Microsoft 365 Statistics By Downloads, Subscribers, Revenue and Facts

Updated · Feb 26, 2025

Table of Contents

- Introduction

- Editor’s Choice

- Number of Office 365 Enterprise Subscribers Worldwide By Country

- Microsoft Market Share

- Microsoft 365 Price Statistics

- Microsoft 365 Using By Age-groups

- Microsoft Revenue By Product Line

- Microsoft Software Spending

- Microsoft 365 Users

- Microsoft 365 Using By Industries

- Integration of Artificial Intelligence

- Conclusion

Introduction

Microsoft 365 Statistics: Microsoft 365 slotted into the position it occupies as a prime mover among cloud-based productivity solutions. In continuous development since 2017, Microsoft 365 represents a one-stop shop for any open application that meets the needs of business and personal use around the world.

The present article will track the historical river of Microsoft 365 with respect to important milestones, who and where thousand users and income growth global Microsoft 365 statistics, giving the ubiquity of Microsoft 365 in the modern digital workspace.

Editor’s Choice

- According to Microsoft 365 statistics, There are more than a million companies worldwide using Microsoft 365, with over a million businesses in the U.S. alone.

- Microsoft 365, previously known as Office 365, encompasses a core set of applications such as Outlook, Word, Excel, PowerPoint, OneDrive, SharePoint, OneNote, and Teams.

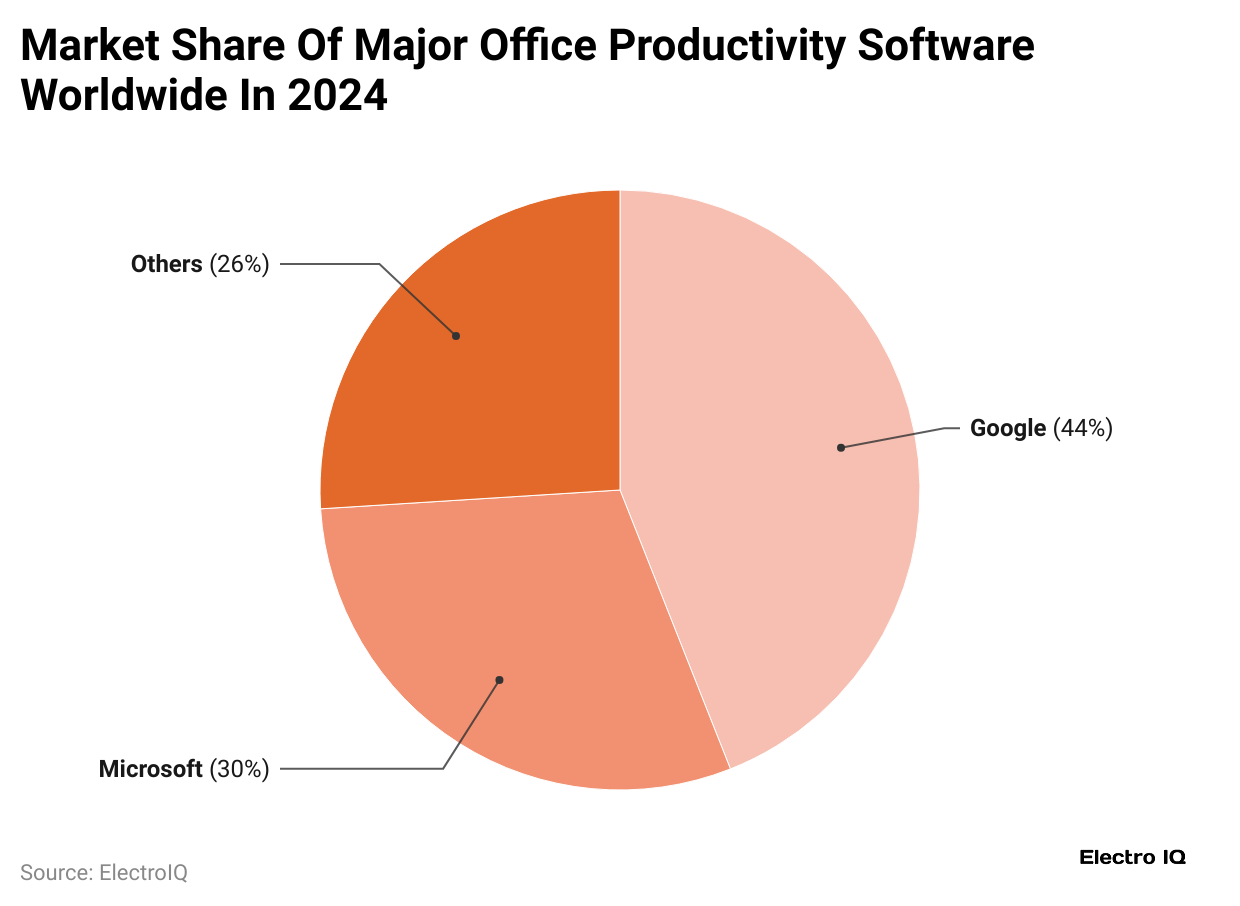

- Google holds 48% of the global office software market, while Microsoft 365, a fellow competitor, trails behind with 46%.

- Microsoft dominates in China, owning 57.22% of the market share.

- As of February 2024, Microsoft 365 had a 30% share in the global office software market, while Google Workspace was leading with 44%.

- Operating systems and productivity software generated US$133 billion in revenue in the U.S. market in 2021.

- Microsoft 365 statistics state that Microsoft 365 Business Premium is priced at US$22 per user/month, Business Standard at US$12, Apps for Business at US$8.25, and Business Basic at US$6.

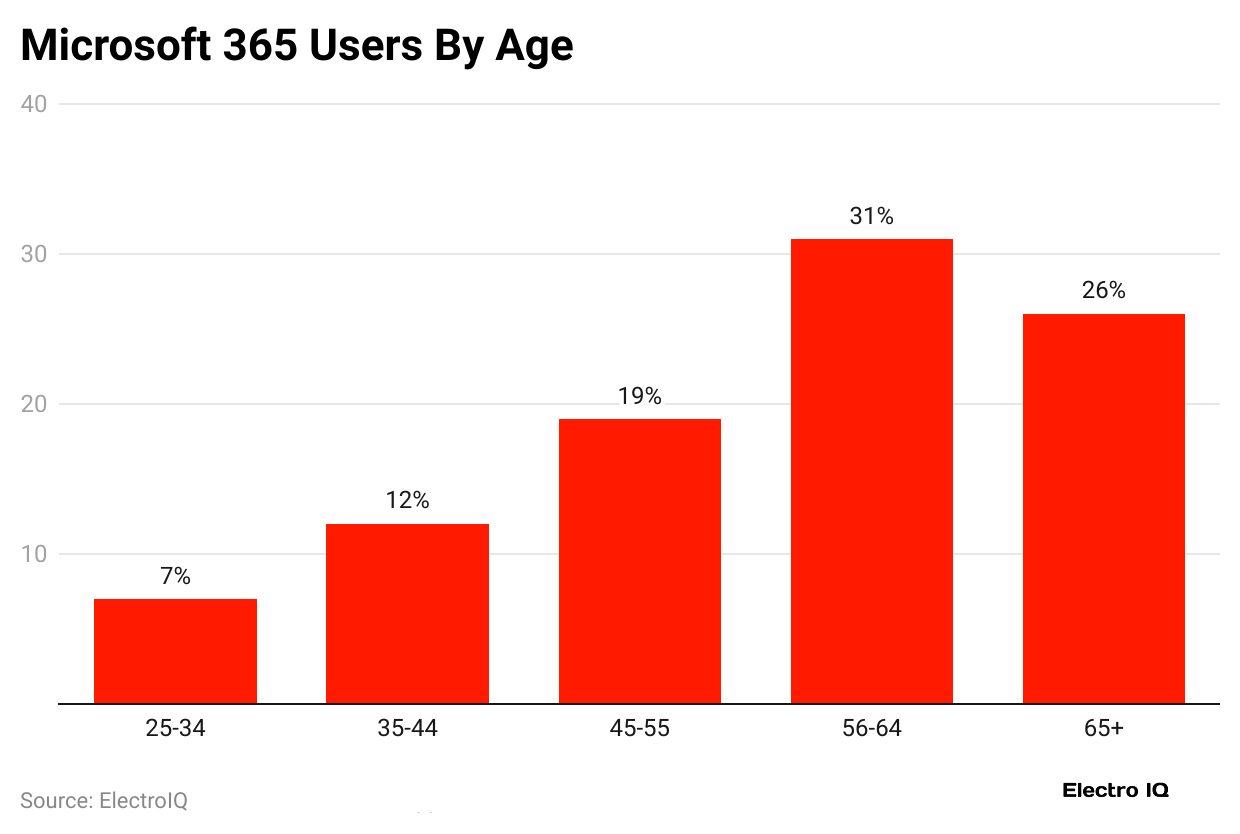

- Users aged 25-34 make up the largest demographic (31%), followed by the 15-24 demographic (25.6%) and the 35-44 demographic (19.33%).

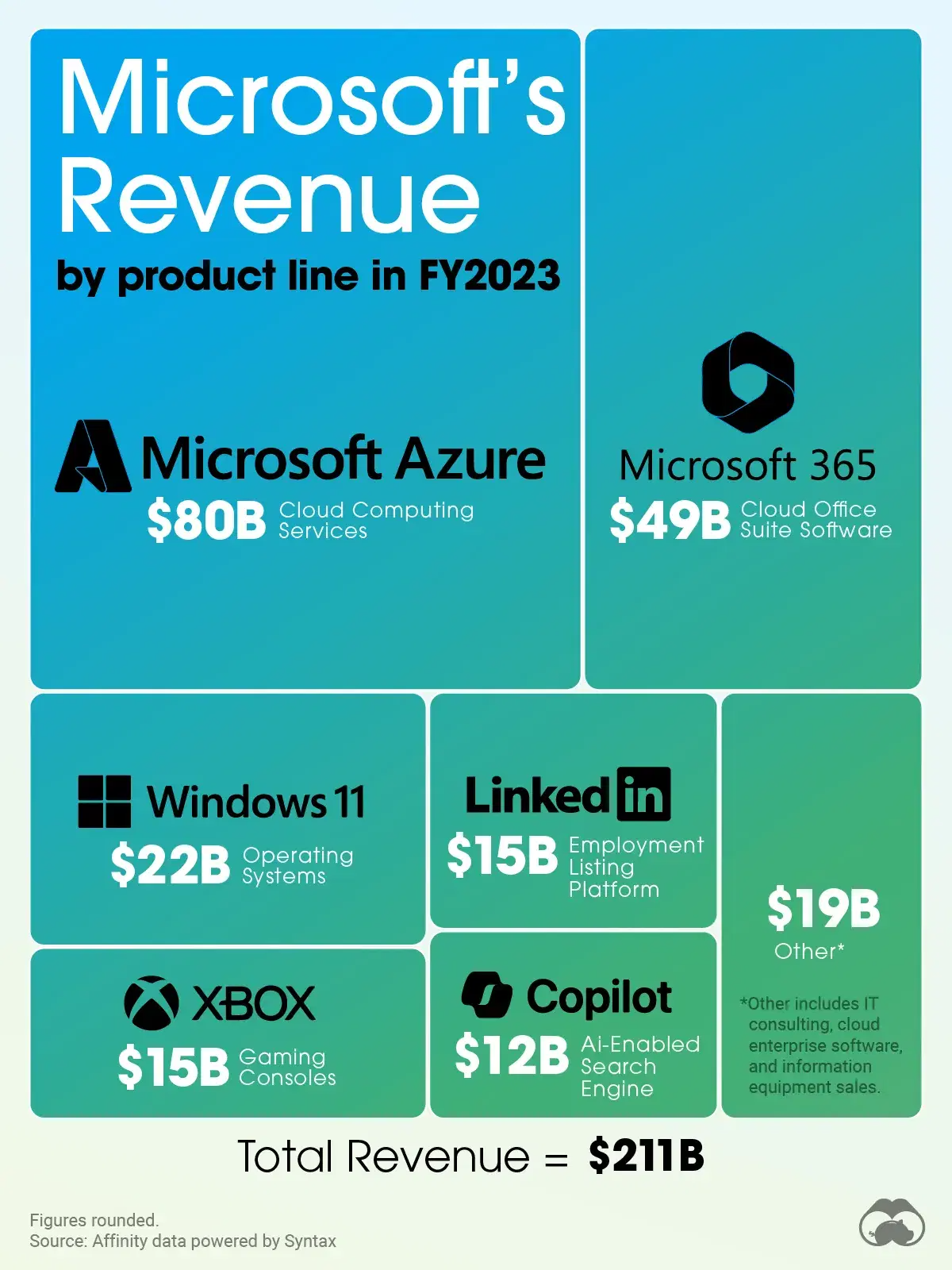

- Microsoft’s total revenue for 2023 was US$211 billion, with Microsoft Azure now commanding the greatest revenue share at US$80 billion.

- Microsoft 365 generated US$49 billion, Windows 11 US$22 billion, Xbox US$15 billion, and LinkedIn US$15 billion.

- Microsoft 365 statistics show that Microsoft 365 has nearly 345 million paid subscribers and an estimated 321 million active users.

- With 6% of the construction industry in Microsoft 365, adoption is highest there; IT and retail follow with 4% each; healthcare and finance follow with 3% each.

- Microsoft 365 mobile applications are downloaded over 500 million times on Android and 376,700 times on iOS.

- Microsoft 365 statistics reveal that a significant investment of US$80 billion has been put into AI by Microsoft, with Copilot Studio helping 10,000 organizations improve productivity for business purposes.

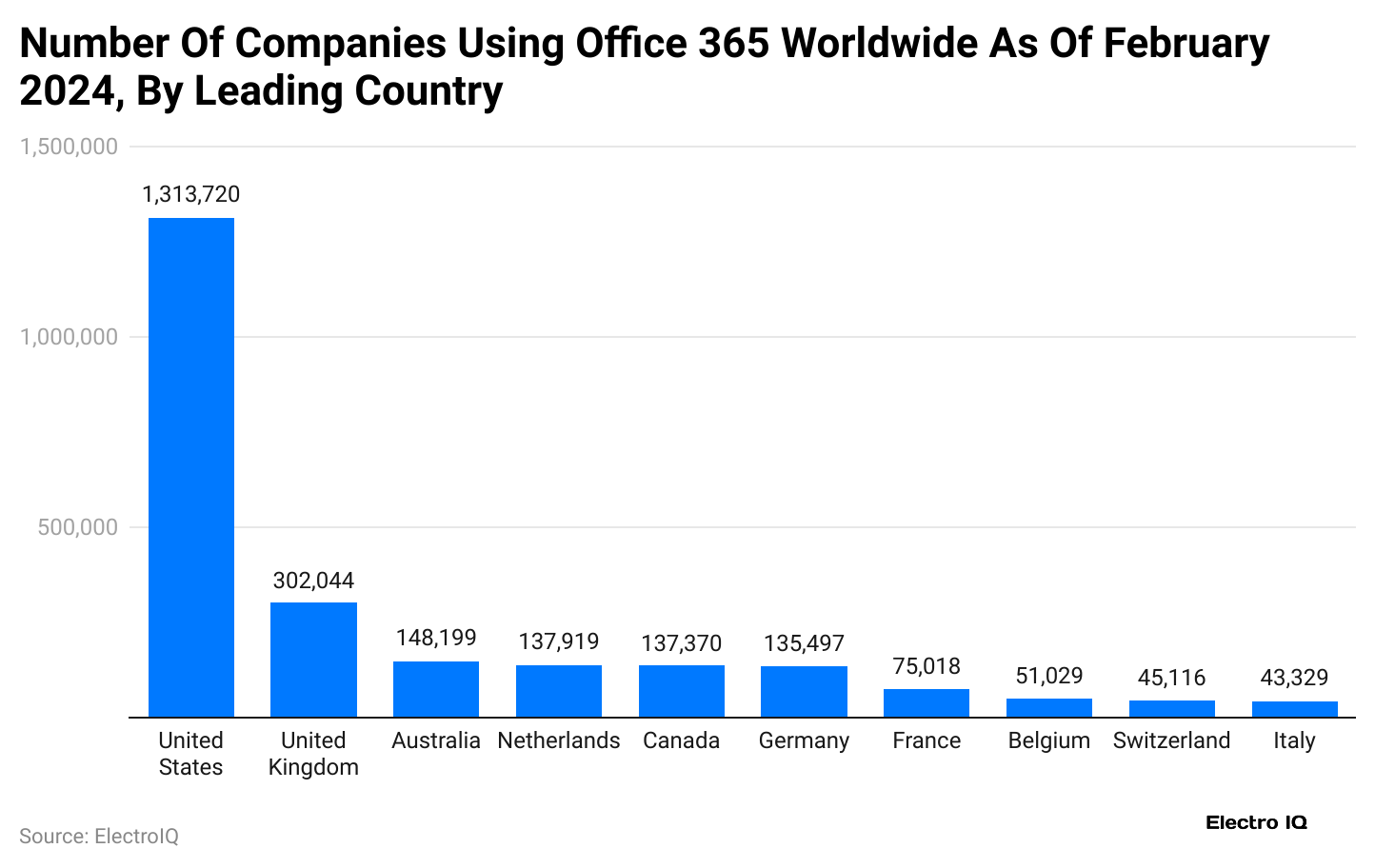

Number of Office 365 Enterprise Subscribers Worldwide By Country

(Reference: statista.com)

(Reference: statista.com)

- According to Microsoft 365 statistics, More than one million companies from around the world use Microsoft 365. Over a million businesses in the United States use this software suite to serve more day-to-day business functions.

- Microsoft 365 was formerly known as Office 365, a name given to it when it sold many productivity tools meant to help its users organise their work.

- Tools such as email- Outlook, OneDrive- for cloud storage, Word- for document writing, Excel- for spreadsheets, PowerPoint- for presentations, OneNote- for taking notes, SharePoint- for sharing files, and Microsoft Teams – to communicate and collaborate were part of these.

- In changing Office 365 for its consumer and small business plans to Microsoft 365 in April 2020, Microsoft was at the start of the month.

- These office software tools are primarily dominated by two players: Google G Suite and Microsoft’s Office 365.

- Google and Microsoft dominate the rest, with around 48% of the global market share for the former and about 46% for the latter. This is more or less the same in most regions, except for a few countries that depart from this trend.

- For instance, even though the vast majority of the market in the United States belongs to Google, which, after selling G Suite, had acquired 59% of the market, Microsoft 365 still obtained 40%.

- Microsoft, however, is more popular in China, as it has a 57.22% share compared to 42.74% of Google’s G Suite.

(Reference: geekyminded.com)

(Reference: geekyminded.com)

- With effect from February 2024, Google’s Office suite had the biggest share by scope, accounting for 44% worldwide usage followed by Office 365 of Microsoft, which occupies the second place with a 30% share.

- These two companies seem to monopolize the industry of office productivity tool business. The productivity software thus includes applications for email, scheduling, and time management to increase individual efficiency. Productivity software can be found in many workplaces and schools.

- Microsoft 365 statistics estimated that the applications operating systems and productivity have revenue figures of about USD 133 billion in the 2021 market in the USA. This segment has speedily grown as there are many businesses and individuals who depend on digital tools for work.

- Most companies use productivity software enterprise-wide, thus meaning that they buy such tools on behalf of their entire organization rather than just individuals.

- The largest enterprise business tool incorporating cloud technology generally applies enterprise functionality for businesses, thus allowing teams to effortlessly manage customer relationships, analyze data, or conduct any other commercial operation. Some of these major providers include Salesforce, SAP, and Oracle.

Microsoft 365 Price Statistics

- Microsoft 365 statistics state that Microsoft 365 Business Premium is the most comprehensive option, priced at US$22 per user a month.

- It includes almost all top features, security tools, and integrations using Microsoft for organizations that want to cover everything in Microsoft.

- One step down is Microsoft 365 Business Standard, which costs US$12 per user per month. This manages to provide a good mix of features that work well for most businesses.

- If you do not require the bells and whistles but need mostly Microsoft’s apps, then Microsoft 365 Apps for Business should suit you as this costs US$8.25 per user every month and provides access to core programs like Word, Excel, and PowerPoint.

- The last and cheapest option for businesses or startups only needing the bare minimum is Microsoft 365 Business Basic, which costs US$6 per user each month.

- This includes the most important tools to help teams work together and stay organized but avoid including too many extras.

Microsoft 365 Using By Age-groups

- Microsoft 365 statistics reveal that Young adults between 25 and 34 years old are the biggest users of Microsoft 365, making up almost 31% of the total users.

- This makes sense since many in this age group are settling into their careers and need the software for work.

- Right behind them are teenagers and young adults aged 15 to 24 years, who account for 25.6% of users. Whether for school, college, or starting their first jobs, they rely on Microsoft 365 to get things done.

- People aged 35 to 44 years also use the suite a lot, making up 19.33% of the users. At this stage, many are well into their careers, so it’s no surprise they frequently use these tools for their work.

- The 45 to 55-year-olds make up 12.41% of the user base.

- While the percentage is a bit lower than in younger groups, it still shows that Microsoft 365 is useful for professionals across different stages of life. For those between 55 and 64 years old, 7.42% use Microsoft 365.

- There’s a slight drop compared to younger users, but it’s clear that this age group is still engaged with digital tools.

- Even seniors aged 65 and above are on board, making up 4.30% of users. While they have the smallest percentage, it’s great to see that technology is reaching people of all ages, helping them stay connected and productive.

Microsoft Revenue By Product Line

(Source: coolest-gadgets.com)

(Source: coolest-gadgets.com)

- In the fiscal year of 2023, Microsoft accumulated a total revenue of US$211 billion, representing an increase of 6.88% from the previous year. Such growth has been a result of its key products and services.

- The highest revenue-generating segment has been Microsoft Azure, the company’s cloud computing service, with US$80 billion in revenue generation, followed by Microsoft 365-all office applications such as Word, Excel, and Teams, earning US$49 billion.

- Other significant ways of delivery have also made substantial contributions. Windows 11 alone, the operating system from Microsoft, earned US$22 billion, contributing 10% to the total revenue.

- Likewise, the gaming division, Xbox, had revenues of US$15 billion, hence 7% of total earnings. Once again, LinkedIn contributes an estimated US$15 billion, or another 7%.

- AI-enabled search Copilot brought in US$12 billion or 6% of the total revenue. Other products and services generated a total of US$19 billion, accounting for the remaining 9%.

- Microsoft 365 statistics show the extent of Microsoft’s product portfolio and its financial performance in 2023.

Microsoft Software Spending

(Source: coolest-gadgets.com)

(Source: coolest-gadgets.com)

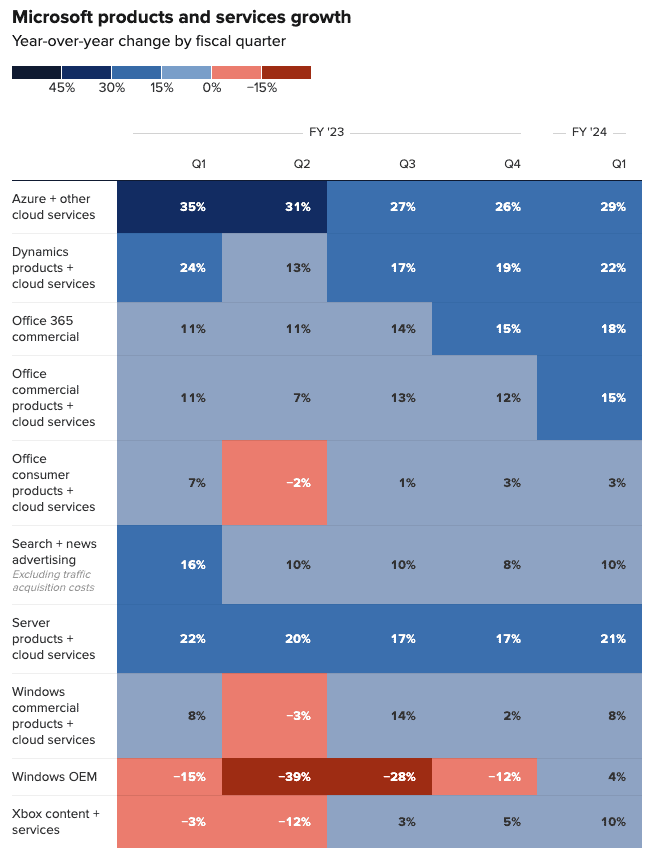

- Cloud services, including Azure, represented 29% of overall spending and were the largest category of Microsoft software spending for Q1 2024; Azure expenditure in the prior year had quarterly rates of 35% in Q1, 31% in Q2, 27% in Q3, and 26% in Q4.

- Total quarterly spending on Dynamics products and cloud services in 2023 was 24% in Q1, 13% in Q2, 17% in Q3, and 19% in Q4. Expenditure for Dynamics in the Azure Cloud in Q1 2024 was 22%.

- Expenditure in Office 365 commercial software held steady at 11% for both Q1 and Q2 of 2023 before going up to 14% in Q3 and 15% in Q4. It surged to 22% in Q1 2024.

- Meanwhile, regarding other Office commercial products and cloud services, 11% was spent in Q1 of 2023, which went low to 7% in Q2, then recovered to 13% in Q3, and dropped again to 12% in Q4. In Q1 of 2024, it accounted for 15% of total expenditure.

- The spending percentages for Office consumer products and cloud services changed throughout 2023, with 7% in Q1, -2% in Q2, a slight recovery with 1% in Q3, and finishing at 3% in Q4. This held firm at 3% in Q1 2024.

- Advertising expenditure on search and news in 2023 saw a decline throughout the year, from 16% in Q1 to 10% in Q2, staying on at 10% in Q3 and closing out at 8% in Q4.

- In Q1 2024, it remained at 10%. Server products and cloud services contributed to spending in 2023 at a rate of 22% in Q1, then slightly dipped to 20% in Q2, then 17% for both Q3 and Q4. This was 21% in Q1 of 2024.

- Windows commercial products and cloud services had fluctuating expenditure in 2023, starting with 8% in Q1, dropping to -3% in Q2, jumping to 14% in Q3, and falling again to 2% in Q4. Moving forward into Q1 2024, it captured 8%.

- Windows OEM had a negative expenditure for 2023, with -16% in Q1, -39% in Q2, -28% in Q3, and -12% in Q4. However, for Q1 2024, expenditure switched to a positive figure, recording 4%.

- Xbox content and services’ expenditure started at -3% in Q1, with a decline in Q2 to -12%, while recovering to 3% in Q3 and 5% in Q4. In Q1 2024, it plummeted to 10%.

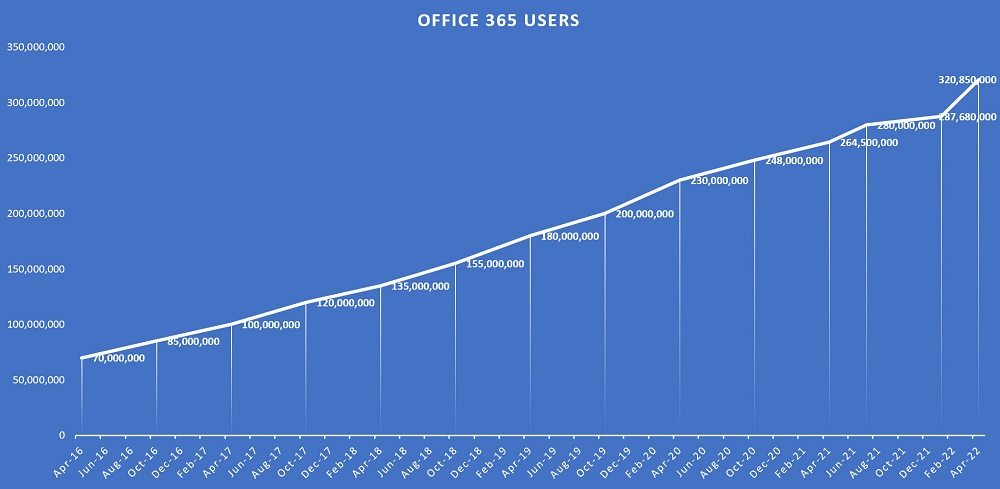

Microsoft 365 Users

- Microsoft has changed its attitude towards openly declaring the use numbers of Office 365.

- They stopped reporting the daily and monthly active users a year ago and now focus on paid subscriptions.

- Microsoft 365 statistics revealed that Office 365 had about 300 million paid subscribers.

- Currently, the figure is close to 345 million active paid users, which gives a related growth of 17% revenue from Office 365 business subscriptions in the past year.

- However, not all payees use services. Estimating on the basis of growth data provided by Microsoft, it is found about 321 million people practically use Office 365.

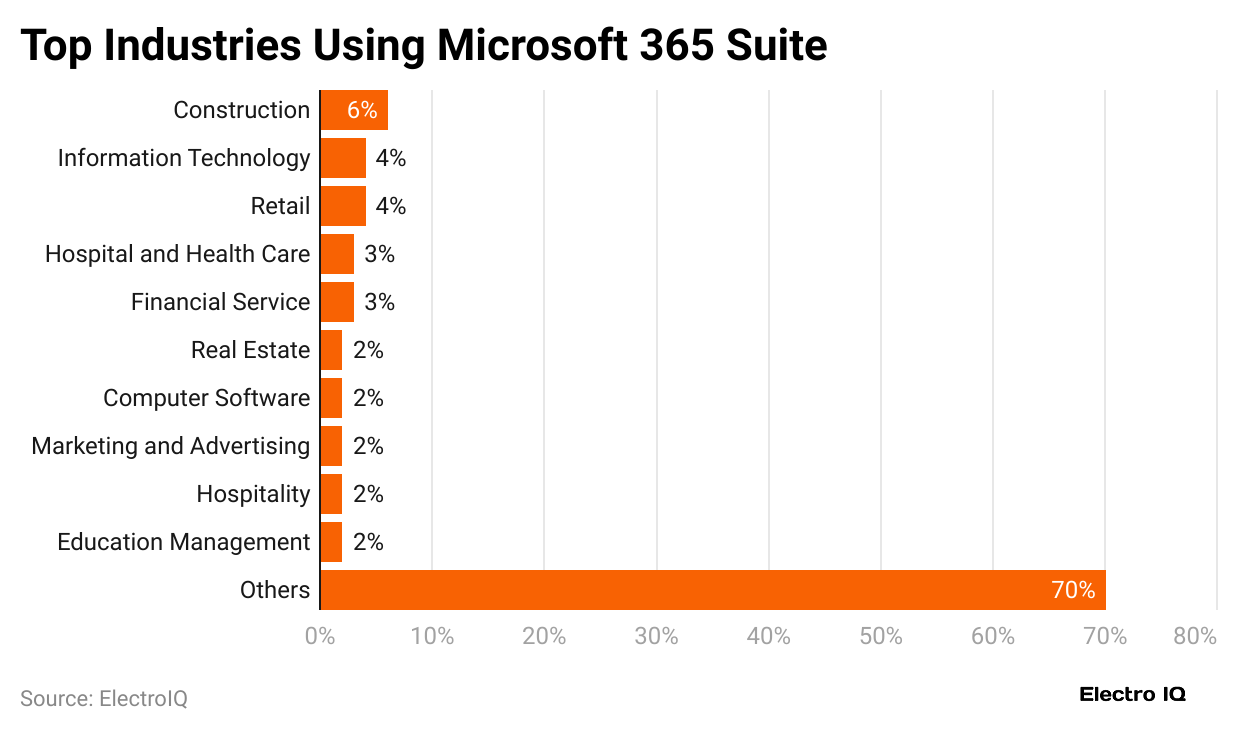

Microsoft 365 Using By Industries

(Reference: contentdetector.ai)

(Reference: contentdetector.ai)

- Businesses in various industries utilise Microsoft 365, with some industries using the software more than others.

- Adoption among construction clients is most pronounced, with an estimated 6% of Microsoft 365 users being from this sector. This is due to the need for the construction industry to use these powerful tools for project management and team collaboration, especially in very large projects.

- About 4% of Microsoft 365 users are in Information Technology and Retail. The

- The IT industry engages in secure communication and data management, while retailers use the platform for inventory tracking, customer engagement, and sales management.

- The Hospital and Health Care industry as well as Financial Services, accounted for 3% of Microsoft 365 users each.

- Hospitals and healthcare practitioners use it for patient care record management and care coordination, while financial service companies trust it for secure document handling and communication.

- Other industries that use Microsoft 365 are real estate, computer software, marketing, advertising, hospitality, and education management, each of these equally constituting 2% of the remaining users.

- The real estate sector uses the platform for client communications and contract management, and its marketing counterparts use it for collaboration on campaign planning.

- The hospitality industry employs it in reservation, and guest service management, and educational institutions use it for online learning and administration.

- Along with many others, these diversities show Microsoft 365’s versatility and extension into every other industry cluster, accounting for the generality of the remaining 70% of Microsoft 365 users.

- This large variety of uses clearly indicates how businesses across the board rely on Microsoft 365 for productivity, communication, and collaboration.

Integration of Artificial Intelligence

- In 2024, Microsoft sharpened its focus on integrating AI into its services. The launch of Microsoft 365 Copilot, an AI assistant meant to help users be more productive, serves as a shining example of this commitment.

- Microsoft 365 statistics state that adoption metrics for Copilot are not publicly available, the 10,000 organisations using Copilot Studio to create add-ons are signalling good acceptance in the enterprise space.

- On the contrary, the hefty investments of up to US$80 billion through capital expenditure invited scrutiny from investors, especially since there have been several quarters of decelerated growth in Azure.

- Nevertheless, even with these apprehensions, Microsoft is anticipating a recovery in Azure, estimating the next quarter’s growth at 33%, and the growth might be helped by services operated by AI.

- Microsoft 365 mobile apps are gaining quite a following, with over 500 million downloads on Android devices and about 376,700 downloads on iOS.

- This mobile-enabled environment guarantees that users stay productive anywhere and can pull up the necessary tools and documents from practically anywhere.

Conclusion

As por Microsoft 365 statistics, Microsoft 365 is offering opportunities like never before in 2024, marking new user acquisition, revenue, and the ever-expanding depth of vertical and geographical penetration. With constant innovation featuring AI and not stopping there, it promises to be a comprehensive cloud solution to productivity.

With most businesses recognizing the need for flexible and efficient ways to work digitally, it has tools and all services to deliver on such promises and live up to their expectations of driving productivity and collaboration in the modern workplace.

Sources

FAQ.

Over a million companies have subscribed to Microsoft 365, while one million have been said to be in the U.S. alone. It contains key essential productivity tools, including Outlook, Word, Excel, PowerPoint, OneDrive, and Teams.

As of February 2024, Google Workspace owns the global office software market share of 44%, while Microsoft 365 holds 30%. Comparatively, Microsoft 365 accounts for 57.22% of the market in mainland China.

To serve different needs, Microsoft prices its plans as follows: Business Premium – US$22 per user/month, Business Standard – US$12 per user/month, Apps for Business – US$8.25 per user/month, Business Basic – US$6 monthly/user.

- The adoption rate is highest in construction, at 6%, which is again followed by IT and retail, both at 4%. The health and finance sectors are both at 3%, with many other domains also reaping the benefits of Microsoft 365.

Microsoft is spending US$80 billion to invest in AI technology, and part of it includes introducing Microsoft 365 Copilot, an AI-powered assistant designed to improve individual productivity and efficiency. This has been adopted by over 10,000 organisations for developing customised business solutions using Copilot Studio.

Joseph D'Souza founded ElectroIQ in 2010 as a personal project to share his insights and experiences with tech gadgets. Over time, it has grown into a well-regarded tech blog, known for its in-depth technology trends, smartphone reviews and app-related statistics.