NXP Semiconductors Statistics and Facts

Updated · Jul 02, 2025

Table of Contents

Introduction

NXP Semiconductors Statistics: NXP Semiconductors, a global leader in semiconductor production and sales, has forecasted its financial strategies and expectations for 2025. The company anticipates continued growth driven by advancements in the automotive sector and an overall increase in demand. In this article, we will discuss NXP’s statistics related to revenue, earnings, and workforce.

Editor’s Choice

- Revenue was USD 3.13 billion in Q1 of 2024, showing an increase of 0.2% year-on-year. Your GAAP quarter gross margin was 57.0%, with a GAAP operating margin of 27.4%.

- Revenue for Q2 2024 remained tied with Q1 at USD 3.13 billion; it declined 5% compared to the previous year but showed a further higher GAAP gross margin of 57.3% and an operating margin of 28.7%.

- NXP Semiconductors Statistics state that Q3 2024 achieved USD 3.25 billion, a revenue increase of 5% year-on-year. Non-GAAP margins reached 58.2% gross and 35.5% operating.

- For Q3, the policy under the capital return program was as follows: Cash dividends totalled USD 259 million and share repurchases amounted to USD 305 million equivalent to 95% of the non-GAAP free cash flow.

- Revenue for the vendor was at least cut to USD 3.422 billion in 2023, compared to USD 13.21 billion the previous year, which represents a huge drop.

- In 2023, 60% were from APAC, 22% from EMEA, and 18% from the Americas.

- A trend over the years among individual contributors in the NXP workforce was that people have grown, particularly in the indirect labour category, while levels of people managers remained somehow stable.

- NXP marked big semiconductor manufacturing milestones in 2024, which include ESMC and VisionPower joint ventures.

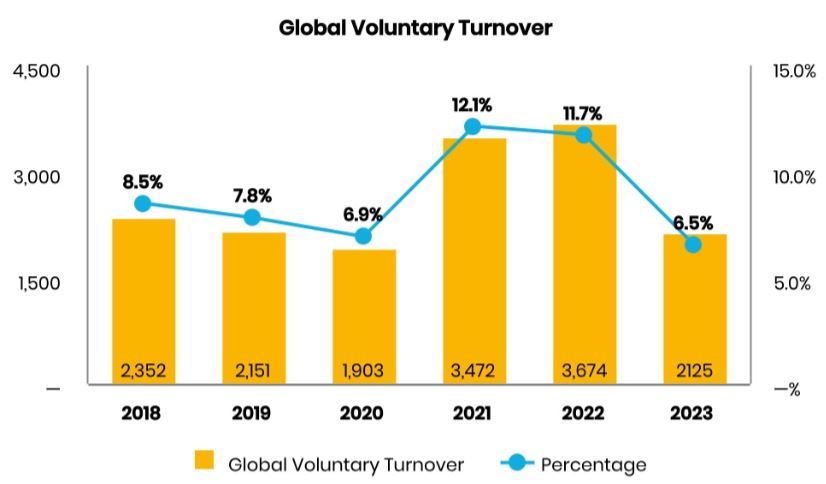

- NXP Semiconductors Statistics, indicate that on a global level, the changes in voluntary turnover with NXP from 12.1% as the peak turnover rate in 2021 down to 6.5% in 2023 indicated improved employee retention.

- It commits 36% of its workforce to R&D activities and has made huge investments in talent advancement like new appointments and promotions.

NXP Revenue

![]() (Reference: statista.com)

(Reference: statista.com)

- NXP Semiconductors Statistics, reveal that NXP revenue decreased for NXP Semiconductors in 2023 to USD 3.422 billion but it was a great deal lower than in 2022 when sales were at a peak of USD 13.21 billion.

- On August 20, 2024, joint venture ESMC, to be formed by TSMC, Robert Tosch Gmbh, Infineon Technologies AG, and NXP Semiconductors NV, broke ground in Dresden, Germany, on its first semiconductor fabrication plant.

- On September 4, 2024, Vanguard International Semiconductor Corporation and NXP Semiconductors NV jointly reported to have received all necessary approvals from the government and had capitalized to formally establish the VisionPower Semiconductor Manufacturing Company Pte Ltd (VSMC) joint venture. This achievement marked the beginning of construction for a facility.

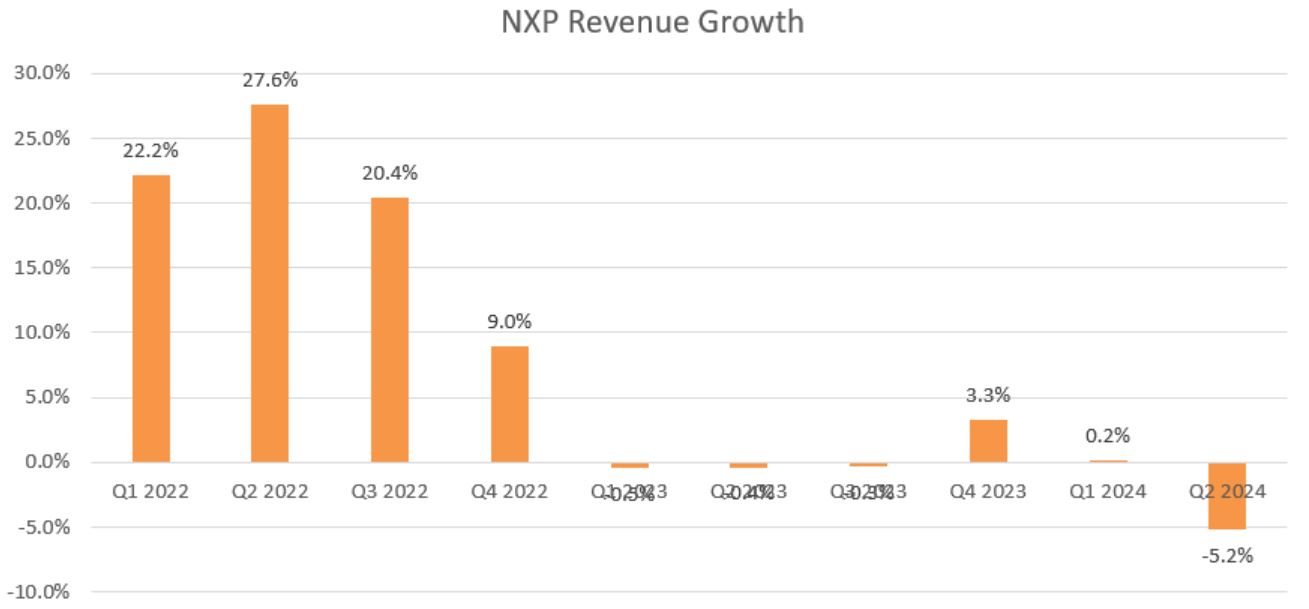

NXP Revenue Growth

(Source: seekingalpha.com)

(Source: seekingalpha.com)

- According to NXP Semiconductors Statistics, for the first quarter of 2024, its revenue reached 3.13 billion U.S. dollars, which represents an increase of just 0.20 % compared to the previous year.

- Consequently, the margin GAAP gross reached 57.0 %, and the operational margin stood at 27.4 %. Then, GAAP diluted net income per share came in at 2.47 U.S. dollars with non-GAAP, gross margin at 58.2%, operational margin at 34.5 %, and diluted net income per share reported at 3.24 U.S. dollars.

- Cash flows from operations totalled 851 million U.S. dollars, while capital expenditures amounted to 224 million U.S. dollars, which, therefore, made free cash flow non-GAAP of 627 million U.S. dollars.

- An additional policy for returning capital continued through the implementation of NXP into the first quarter of 2024, with the distribution of 261 million U.S. dollars in cash dividends and share repurchases of 303 million U.S. dollars.

- Hence, the total return for the quarter reached 564 million U.S. dollars, which amounts to 90% of the non-GAAP free cash flow for the first quarter.

- Capital returned to shareholders during the last 12 months amounted to 2.39 billion U.S. dollars compared with 82 % of non-GAAP free cash flow.

- The interim dividend for the first quarter of 2024 has been paid in cash to all stockholders of record on March 21, 2024, and distributed on April 10, 2024.

NXP Q2 Earnings

- The value of revenue stood at 3.13 billion U.S. dollars, indicating a decrease of 5% year on year. The GAAP gross margin was at 57.3% and the operating margin at 28.7%.

- The net income figure per share was 2.54 U.S. dollars on a GAAP diluted net basis. On a non-GAAP basis, the gross margin is put at 58.6%, the operating margin at 34.3%, and the diluted net income per share at 3.20 U.S. dollars.

- The Operating Cash flow was at 761 million US dollars while the total capital expense reached 184 million US dollars which led to a non-GAAP free cash flow of 577 million US dollars.

- It refers to NXP’s continuous progress in the implementation of its capital return strategy recovery as the distribution of cash dividends in that quarter amounted to USD 260M and the repurchase of USD 310M of shares.

- In total, such capital return for the quarter reached 570 million U.S. dollars and accounted for 99 % of the second quarter’s non-GAAP free cash flow.

- The equity return to shareholders for the twelve months ended at 2.4 billion U.S. dollars, the same accounting for 81 % of non-GAAP free cash flow.

NXP 3rd Quater Earnings

- For Q3 2024, revenue reached 3.25 billion US dollars, reflecting a 5% decrease from the same period last year.

- The GAAP gross margin was 57.4 % and the GAAP operating margin of 30.5 %. Income per diluted share GAAP was reported at 2.79 US dollars. For the non-GAAP numbers, gross margin was 58.2 %, operating margin shifted to 35.5 %, and diluted net income per share was reported as 3.45 dollars.

- The Operating Cash flow amounted to 779 million US dollars while the sum of total capital expense reached 186 million US dollars which eventually gave a non-GAAP free cash flow of 593 million US dollars.

- NXP Semiconductors statistics reveal that in Quarter 3 2024, NXP managed to do another step in its process of implementing its capital return rule by distributing 259 million dollars in cash dividends and a further 305 million US dollars was spent on shares as they were repurchased.

- The total capital return for the quarter reached 564 million dollars, which was 95 % of 3Q non-GAAP free cash returns.

- During the last twelve months, 2.4 billion dollars were returned to shareholders as capital, that is, 87% of the free cash flow without GAAP consideration.

- The interim dividend was distributed in cash on October 9, 2024, for the third quarter, to shareholders who were recorded as of September 12, 2024. NXP compressed a further USD 2.0 billion in shares for repurchases on August 29, 2024, by its board.

- That increased the total buyback balance to USD 2.64 billion through the whole third quarter.

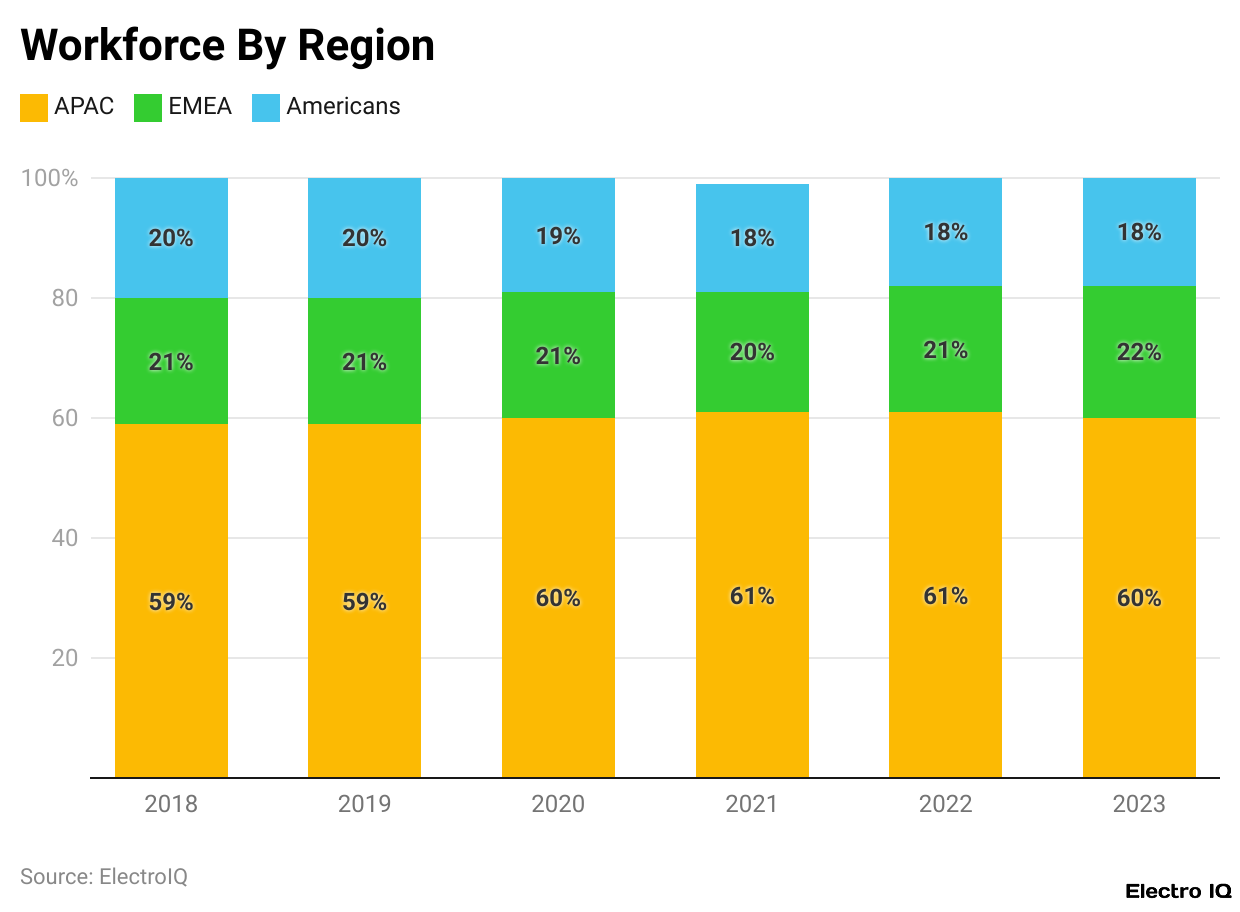

NXP Workforce By Region

- The integration of employees at NXP varies slightly per region across the years. While in 2018 and 2019, the majority of staff were in the Asia-Pacific (APAC) zone, at 59%, the EMEA region supplied 21% with DDL and the Middle East, while the Americas served 20% of staff.

- Then, in 2020, the proportion of APAC employees increased to 60%, maintaining EMEA and reducing America to 19%. With regard to 2021, APAC took more than 61%, whereas EMEA declined proportionally by 1% to 20% and again went down by 1% in the Americas.

- In 2022, APAC retained its 61%, EMEA share increased to 21% while the Americas held at the line of 18%.

- NXP statistics state that in 2023, the APAC staff reduced from 61% to 60%, while EMEA actually moved up to 22%; again, the Americas remained at 18%.

- These data show a declining trend in the Asian workforce percentage as it seems to grow in Europe, the Middle East, and Africa, whereas the latter remains at the top in terms of NXP employee heads.

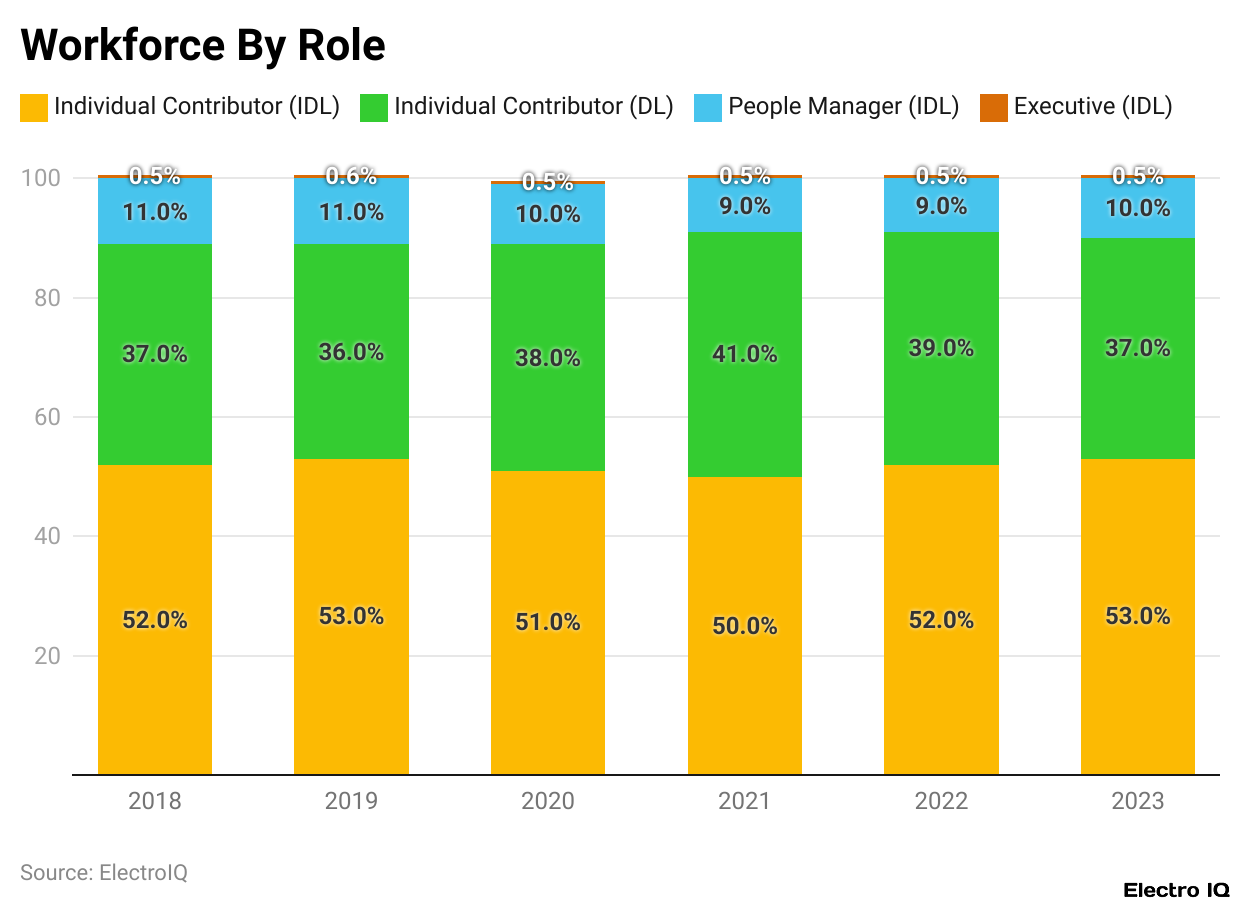

NXP Workforce By Role

(Reference: seekingalpha.com)

(Reference: seekingalpha.com)

- NXP statistics represent that NXP’s workforce distribution across different roles has not changed much over the years. The workforce has increased in 2023 to more than 53% among all individual contributors in IDL(Indirect Labor), and also people managers increased up to more than 10%.

- In total, around 37% of individual contributors declined in the DL(Direct Labor) category, and about 0.50% of the workforce falls within the domain of the executive level.

- In 2018, individual contributors in IDL(Indirect Labor) made up 52% of the workforce, while people managers were at 11%.

- Individual contributors in the DL(Direct Labor) category had 37%, while in IDL(Indirect Labor), the figure was about 0.50%.

- In 2019, the %age of individual contributors in IDL(Indirect Labor) increased to 53%, whereas people managers remained unchanged at 11%.

- The portion of individual contributors decreased slightly to 36% in DL(Direct Labor) but rose from 0.50% to 0.60% for executives.

- The trend in 2020 saw the following division of labor-51% of the workforce comprised the group of individual contributors in IDL(Indirect Labor), while the people managers continued to fall to 10%.

- There were 38% of individual contributors in DL(Direct Labor) by 2020, and executives in IDL(Indirect Labor) once again constituted 0.50% of the workforce.

- With the new year in 2021, industry experts would note a 50% share of individual contributors in IDL(Indirect Labor), while office managers would be reduced to 9%.

- In this case, individual contributors in DL(Direct Labor) would take up around 41%, whereas executives would have only 0.50%.

- By 2022, the business will have 52% of individual contributors in IDL(Indirect Labor) and down from little in people managers to 9%.

- Meanwhile, individual contributors in DL(Direct Labor) dropped from 40% to 39%, and executives stayed at 0.50% at the bottom.

NXP Global Turnover

(Source: seekingalpha.com)

(Source: seekingalpha.com)

- NXP has seen various trends over the years across different industries in the world that mould turnover. In the year 2023, the decline in the number of voluntary leave takers fell to 2,125, and % the fall stood at 6.5%. This was a clear indicator that employee retention was rising within the company.

- In 2018, 2,352 employees left the company voluntarily, i.e., 8.5% of its total manpower. In the year 2019, the number fell by a slight amount, further down to 2,151 employees, the turnover being 7.8%.

- In 2020, these numbers diminished even more dramatically with 1,903 voluntary departures and a decrease to a 6.9% turnover rate.

- This change was quite significant in that, by 2021, the rate jumped dramatically to a figure of 3,472 employees. This was at 12.1%.

- The sudden great improvement in turnover may be explained by the fact that the global economy resumed; this made employees seek better opportunities.

- Although the previous year saw a slight reduction in the rate, in 2022, the number of persons actually leaving voluntarily increased to 3,674. This was 11.7%.

NXP R&D Talent Development

- The company, with approximately 12,000 employees (roughly 36 % of the workforce and 57% of the indirect employee population) with direct employment equivalent to 57 % of its 20,000 consulting staff could be better defined as a research and development organization. NXP has rolled out a scheme worth 12 per cent for the career development of its R&D staff internally in 2023.

- Moreover, the expansion of R&D staff has been done by employing over 1,493 new R&D team members, significant elevations such as the appointment of 27 R&D team members and eight program directors, five senior program directors, 71 technical directors, nine fellows, and two senior fellows, may be counted.

- Long-term strategy development yet another important indicator of workforce renewal is that NXP is in the course of a full analysis of its existing R&D workforce on the basis of the new R&D job structure that was introduced at the end of the previous year last year in relation to future workforce provision Following the Strategic Planning Alignment (SPA) for 2022, the workforce was planned and information shared with R&D Management Team for the events that would shape forthcoming R&D talent.

- 2023 NXP, therefore, focused on creating the framework for building future technical leaders and long-term site strategy.

Conclusion

NXP Semiconductors Statistics, show that NXP Semiconductors have put their company on a brisk growth path advantage derived from strong strategic investments, increased demand in critical sectors, and the continued dedication to maintaining strong financial performance.

An indicator of its conviction that the challenge in the semiconductor sector is likely to continue in transition into other opportunities, according to company estimates, is the prospect.

FAQ.

NXP Semiconductors reported a revenue whistle-sharp downward slip as the accountants tallied US$3.422 billion against the outgoing US$13.21 billion in 2022. In broader terms, this means they plunged for the recovery hits that plagued sales in the semiconductor channels last year.

NXP joint ventures are as crucial as ESMC (with TSMC, Robert Bosch, and Infineon Technologies) and VisionPower (with Vanguard International Semiconductor Corporation). These two ventures broke the ground for the semiconductor facility in Dresden, Germany, and also for the establishment of VisionPower’s 300mm-wafer manufacturing plant.

The quarterly earnings modest growth and slight declines crossed in opposition over the first quarter; sales turned into a mere rise of 0.2% YoY to US$3.13 billion. But Q2 and Q3 suffered a 5% drop YoY in revenue, whereas both non-GAAP margins stayed solid and returned focused capital to shareholders.

NXP employee geographical distribution includes 60% of the Asia Pacific; 22% in Europe, the Middle East, and Africa; and 18% in the Americas as of 2023. It grew to 53% of individual contributors in indirect labour (IDL) positions, while people managers and executives remained more or less stable throughout the years for role analysis.

NXP employs 36% of its workforce dedicated to research and development (R&D) along with internal talent development. Plus, in 2023, 12% of the whole team had promotions, while over 1,493 members were recruited against R&D. NXP has further broadened the NXP Academy, special training in engineering fields to develop expertise in artificial intelligence, design, efficient robustness, and safety.

Barry Elad is a tech enthusiast who loves diving deep into various technology topics. He gathers important statistics and facts to help others understand the tech world better. With a keen interest in software, Barry writes about its benefits and how it can improve our daily lives. In his spare time, he enjoys experimenting with healthy recipes, practicing yoga, meditating, or taking nature walks with his child. Barry’s goal is to make complex tech information easy and accessible for everyone.