3D Camera Statistics and Facts

Updated · Feb 04, 2025

Table of Contents

Introduction

3D Camera Statistics: Recently, the 3D camera segment has experienced remarkable growth, driven by advancements in technology and an increasing range of applications across various sectors. A 3D camera captures three-dimensional images or videos using several advanced techniques, including stereoscopic vision, time-of-flight (ToF), structured light, and Lidar.

Structured light projects specific patterns to determine depth, while Lidar utilizes laser pulses to achieve high accuracy in 3D mapping. According to statistics, 3D cameras are used in numerous areas such as 3D imaging, scanning, and depth sensing. These applications enable lifecycle visualization, precision measurements, and improved interaction.

Editor’s Choice

- The global 3D camera market was valued at USD 7.21 billion in 2024 and is projected to reach USD 35.25 billion by 2034, growing at a CAGR of 17.20% from 2025 to 2034.

- Key drivers for market growth include advancements in 3D scanning, computational photography, autonomous vehicles, drone technology, and industrial applications.

- The 3D visualization and rendering software market was valued at USD 1.63 billion in 2019 and is expected to reach USD 9.61 billion by 2030, driven by the increasing adoption of augmented reality (AR) and virtual reality (VR) and the rising demand for realistic digital experiences.

- The Asia Pacific region dominates the 3D camera market, holding a 38.2% share due to strong manufacturing capabilities and the rapid adoption of 3D imaging technologies.

- Stereo vision cameras remain the most widely used system, accounting for 64.9% of the market share in 2023.

- Canon and Sony lead the 3D camera market, each holding a 26.1% share, followed by Nikon (11.7%), Fujifilm (5.8%), and Panasonic (4.3%).

- Camera shipments declined by 94% from 2010 to 2023, with smartphones replacing dedicated cameras. In 2023, only 1.7 million fixed-lens cameras were shipped.

- Apple acquired LinX Imaging for USD 345 million in early 2023 to enhance depth-sensing and AR capabilities for its iPhones and iPads.

- Intel acquired Itseez for USD 50 million in mid-2023 to integrate computer vision technology with its RealSense 3D cameras.

- Sony launched the DepthSense camera in early 2024, designed for high-depth precision measurements in smartphones, gaming consoles, and AR/VR devices.

- Intel introduced the RealSense D455 camera in mid-2023, featuring an increased field of view and enhanced depth perception for robotics, drones, and industrial automation applications.

- Occipital raised USD 80 million in 2023 to advance its 3D sensing technology, while Vayyar Imaging secured USD 109 million in early 2024 for healthcare and automotive applications.

- Multi-camera systems are under development to improve 3D mapping and depth perception for robotics, VR, and AR.

- The primary applications of 3D cameras include 3D modeling, AR/VR, visual effects in post-production, and facial recognition.

- The leading companies in the 3D camera market include Sony Corporation, Fujifilm Holdings Corporation, and Samsung Electronics Co. Ltd.

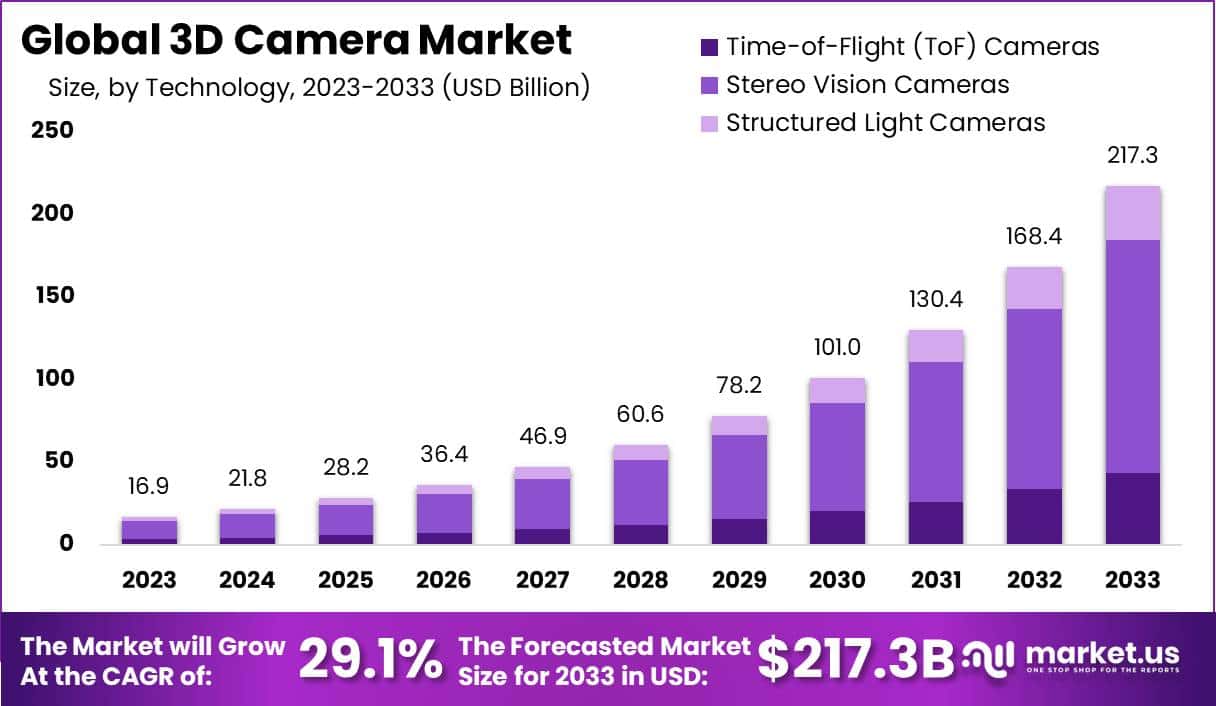

3D Camera Market Size – By Market.us

- The global 3D camera market is projected to grow at a CAGR of 29.1% from 2024 to 2033.

- The market was valued at USD 16.9 billion in 2023 and is expected to reach USD 217.3 billion by 2033.

- Stereo vision cameras held a dominant market share of 64.9% in 2023.

- Asia Pacific led the market, capturing 38.2% of the total share, driven by a strong manufacturing ecosystem and increasing adoption of 3D imaging technologies.

- The demand for 3D cameras is fueled by the need for high-quality image capture in smartphones, tablets, and digital cameras.

- Major applications of 3D cameras include 3D modeling and design, augmented/virtual reality, post-production VFX, and facial recognition.

- LiDAR integration and depth sensing for photography are emerging trends shaping the 3D camera market.

- The healthcare sector presents significant growth opportunities, particularly in medical imaging and surgical navigation.

- Key market players include Sony Corporation, Fujifilm Holdings Corporation, Panasonic Corporation, Canon Inc., Nikon Corporation, GoPro, Inc., and Samsung Electronics Co., Ltd.

- Challenges in the market include calibration and accuracy issues, complex data processing, interoperability concerns, and ethical considerations.

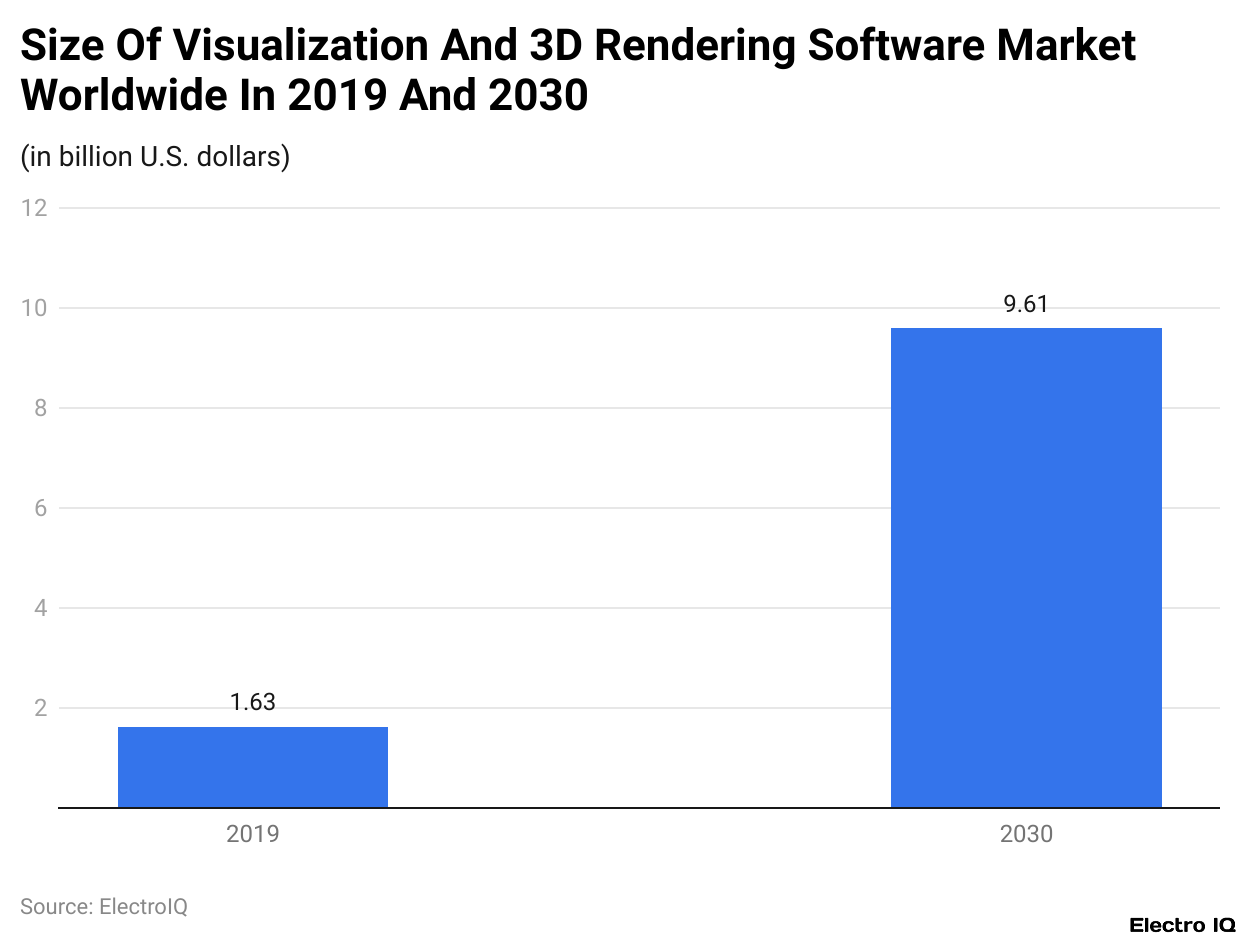

Visualisation And 3D Rendering Software Market Revenues Worldwide

(Reference: statista.com)

(Reference: statista.com)

- As diagnostic insights by NMSC show, the global market for visualization and 3D rendering software was valued at about USD 1.63 billion in 2019.

- The market keeps expanding because of the increasing demand for high-quality 3D graphics across various industries, encompassing gaming, architecture, and entertainment.

- Experts see the market value rising exponentially to about USD 9.61 billion by 2030.

- 3D camera statistics show that this rapid growth is being propelled by technical buzzwords, the growing use of virtual and augmented reality, and the demand for hyper-realistic digital experiences.

3D Technology

- From shaping social norms, values, and traditions to manipulating everyday life, 3D technologies are fast becoming the right tools in a digital and physical world.

- Software and hardware advancements in AR/VR are opening new possibilities, from training in the workplace to therapy for trauma patients.

- In addition, 3D printers turn digital designs into tangible objects and have become so user-friendly that anyone can start making small homewares.

- In entertainment, 3D media creates the perception of depth by projecting two slightly different images, one to each eye.

- 3D camera statistics reveal that over 122,000 digital 3D cinema screens were reported all over the world by the year 2020.

- Other than cinema, AR and VR apparatuses are utilized to create engrossing 3D experiences.

- VR creates a artificial environment, while AR adds bits of digital to the real world. Users can interact with these technologies through a headset, AR glasses, and smartphone apps.

- Major tech companies are investing heavily in extended reality (XR), which refers to AR, VR, and MR.

- The next phase of the internet, the metaverse, is being conceived as a blend of the digital and physical world by leveraging VR and AR devices for meaningful interaction.

- The early 2010s saw the advent of 3D printing or additive manufacturing. This technology is being adopted in diverse sectors such as aerospace, automotive, consumer goods, and healthcare.

- The essential medical supplies: face shields, masks, respirators, and swabs for COVID-19 test kits were all produced via 3D printing during the COVID-19 pandemic, showcasing the technology’s utility.

- Currently, the 3D printing industry is experiencing rapid growth, estimated to be valued at US$17.4 billion by 2022 and projected to reach US$37.2 billion by 2026.

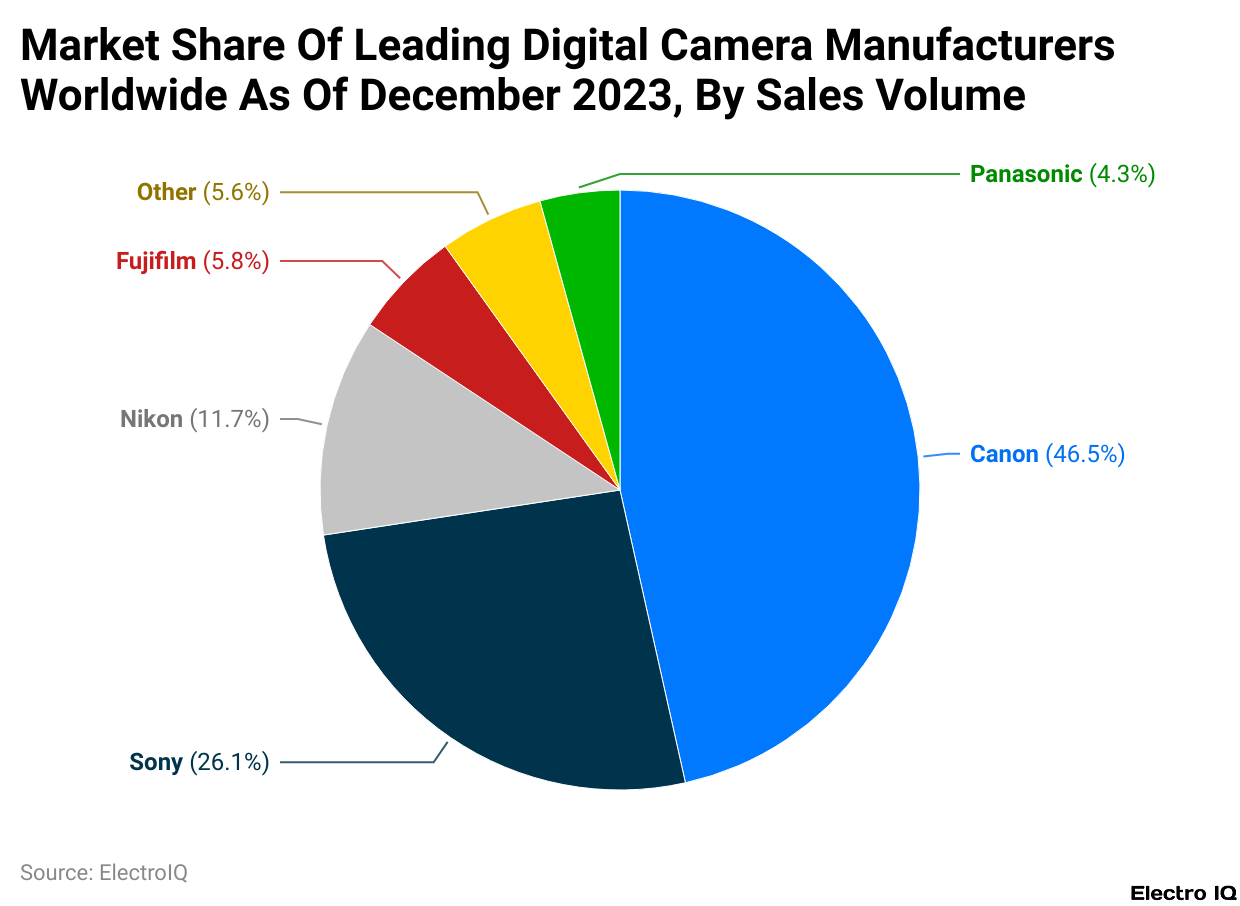

- 3D camera statistics give an overview of the leading brands in the market for 3D cameras based on market share.

- Canon occupies the largest share at 46.5%, making it the market leader.

- This suggests that Canon’s 3D cameras have become widely favored, most likely due to advanced technology, reliability, and a strong reputation.

- In the second place comes Sony, occupying 26.1% of the market. This means that Sony holds a sizeable presence in the market, likely derived from innovation in imaging technology and integration of 3D capabilities into its camera systems.

- Nikon finds itself in the third position, holding 11.7% market share; this indicates that, while it remains a key player, it possesses a much smaller share in comparison to Canon and Sony.

- With a 5.8% share, Fujifilm and 4.3%, Panasonic have a more niche presence in the field of 3D cameras.

- The remaining 5.6% is accounted for by other brands, which indicates that though certain companies are present in the industry, each has a relatively smaller share of the overall market.

- To conclude, Canon and Sony dominate the 3D camera market, while Nikon, Fujifilm, and Panasonic have important but comparatively smaller roles.

Worldwide Shipments Of 3D/Digital Cameras

(Source: petapixel.com)

(Source: petapixel.com)

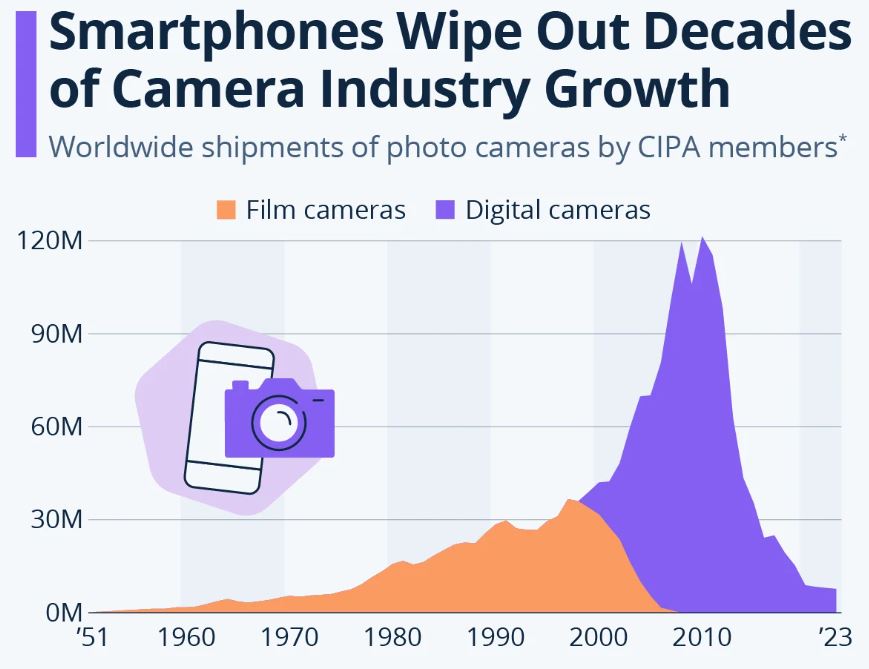

- The chart on 3D camera statistics describes the complete recordings of worldwide shipments of photo cameras by CIPA. It is, therefore, rightly stated that factories include all cameras shipped by CIPA members since 1951: OM Digital Solutions, Canon, Fujifilm, Sony, Nikon, Panasonic, and others.

- Slowly increasing camera sales during the film period from the 1950s through to 1970s, with film camera sales represented in orange. Major growth occurred in the 1980s, followed by a massive wave of sales from 2000 to 2010 during the digital camera boom.

- Sales hit peak levels at over 120 million units in a single year, but the entire market started crashing down from 2010 to 2023 as smartphones took the place of traditional point-and-shoot cameras.

- As per Statista, camera shipments fell by 94% from 2010 to 2023, which wiped away decades of growth.

- In 2023, CIPA members shipped only 1.7 million fixed-lens cameras, a significant fall from what was formerly the backbone of the digital camera industry.

- With AI features on smartphones, the need for dedicated cameras is becoming, for most consumers, a distant memory, with modern smartphones producing image quality that satisfies the average working consumer.

- Looking at better AI and camera capabilities in smartphones, the prospects for the enhancement of phone cameras mean, by all probability, that dedicated cameras will soon bear little relevance to a considerable number of true everyday users.

Specifications Of 3D Cameras

3D-A5000

- Versatile through functionality and components, the 3D-A5000 is an ultra-compact yet rugged 3D camera. Measures 324x137x97 mm. Weighs 3.0 kilograms.

- It operates in the temperature range of 0 to 40 °C (32–104 °F) and can be stored in conditions between -10 to 60 °C (14–140 °F).

- Relative humidity of less than 85% (non-condensing) is favorable for its operation. An IP65 rating hides from dust and water.

- It has been tested against shock of 50 gs, Half Sine Pulse of 11 ms, and vibrations of 4 gs for 10–120 Hz for 30 minutes.

Canon EOS 5D Mark IV Kit

- The Canon EOS 5D Mark IV Kit (EF 24-105 IS II USM) is a professional-grade DSLR of the highest availability and power.

- It boasts a 61-point autofocus system containing up to 41 cross-type points and offers various autofocus modes: One-Shot, AI Servo, AI Focus, and Manual.

- The 30.4-megapixel sensor enables an ISO range of 100-32,000, extendable to 102,400. It has a 3.2 LCD with 1,620,000 dots but no built-in flash.

- It comes with a 24-105 mm lens with 4.3x optical zoom.

- The camera accepts CF Type I, SD, SDHC, and SDXC UHS-I memory cards and includes an RGB+IR sensor for metering at 150,000 pixels with a TTL system consisting of 252 zones.

Sony HDR-TD10 3D

- The Sony HDR-TD10 3D Handycam Camcorder features dual “Exmor R” CMOS sensors and BIONZ® processors, delivering a pixel count of about 4200K and an effective resolution of 3540K pixels (4:3).

- It includes 64GB of internal memory and supports Memory Stick PRO Duo™, Memory Stick PRO-HG Duo™, and SD/SDHC/SDXC cards.

- The camcorder captures still images at 7.1 megapixels and records videos in 3D HD, HD, and STD formats, with resolutions up to 1920×1080/60i.

- It offers Dolby® Digital 5.1ch audio, built-in zoom microphones, and Clear Phase Stereo Speakers.

Nikon D3 FX DSLR

- The Nikon D3 FX DSLR camera is a class-leading imaging product that boasts a 12.1-megapixel FX-format (23.9 x 36mm) CMOS sensor.

- It sports a 51-point autofocus system with 3D Focus Tracking, providing real-time and accurate subject tracking.

- The camera is capable of continuous shooting at nine frames per second at full FX resolution and is thus highly suited for fast-paced action photography.

- The images can be recorded onto CF I/II memory cards to afford flexibility in their use.

GoPro MAX

- The GoPro MAX Waterproof 360 Action Camera is for every action footage opportunity.

- The package includes the GoPro MAX camera, a protective case, a rechargeable battery, a curved adhesive mount, protective lens caps, a microfiber bag, a buckle, and a thumb screw with a USD-C cable. Users can change from HERO to 360 mode to capture immersive 6K footage.

- The camera offers Max HyperSmooth stabilization, keeping shots steady even during spirited on-the-go activities.

Recent Developments

- Early in 2023, Apple acquired LinX Imaging, an Israeli 3D camera technology company famous for enhancing depth sensing and AR features for iPhones and iPads, for US$345 million.

- Then came Intel, acquiring Itseez in mid-2023 for US$50 million; its computer vision technology enhanced Intel’s RealSense 3D camera family.

- New products are up-Sony DepthSense cameras targeted toward smartphones, gaming consoles, and AR/VR devices, launched in early 2024-a, a high-precision depth-sensing camera with improved low-light performance.

- 3D camera statistics show that in mid-2023, Intel announced the RealSense D455, offering a wider field of view and improved depth performance for applications in robotics, drones, and industrial automation.

- With funding rounds being a pivotal resource to spur innovation, Occipital 2023 raised US$80 million to scale its 3D sensing technology, and Vayyar Imaging raised US$109 million in early 2024 to address applications in healthcare, automotive, and smart homes.

- The advancement of technology integrates the application of AI and machine learning in 3D cameras for better object recognition and real-time processing.

- The trend goes more on the miniaturization of 3D camera modules for smartphones, wearables, and IoT devices.

- 3D camera statistics state that the rapid rise in the demand for 3D cameras in smartphone applications, automotive, and industrial sectors, coupled with advances in AR/VR, will accelerate the growth of the market with a CAGR of 14.2% from 2023-2028.

- The automotive sector has embraced 3D camera technology to steer the implementation of autonomous driving and driver assistance alongside in-cabin monitoring.

- Lastly, EU GDPR-compliance measures for data privacy and FCC rules introduced in the US in early 2024 regulate the safe deployment of 3D imaging devices.

- Together with these, advanced depth-sensing technologies like time-of-flight and structured light are being explored to obtain maximum precision.

- Multi-camera systems vary 3D mapping and depth perception for robotic applications as well as VR and AR experiences.

Conclusion

According to 3D camera statistics, 3D camera markets witnessed a lot of change, growth, and technological advancement through the year 2024. Since several industries are adopting 3D imaging in their various operations, the impending year will see a future expansion in the economy.

Despite factors such as high costs and regional acceptance rates confronting the 3D camera, these issues will probably be resolved again by future research and development. In a nutshell, the 3D camera market is all set for continuous growth and innovation.

FAQ.

The global 3D camera market was valued at US$7.21 billion in 2024 and is expected to reach US$35.25 billion by 2034, with a CAGR of 17.20% from 2025 to 2034. Growth in the industry is propelled by technological advancements in 3D scanning, computational photography, autonomous vehicles, drones, and industrial applications.

Canon leads with a market share of 46.5%, followed by Sony (26.1%), Nikon (11.7%), Fujifilm (5.8%), and Panasonic (4.3%). The rest of the brands make up 5.6% of the market.

3D cameras are used widely across industries such as entertainment, healthcare, automotive, and industrial automation. They act as an important factor in AR/VR applications, autonomous driving, robotics, 3D scanning, and digital imaging.

New technologies include AI and machine learning to assist with object recognition, the miniaturisation of 3D camera modules for use in smartphones and wearables, and multi-camera systems to improve 3D mapping. Sony, Intel, and Apple have also released precision depth-sensing cameras for different applications.

The emerging smartphones of the present, which feature immensely capable AI-based cameras, have greatly reduced the demand for dedicated cameras. Shipments of cameras were reduced by 94% from 2010 to 2023, with only 1.7 million fixed-lens cameras shipped in 2023. Many consumers rely on smartphones for photography these days, leading to a decline in sales of standalone digital cameras.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.