Payment Gateway Statistics By Market Size, Share Of Respondents And Sales

Updated · Aug 28, 2024

Table of Contents

- Introduction

- Editor’s Choice

- Workings Of Payment Gateways

- List of Popular Payment Gateways

- Global Mobile Payment Transactions

- Online Payment Adoption

- Online Sales Adoption In The Retail Sector

- Value Of UPI Transactions

- Real-time Payment Adoption System

- Consumer Opinion of AI Enable Digital Payment

- Nonprofit Payment Gateway Statistics

- Payment Gateway Market Size Forecast

- India Payment Gateway Market Size

- Regional Analysis

- Recent Developments

- Conclusion

Introduction

Payment Gateway Statistics: Payment gateways are crucial in e-commerce, serving as the backbone of digital transactions. These platforms enable seamless money transfers by e-businesses, retailers, and individuals.

Over the past 50 years, digital payment methods have seen a remarkable surge, making it imperative to delve into payment gateway statistics to grasp their evolution. This exploration also provides a comprehensive understanding of the various technologies that underpin adequate payments.

Editor’s Choice

- Global payment transactions are expected to reach USD 9,419 billion by 2025.

- India has the highest adoption rate of mobile wallets in the world, with 90.8% of users.

- The subscription economy is projected to exceed USD 1 trillion by the end of 2024.

- Cyberattacks are a major challenge for payment gateways, accounting for 20% of all cyberattacks in 2023.

- Blockchain technology is emerging as an effective solution for fast and secure transactions.

- The global payment gateway market generated USD 31.0 billion in revenue in 2023.

- By 2032, the global payment gateway market is expected to reach USD 161.0 billion.

- Large enterprises hold 55% of the market share in the payment gateway sector.

- In 2020, 77% of people in South Korea preferred cashless transactions.

- The Asia-Pacific region’s cashless transactions are set to rise from USD 494 billion in 2020 to USD 1,818 billion by 2030.

- Digital wallets are expected to grow from 49% in 2022 to 54% in 2026.

- Data privacy and cybersecurity are the top concerns for 48% of respondents.

- The payment gateway market in North America is growing, with the United States leading at USD 38.63 billion.

Workings Of Payment Gateways

- The customer initiates payment when the order is placed.

- Payment information passes through the payment gateway.

- The merchant provides payment information.

- The issuing bank validates the request and initiates transactions.

- After payment, the payment information is forwarded to the relevant website.

- After the merchant approves the payment, a receipt is issued.

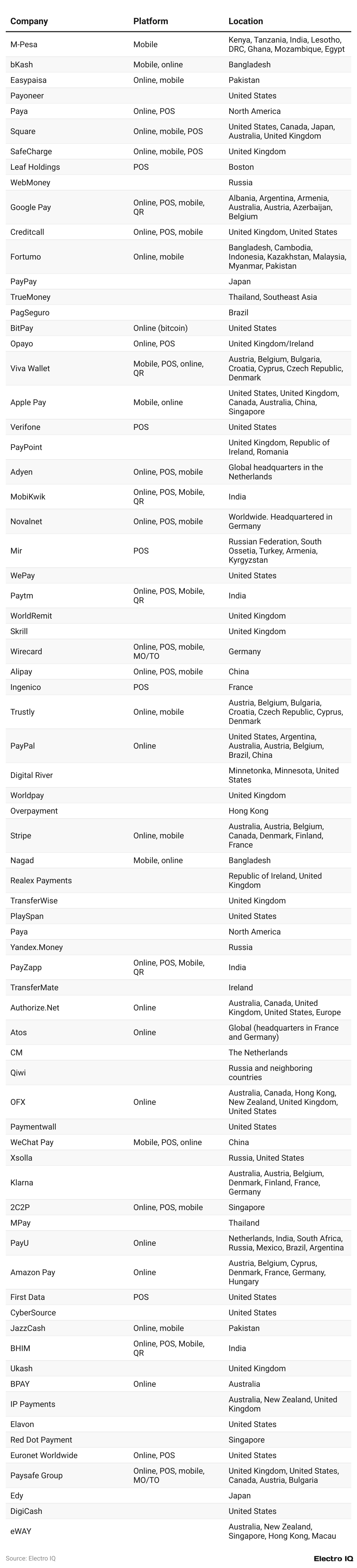

List of Popular Payment Gateways

Referring to payment gateway statistics, you will find the following popular payment gateways.

(Reference: wikipedia.org)

Global Mobile Payment Transactions

(Reference: Statista.com)

- Regarding payment gateway statistics, the rise of mobile wallet-based transactions with mainstream smartphone usage is evident.

- Regarding transaction amounts, the Far East and China region will take the first position with $4,666.81 billion in 2023. By the end of 2025, it is projected to reach $5,704 billion.

- Overall, there is a substantial growth in mobile wallet-based transactions. As showcased in the graph, the total transaction amount is $7,251 billion in 2023, and by the end of 2025, it will reach $9,419.

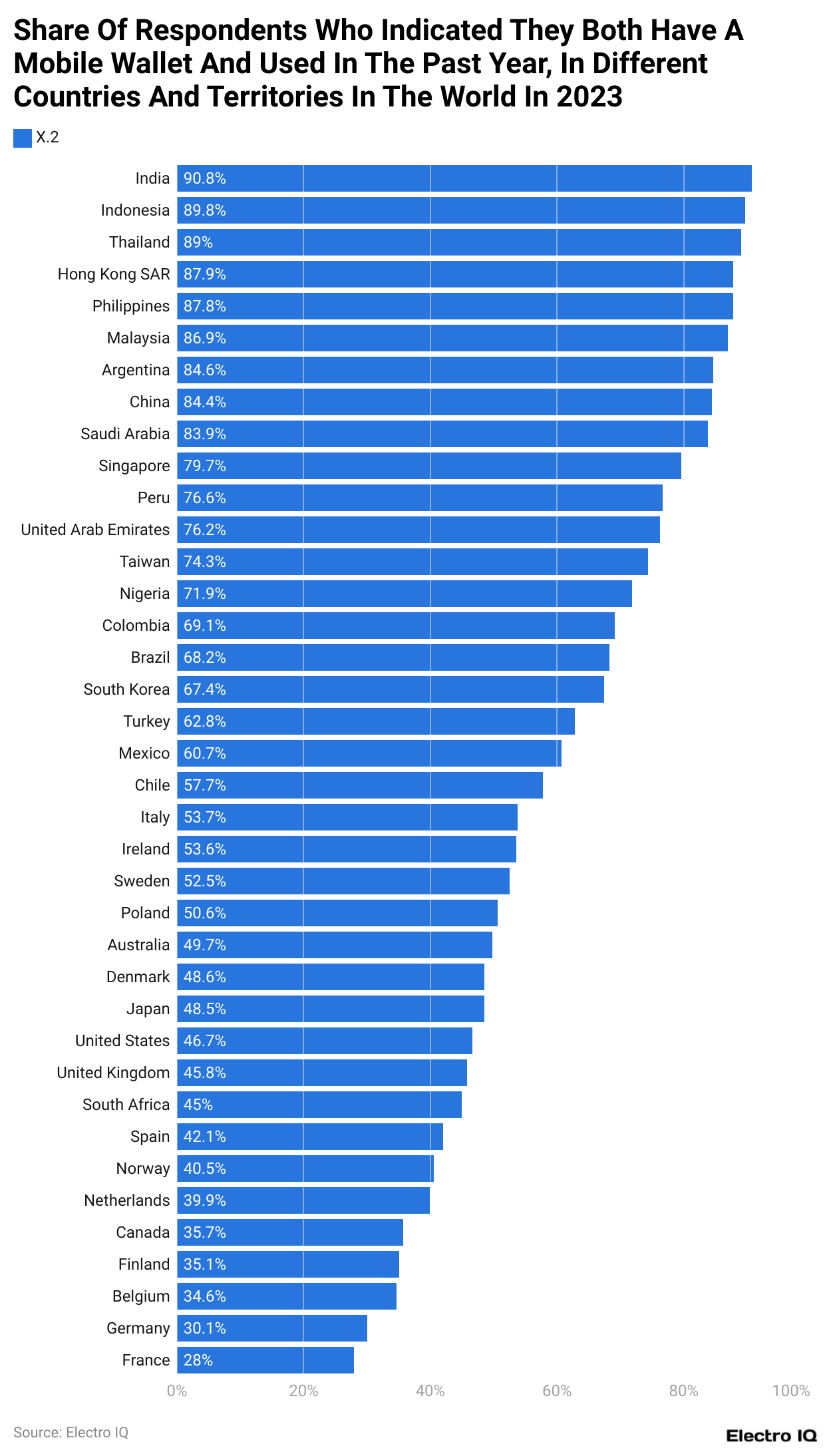

Online Payment Adoption

(Reference: Statista.com)

- Payment gateway statistics provide comprehensive information on adopting online payment modes in different countries.

- India currently has the highest adoption rate, with 90.8% of respondents admitting to having a mobile wallet they use consistently.

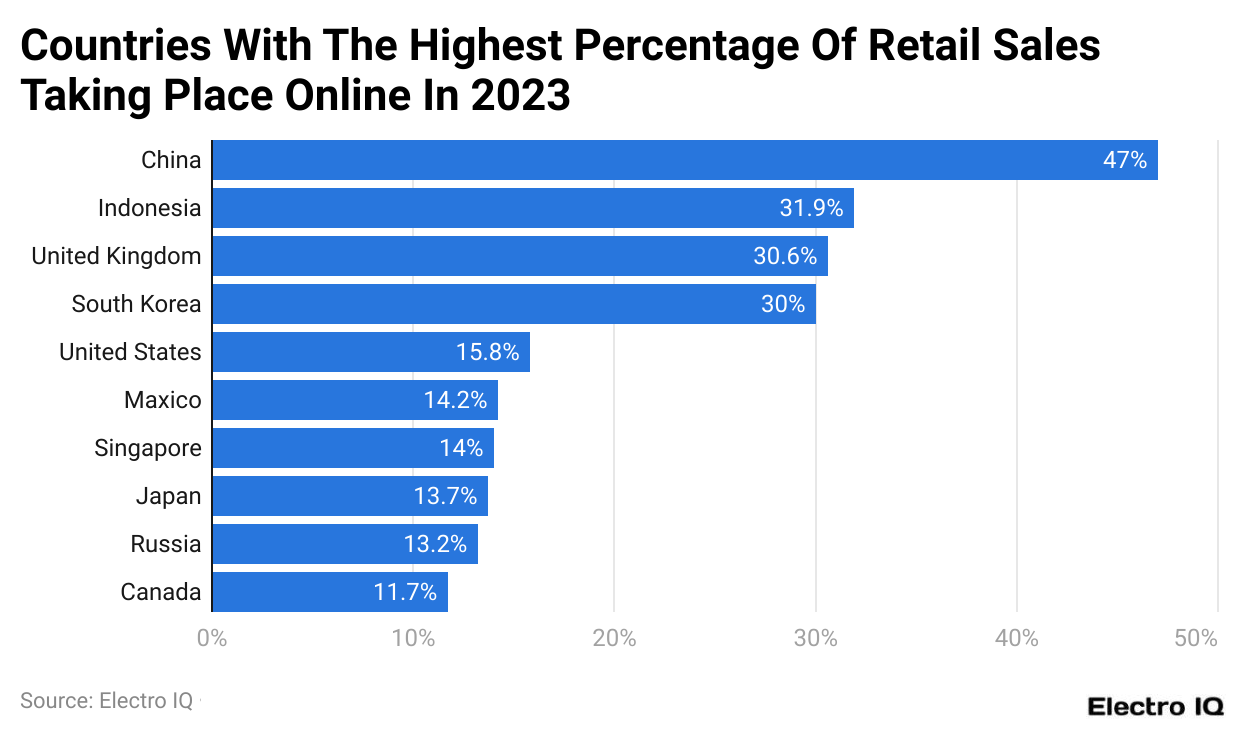

Online Sales Adoption In The Retail Sector

(Reference: Statista.com)

- With almost 50% of all retail store transactions online, China has the highest percentage of retail sales.

- Based on payment gateway statistics, Indonesia and the UK have 2nd and 3rd most significant proportion of online retail sales.

Value Of UPI Transactions

(Reference: Statista.com)

- The adoption of the Unified Payment Interface (UPI) has been widespread among Indian audiences.

- Payment gateway statistics state that there were ₹14,754 billion transactions using UPI in June 2023.

- During its initial years, UPI transactions amounted to ₹542.12 billion as of Aug 2018, showcasing its exponential growth.

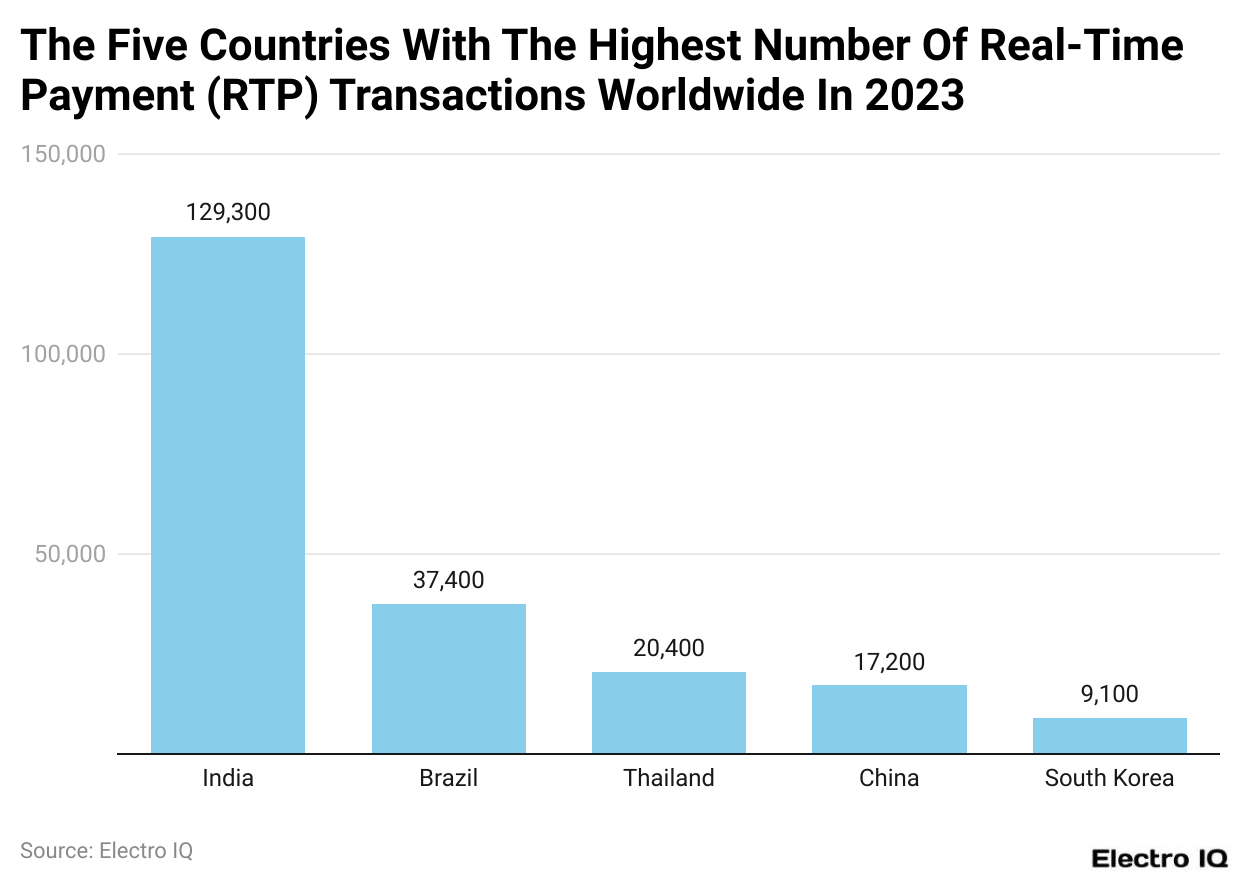

Real-time Payment Adoption System

(Reference: Statista.com)

- India, Brazil, Thailand, China, and South Korea are among the top 5 countries that use real-time payment transactions on a large scale.

- India has the highest amount of transactions, amounting to 129,300 billion. While going through payment gateway statistics, you will find a 44.6% increase from the previous year.

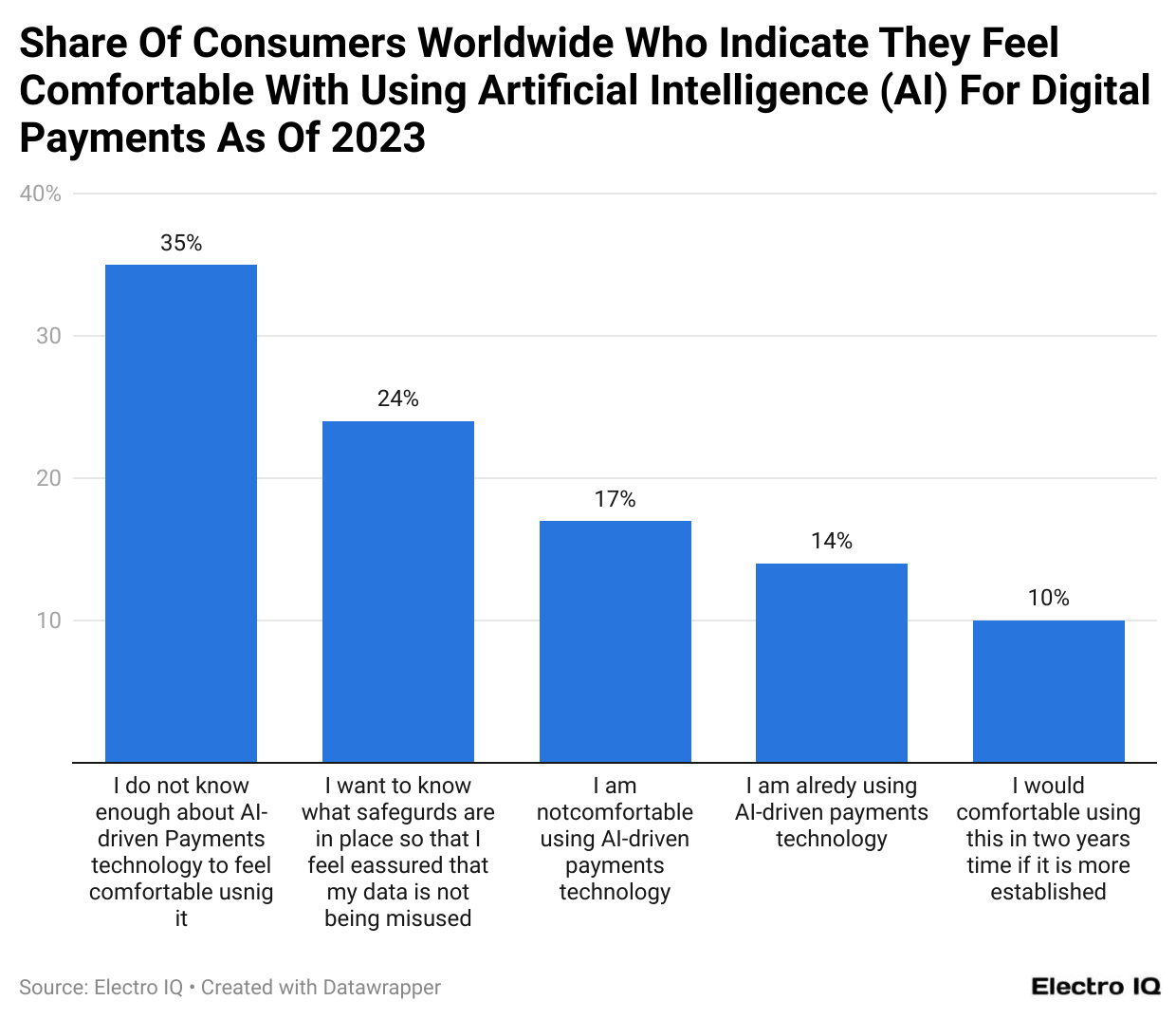

Consumer Opinion of AI Enable Digital Payment

(Reference: Statista.com)

- According to Payment Gateway statistics, 35% of users lack enough information about AI technology to understand its usage for digital payments.

- Only 10% of respondents are well-versed in technology usage and thus are comfortable with its integration.

Nonprofit Payment Gateway Statistics

- Online donations have grown by 12.1% in the past year, based on data gathered by Double the Donations.

- Around 53.4% of donors cover part of the donation cost when given the option on donation forms.

- People might spend up to 20% more when using a credit card compared to other payment methods.

- Donor retention rates have been around 40%, meaning 6 out of 10 donors only give once and do not donate again.

- Due to supporting crowdfunding campaigns, 16% of crowdfunders donate less to non-governmental organizations (NGOs) and non-profit organizations (NPOs).

- Direct mail has encouraged 24% of baby boomers to make online donations.

- After engaging with a topic on social media, 25% of people contact their political representatives.

- Corporate funding for education causes, including K–12 and higher education, accounts for 29% of total corporate donations.

- In the last year, 30% of people over the age of 75 made online donations, and they donate 25% more frequently than younger generations.

- 31% of global donors support NGOs and charities based in other countries.

- 39% of smartphone users, or 53 million adults, have used their phones to pay at least one bill in the past month.

- After being asked to volunteer, 42.1% of people became volunteers with their primary organization.

- Social media has led 43% of people to attend or participate in local charity events.

- For small purchases, 44% of millennials prefer using smartphones over cash.

- Around 54% of donors prefer making online donations using credit or debit cards.

- 60% of customers expect businesses to answer their questions within an hour, but the average response time is 1 hour and 24 minutes.

- 67% of school principals let their parent-teacher organizations make fundraising decisions, which some experts believe can hurt the fundraiser's effectiveness.

- Most donors, 68%, trust websites with the .org domain extension.

- 71% of parents have sold fundraising items to friends, family, and colleagues.

- 72% of baby boomers donate to charities, giving an average of $1,212 each year to 4.5 organizations.

- 75% of Instagram users take action after seeing an ad, like visiting a website or making a purchase.

- Offering employee engagement opportunities is considered a crucial strategy for attracting millennials, according to 77% of respondents.

- 79% of people say they would use mobile payments more often if discounts or coupons were offered.

- 84% of Facebook users share content to promote causes and raise awareness about issues important to them.

- Including a person's name and using full color in direct mail can increase response rates by 135%.

- A website’s fast checkout option can increase mobile donations and sales by up to 55%.

- Around 25% of American adults, or 63 million people, volunteer their time, skills, and energy to make a difference.

- Donations to arts, culture, and humanities organizations increased by 8.7% to $19.51 billion.

- Oversized envelopes provide the highest return on investment in direct mail campaigns, followed by postcards and letter-sized envelopes.

- Nonprofit organizations can increase their donations by 126% by using mobile-responsive design on their websites.

- Donations to environmental and animal welfare charities grew by 7.2% to $11.83 billion.

- Companies match 12% of their total corporate cash donations with employee donations.

- Campaign owners who update their supporters see a 126% increase in donations.

- Direct mail drove 36% more people to make online donations in 2016 compared to the previous year.

- Donations to human services charities grew by 5.1% to $50.06 billion.

- Email prompts 31% of Gen Xers to donate online, while social media influences 59% of Gen Zs to make charitable donations.

- Environmental and animal groups saw a 72% increase in donations in 2016 compared to 2015.

- 55% of donors are interested in using PayPal or Venmo for donations, and 20% reconsider donating if their preferred payment method is not available.

- One-time donations made with PayPal are 30% larger than those made with credit cards for nonprofits using PayPal on Classy Pay.

- 89% of U.S. consumers who use digital wallets specifically use PayPal.

- Adding an ACH payment option has increased recurring donations by 55%.

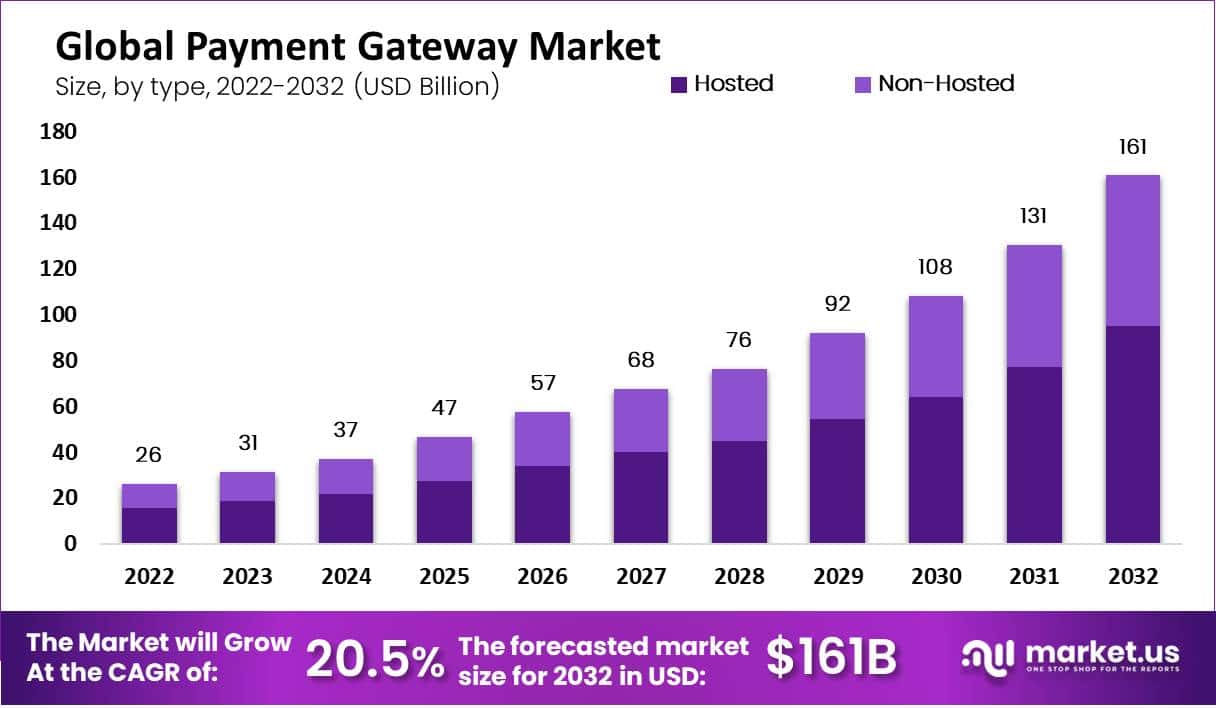

Payment Gateway Market Size Forecast

- In 2023, the global payment gateway market was worth USD 31 billion.

- By 2032, it is projected to grow to USD 161 billion.

- This market is expected to grow at a strong annual rate of 20.5% from 2023 to 2032.

- The market is divided into two types: Hosted and Non-hosted.

- The Hosted segment accounts for 59% of the market.

- Large enterprises hold 55% of the market share.

- Small and medium-sized businesses are expected to grow quickly.

- North America has the largest market share, at 38%.

- The United States and Canada lead this growth.

- The growth in North America is driven by a strong e-commerce sector.

- Mobile payment adoption is also rising in this region.

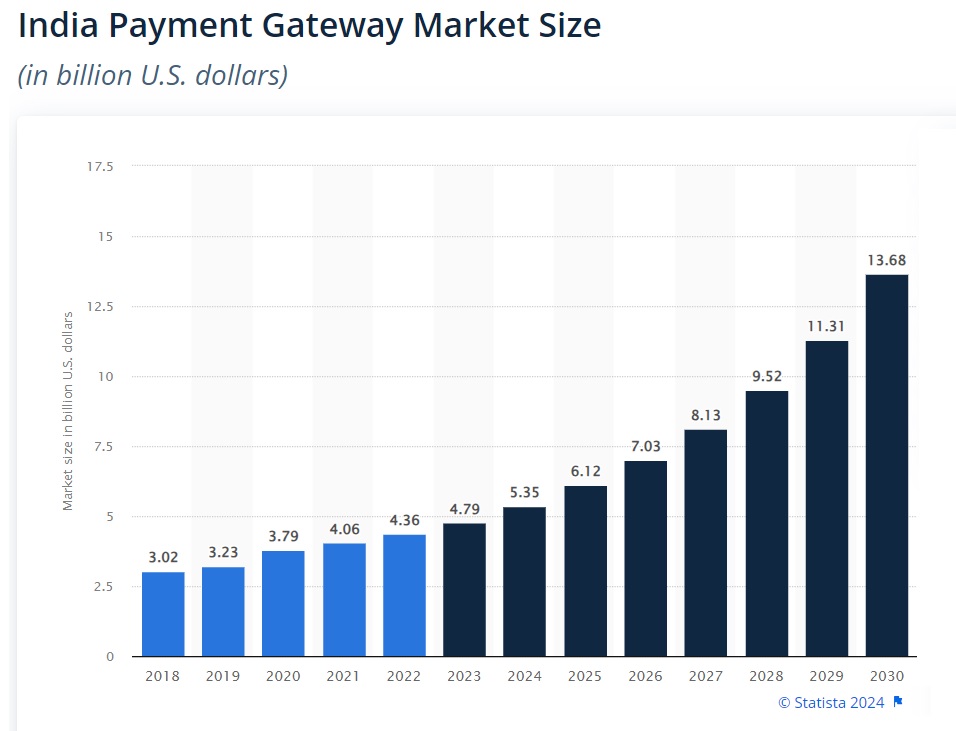

India Payment Gateway Market Size

- The market size of payment gateways in India is expected to nearly triple between 2023 and 2030. The Extrapolate predicts a CAGR of 16.2% during this period.

- Few Payment gateways in India refer to services such as Stripe, Braintree, PayPal, Adyen, Square, or Worldpay. These services support payment methods like Visa, Apple Pay, and local options specific to a country.

- Payment gateways are becoming increasingly popular in the fintech industry.

- They offer features like automatic customer billing for recurring transactions.

- This recurring billing can help businesses build customer loyalty, similar to cash-back programs.

Regional Analysis

North America

- The payment gateway market in North America is growing rapidly.

- The United States leads the region with a market size of USD 38.63 billion.

- This growth is due to advanced technology and widespread e-commerce use.

- Canada has a market size of USD 9.5 billion, showing strong adoption of payment gateways.

- Mexico's market size is USD 4.76 billion, highlighting the increasing role of digital payments in its economy.

Europe

- The payment gateway market in Europe is diverse and growing.

- Germany has the largest market, worth USD 10.82 billion.

- The United Kingdom follows with a market size of USD 7.59 billion.

- France's market is valued at USD 7.37 billion.

- Italy's market size is USD 3.84 billion.

- Spain's payment gateway market is worth USD 2.95 billion.

- The rest of Europe collectively accounts for USD 5.27 billion, showing varied adoption across the region.

Recent Developments

- Stripe's Expansion and Innovations: In 2024, Stripe raised $600 million in a funding round, bringing its valuation to $95 billion. The company introduced new products such as the Stripe Reader S700, a customizable smart card reader, and enhanced its checkout suite to improve transaction speed and security. Additionally, Stripe formed strategic partnerships with companies like Google and Airbnb to streamline payment processes.

- Block, Inc. Acquisitions and Enhancements: Block, Inc. (formerly Square) continues to expand its market presence. In 2022, it completed the acquisition of Afterpay, which significantly boosted its buy-now, pay-later capabilities. The company has also been focusing on integrating AI-driven tools into its platforms to enhance transaction speed and security.

- Euronet's Strategic Acquisition: In February 2024, Euronet acquired Singapore-based Infinitium Holdings, a digital payments company. This acquisition is aimed at integrating with Euronet's Ren payments platform to enhance online payment security and fraud prevention.

- NOWPayments' Focus on Stablecoins: In April 2024, NOWPayments, a cryptocurrency payment gateway, highlighted the growing use of stablecoins on its platform. The platform reported that USDTSOL led with 85.9% of stablecoin transactions, demonstrating increased trust in stablecoins.

- American Express's B2B Expansion: In early 2024, American Express acquired Nipendo, a specialist in B2B payments automation, to enhance its business payments network. Additionally, Amex launched the American Express Business Blueprint, a digital hub for small businesses to manage finances efficiently.

Conclusion

The payment gateway has become a vital component of the digital economy. It primarily facilitates secure and robust transactions between buyers and sellers. According to payment gateway statistics, the digital transaction-based market has experienced rapid growth in recent years.

Technological advancements such as AI, machine learning, and blockchain have challenging considerations but can potentially enhance the convenience and security of digital transactions. As the number of transactions based on digital payment increases, there will be a rise in technologies that facilitate these transactions.

Sources

FAQ.

A payment gateway is a technology used to organize and process online transactions.

The latest payment gateway statistics reveal that the global payment gateway market is predicted to reach $40 billion by the end of 2024.

As of June 2023, the total amount of UPI transactions in India accounted for ₹14,754 billion.

Aruna Madrekar is an editor at Smartphone Thoughts, specializing in SEO and content creation. She excels at writing and editing articles that are both helpful and engaging for readers. Aruna is also skilled in creating charts and graphs to make complex information easier to understand. Her contributions help Smartphone Thoughts reach a wide audience, providing valuable insights on smartphone reviews and app-related statistics.