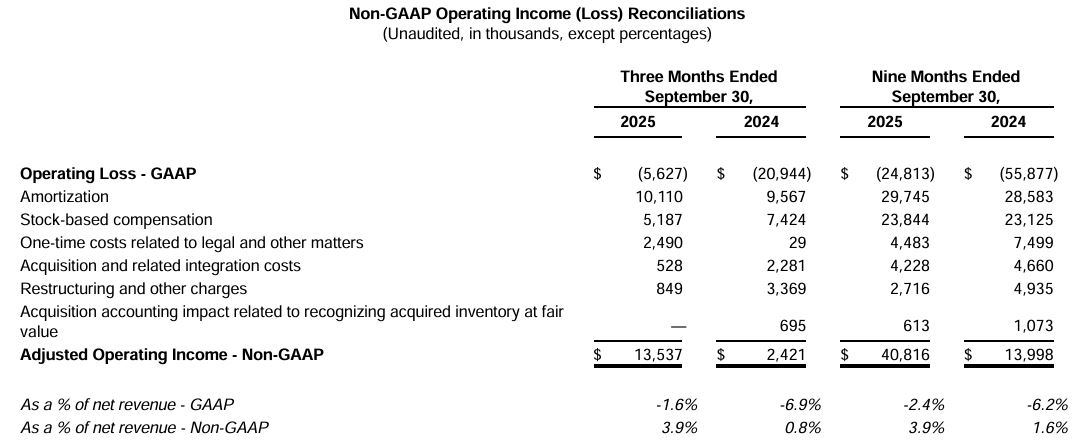

Corsair Operating Loss

(Source: corsair.com)

- Figures show the change in operating results for Corsair, comparing both the three-month and nine-month periods ending September 30, 2025, and 2024. Data are in thousands of dollars.

- The company incurred an operating loss of USD 5,627 for the three months in 2025.

- This constitutes a significant improvement in comparison to the wide operating loss of USD 20,944 recognized in the same period of 2024.

- The amortization in 2025 was USD 10,110, and in 2024 it was USD 9,567.

- The compensation of the stock was USD 5,187 in 2025, which is lower than USD 7,424 in the previous year. The one-time legal and related costs in 2025 were USD 2,490, which is much higher than just USD 29 in 2024.

- The integration costs related to acquisition were USD 528 in 2025 compared to USD 2,281 in 2024. The restructuring charges amounted to USD 849 in 2025 and USD 3,369 in 2024.

- There were no acquisition-related inventory fair-value adjustments in 2025, whereas 2024 included USD 695 for this item.

- For the nine months, Corsair reported an operating loss of USD 24,813 in 2025; this loss was again significantly smaller than the USD 55,877 loss reported in 2024.

- Amortization was USD 29,745 in the year 2025, while it was USD 28,583 in the year 2024. Stock-based compensation cost was USD 23,844 in 2025 versus USD 23,125 in 2024.

- One-time legal and related costs incurred were USD 4,483 in 2025 compared with USD 7,499 in 2024.

- The acquisition-related integration costs were USD 4,228 in 2025, while they were USD 4,660 in 2024. Restructuring and other charges were USD 2,716 in 2025 compared with USD 4,935 in 2024.

- There was a USD 613 adjustment for the acquisition-related inventory fair value in 2025 and USD 1,073 in 2024.

- After the items were excluded, operating income was adjusted to USD 40,816 in 2025, reflecting at least a twofold increase from USD 13,998 in 2024.

- The GAAP operating loss as a percentage of revenue was –2.4% in 2025 compared to –6.2% in 2024. Operating income on a non-GAAP basis was 3.9% of revenue in 2025, as against 1.6% in 2024.

Stock Price (Nov 12-Nov 17, 2025)

(Source: yahoo.com)

- The data presented here gives an insight into the latest stock trading of Corsair Gaming, Inc.

- The latest day’s regular trading session has seen the stock quoted at USD 6.07, down by USD 0.15 or 2.41% which is quite a considerable decline percentage-wise.

- In after-hours trading, the price fell further to USD 5.89, representing a USD 0.18 drop, or a staggering 2.97%.

- On November 14, 2025, the stock price opened at USD 6.08 and reached a peak of USD 6.17 before moving down to USD 6.02 and finally retracing to USD 6.07; the trading volume was 802,100 shares.

- On November 13, 2025, the stock opened at USD 6.46, with a high of USD 6.51; it then fell to USD 6.14 and closed at USD 6.22. In total, 836,400 shares were traded.

- The next day, on November 12, 2025, the stock started at USD 6.52, rose to USD 6.72 at its peak, then fell to USD 6.51 before closing at USD 6.55. The trading volume was at its highest, 1,075,900 shares.

- The 3-day show a gradual price decrease at the close, while trading volume fluctuated day by day.

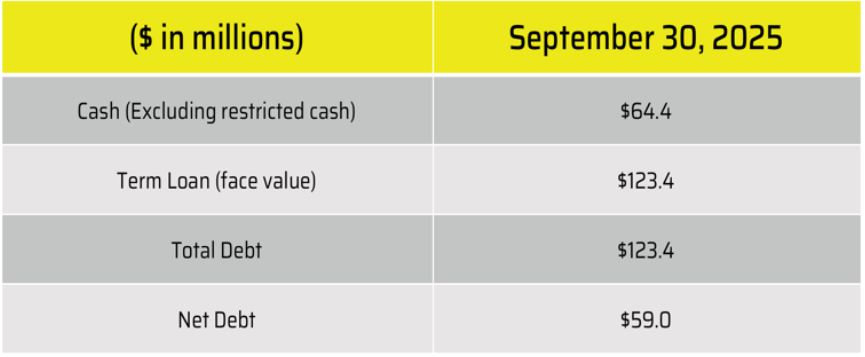

Corsair Cash And Debt Statistics

(Source: investing.com)

- Corsair’s financial overview reported its current assets and liabilities situation as of September 30, 2025.

- With USD 64.4 million in cash (excluding restricted cash), the company had a strong cash reserve. Its complete debt included only a term loan worth USD 123.4 million.

- Corsair’s net debt was thus USD 59.0 million when comparing cash available against total debt—the amount owed after cash has been deducted.

- This shows that the company has a debt burden, and on the other hand, its cash reserve is large enough to cover a part of it, so that the company is left with only a moderate net debt level.

Conclusion

Corsair Statistics: The 2025 performance of Corsair reflects a change in trend; its strong results were mainly due to increased demand for peripherals and gaming components. The overall revenues, which were strongly increasing, as well as the gross profit and margins, particularly, were the first to be positively affected. Operating losses were reduced significantly; meanwhile, adjusted operating income benefited most from effective resource management and a healthy product mix.

The recent decrease in stock prices has not affected Corsair’s financial power, which remains moderately net debt and with substantial cash reserves. All things considered, the company’s current situation supports significant operational recovery and a robust foundation for future growth in the gaming and creator markets.

Sources

FAQ.

Corsair had a very good year in terms of revenues, and one of the reasons was the increase in sales of both peripherals and components/systems. The total revenue for the first quarter was US$304.2 million, and for the second quarter, it was US$345.8 million, plus the revenue for nine months was US$132.9 million more compared to last year. The component and system segment was the main contributor to this increase by almost US$108.8 million over nine months, while peripherals added approximately US$24.1 million.

The company’s gross profit was substantially higher in the case of Corsair, whose quarterly profit increased by US$23.4 million and its nine-month profit by US$61.9 million. The main reason for this enhancement was the components and systems’ performance, which processed the gross margin from 15.1% to 20.9% in the quarter. Peripherals also had a slight increase in margin. Overall gross margin went up to 26.9% quarterly and 27.2% for the nine months, which is a result of a more efficient product mix and better cost control.

Corsair was able to cut down significantly on its operating loss. The quarterly operating loss decreased from -US$20.9 million in 2024 to -US$5.6 million in 2025, and the nine-month losses fell from -US$55.9 million to -US$24.8 million. The company was able to achieve this result through savings in restructuring costs, the elimination of stock-based compensation, and less money spent on acquisitions. The company’s operating income under non-GAAP accounting chain increased to US$13.5 million for the quarter and US$40.8 million for the nine-month period.

Corsair’s stock price during the three-day period reflected a decreasing trend with no doubt at all. The price at the end of the day went down from US$6.55 on November 12 to US$6.07 on November 14. The amount of shares traded varied, with the highest volume being over 1 million shares on November 12. After-hours trading on November 14 also saw a drop to US$5.89, which pointed to the fact that investors are still very cautious even though there are some positive changes in the company’s fundamentals.

On September 30, 2025, Corsair had cash of US$64.4 million and total debt of US$123.4 million, which consisted entirely of a term loan. Net debt was US$59.0 million after cash was subtracted from total debt. The company is considered to have moderate net debt since the amount is not too high and does not pose a risk to the company’s liquidity management.

I hold an MBA in Finance and Marketing, bringing a unique blend of business acumen and creative communication skills. With experience as a content in crafting statistical and research-backed content across multiple domains, including education, technology, product reviews, and company website analytics, I specialize in producing engaging, informative, and SEO-optimized content tailored to diverse audiences. My work bridges technical accuracy with compelling storytelling, helping brands educate, inform, and connect with their target markets.