Limestone Statistics and Facts

Updated · Jan 23, 2025

Table of Contents

Introduction

Limestone Statistics: Limestone is one of the sedimentary rocks, rich in calcium carbonate that is very important as well as the primary raw material in many major sectors such as construction, the manufacturing of steel, and agriculture. The Global Limestone Market travel through 2025, has a smoothening trade landscape that further enhances its potential value, as different industries increase their uptake.

This article gives a complete summary of the 2025 limestone markets, with key limestone statistics, the information provided, and growth trend observations, as well as regional nuances.

Editor’s Choice

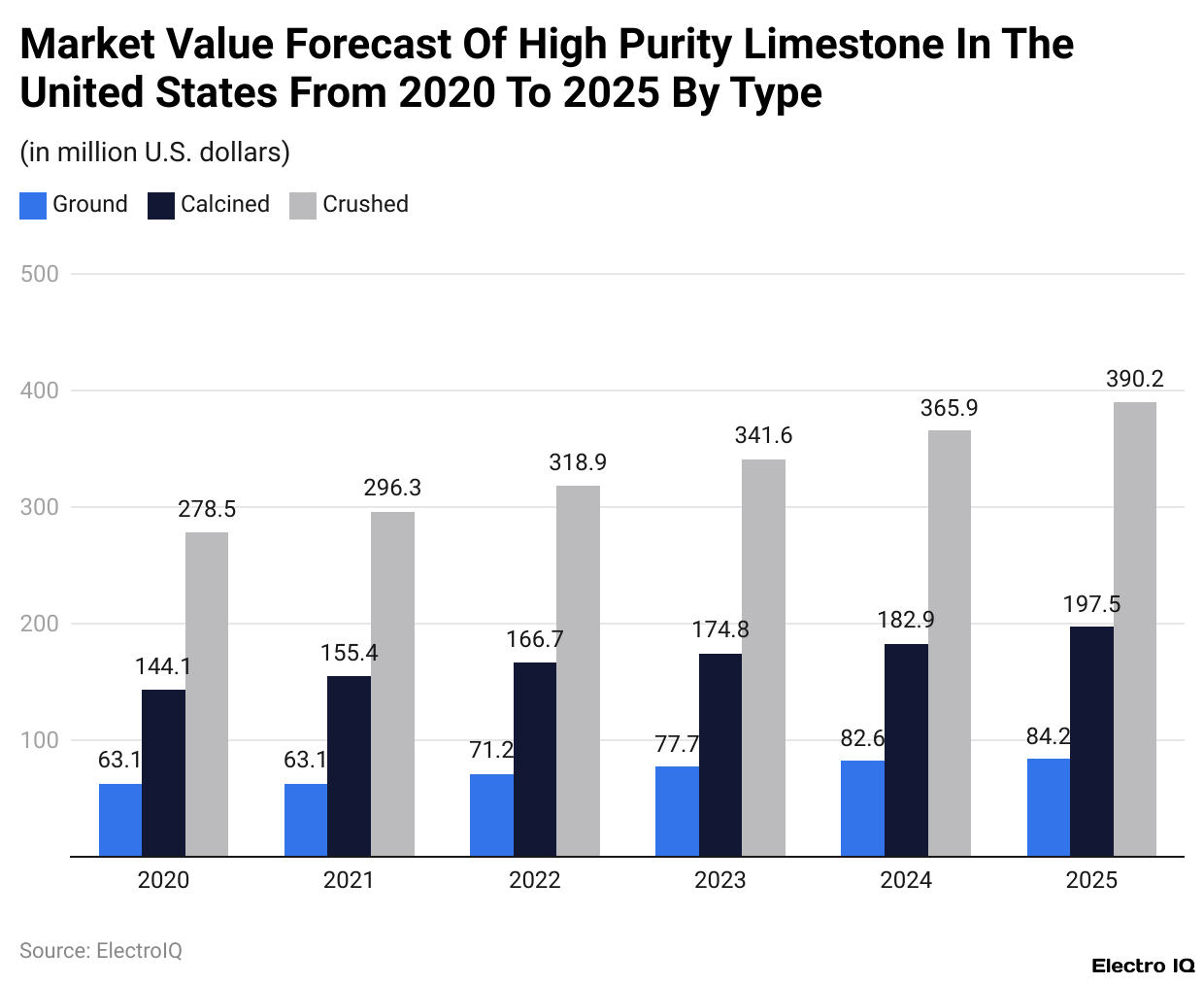

- According to limestone statistics, Market demand is set to increase due to the anticipated break-out of infrastructure enabling cement production capacity, which will push the market toward about 55% growth over by the year 2025.

- Portland cement production will drive an increase in high-purity limestone from the U.S. market to exceed USD 390 million in 2025 for potential sales.

- Limestone statistics reveal that Global limestone production totalled around 430 million tons in both 2022 and 2023; Chinese limestone production accounted for more than 70% of total global limestone production (310 million tons).

- Other top limestone producers were the U.S. (17 million metric tons), India (16 million metric tons), Brazil (8.3 million metric tons), and Germany (5.9 million metric tons).

- Limestone production in India increased from INR 102.01 bn in 2022 to an estimated 115 billion INR by 2024 on account of construction and cement demand.

- United States limestone production showed fluctuations from 16.9 million metric tons in 2019 up to 17MM in 2022-2023, with apparent consumption following production.

- Limestone statistics state that Lime imports reached 354,000 ents in 2022, while the export of lime-derived material rebounded slightly in 2023, totalling 350,000 metric tons.

- Quicklime prices in the USA increased from USUSD 128.3 per metric ton in 2019 to USUSD 155 in 2023, while hydrated lime rose from USUSD 154.6 to USUSD 185.

- These producers could number 28 in the U.S. lime industry for 2023, with 18 participants in trade within internal sales and 10 selling within themselves, principally for sugar production.

- Eight out of the top five U.S. lime producers accounted for 80% of the domestic total, with Alabama, Missouri, Ohio, and Texas constituting a few of the key-producing states.

- The largest consumption of lime (from an intersectoral industry perspective) is by the steel industry, chemical applications, flue gas treatment, construction, water treatment, and nonferrous metal mining sectors.

- Limestone is used not only in steel production but also in steel making with an integrated production requirement of just over 270 kg per ton of crude steel and between 63 kg and 88 kg in electric arc furnaces.

- Limestone statistics reveal that 1.71 billion metric tons, 1 year later, was the aggregate world steel yield in 2023, which showed an increase of 0.5 % between 2022 and 2023 owing to limestone consumption.

- In December 2023, China’s production of steel was 67.44 million metric tons, down from 76.1 million metric tonnes in November, primarily attributable to regulatory developments.

- Steel exports from US mills during December 2023 increased by 2.6% to 7,082,921 net tons from 6,901,567 net tons in December 2022.

- Limestone statistics show that the crude steel production of Germany, in 2022 was 36.85 billion metric tonnes, as opposed to 32.81 billion in 2023.

- The income of the iron and steel foundry sector in Brazil remained unchanged at the level of USD 793.23 million in 2023, just as it was in 2022, fluctuating at around USD 790.82 million.

Limestone Market Value

(Reference: statista.com)

(Reference: statista.com)

- Limestone statistics show that the specific type of crushed top-quality limestone is forecast to surpass USD 390 million in value in the US market by the year 2025.

- This variant of limestone is generously endowed with calcium an integral role in the manufacture of Portland cement clinker.

- Portland cement clinker is an essential ingredient for cement manufacturing that the construction sector cannot operate without the increased infrastructure and real estate projects, alongside another request for cement as an industrial material, making it the best material of choice.

- Expansion within the various infrastructure and real estate works drives demand for high-purity limestone to continually increase.

- This material is, at present, one of the important materials of construction within the U.S. because it supplies much of the dynamic increase in construction activities.

Global Limestone Production

(Source: pubs.usgs.gov)

(Source: pubs.usgs.gov)

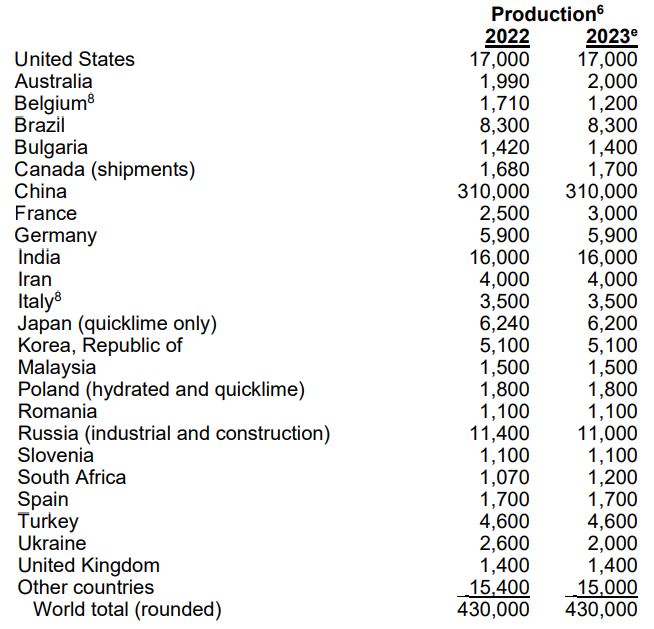

- Data reading limestone statistics acquired estimated lime production for the whole world during 2022 and 2023, showing production quantity in metric tons in various territories.

- Approximately 430 M metric tons of lime were manufactured in both years, with China being the most significant producer having a 310 M metric ton contribution to global share, over 70% of it.

- Furthermore, the United States and India have produced 17 M and 16 M metric tonnes of lime, respectively. The production level stayed constant in the case of several countries, for instance, Brazil (8.3 million), Germany (5.9 million), Iran (4 million) and Turkey (4.6 million).

- Several countries, for example, Australia had a significant increment in its production, from 1.99 million to 2 M metric tons, and France from 2.5 million to 3 million.

- Conversely, a slight fall occurred in the output of some countries; for instance, Belgium’s production slid to 1.71 million tonnes from 1.2 million tonnes, while for Ukraine, the fall was from 2.6 million tonnes to 2 million.

- Russia’s lime production decreased slightly, from 11.4 million to 11, among many larger producers.

- Smaller producers such as Canada, Poland, Malaysia, Romania, Slovenia and the United Kingdom had a steady production level.

- South Africa enhanced its lime production, from 1.07 million to 1.2 million metric tons and Bulgaria reported a slight decrease of production capacity, from 1.42 million to 1.4 million metric tons.

- A generally constant level of lime production was experienced globally by 2023, but at the territorial level, probably changes often result from economic and industrial issues.

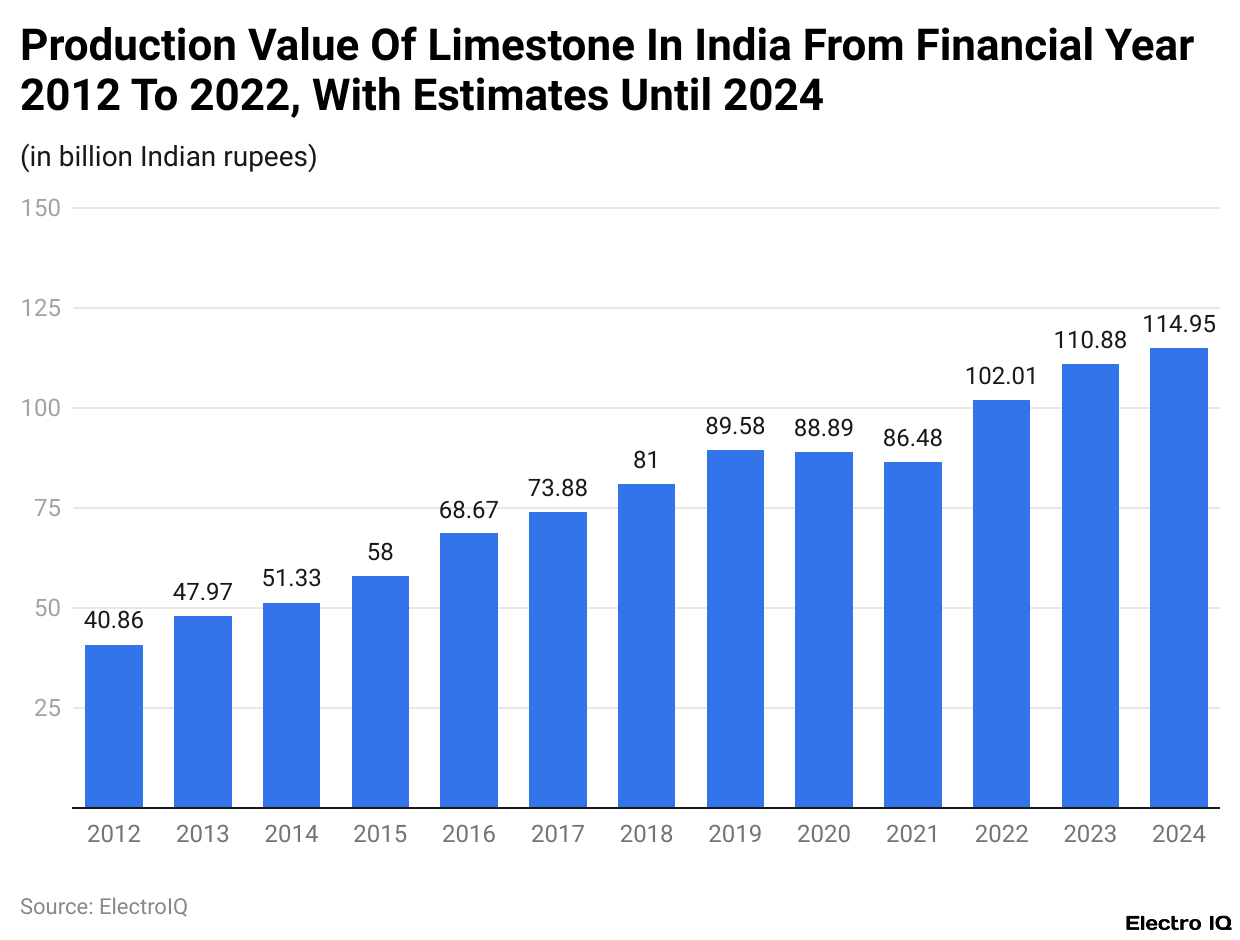

Production Value Of Limestone In India

- limestone statistics state that India is at the end of the fiscal year 2022 going to deliver limestone production as much as 102.01 billion Indian rupees.

- The value witnessed an accordingly progressing two-year rise to 115 billion Indian rupees by the end of the financial year 2024.

- This growth reflects growing demand driven by higher construction growth, new infrastructure works, and an increase in cement manufacturing.

- The increase reveals a steady growth trend in the Indian Mining and Mineral Sector, thereby making a contribution towards the overall economic development of the country.

Production And Consumption Value In The US

(Source: pubs.usgs.gov)

(Source: pubs.usgs.gov)

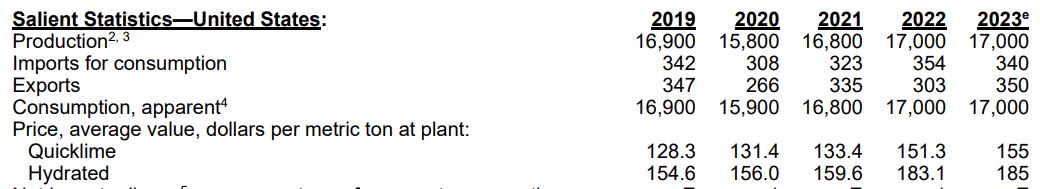

- Limestone statistics presents production limestone trade statistics for 2019-2023 and the trends in prices.

- Production levels are slightly unstable year after year having started at 16,900 thousand metric tons in 2019, dropping slightly to 15,800 in 2020, then slightly up to 17,000 in 2022 and 2023.

- Apparent consumptions are almost the same as those of production due to the nature of the trade. Import variations for consumption have been recorded at 354, with both maximum and minimum thereby the maximum peak was noted in 2022 at 354 thousand metric tons.

- Export figures showed a slight decline in 2019; however, despite the decrease in exports from 347 in 2019 to 266 in 2020, there is a recovery in export figures that go back to 350 by 2023.

- Limestone prices continued to increase as reflected by an increase in the average price per metric ton for quicklime from USD 128.3 in 2019 to USD 155 in 2023.

- It follows the same trend with hydrated limestone which increased in rate, from USD 154.6 in 2019 to USD 185 in 2023.

- The price movements are attributed to increased costs of production perhaps due to increased demand in the market. By the year 2023, there were 28 producers of lime in the United States, 18 of which were in commercial sales and the other 10 engaged exclusively in producing lime from sugar processing.

- These were responsible for maintaining 73 primary lime plants (quicklime kiln-bearing facilities)-in 1 of the 28 states or Puerto Rico only exception bay being that 1 plant located in the said region did not operate a kiln that year.

- Also, there were functioning hydrating plants operated by 5 U.S. enterprises all of which were confined in 9 states.

- The top five lime production companies in America captured operations in 22 states and held responsible for about 80% of the total lime produced domestically. The leading states in lime production were Alabama, Missouri, Ohio, and Texas.

- A varying number of sectors were somewhat dependent on lime. Among the top players were steelmaking; chemical and industrial applications, where it was used in the production of fertilizers, in glassworks and for making paper and pulp; production of precipitated calcium carbonate; and in the sugar industry; flue gas treatment; in construction; water treatment; and in nonferrous metal mining.

Limestone Market Trends

- Iron ore is critical for making steel, particularly when forming slag. It requires calcium which combined with low silica, and something that is limestone has to be very low alumina and minimizes the need for a further flux.

- In most cases, the wetness of the slag needs not so much heat as one usually will cause a fluidifying action in the limestone by the addition of impurities.

- Limestone statistics indicate that Integrated steel production needs about 270 kg/l000 kg of crude steel of limestone whilst scrap steel alone hv-ES must often call for approx 88 kg.

- It still remains one of the most vital alloys used in varied sectors such as construction, automotive, electronics, and even aerospace and defence.

- On the basis of World Steel Association data, 2023 January had come down to only 1.71 billion tonnes of crude steel production; 0.5% more than the previous particular year.

- In terms of higher limestone demand, such growth is projected to translate into demands in the steel industry.

- China, the largest producer of crude steel, has simply seen a decrease in its production.

- The NBS data indicated that crude steel production declined to 67.44 million metric tonnes in December 2023 from 76.1 million metric tonnes in November 2023. However, good achievements were noticed in U.S. mills, which saw an increase in quantities of shipments.

- As of the close of December 2023, according to American Iron and Steel Institute (AISI) data, there was an increase in shipments at U.S. mills to the tune of 7,082,921 net tons in December 2023, which reflects a previous 2.6% improvement to 6,901,567 net tons in December 2022.

- Germany is the second-largest producer in the EU, and current new data as to its world ranking still matter.

- Total crude steel production from the Steel Economic Association of Germany stood at 32.81 million tons from 36.85 million tons in 2022.

- The production of lime is also indispensable in steel production, an industry where it serves as a fluxing agent; helps remove impurities; helps these meltdown reactions; and also increases the efficiency of blast furnaces. In contrast, the iron and steel foundry industry in Brazil was less volatile in its revenue flow.

- The Instituto Brasileiro de Geografia e Estatistica announced that industry revenue was worth USD 793.23 million in 2023, very close to the USD 790.82 million allotted last year in 2022.

Conclusion

The limestone statistics market is pegged to perform and achieve robust growth due to the fact that limestone will continue to find indispensable applications in construction, steel production, and agriculture. The limestone market is to face further upscale under increasingly favourable market dynamics and increasing demand in the regional markets, which is promising for those interesting parties and most importantly for promoting a global economy.

FAQ.

Major growth will take place in the limestone market because most sectors (construction, steel manufacturing, agriculture) need it. More substantial will be infrastructure expansion and an increase in cement production logged in the United States, which is also increasing the usage of a high-purity limestone needed for cement production.

China having a global share of 70% in production, will continue as being the largest exporter of limestone, some 310 million metric tons. The other bigger producers include the USA (17 million metric tons), India (16 million metric tons), Brazil (8.3 million metric tons), and Germany (5.9 million metric tons).

Limestone takes a paramount part in the production of steel, acting in the process as a flux, in the elimination of impurities. With the increase in the volume of steel production at the global level, the demand for this material, especially for steel manufacture, will be expected to grow, too.

Production has shown trivial fluctuations within US production metrics in the past four years, ranging from a modest 16.9 mm in 2019 to an estimated 17 million mt in 2023. Despite these fluctuations, the consumption indexes, more often than not, closely mirror production values. Indeed, modest increases can be noted in the prices of quicklime and hydrated lime over the past few years.

India’s limestone production value has been increasing over the recent years. From INR 102.01 billion in 2022, the production value is set to hit INR 115 billion by 2024. This steady increase in production indicates a higher demand from end users in the construction industry and even in the cement manufacturing industry which spearheaded part of the broader economic development in the country.

Joseph D'Souza founded ElectroIQ in 2010 as a personal project to share his insights and experiences with tech gadgets. Over time, it has grown into a well-regarded tech blog, known for its in-depth technology trends, smartphone reviews and app-related statistics.