Notion Statistics And Facts (2025)

Updated · Mar 28, 2025

Table of Contents

- Introduction

- Editor’s Choice

- Notion Finacial Performance

- Notion Revenue By Segment

- Notion Proportion Of Spending On Local Suppliers

- Notion CO2 Emmissions

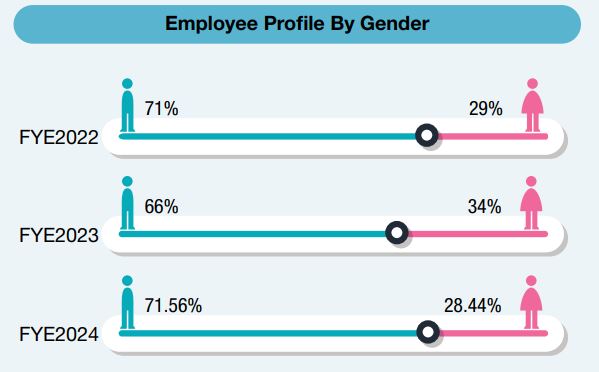

- Notion Number Of Employees By Gender

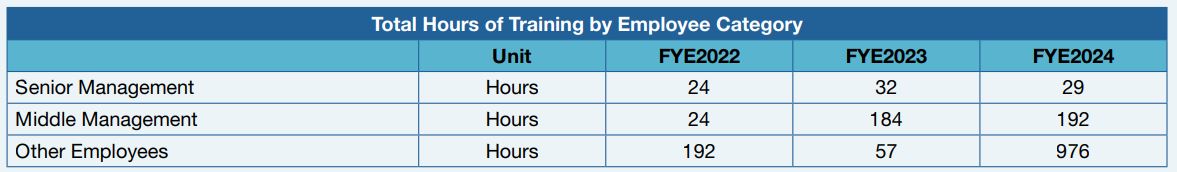

- Total Hours Of Training By Employee Category

- Notion’s Growth, Competition, And Marketing Strategy

- Notion Funding

- Conclusion

Introduction

Notion Statistics: In the ever-evolving productivity software scenario, Notion emerged as one of the best. It combined within its product functionalities of Notes, Project, and Collaborations. Fast becoming a darling of many in the industry after realising some milestones on its timelines, the article is optimised to highlight the key indicators for Notion statistics, i.e., user community, revenue, valuation, and Employees.

Editor’s Choice

- According to Notion statistics, the company exhibited a powerful recovery in the financial sense in 2024. The revenue grew from RM 242.70 million in 2020 to RM 487.90 million in 2024.

- There was a 41.4% increase in revenue between 2023 and 2024, including that pre-tax income has bounced back from RM 42.1 million negative in 2023 to RM 57 million profit in 2024.

- EBITDA results similarly improved due to better operational efficiency, reversing an RM 8.9 million deficit in 2023 to RM 82.5 million in 2024.

- Revenue growth generated by the HDD and EMS segments was driven by the HDD segment of RM 133.35 million (27%) and the EMS segment of RM 189.93 million (39%) in 2024.

- The automotive sector remained consistent at RM 116.91 million (24%), while the camera and industrial products saw a decline, from RM 50.79 million in 2023 to RM 47.77 million in 2024.

- Notion statistics state that Notion maintained Peak support of 87% on local supplies in 2023 but fell to 75% in 2024, with possibly the move out to different suppliers on the radar.

- Scope 1 CO₂ emissions fluctuated, falling by 17.2% in 2023 but rising once again by 14.1% in 2024 to 114.19 tonnes.

- During this period, the Demographics again changed. Female employees rose to 34% year 2023 before sliding back to 28.44% in 2024.

- Training hours in middle management moved up from 24 hours in 2022 to 192 hours in 2024, while for all other employees, training hours increased from 57 hours in 2023 to 976 hours in 2024.

- Notion statistics show that since its inception, Notion has grown exponentially from a small startup to between 100 and 350 employees.

- The company competes fiercely with Microsoft Loop, the product version to be attached to the Microsoft 365 ecosystem, with a view toward enterprise usage.

- Notion’s marketing strategy includes partnering with almost 90 influencers, referred to as “Notion Ambassadors,” each with his or her very own social media followership of around 10,000.

- The company has raised about US$340-350 million in capital from a meager US$20 million amount that was reported in 2019.

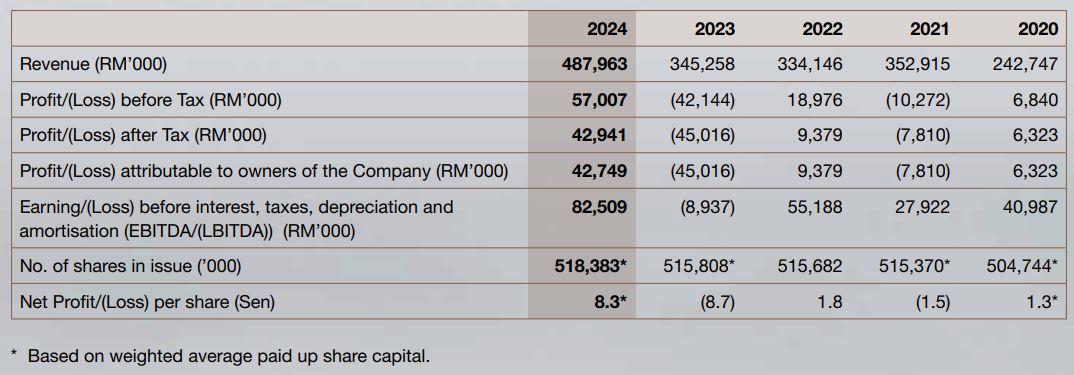

Notion Finacial Performance

(Source: notionvtec.com)

- Notion statistics indicate that the five-year performance of Notion’s financial situation presents a very positive mark for recovery and growth in particularly in terms of the year 2024.

- Revenue showed a consistent rise from RM 242.7 million in 2020 and RM 487.9 million in 2024, a sign of significant upward growth.

- A rise of about 41.4% in revenue from 2023 to 2024 was the highest ever, representing a surge in business activity and market demand. Before then, profitability continued to ebb and flow over the years; there were losses in 2023 before shooting back up in 2024.

- In 2023, the firm suffered a pre-tax loss of RM 42.1 million and recovered in 2024 with a pre-tax profit of RM 57 million; similarly, profit after tax gained impressively by changing from a loss of RM 45 million the previous year to a net profit of RM 42.9 million in 2024.

- Notion statistics state that the profit attributable to the owners of the company followed the same trend, namely a recovery from negative RM 45 million in 2023 to RM 42.7 million in 2024. The company recorded remarkable improvements in EBITDA with the same trend.

- After the loss of RM 8.9 million in 2023, the EBITDA increased remarkably to RM 82.5 million in 2024, which is an indication of enhanced operational efficiencies and profit margins.

- There was also a gradual increase in shares issued, from 504.7 million in 2020 up to 518.3 million in 2024, indicating prospective capital expansions.

- Net profit per share also reflects this financial recovery, rising from a loss of 8.7 sen per share in 2023 to a profit of 8.3 sen per share in 2024.

- This recovery bears testimony to the enhanced financial health and improved investor confidence in the performance of the company.

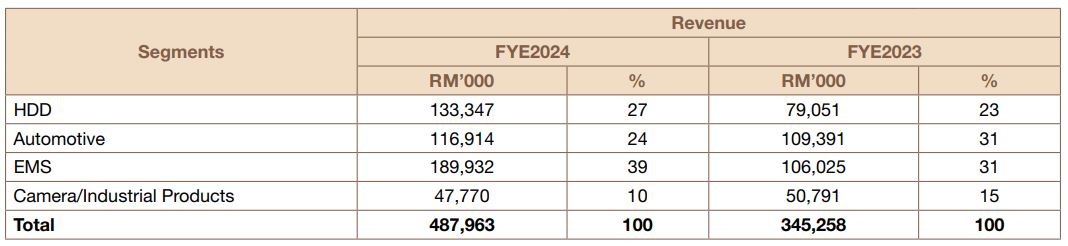

Notion Revenue By Segment

(Source: notionvtec.com)

- Notion statistics show that Notion’s revenue for the financial year ending 2024 was recorded as high as RM487.96 million, a great jump from the previous year’s figures of RM345.26 million. Overall, all the buttons on the business estate have registered important growth.

- The HDD segment generated a revenue of RM133.35 million within the financial year ending in 2024, accounting for 27 % of total revenue, up from RM79.05 million (23%) in the financial year ending in 2023. This shows that there is a great demand for Notion’s HDD-related products.

- Automotive converted into revenue of RM116.91 million for the financial year ending in 2024, which corresponds to 24% of the total.

- Even though revenue was slightly more than for the previous financial year, amounting to RM109.39 million in FYE2023, the percentage contribution fell by a significant margin from 31% to 24%, suggesting other segments were growing at a faster rate.

- EMS contributed the most, picking up from RM106.03 million in FYE2023 (31%) to RM189.93 million in FYE2024 (39%). This increase shows the tendency for expansion and increasing demand for Notion’s EMS services.

- Camera and industrial products’ prices declined in the financial year ending in 2023 to RM50.79 million (15%), compared to RM47.77 million at the end of the financial year ending in 2024 (10%).

- Notion statistics indicate that there might be a decrease in demand or that Notion is perhaps shifting priorities toward other, more efficient and faster-growing segments.

- Notion had a great financial performance for the year ending in 2024, where the strongest growth was derived from the EMS and HDD segments.

- Nevertheless, the automotive sector contributed a stable performance. However, the camera and industrial products segments recorded low revenue contributions.

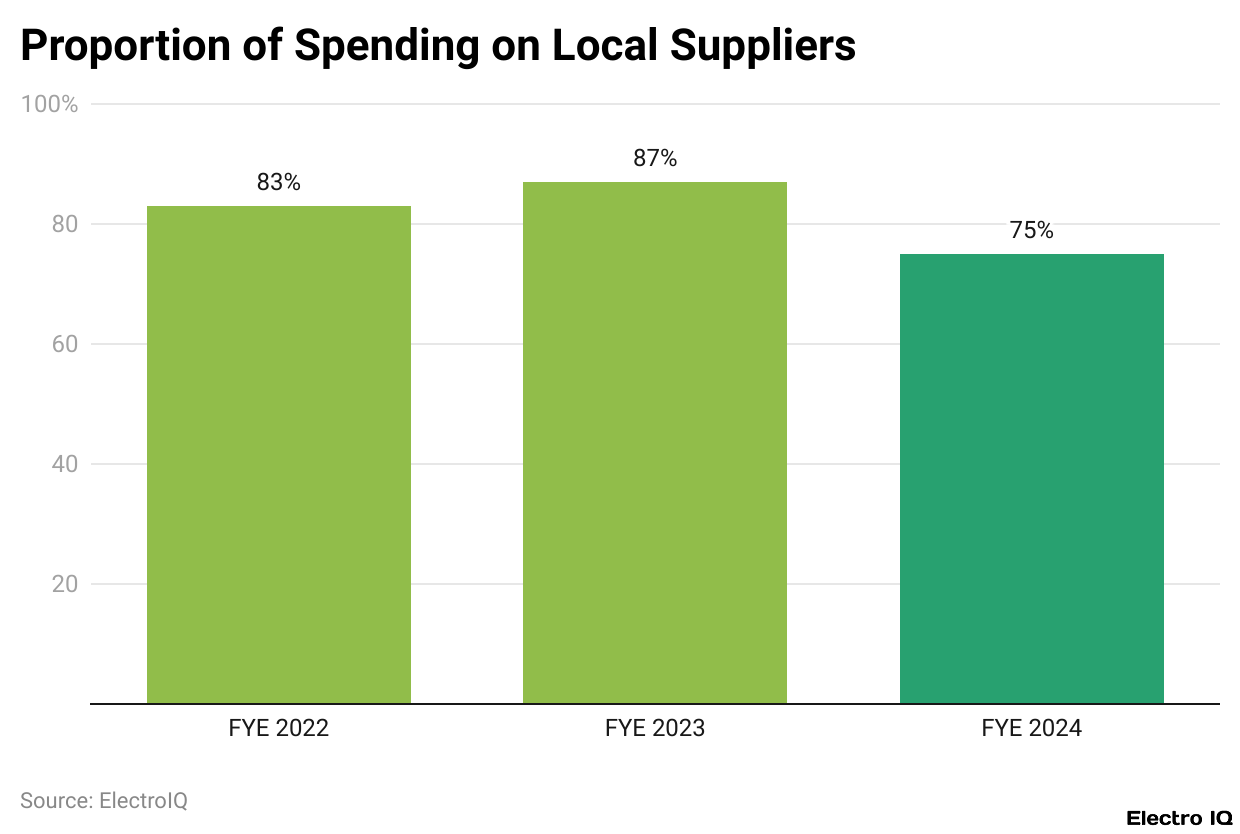

Notion Proportion Of Spending On Local Suppliers

(Reference: notionvtec.com)

- Notion statistics reveal that over the past three financial years, there have been fluctuations in Notion’s percentages of spending on local suppliers, with FYE 2022 noting 83% of the procurement budget utilised for local suppliers, thus showing strong support for local businesses.

- The percentage increased to 87% in FYE 2023, demonstrating an even stronger emphasis on procuring materials and services from local suppliers. In FYE 2024, there was a significant drop in this percentage to 75%.

- The decline could be partly attributed to the diversification of the supplier base and increased cost-efficiency reliance on international vendors, or perhaps there were changes in operational demands.

- While this decline indicates some kind of strategy shift, the company continues to spend a considerable amount with local suppliers, supporting its investment in domestic markets.

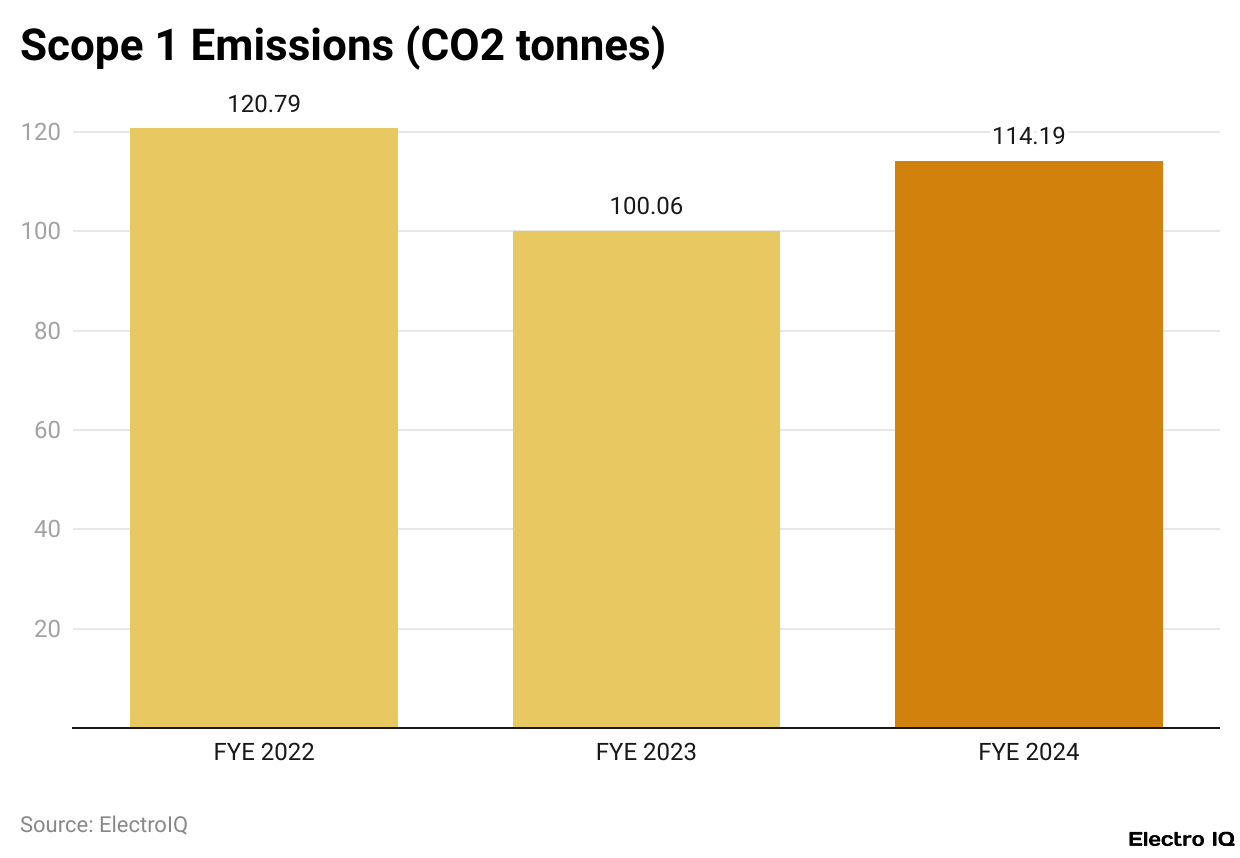

Notion CO2 Emmissions

(Reference: notionvtec.com)

- Scope 1 emissions refer to greenhouse gas emissions occurring as a direct result of company activities from sources owned or controlled by the company.

- Notion statistics show that the fluctuations were recorded in Notion’s Scope 1 emissions over the past three financial years.

- Emissions in FYE 2022 stood at 120.79 tonnes of CO₂, decreasing to 100.06 tonnes in FYE 2023, which arguably reflects a drop of about 17.2%, owing to perhaps efficiency improvements, changes in operational practices, or the implementation of sustainability initiatives.

- But in FYE 2024, emissions climbed again, this time to 114.19 tonnes, representing an increase of about 14.1% compared to the previous year. Increases in business activity, forthcoming expansions, or changes in the consumption of energy may have led to the fluctuations observed in emissions.

- Compared with the trend toward lower emissions, this rebound in 2024 indicates that more sustainability measures are required for long-term reductions.

Notion Number Of Employees By Gender

(Source: notionvtec.com)

- The employee profile by gender for Notion in three fiscal years reveals fluctuations that mark the gender composition within the company.

- In FY2022, men were 71% of the workforce, while women were equal to 29%. By FY2023, the proportion of male employees was reduced to 66% while female representation rose to 34% -indicating an approach toward gender balance in the workforce.

- Conversely, there was an increase in the number of male employees once again in FY2024 to 71.56%, with female representation falling to 28.44%.

- Notion statistics indicate that any gains made in terms of female representation in Notion in 2023 were slightly undermined by the reversals in FY2024, with numbers reverting to those akin to FY2022.

Total Hours Of Training By Employee Category

- For three respective financial years, Notion employee training hours in disparate categories vary considerably in investments across all organisational levels.

- Notion statistics show that at the level of senior management, training hours moved upward from a 24-hour training program in FYE 2022 to a 32-hour one in FYE 2023, while FYE 2024 registered a slight decrease in training hours down to 29.

- In the case of the middle management level, this was sharply juxtaposed with a substantial increase from training hours of 24 in FYE 2022 up to 184 hours in FYE 2023 and a little further up to 192 hours in FYE 2024, thus demonstrating increased emphasis on leadership development.

- The employees greatly affected were the other employees, where training hours plummeted from 192 in FYE 2022 to just 57 in FYE 2023, after which they reached an astonishing 976 hours in FYE 2024.

- This steep climb signifies a renewed priority of investing in skill development and professional growth for the larger populace.

Notion’s Growth, Competition, And Marketing Strategy

- Notion statistics state that by Q3 2023, Notion has grown tremendously and has each employee numbering between 100 to 350 people.

- Such an expansion clearly indicates a great scaling exercise for the company that has transitioned from a small startup with just 12 employees to a well-established organisation.

- A bigger team showcases an increased demand for the services of Notion and, therefore, the need for more hands to manage, develop, and support its expanding user base and product offerings.

- With the growth of Notion’s user base and popularity, it has to increase the workforce that attends to pertinent functions such as development and customer support.

- This expansion facilitates the organisation in matching the rising demand and maintaining the desired service standards. There is an intense rivalry in the productivity and collaboration software market, of which Microsoft is arguably the biggest competitor.

- Microsoft Loop, part of the Microsoft 365 ecosystem, bears a set of characteristics comparable to Notion in collaboration, knowledge sharing, and content creation. It allows users to work together on documents, presentations, and spreadsheets in real time, mirroring some capabilities of Notion.

- Notion attracts individuals and small teams looking for a flexible and customisable tool, while Loop becomes more appealing for larger organisations seeking ease of use throughout Microsoft’s suite of services.

- Instead of drawing a direct parallel, the comparison underlines another aspect of Notion and Loop, being their entirely different user profiles and the way each addresses certain needs. Notion’s association with a collective of about 90 influencers known as “Notion Ambassadors” is a vital testimony to its strategic brand marketing.

- These influencers, each scoring a minimum of 10,000 users as their social media following, are an intricate link that demonstrates the features and benefits of Notion interactively.

- By engaging with modern marketing trends and influential spokespeople, Notion reaches far and wide, nurturing a vibrant community and solidifying its position as a productivity giant.

Notion Funding

- Notion’s total amount of funding is said to have reached an estimated US$340-350 million. The journey of funding into the company actually began in 2015 with a seed round of an undisclosed amount, where the angel funding continued to give the primary capital required in its development on the way to building the organisation’s future growth.

- Well, in 2017, they then took another angel round to launch the business expansion. The event that probably had the largest aegis under it was the Series A funding in July 2019, which was composed of US$18.2 million, as per Forbes.

- The flow of increased interest from investors was soon followed by a US$50 million Series B round in April 2020 and yet an even bigger US$275 million Series C round in October 2021.

- According to Notion statistics, this latest round, led by Coatue and Shine Capital, brought Notion’s total funding to an impressive US$340-350 million. Such notable financial success speaks volumes about the strength of the company’s market position.

- The funding of Notion has now touched this important bundle, which is shockingly a significant uptick from the reported US$20 million of 2019.

- Indeed, all these above-noted increase really suggests some important premises as strong investor confidence, a validated business model, incessant growth and innovation, and a promising market potential.

Conclusion

As per Notion’s statistics, which started as a simple startup, it is now flourishing into a productivity giant due to significant user growth, amazing revenue growth, and product innovation. This period in which Notion, with more than a hundred million users and valuation, serves as an example of how a clear vision, user-centered design, and adaptable strategies can drive victory in the competitive tech landscape.

The platform is well-placed with the promise of enhancing user experience further with innovations like Notion AI and customisable workflows.

Sources

FAQ.

Notion had a wonderful financial year in 2024, with revenue almost ringing in a 41.4% increase from RM 345.26 million in 2023 to RM 487.96 million in 2024. The company also recovered the pre-tax loss of RM 42.1 million before tax in 2023 to a pre-tax profit of RM 57 million in 2024.

The EMS (Electronic Manufacturing Services) segment was the largest contributor, at RM 189.93 million of total revenue (39% of total revenue). The HDD segment was next with RM 133.35 million (27%) of revenue from sales. The automotive remained flat at RM 116.91 million or the remaining 24%.

The female percentage increased 29% in 2022, 34% in 2023, and decreased to 28.44% in 2024. Meanwhile, the proportion of males employed increased again up to 71.56% in 2024, detracting from the diversity with which gender presents in the organisation.

Notion is now hell-bent on competition with Microsoft’s Loop, given that it integrates with Microsoft’s 365 package and therefore attracts its enterprise customers. The primary fuel that power has for its use in productivity-related software is the viability of such products through delivering services and applications that can be hosted on Microsoft’s environment.

Notion has gathered around US$340-US$350 million in funding, of which the most important rounds were a US$18.2 million Series A in 2019, a US$50 million Series B in 2020, and a Series C round of US$275 million in 2021.

Joseph D'Souza founded ElectroIQ in 2010 as a personal project to share his insights and experiences with tech gadgets. Over time, it has grown into a well-regarded tech blog, known for its in-depth technology trends, smartphone reviews and app-related statistics.